UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Pursuant

to Section 14(a) of the Securities

Exchange

Act of 1934

Filed by the Registrant x

Filed

by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary

Proxy Statement

¨ Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive

Proxy Statement

x Definitive

Additional Materials

¨ Soliciting

Material under §240.14a-12

CANOPY GROWTH CORPORATION

(Name of Registrant as Specified

in Its Charter)

N/A

(Name of Person(s) Filing

Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

x No

fee required

¨ Fee

paid previously with preliminary materials.

¨ Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

Dear Shareholder

We are very excited to be advancing our Canopy USA, LLC (“Canopy

USA”) strategy to accelerate entry into the U.S. cannabis industry and unleash the value of its full U.S. cannabis ecosystem.

We believe this strategy will make Canopy Growth Corporation (“Canopy Growth” or “Company”) the

first and only U.S. listed company offering shareholders a unique opportunity to gain exposure to the fastest growing cannabis market

in the world through what will be Canopy Growth’s unconsolidated interest in Canopy USA.

For the next step in executing this strategy, we have scheduled a special

shareholder meeting for April 12, 2024 (the “Meeting”) during which shareholders of Canopy Growth (the “Shareholders”)

will be asked to consider, and if deemed appropriate, pass a special resolution authorizing an amendment to the Company’s articles

of incorporation, as amended, (the “Amendment Proposal”) in order to: (i) create and authorize the issuance of

an unlimited number of a new class of non-voting and non-participating exchangeable shares in the capital of Canopy Growth (the “Exchangeable

Shares”); and (ii) restate the rights of the common shares in the capital of Canopy Growth to provide for a conversion

feature whereby each share may at any time, at the option of the holder, be converted into one Exchangeable Share. The Meeting will be

conducted in virtual format by live audio webcast at:

www.virtualshareholdermeeting.com/WEED2024SM.

YOUR VOTE IS IMPORTANT

NO MATTER HOW MANY SHARES YOU HOLD.

Please vote your shares today

Canopy Growth’s board of directors recommends

that Shareholders vote FOR the resolution to authorize and approve the Amendment Proposal

This upcoming vote by Shareholders is expected to be a critical step

in the Company’s strategy to accelerate its entry into the over $50B1 U.S. THC market. Shareholders will find important

information and detailed instructions about how to participate in the Meeting in the Company’s definitive proxy statement dated

February 12, 2024 (the “Proxy Statement”), which is available at:

www.canopygrowth.com/investors/investor-events/special-meeting-2024.

QUESTIONS & VOTING

If you have questions about the meeting matters

or require voting assistance, please contact Canopy Growth’s proxy solicitation agent:

Laurel Hill Advisory Group

Toll-Free: 1-877-452-7184 in North America (1-416-304-0211 outside North America)

Email: assistance@laurelhill.com

Please vote your shares ahead of the proxy voting

deadline on April 10, 2024 at 1:00 PM Eastern Time (Toronto time).

1

MJBiz market forecast of total US cannabis market by 2026, in USD currency.

Best Regards,

Canopy Growth Corporation.

Notice Regarding Forward-Looking Information

This email contains “forward-looking statements”

within the meaning of applicable securities laws, which involve certain known and unknown risks and uncertainties. Forward-looking statements

predict or describe our future operations, business plans, business and investment strategies and the performance of our investments.

These forward-looking statements are generally identified by their use of such terms and phrases as “intend,” “goal,”

“strategy,” “estimate,” “expect,” “project,” “projections,” “forecasts,”

“plans,” “seeks,” “anticipates,” “potential,” “proposed,” “will,”

“should,” “could,” “would,” “may,” “likely,” “designed to,” “foreseeable

future,” “believe,” “scheduled” and other similar expressions. Our actual results or outcomes may differ

materially from those anticipated. You are cautioned not to place undue reliance on these forward-looking statements, which speak only

as of the date the statement was made.

Forward-looking statements include, but are not

limited to, statements with respect to: expectations regarding the Canopy USA THC platform, the anticipated timing, occurrence and outcome

of the Meeting; statements regarding the expected size of the U.S. cannabis market; statements with respect to our ability to execute

on our strategy to accelerate the Company’s entry into the U.S. cannabis industry, and the anticipated benefits of such strategy,

expectations regarding the Company’s ability to deconsolidate the financial results of Canopy USA from the financial results of

Canopy Growth; expectations regarding the potential success of, and the costs and benefits associated with, our acquisitions, joint ventures,

strategic alliances, equity investments and dispositions; our ability to successfully create and launch brands and further create, launch

and scale cannabis-based products; our ability to continue as a going concern; our ability to execute on our strategy and the anticipated

benefits of such strategy; the timing and nature of legislative changes in the U.S. regarding the regulation of cannabis, including THC;

the future performance of our business and operations; and our ability to comply with the listing requirements of the Nasdaq Stock Market

LLC and the Toronto Stock Exchange.

Certain of the forward-looking statements contained

herein concerning the industries in which we conduct our business are based on estimates prepared by us using data from publicly available

governmental sources, market research, industry analysis and on assumptions based on data and knowledge of these industries, which we

believe to be reasonable. However, although generally indicative of relative market positions, market shares and performance characteristics,

such data is inherently imprecise. The industries in which we conduct our business involve risks and uncertainties that are subject to

change based on various factors, which are described further below.

The forward-looking statements contained herein

are based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including, without

limitation: (i) management’s perceptions of historical trends, current conditions and expected future developments; (ii) general

economic, financial market, regulatory and political conditions in which we operate; (iii) anticipated and unanticipated costs; (iv) government

regulation; (v) our ability to realize anticipated benefits, synergies or generate revenue, profits or value; and (xiii) other

considerations that management believes to be appropriate in the circumstances. While our management considers these assumptions to be

reasonable based on information currently available to management, there is no assurance that such expectations will prove to be correct.

By their nature, forward-looking statements are

subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations,

forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct and that objectives,

strategic goals and priorities will not be achieved. A variety of factors, including known and unknown risks, many of which are beyond

our control, could cause actual results to differ materially from the forward-looking statements in this email and other reports we file

with, or furnish to, the SEC and other regulatory agencies and made by our directors, officers, other employees and other persons authorized

to speak on our behalf. Such factors include, without limitation, our limited operating history; the diversion of management time on issues

related to Canopy USA; the risks the risks relating to the conditions precedent to the acquisitions of Acreage, Wana and Jetty not being

satisfied or waived; the risks related to Acreage’s financial statements expressing doubt about its ability to continue as a going

concern; the fact that we have yet to receive audited financial statements from Jetty; the adequacy of our capital resources and liquidity,

including but not limited to, availability of sufficient cash flow to execute our business plan (either within the expected timeframe

or at all); volatility in and/or degradation of general economic, market, industry or business conditions; compliance with applicable

policies and regulations; changes in regulatory requirements in relation to our business and products; our reliance on licenses issued

by and contractual arrangements with various federal, state and provincial governmental authorities; inherent uncertainty associated with

projections; future levels of revenues and the impact of increasing levels of competition; third-party manufacturing risks; third-party

transportation risks; inflation risks; our exposure to risks related to an agricultural business, including wholesale price volatility

and variable product quality; changes in laws, regulations and guidelines and our compliance with such laws, regulations and guidelines;

risks relating to our ability to refinance debt as and when required on terms favorable to us and to comply with covenants contained in

our debt facilities and debt instruments; risks related to the integration of acquired businesses; the timing and manner of the legalization

of cannabis in the United States; business strategies, growth opportunities and expected investment; counterparty risks and liquidity

risks that may impact our ability to obtain loans and other credit facilities on favorable terms; the potential effects of judicial, regulatory

or other proceedings, litigation or threatened litigation or proceedings, or reviews or investigations, on our business, financial condition,

results of operations and cash flows; the anticipated effects of actions of third parties such as competitors, activist investors or federal,

state, provincial, territorial or local regulatory authorities, self-regulatory organizations, plaintiffs in litigation or persons threatening

litigation; consumer demand for cannabis; the implementation and effectiveness of key personnel changes; risks related to stock exchange

restrictions; the risks related to the Exchangeable Shares having different rights from our common shares and the fact that there may

never be a trading market for the Exchangeable Shares; future levels of capital, environmental or maintenance expenditures, general and

administrative and other expenses; and the factors discussed under the heading “Risk Factors” in the Company’s Annual

Report on Form 10-K for the year ended March 31, 2023 filed with the SEC on EDGAR and with the Canadian securities regulators

on SEDAR+ on June 22, 2023, in Item 1A of Part II of the Company’s Form 10-Q for the fiscal quarter ended December 31,

2023 filed with the SEC on EDGAR and with the Canadian securities regulators on SEDAR+ on February 9, 2024, as well as those disclosed

under the heading “Amendment Proposal—Risk Factors Relating to the Amendment Proposal” in the Proxy Statement . Readers

are cautioned to consider these and other factors, uncertainties and potential events carefully and not to put undue reliance on forward-looking

statements.

While we believe that the assumptions and expectations

reflected in the forward-looking statements are reasonable based on information currently available to management, there is no assurance

that such assumptions and expectations will prove to have been correct. Forward-looking statements are made as of the date they are made

and are based on the beliefs, estimates, expectations and opinions of management on that date. We undertake no obligation to update or

revise any forward-looking statements, whether as a result of new information, estimates or opinions, future events or results or otherwise

or to explain any material difference between subsequent actual events and such forward-looking statements, except as required by law.

The forward-looking statements contained in this email and other reports we file with, or furnish to, the SEC and other regulatory agencies

and made by our directors, officers, other employees and other persons authorized to speak on our behalf are expressly qualified in their

entirety by these cautionary statements.

Participants in the Solicitation

Canopy Growth and its directors and executive officers may be deemed

participants in the solicitation of proxies from Shareholders with respect to the solicitation of votes to consider the Amendment Proposal.

A description of the interests of our directors and executive officers in the Amendment Proposal is contained in the Proxy Statement and

is available free of charge at the SEC’s website at www.sec.gov, or by directing a request to Canopy Growth Corporation, 1 Hershey

Drive, Smiths Falls, Ontario, K7A 0A8 or by email to invest@canopygrowth.com. Investors should read the Proxy Statement as it contains

important information.

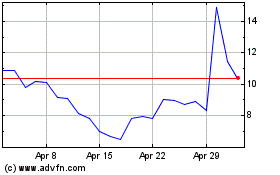

Canopy Growth (NASDAQ:CGC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canopy Growth (NASDAQ:CGC)

Historical Stock Chart

From Apr 2023 to Apr 2024