0001494650false00014946502024-03-072024-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________________________

FORM 8-K

____________________________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 7, 2024

__________________________________________________________________________________________

OPTINOSE, INC.

(Exact Name of Registrant as Specified in its Charter)

____________________________________________________________________________________________ | | | | | | | | |

| Delaware | 001-38241 | 42-1771610 |

| (State or Other Jurisdiction of Incorporation or Organization) | (Commission File No.) | (I.R.S. Employer Identification No.) |

1020 Stony Hill Road, Suite 300

Yardley, Pennsylvania 19067

(Address of principal executive offices and zip code)

(267) 364-3500

(Registrant’s telephone number, including area code)

(Former name or former address, if changed from last report)

____________________________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-14(c)) |

| |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| |

| ☐ | Emerging growth company |

| |

| ☐ | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | | OPTN | | Nasdaq Global Select Market |

Item 2.02 Results of Operations and Financial Condition.

On March 7, 2024, OptiNose, Inc. (the “Company”) issued a press release announcing its financial results for the quarter and year ended December 31, 2023. A copy of the press release is attached as Exhibit 99.1 to this report and is incorporated herein by reference.

* * *

The information included in Item 2.02 (including Exhibit 99.1) of this Form 8-K, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any Company filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

On March 7, 2024, the Company will present an updated Corporate Presentation during its financial results and corporate updates call. A copy of the presentation is attached as Exhibit 99.2 to this report and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | |

|

| | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

|

| | |

| | | |

| | | OptiNose, Inc. |

| | By: /s/ Anthony Krick |

| | | Anthony Krick |

| | | Chief Accounting Officer |

Date: March 7, 2024

Optinose Reports Fourth Quarter and Full Year 2023 Financial Results

and Recent Operational Highlights

PDUFA target action date is March 16, 2024, for the Company's sNDA. If approved, the Company is prepared for launch of XHANCE for treatment of patients diagnosed with chronic sinusitis

Physicians diagnose chronic sinusitis 10 times more frequently than XHANCE’s current nasal polyps indication and there is no FDA-approved medication for these patients

Company reports fourth quarter and full year 2023 XHANCE net revenue of $19.9 million and $71.0 million

Conference call and webcast to be held today at 8:00 a.m. Eastern Time

YARDLEY, Pa., March 7, 2024 Optinose (NASDAQ:OPTN), a pharmaceutical company focused on patients treated by ear, nose and throat (ENT) and allergy specialists, today reported financial results for the quarter and year ended December 31, 2023, and provided recent operational highlights.

"Our first strategic focus for 2023 was working to secure the first-ever approval of a medication for patients with chronic sinusitis," stated CEO Ramy Mahmoud, MD, MPH. "Our regulatory and clinical teams have been responsive and timely during FDA's review as the agency works towards a target action date of March 16. In addition, during 2023 we worked hard to prepare our organization to make the most of the new opportunity. We revised operations in a variety of ways to better support a 2024 launch while also successfully increasing the efficiency of our business, as evidenced by XHANCE net revenues and operating expenses that both beat our initial expectations for full year 2023. With the target FDA action date in a matter of days, I am confident that we are prepared, if approved, to rapidly make the product available to millions of patients in need, starting in our specialty physician audience."

Fourth Quarter 2023 and Recent Highlights

Chronic Sinusitis Supplemental New Drug Application (sNDA)

In May 2023, the Company announced that the U.S. Food and Drug Administration (FDA) accepted its sNDA for

XHANCE® (fluticasone propionate) in the Exhalation Delivery System™ seeking a new indication for treatment

of adults with chronic rhinosinusitis (commonly referred to as, chronic sinusitis). The assigned Prescription Drug User Fee Act (PDUFA) goal date is March 16, 2024.

Publication of ReOpen Clinical Program Results

In January 2024, the Company announced the publication of peer-reviewed data from the landmark ReOpen program evaluating the efficacy and safety of XHANCE in adult patients with chronic sinusitis in the Journal of Allergy and Clinical Immunology: In Practice. As detailed in the publication, both trials showed statistically significant improvement in symptoms, in inflammation inside the sinuses, and in the number of acute disease exacerbations that occurred in patients treated with XHANCE compared to patients receiving a vehicle combined with the Exhalation Delivery System (EDS-placebo).

Fourth Quarter and Full Year 2023 Financial Results

Revenue

The Company reported $19.9 million in net revenue from sales of XHANCE during the three-month period ended December 31, 2023, a decrease of 5% compared to $20.9 million during the three-month period ended December 31, 2022. This decrease was primarily driven by a decrease in shipments. For the twelve-month period ended December 31, 2023, the Company reported $71.0 million in net revenue from sales of XHANCE, a decrease of 7% compared to $76.3 million during the twelve-month period ended December 31, 2022.

Costs and Expenses and net (loss) income

For the three-month and twelve-month periods ended December 31, 2023, research and development expenses were $1.3 million and $5.3 million, respectively. Selling, general and administrative expenses were $19.0 million and $79.8 million during the three-month and twelve-month periods ended December 31, 2023, respectively. In total, SG&A plus R&D expenses decreased by $37.8 million, or 31%, to $85.1 million for the twelve-month period ended December 31, 2023 when compared to the twelve-month period ended December 31, 2022 total of $122.9 million.

The net loss for the three-month period ended December 31, 2023 was $10.0 million, or $0.09 per share (basic and diluted). The net loss for the twelve-month period ended December 31, 2023 was $35.5 million, or $0.32 per share (basic and diluted).

Balance Sheet

The Company had cash and cash equivalents of $73.7 million as of December 31, 2023.

Corporate Guidance

First Quarter 2024 XHANCE Net Revenue

The Company expects XHANCE net revenues for the first quarter 2024 will be approximately $13.0 million.

Full Year 2024 XHANCE Net Revenue Average Net Revenue per Prescription

The Company expects XHANCE average net revenue per prescription will be approximately $220 for full year 2024.

Company to Host Conference Call

Members of the Company’s leadership team will host a conference call and presentation to discuss financial results and corporate updates beginning at 8:00 a.m. Eastern Time today.

Participants may access the conference call live via webcast by visiting the Investors section of Optinose’s website at http://ir.optinose.com/presentations. To participate via telephone, please register in advance at this link. Upon registration, all telephone participants will receive a confirmation email detailing how to join the conference call, including the dial-in number and a personal PIN that can be used to access the call. In addition, a replay of the webcast will be available on the Company website for 60 days following the event.

| | | | | | | | | | | | | | | | | | | | | | | |

| OptiNose, Inc. |

| Condensed Consolidated Statement of Operations |

| (in thousands, except share and per share data) |

| (Unaudited) |

| | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, | | December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

| Net product revenues | $ | 19,865 | | | $ | 20,856 | | | $ | 70,987 | | | $ | 76,276 | |

| | | | | | | |

| Total revenues | 19,865 | | | 20,856 | | | 70,987 | | | 76,276 | |

| Costs and expenses: | | | | | | | |

| Cost of product sales | 2,131 | | | 2,981 | | | 8,633 | | | 9,263 | |

| Research and development | 1,286 | | | 2,921 | | | 5,303 | | | 15,260 | |

| Selling, general and administrative | 18,960 | | | 23,310 | | | 79,799 | | | 107,649 | |

| Total costs and expenses | 22,377 | | | 29,212 | | | 93,735 | | | 132,172 | |

| Loss from operations | (2,512) | | | (8,356) | | | (22,748) | | | (55,896) | |

| Other expense | 7,455 | | | 6,793 | | | 12,735 | | | 18,937 | |

| Net loss | $ | (9,967) | | | $ | (15,149) | | | $ | (35,483) | | | $ | (74,833) | |

| Net loss per share of common stock, basic and diluted | $ | (0.09) | | | $ | (0.17) | | | $ | (0.32) | | | $ | (0.87) | |

| Weighted average common shares outstanding, basic and diluted | 112,311,983 | | | 9,496,091 | | | 112,080,062 | | | 85,900,139 | |

| | | | | | | | | | | | | | |

| OptiNose, Inc. |

| Condensed Consolidated Balance Sheet Data |

| (in thousands) |

| | | | |

| | December 31, | | December 31, |

| | 2023 | | 2022 |

| | | | |

| Cash and cash equivalents | | $ | 73,684 | | | $ | 94,244 | |

| Other assets | | 34,045 | | | 49,978 | |

| Total assets | | $ | 107,729 | | | $ | 144,222 | |

| | | | |

Total current liabilities (1) | | 176,524 | | | $ | 178,729 | |

| | | | |

| Other liabilities | | 17,811 | | | 22,116 | |

| Total stockholders' equity | | (86,606) | | | (56,623) | |

| Total liabilities and stockholders' equity | | $ | 107,729 | | | $ | 144,222 | |

| | | | |

| (1) – All outstanding principal and fees payable upon maturity have been classified as a current liability in accordance with Generally Accepted Accounting Principles ("GAAP") because, as of the date hereof, the Company believes that it is probable that it will not be able to maintain compliance with certain covenants contained in its Amended and Restated Note Purchase Agreement for at least the next 12-months. As a result, the Company's audited financial statements for the year ended December 31, 2023 (“2023 Audited Financial Statements”) will state that there is substantial doubt about the Company's ability to continue as a going concern (i.e., a "going concern" paragraph). Please refer to the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (including the 2023 Audited Financial Statements) which will be filed after the issuance of this press release for additional information. |

About Optinose

Optinose is a specialty pharmaceutical company focused on serving the needs of patients cared for by ear, nose and throat (ENT) and allergy specialists. To learn more, please visit www.optinose.com or follow us on Twitter and LinkedIn.

About XHANCE

XHANCE is a drug-device combination product that uses the Exhalation Delivery System (also referred to as the EDS) designed to deliver a topical anti-inflammatory to the high and deep regions of the sinonasal cavity, including sinuses and sinus drainage tracts where sinuses ventilate and drain. XHANCE is approved by the U.S. Food and Drug Administration for the treatment of chronic rhinosinusitis with nasal polyps in patients 18 years of age or older and has been studied for treatment of chronic sinusitis (notably including patients without polyps in the nasal cavity) in two phase 3 trials, ReOpen1 and ReOpen2. Results from these trials are the first ever that we are aware of that show improvement in both symptoms and inflammation inside the sinuses, and reduction in acute exacerbations of disease, with a nasal therapy for chronic sinusitis patients, including patients with or without nasal polyps. If approved, XHANCE may be the first drug ever FDA-approved for treatment of chronic rhinosinusitis either with or without nasal polyps.

Important Safety Information

CONTRAINDICATIONS: Hypersensitivity to any ingredient in XHANCE.

WARNINGS AND PRECAUTIONS:

•Local Nasal Adverse Reactions: epistaxis, erosion, ulceration, septal perforation, Candida albicans infection, and impaired wound healing. Monitor patients periodically for signs of possible changes on the nasal mucosa. Avoid use in patients with recent nasal ulcerations, nasal surgery, or nasal trauma until healing has occurred.

•Close monitoring for glaucoma and cataracts is warranted.

•Hypersensitivity reactions (e.g., anaphylaxis, angioedema, urticaria, contact dermatitis, rash, hypotension, and bronchospasm) have been reported after administration of fluticasone propionate. Discontinue XHANCE if such reactions occur.

•Immunosuppression and Risk of Infection: potential increased susceptibility to or worsening of infections (e.g., existing tuberculosis; fungal, bacterial, viral, or parasitic infection; ocular herpes simplex). Use with caution in patients with these infections. More serious or even fatal course of chickenpox or measles can occur in susceptible patients.

•Hypercorticism and adrenal suppression may occur with very high dosages or at the regular dosage in susceptible individuals. If such changes occur, discontinue XHANCE slowly.

•Patients with major risk factors for decreased bone mineral content should be monitored and treated with established standards of care.

ADVERSE REACTIONS: The most common adverse reactions (incidence ≥ 3%) are epistaxis, nasal septal ulceration, nasopharyngitis, nasal mucosal erythema, nasal mucosal ulcerations, nasal congestion, acute sinusitis, nasal septal erythema, headache, and pharyngitis.

DRUG INTERACTIONS: Strong cytochrome P450 3A4 inhibitors (e.g., ritonavir, ketoconazole): Use not recommended. May increase risk of systemic corticosteroid effects.

USE IN SPECIFIC POPULATIONS: Hepatic impairment. Monitor patients for signs of increased drug exposure.

Please see full Prescribing Information, including Instructions for Use

Cautionary Note on Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. All statements that are not historical facts are hereby identified as forward-looking statements for this purpose and include, among others, statements relating to the potential benefits of XHANCE for the treatment of chronic sinusitis (also referred to as "chronic rhinosinusitis" and "chronic rhinosinusitis without nasal polyps"); the potential for XHANCE to be the first FDA-approved drug treatment for chronic sinusitis and the potential benefits thereof; objectives and preparations to launch XHANCE, if approved, for the treatment of chronic sinusitis; potential for an FDA action on the sNDA on or about March 16, 2024; projected average net revenue per prescription for full year 2024; projected XHANCE net revenue for first quarter 2024; potential non-compliance with certain covenants under the Amended and Restated Pharmakon Note Purchase Agreement and the consequences thereof; and other statements regarding the Company's future operations, financial performance, financial position, prospects, objectives, strategies and other future events. Forward-looking statements are based upon management’s current expectations and assumptions and are subject to a number of risks, uncertainties and other factors that could cause actual results and events to differ materially and adversely from those indicated by such forward-looking statements including, among others: physician and patient acceptance of XHANCE for its current and any potential future indication; the Company’s ability to maintain adequate third-party reimbursement for XHANCE (market access) including any future indication; the prevalence of chronic sinusitis and market opportunities for XHANCE may be smaller than expected; the Company’s ability to efficiently generate XHANCE prescriptions and net revenues; the Company's ability to achieve its financial guidance; potential for varying interpretation of the results from the ReOpen program; uncertainties related to the clinical development program and regulatory approval of XHANCE for the treatment of chronic sinusitis; the Company’s ability to comply with the covenants and other terms of the Amended and Restated Pharmakon Note Purchase Agreement; the Company's ability to continue as a going concern; risks and uncertainties relating to intellectual property; and the risks, uncertainties and other factors discussed under the caption "Item 1A. Risk Factors" and elsewhere in the Company’s most recent Form 10-K and Form 10-Q filings with the Securities and Exchange Commission (including the Form 10-K which will be filed on March 7, 2024 after the issuance of this press release) - which are available at www.sec.gov. As a result, you are cautioned not to place undue reliance on any forward-looking statements. Any forward-looking statements made in this press release speak only as of the date of this press release, and the Company undertakes no obligation to update such forward-looking statements, whether as a result of new information, future developments or otherwise.

Optinose Investor Contact

Jonathan Neely

jonathan.neely@optinose.com

267.521.0531

###

Building a Leading ENT / Allergy Specialty Company C o r p o r a t e P r e s e n t a t i o n M a r c h 7 , 2 0 2 4 Exhibit 99.2

2 Forward-Looking Statements This presentation and our accompanying remarks contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. All statements that are not historical facts are hereby identified as forward-looking statements for this purpose and include, among others, statements relating to: the generation of XHANCE prescriptions and net revenues and factors impacting the generation of future prescriptions and net revenues; prescription, net revenue, prescriber and other business trends; potential effects of INS market seasonality on XHANCE prescriptions; potential early year effects on price and volume related to patient insurance; impact of payor utilization management criteria; commercial strategies; projected XHANCE net revenues for first quarter of 2024; projected XHANCE average net revenue per prescription for full year 2024; impact of changes to XHANCE co-pay assistance program; the potential benefits of XHANCE for the treatment of chronic sinusitis; the potential for an FDA action on the sNDA in March 2024; the potential for XHANCE to be the first FDA-approved drug treatment for chronic sinusitis and the potential market expansion and growth opportunities and other benefits of obtaining such indication; our plan to seek a partner to promote XHANCE in primary care and the prospects for, and potential benefits of, such potential partnership; potential non-compliance with certain covenants under the A&R Pharmakon Note Purchase Agreement and the potential consequences thereof; and other statements regarding to our future operations, financial performance, prospects, intentions, strategies, objectives and other future events. Forward-looking statements are based upon management’s current expectations and assumptions and are subject to a number of risks, uncertainties and other factors that could cause actual results and events to differ materially and adversely from those indicated by such forward-looking statements including, among others: impact of, and the uncertainties caused by, physician and patient acceptance of XHANCE for its current and any potential future indication; our ability to maintain adequate third party reimbursement for XHANCE (market access) including any potential future indication; our ability to efficiently generate XHANCE prescriptions and net revenues; the prevalence of chronic sinusitis and market opportunities for XHANCE may be smaller than expected; unexpected costs and expenses; our ability to achieve our financial guidance; potential for varying interpretation of the results from the ReOpen Program; uncertainties related to the clinical development program and regulatory approval of XHANCE for the treatment of chronic sinusitis; our ability to comply with the covenants and other terms of the A&R Pharmakon Note Purchase Agreement; our ability to continue as a going concern; risks and uncertainties relating to intellectual property; and the risks, uncertainties and other factors discussed in the “Risk Factors” section and elsewhere in our most recent Form 10-K and Form 10-Q filings with the Securities and Exchange Commission (SEC) (including our Form 10-K to be filed with the SEC on March 7, 2024) – which are available at http://www.sec.gov. As a result, you are cautioned not to place undue reliance on any forward-looking statements. Any forward-looking statements made in this presentation speak only as of the date of this presentation, and we undertake no obligation to update such forward-looking statements, whether as a result of new information, future developments or otherwise.

3 Key Takeaways Chronic sinusitis is a 10-fold market opportunity for XHANCE Successfully executed our 2023 strategy to prioritize the potential launch of XHANCE as the first-ever FDA approved drug treatment for CS sNDA target action date next week (March 16, 2024) Return to strong growth in 2024, if sNDA approved $74M Cash and equivalents as of Dec. 31, 2023 $71M FY 2023 XHANCE Net Revenues $38M FY 2023 Operating Expense Reduction $209 FY 2023 XHANCE Net Revenue per Prescription

4 Successful Development of XHANCE as the First FDA-approved Drug Treatment for Chronic Sinusitis Creates Multiple New Opportunities for Growth Up to ~1 Million patients with nasal polyps (NP) are treated by specialty physicians in our current sales deployment $1B TAM $3B TAM Up to ~10 Million patients with either NP (~3M) or CS (~7M) are treated by a specialty or PCP physician annually $10B TAM Today With a CS Indication Up to ~3 Million patients with either NP or CS are treated by specialty physicians in our current sales deployment For a Partner, there are 6 to 7 million NP+CS patients currently treated by a Primary Care Physician plus 20 million lapsed patients that could be activated into care

ReOpen Program Update

6 ReOpen Clinical Program – Anticipated Next Steps and Recent Highlights PDUFA target action date is March 16, 2024 ReOpen Program results published January 18 in The Journal of Allergy and Clinical Immunology: In Practice – Efficacy of EDS-FLU for Chronic Rhinosinusitis: Two Randomized Controlled Trials (ReOpen1 and ReOpen2) (1) Insert full citation

Q4 and Full Year 2023 Performance

8 2023 Company Strategy For 2023, we focused on increasing business efficiency, maintaining profitable prescription volume and revenue, while preserving resources and capabilities needed in 2024 to launch the new Chronic Sinusitis indication into our ENT/Allergy specialist audience: ‒ Reduced both commercial and non-commercial operating expenses by a total of ~$38M, or more than 30%, compared to FY 2022; of which $28 million was SG&A ‒ Completed analyses that enabled January 2024 optimization of sales force alignment and distribution strategy to support new opportunity ‒ We made changes in the second half of 2023 to our co-pay assistance program intended to reduce the number and proportion of unprofitable prescriptions ‒ Changes to copay programs had the intended effect of producing better than expected XHANCE net revenues in Q4 2023, including an increased average net revenue per prescription

9 XHANCE Prescriptions – Fourth Quarter 2023 Changes to co-pay assistance reduced the number of unprofitable new and total prescriptions XHANCE New Prescriptions decreased 10% and Total Prescriptions decreased 14% 29.5 26.5 Q4 '22 Q4 '23 (in thousands) XHANCE New Prescriptions 92.5 79.5 Q4 '22 Q4 '23 XHANCE Total Prescriptions (in thousands) Estimated based on monthly prescription and inventory data from third parties and XHANCE preferred pharmacy network. 2022 data updated to reflect current prescription estimation methodology. Previously estimated 27,700 new prescriptions, 86,200 total prescriptions.

10 XHANCE Prescriptions – Full Year 2023 XHANCE New Prescriptions decreased 2% and Total Prescriptions decreased 3% 117.6 115.3 Full Year 2022 Full Year 2023 (in thousands) XHANCE New Prescriptions 351.0 339.4 Full Year 2022 Full Year 2023 XHANCE Total Prescriptions (in thousands) Estimated based on monthly prescription and inventory data from third parties and XHANCE preferred pharmacy network. 2022 data updated to reflect current prescription estimation methodology. Previously estimated 113,100 new prescriptions and 341,000 total prescriptions.

Q4 and Full Year 2023 Financial Update

12 Financial Review – Fourth Quarter 2023 Changes to co-pay assistance drove an 11% increase in revenue per prescription SG&A plus R&D expenses decreased by ~$6 million from Q4 2022 to Q4 2023 and Q4 2023 XHANCE Net Revenues of $19.9 million exceed financial guidance $26.2 $20.2 Q4 '22 Q4 '23 ($M) SG&A plus R&D Expenses $20.9 $19.9 Q4 '22 Q4 '23 ($M) Net Revenue Average Net Revenue per TRx $226 $250 Q4 '22 Q4 '23

13 Financial Review – Full Year 2023 Execution of our 2023 strategy yielded a more efficient business that outperformed guidance Full Year 2023 SG&A plus R&D expenses decreased by ~$38 million (31%) compared to FY 2022 XHANCE Net Revenues of $71.0 million exceeded financial guidance $122.9 $85.1 Full Year 2022 Full Year 2023 ($M) SG&A plus R&D Expenses $76.3 $71.0 Full Year 2022 Full Year 2023 ($M) Net Revenue Average Net Revenue per TRx $217 $209 Full Year 2022 Full Year 2023

2024 Outlook

15 Q1 and Full Year 2024 Financial Guidance XHANCE Net Revenue ‒ Q1 2024 expected to be approximately ~$13 million XHANCE Average Net Revenue per Prescription ‒ FY 2024 expected to be approximately $220

Closing Remarks

17 Key Takeaways Chronic sinusitis is a 10-fold market opportunity for XHANCE Successfully executed our 2023 strategy to prioritize the potential launch of XHANCE as the first-ever FDA approved drug treatment for CS sNDA target action date next week (March 16, 2024) Return to strong growth in 2024, if sNDA approved $74M Cash and equivalents as of Dec. 31, 2023 $71M FY 2023 XHANCE Net Revenues $38M FY 2023 Operating Expense Reduction $209 FY 2023 XHANCE Net Revenue per Prescription

18 Investor Relations – NASDAQ: OPTN Optinose Investor Contact Jonathan Neely, VP, Investor Relations and Business Development 267-521-0531 Investors@optinose.com As of December 31, 2023: – $73.7 million in cash – Debt: $130 million – 112 million common shares o/s – 46 million options, warrants & RSUs o/s 1 - Optinose is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding the Company’s performance made by these analysts are theirs alone and do not represent opinions, forecasts or predictions of Optinose or its management. Optinose does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations. investors@optinose.com www.optinose.com @optinose Analyst Coverage 1 Jefferies: Glen Santangelo Lake Street: Thomas Flaten Piper Sandler: David Amsellem

Building a Leading ENT / Allergy Specialty Company C o r p o r a t e P r e s e n t a t i o n M a r c h 7 , 2 0 2 4

v3.24.0.1

Cover

|

Mar. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 07, 2024

|

| Entity Registrant Name |

OPTINOSE, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38241

|

| Entity Tax Identification Number |

42-1771610

|

| Entity Address, Address Line One |

1020 Stony Hill Road

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Yardley

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19067

|

| City Area Code |

267

|

| Local Phone Number |

364-3500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

OPTN

|

| Security Exchange Name |

NASDAQ

|

| Entity Central Index Key |

0001494650

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

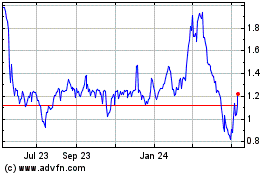

OptiNose (NASDAQ:OPTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

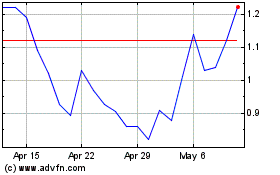

OptiNose (NASDAQ:OPTN)

Historical Stock Chart

From Apr 2023 to Apr 2024