Micron Surges on Unexpected Profit, Five Below and Guess Report Mixed Results

March 21 2024 - 5:18AM

IH Market News

In a notable turn of events, Micron Technology (NASDAQ:MU)

delivered a surprising profit report, surpassing analysts’

predictions and setting an optimistic profit outlook for the

upcoming period. The renowned memory-chip manufacturer not only

projected a significant profit but also anticipated fiscal

third-quarter revenues to be between $6.4 billion and $6.8 billion.

This forecast notably exceeds analysts’ expectations and suggests a

robust 76% increase at the midpoint, igniting a 17% surge in the

company’s shares to $112.15 in after-hours trading.

Conversely, Five Below (NASDAQ:FIVE) presented a contrasting

scenario, revealing that shrinkage issues had intensified since the

previous year, leading to fourth-quarter earnings that barely

touched the lower spectrum of its guidance. The discount retailer’s

first-quarter projections fell short of Wall Street’s hopes, mainly

because the forecast failed to account for any potential mitigation

of retail theft throughout the year. Consequently, Five Below’s

shares experienced a 13% decline, dropping to $182.60

after-hours.

Meanwhile, Guess (NYSE:GES) emerged as another positive story,

announcing both top- and bottom-line results that exceeded

analysts’ expectations. The fashion brand and retailer is looking

forward to a year of substantial growth, projecting a double-digit

revenue increase that starkly contrasts with Wall Street’s more

conservative single-digit growth anticipation. This upbeat forecast

propelled Guess’s shares up by 12%, reaching $29 in after-hours

trading.

The contrasting financial disclosures from these companies

underscore the varied challenges and opportunities within the

retail and technology sectors. Micron’s unexpected profit and

optimistic revenue guidance highlight the strong demand and

favorable market conditions for semiconductor products. On the

other hand, Five Below’s struggles with shrinkage and theft

underscore ongoing operational challenges facing retailers, even as

Guess’s performance signals potential for growth in the fashion

industry, defying broader market expectations.

Investors and market watchers are likely to closely monitor

these companies in the coming quarters, as their performances could

provide valuable insights into broader industry trends and consumer

behaviors.

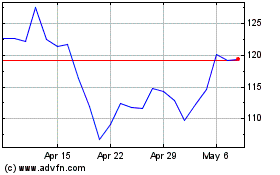

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Apr 2023 to Apr 2024