0001822359FALSE00018223592024-03-072024-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): March 7, 2024

___________________________________

DOCGO INC.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | | | | | | | |

Delaware | | 001-39618 | | 85-2515483 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | |

35 West 35th Street, Floor 6, New York, New York | | 10001 |

(Address of principal executive offices) | | (Zip Code) |

| | | | |

(844) 443-6246 |

(Registrant's telephone number, including area code) |

| | | | |

| N/A |

| (Former name or former address, if changed since last report) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | | DCGO | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 7, 2024, the Board of Directors (the “Board”) of DocGo Inc. (the “Company”) appointed Lee Bienstock, Chief Executive Officer of the Company, to the Board as a Class I director, effective as of April 1, 2024 following Stan Vashovsky’s departure as a director and Chair of the Board on March 31, 2024. Mr. Bienstock will hold such position until his successor is duly elected and qualified or until his earlier resignation, disqualification, death or removal. There are no transactions involving Mr. Bienstock and the Company that require disclosure under Item 404(a) of Regulation S-K. There are also no arrangements or understandings between Mr. Bienstock and any other person pursuant to which he was selected to serve as a director.

As previously reported, on November 6, 2022, Mr. Vashovsky notified the Board that he intended to retire from the Company and step down as the Company’s Chief Executive Officer, director and Chair of the Board, effective as of December 31, 2022. Also as previously reported, on December 29, 2022, the Company announced that, while Mr. Vashovsky would retire as the Chief Executive Officer of the Company as of December 31, 2022, he would continue serving as a director and non-executive Chair of the Board.

After over a year of providing the benefit of his leadership and perspective to the Board, on March 7, 2024, Mr. Vashovsky notified the Board that he intends to retire and step down as a director and Chair of the Board, effective as of March 31, 2024. Mr. Vashovsky indicated his decision to step down as a director and Chair of the Board was due to his desire to focus on his family and personal pursuits and not the result of any disagreement with the Company on any matter relating to the Company’s operations, disclosures, policies or practices.

In connection with Mr. Vashovsky’s retirement, on March 7, 2024, the Board appointed director Steven Katz to succeed Mr. Vashovsky as Chair of the Board, effective as of April 1, 2024. Mr. Katz has been a member of the Board and Chair of the Audit and Compliance Committee of the Board since November 2021 and the Lead Independent Director since April 2023.

In addition, Mr. Vashovsky will continue to serve as a consultant to the Company until March 31, 2025 (such period, the “Consulting Period”) pursuant to a separation and consulting agreement entered into by and between the Company and Mr. Vashovsky on March 7, 2024 (the “Consulting Agreement”). Pursuant to the Consulting Agreement, Mr. Vashovsky will provide advisory services as may be requested from time to time by the Company’s executive officers or the Board and assist with maintaining the Company’s existing customer and investor relationships and, as consideration for his services, receive an equity grant during each quarter of the Consulting Period having a grant date fair value of approximately $35,000. In consideration for a release of claims, Mr. Vashovsky will also be eligible to receive Company-subsidized healthcare coverage for the duration of the Consulting Period. The Consulting Agreement further acknowledges and affirms that Mr. Vashovsky will be bound by and comply with certain restrictive covenants.

The foregoing description of the Consulting Agreement does not purport to be complete and is qualified in its entirety by the full text of the Consulting Agreement, a copy of which is filed herewith as Exhibit 10.1 and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| DOCGO INC. |

| |

By: | /s/ Ely D. Tendler |

Name: | Ely D. Tendler |

Title: | General Counsel and Secretary |

Date: March 8, 2024

Exhibit 10.1

SEPARATION AND CONSULTING AGREEMENT

AND GENERAL RELEASE OF CLAIMS

This SEPARATION AND CONSULTING AGREEMENT AND GENERAL RELEASE OF CLAIMS (this “Agreement”) is entered into by and between DocGo Inc., a Delaware corporation (the “Company”), and Stan Vashovsky (“Consultant”). Consultant and the Company are each referred to herein as a “Party” and collectively as the “Parties.”

WHEREAS, Consultant has resigned as a director and the Chair of the Board of Directors of the Company and resigned as an employee of the Company, in each case, effective as of March 31, 2024 (the “Resignation Date”); and

WHEREAS, reference is made to those certain options to purchase shares of common stock of the Company granted to Consultant on December 9, 2021 (the “Options”), subject to the terms of the Company’s 2021 Stock Incentive Plan (the “2021 Plan”).

NOW, THEREFORE, in consideration of the promises set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by Consultant and the Company, the Parties hereby agree as follows:

1.Separation.

(a)The Company and Consultant acknowledge and agree that Consultant’s employment and service as a director and Chair of the Board of Directors of the Company will end as of the Resignation Date. As of the Resignation Date, Consultant will no longer be employed by any Company Party (as defined below), and Consultant will be deemed to have automatically resigned (i) as an officer of the Company and its affiliates (as applicable) and (ii) from the board of managers, board of directors or similar governing body of each of the Company and its affiliates (as applicable) and any other corporation, limited liability company, trade organization, or other entity in which the Company or any of its affiliates holds an equity interest or with respect to which board or similar governing body Consultant serves as the designee or other representative of the Company or any of its affiliates.

(b)Consultant acknowledges and agrees that Consultant has been paid in full all bonuses, been provided all benefits, and otherwise received all wages, compensation and other sums that Consultant has been owed by each Company Party. Consultant further acknowledges and agrees that Consultant has received all vacation and leaves (paid and unpaid) that Consultant has been entitled to receive from each Company Party.

2.Certain Payments and Benefits. Provided that Consultant: (x) executes this Agreement and returns a copy of this Agreement that has been executed by Consultant to the Company no later than 12:00 a.m. ET on March 12, 2024; and (y) remains in compliance with the other terms and conditions set forth in this Agreement (including under Sections 5 and 6), the Company shall provide one of the following in its discretion:

(a)subject to Consultant’s timely election of continuation coverage under COBRA (as defined in Annex A) and subject to Consultant’s copayment of premium amounts at the applicable active employees’ rate, the Company shall pay the remainder of the premiums for Consultant’s and any qualifying beneficiaries’ participation in the Company’s group health plans pursuant to COBRA for a period ending on the earlier of (i) the end of the Consulting Period (as defined below), (ii) Consultant becoming eligible for other group health benefits from a subsequent employer, or (iii) the expiration of Consultant’s rights under COBRA; or

(b)subject to Consultant’s timely enrollment and subject to the Consultant’s copayment of premium amounts at the applicable active employees’ rate, the Company shall make available to Consultant a health plan that is substantially similar to the Company’s group

health plans offered to active employees of the Company for a period ending on the earlier of (i) the end of the Consulting Period (as defined below) or (ii) Consultant becoming eligible for other group health benefits from a subsequent employer;

in each case, provided, however, that in the event either of the benefit alternatives provided herein would subject the Company or any of its affiliates to any tax or penalty under the Patient Protection and Affordable Care Act or Section 105(h) of the Internal Revenue Code of 1986 (the “Code”), Consultant and the Company agree to work together in good faith to restructure the foregoing benefits.

3.Release of Liability for Claims.

(a)For good and valuable consideration set forth in this Agreement, including the consideration set forth in Section 2, Consultant knowingly and voluntarily (for Consultant, Consultant’s family, and Consultant’s heirs, executors, administrators and assigns) hereby releases and forever discharges the Company, Ambulnz Holdings, LLC (together with the Company and its affiliates, the “DocGo Affiliated Entities”) and their respective affiliates, predecessors, successors, subsidiaries and benefit plans, and the foregoing entities’ respective equity-holders, officers, directors, managers, members, partners, employees, agents, representatives, and other affiliated persons, and the Company’s and its affiliates’ benefit plans (and the fiduciaries and trustees of such plans) (each, a “Company Party” and collectively, the “Company Parties”), from liability for, and Consultant hereby waives, any and all claims, damages, or causes of action of any kind related to Consultant’s ownership of any interest in any Company Party, Consultant’s employment with any Company Party, the termination of such employment, and any other acts or omissions related to any matter occurring on or prior to the date that Consultant executes this Agreement, including (i) any alleged violation through such time of: (A) any federal, state or local anti-discrimination or anti-retaliation law, regulation or ordinance, including Title VII of the Civil Rights Act of 1964, the Civil Rights Act of 1991, Sections 1981 through 1988 of Title 42 of the United States Code and the Americans with Disabilities Act of 1990; (B) the Employee Retirement Income Security Act of 1974 (“ERISA”); (C) the Immigration Reform Control Act; (D) the National Labor Relations Act; (E) the Occupational Safety and Health Act; (F) the Family and Medical Leave Act of 1993; (G) the New York State Human Rights Law, the New York Labor Law (including the New York State Worker Adjustment and Retraining Notification Act, all provisions prohibiting discrimination and retaliation, and all provisions regulating wage and hour law), the New York State Correction Law, the New York State Civil Rights Law, Section 125 of the New York Workers’ Compensation Law and the New York City Human Rights Law; (H) any federal, state or local wage and hour law; (I) any other local, state or federal law, regulation or ordinance; or (J) any public policy, contract, tort, or common law claim; (ii) any allegation for costs, fees, or other expenses including attorneys’ fees incurred in or with respect to a Released Claim; (iii) any and all rights, benefits or claims Consultant may have under any employment contract, incentive compensation plan or equity-based plan with any Company Party or to any ownership interest in any Company Party (other than any rights under the Options); and (iv) any claim for compensation or benefits of any kind not expressly set forth in this Agreement (collectively, the “Released Claims”). This Agreement is not intended to indicate that any such claims exist or that, if they do exist, they are meritorious. Rather, Consultant is simply agreeing that, in exchange for any consideration received by Consultant pursuant to Section 2, any and all potential claims of this nature that Consultant may have against any of the Company Parties, regardless of whether they actually exist, are expressly settled, compromised and waived. THIS RELEASE INCLUDES MATTERS ATTRIBUTABLE TO THE SOLE OR PARTIAL NEGLIGENCE (WHETHER GROSS OR SIMPLE) OR OTHER FAULT, INCLUDING STRICT LIABILITY, OF ANY OF THE COMPANY PARTIES.

(b)In no event shall the Released Claims include (i) any claim that arises after the date that Consultant signs this Agreement; (ii) any claim to vested benefits under an employee benefit plan that is subject to ERISA, unemployment benefits, or worker’s compensation; (iii) any claim for breach of, or otherwise arising out of, this Agreement; and (iv) any claim under the Age Discrimination in Employment Act of 1967 (including as amended by the Older Workers

Benefit Protection Act). Further notwithstanding this release of liability, nothing in this Agreement prevents Consultant from filing any non-legally waivable claim (including a challenge to the validity of this Agreement) with the Equal Employment Opportunity Commission (“EEOC”) or comparable state or local agency or participating in any investigation or proceeding conducted by the EEOC or comparable state or local agency or cooperating in any such investigation or proceeding; however, Consultant understands and agrees that Consultant is waiving any and all rights to recover any monetary or personal relief from a Company Party as a result of such EEOC or comparable state or local agency or proceeding or subsequent legal actions. Further, nothing in this Agreement prohibits or restricts Consultant from (x) filing a charge or complaint with, (y) cooperating in any investigation with, or (z) reporting violations of U.S. federal or state laws or regulations to the Securities and Exchange Commission, the Financial Industry Regulatory Authority, or any other governmental agency, entity or authority (each, a “Government Agency”). This Agreement does not limit Consultant’s right to make disclosures that are protected under U.S. federal and state whistleblower laws and regulations or from receiving an award for information provided to a Government Agency.

4.Representations and Warranties Regarding Claims. Consultant represents and warrants that, as of the time at which Consultant signs this Agreement, Consultant has not filed or joined any claims, complaints, charges, or lawsuits against any of the Company Parties with any governmental agency or with any state or federal court or arbitrator for, or with respect to, a matter, claim, or incident that occurred or arose out of one or more occurrences that took place on or prior to the time at which Consultant signs this Agreement. Consultant further represents and warrants that Consultant has not made any assignment, sale, delivery, transfer or conveyance of any rights Consultant has asserted or may have against any of the Company Parties with respect to any Released Claim. Consultant represents and warrants that, as of the time at which Consultant signs this Agreement, Consultant is not aware of any facts that may lead to a worker’s compensation claim.

5.Consulting Services.

(a)Beginning on the Resignation Date through March 31, 2025 (such period, as may be extended or earlier terminated as provided in Section 5(d), the “Consulting Period”), the Company and Consultant agree that Consultant shall serve as a consultant to the Company providing the Services (as defined below) for a minimum of 30 hours per calendar month on average. During the Consulting Period, Consultant agrees to provide transition advisory services, as may be requested from time to time by the Company’s executive officers or Board of Directors, and assist with maintaining the Company’s existing customer and investor relationships (the “Services”).

(b)As compensation for the Services, when practicable during each quarter of the Consulting Period, Consultant shall be granted a quarterly equity award having a grant date fair value of approximately $35,000, on such terms and conditions as approved by the Board of Directors or the Compensation Committee of the Board of Directors and subject to the 2021 Plan and any applicable award agreement(s). As an independent contractor, no income or other taxes shall be withheld from the amounts paid to Consultant pursuant to this Section 5(b).

(c)During the Consulting Period, Consultant’s relationship with the Company shall be that of an independent contractor. Consultant shall control and determine how the Services are to be accomplished; provided, however, that in all events Consultant shall perform the Services in a quality, workmanlike manner and within reasonable deadlines established by the Company and consistent with the professional talent of Consultant that Consultant applied during Consultant’s prior service with the Company. As an independent contractor, Consultant shall not participate as an active employee in any employee benefit plan of the Company or an affiliate (other than with respect to the Options).

(d)During the Consulting Period, Consultant shall indemnify, defend and hold the Company harmless from against any and all claims (including claims for personal injury, death or damage to property), liabilities, fines, penalties or amounts, losses, damages (including

reasonable attorneys’ fees), and obligations asserted against the Company by any third party to the extent directly and proximately caused by (i) gross negligence or willful misconduct by Consultant or (ii) breach of any applicable law, rule or regulation by Consultant, in each case, in his capacity as an independent contractor during the Consulting Period. During the Consulting Period, the Company shall indemnify, defend and hold Consultant harmless from against any and all claims (including claims for personal injury, death or damage to property), liabilities, fines, penalties or amounts, losses, damages (including reasonable attorneys’ fees), and obligations asserted against Consultant by any third party to the extent arising out of Consultant performing the Services during the Consulting Period (unless resulting from Consultant’s gross negligence, willful misconduct or breach of any applicable law, rule or regulation).

(e)Notwithstanding any other provision of this Section 3, the Consulting Period may be terminated (i) by the Company for Cause (as defined in Annex A), (ii) as a result of Consultant’s death or Disability (as defined in Annex A) and (iii) by either Party upon five days’ written notice to the other Party. The Consulting Period may be extended by mutual agreement of the Parties.

6.Restrictive Covenants. Consultant acknowledges and agrees that Consultant has continuing obligations to the Company and its affiliates pursuant to that certain Executive Employment Agreement between Consultant and the Company (f/k/a Motion Acquisition Corp.), dated November 5, 2021, including obligations relating to proprietary information, confidentiality, non-disparagement, non-competition and non-interference (collectively, the “Covenants”). In entering into this Agreement, Consultant acknowledges the continued effectiveness and enforceability of the Covenants, and Consultant expressly reaffirms Consultant’s commitment to abide by, and agrees that Consultant will abide by, the terms of the Covenants.

7.Covenant to Cooperate in Legal Proceedings. Consultant agrees to reasonably cooperate with the DocGo Affiliated Entities in any internal investigation, any administrative, regulatory, or judicial proceeding or any dispute with a third party. Consultant understands and agrees that Consultant’s cooperation may include, but not be limited to, making Consultant available to the DocGo Affiliated Entities upon reasonable notice for interviews and factual investigations; appearing at the request of any DocGo Affiliated Entity to give testimony without requiring service of a subpoena or other legal process; volunteering to the DocGo Affiliated Entities pertinent information received by Consultant in Consultant’s capacity as an employee; and turning over to the DocGo Affiliated Entities all relevant documents which are or may come into Consultant’s possession in Consultant’s capacity an employee or otherwise, all at times and on schedules that are reasonably consistent with Consultant’s other permitted activities and commitments.

8.Consultant’s Acknowledgements. By executing and delivering this Agreement, Consultant expressly acknowledges that:

(a)Consultant has been given sufficient time to review and consider this Agreement;

(b)Consultant is receiving, pursuant to this Agreement, consideration in addition to anything of value to which Consultant is already entitled;

(c)Consultant has been advised, and hereby is advised in writing, to discuss this Agreement with an attorney of Consultant’s choice and that Consultant has had an adequate opportunity to do so prior to executing this Agreement;

(d)Consultant fully understands the final and binding effect of this Agreement; the only promises made to Consultant to sign this Agreement are those stated herein; and Consultant is signing this Agreement knowingly, voluntarily and of Consultant’s own free will, and that Consultant understands and agrees to each of the terms of this Agreement;

(e)The only matters relied upon by Consultant in causing Consultant to sign this Agreement are the provisions set forth in writing within the four corners of this Agreement; and

(f)No Company Party has provided any tax or legal advice regarding this Agreement, and Consultant has had an adequate opportunity to receive sufficient tax and legal advice from advisors of Consultant’s own choosing such that Consultant enters into this Agreement with full understanding of the tax and legal implications thereof.

9.Governing Law; Arbitration. This Agreement and its performance will be construed and interpreted in accordance with the laws of the State of Delaware, without regard to principles of conflicts of law that would apply the substantive law of any other jurisdiction. For the avoidance of doubt, the arbitration and equitable relief provisions of that certain Mutual Dispute Resolution Agreement between Consultant and the Company, shall apply to any dispute arising under this Agreement.

10.Counterparts. This Agreement may be executed in several counterparts, including by .PDF or .GIF attachment to email or by facsimile, each of which is deemed to be an original, and all of which taken together constitute one and the same agreement.

11.Amendment; Entire Agreement. This Agreement may not be changed orally but only by an agreement in writing agreed to and signed by the Party to be charged. This Agreement constitutes the entire agreement of the Parties with regard to the subject matter hereof and supersede all prior and contemporaneous agreements and understandings, oral or written, between Consultant and any Company Party with regard to the subject matter hereof.

12.Third-Party Beneficiaries. Consultant expressly acknowledges and agrees that each Company Party that is not a party to this Agreement shall be a third-party beneficiary of Sections 3, 5, 6, 7 and 13 and entitled to enforce such provisions as if it were a party hereto.

13.Return of Property. Within 10 days of the end of the Consulting Period, Consultant shall (a) promptly and permanently surrender and deliver to the Company all documents (including electronically stored information) and all copies thereof and all other materials of any nature containing or pertaining to all Confidential Information (as defined in Annex A) and any other Company property (including any Company-issued computer, mobile device or other equipment) in Consultant’s possession, custody or control and Consultant shall not retain any such documents or other materials or property of the Company or any of its affiliates, and (b) certify to the Company in writing that all such documents, materials and property have been returned to the Company or otherwise destroyed.

14.Further Assurances. Consultant shall, and shall cause Consultant’s affiliates, representatives and agents to, from time to time at the request of the Company and without any additional consideration, furnish the Company with such further information or assurances, execute and deliver such additional documents, instruments and conveyances, and take such other actions and do such other things, as may be reasonably necessary or desirable, as determined in the sole discretion of the Company, to carry out the provisions of this Agreement.

15.Severability. Any term or provision of this Agreement (or part thereof) that renders such term or provision (or part thereof) or any other term or provision (or part thereof) hereof invalid or unenforceable in any respect shall be severable and shall be modified or severed to the extent necessary to avoid rendering such term or provision (or part thereof) invalid or unenforceable, and such modification or severance shall be accomplished in the manner that most nearly preserves the benefit of the Parties’ bargain hereunder.

16.Interpretation. The Section headings have been inserted for purposes of convenience and shall not be used for interpretive purposes. The words “hereof,” “herein” and “hereunder” and other compounds of the word “here” shall refer to the entire Agreement and not to any particular provision hereof. The use herein of the word “including” following any general statement, term or matter shall not be construed to limit such statement, term or matter to the

specific items or matters set forth immediately following such word or to similar items or matters, whether or not non-limiting language (such as “without limitation”, “but not limited to”, or words of similar import) is used with reference thereto, but rather shall be deemed to refer to all other items or matters that could reasonably fall within the broadest possible scope of such general statement, term or matter. The word “or” as used herein is not exclusive and is deemed to have the meaning “and/or.” Unless the context requires otherwise, all references herein to a law, agreement, instrument or other document shall be deemed to refer to such law, agreement, instrument or other document as amended, supplemented, modified and restated from time to time to the extent permitted by the provisions thereof. Neither this Agreement nor any uncertainty or ambiguity herein shall be construed against any Party, whether under any rule of construction or otherwise. This Agreement has been reviewed by each of the Parties and shall be construed and interpreted according to the ordinary meaning of the words used so as to fairly accomplish the purposes and intentions of the Parties.

17.No Assignment. No right to receive payments and benefits under this Agreement shall be subject to set off, offset, anticipation, commutation, alienation, assignment, encumbrance, charge, pledge or hypothecation or to execution, attachment, levy, or similar process or assignment by operation of law.

18.Withholdings; Deductions. The Company may withhold and deduct from any payments or benefits made or to be made pursuant to this Agreement (a) all federal, state, local and other taxes as may be required pursuant to any law or governmental regulation or ruling and (b) any deductions consented to in writing by Consultant.

19.Section 409A. This Agreement and the benefits provided hereunder are intended be exempt from, or compliant with, the requirements of Code and the Treasury regulations and other guidance issued thereunder (collectively, “Section 409A”) and shall be construed and administered in accordance with such intent. Each installment payment under this Agreement shall be deemed and treated as a separate payment for purposes of Section 409A. Notwithstanding the foregoing, the Company makes no representations that the benefits provided under this Agreement are exempt from the requirements of Section 409A and in no event shall the Company or any other Company Party be liable for all or any portion of any taxes, penalties, interest or other expenses that may be incurred by Consultant on account of non-compliance with Section 409A.

[Signatures Follow]

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the dates set forth beneath their names below, effective for all purposes as provided above.

CONSULTANT

/s/ Stan Vashovsky

Stan Vashovsky

Date: 03/07/2024

DOCGO INC.

By: /s/ Lee Bienstock

Name: Lee Bienstock

Title: Chief Executive Officer

Date: 03/07/2024

ANNEX A

Definitions

1.“Cause” means the termination of the Consulting Period for one of the following reasons: (i) Consultant’s willful failure to comply with, breach of or continued refusal to comply with, in each case, in any material respect, the material terms of this Agreement, of any written agreement or covenant with the Company or any affiliate (including any employment, consulting, confidentiality, non-competition, non-solicitation, non-disparagement or similar agreement or covenant); (ii) Consultant’s violation of any lawful material policies, standards or regulations of the Company which have been furnished to Consultant, including policies related to discrimination, harassment, performance of illegal or unethical activities, and ethical misconduct; (iii) Consultant’s indictment for, conviction of or plea of no contest to a felony under the laws of the United States or any state; (iv) Consultant’s fraud, embezzlement, dishonesty or breach of fiduciary duty against the Company or its affiliates or material misappropriation of property belonging to the Company or its affiliates; (v) Consultant’s willful failure to perform the Services; or (vi) Consultant’s willful misconduct or gross negligence in connection with the performance of the Services, in each case of (i), (v), (vi), after the receipt of written notice from the Company’s Board of Directors and Consultant’s failure to cure (if curable) within 30 days of Consultant’s receipt of the written notice, providing that the Company must provide Consultant with at least 30 days to cure and if Consultant cures, Cause shall not exist under (i), (v), (vi), as applicable.

2.“COBRA” means the Consolidated Omnibus Budget Reconciliation Act of 1985.

3.“Confidential Information” means all confidential, competitively valuable, non-public or proprietary information that is conceived, made, developed or acquired by or disclosed to Consultant (whether conveyed orally or in writing), individually or in conjunction with others, during the period that Consultant is employed or engaged by the Company or any of its affiliates (whether during business hours or otherwise and whether on the Company’s premises or otherwise) including: (i) technical information of the Company, its affiliates, its investors, customers, vendors, suppliers or other third parties, including computer programs, software, databases, data, ideas, know-how, formulae, compositions, processes, discoveries, machines, inventions (whether patentable or not), designs, developmental or experimental work, techniques, improvements, work in process, research or test results, original works of authorship, training programs and procedures, diagrams, charts, business and product development plans, and similar items; (ii) information relating to the Company or any of its affiliates’ businesses or properties, products or services (including all such information relating to corporate opportunities, operations, future plans, methods of doing business, business plans, strategies for developing business and market share, research, financial and sales data, pricing terms, evaluations, opinions, interpretations, acquisition prospects, the identity of customers or acquisition targets or their requirements, the identity of key contacts within customers’ organizations or within the organization of acquisition prospects, or marketing and merchandising techniques, prospective names and marks) or pursuant to which the Company or any of its affiliates owes a confidentiality obligation; and (iii) other valuable, confidential information and trade secrets of the Company, its affiliates, its customers or other third parties. Moreover, all documents, videotapes, written presentations, brochures, drawings, memoranda, notes, records, files, correspondence, manuals, models, specifications, computer programs, e-mail, voice mail, electronic databases, maps, drawings, architectural renditions, models and all other writings or materials of any type including or embodying any of such information, ideas, concepts, improvements, discoveries, inventions and other similar forms of expression are and shall be the sole and exclusive property of the Company or its other applicable affiliates and be subject to the same restrictions on disclosure applicable to all Confidential Information pursuant to this Agreement. For purposes of this Agreement, Confidential Information shall not include any information that (A) is or becomes generally available to the public other than as a result of a disclosure or wrongful act of Consultant or any of Consultant’s agents; (B) was available to Consultant on a non-confidential basis before its disclosure by the Company or any of its affiliates; (C) becomes available to Consultant on a non-confidential basis from a source other

than the Company or any of its affiliates; provided, however, that such source is not bound by a confidentiality agreement with, or other obligation with respect to confidentiality to, the Company or any of its affiliates; or (D) is required to be disclosed by applicable law.

4.“Disability” means a termination of the Consulting Period due to Consultant’s absence from Consultant’s duties with the Company for at least 180 consecutive days as a result of Consultant’s incapacity due to physical or mental illness which is determined to be total and permanent by a physician selected by the Company or its insurers.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

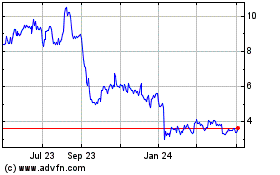

DocGo (NASDAQ:DCGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

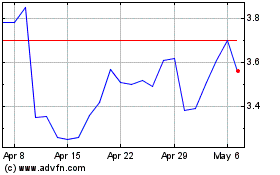

DocGo (NASDAQ:DCGO)

Historical Stock Chart

From Apr 2023 to Apr 2024