Form 8-K - Current report

March 04 2024 - 8:35AM

Edgar (US Regulatory)

0001498710false00014987102024-03-012024-03-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported) March 4, 2024 (March 1, 2024)

SPIRIT AIRLINES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 001-35186 | 38-1747023 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

| | | |

| 2800 Executive Way | Miramar, | Florida | 33025 |

| (Address of Principal Executive) | (Zip Code) |

(954) 447-7920

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value | SAVE | New York Stock Exchange |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

The disclosure set forth below under Item 1.02 of this Current Report on Form 8-K is incorporated by reference herein.

Item 1.02. Termination of a Material Definitive Agreement.

As previously disclosed in our Current Report on Form 8-K filed with the Securities and Exchange Commission on July 28, 2022, Spirit Airlines, Inc. ("Spirit") entered into an Agreement and Plan of Merger on July 28, 2022 (the “Merger Agreement”), with JetBlue Airways Corporation, a Delaware corporation (“JetBlue”), and Sundown Acquisition Corp., a Delaware corporation and a direct, wholly owned subsidiary of JetBlue (“Merger Sub” and, together with Spirit and JetBlue, the “Parties”), pursuant to which and subject to the terms and conditions therein, Merger Sub would be merged with and into Spirit, with Spirit continuing as the surviving entity (the “Merger”).

On March 4, 2024, the Parties entered into a Termination Agreement (the “Termination Agreement”), pursuant to which the Merger Agreement was terminated effective immediately. Under the terms of the Termination Agreement, JetBlue will, no later than 5:00 p.m. ET on March 5, 2024, pay or cause to be paid $69 million in cash to Spirit.

The Parties agreed to certain non-solicitation and non-disparagement covenants for six months following the date of the Termination Agreement. The Parties also agreed to mutual releases of claims in connection with the Merger Agreement and the Merger.

The foregoing description of the Termination Agreement does not purport to be complete and is subject to, and qualified in its entirety by reference to, the full text of the Termination Agreement, which is attached as Exhibit 10.1 and is incorporated herein by reference, and by the terms and conditions of the full text of the Merger Agreement, which was previously filed by Spirit as Exhibit 2.1 to its Current Report on Form 8-K with the SEC on July 28, 2022 which is incorporated herein by reference.

Item 8.01 Other Events.

On March 4, 2024, Spirit issued a press release announcing the termination of the Merger Agreement. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following is furnished as an exhibit to this report and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act:

| | | | | |

| Exhibit No. | Description |

| 10.1 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Date: March 4, 2024 | SPIRIT AIRLINES, INC. |

| |

| By: /s/ Thomas Canfield |

| Name: Thomas Canfield |

| Title: Senior Vice President and General Counsel |

| |

| |

| |

| |

| |

Exhibit 10.1 EXECUTION COPY TERMINATION AGREEMENT THIS TERMINATION AGREEMENT (this “Agreement”) is entered into effective as of March 1, 2024, by and among JetBlue Airways Corporation, a Delaware corporation (“Parent”), Sundown Acquisition Corp., a Delaware corporation and a direct wholly owned Subsidiary of Parent (“Merger Sub”), and Spirit Airlines, Inc., a Delaware corporation (the “Company” and, together with Parent and Merger Sub, the “Parties”). All capitalized terms used but not otherwise defined herein shall have the respective meanings assigned to them in that certain Agreement and Plan of Merger, dated as of July 28, 2022 (the “Merger Agreement”), by and among the Parties. For good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the Parties hereby agree as follows: 1. Termination of Merger Agreement. Effective immediately upon the execution and delivery by the Parties of this Agreement, and in accordance with Section 7.1(a) of the Merger Agreement, the Parties hereby terminate the Merger Agreement, including all schedules and exhibits thereto, and agree to abandon the transactions contemplated thereby; provided that Sections 5.18(e) and 5.18(f), including any defined terms referred to therein, of the Merger Agreement (the “Surviving Provisions”) shall continue in effect in accordance with their terms. 2. Termination Payment. Not later than 5:00 p.m. Eastern time on March 5, 2024, Parent will pay or cause to be paid to the Company the amount of $69,000,000 (sixty-nine million US dollars) (the “Termination Payment”) in cash by wire transfer of immediately available funds in accordance with Company’s wire instructions set forth on Section 7.2(g) of the Company Disclosure Schedule. The payment of the Termination Payment shall be the sole and exclusive remedy of the Company, its Affiliates and its Representatives against Parent and any of its Representatives and Affiliates for any loss or damage suffered as a result of the failure of the Merger or for a breach of, or failure to perform under, the Merger Agreement (including all schedules and exhibits thereto) or otherwise or in respect of any oral representation made or alleged to have been made in connection therewith, and upon payment of such amount, none of Parent, Merger Sub or their respective Representatives or Affiliates shall have any further liability or obligation relating to or arising out of the Merger Agreement (including all schedules and exhibits thereto), whether in equity or at law, in contract, in tort or otherwise, except in respect of the Surviving Provisions. 3. Mutual Release. Subject only to the payment of the amount contemplated by Section 2 of this Agreement, each of the Parties, on behalf of itself and each of its respective past, present or future assigns, officers, directors, affiliates, subsidiaries, members, managers, predecessors in interest and successors (the “Releasors”) does to the fullest extent permitted by Law, hereby fully release, quitclaim, discharge and hold harmless each other and their respective past, present or future assigns, officers, directors, employees, affiliates, subsidiaries, parents,

shareholders, members, managers, attorneys, accountants, representatives, advisors, agents, predecessors in interest and successors (the “Releasees”) of and from any and all claims, demands, damages, actions, causes of action or liability of every kind or nature whatsoever for, on account of or growing out of any matters pertaining to, relating to or arising out of (a) the Merger Agreement (including all schedules and exhibits thereto) and the transactions contemplated therein or thereby (including, for the avoidance of doubt, the negotiation thereof and all due diligence activities undertaken in connection therewith) and (b) any public statements made prior to the date hereof relating to the foregoing (collectively, “Claims”). Nothing in this Section 3 shall (i) apply to any action by any Party to enforce the rights and obligations pursuant to this Agreement or the Surviving Provisions or (ii) constitute a release by any Party for any Claim arising under this Agreement or in respect of the Surviving Provisions. 4. Covenant Note to Sue. Each of Parent and the Company on behalf of itself and its Releasors covenants not to bring any Claim before any court, arbitrator, or other tribunal in any jurisdiction, whether as a claim, a cross claim, or counterclaim, in respect of the Merger Agreement (other than in respect of the Surviving Provisions). Any Releasee may plead this Agreement as a complete bar to any such Claim brought in derogation of this covenant not to sue. The covenants contained in this Section 4 shall become effective on the date hereof and shall survive this Agreement indefinitely regardless of any statute of limitations. 5. Non-solicitation. For a period of six months following the date hereof, neither Parent nor the Company will, and each of them will cause its respective Affiliates not to, solicit or cause to be solicited for employment any officer, employee or consultant of the other Party (or any of its Affiliates) who was involved in the integration planning process engaged in by the Parties in respect of the proposed Merger; provided that this Section 5 shall not prevent either Party (or any of its Affiliates) from (x) soliciting for employment any person who has not been employed by the other Party (or any of its Affiliates) or, in the case of consultants, engaged as a consultant by the other Party, as the case may be, for at least six months prior to such solicitation or (y) engaging in any general solicitation of employment not specifically directed at employees of the other Party (or any of its Affiliates), or, in the case of consultants, consultant of the other Party. If any of the time or activity limitations set forth herein are determined to be unreasonable by a court or other tribunal of competent jurisdiction, the Parties agree to the modification and/or reduction of such time or activity limitations (including the imposition of such a limitation if it is missing) to such a period or scope of activity as said court or tribunal shall deem reasonable under the circumstances. 6. Non-Disparagement. For a period of six months following the date of this Agreement, except as required by applicable Law or the rules or regulations of any Governmental Entity or by the order of any court of competent jurisdiction, none of the Parties shall, directly or indirectly, make any public statements or any private statements to third parties (in each case, oral or written) in respect of the Merger Agreement or the transactions contemplated thereby that could reasonably be understood as disparaging the other Parties or their respective affiliates.

7. Governing Law; Consent to Jurisdiction; Waiver of Trial by Jury. This Agreement will be governed by, and construed in accordance with, the Laws of the State of Delaware, without regard to laws that may be applicable under conflicts of laws principles (whether of the State of Delaware or any other jurisdiction) that would cause the application of the Laws of any jurisdiction other than the State of Delaware. Each of the Parties hereby irrevocably and unconditionally submits, for itself and its property, to the exclusive jurisdiction of the Court of Chancery of the State of Delaware (the “Chancery Court”), or, if the Chancery Court lacks subject matter jurisdiction of the action or proceeding, any Federal court of the United States of America sitting in Delaware, and any appellate court from any thereof, in any action or proceeding arising out of or relating to this Agreement or the transactions contemplated hereby or for recognition or enforcement of any judgment relating thereto, and each of Parties hereby irrevocably and unconditionally (i) agrees not to commence any such action or proceeding, except in such court, (ii) agrees that any claim in respect of any such action or proceeding may be heard and determined in such court, (iii) waives, to the fullest extent it may legally and effectively do so, any objection which it may now or hereafter have to the laying of venue of any such action or proceeding in any such court and (iv) waives, to the fullest extent permitted by Law, the defense of an inconvenient forum to the maintenance of such action or proceeding in any such court. Each of the Parties agrees that a final judgment in any such action or proceeding will be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any other manner provided by Law. Each Party irrevocably consents to service of process in the manner provided for notices in Section 8.3 of the Merger Agreement. Nothing in this Agreement will affect the right of any party to this Agreement to serve process in any other manner permitted by Law. EACH PARTY ACKNOWLEDGES AND AGREES THAT ANY CONTROVERSY WHICH MAY ARISE UNDER THIS AGREEMENT IS LIKELY TO INVOLVE COMPLICATED AND DIFFICULT ISSUES, AND THEREFORE IT HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVES ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY LITIGATION DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY. EACH PARTY CERTIFIES AND ACKNOWLEDGES THAT (I) NO REPRESENTATIVE, AGENT OR ATTORNEY OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE EITHER OF SUCH WAIVERS, (II) IT UNDERSTANDS AND HAS CONSIDERED THE IMPLICATIONS OF SUCH WAIVERS, (III) IT MAKES SUCH WAIVERS VOLUNTARILY AND (IV) IT HAS BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 7. 8. Entire Agreement. This Agreement constitutes the entire agreement of the Parties and supersedes all prior agreements and undertakings, both written and oral, among the Parties, or any of them, with respect to the subject matter hereof.

9. Severability. Any term or provision of this Agreement that is deemed or determined by a court of competent jurisdiction to be invalid or unenforceable in any situation in any jurisdiction shall not affect the validity or enforceability of the remaining terms and provisions hereof or the validity or enforceability of the offending term or provision in any other situation or in any other jurisdiction. If a court of competent jurisdiction declares that any term or provision hereof is invalid or unenforceable, the Parties agree that the court making such determination shall have the power to limit the term or provision, to delete specific words or phrases, or to replace any invalid or unenforceable term or provision with a term or provision that is valid and enforceable and that comes closest to expressing the intention of the invalid or unenforceable term or provision, and this Agreement shall be enforceable as so modified. In the event such court does not exercise the power granted to it in the prior sentence, the Parties agree to replace such invalid or unenforceable term or provision with a valid and enforceable term or provision that will achieve, to the maximum extent possible, the economic, business and other purposes of such invalid or unenforceable term and the overall purpose of this Agreement as expressly described herein. 10. Notices. The provisions of Section 8.3 of the Merger Agreement are incorporated herein by reference. 11. Counterparts. This Agreement may be executed in one or more counterparts, and by the different Parties in separate counterparts, each of which when executed will be deemed to be an original but all of which taken together will constitute one and the same agreement. 12. Third-Party Beneficiaries. Except for the provisions of Section 3, with respect to which each Releasee is an expressly intended third-party beneficiary thereof, this Agreement is not intended to (and does not) confer on any Person other than the Parties any rights or remedies or impose on any Person other than the Parties any obligations. [Signature Pages Follow.]

[Signature Page to Termination Agreement] IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first above written. JETBLUE AIRWAYS CORPORATION By: /s/ Brandon Nelson Name: Brandon Nelson Title: General Counsel & Corporate Secretary SUNDOWN ACQUISITION CORP. By: /s/ Brandon Nelson Name: Brandon Nelson Title: General Counsel & Corporate Secretary

[Signature Page to Termination Agreement] IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first above written. SPIRIT AIRLINES, INC. By: /s/ Edward M. Christie Name: Edward M. Christie Title: President & Chief Executive Officer

Exhibit 99.1 Spirit Announces Termination of Merger Agreement with JetBlue MIRAMAR, Fla., March 4, 2024 – Spirit Airlines, Inc. (“Spirit”) (NYSE: SAVE) today announced that its merger agreement with JetBlue Airways Corporation has been terminated by mutual agreement. “After discussing our options with our advisors and JetBlue, we concluded that current regulatory obstacles will not permit us to close this transaction in a timely fashion under the merger agreement,” said Ted Christie, Spirit's President and Chief Executive Officer. “We are disappointed we cannot move forward with a deal that would save hundreds of millions for consumers and create a real challenger to the dominant “Big 4” U.S. airlines. However, we remain confident in our future as a successful independent airline. We wish the JetBlue team well.” Christie continued, “Throughout the transaction process, given the regulatory uncertainty, we have always considered the possibility of continuing to operate as a standalone business and have been evaluating and implementing several initiatives that will enable us to bolster profitability and elevate the Guest experience. As we go forward, I am certain our fantastic Spirit team will continue delivering affordable fares and great experiences to our Guests.” Spirit is confident in its strengths and is focused on returning to profitability. The Company has been taking, and will continue to take, prudent steps to ensure the strength of its balance sheet and ongoing operations, including assessing options to refinance upcoming debt maturities. In that regard, Spirit has retained Perella Weinberg & Partners L.P. and Davis Polk & Wardwell LLP as advisors. As part of the termination, JetBlue will pay Spirit $69 million. While the merger agreement was in effect, Spirit stockholders received approximately $425 million in total prepayments. About Spirit Airlines Spirit Airlines (NYSE: SAVE) is committed to delivering the best value in the sky. We are the leader in providing customizable travel options starting with an unbundled fare. This allows our Guests to pay only for the options they choose — like bags, seat assignments, refreshments and Wi-Fi — something we call À La Smarte®. Our Fit Fleet® is one of the youngest and most fuel- efficient in the United States. We serve destinations throughout the U.S., Latin America and the Caribbean, making it possible for our Guests to venture further and discover more than ever before. We are committed to inspiring positive change in the communities where we live and work through the Spirit Charitable Foundation. Come save with us at spirit.com. Investor inquiries: DeAnne Gabel (954) 447-7920 investorrelations@spirit.com

Exhibit 99.1 Media inquiries: Spirit Media Relations Media_Relations@spirit.com or FGS Global Robin Weinberg / Emily Claffey / Bridget Stephan (212) 687-8080 Spirit@FGSGlobal.com

v3.24.0.1

Cover Page

|

Mar. 01, 2024 |

| Cover page. [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 01, 2024

|

| Entity Registrant Name |

SPIRIT AIRLINES, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35186

|

| Entity Tax Identification Number |

38-1747023

|

| Entity Address, Address Line One |

2800 Executive Way

|

| Entity Address, City or Town |

Miramar,

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33025

|

| City Area Code |

954

|

| Local Phone Number |

447-7920

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

SAVE

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001498710

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

save_Coverpage.Abstract |

| Namespace Prefix: |

save_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

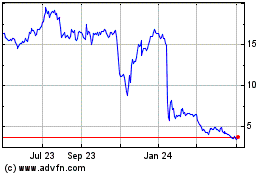

Spirit Airlines (NYSE:SAVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

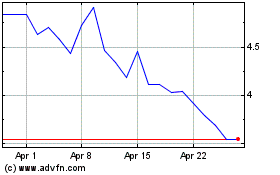

Spirit Airlines (NYSE:SAVE)

Historical Stock Chart

From Apr 2023 to Apr 2024