Mixed Futures Amidst Quiet Economic Schedule; Oil Prices Climb

March 13 2024 - 7:03AM

IH Market News

U.S. index futures displayed varied behavior on Wednesday,

following significant gains in the previous session that led the

S&P 500 to close the day at a historic high, driven by consumer

inflation data that met expectations. With a light economic

schedule and the U.S. earnings season nearing its end,

Dollar Tree (NASDAQ:DLTR) is scheduled to reveal

its financial performance this morning while construction company

Lennar (NYSE:LEN) is expected to announce its

results at the end of the day.

At 06:27 AM, Dow Jones futures (DOWI:DJI) rose 22 points, or

0.06%. S&P 500 futures were stable, and Nasdaq-100 futures fell

0.12%. The yield on 10-year Treasury bonds was at 4.161%.

In the commodities market, West Texas Intermediate crude oil for

April rose 1.30% to $78.57 per barrel. Brent crude oil for May rose

1.25% to nearly $82.94 per barrel. Iron ore traded on the Dalian

Exchange fell 2.53% to $112.24 per metric ton.

Wednesday’s economic agenda has few highlights, but investors’

eyes will be on the U.S. Department of Energy’s oil inventory data

release at 10:30 AM.

In the U.S. political scene, Joe Biden and Donald Trump secured

enough delegates to become the presidential candidates for the

Democratic and Republican parties, respectively. Thus, both

political leaders will revisit the electoral showdown of 2020 in

the race for the presidency, promising an intense rematch in the

battle for leadership of the nation in the White House.

The Asia-Pacific stock markets had a mixed performance on

Wednesday, reflecting a diverse set of regional influences. In

China, the real estate sector returned to the spotlight, with new

concerns about the housing crisis pressuring local stocks. The

Shanghai Composite Index fell 0.40%, while the Shenzhen Composite

experienced a slight contraction of 0.11%. This scenario was

influenced by unfavorable news about real estate sales and

financial difficulties of major developers, such as Country Garden,

which failed to make a bond payment. In contrast, Tokyo’s market

saw deeper losses, with investors attentive to speculations about

possible adjustments in Japan’s monetary policy. Other markets in

the region, like South Korea and Australia, managed to post

gains.

European markets are on an upward trend, reflecting investors’

reaction to the latest U.S. inflation data and economic performance

in the United Kingdom. The UK’s Office for National Statistics

(ONS) reported that the UK’s GDP grew by 0.2% in January, in line

with experts’ projections, indicating economic resilience amidst

global challenges. However, the eurozone faced setbacks, with

January’s industrial production declining by 3.2% compared to the

previous month, a sharper contraction than the 1.5% forecasted by a

Reuters survey.

Following declines in previous sessions, U.S. stock markets

rebounded on Tuesday, with major indices closing higher. The

positive movement was influenced by an inflation report that met

expectations, generating optimism about a possible moderation in

the Federal Reserve’s monetary policy. Oracle

(NYSE:ORCL)stood out with strong performance following

better-than-expected results, and the technology sector led the

gains, while gold and related stocks retreated. The Dow Jones

advanced 0.61%. The S&P 500 rose 1.12% and Nasdaq advanced

1.54%.

In terms of quarterly earnings, Dollar Tree

(NASDAQ:DLTR), Zim Integrated Shipping Services

(NYSE:ZIM), Arcos Dorados (NYSE:ARCO),

Petco (NASDAQ:WOOF), Village

Farms (NASDAQ:VFF), Williams-Sonoma

(NYSE:WSM), Vera Bradley (NASDAQ:VRA), ADC

Therapeutics (NYSE:ADCT), Silence

Therapeutics (NASDAQ:SLN), Global Indemnity

Group (NYSE:GBLI), among others, are scheduled to present

their financial reports before the market opens.

After the close, numbers from UiPath

(NYSE:PATH), SentinelOne (NYSE:S), ESS

Tech Inc (NYSE:GWH), Vroom (NASDAQ:VRM),

GrowGeneration Corp (NASDAQ:GRWG), Vaalco

Energy (NYSE:EGY), FTC Solar

(NASDAQ:FTCI), Anika (NASDAQ:ANIK), Quoin

Pharmaceuticals (NASDAQ:QNRX), Lennar

(NYSE:LEN), and more are awaited.

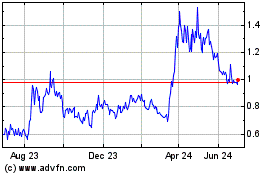

Village Farms (NASDAQ:VFF)

Historical Stock Chart

From Mar 2024 to Apr 2024

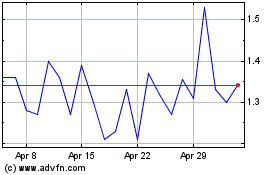

Village Farms (NASDAQ:VFF)

Historical Stock Chart

From Apr 2023 to Apr 2024