0001593034false00015930342024-03-062024-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________

FORM 8-K

_______________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): March 6, 2024

_______________________________

Endo International plc

(Exact name of registrant as specified in its charter)

_______________________________

| | | | | | | | |

Ireland | 001-36326 | 68-0683755 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

First Floor, Minerva House, Simmonscourt Road | |

Ballsbridge, Dublin 4, | Ireland | Not Applicable |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code 011-353-1-268-2000

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None (1)

| | | | | | | | | | | |

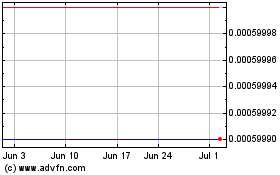

| (1) | On August 26, 2022, Endo International plc’s ordinary shares, which previously traded on the Nasdaq Global Select Market under the symbol ENDP, began trading exclusively on the over-the-counter market under the symbol ENDPQ. On September 14, 2022, Nasdaq filed a Form 25-NSE with the United States Securities and Exchange Commission and Endo International plc’s ordinary shares were subsequently delisted from the Nasdaq Global Select Market. On December 13, 2022, Endo International plc’s ordinary shares were deregistered under Section 12(b) of the Securities Exchange Act of 1934, as amended. |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On March 6, 2024, Endo International plc (the “Company,” “Endo,” or “we”) issued an earnings release announcing its financial results for the three and twelve months ended December 31, 2023 and 2022 (the “Earnings Release”). A copy of the Earnings Release is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

The Company utilizes certain financial measures that are not prescribed by or prepared in accordance with accounting principles generally accepted in the U.S. (“GAAP”). The Company utilizes these financial measures, commonly referred to as “non-GAAP,” as supplements to financial measures determined in accordance with GAAP when evaluating the Company’s operating performance and the Company believes that they will be used by certain investors to measure the Company’s operating results. The Company believes that presenting these non-GAAP financial measures provides useful information about the Company’s performance across reporting periods on a consistent basis by excluding certain items, which may be favorable or unfavorable, pursuant to the procedure described in the succeeding paragraph.

The initial identification and review of the adjustments necessary to arrive at these non-GAAP financial measures are performed by a team of finance professionals that include the Chief Accounting Officer and segment finance leaders in accordance with the Company’s Adjusted Income Statement Policy, which is reviewed and approved annually by the Audit & Finance Committee of the Company’s Board of Directors. Company tax professionals review and determine the tax effect of adjusted pre-tax income at applicable tax rates and other tax adjustments as described below. Proposed adjustments, along with any items considered but excluded, are presented to the Chief Accounting Officer, Chief Executive Officer and/or the Chief Financial Officer for their consideration. In turn, the non-GAAP adjustments are presented to the Audit & Finance Committee on a quarterly basis as part of the Company’s standard procedures for preparation and review of the earnings release and other quarterly materials.

These non-GAAP financial measures should be considered supplemental to and not a substitute for financial information prepared in accordance with GAAP. The Company’s definition of these non-GAAP financial measures may differ from similarly titled measures used by others. The definitions of the most commonly used non-GAAP financial measures are presented below.

Adjusted income from continuing operations

Adjusted income from continuing operations represents Loss from continuing operations prepared in accordance with GAAP and adjusted for certain items. Adjustments to GAAP amounts may include, but are not limited to, acquisition-related and integration items, including transaction costs and changes in the fair value of contingent consideration; cost reduction and integration-related initiatives such as separation benefits, continuity payments, other exit costs and certain costs associated with integrating an acquired company’s operations; certain amounts related to strategic review initiatives; asset impairment charges; amortization of intangible assets; inventory step-up recorded as part of our acquisitions; litigation-related and other contingent matters; certain legal costs; gains or losses from early termination of debt; debt modification costs; gains or losses from the sales of businesses and other assets; foreign currency gains or losses on intercompany financing arrangements; reorganization items, net; the tax effect of adjusted pre-tax income at applicable tax rates and other tax adjustments; and certain other items.

Adjusted diluted net income per share from continuing operations and Adjusted diluted weighted average shares

Adjusted diluted net income per share from continuing operations represents Adjusted income from continuing operations divided by the number of Adjusted diluted weighted average shares.

Both GAAP and non-GAAP diluted Net income (loss) per share data is computed based on weighted average shares outstanding and, if there is net income from continuing operations (rather than net loss) during the period, the dilutive impact of share equivalents outstanding during the period. Diluted weighted average shares outstanding and Adjusted diluted weighted average shares outstanding are calculated on the same basis except for the net income or loss figure used in determining whether to include such dilutive impact.

Adjusted gross margin

Adjusted gross margin represents total revenues less cost of revenues prepared in accordance with GAAP and adjusted for the items enumerated above under the heading “Adjusted income from continuing operations,” to the extent such items relate to cost of revenues. Such items may include, but are not limited to, cost reduction and integration-related initiatives such as separation benefits, continuity payments, other exit costs and certain costs associated with integrating an acquired company’s operations; certain amounts related to strategic review initiatives; amortization of intangible assets; inventory step-up recorded as part of our acquisitions; and certain other items.

Adjusted operating expenses

Adjusted operating expenses represent operating expenses prepared in accordance with GAAP and adjusted for the items enumerated above under the heading “Adjusted income from continuing operations,” to the extent such items relate to operating expenses. Such items may include, but are not limited to, acquisition-related and integration items, including transaction costs and changes in the fair value of contingent consideration; cost reduction and integration-related initiatives such as separation benefits, continuity payments, other exit costs and certain costs associated with integrating an acquired company’s operations; certain amounts related to strategic review initiatives; asset impairment charges; amortization of intangible assets; inventory step-up recorded as part of our acquisitions; litigation-related and other contingent matters; certain legal costs; debt modification costs; and certain other items.

Adjusted income taxes and Adjusted effective tax rate

Adjusted income taxes are calculated by tax effecting adjusted pre-tax income and permanent book-tax differences at the applicable effective tax rate that will be determined by reference to statutory tax rates in the relevant jurisdictions in which the Company operates. Adjusted income taxes include current and deferred income tax expense commensurate with the non-GAAP measure of profitability. Adjustments are then made for certain items relating to prior years and for tax planning actions that are expected to be distortive to the underlying effective tax rate and trend in the effective tax rate. The most directly comparable GAAP financial measure for Adjusted income taxes is Income tax expense, prepared in accordance with GAAP. The Adjusted effective tax rate represents the rate generated when dividing Adjusted income taxes by the amount of adjusted pre-tax income.

EBITDA and Adjusted EBITDA

EBITDA represents Net income (loss) before Interest expense, net; Income tax expense; Depreciation; and Amortization, each prepared in accordance with GAAP. Adjusted EBITDA further adjusts EBITDA by excluding other (income) expense, net; share-based compensation; acquisition-related and integration items, including transaction costs and changes in the fair value of contingent consideration; cost reduction and integration-related initiatives such as separation benefits, continuity payments, other exit costs and certain costs associated with integrating an acquired company’s operations; certain amounts related to strategic review initiatives; asset impairment charges; inventory step-up recorded as part of our acquisitions; litigation-related and other contingent matters; certain legal costs; debt modification costs; reorganization items, net; discontinued operations, net of tax; and certain other items.

The Company’s Adjusted income from continuing operations, Adjusted diluted net income per share from continuing operations, Adjusted operating expenses and Adjusted EBITDA exclude opioid-related legal expenses. The Company believes that such costs are not indicative of business performance and that excluding them more accurately reflects the Company’s results and better enables management to compare financial results between periods.

Because adjusted financial measures exclude the effect of items that will increase or decrease the Company’s reported results of operations, the Company strongly encourages investors to review the Company’s consolidated financial statements and publicly filed reports in their entirety. Investors are also encouraged to review the reconciliation of the non-GAAP financial measures used in the Earnings Release to their most directly comparable GAAP financial measures as included in the Earnings Release. However, the Company does not provide reconciliations of projected non-GAAP financial measures to GAAP financial measures, nor does it provide comparable projected GAAP financial measures for such projected non-GAAP financial measures. The Company is unable to provide such reconciliations without unreasonable efforts due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations, including adjustments that could be made for asset impairments, contingent consideration adjustments, legal settlements, gains or losses on extinguishment of debt, adjustments to inventory and other charges reflected in the reconciliation of historic numbers, the amount of which could be significant.

The information in this Item 2.02 and in Exhibit 99.1 attached hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information contained in this Item 2.02 and in Exhibit 99.1 attached hereto shall not be incorporated into any registration statement or other document filed by the Registrant with the U.S. Securities and Exchange Commission under the Securities Act of 1933, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Number | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | |

| |

| ENDO INTERNATIONAL PLC |

|

| |

| By: | /s/ Matthew J. Maletta |

| Name: | Matthew J. Maletta |

| Title: | Executive Vice President,

Chief Legal Officer and Company Secretary |

Dated: March 6, 2024

Exhibit 99.1

ENDO REPORTS FOURTH-QUARTER 2023 FINANCIAL RESULTS

DUBLIN, March 6, 2024 -- Endo International plc (OTC: ENDPQ) today reported financial results for the fourth-quarter ended December 31, 2023.

FOURTH-QUARTER FINANCIAL PERFORMANCE

(in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | | | Year Ended December 31, | | |

| 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Total Revenues, Net | $ | 497,734 | | | $ | 555,812 | | | (10) | % | | $ | 2,011,518 | | | $ | 2,318,875 | | | (13) | % |

| Reported Loss from Continuing Operations | $ | (2,441,038) | | | $ | (245,163) | | | NM | | $ | (2,447,786) | | | $ | (2,909,618) | | | (16) | % |

| Reported Diluted Weighted Average Shares | 235,220 | | | 235,205 | | | — | % | | 235,219 | | | 234,840 | | | — | % |

| Reported Diluted Net Loss per Share from Continuing Operations (1) | $ | (10.38) | | | $ | (1.04) | | | NM | | $ | (10.41) | | | $ | (12.39) | | | (16) | % |

| Reported Net Loss | $ | (2,441,483) | | | $ | (243,535) | | | NM | | $ | (2,449,807) | | | $ | (2,923,105) | | | (16) | % |

| Adjusted Income from Continuing Operations (2)(3) | $ | 151,060 | | | $ | 189,529 | | | (20) | % | | $ | 706,534 | | | $ | 463,858 | | | 52 | % |

| Adjusted Diluted Weighted Average Shares (1)(2) | 235,220 | | | 236,500 | | | (1) | % | | 235,441 | | | 236,404 | | | — | % |

| Adjusted Diluted Net Income per Share from Continuing Operations (2)(3) | $ | 0.64 | | | $ | 0.80 | | | (20) | % | | $ | 3.00 | | | $ | 1.96 | | | 53 | % |

| Adjusted EBITDA (2)(3) | $ | 166,341 | | | $ | 210,102 | | | (21) | % | | $ | 761,838 | | | $ | 892,050 | | | (15) | % |

__________

(1)Reported Diluted Net Loss per Share from Continuing Operations is computed based on weighted average shares outstanding and, if there is income from continuing operations during the period, the dilutive impact of ordinary share equivalents outstanding during the period. In the case of Adjusted Diluted Weighted Average Shares, Adjusted Income from Continuing Operations is used in determining whether to include such dilutive impact.

(2)The information presented in the table above includes non-GAAP financial measures such as Adjusted Income from Continuing Operations, Adjusted Diluted Weighted Average Shares, Adjusted Diluted Net Income per Share from Continuing Operations and Adjusted EBITDA. Refer to the “Supplemental Financial Information” section below for reconciliations of certain non-GAAP financial measures to the most directly comparable GAAP financial measures.

(3)Effective January 1, 2022, these non-GAAP financial measures now include acquired in-process research and development charges which were previously excluded under Endo’s legacy non-GAAP policy. Refer to note (13) in the “Notes to the Reconciliations of GAAP and Non-GAAP Financial Measures” section below for additional discussion.

CONSOLIDATED FINANCIAL RESULTS

Total revenues were $498 million in fourth-quarter 2023, a decrease of 10% compared to $556 million in fourth-quarter 2022. This decrease was primarily attributable to decreased revenues from the Generic Pharmaceuticals and Sterile Injectables segments, partially offset by increased revenues from the Branded Pharmaceuticals segment.

Reported loss from continuing operations in fourth-quarter 2023 was $2,441 million compared to reported loss from continuing operations of $245 million in fourth-quarter 2022. This change was driven by adjustments to our estimated allowed claims, including with respect to certain litigation matters and debt obligations. The allowed claims will be reduced to reflect actual payments upon Chapter 11 emergence, which is expected to occur in second-quarter 2024.

Adjusted income from continuing operations in fourth-quarter 2023 was $151 million compared to $190 million in fourth-quarter 2022. This change was primarily driven by decreased revenues.

BRANDED PHARMACEUTICALS SEGMENT

Fourth-quarter 2023 Branded Pharmaceuticals segment revenues were $246 million compared to $224 million during fourth-quarter 2022.

Specialty Products revenues increased 16% to $188 million in fourth-quarter 2023 compared to $162 million in fourth-quarter 2022. This change was primarily due to an increase in XIAFLEX® revenues, partially offset by a decrease in SUPPRELIN® LA revenues mainly driven by lower volumes. Fourth-quarter 2023 XIAFLEX® revenues were $148 million, a 29% increase compared to fourth-quarter 2022 driven by increased net selling price and increased volumes. The increase in net selling price was primarily attributable to reversing approximately $14 million of reserves recorded during the first three quarters of 2023 following application of the final Inflation Reduction Act vial-wastage rebate determination.

STERILE INJECTABLES SEGMENT

Fourth-quarter 2023 Sterile Injectables segment revenues were $96 million, a decrease of 11% compared to $108 million during fourth-quarter 2022. This decrease was primarily attributable to competitive pressure on VASOSTRICT® and ADRENALIN®.

GENERIC PHARMACEUTICALS SEGMENT

Fourth-quarter 2023 Generic Pharmaceuticals segment revenues were $139 million, a decrease of 32% compared to $205 million during fourth-quarter 2022. This decrease was primarily attributable to competitive pressure on varenicline tablets, the generic version of Chantix®, and lubiprostone capsules, the authorized generic of Mallinckrodt’s Amitiza®, partially offset by revenue from dexlansoprazole delayed release capsules, the generic version of Dexilant®, which launched during fourth-quarter 2022.

INTERNATIONAL PHARMACEUTICALS SEGMENT

Fourth-quarter 2023 International Pharmaceuticals segment revenues were $17 million, a decrease of 14% compared to $20 million during fourth-quarter 2022. This decrease was primarily attributable to competitive pressure on several products.

2024 FINANCIAL EXPECTATIONS

Endo is providing financial guidance for the full-year ending December 31, 2024, which contemplates key uncertainties, including competitive assumptions related to VASOSTRICT® ready-to-use, ADRENALIN® and generic Dexilant® products. All financial expectations provided by Endo are forward-looking, and actual results may differ materially from such expectations, as further discussed below under the heading “Cautionary Note Regarding Forward-Looking Statements.”

| | | | | | | |

| | | Full-Year 2024 Adjusted Results |

| ($ in millions) | | | |

| Total Revenues, Net | | | $1,685 - $1,770 |

| EBITDA | | | $615 - $645 |

| Assumptions: | | | |

| Segment Revenues: | | | |

| Branded Pharmaceuticals | | | $860 - $905 |

| Sterile Injectables | | | $370 - $390 |

| Generic Pharmaceuticals | | | $395 - $415 |

| International Pharmaceuticals | | | $60 |

| Gross Margin as a Percentage of Total Revenues, Net | | | ~67% |

| Operating Expenses | | | $585 - $605 |

CASH, CASH FLOW AND OTHER UPDATES

As of December 31, 2023, the Company had approximately $778 million in unrestricted cash and cash equivalents. Fourth-quarter 2023 net cash provided by operating activities was approximately $115 million compared to approximately $110 million net cash provided by operating activities during fourth-quarter 2022.

Amitiza® is a registered trademark of a Mallinckrodt company.

Dexilant® is a registered trademark of Takeda Pharmaceutical U.S.A., Inc.

Chantix® is a registered trademark of Pfizer Inc.

FINANCIAL SCHEDULES

The following table presents Endo’s unaudited Total revenues, net for the three months and years ended December 31, 2023 and 2022 (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Percent Growth | | Year Ended December 31, | | Percent Growth |

| 2023 | | 2022 | | | 2023 | | 2022 | |

| Branded Pharmaceuticals: | | | | | | | | | | | |

| Specialty Products: | | | | | | | | | | | |

| XIAFLEX® | $ | 147,760 | | | $ | 114,304 | | | 29 | % | | $ | 475,014 | | | $ | 438,680 | | | 8 | % |

| SUPPRELIN® LA | 23,459 | | | 28,159 | | | (17) | % | | 96,849 | | | 113,011 | | | (14) | % |

| Other Specialty (1) | 16,515 | | | 19,986 | | | (17) | % | | 73,797 | | | 70,009 | | | 5 | % |

| Total Specialty Products | $ | 187,734 | | | $ | 162,449 | | | 16 | % | | $ | 645,660 | | | $ | 621,700 | | | 4 | % |

| Established Products: | | | | | | | | | | | |

| PERCOCET® | $ | 27,584 | | | $ | 26,460 | | | 4 | % | | $ | 106,375 | | | $ | 103,943 | | | 2 | % |

| TESTOPEL® | 10,265 | | | 10,396 | | | (1) | % | | 42,464 | | | 38,727 | | | 10 | % |

| | | | | | | | | | | |

| Other Established (2) | 20,186 | | | 24,523 | | | (18) | % | | 64,588 | | | 86,772 | | | (26) | % |

| Total Established Products | $ | 58,035 | | | $ | 61,379 | | | (5) | % | | $ | 213,427 | | | $ | 229,442 | | | (7) | % |

| Total Branded Pharmaceuticals (3) | $ | 245,769 | | | $ | 223,828 | | | 10 | % | | $ | 859,087 | | | $ | 851,142 | | | 1 | % |

| Sterile Injectables: | | | | | | | | | | | |

| ADRENALIN® | $ | 24,329 | | | $ | 28,790 | | | (15) | % | | $ | 99,910 | | | $ | 114,304 | | | (13) | % |

| VASOSTRICT® | 21,983 | | | 28,479 | | | (23) | % | | 93,180 | | | 253,696 | | | (63) | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Other Sterile Injectables (4) | 49,587 | | | 50,472 | | | (2) | % | | 236,473 | | | 221,633 | | | 7 | % |

| Total Sterile Injectables (3) | $ | 95,899 | | | $ | 107,741 | | | (11) | % | | $ | 429,563 | | | $ | 589,633 | | | (27) | % |

| Total Generic Pharmaceuticals (5) | $ | 139,211 | | | $ | 204,701 | | | (32) | % | | $ | 650,352 | | | $ | 795,457 | | | (18) | % |

| Total International Pharmaceuticals (6) | $ | 16,855 | | | $ | 19,542 | | | (14) | % | | $ | 72,516 | | | $ | 82,643 | | | (12) | % |

| Total revenues, net | $ | 497,734 | | | $ | 555,812 | | | (10) | % | | $ | 2,011,518 | | | $ | 2,318,875 | | | (13) | % |

__________

(1)Products included within Other Specialty include AVEED®, NASCOBAL® Nasal Spray and QWO®.

(2)Products included within Other Established include, but are not limited to, EDEX®.

(3)Individual products presented above represent the top two performing products in each product category for the year ended December 31, 2023 and/or any product having revenues in excess of and/or any product having revenues in excess of $25 million during any completed quarterly period in 2023 or 2022.

(4)No individual product within Other Sterile Injectables has exceeded 5% of consolidated total revenues for the periods presented.

(5)The Generic Pharmaceuticals segment is comprised of a portfolio of products that are generic versions of branded products, are distributed primarily through the same wholesalers, generally have limited or no intellectual property protection and are sold within the U.S. Varenicline tablets (Endo’s generic version of Pfizer Inc.’s Chantix®), which launched in September 2021, made up less than 5% and 16% for the three months ended December 31, 2023 and 2022, respectively, and 8% and 13% for the years ended December 31, 2023 and 2022, respectively, of consolidated total revenues. Dexlansoprazole delayed release capsules (Endo’s generic version of Takeda Pharmaceuticals USA, Inc.’s Dexilant®), which launched in November 2022, made up 6% for the quarter and full-year ended December 31, 2023 of consolidated total revenues. No other individual product within this segment has exceeded 5% of consolidated total revenues for the periods presented.

(6)The International Pharmaceuticals segment, which accounted for less than 5% of consolidated total revenues for each of the periods presented, includes a variety of specialty pharmaceutical products sold outside the U.S., primarily in Canada through Endo’s operating company Paladin Labs Inc.

The following table presents unaudited Condensed Consolidated Statement of Operations data for the three months and years ended December 31, 2023 and 2022 (in thousands, except per share data):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| TOTAL REVENUES, NET | $ | 497,734 | | | $ | 555,812 | | | $ | 2,011,518 | | | $ | 2,318,875 | |

| COSTS AND EXPENSES: | | | | | | | |

| Cost of revenues | 249,535 | | | 294,266 | | | 946,415 | | | 1,092,499 | |

| Selling, general and administrative | 140,433 | | | 176,957 | | | 567,727 | | | 777,169 | |

| Research and development | 28,140 | | | 30,230 | | | 115,462 | | | 128,033 | |

| Acquired in-process research and development | — | | | — | | | — | | | 68,700 | |

| Litigation-related and other contingencies, net | 1,556,773 | | | 33,984 | | | 1,611,090 | | | 478,722 | |

| Asset impairment charges | 357 | | | 191,530 | | | 503 | | | 2,142,746 | |

| Acquisition-related and integration items, net | 148 | | | 1,359 | | | 1,972 | | | 408 | |

| Interest (income) expense, net | (239) | | | 290 | | | — | | | 349,776 | |

| | | | | | | |

| Reorganization items, net | 942,382 | | | 78,766 | | | 1,169,961 | | | 202,978 | |

| Other income, net | (7,525) | | | (11,907) | | | (9,688) | | | (34,054) | |

| LOSS FROM CONTINUING OPERATIONS BEFORE INCOME TAX | $ | (2,412,270) | | | $ | (239,663) | | | $ | (2,391,924) | | | $ | (2,888,102) | |

| INCOME TAX EXPENSE | 28,768 | | | 5,500 | | | 55,862 | | | 21,516 | |

| LOSS FROM CONTINUING OPERATIONS | $ | (2,441,038) | | | $ | (245,163) | | | $ | (2,447,786) | | | $ | (2,909,618) | |

| DISCONTINUED OPERATIONS, NET OF TAX | (445) | | | 1,628 | | | (2,021) | | | (13,487) | |

| NET LOSS | $ | (2,441,483) | | | $ | (243,535) | | | $ | (2,449,807) | | | $ | (2,923,105) | |

| NET LOSS PER SHARE—BASIC: | | | | | | | |

| Continuing operations | $ | (10.38) | | | $ | (1.04) | | | $ | (10.41) | | | $ | (12.39) | |

| Discontinued operations | — | | | — | | | (0.01) | | | (0.06) | |

| Basic | $ | (10.38) | | | $ | (1.04) | | | $ | (10.42) | | | $ | (12.45) | |

| NET LOSS PER SHARE—DILUTED: | | | | | | | |

| Continuing operations | $ | (10.38) | | | $ | (1.04) | | | $ | (10.41) | | | $ | (12.39) | |

| Discontinued operations | — | | | — | | | (0.01) | | | (0.06) | |

| Diluted | $ | (10.38) | | | $ | (1.04) | | | $ | (10.42) | | | $ | (12.45) | |

| WEIGHTED AVERAGE SHARES: | | | | | | | |

| Basic | 235,220 | | | 235,205 | | | 235,219 | | | 234,840 | |

| Diluted | 235,220 | | | 235,205 | | | 235,219 | | | 234,840 | |

The following table presents unaudited Condensed Consolidated Balance Sheet data at December 31, 2023 and December 31, 2022 (in thousands):

| | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| ASSETS | | | |

| CURRENT ASSETS: | | | |

| Cash and cash equivalents | $ | 777,919 | | | $ | 1,018,883 | |

| Restricted cash and cash equivalents | 167,702 | | | 145,358 | |

| Accounts receivable | 386,919 | | | 493,988 | |

| Inventories, net | 246,017 | | | 274,499 | |

| | | |

| Other current assets | 89,944 | | | 144,040 | |

| Total current assets | $ | 1,668,501 | | | $ | 2,076,768 | |

| TOTAL NON-CURRENT ASSETS | 3,468,793 | | | 3,681,169 | |

| TOTAL ASSETS | $ | 5,137,294 | | | $ | 5,757,937 | |

| LIABILITIES AND SHAREHOLDERS’ DEFICIT | | | |

| CURRENT LIABILITIES: | | | |

| Accounts payable and accrued expenses, including legal settlement accruals | $ | 537,736 | | | $ | 687,183 | |

| | | |

| Other current liabilities | 1,058 | | | 2,444 | |

| Total current liabilities | $ | 538,794 | | | $ | 689,627 | |

| | | |

| OTHER LIABILITIES | 100,192 | | | 61,700 | |

| LIABILITIES SUBJECT TO COMPROMISE | 11,095,868 | | | 9,168,782 | |

| SHAREHOLDERS’ DEFICIT | (6,597,560) | | | (4,162,172) | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ DEFICIT | $ | 5,137,294 | | | $ | 5,757,937 | |

The following table presents unaudited Condensed Consolidated Statement of Cash Flow data for the years ended December 31, 2023 and 2022 (in thousands):

| | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| OPERATING ACTIVITIES: | | | |

| Net loss | $ | (2,449,807) | | | $ | (2,923,105) | |

| Adjustments to reconcile Net loss to Net cash provided by operating activities: | | | |

| Depreciation and amortization | 306,448 | | | 391,629 | |

| Asset impairment charges | 503 | | | 2,142,746 | |

| Non-cash reorganization items, net | 905,868 | | | 89,197 | |

| Other, including cash payments to claimants from Qualified Settlement Funds | 1,672,086 | | | 568,726 | |

| Net cash provided by operating activities | $ | 435,098 | | | $ | 269,193 | |

| INVESTING ACTIVITIES: | | | |

| Capital expenditures, excluding capitalized interest | $ | (94,325) | | | $ | (99,722) | |

| Acquisitions, including in-process research and development, net of cash and restricted cash acquired | — | | | (90,320) | |

| | | |

| Proceeds from sale of business and other assets | 5,134 | | | 41,400 | |

| Other | 39,397 | | | 15,495 | |

| Net cash used in investing activities | $ | (49,794) | | | $ | (133,147) | |

| FINANCING ACTIVITIES: | | | |

| Payments on borrowings, including certain adequate protection payments, net (a) | $ | (599,492) | | | $ | (509,513) | |

| Other | (5,136) | | | (4,360) | |

| Net cash used in financing activities | $ | (604,628) | | | $ | (513,873) | |

| Effect of foreign exchange rate | 704 | | | (4,242) | |

| | | |

| NET DECREASE IN CASH, CASH EQUIVALENTS, RESTRICTED CASH AND RESTRICTED CASH EQUIVALENTS | $ | (218,620) | | | $ | (382,069) | |

| CASH, CASH EQUIVALENTS, RESTRICTED CASH AND RESTRICTED CASH EQUIVALENTS, BEGINNING OF PERIOD | 1,249,241 | | | 1,631,310 | |

| CASH, CASH EQUIVALENTS, RESTRICTED CASH AND RESTRICTED CASH EQUIVALENTS, END OF PERIOD | $ | 1,030,621 | | | $ | 1,249,241 | |

__________

(a)Beginning during the third quarter of 2022, Endo became obligated to make certain adequate protection payments as a result of the Chapter 11 proceedings, which are currently being accounted for as a reduction of the carrying amount of the related debt instruments and presented as financing cash outflows. Some or all of the adequate protection payments may later be recharacterized as interest expense and/or as operating cash outflows depending upon certain developments in the Chapter 11 proceedings, which could result in increases in interest expense and/or decreases in operating cash flows in future periods that may be material.

SUPPLEMENTAL FINANCIAL INFORMATION

To supplement the financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), the Company uses certain non-GAAP financial measures. For additional information on the Company’s use of such non-GAAP financial measures, refer to Endo’s Current Report on Form 8-K furnished today to the U.S. Securities and Exchange Commission, which includes an explanation of the Company’s reasons for using non-GAAP measures.

The tables below provide reconciliations of certain of the Company’s non-GAAP financial measures to their most directly comparable GAAP amounts. Refer to the “Notes to the Reconciliations of GAAP and Non-GAAP Financial Measures” section below for additional details regarding the adjustments to the non-GAAP financial measures detailed throughout this Supplemental Financial Information section.

Reconciliation of EBITDA and Adjusted EBITDA (non-GAAP)

The following table provides a reconciliation of Net loss (GAAP) to Adjusted EBITDA (non-GAAP) for the three months and years ended December 31, 2023 and 2022 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net loss (GAAP) | $ | (2,441,483) | | | $ | (243,535) | | | $ | (2,449,807) | | | $ | (2,923,105) | |

| Income tax expense | 28,768 | | | 5,500 | | | 55,862 | | | 21,516 | |

| Interest (income) expense, net | (239) | | | 290 | | | — | | | 349,776 | |

| Depreciation and amortization (1) | 74,358 | | | 89,342 | | | 306,448 | | | 387,856 | |

| EBITDA (non-GAAP) | $ | (2,338,596) | | | $ | (148,403) | | | $ | (2,087,497) | | | $ | (2,163,957) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Amounts related to continuity and separation benefits, cost reductions and strategic review initiatives (2) | 7,380 | | | 59,356 | | | 44,098 | | | 198,381 | |

| Certain litigation-related and other contingencies, net (3) | 1,556,773 | | | 33,984 | | | 1,611,090 | | | 478,722 | |

| Certain legal costs (4) | 2,069 | | | 434 | | | 7,256 | | | 31,756 | |

| Asset impairment charges (5) | 357 | | | 191,530 | | | 503 | | | 2,142,746 | |

| | | | | | | |

| Fair value of contingent consideration (6) | 148 | | | 1,359 | | | 1,972 | | | 408 | |

| | | | | | | |

| Share-based compensation (1) | — | | | 4,124 | | | 2,091 | | | 17,145 | |

| Other income, net (7) | (7,525) | | | (11,907) | | | (9,688) | | | (34,054) | |

| Reorganization items, net (8) | 942,382 | | | 78,766 | | | 1,169,961 | | | 202,978 | |

| Other (9) | 2,908 | | | 2,487 | | | 20,031 | | | 4,438 | |

| Discontinued operations, net of tax (10) | 445 | | | (1,628) | | | 2,021 | | | 13,487 | |

| Adjusted EBITDA (non-GAAP) (13) | $ | 166,341 | | | $ | 210,102 | | | $ | 761,838 | | | $ | 892,050 | |

Reconciliation of Adjusted Income from Continuing Operations (non-GAAP)

The following table provides a reconciliation of the Company’s Loss from continuing operations (GAAP) to Adjusted income from continuing operations (non-GAAP) for the three months and years ended December 31, 2023 and 2022 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Loss from continuing operations (GAAP) | $ | (2,441,038) | | | $ | (245,163) | | | $ | (2,447,786) | | | $ | (2,909,618) | |

| Non-GAAP adjustments: | | | | | | | |

| Amortization of intangible assets (11) | 61,823 | | | 75,467 | | | 255,933 | | | 337,311 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Amounts related to continuity and separation benefits, cost reductions and strategic review initiatives (2) | 7,380 | | | 59,356 | | | 44,098 | | | 198,381 | |

| Certain litigation-related and other contingencies, net (3) | 1,556,773 | | | 33,984 | | | 1,611,090 | | | 478,722 | |

| Certain legal costs (4) | 2,069 | | | 434 | | | 7,256 | | | 31,756 | |

| Asset impairment charges (5) | 357 | | | 191,530 | | | 503 | | | 2,142,746 | |

| | | | | | | |

| Fair value of contingent consideration (6) | 148 | | | 1,359 | | | 1,972 | | | 408 | |

| | | | | | | |

| Reorganization items, net (8) | 942,382 | | | 78,766 | | | 1,169,961 | | | 202,978 | |

| Other (9) | (3,641) | | | (10,022) | | | 13,485 | | | (32,980) | |

| Tax adjustments (12) | 24,807 | | | 3,818 | | | 50,022 | | | 14,154 | |

| Adjusted income from continuing operations (non-GAAP) (13) | $ | 151,060 | | | $ | 189,529 | | | $ | 706,534 | | | $ | 463,858 | |

Reconciliation of Other Adjusted Income Statement Data (non-GAAP)

The following tables provide detailed reconciliations of various other income statement data between the GAAP and non-GAAP amounts for the three months and years ended December 31, 2023 and 2022 (in thousands, except per share data):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

| Total revenues, net | | Cost of revenues | | Gross margin | | Gross margin % | | Total operating expenses | | Operating expense to revenue % | | Operating (loss) income from continuing operations | | Operating margin % | | Other non-operating expense (income), net | | (Loss) income from continuing operations before income tax | | Income tax expense | | Effective tax rate | | (Loss) income from continuing operations | | Discontinued operations, net of tax | | Net (loss) income | | Diluted net (loss) income per share from continuing operations (14) |

| Reported (GAAP) | $ | 497,734 | | | $ | 249,535 | | | $ | 248,199 | | | 49.9 | % | | $ | 1,725,851 | | | 346.7 | % | | $ | (1,477,652) | | | (296.9) | % | | $ | 934,618 | | | $ | (2,412,270) | | | $ | 28,768 | | | (1.2) | % | | $ | (2,441,038) | | | $ | (445) | | | $ | (2,441,483) | | | $ | (10.38) | |

| Items impacting comparability: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Amortization of intangible assets (11) | — | | | (61,823) | | | 61,823 | | | | | — | | | | | 61,823 | | | | | — | | | 61,823 | | | — | | | | | 61,823 | | | — | | | 61,823 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Amounts related to continuity and separation benefits, cost reductions and strategic review initiatives (2) | — | | | (702) | | | 702 | | | | | (6,678) | | | | | 7,380 | | | | | — | | | 7,380 | | | — | | | | | 7,380 | | | — | | | 7,380 | | | |

| Certain litigation-related and other contingencies, net (3) | — | | | — | | | — | | | | | (1,556,773) | | | | | 1,556,773 | | | | | — | | | 1,556,773 | | | — | | | | | 1,556,773 | | | — | | | 1,556,773 | | | |

| Certain legal costs (4) | — | | | — | | | — | | | | | (2,069) | | | | | 2,069 | | | | | — | | | 2,069 | | | — | | | | | 2,069 | | | — | | | 2,069 | | | |

| Asset impairment charges (5) | — | | | — | | | — | | | | | (357) | | | | | 357 | | | | | — | | | 357 | | | — | | | | | 357 | | | — | | | 357 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fair value of contingent consideration (6) | — | | | — | | | — | | | | | (148) | | | | | 148 | | | | | — | | | 148 | | | — | | | | | 148 | | | — | | | 148 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reorganization items, net (8) | — | | | — | | | — | | | | | — | | | | | — | | | | | (942,382) | | | 942,382 | | | — | | | | | 942,382 | | | — | | | 942,382 | | | |

| Other (9) | — | | | (375) | | | 375 | | | | | (2,533) | | | | | 2,908 | | | | | 6,549 | | | (3,641) | | | — | | | | | (3,641) | | | — | | | (3,641) | | | |

| Tax adjustments (12) | — | | | — | | | — | | | | | — | | | | | — | | | | | — | | | — | | | (24,807) | | | | | 24,807 | | | — | | | 24,807 | | | |

| Discontinued operations, net of tax (10) | — | | | — | | | — | | | | | — | | | | | — | | | | | — | | | — | | | — | | | | | — | | | 445 | | | 445 | | | |

| After considering items (non-GAAP) (13) | $ | 497,734 | | | $ | 186,635 | | | $ | 311,099 | | | 62.5 | % | | $ | 157,293 | | | 31.6 | % | | $ | 153,806 | | | 30.9 | % | | $ | (1,215) | | | $ | 155,021 | | | $ | 3,961 | | | 2.6 | % | | $ | 151,060 | | | $ | — | | | $ | 151,060 | | | $ | 0.64 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2022 |

| Total revenues, net | | Cost of revenues | | Gross margin | | Gross margin % | | Total operating expenses | | Operating expense to revenue % | | Operating (loss) income from continuing operations | | Operating margin % | | Other non-operating expense, net | | (Loss) income from continuing operations before income tax | | Income tax expense | | Effective tax rate | | (Loss) income from continuing operations | | Discontinued operations, net of tax | | Net (loss) income | | Diluted net (loss) income per share from continuing operations (14) |

| Reported (GAAP) | $ | 555,812 | | | $ | 294,266 | | | $ | 261,546 | | | 47.1 | % | | $ | 434,060 | | | 78.1 | % | | $ | (172,514) | | | (31.0) | % | | $ | 67,149 | | | $ | (239,663) | | | $ | 5,500 | | | (2.3) | % | | $ | (245,163) | | | $ | 1,628 | | | $ | (243,535) | | | $ | (1.04) | |

| Items impacting comparability: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Amortization of intangible assets (11) | — | | | (75,467) | | | 75,467 | | | | | — | | | | | 75,467 | | | | | — | | | 75,467 | | | — | | | | | 75,467 | | | — | | | 75,467 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Amounts related to continuity and separation benefits, cost reductions and strategic review initiatives (2) | — | | | (38,153) | | | 38,153 | | | | | (21,203) | | | | | 59,356 | | | | | — | | | 59,356 | | | — | | | | | 59,356 | | | — | | | 59,356 | | | |

| Certain litigation-related and other contingencies, net (3) | — | | | — | | | — | | | | | (33,984) | | | | | 33,984 | | | | | — | | | 33,984 | | | — | | | | | 33,984 | | | — | | | 33,984 | | | |

| Certain legal costs (4) | — | | | — | | | — | | | | | (434) | | | | | 434 | | | | | — | | | 434 | | | — | | | | | 434 | | | — | | | 434 | | | |

| Asset impairment charges (5) | — | | | — | | | — | | | | | (191,530) | | | | | 191,530 | | | | | — | | | 191,530 | | | — | | | | | 191,530 | | | — | | | 191,530 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fair value of contingent consideration (6) | — | | | — | | | — | | | | | (1,359) | | | | | 1,359 | | | | | — | | | 1,359 | | | — | | | | | 1,359 | | | — | | | 1,359 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reorganization items, net (8) | — | | | — | | | — | | | | | — | | | | | — | | | | | (78,766) | | | 78,766 | | | — | | | | | 78,766 | | | — | | | 78,766 | | | |

| Other (9) | — | | | (125) | | | 125 | | | | | (2,355) | | | | | 2,480 | | | | | 12,502 | | | (10,022) | | | — | | | | | (10,022) | | | — | | | (10,022) | | | |

| Tax adjustments (12) | — | | | — | | | — | | | | | — | | | | | — | | | | | — | | | — | | | (3,818) | | | | | 3,818 | | | — | | | 3,818 | | | |

| Discontinued operations, net of tax (10) | — | | | — | | | — | | | | | — | | | | | — | | | | | — | | | — | | | — | | | | | — | | | (1,628) | | | (1,628) | | | |

| After considering items (non-GAAP) (13) | $ | 555,812 | | | $ | 180,521 | | | $ | 375,291 | | | 67.5 | % | | $ | 183,195 | | | 33.0 | % | | $ | 192,096 | | | 34.6 | % | | $ | 885 | | | $ | 191,211 | | | $ | 1,682 | | | 0.9 | % | | $ | 189,529 | | | $ | — | | | $ | 189,529 | | | $ | 0.80 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2023 |

| Total revenues, net | | Cost of revenues | | Gross margin | | Gross margin % | | Total operating expenses | | Operating expense to revenue % | | Operating (loss) income from continuing operations | | Operating margin % | | Other non-operating expense (income), net | | (Loss) income from continuing operations before income tax | | Income tax expense | | Effective tax rate | | (Loss) income from continuing operations | | Discontinued operations, net of tax | | Net (loss) income | | Diluted net (loss) income per share from continuing operations (14) |

| Reported (GAAP) | $ | 2,011,518 | | | $ | 946,415 | | | $ | 1,065,103 | | | 53.0 | % | | $ | 2,296,754 | | | 114.2 | % | | $ | (1,231,651) | | | (61.2) | % | | $ | 1,160,273 | | | $ | (2,391,924) | | | $ | 55,862 | | | (2.3) | % | | $ | (2,447,786) | | | $ | (2,021) | | | $ | (2,449,807) | | | $ | (10.41) | |

| Items impacting comparability: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Amortization of intangible assets (11) | — | | | (255,933) | | | 255,933 | | | | | — | | | | | 255,933 | | | | | — | | | 255,933 | | | — | | | | | 255,933 | | | — | | | 255,933 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Amounts related to continuity and separation benefits, cost reductions and strategic review initiatives (2) | — | | | (4,514) | | | 4,514 | | | | | (39,584) | | | | | 44,098 | | | | | — | | | 44,098 | | | — | | | | | 44,098 | | | — | | | 44,098 | | | |

| Certain litigation-related and other contingencies, net (3) | — | | | — | | | — | | | | | (1,611,090) | | | | | 1,611,090 | | | | | — | | | 1,611,090 | | | — | | | | | 1,611,090 | | | — | | | 1,611,090 | | | |

| Certain legal costs (4) | — | | | — | | | — | | | | | (7,256) | | | | | 7,256 | | | | | — | | | 7,256 | | | — | | | | | 7,256 | | | — | | | 7,256 | | | |

| Asset impairment charges (5) | — | | | — | | | — | | | | | (503) | | | | | 503 | | | | | — | | | 503 | | | — | | | | | 503 | | | — | | | 503 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fair value of contingent consideration (6) | — | | | — | | | — | | | | | (1,972) | | | | | 1,972 | | | | | — | | | 1,972 | | | — | | | | | 1,972 | | | — | | | 1,972 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reorganization items, net (8) | — | | | — | | | — | | | | | — | | | | | — | | | | | (1,169,961) | | | 1,169,961 | | | — | | | | | 1,169,961 | | | — | | | 1,169,961 | | | |

| Other (9) | — | | | (1,278) | | | 1,278 | | | | | (18,753) | | | | | 20,031 | | | | | 6,546 | | | 13,485 | | | — | | | | | 13,485 | | | — | | | 13,485 | | | |

| Tax adjustments (12) | — | | | — | | | — | | | | | — | | | | | — | | | | | — | | | — | | | (50,022) | | | | | 50,022 | | | — | | | 50,022 | | | |

| Discontinued operations, net of tax (10) | — | | | — | | | — | | | | | — | | | | | — | | | | | — | | | — | | | — | | | | | — | | | 2,021 | | | 2,021 | | | |

| After considering items (non-GAAP) (13) | $ | 2,011,518 | | | $ | 684,690 | | | $ | 1,326,828 | | | 66.0 | % | | $ | 617,596 | | | 30.7 | % | | $ | 709,232 | | | 35.3 | % | | $ | (3,142) | | | $ | 712,374 | | | $ | 5,840 | | | 0.8 | % | | $ | 706,534 | | | $ | — | | | $ | 706,534 | | | $ | 3.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2022 |

| Total revenues, net | | Cost of revenues | | Gross margin | | Gross margin % | | Total operating expenses | | Operating expense to revenue % | | Operating (loss) income from continuing operations | | Operating margin % | | Other non-operating expense, net | | (Loss) income from continuing operations before income tax | | Income tax expense | | Effective tax rate | | (Loss) income from continuing operations | | Discontinued operations, net of tax | | Net (loss) income | | Diluted net (loss) income per share from continuing operations (14) |

| Reported (GAAP) | $ | 2,318,875 | | | $ | 1,092,499 | | | $ | 1,226,376 | | | 52.9 | % | | $ | 3,595,778 | | | 155.1 | % | | $ | (2,369,402) | | | (102.2) | % | | $ | 518,700 | | | $ | (2,888,102) | | | $ | 21,516 | | | (0.7) | % | | $ | (2,909,618) | | | $ | (13,487) | | | $ | (2,923,105) | | | $ | (12.39) | |

| Items impacting comparability: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Amortization of intangible assets (11) | — | | | (337,311) | | | 337,311 | | | | | — | | | | | 337,311 | | | | | — | | | 337,311 | | | — | | | | | 337,311 | | | — | | | 337,311 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Amounts related to continuity and separation benefits, cost reductions and strategic review initiatives (2) | — | | | (61,806) | | | 61,806 | | | | | (136,575) | | | | | 198,381 | | | | | — | | | 198,381 | | | — | | | | | 198,381 | | | — | | | 198,381 | | | |

| Certain litigation-related and other contingencies, net (3) | — | | | — | | | — | | | | | (478,722) | | | | | 478,722 | | | | | — | | | 478,722 | | | — | | | | | 478,722 | | | — | | | 478,722 | | | |

| Certain legal costs (4) | — | | | — | | | — | | | | | (31,756) | | | | | 31,756 | | | | | — | | | 31,756 | | | — | | | | | 31,756 | | | — | | | 31,756 | | | |

| Asset impairment charges (5) | — | | | — | | | — | | | | | (2,142,746) | | | | | 2,142,746 | | | | | — | | | 2,142,746 | | | — | | | | | 2,142,746 | | | — | | | 2,142,746 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fair value of contingent consideration (6) | — | | | — | | | — | | | | | (408) | | | | | 408 | | | | | — | | | 408 | | | — | | | | | 408 | | | — | | | 408 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reorganization items, net (8) | — | | | — | | | — | | | | | — | | | | | — | | | | | (202,978) | | | 202,978 | | | — | | | | | 202,978 | | | — | | | 202,978 | | | |

| Other (9) | — | | | (500) | | | 500 | | | | | (3,925) | | | | | 4,425 | | | | | 37,405 | | | (32,980) | | | — | | | | | (32,980) | | | — | | | (32,980) | | | |

| Tax adjustments (12) | — | | | — | | | — | | | | | — | | | | | — | | | | | — | | | — | | | (14,154) | | | | | 14,154 | | | — | | | 14,154 | | | |

| Discontinued operations, net of tax (10) | — | | | — | | | — | | | | | — | | | | | — | | | | | — | | | — | | | — | | | | | — | | | 13,487 | | | 13,487 | | | |

| After considering items (non-GAAP) (13) | $ | 2,318,875 | | | $ | 692,882 | | | $ | 1,625,993 | | | 70.1 | % | | $ | 801,646 | | | 34.6 | % | | $ | 824,347 | | | 35.5 | % | | $ | 353,127 | | | $ | 471,220 | | | $ | 7,362 | | | 1.6 | % | | $ | 463,858 | | | $ | — | | | $ | 463,858 | | | $ | 1.96 | |

Notes to the Reconciliations of GAAP and Non-GAAP Financial Measures

Notes to certain line items included in the reconciliations of the GAAP financial measures to the non-GAAP financial measures for the three months and years ended December 31, 2023 and 2022 are as follows:

(1) Depreciation and amortization and Share-based compensation amounts per the Adjusted EBITDA reconciliations do not include amounts reflected in other lines of the reconciliations, including Amounts related to continuity and separation benefits, cost reductions and strategic review initiatives.

(2) Adjustments for amounts related to continuity and separation benefits, cost reductions and strategic review initiatives included the following (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, |

| 2023 | | 2022 |

| Cost of revenues | | Operating expenses | | Cost of revenues | | Operating expenses |

| Continuity and separation benefits | $ | 693 | | | $ | 6,677 | | | $ | 5,802 | | | $ | 21,642 | |

| | | | | | | |

| Inventory adjustments | 9 | | | 1 | | | 32,351 | | | 116 | |

| Other, including strategic review initiatives | — | | | — | | | — | | | (555) | |

| Total | $ | 702 | | | $ | 6,678 | | | $ | 38,153 | | | $ | 21,203 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| Cost of revenues | | Operating expenses | | Cost of revenues | | Operating expenses |

| Continuity and separation benefits | $ | 3,833 | | | $ | 39,866 | | | $ | 18,301 | | | $ | 67,277 | |

| Accelerated depreciation | — | | | — | | | 2,164 | | | 1,660 | |

| Inventory adjustments | 90 | | | (323) | | | 33,785 | | | 2,577 | |

| Other, including strategic review initiatives | 591 | | | 41 | | | 7,556 | | | 65,061 | |

| Total | $ | 4,514 | | | $ | 39,584 | | | $ | 61,806 | | | $ | 136,575 | |

| | | | | | | |

| |

| | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

The amounts in the tables above include adjustments related to previously announced restructuring activities, certain continuity and transitional compensation arrangements, certain other cost reduction initiatives and certain strategic review initiatives.

(3) To exclude adjustments to accruals for litigation-related settlement charges.

(4) To exclude amounts related to opioid-related legal expenses.

(5) Adjustments for asset impairment charges included in the following (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Goodwill impairment charges | $ | — | | | $ | — | | | $ | — | | | $ | 1,845,000 | |

| Other intangible asset impairment charges | — | | | 185,548 | | | — | | | 288,701 | |

| Property, plant and equipment impairment charges | 357 | | | 5,982 | | | 503 | | | 9,045 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Total | $ | 357 | | | $ | 191,530 | | | $ | 503 | | | $ | 2,142,746 | |

(6) To exclude the impact of changes in the fair value of contingent consideration liabilities resulting from changes to estimates regarding the timing and amount of the future revenues of the underlying products and changes in other assumptions impacting the probability of incurring, and extent to which the Company could incur, related contingent obligations.

(7) To exclude Other income, net per the Consolidated Statements of Operations.

(8) Amounts relate to the net expense or income recognized during Endo’s bankruptcy proceedings required to be presented as Reorganization items, net under Accounting Standards Codification Topic 852, Reorganizations.

(9) The “Other” rows included in each of the above reconciliations of GAAP financial measures to non-GAAP financial measures (except for the reconciliations of Net loss (GAAP) to Adjusted EBITDA (non-GAAP)) include the following (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, |

| 2023 | | 2022 |

| Cost of revenues | | Operating expenses | | Other non-operating expenses | | Cost of revenues | | Operating expenses | | Other non-operating expenses |

| Foreign currency impact related to the re-measurement of intercompany debt instruments | $ | — | | | $ | — | | | $ | 2,156 | | | $ | — | | | $ | — | | | $ | 1,786 | |

| Gain on sale of business and other assets | — | | | — | | | (8,705) | | | — | | | — | | | (14,288) | |

| | | | | | | | | | | |

| Other miscellaneous | 375 | | | 2,533 | | | — | | | 125 | | | 2,355 | | | — | |

| Total | $ | 375 | | | $ | 2,533 | | | $ | (6,549) | | | $ | 125 | | | $ | 2,355 | | | $ | (12,502) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| Cost of revenues | | Operating expenses | | Other non-operating expenses | | Cost of revenues | | Operating expenses | | Other non-operating expenses |

| Foreign currency impact related to the re-measurement of intercompany debt instruments | $ | — | | | $ | — | | | $ | 2,159 | | | $ | — | | | $ | — | | | $ | (5,328) | |

| Gain on sale of business and other assets | — | | | — | | | (8,705) | | | — | | | — | | | (26,508) | |

| | | | | | | | | | | |

| Other miscellaneous | 1,278 | | | 18,753 | | | — | | | 500 | | | 3,925 | | | (5,569) | |

| Total | $ | 1,278 | | | $ | 18,753 | | | $ | (6,546) | | | $ | 500 | | | $ | 3,925 | | | $ | (37,405) | |

| | | | | | | | | | | |

| | | |

| | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

The “Other” row included in the reconciliations of Net loss (GAAP) to Adjusted EBITDA (non-GAAP) primarily relates to the items enumerated in the foregoing “Cost of revenues” and “Operating expenses” columns.

(10) To exclude the results of the businesses reported as discontinued operations, net of tax.

(11) To exclude amortization expense related to intangible assets.

(12) Adjusted income taxes are calculated by tax effecting adjusted pre-tax income and permanent book-tax differences at the applicable effective tax rate that will be determined by reference to statutory tax rates in the relevant jurisdictions in which the Company operates. Adjusted income taxes include current and deferred income tax expense commensurate with the non-GAAP measure of profitability.

(13) Amounts of Acquired in-process research and development charges included within these non-GAAP financial measures are set forth in the table below (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | |

Acquired in-process research and development charges | $ | — | | | $ | — | | | $ | — | | | $ | 68,700 | | | |

(14) Calculated as income or loss from continuing operations divided by the applicable weighted average share number. The applicable weighted average share numbers are as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| GAAP | 235,220 | | | 235,205 | | | 235,219 | | | 234,840 | |

| Non-GAAP Adjusted | 235,220 | | | 236,500 | | | 235,441 | | | 236,404 | |

Non-GAAP Financial Measures

The Company utilizes certain financial measures that are not prescribed by or prepared in accordance with accounting principles generally accepted in the U.S. (GAAP). These non-GAAP financial measures are not, and should not be viewed as, substitutes for GAAP net income and its components and diluted net income per share amounts. Despite the importance of these measures to management in goal setting and performance measurement, the Company stresses that these are non-GAAP financial measures that have no standardized meaning prescribed by GAAP and, therefore, have limits in their usefulness to investors. Because of the non-standardized definitions, non-GAAP adjusted EBITDA and non-GAAP adjusted net income from continuing operations and its components (unlike GAAP net income from continuing operations and its components) may not be comparable to the calculation of similar measures of other companies. These non-GAAP financial measures are presented solely to permit investors to more fully understand how management assesses performance.

Investors are encouraged to review the reconciliations of the non-GAAP financial measures used in this press release to their most directly comparable GAAP financial measures. However, the Company does not provide reconciliations of projected non-GAAP financial measures to GAAP financial measures, nor does it provide comparable projected GAAP financial measures for such projected non-GAAP financial measures. The Company is unable to provide such reconciliations without unreasonable efforts due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations, including adjustments that could be made for asset impairments, contingent consideration adjustments, legal settlements, gain / loss on extinguishment of debt, adjustments to inventory and other charges reflected in the reconciliation of historic numbers, the amounts of which could be significant.

See Endo’s Current Report on Form 8-K furnished today to the U.S. Securities and Exchange Commission for an explanation of Endo’s non-GAAP financial measures.

About Endo

Endo (OTC: ENDPQ) is a specialty pharmaceutical company committed to helping everyone we serve live their best life through the delivery of quality, life-enhancing therapies. Our decades of proven success come from passionate team members around the globe collaborating to bring treatments forward. Together, we boldly transform insights into treatments benefiting those who need them, when they need them. Learn more at www.endo.com or connect with us on LinkedIn.

Cautionary Note Regarding Forward-Looking Statements

Certain information in this press release may be considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and any applicable Canadian securities legislation, including, but not limited to, statements with respect to financial guidance, expectations or outlook, bankruptcy court hearings or approvals, Chapter 11 emergence, and any other statements that refer to expected, estimated or anticipated future results or that do not relate solely to historical facts. Statements including words or phrases such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “plan,” “will,” “may,” “look forward,” “outlook,” “guidance,” “future,” “potential” or similar expressions are forward-looking statements. All forward-looking statements in this communication reflect the Company’s current views as of the date of this communication about its plans, intentions, expectations, strategies and prospects, which are based on the information currently available to it and on assumptions it has made. Actual results may differ materially and adversely from current expectations based on a number of factors, including, among other things, the following: the Company’s restructuring activities; the timing, impact or results of any pending or future litigation, investigations, proceedings or claims, including opioid, tax and antitrust related matters; actual or contingent liabilities; settlement discussions or negotiations; the Company's liquidity, financial performance, cash position and operations; the Company's

strategy; risks and uncertainties associated with Chapter 11 proceedings; the negative impacts on the Company's businesses as a result of filing for and operating under Chapter 11 protection; the time, terms and ability to obtain approval and consummate the proposed Plan or Reorganization or a sale under Section 363 of the U.S. Bankruptcy Code; the adequacy of the capital resources of the Company's businesses and the difficulty in forecasting the liquidity requirements of the operations of the Company's businesses; the unpredictability of the Company's financial results while in Chapter 11 proceedings; the Company's ability to discharge claims in Chapter 11 proceedings; negotiations with the holders of the Company's indebtedness and its trade creditors and other significant creditors; risks and uncertainties with performing under the terms of the restructuring support agreement and any other arrangement with lenders or creditors while in Chapter 11 proceedings; the Company's ability to conduct business as usual; the Company's ability to continue to serve customers, suppliers and other business partners at the high level of service and performance they have come to expect from the Company; the Company's ability to continue to pay employees, suppliers and vendors; the ability to control costs during Chapter 11 proceedings; adverse litigation; the risk that the Company's Chapter 11 Cases may be converted to cases under Chapter 7 of the Bankruptcy Code; the Company’s ability to secure operating capital; the Company’s ability to take advantage of opportunities to acquire assets with upside potential; the impact of competition and the timing of competitive entrants; the Company’s ability to satisfy judgments or settlements or pursue appeals including bonding requirements; the Company’s ability to adjust to changing market conditions; the Company’s ability to attract and retain key personnel; supply chain interruptions or difficulties; changes in competitive or market conditions; changes in legislation or regulatory developments; the Company’s ability to obtain and maintain adequate protection for intellectual property rights; the timing and uncertainty of the results of both the research and development and regulatory processes, including regulatory decisions, product recalls, withdrawals and other unusual items; domestic and foreign health care and cost containment reforms, including government pricing, tax and reimbursement policies; technological advances and patents obtained by competitors; the performance, including the approval, introduction, and consumer and physician acceptance of new products and the continuing acceptance of currently marketed products; the Company’s ability to integrate any newly acquired products into its portfolio and achieve any financial or commercial expectations; the impact that known and unknown side effects may have on market perception and consumer preference for the Company’s products; the effectiveness of advertising and other promotional campaigns; the timely and successful implementation of any strategic initiatives; unfavorable publicity regarding the misuse of opioids; the uncertainty associated with the identification of and successful consummation and execution of external corporate development initiatives and strategic partnering transactions; the Company’s ability to advance its strategic priorities, develop its product pipeline and continue to develop the market for XIAFLEX® and other branded and unbranded products; and the Company’s ability to obtain and successfully manufacture, maintain and distribute a sufficient supply of products to meet market demand in a timely manner. In addition, U.S. and international economic conditions, including consumer confidence and debt levels, inflation, taxation, changes in interest and currency exchange rates, international relations, capital and credit availability, the status of financial markets and institutions and the impact of continued economic volatility, can materially affect the Company’s results. Therefore, the reader is cautioned not to rely on these forward-looking statements. The Company expressly disclaims any intent or obligation to update these forward-looking statements, except as required to do so by law.

Additional information concerning risk factors, including those referenced above, can be found in press releases issued by the Company, as well as public periodic filings with the U.S. Securities and Exchange Commission (the “SEC”) and with securities regulators in Canada, including the discussion under the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or other filings with the SEC. Copies of the Company’s press releases and additional information about the Company are available at www.endo.com or you can contact the Endo Investor Relations Department at relations.investor@endo.com.

SOURCE Endo International plc

| | | | | | | | |

| Media: | | Investors: |

Linda Huss | | Laure Park |

(484) 216-6829 | | (845) 364-4862 |

media.relations@endo.com | | relations.investor@endo.com |

#####

v3.24.0.1

Document and Entity Information

|

Mar. 06, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 06, 2024

|

| Entity Registrant Name |

Endo International plc

|

| Entity Central Index Key |

0001593034

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

L2

|

| Entity File Number |

001-36326

|

| Entity Tax Identification Number |

68-0683755

|

| Entity Address, Address Line One |

First Floor, Minerva House, Simmonscourt Road

|

| Entity Address, City or Town |

Ballsbridge, Dublin 4,

|

| Entity Address, Country |

IE

|

| Entity Address, Postal Zip Code |

Not Applicable

|

| City Area Code |

353

|

| Local Phone Number |

1-268-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |