false

0000906709

0000906709

2024-03-04

2024-03-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (Date of earliest event reported):

March 4, 2024

NEKTAR THERAPEUTICS

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

0-24006 |

|

94-3134940 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

455 Mission Bay Boulevard South

San Francisco, California 94158

(Address of Principal Executive Offices and

Zip Code)

Registrant’s telephone number, including

area code: (415) 482-5300

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the

Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value |

|

NKTR |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On March 4, 2024, Nektar

Therapeutics (“Nektar”) and entities managed by Healthcare Royalty entered into an Amendment No 1. (the

“Amendment”) to that certain Purchase and Sale Agreement, dated as of December 16, 2020, as more fully described in

Nektar’s Current Report on Form 8-K filed on December 22, 2020 (the “Purchase Agreement”). The terms of the

Purchase Agreement provided for Nektar to receive a reversionary interest in the royalties if certain aggregate thresholds were met.

The Amendment removes Nektar’s revisionary interest in the royalties in exchange for a $15 million cash payment from entities

managed by Healthcare Royalty to Nektar.

The foregoing description of the Amendment does

not purport to be complete and is qualified in its entirety by the full text of the Amendment, a copy of which will be filed as an exhibit

to Nektar’s Quarterly Report on Form 10-Q for the period ended March 31, 2024.

Item 2.02 Results of Operations and Financial

Condition.

On

March 4, 2024, Nektar issued a press release (the “Press Release”) announcing its financial results for the quarter and

year ended December 31, 2023. A copy of the Press Release is furnished herewith as Exhibit 99.1.

The

information in this report, including the exhibit hereto, is being furnished and shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information

contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing with the Securities and Exchange

Commission made by Nektar, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

NEKTAR THERAPEUTICS |

| |

|

|

| Date: March 4, 2024 |

By: |

/s/ Mark A. Wilson |

| |

|

Mark A. Wilson |

| |

|

Chief Legal Officer and Secretary |

2

Exhibit 99.1

Nektar Therapeutics

Reports Fourth Quarter and Year-End 2023 Financial Results

SAN FRANCISCO, March

4, 2024 /PRNewswire/ -- Nektar Therapeutics (Nasdaq: NKTR) today reported financial results for the fourth quarter and full year ended

December 31, 2023.

Cash and

investments in marketable securities at December 31, 2023, were $329.4 million as compared to $505.0 million at December 31, 2022.

Nektar’s cash and marketable securities are expected to support strategic

development activities and operations into the third quarter of 2026.

“We believe

that the progress that we have made in the past nine months puts Nektar in a strong position to advance our highly promising

immunology and inflammation pipeline programs,” said Howard W. Robin, President and CEO of Nektar. “We are looking

forward to multiple potential value-creating data readouts for REZPEG in the first half of 2025 in both atopic dermatitis and

alopecia areata. As we build our pipeline in immunology, we are also conducting

IND-enabling studies for NKTR-0165, our novel agonist antibody targeting TNFR2.”

Summary of Financial

Results

Revenue in the fourth

quarter of 2023 was $23.9 million as compared to $22.0 million in the fourth quarter of 2022. Revenue for the year ended December 31,

2023 was $90.1 million as compared to $92.1 million in 2022.

Total operating costs

and expenses in the fourth quarter of 2023 were $57.4 million as compared to $74.5 million in the fourth quarter of 2022. Total operating

costs and expenses for the full year 2023 were $353.8 million as compared to $468.2 million in 2022. Operating costs and expenses for

both the fourth quarter and the full year 2023 decreased as compared to 2022 primarily due to decreases in research and development expenses,

general and administrative expense and restructuring, impairment and costs of terminated program, partially offset by $76.5 million in

non-cash goodwill impairment recorded in the first quarter of 2023.

R&D expense in the

fourth quarter of 2023 was $29.9 million as compared to $34.7 million for the fourth quarter of 2022. R&D expense for the year ended

December 31, 2023 was $114.2 million as compared to $218.3 million in 2022. R&D expense decreased for full year 2023 primarily due

to the wind down of the bempegaldesleukin program.

G&A expense was $17.3

million in the fourth quarter of 2023 and $21.9 million in the fourth quarter of 2022. G&A expense for the full year 2023 was $77.4

million as compared to $92.3 million in 2022. G&A expense decreased for the full year 2023 primarily due to the wind down of the bempegaldesleukin

program.

Restructuring, impairment

and other costs of the terminated program were $2.9 million in the fourth quarter of 2023 and $52.0 million in the full year 2023, as

compared to $11.6 million in the fourth quarter of 2022 and $135.9 million in the full year 2022. The full year 2023 amount includes $7.9

million in severance expense, $35.3 million in non-cash lease impairment charges, $5.5 million for clinical trial and related

employee compensation costs for the wind down of the bempegaldesleukin program, and $3.3 million in other restructuring costs. The full

year 2022 amount includes $30.9 million in severance expense, $65.8 million in non-cash lease impairment charges, $31.7

million for clinical trial and related employee compensation costs for the wind down of the bempegaldesleukin program, as well as $7.5

million in other restructuring costs.

Net loss for the fourth

quarter of 2023 was $42.1 million or $0.22 basic and diluted loss per share as compared to a net loss of $59.7 million or $0.32 basic

and diluted loss per share in the fourth quarter of 2022. Net loss for the year ended December 31, 2023 was $276.1 million or $1.45 basic

and diluted loss per share as compared to a net loss of $368.2 million or $1.97 basic and diluted loss per share in 2022. Excluding the

$111.8 million in non-cash goodwill and other impairment charges, net loss, on a non-GAAP basis, for the full year 2023 was $164.3 million

or $0.86 basic and diluted loss per share.

2023 and Recent Business

Highlights

| ● | In March 2024, we entered into a securities

purchase agreement with TCG Crossover Fund, an institutional accredited investor, to sell securities in a private placement financing

for gross proceeds of approximately $30 million, before deducting expenses. |

| ● | In December 2023, Nektar’s collaborators from the Cairo Laboratory

at New York Medical College presented preclinical data on NKTR-255 in combination with obinutuzumab at the 65th American Society of Hematology

(ASH) Annual Meeting. NKTR-255 significantly enhanced the cytotoxicity of expanded Natural Killer (NK) cells when combined with obinutuzumab

against rituximab-resistant Burkitt lymphoma (BL) cells in vitro and significantly improved the survival of mice xenografted with Raji-4RH

compared to controls. |

| ● | In October 2023, Nektar initiated a Phase 2b study of rezpegaldesleukin

in patients with moderate-to-severe atopic dermatitis. The Company expects initial data from the study in the first half of 2025. |

| ● | In October 2023, Nektar presented data from the Phase 1b study of rezpegaldesleukin in

patients with atopic dermatitis (AD) in an oral session at the 2023 European Academy of Dermatology and Venereology (EADV) Congress.

Patients with moderate-to-severe AD that were treated with rezpegaldesleukin showed dose-dependent improvements in Eczema Area and Severity

Index (EASI), Validated Investigator Global Assessment (vIGA), Body Surface Area (BSA), and Itch Numeric Rating Scale (NRS) over 12 weeks

of treatment compared to placebo, which were sustained post-treatment over an additional 36 weeks. |

| ● | In September 2023, Nektar announced a clinical study collaboration with AbelZeta

Pharma, Inc. (formerly Cellular Biomedicine Group Inc.) to evaluate NKTR-255 in combination with C-TIL051 in advanced non-small

cell lung cancer (NSCLC) patients that are relapsed or refractory to anti-PD-1 therapy. Under the collaboration, AbelZeta will add NKTR-255

to its ongoing Phase 1 clinical trial being conducted at Duke Cancer Institute. Enrollment for this trial is ongoing. |

| ● | In August 2023, Nektar announced promising new and corrected rezpegaldesleukin

efficacy data which were previously reported in 2022 and inaccurately calculated by former collaborator Eli Lilly and Company. Nektar

regained the full rights to rezpegaldesleukin from Eli Lilly in April 2023. |

| ● | In April 2023, Nektar announced a strategic reprioritization and cost restructuring

plan in order to enable a new focus of its pipeline on immunology and inflammation programs. |

Conference Call to

Discuss Fourth Quarter and Year-End 2023 Financial Results

Nektar management will

host a conference call to review the results beginning at 5:00 p.m. Eastern Time/2:00 p.m. Pacific Time, March 4, 2024.

This press release and

live audio-only webcast of the conference call can be accessed through a link that is posted on the Home Page and Investors section of

the Nektar website: http://ir.nektar.com/. The web broadcast of the conference call will be available for replay through April 5, 2024.

To access the conference

call, please pre-register at Nektar Earnings Call Registration. All registrants will receive dial-in information and a PIN allowing them

to access the live call.

About Nektar Therapeutics

Nektar Therapeutics is

a biotechnology company with a robust, wholly owned R&D pipeline of investigational medicines in immunology and oncology as well

as a portfolio of approved partnered medicines. Nektar is headquartered in San Francisco, California, with additional operations in Huntsville,

Alabama. Further information about the company and its drug development programs and capabilities may be found online at http://www.nektar.com.

Cautionary Note

Regarding Forward-Looking Statements

This press release

contains forward-looking statements which can be identified by words such as: “expect,” “believe,”

“design,” “plan,” “will,” “develop,” “advance” and similar references to

future periods. Examples of forward-looking statements include, among others, statements regarding the therapeutic potential of, and

future development plans for, rezpegaldesleukin and NKTR-0165, and expectations for how long our cash and marketable securities will

support our development activities and operations. Forward-looking statements are neither historical facts nor assurances of future

performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business,

future plans and strategies, anticipated events and trends, the economy and other future conditions. Because forward-looking

statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult

to predict and many of which are outside of our control. Our actual results may differ materially from those indicated in the

forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could

cause our actual results to differ materially from those indicated in the forward-looking statements include, among others: (i) our

statements regarding the therapeutic potential of rezpegaldesleukin and NKTR-0165 are based on preclinical and clinical findings and

observations and are subject to change as research and development continue; (ii) rezpegaldesleukin and NKTR-0165 are

investigational agents and continued research and development for these drug candidates is subject to substantial risks, including

negative safety and efficacy findings in future studies (notwithstanding positive findings in earlier preclinical and clinical

studies); (iii) NKTR-0165 is in preclinical development and rezpegaldesleukin is in clinical development, and the risk of failure is

high for drug candidates at this stage of development and can unexpectedly occur at any stage prior to regulatory approval; (iv) the

timing of the commencement or end of clinical trials and the availability of clinical data may be delayed or unsuccessful due to

challenges caused by regulatory delays, slower than anticipated patient enrollment, manufacturing challenges, changing standards of

care, evolving regulatory requirements, clinical trial design, clinical outcomes, competitive factors, or delay or failure in

ultimately obtaining regulatory approval in one or more important markets; (v) we may not achieve the expected cost savings we

expect from our prior corporate restructuring and reorganization plans and we may undertake additional restructuring and cost-saving

activities in the future, (vi) patents may not issue from our patent applications for our drug candidates, patents that have issued

may not be enforceable, or additional intellectual property licenses from third parties may be required; and (vii) certain other

important risks and uncertainties set forth in our Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission

on November 8, 2023. Any forward-looking statement made by us in this press release is based only on information currently available

to us and speaks only as of the date on which it is made. We undertake no obligation to update any forward-looking statement,

whether written or oral, that may be made from time to time, whether as a result of new information, future developments or

otherwise.

Contact:

For Investors:

Vivian Wu of Nektar Therapeutics

(628) 895-0661

For Media:

David Rosen of Argot Partners

(212) 600-1902

david.rosen@argotpartners.com

NEKTAR THERAPEUTICS

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)

| | |

December 31,

2023 | | |

December 31,

2022 (1) | |

| ASSETS | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 35,277 | | |

$ | 88,227 | |

| Short-term investments | |

| 268,339 | | |

| 416,750 | |

| Accounts receivable | |

| 1,205 | | |

| 5,981 | |

| Inventory | |

| 16,101 | | |

| 19,202 | |

| Other current assets | |

| 9,779 | | |

| 15,808 | |

| Total current assets | |

| 330,701 | | |

| 545,968 | |

| | |

| | | |

| | |

| Long-term investments | |

| 25,825 | | |

| - | |

| Property, plant and equipment, net | |

| 18,856 | | |

| 32,451 | |

| Operating lease right-of-use assets | |

| 18,007 | | |

| 53,435 | |

| Goodwill | |

| - | | |

| 76,501 | |

| Other assets | |

| 4,644 | | |

| 2,245 | |

| Total assets | |

$ | 398,033 | | |

$ | 710,600 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

| 9,848 | | |

| 12,980 | |

| Accrued expenses | |

| 22,162 | | |

| 36,557 | |

| Operating lease liabilities, current portion | |

| 19,259 | | |

| 18,667 | |

| Total current liabilities | |

| 51,269 | | |

| 68,204 | |

| | |

| | | |

| | |

| Operating lease liabilities, less current portion | |

| 98,517 | | |

| 112,829 | |

| Liabilities related to the sales of future royalties, net | |

| 112,625 | | |

| 155,378 | |

| Other long-term liabilities | |

| 4,635 | | |

| 7,551 | |

| Total liabilities | |

| 267,046 | | |

| 343,962 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock | |

| - | | |

| - | |

| Common stock | |

| 19 | | |

| 19 | |

| Capital in excess of par value | |

| 3,608,137 | | |

| 3,574,719 | |

| Accumulated other comprehensive income (loss) | |

| 80 | | |

| (6,907 | ) |

| Accumulated deficit | |

| (3,477,249 | ) | |

| (3,201,193 | ) |

| Total stockholders’ equity | |

| 130,987 | | |

| 366,638 | |

| Total liabilities and stockholders’ equity | |

$ | 398,033 | | |

$ | 710,600 | |

| (1) | The consolidated balance sheet at December 31, 2022 has been

derived from the audited financial statements at that date but does not include all of the information and notes required by generally

accepted accounting principles in the United States for complete financial statements. |

NEKTAR THERAPEUTICS

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share information)

(Unaudited)

| | |

Three months ended

December 31, | | |

Year ended

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenue: | |

| | |

| | |

| | |

| |

| Product sales | |

$ | 5,483 | | |

$ | 4,379 | | |

$ | 20,681 | | |

$ | 20,348 | |

| Non-cash royalty revenue related to the sales of future royalties | |

| 18,061 | | |

| 17,627 | | |

| 68,921 | | |

| 69,794 | |

| License, collaboration and other revenue | |

| 341 | | |

| 17 | | |

| 520 | | |

| 1,913 | |

| Total revenue | |

| 23,885 | | |

| 22,023 | | |

| 90,122 | | |

| 92,055 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating costs and expenses: | |

| | | |

| | | |

| | | |

| | |

| Cost of goods sold | |

| 7,283 | | |

| 6,233 | | |

| 33,768 | | |

| 21,635 | |

| Research and development | |

| 29,942 | | |

| 34,740 | | |

| 114,162 | | |

| 218,323 | |

| General and administrative | |

| 17,320 | | |

| 21,939 | | |

| 77,417 | | |

| 92,333 | |

| Restructuring, impairment and costs of terminated program | |

| 2,851 | | |

| 11,580 | | |

| 51,958 | | |

| 135,930 | |

| Impairment of goodwill | |

| | | |

| | | |

| 76,501 | | |

| - | |

| Total operating costs and expenses | |

| 57,396 | | |

| 74,492 | | |

| 353,806 | | |

| 468,221 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (33,511 | ) | |

| (52,469 | ) | |

| (263,684 | ) | |

| (376,166 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Non-operating income (expense): | |

| | | |

| | | |

| | | |

| | |

| Change in fair value of development derivative liability | |

| - | | |

| - | | |

| - | | |

| 33,427 | |

| Non-cash interest expense on liabilities related to the sales of future royalties | |

| (6,867 | ) | |

| (7,201 | ) | |

| (25,334 | ) | |

| (28,911 | ) |

| Interest income | |

| 4,617 | | |

| 3,346 | | |

| 19,009 | | |

| 6,783 | |

| Other income (expense), net | |

| (6,347 | ) | |

| (220 | ) | |

| (6,247 | ) | |

| (116 | ) |

| Total non-operating income (expense), net | |

| (8,597 | ) | |

| (4,075 | ) | |

| (12,572 | ) | |

| 11,183 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before provision for income taxes | |

| (42,108 | ) | |

| (56,544 | ) | |

| (276,256 | ) | |

| (364,983 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision (benefit) for income taxes | |

| (29 | ) | |

| 3,144 | | |

| (200 | ) | |

| 3,215 | |

| Net loss | |

$ | (42,079 | ) | |

$ | (59,688 | ) | |

$ | (276,056 | ) | |

$ | (368,198 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted net loss per share | |

$ | (0.22 | ) | |

$ | (0.32 | ) | |

$ | (1.45 | ) | |

$ | (1.97 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding used in computing basic and diluted net loss per share | |

| 191,040 | | |

| 188,237 | | |

| 190,001 | | |

| 187,138 | |

5

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

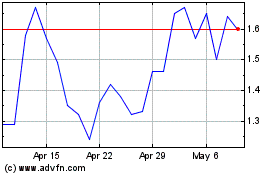

Nektar Therapeutics (NASDAQ:NKTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nektar Therapeutics (NASDAQ:NKTR)

Historical Stock Chart

From Apr 2023 to Apr 2024