Filed by SensaSure Technologies Inc.

Commission File No. 001-41209

pursuant to Rule 425 under the Securities Act of

1933, as amended,

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Verde Bio Holdings, Inc.

Commission File No. 000-54524

Date: March 5, 2024

On March 5, 2024, SensaSure Technologies Inc. and Verde Bio Holdings,

Inc. issued the following joint press release.

SensaSure Technologies and Verde Bio Holdings File

Registration Statement for Previously Announced Merger

March 5, 2024 – SensaSure Technologies, Inc. (OTCQB:

SSTC) (“SensaSure”) and Verde Bio Holdings, Inc. (OTC: VBHI) ("Verde" or the "Company"), a

growing oil and gas company with a focus on the acquisition and management of oil and gas minerals and royalties, today announced the

filing of a Registration Statement on Form S-4 (the “Registration Statement”) with the Securities and Exchange Commission

(“SEC”) in connection with the previously announced merger between the Company and wholly owned subsidiary of

SensaSure (the “Merger”).

Verde and SensaSure are working to close the Merger as soon as

possible following the satisfaction of all closing conditions, which will create a new OTCQB-listed company focused on the acquisition

and management of oil and gas minerals and royalties.

“The filing of the Registration Statement is a major milestone

for Verde and SensaSure as it signifies another step towards closing,” commented Scott Cox, Chief Executive Officer of Verde. “As

a result of the Merger, we believe the combined company will be a well-positioned oil and gas minerals pure play company squarely focused

on the acquisition of high quality, cash flowing oil and gas minerals and royalties, an opportunity that we believe all stakeholders in

our companies are highly excited about. We look forward to the upcoming closing and diving in headfirst into the tremendous opportunity

before us.”

Jim Hiza, Chief Executive Officer of SensaSure commented, “We

are very excited for this next step towards completing the Merger and are looking forward to increasing stockholder value for the combined

company.”

The Registration Statement has not yet become effective, is subject

review by the SEC and contains a preliminary joint proxy statement/prospectus which provides important information about Verde and SensaSure,

as well as the proposed Merger and related transactions.

About SensaSure Technologies, Inc.

Until November 2023, SensaSure Technologies, Inc. (OTCQB: SSTC)

was a medical technology or “MedTech” company that supplied a simple device and method to collect a breath sample for lab-based

analysis. Subsequent to the six months ended October 31, 2023, management of SensaSure has been in the process of establishing a new business

segment to develop energy related businesses which led to the entry into the pending Merger transaction.

About Verde Bio Holdings, Inc.

Verde Bio Holdings, Inc. (OTC: VBHI) is an oil and gas company

engaged in the acquisition and management of mineral and royalty interests in lower risk, onshore oil and gas properties within the major

oil and gas plays in the U.S. The Company’s dual-focused growth strategy relies primarily on leveraging management’s expertise

to grow through the strategic acquisition of revenue producing royalty interest and strategic and opportunistic non-operated working interests. www.verdebh.com

Additional Information and Where to Find

It

In connection with the Merger and related transactions, SensaSure

has filed with the SEC the Registration Statement that includes a joint proxy statement of SensaSure and Verde and also will constitute

a prospectus with respect to shares of SensaSure capital stock to be issued in the proposed transaction. Before making any voting or investment

decision, investors and security holders of SensaSure and Verde and other interested parties are urged to read the Registration Statement,

any amendments thereto and any other documents filed with the SEC carefully and in their entirety when they become available because they

contain and will contain important information about the transaction and the parties to the transaction. Investors and security holders

may obtain free copies of the Registration Statement and amendments (when available) and other documents filed with the SEC through the

website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by SensaSure will be available by contacting

SensaSure by email at info@pcgadvisory.com. Copies of the documents filed with the SEC by Verde will be available free of charge on Verde’s

website at https://investors.verdebh.com/financial-information/sec-filings or by contacting Verde by email at ir@verdebh.com.

Participants in the Solicitation

SensaSure, Verde and their respective directors and executive officers

and other employees may be considered participants in the solicitation of proxies from the stockholders of SensaSure or Verde with respect

to the transaction. Information about the directors and executive officers of SensaSure is set forth in its Annual Report on Form 10-K

for the fiscal year ended April 30, 2023 filed with the SEC on August 14, 2023. Information about the directors and executive officers

of Verde is set forth in its Annual Report on Form 10-K for the fiscal year ended April 30, 2023 filed with the SEC on August 2, 2023.

Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests,

by security holdings or otherwise, is included in the Registration Statement and other relevant materials to be filed with the SEC regarding

the transaction when they become available. Stockholders, potential investors and other interested persons should read the final joint

proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. When available, these

documents can be obtained free of charge from the sources indicated above.

No Offer or Solicitation

This communication shall not constitute a solicitation of a proxy,

consent or authorization with respect to any securities or in respect of the proposed Merger. This communication shall not constitute

an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

state or jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10

of the Securities Act or an exemption therefrom.

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1955. These forward-looking

statements include, without limitation, SensaSure’s expectations with respect to the proposed Merger, including statements regarding

the benefits of the transaction and the anticipated timing of the transaction. Words such as “believe,” “project,”

“expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “may,” “should,” “will,” “would,” “will

be,” “will continue,” “will likely result,” and similar expressions are intended to identify such forward-looking

statements. Forward-looking statements are predictions, projections and other statements about future events that are based on current

expectations and assumptions and, as a result, are subject to significant risks and uncertainties that could cause the actual results

to differ materially from the expected results. Most of these factors are outside of SensaSure’s and Verde’s control and are

difficult to predict. Factors that may cause actual future events to differ materially from the expected results, include, but are not

limited to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price

of SensaSure’s and Verde’s securities, (ii) the failure to satisfy the conditions to the consummation of the transaction,

including the adoption of the merger agreement by the stockholders of Verde, (iii) the occurrence of any event, change or other circumstance

that could give rise to the termination of the merger agreement, (iv) the failure to obtain any applicable regulatory approvals required

to consummate the Merger, (v) the receipt of an unsolicited offer from another party for an alternative transaction that could interfere

with the Merger, (vi) the effect of the announcement or pendency of the transaction on SensaSure’s and Verde’s business relationships,

performance, and business generally, (vii) the inability to recognize the anticipated benefits of the Merger, which may be affected by,

among other things, competition and the ability of the post-combination company to grow and manage growth profitability and retain its

key employees, (viii) costs related to the Merger, (ix) the outcome of any legal proceedings that may instituted against SensaSure or

Verde, regarding the proposed Merger, (x) the ability to maintain the listing of SensaSure’s or Verde’s securities on the

OTC prior to the Merger, (xi) the risk that SensaSure or Verde is not able to maintain and enhance its brand and reputation in its marketplace,

adversely affecting SensaSure’s or Verde’s business, financial condition and results of operations, (xii) the risk that periods

of rapid growth and expansion could place a significant strain on SensaSure’s resources, including its employee base, which could

negatively impact SensaSure’s operating results; (xiii) the risk that SensaSure may never achieve or sustain profitability; (xiv)

the risk that SensaSure may need to raise additional capital to execute its business plan, which many not be available on acceptable terms

or at all; (xv) the risk that the post-combination SensaSure’s securities will not be approved for listing on OTC or if approved,

maintain the listing and (xvi) other risks and uncertainties indicated from time to time in the Registration Statement. There may be additional

risks that SensaSure or Verde does not know or that SensaSure and Verde currently believe to be immaterial that could also cause results

to differ from those contained in any forward-looking statements. Forward-looking statements speak only as of the date they are made.

Readers are cautioned not to put undue reliance on forward-looking statements, and SensaSure assumes no obligation and do not intend to

update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

The foregoing list of factors is not exhaustive. Recipients should

carefully consider such factors and the other risks and uncertainties described in the “Risk Factors” section of periodic

reports filed by SensaSure or Verde with the SEC, the Registration Statement and other documents filed or to be filed by SensaSure from

time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events

and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of

the date they are made. Recipients are cautioned not to put undue reliance on forward-looking statements, and neither SensaSure, nor

Verde assumes any obligation to, nor intend to, update or revise these forward-looking statements, whether

as a result of new information, future events, or otherwise, except as required by law. Neither SensaSure, nor Verde gives any assurance

that either SensaSure or Verde, or the combined company, will achieve its expectations.

For more

information, contact:

Kirin Smith, President

PCG Advisory, Inc.

ksmith@pcgadvisory.com

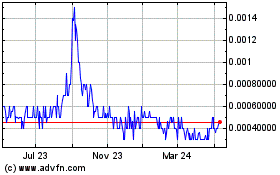

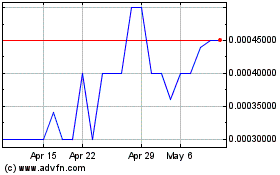

Verde Bio (PK) (USOTC:VBHI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Verde Bio (PK) (USOTC:VBHI)

Historical Stock Chart

From Apr 2023 to Apr 2024