| PROSPECTUS |

File No. 333-277336 |

| |

Filed

Pursuant to Rule 424(b)(3) |

Connexa

Sports Technologies, Inc.

20,136,080

Shares of Common Stock

This

prospectus relates to the offer and sale from time to time by the selling stockholders identified in this prospectus of up to an

aggregate of 20,136,080 shares of our common stock consisting of (a) 9,944,406 shares of our common stock, par value $0.001

per share (the “Common Stock”) issuable upon the exercise of warrants issued on December 6, 2023, as amended,

each at an exercise price, following the shareholder approval being sought in

compliance with Nasdaq Listing Rule 5635(d), to issue the shares of Common Stock at a price below the Minimum Price (as defined by

Nasdaq Listing Rule 5635(d)), which the Company will seek to obtain by May 3, 2024 (and, if not obtained by such date, the

Company will call a shareholder meeting every sixty (60) days until shareholder approval is obtained) of $0.16 per share

(subject to adjustment) with a term of five and one half years (the “December Warrants”), (b) 9,991,674 shares

of Common Stock issuable upon conversion, at a conversion price of $0.32, of an aggregate amount of $3,197,335.65 owed pursuant to a

promissory note (the “Note”) issued pursuant to a Loan and Security Agreement, as amended (defined herein as the

“LSA”) and (c) up to 200,000 shares of Common Stock owned by Smartsports LLC, an investor relations consultant engaged

by the Company.

We

are registering the shares of Common Stock underlying the December Warrants as required by the inducement offer letter agreement

that we entered into with Armistice Capital Master Fund Ltd. (the “Armistice Selling Stockholder”) on December 6,

2023 (the “Inducement Letter”).

We

are registering the shares of Common Stock underlying the Note as required by the Waiver, Warrant Amendment and Second Loan and Security

Modification Agreement (the “Waiver, Amendment, and Modification Agreement”) that we entered into with the Armistice Selling

Stockholder on February 21, 2024.

Our

registration of the shares of Common Stock covered by this prospectus does not mean that the selling stockholders will offer or sell

any of the shares. The selling stockholders may offer and sell or otherwise dispose of the shares of Common Stock described in this prospectus

from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices or

at privately negotiated prices. See “Plan of Distribution” beginning on page 84 for more information.

We

are not selling any shares of Common Stock and will not receive any of the proceeds from the sale by the selling stockholders of the

shares of Common Stock offered hereby. If the Armistice Selling Stockholder exercises all 9,944,406 shares of Common Stock underlying

the December Warrants via a cash exercise, however, we will receive aggregate gross proceeds of approximately $1,591,105.

The

selling stockholders will pay all underwriting discounts and selling commissions, if any, in connection with the sale of the shares of

Common Stock. We have agreed to pay certain expenses in connection with the registration statement of which this prospectus

forms a part and to indemnify the Armistice Selling Stockholder and certain related persons against certain liabilities. As of the

date of this prospectus, no underwriter or other person has been engaged to facilitate the sale of shares of Common Stock in this prospectus.

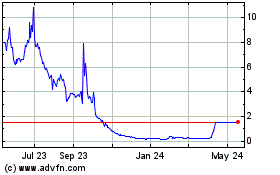

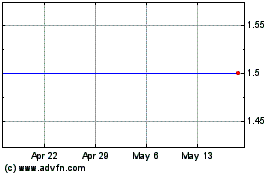

The

Common Stock is listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “CNXA.” On March 1, 2024,

the closing sale price of the Common Stock was $0.2899.

You

should carefully consider the risks that we have described in “Risk Factors” beginning on page 7 before deciding whether

to invest in the Common Stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is March 1, 2024.

TABLE

OF CONTENTS

You

should read this prospectus carefully before you invest. It contains important information you should consider when making your investment

decision. You should rely only on the information provided in this prospectus. We have not authorized anyone to provide you with different

information.

The

information in this document may only be accurate on the date of this document. You should assume that the information appearing in this

prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations

and prospects may have changed since that date.

We

have not authorized anyone to provide any information or to make any representations other than those contained in or incorporated by

reference in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We

take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This

prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to

do so. The information contained in this prospectus is accurate only as of its date regardless of the time of delivery of this prospectus

or of any sale of shares of Common Stock.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some

of the documents referred to herein have been filed or will be filed, and you may obtain copies of those documents as described below

under “Where You Can Find More Information.”

Neither

we nor the selling stockholders have done anything that would permit this offering or possession or distribution of this prospectus

in any jurisdiction where action for that purpose is required, other than in the United States. Persons who come into possession of this

prospectus and any free writing prospectus in jurisdictions outside the United States are required to inform themselves about and to

observe any restrictions as to this offering and the distribution of this prospectus and any free writing prospectus applicable to that

jurisdiction.

This

prospectus and the documents in this prospectus contain market data and industry statistics and forecasts that are based on independent

industry publications and other publicly available information. Although we believe that these sources are reliable, we do not guarantee

the accuracy or completeness of this information and we have not independently verified this information. Although we are not aware of

any misstatements regarding the market and industry data presented in this prospectus, these estimates involve risks and uncertainties

and are subject to change based on various factors, including those discussed under the heading “Risk Factors” and

any related free writing prospectus. Accordingly, investors should not place undue reliance on this information.

Unless

otherwise stated, all share figures in this prospectus have been adjusted to reflect the one-for-forty (1-for-40) reverse stock split effected by the

Company on September 25, 2023.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus

contains forward-looking statements within the meaning of Section 27A of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). The words “believe,” “expect,” “anticipate,” “intend,” “estimate,”

“may,” “should,” “could,” “will,” “plan,” “future,” “continue,”

and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify

forward-looking statements. These forward-looking statements are based largely on our expectations or forecasts of future events, can

be affected by inaccurate assumptions, and are subject to various business risks and known and unknown uncertainties, a number of which

are beyond our control. Therefore, actual results could differ materially from the forward-looking statements contained in this document,

and readers are cautioned not to place undue reliance on such forward-looking statements. We undertake no obligation to publicly update

or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A wide variety of factors

could cause or contribute to such differences and could adversely impact revenues, profitability, cash flows and capital needs. There

can be no assurance that the forward-looking statements contained in this document will, in fact, transpire or prove to be accurate.

These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the

section entitled “Risk Factors” in our Form 10-K for the fiscal year ended April 30, 2023, filed on September 14, 2023, that

may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from

any future results, levels of activity, performance or achievements expressed or implied by any forward-looking statements.

Important

factors that may cause the actual results to differ from the forward-looking statements, projections or other expectations include, but

are not limited to, the following:

| |

● |

risk

that we will not be able to remediate identified material weaknesses in our internal control over financial reporting and disclosure

controls and procedures; |

| |

|

|

| |

● |

risk

that we fail to meet the requirements of the agreements under which we acquired our business interests, including any cash payments

to the business operations, which could result in the loss of our right to continue to operate or develop the specific businesses

described in the agreements; |

| |

|

|

| |

● |

risk

that we will be unable to secure additional financing in the near future in order to commence and sustain our planned development

and growth plans; |

| |

|

|

| |

● |

risk

that we cannot attract, retain and motivate qualified personnel, particularly employees, consultants and contractors for our operations; |

| |

|

|

| |

● |

risks

and uncertainties relating to the various industries and operations we are currently engaged in; |

| |

|

|

| |

● |

results

of initial feasibility, pre-feasibility and feasibility studies, and the possibility that future growth, development or expansion

will not be consistent with our expectations; |

| |

|

|

| |

● |

risks

related to the inherent uncertainty of business operations including profit, cost of goods, production costs and cost estimates and

the potential for unexpected costs and expenses; |

| |

|

|

| |

● |

risks

related to commodity price fluctuations; |

| |

|

|

| |

● |

the

uncertainty of profitability based upon our history of losses; |

| |

|

|

| |

● |

risks

related to failure to obtain adequate financing on a timely basis and on acceptable terms for our planned development projects; |

| |

|

|

| |

● |

risks

related to environmental regulation and liability; |

| |

|

|

| |

● |

risks

related to tax assessments; and |

| |

|

|

| |

● |

other

risks and uncertainties related to our prospects, properties and business strategy. |

Although

we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels

of activity, performance or achievements. You should not place undue reliance on these forward-looking statements, which speak only as

of the date of this report. Except as required by law, we do not undertake to update or revise any of the forward-looking statements

to conform these statements to actual results, whether as a result of new information, future events or otherwise. The identification

in this document of factors that may affect future performance and the accuracy of forward-looking statements is meant to be illustrative

and by no means exhaustive. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty.

You may rely only on the information contained in this prospectus.

We

have not authorized anyone to provide information different from that contained in this prospectus. Neither the delivery of this prospectus

nor the sale of shares of Common Stock means that the information contained in this prospectus is correct after the date of this

prospectus. This prospectus is not an offer to sell or solicitation of an offer to buy these securities in any circumstances under which

the offer or solicitation is unlawful.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in the prospectus. Because it is a summary, it does not contain all of the

information that you should consider before investing in the Common Stock. You should read and carefully consider this entire

prospectus before making an investment decision, especially the information presented under the headings “Risk Factors,”

and “Cautionary Note Regarding Forward-Looking Statements and “Management’s Discussion and Analysis of Financial

Condition and Results of Operation” and our consolidated financial statements and related notes beginning on page

F-1”.

Unless

otherwise indicated by the context, references to “Connexa,” “Company,” “we,” “us,” or

“our” and similar terms refer to the operations of Connexa Sports Technologies Inc., Slinger Bag Inc., Slinger Bag Americas,

Slinger Bag Canada, Slinger Bag UK, SBL and Gameface.

Our

fiscal year end is April 30 and our fiscal years ended April 30, 2023 and 2022 are sometimes referred to herein as fiscal

years 2023 and 2022, respectively.

On

September 20, 2023, we filed a Certificate of Amendment to our Articles of Incorporation, as amended, to effect a one-for-forty (1-for-40)

reverse stock split effective September 25, 2023. Unless otherwise stated, all share and per share information in this prospectus

has been adjusted to reflect this reverse stock split.

Our

Company

Overview

The

Company operates in the sports equipment and technology business. The Company is the owner of the Slinger Bag Launcher, which is comprised

of a portable tennis ball launcher, a portable padel tennis ball launcher and a portable pickleball launcher and Gameface, providing

AI technology and performance analytics for sports.

Brief

History

Lazex

Inc. (“Lazex”) was incorporated under the laws of the State of Nevada on July 12, 2015. On August 23, 2019, the majority

owner of Lazex entered into a Stock Purchase Agreement with Slinger Bag Americas Inc., a Delaware corporation (“Slinger Bag Americas”),

which was 100% owned by Slinger Bag Ltd. (“SBL”), an Israeli company. Effective September 13, 2019, Lazex changed its name

to Slinger Bag Inc. On October 31, 2019, Slinger Bag Americas acquired control of Slinger Bag Canada, Inc., (“Slinger Bag Canada”)

a Canadian company incorporated on November 3, 2017. On February 10, 2020, Slinger Bag Americas became the 100% owner of SBL, along with

SBL’s wholly owned subsidiary Slinger Bag International (UK) Limited (“Slinger Bag UK”), which was formed on April

3, 2019. On February 10, 2021, Zehava Tepler, the owner of SBL, contributed Slinger Bag UK to Slinger Bag Americas for no consideration.

On

June 21, 2021, Slinger Bag Americas entered into a membership interest purchase agreement with Charles Ruddy to acquire a 100% ownership

stake in Foundation Sports Systems, LLC (“Foundation Sports”). On February 2, 2022, the Company entered into a share purchase

agreement with Flixsense Pty, Ltd. (“Gameface”). As a result of the share purchase agreement, Gameface would become a wholly

owned subsidiary of the Company. On February 22, 2022, the Company entered into a merger agreement with PlaySight Interactive Ltd. (“PlaySight”)

and Rohit Krishnan. As a result of the merger agreement, PlaySight became a wholly owned subsidiary of the Company. On December 5, 2022,

the Company assigned 75% of its membership interest in Foundation Sports to Charles Ruddy, its founder and granted him the right for

a period of three years to purchase the remaining 25% of its Foundation Sports membership interests for $500,000 in cash. As of December

5, 2022, the results of Foundation Sports were no longer consolidated in the Company’s financial statements, the Company recorded

a loss on the sale and the investment is now accounted for as an equity method investment. On December 5, 2022, the Company analyzed

this investment and established a reserve for the investment at the full amount of $500,000. On November 27, 2022, the Company entered

into a share purchase agreement (the “Agreement”) with PlaySight, Chen Shachar and Evgeni Khazanov (together, the “Buyer”)

pursuant to which the Buyer purchased 100% of the issued and outstanding shares of PlaySight from the Company in exchange for consideration.

The total loss on disposal of Foundation Sports and PlaySight amounted to $41,413,892 in the year ended April 30, 2023.

In

April 2023, the Company determined that the technology utilized in Gameface would take substantially more financial resources and more

time to bring to market and achieve profitability than originally anticipated. As a result, the goodwill and intangible assets related

to Gameface were fully impaired as of April 30, 2023, resulting in an impairment loss of $11,421,817. The Company previously classified

Foundation Sports in continuing operations, until December 5, 2022 when they sold 75% of Foundation Sports back to the original owners

at which time it deconsolidated this subsidiary and recorded a loss on the sale. The Company also determined to dispose of the PlaySight

entity during the year ended April 30, 2023. The Company completed the sale in November 2022 and recorded a loss on the sale at that

time. The total loss on disposal of Foundation Sports and PlaySight amounted to $41,413,892 in the year ended April 30, 2023. The Company

impaired all goodwill as of April 30, 2023. For a more detailed description of our history, please refer to the section entitled “Description

of Business.”

Recent

Developments

On

June 8, 2023, the Company entered into a merchant cash advance agreement with Meged Funding Group (“Meged”) pursuant to which

the Company sold $315,689 in future receivables to Meged (the “Meged Receivables Purchased Amount”) to in exchange for payment

to the Company of $210,600 in cash less fees of $10,580. The Company agreed to pay Meged $17,538 each week until the Meged Receivables

Purchased Amount is paid in full.

On

January 30, 2024, the Company received a letter from the staff of the Nasdaq Stock Market confirming that following the receipt of a

an investment of $16.5 million as disclosed in the Company’s current report filed on Form 8-K on January 24, 2024 (i) the Company

has regained compliance with the minimum shareholder equity requirement in Listing Rule 5550(b)(1) (the “Equity Rule”), as

required by the Nasdaq Hearing Panel’s (“Panel”) decision dated April 12, 2023, as amended, and (ii) in application

of Listing Rule 5815(d)(4)(B), the Company will be subject to a mandatory panel monitor for a period of one year from the date of such

letter. If, within that one-year monitoring period, the Nasdaq Listing Qualifications staff (the “Staff”) finds that the

Company is no longer in compliance with the Equity Rule, then, notwithstanding Rule 5810(c)(2), the Company will not be permitted to

provide Staff with a plan of compliance with respect to such deficiency and Staff will not be permitted to grant additional time for

the Company to regain compliance with respect to such deficiency, nor will the Company be afforded an applicable cure or compliance period

pursuant to Rule 5810(c)(3). Instead, Staff will issue a Delist Determination Letter and the Company will have an opportunity

to request a new hearing with the initial Panel or a newly convened Hearings Panel if the initial Panel is unavailable. The Company will

have the opportunity to respond/present to the Hearings Panel as provided by Listing Rule 5815(d)(4)(C) and the Company’s securities

may at that time be delisted from Nasdaq.

It

is further reported that, in application of Listing Rule 5815(d)(4)(B), the Company is also subject to a mandatory panel monitor in respect

of its period filing requirements in Listing Rule 5250(c)(1) (the “Periodic Filing Rule”) for a period of one year from October

11, 2023. If, within that one-year monitoring period, the Staff finds the Company again out of compliance with the Periodic Filing Rule,

notwithstanding Rule 5810(c)(2), the Company will not be permitted to provide Staff with a plan of compliance with respect to that deficiency

and Staff will not be permitted to grant additional time for the Company to regain compliance with respect to that deficiency, nor will

the company be afforded an applicable cure or compliance period pursuant to Rule 5810(c)(3). Instead, Staff will issue a Delist Determination

Letter and the Company will have an opportunity to request a new hearing with the initial Panel or a newly convened Hearings Panel if

the initial Panel is unavailable. The Company will have the opportunity to respond/present to the hearing panel as provided by Listing

Rule 5815(d)(4)(C) and the Company’s securities may at that time be delisted from Nasdaq.

On

August 7, 2023, the Company entered into an agreement with UFS (the “UFS Agreement”) pursuant to which the Company sold $797,500

in future receivables (the “UFS Second Receivables Purchased Amount”) to UFS in exchange for payment to the Company of $550,000

in cash less fees of $50,000. The Company agreed to pay UFS $30,000 each week until the UFS Second Receivables Purchased Amount is paid

in full.

In

order to secure payment and performance of the Company’s obligations to UFS under the UFS Agreement, the Company granted to UFS

a security interest in the following collateral: all accounts receivable and all proceeds as such term is defined by Article 9 of the

UCC. The Company also agreed not to create, incur, assume, or permit to exist, directly or indirectly, any lien on or with respect to

any of such collateral.

On

September 13, 2023, the Company held a special meeting of stockholders in which the following items were approved: (i) the issuance

of (i) 25,463 shares of our common stock, par value $0.001 per share (the “Common Stock”), that were issued on

October 3, 2022, and, (ii) 295,051 shares of Common Stock issuable upon exercise of pre-funded warrants at an exercise price

of $0.00001 per share, (iii) 320,513 shares of Common Stock issuable upon the exercise of the 5-Year Warrants at an exercise

price of $15.60 per share, (iv) 641,026 shares of Common Stock issuable upon the exercise of the 7.5 Year Warrants at an

exercise price of $17.20 per share and (v) 452,489 shares of Common Stock issuable upon the exercise of the warrants issued on

January 6, 2023 to the Armistice Selling Stockholder at an exercise price or $8.84 and with a term of five and one half years

(the “5.5-Year Warrants”) at an exercise price per share equal to $8.84 per share to the Armistice Selling

Stockholder and (ii) a reverse stock split of the Common Stock within a range of one (1)-for-ten (10) to one

(1)-for-forty (40), with the Board of Directors of the Company to set the specific ratio and determine the date for the reverse

split to be effective and any other action deemed necessary to effectuate the reverse stock split, without further approval

or authorization of stockholders, at any time within 12 months of the special meeting date. The Company effected a 1-for-40

reverse stock split (the “Reverse Stock Split”) on September 25, 2023.

From September 18,

2023 through January 31, 2024, the Company issued the

Armistice Selling Stockholder 9,574,165 shares of Common Stock related to the exercise of the pre-funded warrants.

On

September 19, 2023, the Company entered into an agreement with Meged (the “Second Meged Agreement”) pursuant to which the

Company sold $423,000 in future receivables to Meged (the “Meged Second Receivable Amount”) in exchange for paying the then

outstanding balance of $70,153 of the Meged Receivables Purchased Amount in full with the balance being retained by the Company in

cash for general purposes. The Company agreed to pay Meged $15,107 each week until the Meged Second Receivable Amount is paid in full.

In

order to secure payment and performance of the Company’s obligations to Meged under the Second Meged Agreement, the Company granted

to Meged a security interest in the following collateral: all accounts receivable and all proceeds as such term is defined by Article

9 of the UCC. The Company also agreed not to create, incur, assume, or permit to exist, directly or indirectly, any lien on or with respect

to any of such collateral.

On

October 11, 2023, the Company, the Lenders and the Agent (as defined in the LSA)

entered into a loan and security modification agreement to allow for an additional loan

of $1,000,000 pursuant to the loan and security modification agreement. In addition, on

October 11, 2023, the Company agreed to issue warrants to purchase up to 169,196 shares of Common Stock at an exercise price of

$1.90 per share (the “October Warrants”).

On

December 6, 2023, the Company entered into an inducement offer letter agreement (the “Inducement Letter”) with the Armistice

Selling Stockholder with regard to certain of the Company’s existing warrants to purchase up to a total of 4,972,203 shares of Common Stock,

consisting of: (i) 1,410,151 shares of Common Stock issuable upon the exercise of warrants issued on September 28, 2022 each at an exercise

price of $3.546 per share with a term of five year (the “September 2022 Five Year Warrants”); (ii) 3,109,563 shares of Common

Stock issuable upon the exercise of warrants issued on September 28, 2022 each at an exercise price of $3.546 per share with a term of

seven and one half years (the “September 2022 Seven and a Half Year Warrants”); and (iii) 452,489 shares of Common Stock

issuable upon the exercise of warrants issued on January 6, 2023 (the “January 2023 Warrants” and, together with the September

2022 Five Year Warrants and the September 2022 Seven and a Half Year Warrants, the “2022 and 2023 Warrants”).

Pursuant

to the Inducement Letter, the Armistice Selling Stockholder agreed to exercise for cash the 2022 and 2023 Warrants to purchase an aggregate

of 4,972,203 shares of Common Stock at a reduced exercise price of $0.294 per share in consideration of the Company’s agreement

to issue the December Warrant. The Company received aggregate gross proceeds of $1,461,827.68 from the exercise of the 2022 and 2023

Warrants by the Holder, before deducting offering expenses payable by us. The transaction closed on December 7, 2023.

The

resale of the shares of the Common Stock underlying the 2022 and 2023 Warrants and 224,472 shares of Common Stock owned by Sapir LLC,

a consultant engaged by the Company were registered pursuant to an existing registration statement on Form S-1 (File No. 333-275407),

declared effective by the Securities and Exchange Commission (the “SEC”) on December 4, 2023.

As

of February 21, 2024, the total amount owed pursuant to the Note was $3,197,335.65. Of this amount, the Company received gross proceeds

of $3 million from the Lenders.

On

February 21, 2024, the Company and the Lenders and the Agent entered into a Waiver, Warrant

Amendment and Second Loan and Security Modification Agreement (the “Waiver, Amendment, and Modification Agreement”).

Pursuant

to the Waiver, Amendment, and Modification Agreement, the Lenders and the Agent agreed to

waive certain events of default with regard to certain covenants and obligations the Company had pursuant to (a) that certain registration

rights agreement between the Company and the Lenders and the Agent entered into in September

2022, (b) the LSA (as modified), and (c) the Inducement Letter.

Pursuant

to the Waiver, Amendment, and Modification Agreement, the Company and the Lenders and the Agent

agreed to modify the Loan and Security Agreement such that the Note is now convertible into up to 9,991,674 shares of Common Stock

based on the agreed to conversion price of $0.32. The Company believes that the $0.32 conversion price meets the definition of “Minimum

Price” in Nasdaq Listing Rule 5635(d).

Pursuant

to the Waiver, Amendment, and Modification Agreement, the Lenders and the Agent agreed to

use its reasonable best efforts to voluntarily convert all amounts owed under the Note on or prior to the last trading day before the

trading day on which the next meeting of the Company’s shareholders will take place.

Pursuant

to the Waiver, Amendment, and Modification Agreement, the Company and the Lenders and the Agent

agreed that following shareholder approval, which the Company will seek to obtain by May 3, 2024 (and, if not obtained by such

date, the Company agreed to call a shareholder meeting every sixty (60) days until shareholder approval is obtained), the October Warrants

and December Warrants will be amended to lower the exercise price of such warrants to $0.16 per share. The October Warrants and December

Warrants cannot be exercised at the $0.16 exercise price until the Company, in compliance with Nasdaq Listing Rule 5635(d), obtains shareholder

approval to issue the shares of Common Stock at a price below the Minimum Price.

Pursuant

to the Waiver, Amendment, and Modification Agreement, the Company agreed that Slinger Bag Americas Inc., a Delaware subsidiary of the

Company (“Slinger”) will, within ten (10) business days of the six month anniversary of the effectiveness of the registration

statement on Form S-1 registering the shares of Common Stock issuable pursuant to the conversion of the Note (the “Effectiveness

Date”), pay in cash to the Lenders and the Agent the difference, if any, between (i)

$6 million (the “Guaranteed Amount”) and (ii) the combined gross proceeds realized by the

Lenders and the Agent from its sale of the shares of Common Stock issued pursuant to (a) conversions of the Note and (b) exercises

of the October Warrants and December Warrants(the “Realized Amount”). Slinger is obligated to fund an escrow account with

$2 million within ten (10) weeks of February 21, 2024. The Company and the Lenders and the Agent also agreed that if, due to a Force

Majeure Event, the Lenders and the Agent has not fully converted the Note prior to the six-month

anniversary of the Effectiveness Date, the Company will repurchase the Note and the October Warrants and December Warrants by paying

in cash to the Lenders and the Agent the difference, if any, between the Guaranteed Amount

and the Realized Amount.

Pursuant

to the Waiver, Amendment, and Modification Agreement, the Company and the Lenders and the Agent

agreed that once the Note is fully repaid (either via a combination of cash payments and conversions into shares of Common Stock

or just via conversions into shares of Common Stock) all liens and security interests of the Lenders

and the Agent in any and all of the property of the Company and the Guarantors (as defined in the Waiver, Amendment, and Modification

Agreement) will be automatically released and terminated, including without limitation, any liens and security interests evidenced by

Uniform Commercial Code financing statements.

Pursuant

to the Waiver, Amendment, and Modification Agreement, the Company agreed to prepare and file a registration statement on Form S-1 registering

the shares of Common Stock issuable pursuant to the conversion of the Note with the SEC within five (5) business days of February 21,

2024 and use commercially reasonable best efforts to cause such registration statement to be declared effective by the SEC as soon as

practical thereafter and, in any event, within thirty (30) calendar days of February 21, 2024. The registration statement of which this

prospectus forms a part was filed in compliance with this obligation.

On October 12, 2023, the

Board of Directors of the Company approved an amendment to the Bylaws of the Company to reduce the percentage of shares of stock, issued

and outstanding and entitled to vote, to be present in person or represented by proxy in order to constitute a quorum for the transaction

of any business from a majority to thirty three and one third percent (33 1/3%).

On November 14, 2023, the Company

issued 224,472 shares of Common Stock to Sapir LLC. Sapir LLC is controlled by Aitan Zacharin, an investor relations and financial structuring

consultant to the Company who is a party to an amended and restated consulting agreement with the Company dated April 30, 2020 (the “AZ

Consulting Agreement”). Pursuant to the AZ Consulting Agreement, the Company owed Mr. Zacharin $127,500 as consulting fee compensation

through November 30, 2023 (the “Consulting Fee Compensation”). In addition, the Company granted Mr. Zacharin $127,500 as discretionary

compensation (“Discretionary Compensation”) pursuant to Section 2.1(d) of the AZ Consulting Agreement. In consideration of

the Consulting Fee Compensation and the Discretionary Compensation, the issuance of shares of Common Stock consisted of (i) 160,338 shares

of Common Stock as payment of the Consulting Fee Compensation, and (ii) 64,134 shares of Common Stock as payment of the Discretionary

Compensation.

On

December 12, 2023, the Company received a letter (“Notice”) from the Staff informing the Company that because the closing

bid price for the Common Stock listed on Nasdaq was below $1.00 for 30 consecutive trading days, the Company is not in

compliance with the minimum bid price requirement for continued listing on Nasdaq as set forth in Nasdaq Listing Rule 5550(a)(2)

(the “Minimum Bid Price Requirement”). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has a period

of 180 calendar days from December 12, 2023, or until June 10, 2024, to regain compliance with the Minimum Bid Price Requirement. If

at any time before June 10, 2024, the closing bid price of the Common Stock closes at or above $1.00 per share for a

minimum of 10 consecutive trading days (which number days may be extended by Nasdaq), Nasdaq will provide written notification that the

Company has achieved compliance with the Minimum Bid Price Requirement, and the matter would be resolved. The Notice also disclosed that

in the event the Company does not regain compliance by June 10, 2024, the Company may be eligible for an additional 180-calendar day

compliance period. To qualify for additional time, the Company would be required to meet the continued listing requirement for market

value of publicly held shares and all other initial listing standards for Nasdaq, with the exception of the bid price requirement, and

would need to provide written notice of its intention to cure the deficiency during the second compliance period, by effecting a reverse

stock split, if necessary. In the event the Company is not eligible for the second grace period, Nasdaq will provide written notice that

the Common Stock is subject to delisting. If the Company is notified by Nasdaq that its securities will be subject to

delisting, the Company may appeal the delisting determination and request a hearing before a Nasdaq Hearings Panel (the “New Panel”).

If the request for a New Panel is timely made, any further suspension or delisting action would be stayed pending the conclusion of the

hearing process and expiration of any extension that may be granted by the New Panel. There can be no assurance that the Company will

be able to satisfy Nasdaq’s continued listing requirements, regain compliance with the Minimum Bid Price Requirement and maintain

compliance with other Nasdaq listing requirements.

On

January 10, 2024, the Company entered into an agreement with Agile Capital Funding, LLC (the “Agile Jan Agreement”) pursuant

to which the Company sold $1,460,000 in future receivables to Agile Capital Funding, LLC (the “Agile Jan Receivable Amount”)

in exchange for $1,000,000 in cash. The Company agreed to pay Agile Capital Funding, LLC (“Agile”) $52,142.86 each week until

the Agile Receivable Amount is paid in full. In order to secure payment and performance of the Company’s obligations to Agile under

the Agile Jan Agreement, the Company granted to Agile a security interest in the following collateral: all present and future accounts

receivable. The Company also agreed not to create, incur, assume, or permit to exist, directly or indirectly, any lien on or with respect

to any of such collateral. The proceeds from the sale of future receivables were used, in part, to pay the outstanding balance of the

ACF Receivable Amount (as defined below).

On

January 19, 2024, the Company entered into a securities purchase agreement (the “Securities Purchase Agreement”) with

three investors (the “Investors”) for the issuance and sale to each investor of (i) 2,330,200 shares of Common Stock (the

“Shares”) and (ii) pre-funded warrants (the “Pre-Funded Warrants”) to purchase an aggregate of 25,169,800 shares

of Common Stock at a combined purchase price of $0.20 per share of Common Stock for an aggregate amount of approximately $16.5

million. The Pre-Funded Warrants have an exercise price of $0.00001 per share of Common Stock and are exercisable

beginning on the date stockholder approval is received and effective allowing exercisability of Pre-Funded Warrants under Nasdaq rules

until the Pre-Funded Warrants are exercised in full. The aggregate number of Shares to be issued is 6,990,600 and the aggregate number

of Pre-Funded Warrants is 75,509,400.

On

January 23, 2024, the Company issued 200,000 shares of Common Stock to Smartsports LLC. Smartsports LLC is an investor relations consultant

to the Company who is a party to a consulting agreement with the Company dated January 23, 2024 (the “Smartsports Consulting Agreement”).

Pursuant to the Smartsports Consulting Agreement, the Company agreed to issue and deliver to Smartsports LLC 200,000 shares of Common

Stock as a consulting fee for the provision of investor relations services (the “Consulting Fee Compensation”) and use its

commercially reasonable efforts to prepare and file with the Securities Exchange Commission a registration statement covering the resale

of all of the shares on Form S-1 as soon as is reasonably practicable. The registration statement of which this prospectus

forms a part was filed in compliance with this obligation.

On

January 29, 2024, the Company entered into an agreement with Cedar Advance LLC (the “Cedar Agreement”) pursuant to which

the Company sold $1,183,200 in future receivables to Cedar Advance LLC (the “Cedar Receivable Amount”) in exchange for $752,000

in cash. The Company agreed to pay Cedar Advance LLC (“Cedar”) $39,440 each week until the Cedar Receivable Amount is paid

in full. In order to secure payment and performance of the Company’s obligations to Cedar under the Cedar Agreement, the Company

granted to Cedar a security interest in the following collateral: all present and future accounts receivable. The Company also agreed

not to create, incur, assume, or permit to exist, directly or indirectly, any lien on or with respect to any of such collateral.

Our

Corporate Information

The

Company was incorporated under the laws of the State of Nevada on July 12, 2015 and redomiciled in the State of Delaware on April 7,

2022 under the name Connexa Sports Technologies Inc.

Please refer to our brief history described above. Our corporate offices are located at 2709 North Rolling Road, Suite 138, Windsor Mill,

Maryland, 21244. Our telephone number is (443) 407-7564. Our website is www.connexasports.com. None of the information on our

website or any other website identified herein is part of this prospectus or the registration statement of which it forms a part.

The

Offering

| Issuer |

|

Connexa

Sports Technologies, Inc. |

| |

|

|

| Common

Stock offered by the selling stockholders |

|

Up

to an aggregate of 20,136,080 shares of Common Stock consisting of (a) 9,944,406 shares of

Common Stock issuable upon the exercise of the December Warrants, each at an exercise price,

following the shareholder approval being sought in compliance with Nasdaq Listing Rule 5635(d),

to issue the shares of Common Stock at a price below the Minimum Price (as

defined by Nasdaq Listing Rule 5635(d)), which the Company will seek to obtain by

May 3, 2024 (and, if not obtained by such date, the Company will call a shareholder meeting

every sixty (60) days until shareholder approval is obtained) of $0.16 per share (subject

to adjustment) with a term of five and one half years, (b) 9,991,674 shares of Common Stock

issuable upon conversion, at a conversion price of $0.32, of an aggregate amount of $3,197,335.65

owed pursuant to the Note issued pursuant to the LSA and (c) up to 200,000 shares of Common

Stock owned by Smartsports LLC, an investor relations consultant engaged by the Company. |

| |

|

|

| Common

Stock issued and outstanding after this offering (1) |

|

41,508,527

shares

of Common Stock |

| |

|

|

| Use

of proceeds |

|

We

will not receive any of the proceeds from the sale by the selling stockholders of the securities.

If the Armistice Selling Stockholder exercises all 9,944,406 shares of Common Stock underlying

the December Warrants via a cash exercise, we will receive aggregate gross proceeds

of approximately $1,591,105. Any proceeds from the exercise of the December

Warrants will be used for working capital and general corporate purposes. See section entitled

“Use of Proceeds.” |

| |

|

|

| Common

Stock Nasdaq Symbol |

|

CNXA

|

| |

|

|

| Risk

factors |

|

You

should read the section entitled “Risk Factors” beginning on page 7 for a discussion of some of the risks and

uncertainties you should carefully consider before deciding to invest in our securities. |

| (1) |

The

number of shares of Common Stock outstanding after this offering is based on 21,572,447 shares of Common Stock outstanding

as of February 23, 2024 and excludes the following: |

| |

● |

57,161

shares of Common Stock underlying other

outstanding warrants; |

| |

● |

46,651

shares of Common Stock issuable upon exercise of outstanding stock options by the members of our board of directors and

third parties; and |

| |

● |

10,500

shares of Common Stock reserved for future issuance under our 2020 Slinger Bag Inc. Global Share Incentive Plan (the “2020

Plan”). |

Except

as otherwise indicated herein, all information in this prospectus assumes the conversion of the Note and the exercise of the December

Warrants and sale of all shares available for sale under this prospectus and no further acquisitions of shares by the selling stockholders.

RISK

FACTORS SUMMARY

Investing

in shares of the Common Stock involves a high degree of risk. See section entitled “Risk Factors” beginning on page 7

of this prospectus for a discussion of factors you should carefully consider before investing in the Common Stock. If any

of these risks actually occurs, our business, financial condition, results of operations, cash flows and prospects would likely be materially

and adversely affected. As a result, the trading price of the Common Stock would likely decline, and you could lose all or part

of your investment. Listed below is a summary of some of the principal risks related to our business:

| |

● |

The

cost of raw materials, labor or freight could lead to an increase in our cost of sales and cause our results of operations to suffer. |

| |

|

|

| |

● |

Our

international operations involve inherent risks which could result in harm to our business. |

| |

|

|

| |

● |

We

develop products in Israel and our chief marketing officer is located in Israel and, therefore, our business, financial condition

and results of operation may be adversely affected by political, economic and military instability in Israel. |

| |

|

|

| |

● |

Conditions in Israel, including the recent attack by Hamas and

other terrorist organizations from the Gaza Strip and Israel’s war against them, may adversely affect our operations and limit

our ability to manage and market our products, which would lead to a decrease in revenues. |

| |

|

|

| |

● |

We

rely heavily on supply chain reliability and predictability and continued disruption in our supply chain could have a material adverse

impact on operations. |

| |

|

|

| |

● |

The

growth of our business depends on the successful execution of our growth strategy, and our efforts to expand internationally by growing

our e-commerce business. |

| |

|

|

| |

● |

Our

extended supply chain requires long lead times and relies heavily on manufacturers in Asia. |

| |

|

|

| |

● |

We

do not employ traditional advertising channels, and if we fail to adequately market our brand through product introductions and other

means of promotion, our business could be adversely affected. |

| |

|

|

| |

● |

Our

products face intense competition. |

| |

|

|

| |

● |

Failure

to continue to obtain or maintain high-quality endorsers of our products could harm our business. |

| |

|

|

| |

● |

There

is substantial doubt regarding our ability to continue as a going concern absent obtaining adequate new debt or equity financing

and achieving sufficient sales levels. |

| |

|

|

| |

● |

Our

business may be affected by seasonality, which could result in fluctuations in our operating results. |

| |

|

|

| |

● |

Our

products are subject to risks associated with overseas sourcing, manufacturing and financing. |

| |

|

|

| |

● |

Our

internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being

disseminated to the public. |

| |

|

|

| |

● |

The

costs of being a public company could result in us being unable to continue as a going concern. |

| |

|

|

| |

● |

Our

ability to sell our products and services will be dependent on the quality of our technical support and our failure to deliver high-quality

technical support services could have a material adverse effect on our sales and results of operations. |

| |

|

|

| |

● |

Failure

to adequately protect our intellectual property and curb the sale of counterfeit merchandise could injure our brand and negatively

affect our sales. |

| |

|

|

| |

● |

We

may become subject to claims for remuneration or royalties for assigned service invention rights by our employees, which could result

in litigation and adversely affect our business. |

| |

|

|

| |

● |

We

may be subject to product liability lawsuits or claims, which could harm our financial condition and liquidity if we are not able

to successfully defend or insure against such claims. |

| |

|

|

| |

● |

Failure

of our contractors or our licensees’ contractors to comply with local laws and other standards could harm our business. |

| |

|

|

| |

● |

Our

stock price may be volatile, or may decline regardless of our operating performance, and you could lose all or part of your investment

as a result. |

| |

|

|

| |

● |

Shareholders

may be diluted significantly through our efforts to obtain financing, satisfy obligations through issuance of additional shares,

or reset the exercise price of the December Warrants. |

RISK

FACTORS

You

should carefully consider the risks described below and other information in this prospectus, including the financial statements and

related notes that appear at the end of this report, before deciding to invest in our securities. These risks should be considered in

conjunction with any other information included herein, including in conjunction with forward-looking statements made herein. If any

of the following risks actually occur, they could materially adversely affect our business, financial condition and operating results.

Additional risks and uncertainties that we do not presently know or that we currently deem immaterial may also impair our business, financial

condition and operating results. The following discussion of risks is not all-inclusive but is designed to highlight what we believe

are the material factors to consider when evaluating our business and expectations. These factors could cause our future results to differ

materially from our historical results and from expectations reflected in forward-looking statements.

Risks Related to Our Business, Operations,

and Industry

We

depend on the strength of our brands.

We

expect to derive substantially all of our net sales from sales of branded products and services we own, including Slinger and Gameface.

The reputation and integrity of our brands are essential to the success of our business. We believe that our consumers value the status

and reputation of brands we promote, and the superior quality, performance, functionality and durability that our brands represent. Building,

maintaining and enhancing the status and reputation of our brands’ image is important to expanding our consumer base. Our continued

success and growth depend on our ability to protect and promote our brands, which, in turn, depends on factors such as the quality, performance,

functionality and durability of our products and services, our communication activities, including advertising and public relations,

and our management of the consumer experience, including direct interfaces through customer service and warranty repairs. We may decide

to make substantial investments in these areas in order to maintain and enhance our brand, and such investments may not be successful.

Additionally,

in order to expand our reach, we engage with third-party distributors. To the extent those third-party distributors fail to comply with

our operating guidelines, we may not be successful in protecting our brand image. Product defects, product recalls, counterfeit products

and ineffective marketing are among the potential threats to the strength of our brands and to protect our brands’ status we may

need to make substantial expenditures to mitigate the impact of such threats.

Moreover,

if we fail to continue to innovate to ensure that our products are deemed to achieve superior levels of function, quality and design,

or to otherwise be sufficiently distinguishable from our competitors’ products, or if we fail to manage the growth of our on-line

sales in a way that protects the high-end nature of our brands, the value of our brands may be diluted, and we may not be able to maintain

our premium position and pricing or sales volumes, which could adversely affect our financial performance and business. We believe that

maintaining and enhancing our brands image in new markets where we have limited brand recognition is important to expanding our consumer

base. If we are unable to maintain or enhance our brands in new markets, then our growth strategy could be adversely affected.

The

cost of raw materials, labor or freight could lead to an increase in our cost of sales and cause our results of operations to suffer.

Increasing

costs for raw materials, labor or freight could make our sourcing processes more costly and negatively affect our gross margin and profitability.

Labor costs at our independent manufacturers’ sites have been increasing and it is unlikely that these increases will abate. Wage

and price inflation in our source countries could cause unanticipated price increases, which may be significant. Such price increases

by our independent manufacturers could be rapid in the absence of manufacturing contracts. Energy costs have fluctuated dramatically

in the past and may fluctuate in the future. Rising energy costs may increase our costs of transporting our products for distribution

and the costs of products that we source from independent suppliers. Further, many of our products are made of materials, such as high

impact plastics, plastic-injected molded parts, and lightweight high tensile strength metals, that are either petroleum-based or require

energy to construct and transport. Costs for transportation of such materials have been increasing as the price of petroleum increases.

Our independent suppliers and manufacturers may attempt to pass these cost increases on to us, and our relationships with them may be

harmed or lost if we refuse to pay such increases, which could lead to product shortages. If we pay such increases, we may not be able

to offset them through increases in our pricing and other means, which could adversely affect our ability to maintain our targeted gross

margins. If we attempt to pass the increases on to consumers, our sales may be adversely affected.

Our

international operations involve inherent risks which could result in harm to our business.

All

of our equipment is manufactured outside of the U.S. with a large volume of our products being also sold outside of the U.S. Accordingly,

we are subject to the risks generally associated with global trade and doing business abroad, which include foreign laws and regulations,

varying consumer preferences across geographic regions, political unrest, disruptions or delays in cross-border shipments and changes

in economic conditions in countries in which our products are manufactured or where we sell products. This includes, for example, the

uncertainty surrounding the effect of Brexit, including changes to the legal and regulatory framework that apply to the United Kingdom

and its relationship with the European Union, as well as new and proposed changes affecting tax laws and trade policy in the U.S. and

elsewhere as further described in other risks in this section. The U.S. presidential administration has indicated a focus on policy reforms

that discourage U.S. corporations from outsourcing manufacturing and production activities to foreign jurisdictions, including through

tariffs or penalties on goods manufactured outside the U.S., which may require us to change the way we conduct business and adversely

affect our results of operations.

We

develop products in Israel, our chief marketing officer and general counsel are located in Israel, and our team developing our

baseball and softball launcher products are located in Israel, and, therefore, our business, financial condition and results of

operation may be adversely affected by political, economic and military instability in Israel.

A

portion of our operations, including product development, is based in Israel. Our research and development is conducted through our Israeli

subsidiary and our chief marketing officer and chief innovation officer are both located in Israel. Accordingly, political, economic

and military conditions in Israel directly affect our business.

Political,

economic and military conditions in Israel may directly affect our business. Since the establishment of the State of Israel in 1948,

a number of armed conflicts have taken place between Israel and its neighboring countries, and between Israel and the Hamas and Hezbollah

extremist groups. In addition, several countries, principally in the Middle East, restrict doing business with Israel, and additional

countries may impose restrictions on doing business with Israel and Israeli companies whether as a result of hostilities in the region

or otherwise. Any hostilities involving Israel, terrorist activities, political instability or violence in the region or the interruption

or curtailment of trade or transport between Israel and its trading partners could adversely affect our operations and results of operations

and adversely affect the market price of our shares.

Our

commercial insurance does not cover losses that may occur as a result of an event associated with the security situation in the Middle

East. Although the Israeli government is currently committed to covering the reinstatement value of direct damages that are caused by

terrorist attacks or acts of war, there can be no assurance that this government coverage will be maintained, or if maintained, will

be sufficient to compensate us fully for damages incurred. Any losses or damages incurred by us could have a material adverse effect

on our business, financial condition and results of operations.

Further,

our operations could be disrupted by the obligations of our employees to perform military service. Our chief marketing officer is subject

to the obligation to perform reserve military duty. In response to increased tension and hostilities in the region, there have been,

at times, call-ups of military reservists, and it is possible that there will be additional call-ups in the future. Our operations could

be disrupted by the absence of these employees due to military service. Such disruption could harm our business and operating results.

Popular

uprisings in various countries in the Middle East and North Africa are affecting the political stability of those countries. Such instability

may lead to deterioration in the political and trade relationships that exist between the State of Israel and these countries. Furthermore,

several countries, principally in the Middle East, restrict doing business with Israel and companies with an Israeli presence, and additional

countries may impose restrictions on doing business with Israel and Israeli companies if hostilities in the region continue or intensify.

Such restrictions may seriously limit our ability to sell our products to customers in those countries.

Conditions

in Israel, including the recent attack by Hamas and other terrorist organizations from the Gaza Strip and Israel’s war

against them, may adversely affect our operations and limit our ability to manage and market our products, which would lead to a decrease

in revenues.

Because

we develop products in Israel, our chief marketing officer and general

counsel are located in Israel, and our team developing our baseball and softball launcher are located in Israel, our business and operations

are directly affected by economic, political, geopolitical and military conditions affecting Israel. Since the establishment of the State

of Israel in 1948, a number of armed conflicts have occurred between Israel and its neighboring countries and other hostile non-state

actors. These conflicts have involved missile strikes, hostile infiltrations and terrorism against civilian targets in various parts of

Israel, which have negatively affected business conditions in Israel.

On

October 7, 2023, Hamas militants and members of other terrorist organizations infiltrated Israel’s southern border from

the Gaza Strip and conducted a series of terror attacks on civilian and military targets. Thereafter, these terrorists launched extensive

rocket attacks on the Israeli population and industrial centers located along the Israeli border with the Gaza Strip. As of October 11,

2023, such attacks collectively resulted in over 1,200 deaths and over 2,600 injured people, in addition to the kidnapping of a currently

indefinite number of civilians, including women and children. Shortly following the attack, Israel’s security cabinet declared

war against Hamas.

The

intensity and duration of Israel’s current war against Hamas is difficult to predict, and as are such war’s economic

implications on the Company’s business and operations and on Israel’s economy in general. On October 9, 2023, the Central

Bank of Israel announced its intent to sell up to $30 billion order to protect the New Israeli Shekel (“NIS”) from collapse,

however despite the foregoing announcement the NIS weakened to approximately 3.92 NIS for one US dollar as of the same day. In addition,

on October 9, 2023, the Tel Aviv-35 stock index of blue-chip companies dropped by 6.4% whereas the benchmark TA-125 index fell by 6.2%.

These events may imply wider macroeconomic indications of a deterioration of Israel’s economic standing, which may have a material

adverse effect on the Company and its ability to effectively conduct is business, operations and affairs.

It

is possible that other terrorist organizations will join the hostilities as well, including Hezbollah in Lebanon, and Palestinian military

organizations in the West Bank. In the event that hostilities disrupt the development of our products, our ability to deliver products

to customers in a timely manner to meet our contractual obligations with customers and vendors could be materially and adversely affected.

Our

commercial insurance does not cover losses that may occur as a result of events associated with war and terrorism. Although the Israeli

government currently covers the reinstatement value of direct damages that are caused by terrorist attacks or acts of war, we cannot

assure you that this government coverage will be maintained or that it will sufficiently cover our potential damages. Any losses or damages

incurred by us could have a material adverse effect on our business.

As

a result of the Israeli security cabinet’s decision to declare war against Hamas, several hundred thousand Israeli reservists

were drafted to perform immediate military service. If any of our employees and consultants in Israel are called for service in the current

war with Hamas, our operations may be disrupted by such absences, which may materially and adversely affect our business and results

of operations. Additionally, the absence of employees of our Israeli suppliers and contract manufacturers due to their military service

in the current war or future wars or other armed conflicts may disrupt their operations, in which event our ability to deliver products

to customers may be materially and adversely affected.

In

addition, popular uprisings in various countries in the Middle East and North Africa have affected the political stability of those countries.

Such instability may lead to a deterioration in the political and trade relationships that exist between the State of Israel and these

countries, such as Turkey. Moreover, some countries around the world restrict doing business with Israel and Israeli companies, and additional

countries may impose restrictions on doing business with Israel and Israeli companies if hostilities in Israel or political instability

in the region continues or increases. These restrictions may limit materially our ability to obtain raw materials from these countries

or sell our products to companies and customers in these countries. In addition, there have been increased efforts by activists to cause

companies and consumers to boycott Israeli goods. Such efforts, particularly if they become more widespread, may materially and adversely

impact our ability to sell our products outside of Israel.

Prior

to the Hamas attack in October 2023, the Israeli government pursued extensive changes to Israel’s judicial system, which sparked

extensive political debate and unrest. In response to such initiative, many individuals, organizations and institutions, both within

and outside of Israel, have voiced concerns that the proposed changes may negatively impact the business environment in Israel including

due to reluctance of foreign investors to invest or transact business in Israel as well as to increased currency fluctuations, downgrades

in credit rating, increased interest rates, increased volatility in security markets, and other changes in macroeconomic conditions.

The risk of such negative developments has increased in light of the recent Hamas attacks and the war against Hamas declared

by Israel. To the extent that any of these negative developments do occur, they may have an adverse effect on our business, our results

of operations and our ability to raise additional funds, if deemed necessary by our management and board of directors.

Our

manufacturing takes place in China and is susceptible to shutdowns and delays caused by the Coronavirus and other diseases and epidemics.

Additionally, we rely on independent manufacturers and suppliers.

As

of November 24, 2023, one of our manufacturing facilities is located in southern China. Following the outbreak of the Coronavirus

our manufacturing facility was shut down for three months, which caused some unforeseen delays in manufacturing and delivery of our products.

However, there may be further outbreaks of the Coronavirus and other diseases and epidemics, which may cause further delays and shutdowns.

This, in turn, will negatively affect our revenue and increase our expenses and costs.

We

do not control our independent manufacturers and suppliers or their labor and other business practices. Violations of labor, environmental

or other laws by an independent manufacturer or supplier, or divergence of an independent manufacturer’s or supplier’s labor

or other practices from those generally accepted as ethical or appropriate in the U.S., could disrupt the shipments of our products or

draw negative publicity for us, thereby diminishing the value of our brand, reducing demand for our products and adversely affecting

our net income. Additionally, since we do not manufacture our products, we are subject to risks associated with inventory and product

quality-control.

Further,

we have not historically entered into manufacturing contracts with our manufacturers; instead, we have hired them on an ad hoc basis.

Identifying a suitable manufacturer is an involved process that requires us to become satisfied with the prospective manufacturer’s

quality control, responsiveness and service capabilities, financial stability and labor practices. While we have business continuity

and contingency plans for alternative sourcing, we may be unable, in the event of a significant disruption in our sourcing, to locate

alternative manufacturers or suppliers of comparable quality at an acceptable price, or at all, which could result in product shortages

or decreases in product quality, and adversely affect our net sales, gross margin, net income, customer relationships and our reputation.

We

rely heavily on supply chain reliability and predictability and continued disruption in our supply chain could have a material adverse

impact on operations.

We

rely heavily on supply chain reliability and predictability in producing, transporting and delivering our products. The COVID-19

pandemic, Ukraine war, Israel-Hamas war, inflationary trends, shifts in consumer purchasing patterns, availability of transport,

labor shortages in the shipping, trucking, and warehousing industries, port strikes, infrastructure congestion, equipment shortages

and other factors have all contributed to delivery delays, greater costs and uncertainty in arranging and scheduling transport of

our products. If we are unable to reliably and consistently arrange shipment and storage of our products, we may be unable to ship,

deliver and store our products in which case, we will have to reverse sales and issue refunds to purchasers of our products. Changes

in U.S. and international trade policies, including to import tariffs and trade policies and agreements, to address supply chain

issues or otherwise could also have a significant impact on our activities both in the United States and internationally. Supply

chain disruptions, both domestic and international, have adversely impacted our operations. Continued disruptions in our supply

chain and adverse consequences from aggressive trade policies could have a material adverse impact on our profitability and

financial performance.

We

face risks associated with operating in international markets.

We

operate in a global marketplace and international sales growth is a key element of our growth strategy. We are subject to risks associated

with our international operations, including, but not limited to:

| |

● |

Foreign

currency exchange rates; |

| |

● |

Economic

or governmental instability in foreign markets in which we operate or in those countries from which we source our merchandise; |

| |

|

|

| |

● |

Unexpected

changes in laws, regulatory requirements, taxes or trade laws; |

| |

|

|

| |

● |

Increases

in the cost of transporting goods globally; |

| |

|

|

| |

● |

Acts

of war, terrorist attacks, outbreaks of contagious disease and other events over which we have no control; and |

| |

|

|

| |

● |

Changes

in foreign or domestic legal and regulatory requirements resulting in the imposition of new or more onerous trade restrictions, tariffs,

duties, taxes, embargoes, exchange or other government controls. |

Any

of these risks could have an adverse impact on our results of operations, financial position or growth strategy. Furthermore, some of

our international operations are conducted in parts of the world that experience corruption to some degree. Our employees and wholesalers

could take actions that violate applicable anti-corruption laws or regulations. Violations of these laws, or allegations of such violations,

could have an adverse impact on our reputation, our results of operations or our financial position.

Foreign

exchange movements may also negatively affect the relative purchasing power of consumers and their willingness to purchase discretionary

premium goods, such as our products, which would adversely affect our net sales. We do not currently use the derivative markets to hedge

foreign currency fluctuations.

The

growth of our business depends on the successful execution of our growth strategy, and our efforts to expand internationally by growing

our e-commerce business.

We

are focused on developing an integrated Play and Learn platform under our Connexa brand. The Platform will bring together our owned offerings

of Gameface and Slinger Bag under the umbrella of the Connexa brand. We believe our success will in large part depend on our ability

to develop a cohesive platform that integrates elements of performance analysis from each. We may face difficulties integrating the technology

and offerings from each brand in order create a cohesive business. For example, users of the Slinger Bag may view us a sporting goods

company and choose not to engage with our technology offerings from the Gameface brand, and users of our Gameface app services may

not purchase our ball launchers.

Our

current growth strategy depends on our ability to continue to expand our reach geographically in a number of international regions in

Asia, Europe, North America, Africa and Australia. This growth strategy is contingent upon our ability to introduce our products to new

markets. The implementation of higher tariffs, quotas or other restrictive trade policies in any international regions in which we seek

to operate could adversely affect our ability to commence new international operations, which could have an adverse impact on our growth

strategy. Further, consumer demand behavior, as well as tastes and purchasing trends, may differ in various countries and, as a result,

sales of our products may not be, or may take time to become, successful, and gross margins on those net sales may not be in line with

what we currently experience. Our ability to execute our international growth strategy, especially where we are not yet established,

depends on our ability to understand regional market demographics, and we may not be able to do so.

If

we are unable to develop the integrated Play and Learn platform and expand our business internationally, our growth strategy and our

financial results could be materially adversely affected.

If

we are unable to respond effectively to changes in market trends and consumer preferences, our market share, net sales and profitability

could be adversely affected.

The

success of our business depends on our ability to identify the key product and market trends and bring products to market in a timely

manner that satisfy the current preferences of a broad range of consumers (either by enhancing existing products or by developing new

product offerings). Consumer preferences differ across and within different parts of the world, and shift over time in response to changing

aesthetics and economic circumstances. We believe that our success in developing products that are innovative and that meet our consumers’

functional needs is an important factor in our image as a premium brand, and in our ability to charge premium prices. We may not be able

to anticipate or respond to changes in consumer preferences, and, even if we do anticipate and respond to such changes, we may not be

able to bring to market in a timely manner enhanced or new products that meet these changing preferences. If we fail to anticipate or

respond to changes in consumer preferences or fail to bring products to market in a timely manner that satisfy new preferences, our market

share and our net sales and profitability could be adversely affected.

We

may be unable to appeal to new consumers while maintaining the loyalty of our core consumers.

Part

of our growth strategy is to introduce new consumers, including young consumers, to our brands. If we are unable to attract new consumers,

including young consumers, our business and results of operations may be adversely affected as our core consumers’ age increases

and purchasing frequency decrease. Initiatives and strategies intended to position our brand to appeal to new and young consumers may

not appeal to our core consumers and may diminish the appeal of our brand to our core consumers, resulting in reduced core consumer loyalty.

If we are unable to successfully appeal to new and young consumers while maintaining our brand’s image with our core consumers,

then our net sales and our brand image may be adversely affected.

Our

business could suffer if we are unable to maintain our website or manage our inventory effectively.

We

employ a distribution strategy that is heavily dependent upon our website and third-party distributors’ e-commerce websites. The