UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE 14A

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Pursuant

to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed

by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary

Proxy Statement

¨ Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive

Proxy Statement

x Definitive

Additional Materials

¨ Soliciting

Material under §240.14a-12

CANOPY GROWTH

CORPORATION

(Name of

Registrant as Specified in Its Charter)

N/A

(Name of Person(s)

Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that

apply):

x No

fee required

¨ Fee

paid previously with preliminary materials.

¨ Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

CANOPY

GROWTH ANNOUNCES DETAILS REGARDING CONVERTING INTO EXCHANGEABLE SHARES

SMITHS FALLS, ONTARIO MARCH

11, 2024 — Canopy Growth Corporation (“Canopy Growth” or the “Company”) (TSX: WEED, Nasdaq:

CGC) today announced additional details with respect to the previously announced special resolution to be voted on by the shareholders

of Canopy Growth (the “Canopy Shareholders”) authorizing an amendment to the Company’s articles of incorporation,

as amended (the “Amendment Proposal”), in order to: (i) create and authorize the issuance of an unlimited number of

a new class of non-voting and non-participating exchangeable shares in the capital of Canopy Growth (the “Exchangeable Shares”);

and (ii) restate the rights of the common shares in the capital of Canopy Growth (the “Common Shares”) to provide for

a conversion feature whereby each Common Share may at any time, at the option of the holder, be converted into one Exchangeable Share.

Canopy Shareholders will be asked to consider and vote on the Amendment Proposal at a special meeting of Canopy Shareholders on Friday,

April 12, 2024 at 1:00PM ET (the “Meeting”).

In the event that the Amendment

Proposal is approved by the Canopy Shareholders at the Meeting and Canopy Growth files articles of amendment to its articles of incorporation,

as amended, such that the creation of the Exchangeable Shares becomes effective (such time of filing being, the “Effective Time”),

Canopy Shareholders may elect to convert all or part of their Common Shares into Exchangeable Shares (the “Common Share Conversion

Right”) and holders of Exchangeable Shares may elect to convert all or part of their Exchangeable Shares into Common Shares

(the “Exchangeable Share Conversion Right”, together with the Common Share Conversion Right, the “Conversion

Right”).

The Conversion Right may

be exercised by registered holders of Common Shares and Exchangeable Shares, as applicable, at any time following the Effective

Time, by completing and signing a notice of conversion (a “Notice of Conversion”). The Company has enclosed two

different Notices of Conversion with this press release, one with respect to the Common Share Conversion Right and one with respect

to the Exchangeable Share Conversion Right. Each such Notice of Conversion will be available on the Company’s website and will

be filed with the U.S. Securities and Exchange Commission (the “SEC”) on EDGAR and with the Canadian securities

regulators on SEDAR+ following the Effective Time. A Notice of Conversion must be delivered to the Company’s transfer agent,

Odyssey Trust Company (the “Transfer Agent”), accompanied by the certificate(s) representing the Common Shares or

Exchangeable Shares, as applicable, or, if uncertificated, such other evidence of ownership as the Transfer Agent may require, in

respect of which the holder wishes to exercise the Conversion Right.

Upon receipt of a Notice of

Conversion and share certificate(s) or other evidence of ownership satisfactory to the Transfer Agent, the Company will cause the Transfer

Agent to issue a share certificate or other evidence of ownership representing Exchangeable Shares or Common Shares, as applicable, to

the registered holder of the Common Shares or Exchangeable Shares, as applicable. If fewer than all of the Common Shares or Exchangeable

Shares, as applicable, represented by a certificate accompanying a Notice of Conversion are to be converted, the holder of Common Shares

or Exchangeable Shares, as applicable, is entitled to receive a new certificate or other evidence of ownership representing the Common

Shares or Exchangeable Shares, as applicable, comprised in the original certificate which are not to be converted. Common Shares converted

into Exchangeable Shares and Exchangeable Shares converted into Common Shares, as applicable, pursuant to the Notice of Conversion will

automatically be cancelled.

Each Canopy Shareholder that

exercises its Common Share Conversion Right will be required to provide an undertaking to the Company (the “Undertaking”),

which provides that, prior to any transfer of Exchangeable Shares (the “Exchangeable Shares Transfer”), the holder

of such Exchangeable Shares will deliver a certification to Canopy Growth, that such holder reasonably believes that the Exchangeable

Shares Transfer is occurring in compliance with the Canadian take-over bid requirements as though the Exchangeable Shares were voting

securities or equity securities of Canopy Growth (the “Certification”). The Notice of Conversion with respect to the

Common Share Conversion Right contains the Undertaking along with the form of Certification.

If a Canopy Shareholder

has Common Shares that are registered in the name of a broker, bank, trust company, investment dealer or other financial

institution, the Canopy Shareholder must arrange for the Common Shares to be registered in their own name prior to exercising the

Common Share Conversion Right.

For more information on the Exchangeable Shares in the capital of Canopy Growth, please refer to the

Company’s definitive proxy statement dated February 12, 2024 (the “Proxy Statement”) that is available

at:

www.canopygrowth.com/investors/investor-events/special-meeting-2024.

Your Vote is Important

Regardless of the Number of Shares You Own

The Meeting will be held on

Friday, April 12, 2024, at 1:00 p.m. Eastern Time (Toronto time). The Meeting will be conducted in virtual format by live audio webcast

at

www.virtualshareholdermeeting.com/WEED2024SM.

Shareholders

who are eligible to vote have been mailed a Notice of Internet Availability in accordance with securities regulations which will provide

instructions on how to access proxy materials and vote their shares. The Proxy Statement is available at https://www.canopygrowth.com/investors/investor-events/special-meeting-2024/ and has been filed along with related Meeting materials under the Company’s profile on SEDAR and

EDGAR.

Shareholders are encouraged

to vote and submit proxies as early as possible in advance of the Meeting by one of the methods described in the Proxy Statement. The

deadline for Canopy Shareholders to return their completed proxies or voting instruction forms is Wednesday, April 10, 2024, at 1:00 p.m.

Eastern Time (Toronto time).

The Proxy Statement contains,

among other things, details concerning the Amendment Proposal, the background to and reasons for the favourable recommendation of the

Amendment Proposal by the board of directors of Canopy Growth, the requirements for the Amendment Proposal to become effective, procedures

for voting at the Meeting and other related matters. Canopy Shareholders are urged to carefully review the Proxy Statement and accompanying

materials as they contain important information regarding the Amendment Proposal.

Shareholder Questions and

Voting Assistance

Canopy Shareholders who have

questions or need assistance in voting should contact Laurel Hill Advisory Group by telephone at 1-877-452-7184 (North American Toll Free)

or 1-416-304-0211 (Outside North America), or by email at assistance@laurelhill.com.

More Information

Laura Nadeau

Communications

media@canopygrowth.com

Investor Contact:

Tyler Burns

Director, Investor Relations

tyler.burns@canopygrowth.com

About Canopy Growth Corporation

Canopy Growth is a leading

North American cannabis and consumer packaged goods (“CPG”) company dedicated to unleashing the power of cannabis to improve

lives.

Through an unwavering commitment

to our consumers, Canopy Growth delivers innovative products with a focus on premium and mainstream cannabis brands including Doja, 7ACRES,

Tweed, and Deep Space. Canopy Growth's CPG portfolio features gourmet wellness products by Martha Stewart CBD, and category defining vaporizer

technology made in Germany by Storz & Bickel.

Canopy Growth has also established

a comprehensive ecosystem to realize the opportunities presented by the U.S. THC market through its rights to Acreage Holdings, Inc.,

a vertically integrated multi-state cannabis operator with principal operations in densely populated states across the Northeast, as well

as Wana Brands, a leading cannabis edible brand in North America, and Jetty Extracts, a California-based producer of high- quality cannabis

extracts and pioneer of clean vape technology.

Beyond its world-class products,

Canopy Growth is leading the industry forward through a commitment to social equity, responsible use, and community reinvestment—pioneering

a future where cannabis is understood and welcomed for its potential to help achieve greater well-being and life enhancement.

For more information visit

www.canopygrowth.com.

Notice Regarding Forward-Looking Information

This press release

contains “forward-looking statements” within the meaning of applicable securities laws, which involve certain known and

unknown risks and uncertainties. Forward-looking statements predict or describe our future operations, business plans, business and

investment strategies and the performance of our investments. These forward-looking statements are generally identified by their use

of such terms and phrases as “intend,” “goal,” “strategy,” “estimate,”

“expect,” “project,” “projections,” “forecasts,” “plans,”

“seeks,” “anticipates,” “potential,” “proposed,” “will,”

“should,” “could,” “would,” “may,” “likely,” “designed to,”

“foreseeable future,” “believe,” “scheduled” and other similar expressions. Our actual results

or outcomes may differ materially from those anticipated. You are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date the statement was made.

Forward-looking statements

include, but are not limited to, statements with respect to: the anticipated timing, occurrence and outcome of the Meeting; statements

with respect to the U.S. cannabis sector; expectations regarding the U.S. federal laws and regulations and any amendments thereto; expectations

regarding the potential success of, and the costs and benefits associated with, our acquisitions, joint ventures, strategic alliances,

equity investments and dispositions; the future performance of our business and operations; and expectations for other economic, business,

and/or competitive factors.

By their nature,

forward-looking statements are subject to inherent risks and uncertainties that may be general or specific and which give rise to

the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that

assumptions may not be correct and that objectives, strategic goals and priorities will not be achieved. A variety of factors,

including known and unknown risks, many of which are beyond our control, could cause actual results to differ materially from the

forward-looking statements in this press release. Such factors include, without limitation, our limited operating history; the

diversion of management time on issues related to the Amendment Proposal and Canopy USA, LLC; the adequacy of our capital resources

and liquidity, including but not limited to, availability of sufficient cash flow to execute our business plan (either within the

expected timeframe or at all); volatility in and/or degradation of general economic, market, industry or business conditions;

compliance with applicable policies and regulations; changes in regulatory requirements in relation to our business and products;

our reliance on licenses issued by and contractual arrangements with various federal, state and provincial governmental authorities;

changes in laws, regulations and guidelines and our compliance with such laws, regulations and guidelines; risks relating to our

ability to refinance debt as and when required on terms favorable to us and to comply with covenants contained in our debt

facilities and debt instruments; risks related to the integration of acquired businesses; the timing and manner of the legalization

of cannabis in the United States; business strategies, growth opportunities and expected investment; counterparty risks and

liquidity risks that may impact our ability to obtain loans and other credit facilities on favorable terms; the potential effects of

judicial, regulatory or other proceedings, litigation or threatened litigation or proceedings, or reviews or investigations, on our

business, financial condition, results of operations and cash flows; the anticipated effects of actions of third parties such as

competitors, activist investors or federal, state, provincial, territorial or local regulatory authorities, self-regulatory

organizations, plaintiffs in litigation or persons threatening litigation; risks related to stock exchange restrictions; the risks

related to the Exchangeable Shares having different rights from our common shares and the fact that there may never be a trading

market for the Exchangeable Shares; future levels of capital, environmental or maintenance expenditures, general and administrative

and other expenses; and the factors discussed under the heading “Risk Factors” in the Company’s Annual Report on

Form 10-K for the year ended March 31, 2023 filed with the SEC on EDGAR and with the Canadian securities regulators on SEDAR+ on

June 22, 2023, in Item 1A of Part II of the Company’s Form 10-Q for the fiscal quarter ended December 31, 2023 filed with the

SEC on EDGAR and with the Canadian securities regulators on SEDAR+ on February 9, 2024, as well as those disclosed under the heading

“Amendment Proposal—Risk Factors Relating to the Amendment Proposal” in the Proxy Statement . Readers are

cautioned to consider these and other factors, uncertainties and potential events carefully and not to put undue reliance on

forward-looking statements.

While we believe that the

assumptions and expectations reflected in the forward-looking statements are reasonable based on information currently available to management,

there is no assurance that such assumptions and expectations will prove to have been correct. Forward-looking statements are made as of

the date they are made and are based on the beliefs, estimates, expectations and opinions of management on that date. We undertake no

obligation to update or revise any forward-looking statements, whether as a result of new information, estimates or opinions, future events

or results or otherwise or to explain any material difference between subsequent actual events and such forward-looking statements, except

as required by law. The forward-looking statements contained in this press release and other reports we file with, or furnish to, the

SEC and other regulatory agencies and made by our directors, officers, other employees and other persons authorized to speak on our behalf

are expressly qualified in their entirety by these cautionary statements.

Participants in the Solicitation

Canopy Growth and its directors and executive

officers may be deemed participants in the solicitation of proxies from shareholders with respect to the solicitation of votes to consider

the Amendment Proposal. A description of the interests of our directors and executive officers in the Amendment Proposal is contained

in the Proxy Statement and is available free of charge at the SEC’s website at www.sec.gov, or by directing a request to Canopy

Growth Corporation, 1 Hershey Drive, Smiths Falls, Ontario, K7A 0A8 or by email to invest@canopygrowth.com. Investors should read the

Proxy Statement as it contains important information.

FORM OF NOTICE OF CONVERSION OF COMMON SHARES

| TO: | ODYSSEY TRUST COMPANY (the “Transfer Agent”) |

702 – 67 Yonge Street

Toronto, Ontario

M5E 1J8

| CC: |

CANOPY GROWTH CORPORATION (the “Corporation”) |

1 Hershey Drive

Smiths Falls, Ontario K7A 0A8

Email: contracts@canopygrowth.com

The undersigned hereby gives

notice to the Transfer Agent of such person’s desire to convert the _______________ common shares in the capital of the Corporation

(“Common Shares”) registered in such person’s name into non-voting exchangeable shares in the capital of the

Corporation (“Exchangeable Shares”) in accordance with the provisions attaching to the Common Shares and tenders herewith

such Common Shares.

The undersigned acknowledges

that before transferring the Exchangeable Shares, the undersigned shall be required to certify to the Corporation that the undersigned

reasonably believes that the transfer is occurring in compliance with the Canadian take-over bid requirements as though the Exchangeable

Shares were voting securities or equity securities of the Corporation in the form attached hereto as Schedule “A”.

The undersigned hereby acknowledges

that the undersigned is aware that the Exchangeable Shares received on conversion may be subject to restrictions on resale under applicable

securities legislation.

The undersigned hereby irrevocably

directs that any said Exchangeable Shares be issued, registered and delivered as follows:

| Name(s) in Full |

|

Address(es) |

|

Number |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

Please print full name in which the Exchangeable

Shares are to be issued.

DATED as of the _____

day of _________________, 20____.

sCHEDULE

“a”

Shareholder’s

Certificate

| To: |

Canopy Growth Corporation (“Canopy Growth”) |

| |

|

| And To: |

Odyssey Trust Company (the “Transfer Agent”) |

| |

|

| RE: |

Exchangeable shares in the capital of Canopy Growth (the “Exchangeable Shares”) |

WHEREAS the undersigned is currently the

holder of __________________ Exchangeable Shares;

AND WHEREAS the undersigned proposes to

sell or offer to sell (each, a “Transfer”) or enter into an agreement with respect to the Transfer of, __________________

Exchangeable Shares (“Exchangeable Shares Transfer”);

NOW, THEREFORE the undersigned hereby certifies

and acknowledges the following:

| 1. | The undersigned reasonably believes that the Exchangeable Shares Transfer will occur in compliance with

the Canadian take-over bid requirements in effect as of the date hereof as though the Exchangeable Shares were voting securities or equity

securities of Canopy Growth; |

| 2. | This certification (this “Certification”) is irrevocable and, once signed by the undersigned,

may not be revoked under any circumstances by the undersigned unless the undersigned delivers written notice to Canopy Growth certifying

that the undersigned did not complete the Exchangeable Shares Transfer, in which case this Certification will be revoked and of no further

force and effect; and |

| 3. | The undersigned has had the time and opportunity to obtain independent legal advice with respect to the

execution of this Certification, or has waived that opportunity. |

DATED at ___________________ the _______

day of ________________, 20__.

or

| |

|

|

| |

|

[Company Name] |

| |

|

|

| |

|

Per: |

|

| |

|

|

Name: |

| |

|

|

Title: |

| |

|

|

|

| |

|

I/We have authority to bind the corporation. |

FORM OF NOTICE OF CONVERSION OF EXCHANGEABLE

SHARES

| TO: | ODYSSEY TRUST COMPANY (the “Transfer Agent”) |

702 – 67 Yonge Street

Toronto, Ontario

M5E 1J8

| CC: |

CANOPY GROWTH CORPORATION (the “Corporation”) |

1 Hershey Drive

Smiths Falls, Ontario K7A 0A8

Email: contracts@canopygrowth.com

The undersigned hereby gives

notice to the Transfer Agent of such person’s desire to convert the _______________ non-voting exchangeable shares in the capital

of the Corporation (“Exchangeable Shares”) registered in such person’s name into common shares in the capital

of the Corporation (“Common Shares”) in accordance with the provisions attaching to the Exchangeable Shares and tenders

herewith such Exchangeable Shares.

The undersigned hereby acknowledges

that the undersigned is aware that the Common Shares received on conversion may be subject to restrictions on resale under applicable

securities legislation.

The undersigned hereby irrevocably

directs that any said Common Shares be issued, registered and delivered as follows:

| Name(s) in Full |

|

Address(es) |

|

Number |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

Please print full name in which the Common Shares

are to be issued.

DATED as of the _____

day of _________________, 20____.

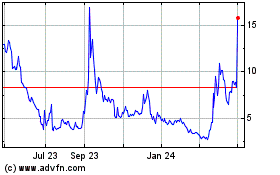

Canopy Growth (NASDAQ:CGC)

Historical Stock Chart

From Mar 2024 to Apr 2024

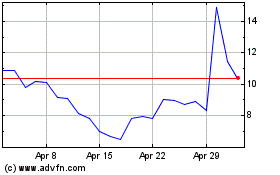

Canopy Growth (NASDAQ:CGC)

Historical Stock Chart

From Apr 2023 to Apr 2024