Filed pursuant to Rule 424(b)(3)

Registration No. 333-239940

PROSPECTUS SUPPLEMENT NO. 86

(to Prospectus dated July 27, 2020)

Nikola Corporation

Up to 249,843,711 Shares of Common Stock

This prospectus supplement supplements the prospectus dated July 27, 2020 (the “Prospectus”), which forms a part of our registration statement on Form S-1 (No. 333-239940). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our current report on Form 8-K, filed with the Securities and Exchange Commission on March 4, 2024 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the offer and sale from time to time by the selling securityholders named in the Prospectus or their donees, pledgees, transferees or other successors in interest (the “Selling Securityholders”) of up to 249,843,711 shares of our common stock, $0.0001 par value per share (“Common Stock”), which includes (i) up to 6,640,000 shares held by certain persons and entities (the “Original Holders”) holding shares of Common Stock initially purchased by VectoIQ Holdings, LLC (the “Sponsor”) and Cowen Investments II, LLC (“Cowen Investments” and, together with the Sponsor, the “Founders”) in a private placement in connection with the initial public offering of VectoIQ Acquisition Corp. and (ii) 243,203,711 shares held by certain affiliates of the Company. We are registering the shares for resale pursuant to such stockholders’ registration rights under a Registration Rights and Lock-Up Agreement between us and such stockholders, which in addition to such registration rights, also provides for certain transfer and lock-up restrictions on such shares.

Our Common Stock is listed on the Nasdaq Global Select Market under the symbol “NKLA”. On March 1, 2024, the closing price of our Common Stock was $0.7319.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

See the section entitled “Risk Factors” beginning on page 7 of the Prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is March 4, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 3, 2024

Nikola Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware (State or Other Jurisdiction of Incorporation) | 001-38495 (Commission File Number) | 82-4151153 (I.R.S. Employer Identification No.) |

4141 E Broadway Road

Phoenix, AZ 85040

(Address of principal executive offices) (Zip Code)

(480) 581-8888

(Registrant’s telephone number,

including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common stock, $0.0001 par value per share | NKLA | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 3, 2024, the board of directors of Nikola Corporation (the “Company”) appointed Thomas B. Okray to serve as the Company’s Chief Financial Officer, Principal Financial Officer and Principal Accounting Officer, effective March 4, 2024.

Mr. Okray, age 61, served as Executive Vice President and Chief Financial Officer of Eaton Corporation PLC, an intelligent power management technologies company, from March 2021 to February 2024, and prior to that, as its Executive Vice President and Chief Financial Officer-Elect, from January 2021 to March 2021. From April 2018 to December 2020, Mr. Okray served as Senior Vice President and Chief Financial Officer of W.W. Grainger, Inc., an industrial supply distributor. Mr. Okray served as Executive Vice President and Chief Financial Officer of Advance Auto Parts, Inc., an automotive aftermarket parts provider, from October 2016 to April 2018. Prior to that, he served in various capacities at Amazon.com, Inc., an e-commerce company, including as President, Finance, North American Operations, from January 2016 to October 2016, and as Vice President, Finance, Global Customer Fulfillment, from June 2015 to January 2016. From January 2010 to June 2015, Mr. Okray worked at General Motors Company, an automotive company, in a variety of finance and supply chain related roles, including as CFO, Global Product Development, Purchasing & Supply Chain. Mr. Okray has served on the board of directors of Monro, Inc. (Nasdaq: MNRO), an automotive service and tire dealer, since February 2024, and the board of directors of Flowserve Corporation (NYSE: FLS), a manufacturer and aftermarket service provider of comprehensive flow control systems, since April 2023. Mr. Okray received an MBA in Finance from the University of Chicago and a Bachelor of Science degree in Engineering from Michigan State University.

In connection with Mr. Okray’s appointment as Chief Financial Officer, Mr. Okray and the Company entered into an Executive Employment Agreement (the “Employment Agreement”), pursuant to which Mr. Okray will be entitled to receive an annual base salary of $695,000 and, subject to approval of the board of directors, 300,000 restricted stock units and 600,000 performance stock unit awards (“PSUs”). Mr. Okray will be eligible to participate in the Company’s 2024 equity incentive program for executive officers. Mr. Okray will also receive a one-time taxable relocation bonus of $20,000 and reimbursement of certain other expenses associated with Mr. Okray’s relocation, each grossed up for applicable taxes, and subject to repayment if Mr. Okray voluntarily leaves the Company (and not pursuant to an Involuntary Termination (as defined in the Employment Agreement), death or disability) prior to his one-year employment anniversary with the Company. The Employment Agreement contains customary confidentiality and intellectual property assignment provisions.

Pursuant to the Employment Agreement, in the event of an Involuntary Termination (as defined in the Employment Agreement) of Mr. Okray employment and subject to Mr. Okray’s delivery of an effective release of claims and ongoing compliance with certain post-termination restrictive covenants, including two-year noncompete and nonsolicitation covenants and a non-disparagement covenant, Mr. Okray would be entitled to receive: (1) a lump sum cash payment in an amount equal to $1,390,000, less applicable withholding taxes; (2) a lump sum cash payment equal to 18 months of COBRA benefits coverage, less applicable withholding taxes; (3) the acceleration in full of all unvested equity and equity based awards, other than any performance-based awards (and the post termination exercise period for any unexercised stock options would be extended to three years following his termination date); and (4) service will be deemed to have been satisfied and any outstanding PSUs will vest and be settled at the end of the performance period based on final actual performance.

The foregoing summary of the Employment Agreement is qualified in its entirety by reference to the Employment Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

In connection with his appointment, the Company expects to enter into its form of indemnification agreement with Mr. Okray.

Mr. Okray has no family relationships with any of the Company’s directors or executive officers, and he has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1# | | Executive Employment Agreement by and between Nikola Corporation and Thomas B. Okray, dated March 1, 2024. |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

| # Indicates management contract or compensatory plan or arrangement. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Dated: March 4, 2024 | | | |

| | | |

| | NIKOLA CORPORATION |

| | | |

| | | |

| | By: | /s/ Britton M. Worthen |

| | | Britton M. Worthen |

| | | Chief Legal Officer |

| | | |

| | | |

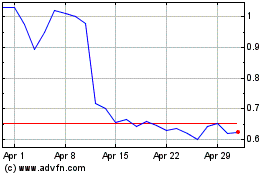

Nikola (NASDAQ:NKLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nikola (NASDAQ:NKLA)

Historical Stock Chart

From Apr 2023 to Apr 2024