U.S. Index Futures Rise as Fed’s Dovish Outlook Spurs Positive Investor Sentiment; Oil Prices See Minor Declines

March 21 2024 - 7:26AM

IH Market News

U.S. index futures are showing an uptrend in Thursday’s

pre-market, driven by the record close of the three major indexes

in the previous session and the more “dovish” stance than

anticipated by the Federal Reserve at the end of its latest

monetary policy meeting.

At 6:48 AM, Dow Jones futures (DOWI:DJI) were up 90 points, or

+0.23%. S&P 500 futures advanced 0.30%, and Nasdaq-100 futures

gained 0.65%. The yield on 10-year Treasury notes was at

4.229%.

In the commodities market, West Texas Intermediate crude oil for

May fell 0.18%, to $81.12 per barrel. Brent crude for May dropped

0.16%, near $85.81 per barrel. Iron ore traded on the Dalian

exchange rose 2.72%, to $118.00 per metric ton.

On Thursday’s economic agenda, the spotlight initially turns to

weekly jobless claims data at 8:30 AM, with LSEG consensus

anticipating around 215,000 applications. Next, at 09:45 AM,

investors’ eyes will be on the service and manufacturing PMI

indexes. Finally, at 10:45 AM, it will be time for February’s

existing home sales.

Asia-Pacific markets mostly closed higher on Thursday, buoyed by

optimism after the Federal Reserve kept interest rates steady but

signaled possible future cuts. Notably, Japan’s Nikkei reached a

new record (+2.03%). South Korea’s Kospi (+2.41%) and Hong Kong’s

Hang Seng (+1.93%) also saw significant gains. The exception was

the Shanghai stock exchange, which closed slightly lower

(-0.08%).

European markets are recording gains, reflecting investors’

reaction to the recent monetary guidance from the Bank of England,

Norges Bank, and the Swiss National Bank. The latter surprised by

cutting its interest rate by 0.25 percentage points to 1.5%,

anticipating that inflation will remain under control. Expectations

revolve around the Bank of England, expected to maintain the rate

at 5.25%, with analysts keen on possible signs of future

reductions.

On Wednesday, U.S. stocks initially fluctuated but gained

momentum after the Federal Reserve kept rates steady and projected

three rate cuts this year. The Dow Jones, S&P 500, and Nasdaq

closed higher, driven by the Fed’s decision and the expectation of

a favorable monetary policy, stimulating gains across various

sectors, including airlines and banks. Specifically, the Dow saw an

increase of 401.37 points, or 1.03%, ending the day at 39,512.13

points. The S&P 500 grew by 46.11 points, or 0.89%, closing at

5,224.62 points, while the Nasdaq Composite advanced 202.62 points,

or 1.25%, to 16,369.41 points.

This market optimism was driven by the Fed’s decision to keep

interest rates stable, aligning with market expectations, but also

by maintaining its previous projections, which indicated the

possibility of three interest rate reductions over the year. The

federal funds rate remained in the range of 5.25% to 5.50%,

unchanged since the quarter-point increase last July. Despite the

need for greater confidence in the slowing inflation trend towards

the 2% target before any rate cuts, the Fed’s projections still

suggest a reduction in rates to the range of 4.50% to 4.75% by the

end of 2024.

In the earnings front, scheduled to present financial reports

before the market opens are Intuitive Machines

(NASDAQ:LUNR), Accenture (NYSE:ACN),

Sundial (NASDAQ:SNDL), Academy Sports

& Outdoors (NASDAQ:ASO), Darden

Restaurants (NYSE:DRI), FactSet

(NYSE:FDS), BaoZun (NASDAQ:BZUN),

Exscientia (NASDAQ:EXAI), Lufax

(NYSE:LU), Mink Therapeutics (NASDAQ:INKT), among

others.

After the close, the numbers from FedEx

(NYSE:FDX), Nike (NYSE:NKE), Direct

Digital Holdings (NASDAQ:DRCT), AAR Corp

(NYSE:AIR), Vitru Education (NASDAQ:VTRU),

Asensus Surgical (AMEX:ASXC),

HireQuest (NASDAQ:HQI), HyperFine

(NASDAQ:HYPR), Worthington Steel (NYSE:WS), and

more will be awaited.

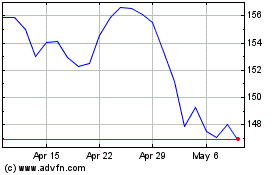

Darden Restaurants (NYSE:DRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

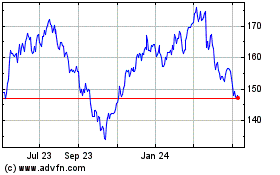

Darden Restaurants (NYSE:DRI)

Historical Stock Chart

From Apr 2023 to Apr 2024