false000160767800016076782024-03-042024-03-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 4, 2024

Viking Therapeutics, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-37355 |

|

46-1073877 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

9920 Pacific Heights Blvd, Suite 350, San Diego, California 92121

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (858) 704-4660

N/A

(Former Name, or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act |

|

|

Title of Each Class |

|

Trading Symbol |

Name of Each Exchange on Which Registered |

Common Stock, par value $0.00001 per share |

|

VKTX |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 8.01. Other Events.

On March 4, 2024, Viking Therapeutics, Inc. (the “Company”) issued a press release announcing the closing of its previously announced underwritten public offering of shares of its common stock. In the offering, the Company sold an aggregate of 7,441,650 shares of its common stock at a public offering price of $85.00 per share, which included the exercise in full by the underwriters of their option to purchase 970,650 additional shares of common stock. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

VIKING THERAPEUTICS, INC. |

|

|

|

|

|

Date: March 4, 2024 |

By: |

/s/ Brian Lian, Ph.D. |

|

|

|

Brian Lian, Ph.D. |

|

|

|

President and Chief Executive Officer (Principal Executive Officer) |

|

Viking Therapeutics Announces Closing of Public Offering of Common Stock Including Full Exercise of Underwriters’ Option to Purchase Additional Shares

SAN DIEGO, CA – March 4, 2024 – Viking Therapeutics, Inc. (“Viking”) (Nasdaq: VKTX), a clinical-stage biopharmaceutical company focused on the development of novel therapies for metabolic and endocrine disorders, today announced the closing of its previously announced underwritten public offering of 7,441,650 shares of its common stock at a price to the public of $85.00 per share, which included the exercise in full by the underwriters of their option to purchase up to 970,650 additional shares of common stock. The gross proceeds to Viking from this offering were approximately $632.5 million, before deducting underwriting discounts and commissions and offering expenses.

Morgan Stanley, Leerink Partners, William Blair, Raymond James, Stifel and Truist Securities acted as joint book-running managers for the offering. Oppenheimer & Co. acted as lead manager for the offering. BTIG, H.C. Wainwright & Co., Maxim Group LLC and Laidlaw & Company (U.K.) Ltd. acted as co-managers for the offering.

Viking currently intends to use the net proceeds from the offering for continued development of its VK2809, VK2735 and VK0214 programs and for general research and development, working capital and general corporate purposes.

The securities described above were offered by Viking pursuant to an automatic shelf registration statement on Form S-3 (File No. 333-273460), previously filed with the Securities and Exchange Commission (the “SEC”) on July 26, 2023, and which automatically became effective upon filing. A final prospectus supplement and the accompanying prospectus relating to and describing the terms of the offering was filed with the SEC on March 1, 2024 and is available on the SEC’s website at www.sec.gov. Copies of the final prospectus supplement and the accompanying prospectus relating to the offering may also be obtained by contacting Morgan Stanley & Co. LLC, Attention: Prospectus Department, 180 Varick Street, 2nd Floor, New York, NY 10014, or by email at prospectus@morganstanley.com; or Leerink Partners LLC, Attention: Syndicate Department, 53 State Street, 40th Floor, Boston, Massachusetts 02109, by telephone at (800) 808-7525, ext. 6105, or by email at syndicate@leerink.com.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of, these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or jurisdiction.

About Viking Therapeutics, Inc.

Viking Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on the development of novel first-in-class or best-in-class therapies for the treatment of metabolic and

endocrine disorders, with three compounds currently in clinical trials. Viking’s research and development activities leverage its expertise in metabolism to develop innovative therapeutics designed to improve patients’ lives. Viking’s clinical programs include VK2809, a novel, orally available, small molecule selective thyroid hormone receptor beta agonist for the treatment of lipid and metabolic disorders, which is currently being evaluated in a Phase 2b study for the treatment of biopsy-confirmed non-alcoholic steatohepatitis (NASH) and fibrosis. In a Phase 2a trial for the treatment of non-alcoholic fatty liver disease (NAFLD) and elevated LDL-C, patients who received VK2809 demonstrated statistically significant reductions in LDL-C and liver fat content compared with patients who received placebo. Viking is also developing VK2735, a novel dual agonist of the glucagon-like peptide 1 (GLP-1) and glucose-dependent insulinotropic polypeptide (GIP) receptors for the potential treatment of various metabolic disorders. Data from a Phase 1 and a Phase 2a trial evaluating VK2735 (dosed subcutaneously) for metabolic disorders demonstrated an encouraging safety and tolerability profile as well as positive signs of clinical benefit. The company is also evaluating an oral formulation of VK2735 in a Phase 1 trial. In the rare disease space, Viking is developing VK0214, a novel, orally available, small molecule selective thyroid hormone receptor beta agonist for the potential treatment of X-linked adrenoleukodystrophy (X-ALD). VK0214 is currently being evaluated in a Phase 1b clinical trial in patients with the adrenomyeloneuropathy (AMN) form of X-ALD. Viking holds exclusive worldwide rights to a portfolio of five therapeutic programs, including VK2809 and VK0214, which are based on small molecules licensed from Ligand Pharmaceuticals Incorporated.

Forward-Looking Statements

This press release contains forward-looking statements under the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, including statements regarding the anticipated use of proceeds from the offering. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially and adversely and reported results should not be considered as an indication of future performance. These risks and uncertainties are described in Viking’s most recent periodic reports filed with the Securities and Exchange Commission, including Viking’s Annual Report on Form 10-K for the year ended December 31, 2023, including the risk factors set forth in those filings. These forward-looking statements speak only as of the date hereof. Viking disclaims any obligation to update these forward-looking statements, except as required by applicable law.

Contacts:

Viking Therapeutics, Inc.

Greg Zante

Chief Financial Officer

858-704-4672

gzante@vikingtherapeutics.com

Vida Strategic Partners

Stephanie Diaz (Investors)

415-675-7401

sdiaz@vidasp.com

Tim Brons (Media)

415-675-7402

tbrons@vidasp.com

v3.24.0.1

Document and Entity Information

|

Mar. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 04, 2024

|

| Entity Registrant Name |

Viking Therapeutics, Inc.

|

| Entity Central Index Key |

0001607678

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-37355

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

46-1073877

|

| Entity Address, Address Line One |

9920 Pacific Heights Blvd

|

| Entity Address, Address Line Two |

Suite 350

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92121

|

| City Area Code |

858

|

| Local Phone Number |

704-4660

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.00001 per share

|

| Trading Symbol |

VKTX

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

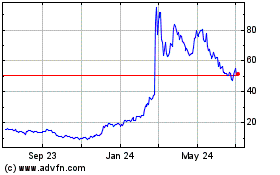

Viking Therapeutics (NASDAQ:VKTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

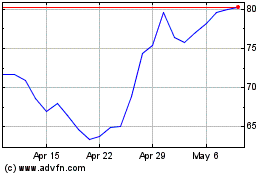

Viking Therapeutics (NASDAQ:VKTX)

Historical Stock Chart

From Apr 2023 to Apr 2024