Profit Taking May Contribute To Initial Pullback On Wall Street

March 04 2024 - 8:52AM

IH Market News

The major U.S. index futures are currently pointing to a

modestly lower open on Monday, with stocks likely to give back

ground after turning in a strong performance last week.

Traders may look to cash in on recent strength in the markets,

which lifted the Nasdaq and S&P 500 to new record closing highs

last Friday.

Overall trading activity may be somewhat subdued, however, as a

lack of major U.S. economic data may keep traders on the sidelines

ahead of several key events later this week.

Federal Reserve Chair Jerome Powell’s congressional testimony is

likely to be in focus, as investors on Wall Street analyze the

central bank chief’s comments for clues about the outlook for

interest rates.

Powell is due to testify before the House Financial Services

Committee on Wednesday and the Senate Banking Committee on

Thursday.

Later in the week, the spotlight will shift to the Labor

Department’s report on the employment situation in the month of

February.

The report, which is due to be released on Friday, is expected

to show employment jumped by 200,000 jobs in February after surging

by 353,000 jobs in January.

On Tuesday, the Institute for Supply Management is due to

release its report on service sector activity in the month of

February.

The ISM’s services PMI is expected to edge down to 53.0 in

February from 53.4 in January, although a reading above 50 would

still indicate growth.

Reports on factory orders, private sector employment, weekly

jobless claims and the U.S. trade deficit are also due to be

released this week along with the Fed’s Beige Book.

Stocks showed a strong move to the upside during trading on

Friday, adding to the gains posted in Thursday’s session. With the

extended upward move, the Nasdaq and S&P 500 once again reached

new record closing highs.

The tech-heavy Nasdaq jumped 183.02 points or 1.1 percent to

16,274.94 and the S&P 500 climbed 40.81 points or 0.8 percent

to 5,137.08. The narrower Dow posted a more modest gain, rising

90.99 points or 0.2 percent to 39,087.38.

For the week, the Nasdaq shot up by 1.7 percent and the S&P

500 advanced by 1.0 percent, but the Dow edged down by 0.1

percent.

The surge by the Nasdaq partly reflected substantial strength

among computer hardware stocks following upbeat results from Dell

(NYSE:DELL), with the NYSE Arca Computer Hardware Index soaring by

6.9 percent to a record closing high.

Shares of Dell skyrocketed by 31.6 percent after the computer

maker reported fourth quarter results that exceeded analyst

estimates on both the top and bottom lines.

The upbeat results from Dell also contributed to significant

strength among semiconductor stocks, as reflected by the 4.3

percent spike by the Philadelphia Semiconductor Index. The index

also reached a record closing high.

Biotechnology and networking stocks also saw considerable

strength, while gold, oil service and pharmaceutical stocks turned

in some of the best performances outside the tech sector.

The strength on Wall Street also came following the release of a

report from the Institute for Supply Management showing

manufacturing activity in the U.S. unexpectedly contracted at an

accelerated rate in the month of February.

The ISM said its manufacturing PMI dipped to 47.8 in February

from 49.1 in January, with a reading below 50 indicating

contraction. Economists had expected the index to inch up to

49.5.

The University of Michigan also released revised data showing

consumer sentiment in the U.S. unexpectedly deteriorated in the

month of February.

The report said the consumer sentiment index for February was

downwardly revised to 76.9 from the previously reported 79.6.

Economists had expected the reading to be unrevised.

With the unexpected downward revision, the consumer sentiment

index is now below the January reading of 79.0.

The data contributed to a downturn by treasury yields, which

added to optimism about the Federal Reserve eventually cutting

interest rates.

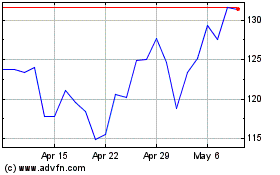

Dell Technologies (NYSE:DELL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dell Technologies (NYSE:DELL)

Historical Stock Chart

From Apr 2023 to Apr 2024