Solid Biosciences Inc. (Nasdaq: SLDB), a life sciences company

developing precision genetic medicines for neuromuscular and

cardiac diseases, today reported financial results for the fourth

quarter and full year ended December 31, 2023, and provided a

business update.

"2023 was an exciting and transformational year for Solid where

we completed the integration with AavantiBio, while diversifying

and expanding our pipeline. We strengthened our management team

with the hiring of a CMO, Dr. Gabriel Brooks, and CFO, Kevin Tan,

and advanced our next generation gene therapy for Duchenne,

SGT-003, towards the clinic with IND clearance in Q4 and received

Fast Track Designation and Orphan Drug Designation in Q4 2023 and

Q1 2024, respectively. We continued to bring in additional assets,

including SGT-501 for the treatment of a fatal childhood disease

called CPVT from ICS Maugeri, while moving additional high

potential programs and capsids through preclinical models,” said Bo

Cumbo, President and CEO of Solid Biosciences. “We enter 2024 with

significant momentum from our recently completed financing in

January which raised $108.9 million from a syndicate of leading

investors. 2024 will be a year of execution and we look forward to

rapidly bringing SGT-003 into the clinic, advancing SGT-501 towards

IND filing and most importantly, continuing to bring hope to all

those suffering from devastating genetic diseases.”

Company Updates

- Solid expects to

initiate dosing in the Phase 1/2 trial of SGT-003 in pediatric

patients with Duchenne in the second quarter of 2024. A safety

update is expected mid-year and initial data from the first two

cohorts of the trial is expected in Q4 2024.

- Solid announced it

expects to file an IND for its first cardiac gene therapy

candidate, SGT-501 for the treatment of catecholaminergic

polymorphic ventricular tachycardia (CPVT), in the first quarter of

2025.

- Solid has entered into a non-exclusive licensing agreement for

use of its proprietary, muscle-targeted AAV-SLB101 capsid. Solid

aims to license AAV-SLB101 broadly to both companies and academic

institutions pursuing treatments for rare diseases.

Recent Company Highlights

- On January 16, 2024,

Solid announced that the FDA granted Orphan Drug Designation for

its Duchenne gene therapy candidate SGT-003. This designation

provides certain benefits, including specified financial

incentives, to support clinical development and the potential for

up to seven years of market exclusivity in the U.S. upon

regulatory approval.

- On January 8, 2024,

Solid announced a $108.9 million private placement with new and

existing investors. The Company expects to use net proceeds of

$104.0 million from the private placement to fund ongoing pipeline

development programs, business development activities, and for

working capital and other general corporate purposes.

- On December 7, 2023,

Solid announced the FDA granted Fast Track Designation for SGT-003.

The Fast Track program facilitates the expedited development

and review of new drugs that are intended to treat serious or

life-threatening conditions and demonstrate the potential to

address unmet medical needs.

- On November 14,

2023, Solid announced that it had received FDA clearance for the

Phase 1/2 trial of SGT-003.

Fourth Quarter and Full-Year 2023 Financial

Highlights

There were no collaboration revenues for the fourth quarter of

2023 and 2022. There were no collaboration revenues for the full

year ended December 31, 2023, compared to $8.1 million for the full

year ended December 31, 2022. Collaboration revenue in 2022 was

related to research services and cost reimbursement from the

Collaboration Agreement with Ultragenyx, which the Company entered

in the fourth quarter of 2020.

Research and development expenses for the fourth quarter of 2023

were $15.4 million, compared to $21.3 million for the fourth

quarter of 2022. Research and development expenses for the full

year ended December 31, 2023, were $76.6 million, compared to $78.4

million for the full year ended December 31, 2022. The decrease of

$1.8 million in research and development expenses was primarily due

to a decrease in expenses related to SGT-001 due to our decision to

prioritize SGT-003, offset by an increase in costs for SGT-003 and

SGT-501.

General and administrative expenses for the fourth quarter of

2023 were $6.8 million, compared to $7.6 million for the fourth

quarter of 2022. General and administrative expenses for the full

year ended December 31, 2023, were $27.8 million, compared to $28.9

million for the full year ended December 31, 2022.

Net loss for the fourth quarter of 2023 was $20.3 million,

compared to $15.2 million for the fourth quarter of 2022. Net loss

for the full year ended December 31, 2023, was $96.0 million,

compared to $86.0 million for the full year ended December 31,

2022. The increase in net loss was primarily related to a gain on

acquisition and collaboration revenue in 2022, offset by decreased

research and development costs, decreased general and

administrative expenses, and an increase in yields on cash

equivalents and available-for-sale securities in 2023.

Solid had $123.6 million in cash, cash equivalents, and

available-for-sale securities as of December 31, 2023, compared to

$213.7 million as of December 31, 2022. The Company expects that

its cash, cash equivalents, and available-for-sale securities as of

December 31, 2023, together with the net proceeds from the January

2024 private placement, will enable it to fund key strategic

priorities into 2026.

About Solid BiosciencesSolid

Biosciences is a life sciences company focused on advancing a

portfolio of gene therapy candidates including SGT-003 for the

treatment of Duchenne muscular dystrophy (Duchenne), SGT-501 for

the treatment of catecholaminergic polymorphic ventricular

tachycardia (CPVT), AVB-401 for the treatment of BAG3-mediated

dilated cardiomyopathy, and additional assets for the treatment of

fatal cardiac diseases. Solid is advancing its diverse pipeline

across rare neuromuscular and cardiac diseases, bringing together

experts in science, technology, disease management, and care.

Patient-focused and founded by those directly impacted, Solid’s

mandate is to improve the daily lives of patients living with these

devastating diseases. For more information, please

visit www.solidbio.com.

Forward-Looking StatementsThis press release

contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995, including

statements regarding future expectations, plans and prospects for

the company; the ability to successfully achieve and execute on the

company’s priorities and achieve key clinical milestones; the

company’s SGT-003 program, including expectations for initiating

dosing and availability of clinical trial data; the company’s

expectations for submission of an IND for SGT-501; Solid’s plans to

license AAV-SLB101 broadly to both companies and academic

institutions; the anticipated use of proceeds from the January 2024

private placement; the cash runway of the company and the

sufficiency of the Company’s cash, cash equivalents, and available

for sale securities to fund its operations; and other statements

containing the words “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “target,” “would,” “working” and

similar expressions. Any forward-looking statements are based on

management’s current expectations of future events and are subject

to a number of risks and uncertainties that could cause actual

results to differ materially and adversely from those set forth in,

or implied by, such forward-looking statements. These risks and

uncertainties include, but are not limited to, risks associated

with the ability to recognize the anticipated benefits of Solid’s

acquisition of AavantiBio; the company’s ability to advance

SGT-003, SGT-501, AVB-401 and other preclinical programs and capsid

libraries on the timelines expected or at all; obtain and maintain

necessary approvals from the FDA and other regulatory authorities;

replicate in clinical trials positive results found in preclinical

studies of the company’s product candidates; obtain, maintain or

protect intellectual property rights related to its product

candidates; compete successfully with other companies that are

seeking to develop Duchenne and other neuromuscular and cardiac

treatments and gene therapies; manage expenses; and raise the

substantial additional capital needed, on the timeline necessary,

to continue development of SGT-003, SGT-501, AVB-401 and other

candidates, achieve its other business objectives and continue as a

going concern. For a discussion of other risks and uncertainties,

and other important factors, any of which could cause the company’s

actual results to differ from those contained in the

forward-looking statements, see the “Risk Factors” section, as well

as discussions of potential risks, uncertainties and other

important factors, in the company’s most recent filings with the

Securities and Exchange Commission. In addition, the

forward-looking statements included in this press release represent

the company’s views as of the date hereof and should not be relied

upon as representing the company’s views as of any date subsequent

to the date hereof. The company anticipates that subsequent events

and developments will cause the company's views to change. However,

while the company may elect to update these forward-looking

statements at some point in the future, the company specifically

disclaims any obligation to do so.

Solid Biosciences Contact:Leah MonteiroVP,

Investor Relations and

Communications617-766-3430lmonteiro@solidbio.com

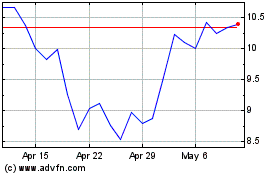

Solid Biosciences (NASDAQ:SLDB)

Historical Stock Chart

From Mar 2024 to Apr 2024

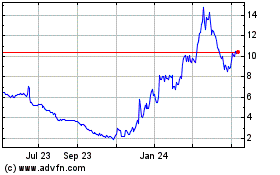

Solid Biosciences (NASDAQ:SLDB)

Historical Stock Chart

From Apr 2023 to Apr 2024