0000065270false00000652702024-03-062024-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 06, 2024 |

METHODE ELECTRONICS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-33731 |

36-2090085 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

8750 West Bryn Mawr Avenue |

|

Chicago, Illinois |

|

60631-3518 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (708) 867-6777 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.50 Par Value |

|

MEI |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry Into a Material Definitive Agreement

On March 6, 2024, Methode Electronics, Inc. (the “Company”) entered into a First Amendment to Second Amended and Restated Credit Agreement (the “First Amendment”) among the Company, each Lender party thereto, and Bank of America, N.A., as Administrative Agent, Swing Line Lender and L/C Issuer.

The First Amendment amended the Company’s existing Second Amended and Restated Credit Agreement, dated as of October 31, 2022 (the “Credit Agreement”), among the Company, Bank of America, N.A., as Administrative Agent, Swing Line Lender and L/C Issuer, the other Lenders party thereto and the other parties thereto. The First Amendment, among other things:

(i) amended the financial covenant that had required (subject to certain exceptions) that the Company’s consolidated leverage ratio as of the end of each fiscal quarter of the Company be no more than 3.25:1.00 to instead require (subject to certain exceptions) that the Company’s consolidated leverage ratio be no more than (a) 3.50:1.00 as of the end of the fiscal quarter ending January 27, 2024, (b) 4.50:1.00 as of the end of the fiscal quarter ending April 27, 2024, (c) 4.00:1.00 as of the end of the fiscal quarters ending July 27, 2024 and October 26, 2024 and (d) 3.25:1.00 as of the end of any fiscal quarter ending thereafter,

(ii) amended the interest rate provisions to provide that when the Company’s consolidated leverage ratio is more than 4.00:1.00, (a) loans denominated in US dollars bear interest at either (x) an adjusted base rate plus 1.75% or (y) an adjusted term SOFR rate or term SOFR daily floating rate (in each case, as determined in accordance with the provisions of the Credit Agreement, as amended by the First Amendment) plus 2.75% and (b) loans denominated (I) in Euros will bear interest at the Euro Interbank Offered Rate, (II) in Pounds Sterling will bear interest at the Sterling Overnight Index Average Reference Rate, (III) in Singapore Dollars will bear interest at the Singapore Interbank Offered Rate, (IV) in Canadian Dollars will bear interest at the forward-looking term rate based on the Canadian Overnight Repo Rate Average and (V) in Hong Dollars will bear interest at the Hong Kong Interbank Offered Rate (in each case, as determined in accordance with the provisions of the Credit Agreement, as amended by the First Amendment), in each case plus 2.75%,

(iii) amended the commitment fees to revolving lenders under the Credit Agreement to provide that when the Company’s consolidated leverage ratio is more than 4.00:1.00, the commitment fee will be 0.40% (instead of 0.35%) of the daily unused portions of the revolving credit facility,

(iv) replaced the benchmark interest rate for borrowings made in Canadian Dollars from the Canadian Dealer Offered Rate to the forward-looking term rate based on the Canadian Overnight Repo Rate Average,

(v) amended the investment, restricted payment and indebtedness baskets that had allowed for unlimited investments, restricted payments and indebtedness, as applicable, so long as the Company’s pro forma consolidated leverage ratio is at least 0.25:1.00 lower than the maximum ratio permitted under the applicable financial covenant to instead provide that during the period from the effective date of the First Amendment to and including the date of reporting for the fiscal quarter ending on January 25, 2025, such unlimited investments, restricted payments and indebtedness would be permitted so long as the Company’s pro forma consolidated leverage ratio is no greater than 3.50:1.00 (or 3.00:1.00 in the case of restricted payments), and

(vi) waived any default or event of default that may have occurred under the Credit Agreement due to non-compliance with the consolidated leverage ratio covenant for the fiscal quarter ended January 27, 2024 that was in effect prior to the First Amendment.

The foregoing description of the First Amendment is not intended to be complete and is qualified in its entirety by reference to the complete text of the First Amendment, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 2.02 Results of Operations and Financial Condition.

On March 7, 2024, the Company issued a press release announcing its financial results for its third quarter ended January 27, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Form 8-K and the Exhibit attached hereto pertaining to the Company’s financial results shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item 9.01 Financial Statements and Exhibits.

|

|

|

Exhibit Number |

|

Description |

10.1 |

|

First Amendment to Second Amended and Restated Credit Agreement, entered into as of March 6, 2024, among Methode Electronics, Inc., each Lender party thereto, Bank of America, N.A., as Administrative Agent, Swing Line Lender and L/C Issuer, and the other parties thereto |

99.1 |

|

Earnings Release of Methode Electronics, Inc. dated March 7, 2024 |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Methode Electronics, Inc. |

|

|

|

|

Date: |

March 7, 2024 |

By: |

/s/ Ronald L.G. Tsoumas |

|

|

|

Ronald L.G. Tsoumas

Chief Financial Officer |

Exhibit 10.1

FIRST AMENDMENT TO SECOND AMENDED AND RESTATED CREDIT AGREEMENT

THIS FIRST AMENDMENT TO SECOND AMENDED AND RESTATED CREDIT AGREEMENT (this “Agreement”) is entered into as of March 6, 2024 among METHODE ELECTRONICS, INC., a Delaware corporation (the “Company”), each Lender party hereto and BANK OF AMERICA, N.A., as Administrative Agent, Swing Line Lender and L/C Issuer. All capitalized terms used herein and not otherwise defined herein shall have the meanings ascribed thereto in the Credit Agreement (as defined below).

RECITALS

. The Company, the Lenders and the Administrative Agent entered into that certain Second Amended and Restated Credit Agreement, dated as of October 31, 2022 (as amended or modified from time to time to time prior to the date hereof, the “Credit Agreement”).

B. The Company has requested that the Lenders amend the Credit Agreement as set forth below.

C. The parties hereto have agreed to amend the Credit Agreement as provided herein.

D. In consideration of the agreements hereinafter set forth, and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the parties hereto agree as follows.

AGREEMENT

1. Amendments: Effective upon satisfaction of the conditions precedent set forth in Section 2 below:

(a) The following new definitions are hereby added to Section 1.01 of the Credit Agreement in the appropriate alphabetical order to read as follows:

“CORRA” means the Canadian Overnight Repo Rate Average administered and published by the Bank of Canada (or any successor administrator).

“First Amendment Effective Date” means March 6, 2024.

“First Amendment Period” means the period from the First Amendment Effective Date to and including the date that the financial statements and Compliance Certificate are delivered pursuant to Sections 6.01(b) and 6.02(b) for the fiscal quarter ending January 25, 2025.

“Term CORRA Adjustment” means (i) 0.29547% (29.547 basis points) for an Interest Period of one-month’s duration and 0.32138% (32.138 basis points) for an Interest Period of three-months’ duration.

“Term CORRA Rate” has the meaning specified in the definition of “Alternative Currency Term Rate”.

(b) Clause (c) in the definition of “Alternative Currency Term Rate” in Section 1.01 of the Credit Agreement is hereby amended to read as follows:

(c) denominated in Canadian Dollars, the rate per annum equal to the forward-looking term rate based on CORRA (“Term CORRA”), as published on the applicable Reuters screen page (or such other commercially available source providing such quotations as may be designated by the Administrative Agent from time to time) (in such case, the “Term CORRA Rate”) on the Rate Determination Date with a term equivalent to such Interest Period plus the Term CORRA Adjustment for such Interest Period.

(c) The definition of “Applicable Rate” in Section 1.01 of the Credit Agreement is hereby amended to read as follows:

“Applicable Rate” means from time to time, the following percentages per annum, based upon the Consolidated Debt to EBITDA Ratio as set forth below:

|

|

|

|

|

|

|

Applicable Rate |

Pricing Level |

Consolidated Debt to EBITDA Ratio |

Commitment Fee |

Term SOFR, Term SOFR Daily Floating Rate and Letters of Credit |

Base Rate |

Alternative Currency Term Rate |

Alternative Currency Daily Rate |

1 |

Greater than 4.00 to 1.00 |

0.40% |

2.75% |

1.75% |

2.75% |

2.75% |

2 |

Greater than 3.00 to 1.00, but less than or equal to 4.00 to 1.00 |

0.35% |

2.25% |

1.25% |

2.25% |

2.25% |

3 |

Greater than 2.25 to 1.00, but less than or equal to 3.00 to 1.00 |

0.30% |

2.00% |

1.00% |

2.00% |

2.00% |

4 |

Greater than 1.50 to 1.00, but less than or equal to 2.25 to 1.00 |

0.25% |

1.75% |

0.75% |

1.75% |

1.75% |

5 |

Less than or equal to 1.50 to 1.00 |

0.20% |

1.375% |

0.375% |

1.375% |

1.375% |

Any increase or decrease in the Applicable Rate resulting from a change in the Consolidated Debt to EBITDA Ratio shall become effective as of the first Business Day immediately following the date a Compliance Certificate is delivered pursuant to Section 6.02(b); provided, however, that if a Compliance Certificate is not delivered when due in accordance with such Section, then, upon the request of the Required Lenders, Pricing Level 1 shall apply as of the first Business Day after the date on which such Compliance Certificate was required to have been delivered and shall remain in effect until the date on which such Compliance Certificate is delivered. The Applicable Rate in effect from the First Amendment Effective Date through the date that the Compliance Certificate for the fiscal year ending April 27, 2024 is delivered pursuant to Section 6.02(b) shall be determined based upon Pricing Level 2.

(d) The definition of “CDOR” is hereby deleted from Section 1.01 of the Credit Agreement.

(e) The definition of “Conforming Changes” in Section 1.01 of the Credit Agreement is hereby amended to read as follows:

“Conforming Changes” means, with respect to the use, administration of or any conventions associated with SOFR, Term SOFR, Term SOFR Daily Floating Rate, CORRA, Term CORRA, Term CORRA Rate, EURIBOR, HIBOR, SONIA, SIBOR, or any proposed Successor Rate for an Alternative Currency, as applicable, any conforming changes to the definitions of “SOFR”, “Term SOFR”, “CORRA”, “Term CORRA”, “Term CORRA Rate”, “EURIBOR”, “HIBOR”, “SONIA”, “SIBOR”, “Interest Period”, timing and frequency of determining rates and making payments of interest and other technical, administrative or operational matters (including, for the avoidance of doubt, the definitions of “Business Day” and “U.S. Government Securities Business Day”, timing of borrowing requests or prepayment, conversion or continuation notices and length of lookback periods) as may be appropriate, in the discretion of the Administrative Agent, to reflect the adoption and implementation of such applicable rate(s) and to permit the administration thereof by the Administrative Agent in a manner substantially consistent with market practice for such Alternative Currency (or, if the Administrative Agent determines that adoption of any portion of such market practice is not administratively feasible or that no market practice for the administration of such rate for such Alternative Currency exists, in such other manner of administration as the Administrative Agent determines is reasonably necessary in connection with the administration of this Agreement and any other Loan Document).

(f) The definition of “Consolidated EBITDA” in Section 1.01 of the Credit Agreement is hereby amended by (i) deleting the “and” immediately before clause (b)(ix) and (ii) adding the following immediately after clause (b)(ix) thereof to read as follows:

and (x) non-recurring legal and professional fees, chief executive officer transition costs and costs related to divestitures, provided that the aggregate amounts added-back pursuant to this clause (b)(x) shall not exceed $12,500,000 during the term of this Agreement,

(g) In the definition of “Interest Period” in Section 1.01 of the Credit Agreement, the phrase “solely with respect to Alternative Currency Term Rate Loans denominated in Canadian Dollars, one, two or three months” is hereby amended to read as, “solely with respect to Alternative Currency Term Rate Loans denominated in Canadian Dollars, one or three months”.

(h) Clause (d) in the definition of “Permitted Acquisition” in Section 1.01 of the Credit Agreement is hereby amended to read as follows:

(d) immediately after giving effect to such Acquisition, (A) during the First Amendment Period, the Company’s Consolidated Debt to EBITDA Ratio determined on a Pro Forma Basis, as calculated in the certificate delivered pursuant to clause (f) of this definition, shall be no greater than 3.50:1.00 and (B) at all times after the First Amendment Period, the Company’s Consolidated Debt to EBITDA Ratio determined on a Pro Forma Basis, as calculated in the certificate delivered pursuant to clause (f) of this definition, shall be at least 0.25:1.00 less than the maximum ratio permitted at such time by Section 7.13(b) (giving effect to any Adjustment Period),

(i) Clause (e) in the definition of “Relevant Rate” in Section 1.01 of the Credit Agreement is hereby amended to read as follows:

(e) Canadian Dollars, the Term CORRA Rate,

(j) The definition of “U.S. Government Securities Business Day” in Section 1.01 of the Credit Agreement is hereby amended to read as follows:

“U.S. Government Securities Business Day” means any day except for (a) a Saturday, (b) a Sunday or (c) a day on which the Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in United States government securities.

(k) In each of (i) the first sentence of the second to last paragraph of Section 3.03(b) of the Credit Agreement and (ii) the last paragraph of Section 3.03(c) of the Credit Agreement, the following language is hereby deleted:

“, which adjustment or method for calculating such adjustment shall be published on an information service as selected by the Administrative Agent from time to time in its reasonable discretion and may be periodically updated”

(l) Clause (ii) in Section 7.02(p) of the Credit Agreement is hereby amended to read as follows:

(ii) (A) during the First Amendment Period, upon giving Pro Forma Effect to such Investment, the Consolidated Debt to EBITDA Ratio is no greater than 3.50:1.00 at the time of such Investment and (B) at all times after the First Amendment Period, upon giving Pro Forma Effect to such Investment, the Consolidated Debt to EBITDA Ratio is at least 0.25:1.00 lower than the maximum Consolidated Debt to EBITDA Ratio permitted pursuant to Section 7.13(b) at the time of such Investment

(m) Clause (i)(C)(2) in Section 7.03(f) of the Credit Agreement is hereby amended to read as follows:

(2)(A) during the First Amendment Period, the Consolidated Debt to EBITDA Ratio shall be no greater than 3:50:1.00 and (B) at all times after the First Amendment Period, the Consolidated Debt to EBITDA Ratio shall be at least

0.25:1.00 less than the maximum ratio permitted at such time by Section 7.13(b) (provided, that, with respect to Indebtedness incurred in connection with any Limited Condition Transaction, the determination of whether the foregoing subclauses (B) and (C) have been satisfied shall be subject to Section 1.10)

(n) Clause (ii) in Section 7.07(f) of the Credit Agreement is hereby amended to read as follows:

(ii)(A) during the First Amendment Period, the Consolidated Debt to EBITDA Ratio (as calculated on a Pro Forma Basis) is no greater than 3.00:1.00 and (B) at all times after the First Amendment Period, the Consolidated Debt to EBITDA Ratio (as calculated on a Pro Forma Basis) is at least 0.25:1.00 lower than the maximum Consolidated Debt to EBITDA Ratio permitted pursuant to Section 7.13(b) at the time of such Restricted Payment.

(o) Section 7.13(b) of the Credit Agreement is hereby amended to read as follows:

(b) Consolidated Debt to EBITDA Ratio. Permit the Consolidated Debt to EBITDA Ratio to be greater than (i) 3.50:1.00 as of the end of the fiscal quarter of the Company ending January 27, 2024, (ii) 4.50:1.00 as of the end of the fiscal quarter of the Company ending April 27, 2024, (iii) 4.00:1.00 as of the end of the fiscal quarters ending July 27, 2024 and October 26, 2024 and (iv) 3.25:1.00 as of the end of any fiscal quarter of the Company ending thereafter; provided, that, after the First Amendment Period, upon the occurrence of a Qualified Acquisition, for each of the four fiscal quarters of the Company immediately following such Qualified Acquisition (including the fiscal quarter of the Company in which such Qualified Acquisition was consummated (such period of increase, a “Adjustment Period”), the ratio set forth above shall be increased to 3.75:1.00; provided, further, that (i) for at least two (2) fiscal quarters of the Company immediately following each Adjustment Period, the Consolidated Debt to EBITDA ratio shall not be greater than 3.25:1.00 prior to giving effect to another Adjustment Period pursuant to the immediately preceding proviso, and (ii) there shall be no more than two (2) Adjustment Periods during the term of this Agreement.

2. Conditions Precedent. This Agreement shall be effective on the date hereof upon:

(a) receipt by the Administrative Agent of copies of this Agreement duly executed by the Company, the Guarantors, the Administrative Agent and the Lenders constituting the Required Lenders;

(b) (i) upon the reasonable request of any Lender made at least five days prior to the date hereof, receipt by such Lender of the documentation and other information so requested in connection with applicable “know your customer” and anti-money-laundering rules and regulations, including the PATRIOT Act, in each case at least five days prior to the date hereof; and (ii) upon the request of any Lender made at least five days prior to the date hereof, if the Company qualifies as a “legal entity customer” under the Beneficial Ownership Regulation, receipt by the Administrative Agent of a Beneficial Ownership Certification in relation to the Company;

(c) to the extent invoiced at least two Business Days prior, payment by the Company of all reasonable and documented fees, charges and disbursements of counsel to the Administrative Agent in connection with this Agreement required to be paid by the Company as provided in the Credit Agreement (directly to such counsel if requested by the Administrative Agent); and

(d) payment by the Company of all agreed fees to the Arranger and the Lenders executing this Agreement.

3. Representations and Warranties of the Loan Parties. (a) After giving effect to this Agreement, the representations and warranties of each Loan Party contained in Article V of the Credit Agreement or any other Loan Document are true and correct in all material respects on and as of the date hereof, except to the extent such representations and warranties refer to an earlier date, in which case they are true and correct as of such earlier date, and (b) no Default has occurred and is continuing or will exist immediately after giving effect to this Agreement.

4. Authority/Enforceability. Each Loan Party represents and warrants as follows:

(h)It has taken all necessary action to authorize the execution, delivery and performance of this Agreement.

(b) This Agreement has been duly executed and delivered by such Loan Party and constitutes its legal, valid and binding obligations, enforceable in accordance with its terms, subject to applicable Debtor Relief Laws and to general principles of equity or principles of good faith and fair dealing.

(c) No approval, consent, exemption, authorization, or other action by, or notice to, or filing with, any Governmental Authority or any other Person is necessary or required in connection with the execution, delivery or performance by such Loan Party of this Agreement other than those that have already been obtained and are in full force and effect.

(d) The execution and delivery of this Agreement does not (i) contravene the terms of its Organization Documents, or (ii) violate any applicable material Law.

5. Waiver. Effective upon satisfaction of the conditions precedent set forth in Section 2 above, the Lenders, Administrative Agent Swing Line Lender and L/C Issuer hereby waive any Default or Event of Default that may have occurred under Section 8.01(b) for failure to observe the financial covenant set forth in Section 7.13(b) for the fiscal quarter ending January 27, 2024 that was in effect under the Credit Agreement before giving effect to this Agreement (the “Specified Default”). The waiver set forth in this Section 5 is a one-time waiver and is limited solely to the Specified Default, and nothing contained herein shall be deemed to constitute a waiver of any other rights or remedies with respect to any other Defaults or Events of Default the Administrative Agent or any Lender may have under the Credit Agreement, any other Loan Documents or under applicable law.

6. Counterparts. This Agreement may be executed in any number of counterparts, each of which when so executed and delivered shall be an original, but all of which shall constitute one and the same instrument. Delivery of executed counterparts of this Agreement by facsimile or other secure electronic format (.pdf) shall be effective as an original.

7. GOVERNING LAW. THIS AGREEMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK. Section 10.20 of the Credit Agreement is hereby incorporated by reference with the full force and effect as if fully set forth herein.

8. Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns.

9. Headings. The headings of the sections hereof are provided for convenience only and shall not in any way affect the meaning or construction of any provision of this Agreement.

10. Severability. If any provision of this Agreement is held to be illegal, invalid or unenforceable, (a) the legality, validity and enforceability of the remaining provisions of this Agreement shall not be affected or impaired thereby and (b) the parties shall endeavor in good faith negotiations to replace the illegal, invalid or unenforceable provisions with valid provisions the economic effect of which comes as close as possible to that of the illegal, invalid or unenforceable provisions. The invalidity of a provision in a particular jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction.

11. Continuing Effectiveness, etc. Except to the extent expressly set forth herein, all of the terms and conditions of the Credit Agreement and the other Loan Documents remain unchanged and in full force and effect. Upon the effectiveness hereof, all references to the Credit Agreement set forth in any other agreement or instrument shall, unless otherwise specifically provided, be references to the Credit Agreement as amended hereby. This Agreement is a Loan Document.

[signature pages follow]

Each of the parties hereto has caused a counterpart of this Agreement to be duly executed and delivered as of the date first above written.

COMPANY: METHODE ELECTRONICS, INC.,

a Delaware corporation

By: /s/ Ronald L.G. Tsoumas

Name: Ronald L.G. Tsoumas

Title: Chief Financial Officer

FIRST AMENDMENT TO CREDIT AGREEMENT

GUARANTORS: DABIR SURFACES, INC.,

a Delaware corporation

By: /s/ Ronald L.G. Tsoumas

Name: Ronald L.G. Tsoumas

Title: Vice President and Treasurer

Hetronic International, Inc.,

a Delaware corporation

By: /s/ Ronald L.G. Tsoumas

Name: Ronald L.G. Tsoumas

Title: Vice President and Treasurer

Hetronic USA, Inc.,

a Delaware corporation

By: /s/ Ronald L.G. Tsoumas

Name: Ronald L.G. Tsoumas

Title: Vice President and Treasurer

Methode Development Company,

a Delaware corporation

By: /s/ Ronald L.G. Tsoumas

Name: Ronald L.G. Tsoumas

Title: Vice President and Treasurer

TouchSensor Technologies, L.L.C.,

a Delaware limited liability company

By: /s/ Ronald L.G. Tsoumas

Name: Ronald L.G. Tsoumas

Title: Vice President and Treasurer

grakon parent, inc.,

a Delaware corporation

By: /s/ Ronald L.G. Tsoumas

Name: Ronald L.G. Tsoumas

Title: Vice President and Treasurer

FIRST AMENDMENT TO CREDIT AGREEMENT

GRAKON INTERMEDIATE HOLDINGS, LLC,

a Delaware limited liability company

By: /s/ Ronald L.G. Tsoumas

Name: Ronald L.G. Tsoumas

Title: Vice President, Finance and Chief Financial Officer

GRAKON HOLDingS LLC,

a Delaware limited liability company

By: /s/ Ronald L.G. Tsoumas

Name: Ronald L.G. Tsoumas

Title: Vice President, Finance and Chief Financial Officer

GRAKON, LLC,

a Delaware limited liability company

By: /s/ Ronald L.G. Tsoumas

Name: Ronald L.G. Tsoumas

Title: Vice President, Finance and Chief Financial Officer

NORDIC LIGHTS NA, INC.,

a Delaware corporation

By: /s/ Tom Nordström

Name: Tom Nordström

Title: President and Secretary

FIRST AMENDMENT TO CREDIT AGREEMENT

ADMINISTRATIVE

AGENT: BANK OF AMERICA, N.A.,

as Administrative Agent

By: /s/ DeWayne D. Rosse

Name: DeWayne D. Rosse

Title: Assistant Vice President

FIRST AMENDMENT TO CREDIT AGREEMENT

LENDERS: bank of america, n.a.,

as a Lender, Swing Line Lender and L/C Issuer

By: /s/ Jonathan M. Phillips

Name: Jonathan M. Phillips

Title: Senior Vice President

FIRST AMENDMENT TO CREDIT AGREEMENT

WELLS FARGO BANK, NATIONAL ASSOCIATION,

as a Lender

By: /s/ Heather Hoopingarner

Name: Heather Hoopingarner

Title: Director

FIRST AMENDMENT TO CREDIT AGREEMENT

PNC BANK, NATIONAL ASSOCIATION,

as a Lender

By: /s/ Debra Hoffenkamp

Name: Debra Hoffenkamp

Title: Assistant Vice President

FIRST AMENDMENT TO CREDIT AGREEMENT

TD BANK, N.A.,

as a Lender

By: /s/ Leonid Batsevitsky

Name: Leonid Batsevitsky

Title: Vice President

FIRST AMENDMENT TO CREDIT AGREEMENT

HSBC BANK USA, NATIONAL ASSOCIATION,

as a Lender

By: /s/ Jillian Clemons

Name: Jillian Clemons

Title: Senior Vice President

FIRST AMENDMENT TO CREDIT AGREEMENT

BMO HARRIS BANK N.A.,

as a Lender

By: /s/ Clair Richards

Name: Clair Richards

Title: Portfolio Manager

FIRST AMENDMENT TO CREDIT AGREEMENT

CITIBANK, N.A.,

as a Lender

By: /s/ Andrew Stella

Name: Andrew Stella

Title: Vice President

FIRST AMENDMENT TO CREDIT AGREEMENT

JPMORGAN CHASE BANK, N.A.,

as a Lender

By: /s/ Richard D. Barritt

Name: Richard D. Barritt

Title: Executive Director

FIRST AMENDMENT TO CREDIT AGREEMENT

THE BANK OF EAST ASIA, LIMITED, NEW YORK BRANCH,

as a Lender

By: /s/ James Hut

Name: James Hut

Title: DGM & Corporate Banking

By: /s/ Chong Tan

Name: Chong Tan

Title: DGM & Risk Management

FIRST AMENDMENT TO CREDIT AGREEMENT

Exhibit 99.1

Methode Electronics, Inc. Reports Fiscal 2024 Third Quarter Financial Results

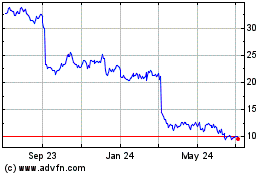

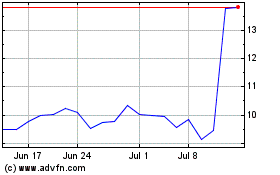

Chicago, IL – March 7, 2024 – Methode Electronics, Inc. (NYSE: MEI), a leading global supplier of custom-engineered solutions for user interface, LED lighting and power distribution applications, today announced financial results for the third quarter of fiscal 2024 ended January 27, 2024.

Fiscal Third Quarter 2024 Highlights

•Net sales were $259.5 million

•Electric and hybrid vehicle applications were 19 percent of net sales

•Net loss was $11.6 million, or $0.33 per diluted share

•Free cash flow was $12.2 million

•Company purchased 130,592 shares of its common stock for $3.0 million

•Forward-looking guidance suspended

Management Comments

President and Chief Executive Officer Avi Avula said, “Our sales in the quarter were impacted by auto program roll-offs and persistent demand weakness in the e-bike and data center markets. While EV activity was a stable percentage of our sales, they were down from the previous year on a dollar basis. The lower sales volume and the impact from our ongoing operational inefficiencies in the Automotive segment, which were a combination of lingering challenges from the first half of the fiscal year and costs from program launch delays, drove the net loss in the quarter. Despite these challenges, we returned to positive free cash flow in the quarter.”

Mr. Avula added, “Given ongoing operational inefficiencies, the looming market headwinds in EV, and my recent appointment as CEO, we have suspended guidance. Right now, my primary goal is to restore profitability, starting with an intensive review of and quick actions to reduce hard costs, including items like headcount and various discretionary expenses, and to dispose of non-critical assets. We will also work to reduce working capital, particularly inventory, and increase free cash flow. This will be closely followed by an expeditious, but thorough review of the entire portfolio. We plan to share an update on our business review when we report fiscal fourth quarter results in June. We expect to resume guidance in the near future.”

Mr. Avula concluded, “While I have been at Methode only a month, I am very excited and energized by the potential of the business. Our company foundation is strong with a rich legacy of innovation, close customer relationships, and an unwavering commitment to excellence. I look forward to building on that foundation and charting a course towards even greater success for the organization.”

Consolidated Fiscal Third Quarter 2024 Financial Results

Methode's net sales were $259.5 million, compared to $280.1 million in the same quarter of fiscal 2023. The decrease was mainly driven by lower Automotive segment sales in all geographic regions, which was partially offset by sales from the Nordic Lights acquisition and favorable foreign currency translation. Excluding Nordic Lights and foreign currency translation, net sales were down 15.5% compared to the same quarter of fiscal 2023.

Selling and administrative expense as a percentage of sales was 13.1 percent, compared to 11.7 percent in the same quarter of fiscal 2023. Selling and administrative expense increased $1.0 million from the same quarter of fiscal 2023 primarily due to the acquisition of Nordic Lights, which accounted for $2.4 million of the increase.

Excluding Nordic Lights, selling and administrative expense decreased $1.4 million primarily due to lower stock-based compensation expense including a single restricted stock unit forfeiture of $3.4 million related to a former employee, partially offset by higher professional fees, incentive compensation and salary expense.

Loss from operations was $3.0 million, compared to income of $27.3 million in the same quarter of fiscal 2023. The decrease was primarily due to lower sales volume and continued operational inefficiencies in North America, including higher costs due to upcoming program launches in the Automotive segment. The decrease was partially offset by the Nordic Lights acquisition. Adjusted loss from operations, a non-GAAP financial measure, was $2.9 million, down from adjusted income of $27.3 million in the same quarter of fiscal 2023. The fiscal 2024 third quarter adjusted loss excluded $0.1 million of restructuring costs.

Net loss was $11.6 million or $0.33 per diluted share, compared to net income of $19.9 million or $0.54 per diluted share in the same quarter of fiscal 2023. The lower net income was primarily driven by lower income from operations and higher interest expense, which were partially offset by lower tax expense. Adjusted net loss, a non-GAAP financial measure, was $11.5 million, or $0.33 per diluted share, compared to net income of $19.9 million or $0.54 per diluted share, in the same quarter of fiscal 2023. The fiscal 2024 third quarter adjusted net loss excluded $0.1 million of restructuring costs.

EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization of Intangibles), a non-GAAP financial measure, was $9.4 million, compared to $36.1 million in the same quarter of fiscal 2023. Adjusted EBITDA, a non-GAAP financial measure, was $9.5 million, compared to $36.1 million in the same quarter of fiscal 2023. The fiscal 2024 third quarter adjusted EBITDA excluded $0.1 million of restructuring costs.

Debt was $331.3 million at the end of the quarter, compared to $306.8 million at the end of fiscal 2023. Net debt, a non-GAAP financial measure defined as debt less cash and cash equivalents, was $208.4 million, compared to $149.8 million at the end of fiscal 2023. The increase in debt and net debt was mainly due to working capital investment and increased purchases of property, plant, and equipment. After the end of the fiscal third quarter, the company entered into an amendment to its credit agreement. Following the amendment, the company was in compliance with all debt covenants for the fiscal third quarter.

Net cash provided by operating activities was $28.8 million for the quarter, compared to $55.7 million in the same quarter of fiscal 2023. Free cash flow, a non-GAAP financial measure defined as net cash provided by operating activities less purchases of property, plant, and equipment, was $12.2 million, compared to $42.9 million in the same quarter of fiscal 2023. The decrease was mainly due to lower net income and increased purchases of property, plant, and equipment.

The company purchased and retired 130,592 shares of stock for $3.0 million in the quarter. As of January 27, 2024, a total of 3,243,746 shares have been purchased at a total cost of $130.1 million since the commencement of the $200.0 million share buyback authorization.

Segment Fiscal Third Quarter 2024 Financial Results

Comparing the Automotive segment’s quarter to the same quarter of fiscal 2023,

•Net sales were $139.7 million, down from $176.5 million. Net sales decreased by $36.8 million or 20.8% mainly due to lower volume in North America and Asia primarily related to program roll-offs and EV demand weakness and in Europe related to lower sensor sales resulting from an overstocked e-bike market. Partially offsetting the decline was a favorable foreign currency translation of $1.1 million.

•Loss from operations was $11.0 million, down from income from operations of $18.7 million. Loss from operations was a negative 7.9% of net sales, down from a positive 10.6% primarily due to lower sales volume and costs resulting from the operational inefficiencies, mainly in North America, that occurred

in the first and second fiscal quarters and continued in the third fiscal quarter. These inefficiencies resulted in inventory adjustments, scrap expenses, and higher labor and freight costs.

Comparing the Industrial segment’s quarter to the same quarter of fiscal 2023,

•Net sales were $107.1 million, up from $91.0 million. The acquisition of the Nordic Lights business contributed $21.2 million and favorable foreign currency translation contributed $0.4 million to the sales increase. Net of the acquisition and foreign currency translation, net sales decreased by $5.5 million or 6.0% driven primarily by lower demand for power distribution products in the EV and data center markets.

•Income from operations was $18.9 million, down from $22.3 million. The acquisition of the Nordic Lights business contributed $1.6 million. Income from operations was 17.6% of net sales, down from 24.5% mainly due to product sales mix.

Comparing the Interface segment’s quarter to the same quarter of fiscal 2023,

•Net sales were $12.7 million, up from $12.0 million. The increase was mainly due to higher volume of appliance products.

•Income from operations was $1.5 million, up from $1.0 million. Income from operations was 11.8% of net sales, up from 8.3%. Both increases were mainly due to the higher sales volume.

Guidance

Due to the recent transition at the CEO position and the various market and operational challenges the business is facing, the company has suspended forward-looking guidance. Any and all previous guidance provided by the company should no longer be relied upon.

Conference Call

The company will conduct a conference call and webcast to review financial and operational highlights led by its President and Chief Executive Officer, Avi Avula, and Chief Financial Officer, Ronald L. G. Tsoumas, today at 10:00 a.m. CST.

To participate in the conference call, please dial 888-506-0062 (domestic) or 973-528-0011 (international) at least five minutes prior to the start of the event. A simultaneous webcast can be accessed through the company’s website, www.methode.com, on the Investors page.

A replay of the teleconference will be available shortly after the call through March 21, 2024, by dialing 877-481-4010 and providing passcode 49943. A webcast replay will also be available through the company’s website, www.methode.com, on the Investors page.

About Methode Electronics, Inc.

Methode Electronics, Inc. (NYSE: MEI) is a leading global supplier of custom-engineered solutions with sales, engineering and manufacturing locations in North America, Europe, Middle East and Asia. We design, engineer, and produce mechatronic products for OEMs utilizing our broad range of technologies for user interface, LED lighting system, power distribution and sensor applications.

Our solutions are found in the end markets of transportation (including automotive, commercial vehicle, e-bike, aerospace, bus, and rail), cloud computing infrastructure, construction equipment, and consumer appliance. Our business is managed on a segment basis, with those segments being Automotive, Industrial, and Interface.

Non-GAAP Financial Measures

To supplement the company's financial statements presented in accordance with generally accepted accounting principles in the United States (“GAAP”), Methode uses Adjusted Net Income (Loss), Adjusted Earnings (Loss) Per Share, Adjusted Pre-Tax Income (Loss), Adjusted Income (Loss) from Operations, EBITDA, Adjusted EBITDA, Net Debt and Free Cash Flow as non-GAAP measures. Reconciliation to the nearest GAAP measures of all non-GAAP measures included in this press release can be found at the end of this release. Methode's definitions of these non-GAAP measures may differ from similarly titled measures used by others. These non-GAAP measures should be considered supplemental to, and not a substitute for, financial information prepared in accordance with GAAP. The company believes that these non-GAAP measures are useful because they (i) provide both management and investors meaningful supplemental information regarding financial performance by excluding certain expenses and benefits that may not be indicative of recurring core business operating results, (ii) permit investors to view Methode's performance using the same tools that management uses to evaluate its past performance, reportable business segments and prospects for future performance (iii) are commonly used by other companies in our industry and provide a comparison for investors to the company’s performance versus its competitors and (iv) otherwise provide supplemental information that may be useful to investors in evaluating Methode.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect, when made, our current views with respect to current events and financial performance. Such forward-looking statements are subject to many risks, uncertainties and factors relating to our operations and business environment, which may cause our actual results to be materially different from any future results, expressed or implied, by such forward-looking statements. All statements that address future operating, financial or business performance or our strategies or expectations are forward-looking statements. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expects,” “plans,” “intends,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “potential,” “outlook,” “upcoming” or “continue,” and other comparable terminology. Factors that could cause actual results to differ materially from these forward-looking statements include, but are not limited to, the following:

•Dependence on our supply chain, including semiconductor suppliers;

•Impact from pandemics, such as the COVID-19 pandemic;

•Dependence on the automotive and commercial vehicle industries;

•Dependence on a small number of large customers, including one large automotive customer;

•Risks relating to our use of requirements contracts;

•Failure to attract and retain qualified personnel;

•Risks related to conducting global operations;

•Potential work stoppages;

•Dependence on the availability and price of materials;

•Timing, quality and cost of new program launches;

•Ability to compete effectively;

•Ability to withstand pricing pressures, including price reductions;

•Our lengthy sales cycle;

•Ability to successfully benefit from acquisitions and divestitures;

•Impact from production delays or cancelled orders;

•Investment in programs prior to the recognition of revenue;

•Electric vehicle ("EV") adoption rates;

•Ability to withstand business interruptions;

•Breaches to our information technology systems or service interruptions;

•Ability to keep pace with rapid technological changes;

•Ability to protect our intellectual property;

•Costs associated with environmental, health and safety regulations;

•International trade disputes resulting in tariffs and our ability to mitigate tariffs;

•Impact from climate change and related regulations;

•Ability to avoid design or manufacturing defects;

•Ability to remediate a material weakness in our internal control over financial reporting;

•Recognition of goodwill and other intangible asset impairment charges;

•Ability to manage our debt levels and comply with restrictions and covenants under our credit agreement;

•Interest rate changes and variable rate instruments;

•Adjustments to compensation expense for performance-based awards;

•Timing and magnitude of costs associated with restructuring activities;

•Income tax rate fluctuations; and

•Judgments related to accounting for tax positions.

Additional details and factors are discussed under the caption “Risk Factors” in our Annual Report. New risks and uncertainties arise from time to time, and it is impossible for us to predict these events or how they may affect us. Any forward-looking statements made by us speak only as of the date on which they are made. We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward-looking statements, whether as a result of new information, subsequent events or otherwise.

For Methode Electronics, Inc.

Robert K. Cherry

Vice President, Investor Relations

rcherry@methode.com

+1-708-457-4030

METHODE ELECTRONICS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME (unaudited)

(in millions, except per-share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

January 27, 2024 |

|

|

January 28, 2023 |

|

|

January 27, 2024 |

|

|

January 28, 2023 |

|

Net sales |

|

$ |

259.5 |

|

|

$ |

280.1 |

|

|

$ |

837.2 |

|

|

$ |

878.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of products sold |

|

|

222.5 |

|

|

|

215.2 |

|

|

|

693.9 |

|

|

|

677.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

37.0 |

|

|

|

64.9 |

|

|

|

143.3 |

|

|

|

200.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling and administrative expenses |

|

|

33.9 |

|

|

|

32.9 |

|

|

|

119.3 |

|

|

|

104.8 |

|

Goodwill impairment |

|

|

— |

|

|

|

— |

|

|

|

56.5 |

|

|

|

— |

|

Amortization of intangibles |

|

|

6.1 |

|

|

|

4.7 |

|

|

|

18.0 |

|

|

|

14.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income from operations |

|

|

(3.0 |

) |

|

|

27.3 |

|

|

|

(50.5 |

) |

|

|

81.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

5.0 |

|

|

|

0.8 |

|

|

|

12.2 |

|

|

|

1.3 |

|

Other expense (income), net |

|

|

2.5 |

|

|

|

3.5 |

|

|

|

2.3 |

|

|

|

(1.7 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-tax (loss) income |

|

|

(10.5 |

) |

|

|

23.0 |

|

|

|

(65.0 |

) |

|

|

82.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

|

1.1 |

|

|

|

3.1 |

|

|

|

1.0 |

|

|

|

13.3 |

|

Net (loss) income |

|

|

(11.6 |

) |

|

|

19.9 |

|

|

|

(66.0 |

) |

|

|

69.0 |

|

Net income attributable to redeemable noncontrolling interest |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income attributable to Methode |

|

$ |

(11.6 |

) |

|

$ |

19.9 |

|

|

$ |

(66.0 |

) |

|

$ |

69.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income per share attributable to Methode: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.33 |

) |

|

$ |

0.56 |

|

|

$ |

(1.86 |

) |

|

$ |

1.91 |

|

Diluted |

|

$ |

(0.33 |

) |

|

$ |

0.54 |

|

|

$ |

(1.86 |

) |

|

$ |

1.87 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends per share |

|

$ |

0.14 |

|

|

$ |

0.14 |

|

|

$ |

0.42 |

|

|

$ |

0.42 |

|

METHODE ELECTRONICS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (unaudited)

(in millions, except share and per-share data)

|

|

|

|

|

|

|

|

|

|

|

January 27, 2024 |

|

|

April 29, 2023 |

|

|

|

(unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

122.9 |

|

|

$ |

157.0 |

|

Accounts receivable, net |

|

|

265.3 |

|

|

|

314.3 |

|

Inventories |

|

|

204.0 |

|

|

|

159.7 |

|

Income tax receivable |

|

|

18.6 |

|

|

|

12.9 |

|

Prepaid expenses and other current assets |

|

|

19.0 |

|

|

|

20.5 |

|

Total current assets |

|

|

629.8 |

|

|

|

664.4 |

|

Long-term assets: |

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

232.5 |

|

|

|

220.3 |

|

Goodwill |

|

|

220.4 |

|

|

|

301.9 |

|

Other intangible assets, net |

|

|

264.3 |

|

|

|

256.7 |

|

Operating lease right-of-use assets, net |

|

|

25.9 |

|

|

|

28.4 |

|

Deferred tax assets |

|

|

36.1 |

|

|

|

33.6 |

|

Pre-production costs |

|

|

47.8 |

|

|

|

36.1 |

|

Other long-term assets |

|

|

34.7 |

|

|

|

37.7 |

|

Total long-term assets |

|

|

861.7 |

|

|

|

914.7 |

|

Total assets |

|

$ |

1,491.5 |

|

|

$ |

1,579.1 |

|

|

|

|

|

|

|

|

LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

146.0 |

|

|

$ |

138.7 |

|

Accrued employee liabilities |

|

|

31.6 |

|

|

|

36.7 |

|

Other accrued liabilities |

|

|

38.2 |

|

|

|

34.5 |

|

Short-term operating lease liabilities |

|

|

6.3 |

|

|

|

6.8 |

|

Short-term debt |

|

|

0.2 |

|

|

|

3.2 |

|

Income tax payable |

|

|

7.6 |

|

|

|

8.1 |

|

Total current liabilities |

|

|

229.9 |

|

|

|

228.0 |

|

Long-term liabilities: |

|

|

|

|

|

|

Long-term debt |

|

|

331.1 |

|

|

|

303.6 |

|

Long-term operating lease liabilities |

|

|

19.9 |

|

|

|

21.8 |

|

Long-term income tax payable |

|

|

9.3 |

|

|

|

16.7 |

|

Other long-term liabilities |

|

|

19.9 |

|

|

|

14.3 |

|

Deferred tax liabilities |

|

|

46.4 |

|

|

|

41.8 |

|

Total long-term liabilities |

|

|

426.6 |

|

|

|

398.2 |

|

Total liabilities |

|

|

656.5 |

|

|

|

626.2 |

|

Redeemable noncontrolling interest |

|

|

— |

|

|

|

11.1 |

|

Shareholders' equity: |

|

|

|

|

|

|

Common stock, $0.50 par value, 100,000,000 shares authorized, 36,825,124 shares and 37,167,375 shares issued as of January 27, 2024 and April 29, 2023, respectively |

|

|

18.4 |

|

|

|

18.6 |

|

Additional paid-in capital |

|

|

181.7 |

|

|

|

181.0 |

|

Accumulated other comprehensive loss |

|

|

(31.2 |

) |

|

|

(19.0 |

) |

Treasury stock, 1,346,624 shares as of January 27, 2024 and April 29, 2023 |

|

|

(11.5 |

) |

|

|

(11.5 |

) |

Retained earnings |

|

|

677.6 |

|

|

|

772.7 |

|

Total shareholders' equity |

|

|

835.0 |

|

|

|

941.8 |

|

Total liabilities, redeemable noncontrolling interest and shareholders' equity |

|

$ |

1,491.5 |

|

|

$ |

1,579.1 |

|

METHODE ELECTRONICS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

|

January 27, 2024 |

|

|

January 28, 2023 |

|

Operating activities: |

|

|

|

|

|

|

Net (loss) income |

|

$ |

(66.0 |

) |

|

$ |

69.0 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

43.3 |

|

|

|

36.8 |

|

Stock-based compensation expense |

|

|

1.8 |

|

|

|

9.4 |

|

Change in cash surrender value of life insurance |

|

|

(1.0 |

) |

|

|

0.2 |

|

Amortization of debt issuance costs |

|

|

0.5 |

|

|

|

0.6 |

|

Loss on sale of assets |

|

|

0.6 |

|

|

|

0.1 |

|

Impairment of long-lived assets |

|

|

0.7 |

|

|

|

0.4 |

|

Goodwill impairment |

|

|

56.5 |

|

|

|

— |

|

Change in deferred income taxes |

|

|

(4.0 |

) |

|

|

0.7 |

|

Other |

|

|

0.8 |

|

|

|

0.2 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

47.7 |

|

|

|

(19.7 |

) |

Inventories |

|

|

(47.1 |

) |

|

|

(16.2 |

) |

Prepaid expenses and other assets |

|

|

(8.8 |

) |

|

|

(17.3 |

) |

Accounts payable |

|

|

11.0 |

|

|

|

7.0 |

|

Other liabilities |

|

|

(13.4 |

) |

|

|

12.6 |

|

Net cash provided by operating activities |

|

|

22.6 |

|

|

|

83.8 |

|

|

|

|

|

|

|

|

Investing activities: |

|

|

|

|

|

|

Purchases of property, plant and equipment |

|

|

(41.1 |

) |

|

|

(30.8 |

) |

Proceeds from settlement of net investment hedge |

|

|

0.6 |

|

|

|

— |

|

Proceeds from disposition of assets |

|

|

1.5 |

|

|

|

3.5 |

|

Net cash used in investing activities |

|

|

(39.0 |

) |

|

|

(27.3 |

) |

|

|

|

|

|

|

|

Financing activities: |

|

|

|

|

|

|

Taxes paid related to net share settlement of equity awards |

|

|

(3.8 |

) |

|

|

(0.5 |

) |

Repayments of finance leases |

|

|

(0.2 |

) |

|

|

(0.3 |

) |

Proceeds from exercise of stock options |

|

|

— |

|

|

|

1.5 |

|

Purchases of common stock |

|

|

(10.8 |

) |

|

|

(39.6 |

) |

Cash dividends |

|

|

(15.0 |

) |

|

|

(14.9 |

) |

Debt issuance costs |

|

|

— |

|

|

|

(3.2 |

) |

Purchase of redeemable noncontrolling interest |

|

|

(10.9 |

) |

|

|

— |

|

Proceeds from borrowings |

|

|

232.9 |

|

|

|

200.0 |

|

Repayments of borrowings |

|

|

(207.2 |

) |

|

|

(206.6 |

) |

Net cash used in financing activities |

|

|

(15.0 |

) |

|

|

(63.6 |

) |

Effect of foreign currency exchange rate changes on cash and cash equivalents |

|

|

(2.7 |

) |

|

|

(0.2 |

) |

Decrease in cash and cash equivalents |

|

|

(34.1 |

) |

|

|

(7.3 |

) |

Cash and cash equivalents at beginning of the period |

|

|

157.0 |

|

|

|

172.0 |

|

Cash and cash equivalents at end of the period |

|

$ |

122.9 |

|

|

$ |

164.7 |

|

|

|

|

|

|

|

|

Supplemental cash flow information: |

|

|

|

|

|

|

Cash paid during the period for: |

|

|

|

|

|

|

Interest |

|

$ |

12.7 |

|

|

$ |

3.0 |

|

Income taxes, net of refunds |

|

$ |

17.0 |

|

|

$ |

15.4 |

|

Operating lease obligations |

|

$ |

6.9 |

|

|

$ |

6.5 |

|

METHODE ELECTRONICS, INC. AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP MEASURES (Unaudited)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

January 27, 2024 |

|

|

January 28, 2023 |

|

|

January 27, 2024 |

|

|

January 28, 2023 |

|

EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(11.6 |

) |

|

$ |

19.9 |

|

|

$ |

(66.0 |

) |

|

$ |

69.0 |

|

Income tax expense |

|

|

1.1 |

|

|

|

3.1 |

|

|

|

1.0 |

|

|

|

13.3 |

|

Interest expense, net |

|

|

5.0 |

|

|

|

0.8 |

|

|

|

12.2 |

|

|

|

1.3 |

|

Amortization of intangibles |

|

|

6.1 |

|

|

|

4.7 |

|

|

|

18.0 |

|

|

|

14.1 |

|

Depreciation |

|

|

8.8 |

|

|

|

7.6 |

|

|

|

25.3 |

|

|

|

22.7 |

|

EBITDA |

|

|

9.4 |

|

|

|

36.1 |

|

|

|

(9.5 |

) |

|

|

120.4 |

|

Goodwill impairment |

|

|

— |

|

|

|

— |

|

|

|

56.5 |

|

|

|

— |

|

Acquisition costs |

|

|

— |

|

|

|

— |

|

|

|

0.5 |

|

|

|

— |

|

Acquisition-related costs - purchase accounting adjustments related to inventory |

|

|

— |

|

|

|

— |

|

|

|

0.5 |

|

|

|

— |

|

Restructuring costs |

|

|

0.1 |

|

|

|

— |

|

|

|

1.4 |

|

|

|

0.6 |

|

Loss on sale of Dabir assets |

|

|

— |

|

|

|

— |

|

|

|

0.6 |

|

|

|

— |

|

Adjusted EBITDA |

|

$ |

9.5 |

|

|

$ |

36.1 |

|

|

$ |

50.0 |

|

|

$ |

121.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

January 27, 2024 |

|

|

January 28, 2023 |

|

|

January 27, 2024 |

|

|

January 28, 2023 |

|

Free Cash Flow: |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

$ |

28.8 |

|

|

$ |

55.7 |

|

|

$ |

22.6 |

|

|

$ |

83.8 |

|

Purchases of property, plant and equipment |

|

|

(16.6 |

) |

|

|

(12.8 |

) |

|

|

(41.1 |

) |

|

|

(30.8 |

) |

Free cash flow |

|

$ |

12.2 |

|

|

$ |

42.9 |

|

|

$ |

(18.5 |

) |

|

$ |

53.0 |

|

|

|

|

|

|

|

|

|

|

|

|

January 27, 2024 |

|

|

April 29, 2023 |

|

Net Debt: |

|

|

|

|

|

|

Short-term debt |

|

$ |

0.2 |

|

|

$ |

3.2 |

|

Long-term debt |

|

|

331.1 |

|

|

|

303.6 |

|

Total debt |

|

|

331.3 |

|

|

|

306.8 |

|

Less: cash and cash equivalents |

|

|

(122.9 |

) |

|

|

(157.0 |

) |

Net debt |

|

$ |

208.4 |

|

|

$ |

149.8 |

|

METHODE ELECTRONICS, INC. AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP MEASURES (Unaudited)

(in millions, except per share data)

Reconciliation of Non-GAAP Financial Measures for the Three Months Ended January 27, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. GAAP

(as reported) |

|

|

Goodwill

impairment |

|

|

Acquisition

costs |

|

|

Purchase accounting adjustments related to inventory |

|

|

Restructuring

costs |

|

|

Loss on sale of

Dabir assets |

|

|

Non-U.S.

GAAP |

|

(Loss) income from operations |

|

$ |

(3.0 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.1 |

|

|

$ |

— |

|

|

$ |

(2.9 |

) |

Pre-tax (loss) income |

|

$ |

(10.5 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.1 |

|

|

$ |

— |

|

|

$ |

(10.4 |

) |

Net (loss) income |

|

$ |

(11.6 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.1 |

|

|

$ |

— |

|

|

$ |

(11.5 |

) |

Diluted (loss) income per share |

|

$ |

(0.33 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

(0.33 |

) |

Reconciliation of Non-GAAP Financial Measures for the Three Months Ended January 28, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. GAAP

(as reported) |

|

|

Goodwill

impairment |

|

|

Acquisition

costs |

|

|

Purchase accounting adjustments related to inventory |

|

|

Restructuring

costs |

|

|

Loss on sale of

Dabir assets |

|

|

Non-U.S.

GAAP |

|

Income from operations |

|

$ |

27.3 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

27.3 |

|

Pre-tax income |

|

$ |

23.0 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

23.0 |

|

Net income |

|

$ |

19.9 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

19.9 |

|

Diluted income per share |

|

$ |

0.54 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.54 |

|

Reconciliation of Non-GAAP Financial Measures for the Nine Months Ended January 27, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. GAAP

(as reported) |

|

|

Goodwill

impairment |

|

|

Acquisition

costs |

|

|

Purchase accounting adjustments related to inventory |

|

|

Restructuring

costs |

|

|

Loss on sale of

Dabir assets |

|

|

Non-U.S.

GAAP |

|

(Loss) income from operations |

|

$ |

(50.5 |

) |

|

$ |

56.5 |

|

|

$ |

0.5 |

|

|

$ |

0.5 |

|

|

$ |

1.4 |

|

|

$ |

— |

|

|

$ |

8.4 |

|

Pre-tax (loss) income |

|

$ |

(65.0 |

) |

|

$ |

56.5 |

|

|

$ |

0.5 |

|

|

$ |

0.5 |

|

|

$ |

1.4 |

|

|

$ |

0.6 |

|

|

$ |

(5.5 |

) |

Net (loss) income |

|

$ |

(66.0 |

) |

|

$ |

56.5 |

|

|

$ |

0.4 |

|

|

$ |

0.4 |

|

|

$ |

1.1 |

|

|

$ |

0.5 |

|

|

$ |

(7.1 |

) |

Diluted (loss) income per share |

|

$ |

(1.86 |

) |

|

$ |

1.59 |

|

|

$ |

0.01 |

|

|

$ |

0.01 |

|

|

$ |

0.03 |

|

|

$ |

0.01 |

|

|

$ |

(0.21 |

) |

Reconciliation of Non-GAAP Financial Measures for the Nine Months Ended January 28, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. GAAP

(as reported) |

|

|

Goodwill

impairment |

|

|

Acquisition

costs |

|

|

Purchase accounting adjustments related to inventory |

|

|

Restructuring

costs |

|

|

Loss on sale of

Dabir assets |

|

|

Non-U.S.

GAAP |

|

Income from operations |

|

$ |

81.9 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.6 |

|

|

$ |

— |

|

|

$ |

82.5 |

|

Pre-tax income |

|

$ |

82.3 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.6 |

|

|

$ |

— |

|

|

$ |

82.9 |

|

Net income |

|

$ |

69.0 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.5 |

|

|

$ |

— |

|

|

$ |

69.5 |

|

Diluted income per share |

|

$ |

1.87 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.01 |

|

|

$ |

— |

|

|

$ |

1.88 |

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details