Filed pursuant to Rule 424(b)(5)

Registration No. 333-273460

PROSPECTUS SUPPLEMENT

(To Prospectus dated July 26, 2023)

6,471,000 Shares

Common Stock

____________________

We are offering 6,471,000 shares of our common stock in this offering.

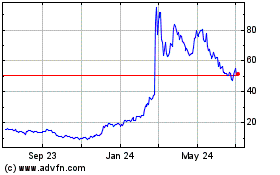

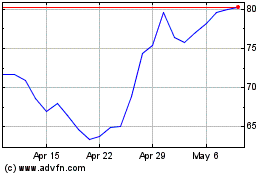

Our common stock is listed on the Nasdaq Capital Market under the symbol “VKTX.” The last reported sale price of our common stock on the Nasdaq Capital Market on February 28, 2024 was $94.50 per share.

Investing in our common stock involves a high degree of risk. See the section titled “Risk Factors” beginning on page S-7 of this prospectus supplement and under similar headings in the documents incorporated by reference into this prospectus supplement and the accompanying base prospectus for a discussion of certain risks you should consider before investing in shares of our common stock.

|

|

|

|

|

|

|

Per Share |

Total |

Public offering price |

$ 85.000000 |

$ 550,035,000 |

Underwriting discounts and commissions(1) |

$ 4.694295 |

$ 30,376,783 |

Proceeds, before expenses, to us |

$ 80.305705 |

$ 519,658,217 |

|

|

|

(1) See “Underwriters” beginning on page S-15 for additional information regarding underwriter compensation.

We have granted the underwriters an option for a period of 30 days to purchase up to 970,650 additional shares of common stock from us at the public offering price set forth above, less underwriting discounts and commissions.

The underwriters expect to deliver the shares against payment in New York, New York on or about March 4, 2024.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

____________________

Morgan Stanley Leerink Partners

William Blair Raymond James Stifel Truist Securities

Oppenheimer & Co.

BTIG H.C. Wainwright & Co. Maxim Group LLC Laidlaw & Company (U.K.) Ltd.

February 28, 2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying base prospectus are part of an “automatic shelf” registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission, or the SEC, as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended, or the Securities Act, using a “shelf” registration process. This prospectus supplement describes the specific terms of this offering. The accompanying base prospectus, including the documents incorporated by reference therein, provides general information about us, some of which, such as the section therein titled “Plan of Distribution,” may not apply to this offering. Generally, when we refer to this prospectus, we are referring to both this prospectus supplement and the accompanying base prospectus, combined.

We urge you to carefully read this prospectus supplement, the accompanying base prospectus, the documents incorporated by reference herein and therein and the additional information under the headings “Information Incorporated by Reference” and “Where You Can Find More Information” before buying any of the securities being offered under this prospectus supplement. These documents contain information you should consider when making your investment decision.

You should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying base prospectus. We have not, and the underwriters have not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus supplement may add, update or change information contained in the accompanying base prospectus. To the extent any information in this prospectus supplement is inconsistent with the accompanying base prospectus, you should rely on the information in this prospectus supplement. The information in this prospectus supplement will be deemed to modify or supersede the information in the accompanying base prospectus and the documents incorporated by reference therein, except for those documents incorporated by reference therein which we file with the SEC after the date of this prospectus supplement.

You should not assume that the information contained or incorporated by reference in this prospectus supplement and the accompanying base prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus supplement and the accompanying base prospectus or on any date subsequent to the date of the document incorporated by reference, as applicable. Our business, financial condition, results of operations and prospects may have changed since those dates.

We are offering to sell, and seeking offers to buy, the securities described in this prospectus supplement only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the offering of the securities in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus supplement outside the United States. This prospectus supplement does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into this prospectus supplement or the accompanying base prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

In this prospectus supplement, unless otherwise indicated or required by the context, the terms “Viking,” “we,” “our,” “us” and the “Company” refer to Viking Therapeutics, Inc. and its consolidated subsidiary.

PROSPECTUS SUPPLEMENT SUMMARY

This summary contains basic information about us and this offering. This summary highlights selected information contained elsewhere in, or incorporated by reference into, this prospectus supplement. This summary is not complete and may not contain all of the information that may be important to you and that you should consider before deciding whether or not to invest in our securities. For a more complete understanding of Viking and this offering, you should carefully read this prospectus supplement, including the information incorporated by reference into this prospectus supplement, in its entirety. Investing in our securities involves risks that are described in this prospectus supplement under the heading “Risk Factors,” under the heading “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 and in our other filings with the SEC.

Overview

We are a clinical-stage biopharmaceutical company focused on the development of novel, first-in-class or best-in-class therapies for metabolic and endocrine disorders.

Our lead clinical program’s drug candidate, VK2809, is an orally available, tissue and receptor-subtype selective agonist of the thyroid hormone receptor beta, or TRß. In November 2019, we initiated the VOYAGE study, a Phase 2b clinical trial of VK2809 in patients with biopsy-confirmed non-alcoholic steatohepatitis, or NASH.

The VOYAGE study is a randomized, double-blind, placebo-controlled, multicenter trial designed to assess the efficacy, safety and tolerability of VK2809 in patients with biopsy-confirmed NASH and fibrosis ranging from stages F1 to F3. The primary endpoint of the study will evaluate the relative change in liver fat content, as assessed by magnetic resonance imaging, proton density fat fraction, or MRI-PDFF, from baseline to week 12 in subjects treated with VK2809 as compared to placebo. Secondary objectives include evaluation of histologic changes assessed by hepatic biopsy after 52 weeks of dosing.

In January 2023, we announced completion of patient enrollment in the VOYAGE study and in May 2023, we reported that the VOYAGE study successfully achieved its primary endpoint, with patients receiving VK2809 experiencing statistically significant reductions in liver fat content from baseline to Week 12 as compared to placebo. Results from the biopsy after 52 weeks of dosing are expected to be available in the first half of 2024.

VK2809 has been evaluated in eight completed clinical studies, which enrolled more than 300 subjects. No serious adverse events, or SAEs, have been observed in subjects receiving VK2809 in these completed studies, and overall tolerability remains encouraging. In addition, the compound has been evaluated in chronic toxicity studies of up to 12 months in duration.

In January 2022, we announced the initiation of a Phase 1 single ascending dose, or SAD, and multiple ascending dose, or MAD, clinical trial of VK2735, a novel dual agonist of the glucagon-like peptide 1, or GLP-1, and glucose-dependent insulinotropic polypeptide, or GIP, receptors. VK2735 is in development for the potential treatment of various metabolic disorders.

On March 28, 2023, we announced the completion of the Phase 1 trial. The study was a randomized, double-blind, placebo-controlled, SAD and MAD study in healthy adults. The primary objectives of the study included evaluation of the safety and tolerability of single and multiple doses of VK2735 delivered subcutaneously and the identification of VK2735 doses suitable for further clinical development. Study investigators also evaluated the pharmacokinetics of single and multiple doses of VK2735. Based upon the results from this Phase 1 study, in September 2023, we initiated the VENTURE study, a Phase 2 clinical trial of VK2735 in patients with obesity.

The Phase 2 VENTURE study is a randomized, double-blind placebo-controlled study to evaluate the safety, tolerability, pharmacokinetics and weight loss efficacy of VK2735, administered subcutaneously, once weekly. The 13-week study will enroll adults who are obese (BMI >= 30 kg/m2) or adults who are overweight (BMI >= 27kg/m2) with at least one weight-related co-morbidity condition. The primary endpoint of the study is the percent change in body weight from baseline to week 13, with secondary and exploratory endpoints evaluating a range of additional safety and efficacy measures. In February 2024, we announced the top-line results from the study, which are discussed in the section below titled “—Recent Developments”.

On March 28, 2023, we announced the initiation of a Phase 1 clinical study to evaluate a novel oral formulation of VK2735. The study, which is an extension of our recently completed Phase 1 evaluation of subcutaneously administered VK2735, is evaluating daily oral doses for 28 days. Results from this study are expected to be available in the first quarter of 2024.

We are also developing VK0214, which is also an orally available, tissue and receptor-subtype selective agonist of TRß for X-linked adrenoleukodystrophy, or X-ALD, a rare X-linked, inherited neurological disorder characterized by a breakdown in the protective barriers surrounding brain and nerve cells. The disease, for which there is no approved treatment, is caused by mutations in a peroxisomal transporter of very long chain fatty acids, or VLCFA, known as ABCD1. As a result, transporter function is impaired and patients are unable to efficiently metabolize VLCFA. The TRß receptor is known to regulate expression of an alternative VLCFA transporter, known as ABCD2. Various preclinical models have demonstrated that increased expression of ABCD2 can lead to normalization of VLCFA metabolism. Preliminary data suggest that VK0214 stimulates ABCD2 expression in an in vitro model and reduces VLCFA levels in an in vivo model of X-ALD.

In June 2021, we initiated a Phase 1b clinical trial of VK0214 in patients with X-ALD. This trial is a multi-center, randomized, double-blind, placebo-controlled study in adult male patients with the adrenomyeloneuropathy, or AMN, form of X-ALD. The study is initially targeting enrollment across three cohorts: placebo, VK0214 20 mg daily, and VK0214 40 mg daily. Pending a blinded review of preliminary safety, tolerability, and pharmacokinetic data, additional dosing cohorts may be pursued. Results from Phase 1b study are expected in the first half of 2024.

The primary objective of the study is to evaluate the safety and tolerability of VK0214 administered once-daily over a 28-day dosing period. Secondary and exploratory objectives include an evaluation of the pharmacokinetics and pharmacodynamics of VK0214 following 28 days of dosing in this population.

Other clinical programs include VK5211, an orally available, non-steroidal selective androgen receptor modulator, or SARM. In November 2017, we announced positive top-line results from a Phase 2 proof-of-concept clinical trial in 108 patients recovering from non-elective hip fracture surgery. Top-line data showed that the trial achieved its primary endpoint, demonstrating statistically significant, dose dependent increases in lean body mass, less head, following treatment with VK5211 as compared to placebo. The study also achieved certain secondary endpoints, demonstrating statistically significant increases in appendicular lean body mass and total lean body mass for all doses of VK5211, compared to placebo. VK5211 demonstrated encouraging safety and tolerability in this study, with no drug-related SAEs reported. Our intent is to continue to pursue partnering or licensing opportunities for VK5211 prior to conducting additional clinical studies.

Our Development Pipeline

The following table highlights our current development pipeline:

Key: TRß, thyroid receptor beta; NASH, nonalcoholic steatohepatitis; GLP-1, glucagon-like peptide 1, GIP, glucose-dependent insulinotropic polypeptide; X-ALD, X-linked adrenoleukodystrophy.

We also have three additional programs targeting metabolic diseases and anemia. The most advanced is VK0612, a first-in-class, orally available Phase 2b-ready drug candidate for type 2 diabetes. Preliminary clinical data suggest VK0612 has the potential to provide substantial glucose-lowering effects, with an attractive safety and convenience profile compared with existing type 2 diabetes therapies. Our preclinical programs are focused on developing inhibitors of diacylglycerol acyltransferase-1, or DGAT-1, for the potential treatment of obesity and dyslipidemia and on identifying orally available erythropoietin, or EPO, receptor, or EPOR, agonists for the potential treatment of anemia.

For a complete description of our business, financial condition, results of operations and other important information, we refer you to our filings with the SEC that are incorporated by reference in this prospectus supplement, including our Annual Report on Form 10-K for the year ended December 31, 2023. For instructions on how to find copies of these documents, see the sections of this prospectus supplement titled “Information Incorporated by Reference” and “Where You Can Find More Information”.

Recent Developments

On February 27, 2024, we announced that patients receiving weekly doses of VK2735 demonstrated statistically significant reductions in mean body weight after 13 weeks, ranging up to 14.7% from baseline. Patients receiving VK2735 also demonstrated statistically significant reductions in mean body weight relative to placebo, ranging up to 13.1%. Statistically significant differences compared to both baseline and placebo were observed for all doses starting at week one and continuing throughout the 13-week treatment period. Reductions in body weight were progressive through the course of the study, with no plateau observed for weight loss at 13 weeks. All doses of VK2735 also demonstrated statistically significant differences relative to placebo on the key secondary endpoint assessing the proportion of patients demonstrating at least 10% weight loss. Up to 88% of patients in VK2735 treatment groups achieved ≥10% weight loss, compared with 4% for placebo. VK2735 is shown to be well-tolerated based on the interim data from the 13-week of once-weekly dosing study. Among patients receiving VK2735, the majority (92%) reported drug-related treatment-emergent adverse events as mild or moderate in severity.

Corporate and Other Information

We were incorporated under the laws of the State of Delaware on September 24, 2012. Our principal executive offices are located at 9920 Pacific Heights Blvd, Suite 350, San Diego, CA 92121, and our telephone number is (858) 704-4660. Our website address is www.vikingtherapeutics.com. We do not incorporate the information on, or accessible through, our website into this prospectus supplement, and you should not consider any information on, or accessible through, our website as part of this prospectus supplement. We have included our website address in this prospectus supplement solely as an inactive textual reference.

We are no longer a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, as of January 1, 2024. We previously elected to take advantage of certain of the scaled disclosure available for smaller reporting companies in our filings under the Exchange Act, including our Annual Report on Form 10-K for the year ended December 31, 2023.

THE OFFERING

|

|

Common stock offered by us |

6,471,000 shares |

Option to purchase additional shares from us |

We have granted the underwriters an option for a period of 30 days from the day of this prospectus supplement to purchase up to 970,650 additional shares of our common stock. |

Common stock to be outstanding immediately after this offering |

108,011,073 shares (or 108,981,723 shares if the underwriters exercise their option to purchase additional shares in full) |

Use of proceeds |

We estimate the net proceeds from this offering will be approximately $519.4 million, or approximately $597.4 million if the underwriters exercise their option to purchase additional shares in full, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We currently intend to use the net proceeds from this offering for continued development of our VK2809, VK2735 and VK0214 programs and for general research and development, working capital and general corporate purposes. See the section titled “Use of Proceeds” for additional detail. |

Risk factors |

Investing in our securities involves a high degree of risk. See the section titled “Risk Factors” beginning on page S-7 and other information included or incorporated by reference in this prospectus supplement for a discussion of factors you should carefully consider before investing in shares our common stock. |

Nasdaq Capital Market trading symbol |

“VKTX” |

The number of shares of our common stock that will be outstanding immediately after this offering is based on 100,113,770 shares of common stock outstanding as of December 31, 2023 and gives effect to the issuance and sale of 1,426,303 shares of our common stock between February 13, 2024 and February 27, 2024 pursuant to the At-The-Market Equity Offering Sales Agreement entered into with Stifel, Nicolaus & Company, Incorporated, Truist Securities, Inc. and H.C. Wainwright & Co., LLC on July 28, 2021, as amended on July 26, 2023, or the Sales Agreement, and excludes:

•5,248,682 shares of our common stock issuable upon the exercise of options outstanding as of December 31, 2023 with a weighted-average exercise price of $6.79 per share;

•2,855,656 shares of our common stock reserved for future issuance upon vesting of outstanding restricted stock units as of December 31, 2023;

•6,526,433 shares of our common stock reserved as of December 31, 2023 for future issuance under our 2014 Equity Incentive Plan, which contains provisions that may increase its share reserve each year through and including January 1, 2024, and pursuant to which 3,503,981 shares of common stock were added to the reserve on January 1, 2024; and

•4,251,444 shares of our common stock reserved as of December 31, 2023 for future issuance under our 2014 Employee Stock Purchase Plan, which contains provisions that may increase its share reserve each year through and including January 1, 2024, and pursuant to which 1,001,137 shares of common stock were added to the reserve on January 1, 2024.

Except as otherwise indicated, all information in this prospectus supplement assumes no exercise by the underwriters of their option to purchase additional shares of common stock from us, assumes no exercise or settlement of outstanding options and restricted stock units referred to above, and does not reflect issuances of options or restricted stock units since December 31, 2023 or the potential issuance of shares of our common stock that remain available for sale as of the date of this prospectus supplement under our “at-the-market” offering program, pursuant to which we may sell common stock for remaining gross proceeds of up to $151.9 million from time to time under the Sales Agreement after the expiration or waiver of the lock-up period applicable to us and described under the section of this prospectus supplement titled “Underwriters”.

RISK FACTORS

Investing in our common stock involves a high degree of risk. Our Annual Report on Form 10-K for the year ended December 31, 2023, which is incorporated by reference into this prospectus supplement, as well as our other filings with the SEC, include material risk factors relating to our business. Those risks and uncertainties and the risks and uncertainties described below are not the only risks and uncertainties that we face. Additional risks and uncertainties that are not presently known to us or that we currently deem immaterial or that are not specific to us, such as general economic conditions, may also materially and adversely affect our business and operations. If any of those risks and uncertainties or the risks and uncertainties described below actually occurs, our business, financial condition, results of operations or prospects could be harmed substantially. In such a case, the trading price of our common stock could decline and you could lose all or part of your investment. You should carefully consider the risks and uncertainties described below and those risks and uncertainties incorporated by reference into this prospectus supplement, as well as the other information included in this prospectus supplement, before making an investment decision with respect to our common stock. Please also carefully read the section below titled “Disclosure Regarding Forward-Looking Statements.”

Risks Related to This Offering

Purchasers of common stock in this offering will experience immediate and substantial dilution in the book value of their investment.

The public offering price per share of common stock in this offering is substantially higher than the net tangible book value per share of our common stock before giving effect to this offering. Accordingly, if you purchase common stock in this offering, you will incur immediate and substantial dilution of approximately $76.54 per share, representing the difference between the public offering price per share of common stock and our pro forma as adjusted net tangible book value as of December 31, 2023. In addition, if our outstanding options are exercised, restricted stock units vest and settle or we raise additional capital, you could experience further dilution. For a further description of the dilution that you will experience immediately after this offering, see the section titled “Dilution.”

Future sales of our common stock, or the perception that such future sales may occur, may cause our stock price to decline.

Sales of a substantial number of shares of our common stock in the public market, or the perception that these sales could occur, following this offering could cause the market price of our common stock to decline. A substantial majority of the outstanding shares of our common stock are, and the shares of common stock sold in this offering upon issuance will be, freely tradable without restriction or further registration under the Securities Act. We may sell large quantities of our common stock at any time pursuant to one or more separate offerings in the future. We cannot predict the effect that future sales of common stock or other equity-related securities would have on the market price of our common stock.

We may issue additional equity or convertible debt securities in the future, which may result in additional dilution to you.

In order to raise additional capital, we expect to in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock. We cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock or other securities convertible into or exchangeable for our common stock in future transactions may be higher or lower than the price per share in this offering.

Our management will have broad discretion to determine how to use the net proceeds from this offering, and may use or invest them in ways with which investors may disagree or that may not enhance our operating results or the price of our common stock.

Our management will have broad discretion over the use of proceeds from this offering, and we could spend the proceeds from this offering in ways with which investors may not agree or that do not yield a favorable return, if at all. We intend to use the net proceeds from this offering for continued development of our VK2809, VK2735 and VK0214 programs and for general research and development, working capital and general corporate purposes. However, our use of these proceeds may differ substantially from our current plans. If we do not invest or apply the net proceeds from this offering in ways that improve our operating results, we may fail to achieve expected financial results, which could cause our stock price to decline

and could harm our business, financial condition, results of operations and prospects. See the section titled “Use of Proceeds” beginning on page S-12 of this prospectus supplement for additional detail.

We do not expect to pay dividends for the foreseeable future. As a result, you must rely on stock appreciation for any return on your investment.

We do not anticipate paying cash dividends on our common stock for the foreseeable future. Any payment of cash dividends will also depend on our financial condition, results of operations, capital requirements and other factors and will be at the discretion of our board of directors. Accordingly, you will have to rely on future appreciation in the market value of our common stock, if any, to earn a return on your investment in our common stock. There is no guarantee that our common stock will appreciate or even maintain the price at which investors have purchased it.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the documents incorporated by reference in this prospectus supplement contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements contained in this prospectus supplement and the documents incorporated by reference in this prospectus supplement include, but are not limited to, statements about:

•risks and uncertainties associated with our research and development activities, including our clinical trials and preclinical studies;

•the timing or likelihood of regulatory filings and approvals or of alternative regulatory pathways for our drug candidates;

•the potential market opportunities for commercializing our drug candidates;

•our expectations regarding the potential market size and the size of the patient populations for our drug candidates, if approved for commercial use, and our ability to serve such markets;

•estimates of our expenses, future revenue, capital requirements and our needs for additional financing;

•our ability to develop, acquire and advance our drug candidates into, and successfully complete, clinical trials and preclinical studies, and obtain regulatory approvals;

•the implementation of our business model and strategic plans for our business and drug candidates;

•the initiation, cost, timing, progress and results of future and current preclinical studies and clinical trials, and our research and development programs;

•the terms of future licensing arrangements, and whether we can enter into such arrangements at all;

•timing and receipt, or payments, of licensing and milestone revenues, if any;

•the scope of protection we are able to establish and maintain for intellectual property rights covering our drug candidates, and our ability to operate our business without infringing the intellectual property rights of others;

•regulatory developments in the United States and foreign countries;

•the performance of our third-party suppliers and manufacturers;

•our ability to maintain and establish collaborations or obtain additional funding;

•the success of competing therapies that are currently or may become available;

•our anticipated use of proceeds from this offering;

•our future financial performance;

•developments and projections relating to our competitors and our industry; and

•other risks and uncertainties, including those listed in the section titled “Risk Factors.”

We caution you that the forward-looking statements highlighted above do not encompass all of the forward-looking statements made in this prospectus supplement or in the documents incorporated by reference in this prospectus supplement.

We have based the forward-looking statements contained in this prospectus supplement and in the documents incorporated by reference in this prospectus supplement primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations and prospects. The outcomes of the events described in these forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results and experience to differ from those projected, including, but not limited to, the risk factors described herein and the risk factors set forth in Part I - Item 1A, “Risk Factors”, in our Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC on February 7, 2024 and elsewhere in the documents incorporated by reference into this prospectus supplement. Moreover, we operate in a very competitive and challenging environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this prospectus supplement and in the documents incorporated by reference in this prospectus supplement. We cannot assure you that the results, events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

The forward-looking statements contained in this prospectus supplement and in the documents incorporated by reference in this prospectus supplement relate only to events as of the date on which the statements are made. We do not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect events or circumstances after the date of this prospectus supplement or to reflect the occurrence of unanticipated events. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, other strategic transactions or investments we may make.

MARKET AND INDUSTRY DATA

This prospectus supplement and the information incorporated by reference herein contain statistical data, estimates, forecasts, projections and other information concerning our industry, our business and the markets for certain diseases, including data regarding the estimated size of those markets and the incidence and prevalence of certain medical conditions. Information that is based on statistical data, estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from reports, research surveys, medical and general publications, government data, studies and similar data prepared by market research firms and other third parties. These third parties may, in the future, alter the manner in which they conduct surveys and studies regarding the markets in which we operate our business. The market and other estimates included in this prospectus supplement and the information incorporated by reference herein, as they relate to projections, involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors, including those discussed in the section of this prospectus supplement titled “Risk Factors” and in the other information contained or incorporated by reference in this prospectus supplement.

USE OF PROCEEDS

We estimate that the net proceeds from the sale of the common stock in this offering will be approximately $519.4 million, or approximately $597.4 million if the underwriters exercise their option to purchase additional shares in full, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

We currently intend to use the net proceeds from this offering for continued development of our VK2809, VK2735 and VK0214 programs and for general research and development, working capital and general corporate purposes. We may also use a portion of the net proceeds to acquire or invest in other businesses, products and technologies that are complementary to our own, although we have no current plans, commitments or arrangements to do so.

The amounts and timing of our use of the net proceeds from this offering will depend on a number of factors, such as the timing and progress of our research and development efforts, the timing and progress of any partnering and commercialization efforts, technological advances and the competitive environment for our products. As of the date of this prospectus supplement, we cannot specify with certainty all of the particular uses for the net proceeds to be received upon the completion of this offering. Additionally, our management will have broad discretion in the timing and application of these proceeds. Pending application of the net proceeds as described above, we intend to invest the proceeds of this offering in money market funds, certificates of deposit and corporate debt securities.

DILUTION

Purchasers of common stock in this offering will experience immediate dilution to the extent of the difference between the public offering price per share of common stock and the as adjusted net tangible book value per share of common stock immediately after this offering.

Our net tangible book value as of December 31, 2023 was approximately $348.2 million, or $3.48 per share of common stock. Net tangible book value per share is determined by dividing the net of total tangible assets less total liabilities, by the aggregate number of shares of common stock outstanding as of December 31, 2023.

Our pro forma net tangible book value as of December 31, 2023 was approximately $394.8 million, or $3.89 per share of common stock. Pro forma net tangible book value per share is determined by dividing the net of total tangible assets less total liabilities, by the aggregate number of shares of common stock outstanding as of December 31, 2023, after giving effect to the issuance of an aggregate of 1,426,303 shares of our common stock pursuant to the Sales Agreement between February 13, 2024 and February 27, 2024 for net proceeds of approximately $46.7 million, after deducting sales commissions payable by us.

After giving effect to (i) the pro forma adjustments described in the preceding paragraph, and (ii) the sale by us of 6,471,000 shares of common stock at the public offering price of $85.00 per share of common stock, and after deducting underwriting discounts and commissions and estimated offering expenses, our pro forma as adjusted net tangible book value as of December 31, 2023 would have been approximately $914.2 million, or $8.46 per share of common stock. This represents an immediate increase in pro forma net tangible book value of $4.57 per share to our existing stockholders and an immediate dilution of $76.54 per share of common stock issued to the investors purchasing shares of our common stock in this offering.

The following table illustrates this per share dilution:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Public offering price per share of common stock |

|

|

|

|

$ |

85.00 |

|

Net tangible book value per share as of December 31, 2023 |

|

$ |

3.48 |

|

|

|

|

Increase in net tangible book value per share attributable to the issuance of an aggregate of 1,426,303 shares of our common stock pursuant to the Sales Agreement between February 13, 2024 and February 27, 2024 |

|

$ |

0.41 |

|

|

|

|

Pro forma net tangible book value per share as of December 31, 2023 |

|

$ |

3.89 |

|

|

|

|

Increase in pro forma net tangible book value per share attributable to this offering |

|

$ |

4.57 |

|

|

|

|

Pro forma as adjusted net tangible book value per share after this offering |

|

|

|

|

$ |

8.46 |

|

Dilution per share to investors participating in this offering |

|

|

|

|

$ |

76.54 |

|

If the underwriters exercise their option to purchase additional shares in full, the dilution in as adjusted net tangible book value per share to investors purchasing shares of common stock in this offering would be $75.90 per share.

The foregoing table and calculations (other than historical net tangible book value) are based on 100,113,770 shares of common stock outstanding as of December 31, 2023, and exclude:

•5,248,682 shares of our common stock issuable upon the exercise of options outstanding as of December 31, 2023 with a weighted-average exercise price of $6.79 per share;

•2,855,656 shares of our common stock reserved for future issuance upon vesting of outstanding restricted stock units as of December 31, 2023;

•6,526,433 shares of our common stock reserved as of December 31, 2023 for future issuance under our 2014 Equity Incentive Plan, which contains provisions that may increase its share reserve each year through and including January 1, 2024, and pursuant to which 3,503,981 shares of common stock were added to the reserve on January 1, 2024; and

•4,251,444 shares of our common stock reserved as of December 31, 2023 for future issuance under our 2014 Employee Stock Purchase Plan, which contains provisions that may increase its share reserve each year through and including January 1, 2024, and pursuant to which 1,001,137 shares of common stock were added to the reserve on January 1, 2024.

To the extent that options are exercised, restricted stock units vest, new options or restricted stock units are issued under our equity incentive plans, if the underwriters exercise their option to purchase additional shares of our common stock or we issue additional shares of common stock or other equity or convertible securities in the future, there may be further dilution to investors participating in this offering. The above table and calculations also do not reflect issuances of options or restricted stock units since December 31, 2023 or the potential issuance of shares of our common stock that remain available for sale as of the date of this prospectus supplement under our “at-the-market” offering program, pursuant to which we may sell common stock for remaining gross proceeds of up to $151.9 million from time to time under the Sales Agreement after the expiration or waiver of the lock-up period applicable to us and described under the section of this prospectus supplement titled “Underwriters”. Moreover, we may choose to raise additional capital because of market conditions or strategic considerations, even if we believe that we have sufficient funds for our current or future operating plans. If we raise additional capital through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

UNDERWRITERS

Under the terms and subject to the conditions in an underwriting agreement dated the date of this prospectus supplement, the underwriters named below, for whom Morgan Stanley & Co. LLC and Leerink Partners LLC are acting as representatives, have severally agreed to purchase, and we have agreed to sell to them, severally, the number of shares of common stock indicated below:

|

|

Name |

Number of Shares |

Morgan Stanley & Co. LLC |

1,666,283 |

Leerink Partners LLC |

1,019,183 |

William Blair & Company, L.L.C. |

808,875 |

Raymond James & Associates, Inc. |

647,100 |

Stifel, Nicolaus & Company, Incorporated |

647,100 |

Truist Securities, Inc. |

647,100 |

Oppenheimer & Co., Inc. |

404,437 |

BTIG, LLC |

210,308 |

H.C. Wainwright & Co., LLC |

210,308 |

Maxim Group LLC |

113,242 |

Laidlaw & Company (U.K.) Ltd. |

97,064 |

Total: |

6,471,000 |

The underwriters and the representatives are collectively referred to as the “underwriters” and the “representatives,” respectively. The underwriters are offering the shares of common stock subject to their acceptance of the shares from us and subject to prior sale. The underwriting agreement provides that the obligations of the several underwriters to pay for and accept delivery of the shares of common stock offered by this prospectus supplement are subject to the approval of certain legal matters by their counsel and to certain other conditions. The underwriters are obligated to take and pay for all of the shares of common stock offered by this prospectus supplement if any such shares are taken. However, the underwriters are not required to take or pay for the shares of common stock covered by the underwriters’ option to purchase additional shares described below.

The underwriters initially propose to offer part of the shares of common stock directly to the public at the offering price listed on the cover page of this prospectus supplement and part to certain dealers at a price that represents a concession not in excess of $2.816577 per share under the public offering price. After the initial offering of the shares of common stock, the offering price and other selling terms may from time to time be varied by the representatives.

We have granted to the underwriters an option, exercisable for 30 days from the date of this prospectus supplement, to purchase up to 970,650 additional shares of common stock at the public offering price listed on the cover page of this prospectus supplement, less underwriting discounts and commissions. To the extent the option is exercised, each underwriter will become obligated, subject to certain conditions, to purchase about the same percentage of the additional shares of common stock as the number listed next to the underwriter’s name in the preceding table bears to the total number of shares of common stock listed next to the names of all underwriters in the preceding table.

The following table shows the per share and total public offering price, underwriting discounts and commissions, and proceeds before expenses to us. These amounts are shown assuming both no exercise and full exercise of the underwriters’ option to purchase up to an additional 970,650 shares of our common stock.

|

|

|

|

|

Per

Share |

Total |

|

|

No

Exercise |

Full

Exercise |

Public offering price |

$ 85.000000 |

$ 550,035,000 |

$ 632,540,250 |

Underwriting discounts and commissions to be paid by us |

$ 4.694295 |

$ 30,376,783 |

$ 34,933,300 |

Proceeds, before expenses, to us |

$ 80.305705 |

$ 519,658,217 |

$ 597,606,950 |

The estimated offering expenses payable by us, exclusive of the underwriting discounts and commissions, are approximately $255,000. We have agreed to reimburse the underwriters for expenses relating to clearance of this offering with the Financial Industry Regulatory Authority, Inc. up to $25,000.

Our common stock is listed on the Nasdaq Capital Market under the symbol “VKTX”.

We have agreed with each underwriter that, without the prior written consent of Morgan Stanley & Co. LLC and Leerink Partners LLC on behalf of the underwriters, we will not, and will not publicly disclose an intention to, during the period ending 90 days after the date of this prospectus supplement, or the restricted period:

(1)offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, any shares of our common stock or any securities convertible into or exercisable or exchangeable for our common stock, make any short sale or otherwise transfer or dispose of, directly or indirectly, including any sales pursuant to the Sales Agreement, or file or confidentially submit with the SEC a registration statement under the Securities Act relating to, any securities of our Company that are substantially similar to the shares offered in this offering, including but not limited to any options or warrants to purchase shares of our common stock or any securities that are convertible into or exchangeable for, or that represent the right to receive, shares of our common stock, or any such substantially similar securities, or publicly disclose the intention to make any offer, sale, pledge, disposition or filing; or

(2)enter into any swap or other agreement that transfers, in whole or in part, any of the economic consequences of ownership of the shares of our common stock, or any such other securities,

whether any such transaction described above is to be settled by delivery of shares of our common stock or such other securities, in cash or otherwise (other than (A) the shares to be sold to the underwriters in this offering, (B) the issuance of options, restricted stock units, warrants or other equity awards to acquire shares of our common stock granted pursuant to our stock plans that are described in this prospectus supplement or the accompanying base prospectus, as such plans may be amended, (C) the issuance of shares of our common stock upon the exercise or vesting of any such options, restricted stock units, warrants or other equity awards to acquire shares of our common stock, (D) shares of our common stock issued upon the exercise of

outstanding warrants, (E) the filing of one or more registration statements on Form S-8 registering securities pursuant to our stock plans, (F) the issuance of any shares of our common stock or any security convertible into or exercisable for shares of our common stock issued by us in connection with a joint venture or other strategic commercial transaction not primarily intended to raise capital between our Company and an unaffiliated third party; and provided that, in the case of clause (F), the aggregate number of shares of our common stock that we may sell or issue or agree to sell or issue pursuant to clause (F) shall not exceed 5% of the total number of shares of our common stock issued and outstanding immediately following the completion of the transactions contemplated by this offering), and provided, further, that any newly appointed director or executive officer that is appointed during the restricted period that is a recipient of shares of our common stock or securities convertible into or exercisable for our common stock pursuant to this clause (F) shall execute and deliver to Morgan Stanley & Co. LLC and Leerink Partners LLC a lock-up agreement covering the remainder of the restricted period, and (G) facilitating the establishment of a trading plan on behalf of a stockholder, officer or director of our Company pursuant to Rule 10b5-1 under the Exchange Act for the transfer of shares of our common stock, provided that (i) such plan for any executive officer or director does not provide for the transfer of our common stock during the restricted period and (ii) to the extent a public announcement or filing under the Exchange Act, if any, is required of us regarding the establishment of such plan, such required announcement or filing shall include a statement to the effect that no transfer of our common stock may be made under such plan during the restricted period, and no other public announcement shall be made voluntarily).

Our directors and officers have agreed that, without the prior written consent of Morgan Stanley & Co. LLC and Leerink Partners LLC on behalf of the underwriters, they will not, and will not publicly disclose an intention to, during the restricted period:

•offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, any shares of our common stock beneficially owned (as such term is used in Rule 13d-3 of Exchange Act), by such lock-up party or any other securities so owned convertible into or exercisable or exchangeable for shares of our common stock, or the lock-up securities;

•enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of the shares of our common stock;

whether any such transaction described above is to be settled by delivery of shares of our common stock or such other securities, in cash or otherwise. The foregoing precludes the lock-up party from engaging in any hedging or other transactions designed or intended, or which could reasonably be expected to lead to or result in, a sale or disposition of any shares of our common stock, or securities convertible into or exercisable or exchangeable for shares of our common stock, even if any such sale or disposition transaction or transactions would be made or executed by or on behalf of someone other than the lock-up party.

The restrictions described in the immediately preceding paragraph shall not apply to:

(1) any grant or exercise by the lock-up party of any option, restricted stock unit award, warrant or other right to acquire any shares of our common stock or options to purchase shares of our common stock or any security convertible into or exercisable for shares of our common stock in accordance with their terms, pursuant to any stock option, stock bonus, equity incentive or other stock plan or arrangement; provided that the underlying shares shall continue to be subject to the restrictions on transfer set forth in the lock-up agreement, and provided further that any filing under Section 16(a) of the Exchange Act with regard to this clause shall clearly indicate in the footnotes thereto that the filing relates to the circumstances described in this provision and no public filing, report or announcement shall be voluntarily made;

(2) any transfer of lock-up securities for bona fide financial and estate planning purposes, including, but not limited to, transfers to the immediate family of the lock-up party or to any trust, partnership, limited liability company or other legal entity commonly used for estate planning purposes, for the direct or indirect benefit of the lock-up party or the immediate family of the lock-up party;

(3) if the lock-up party is a trust, to the beneficiary of such trust;

(4) any bona fide gift;

(5) any transfer of lock-up securities by will or intestate succession;

(6) any distribution or other transfer by a partnership to its partners or former partners or by a limited liability company to its members or retired members or by a corporation to its stockholders or former stockholders or to any wholly-owned subsidiary of such corporation;

(7) transfers or dispositions of shares of our common stock to any corporation, partnership, limited liability company or other entity all of the beneficial ownership interests which are held by the lock-up party and/or the immediate family of the lock-up party;

(8) any transfer in connection with a sale, merger or transfer of all or substantially all of the assets of the lock-up party or any other change of control of the lock-up party, not undertaken for the purpose of avoiding the restrictions imposed by the lock-up agreement; provided that in the event that such transaction is not completed, the lock-up securities shall remain subject to the restrictions set forth in the lock-up agreement;

(9) any transfer to the lock-up party’s affiliates (as defined in Rule 405 promulgated under the Securities Act) or to any investment fund or other entity controlled or managed by the lock-up party;

(10) any transfer by operation of law, such as pursuant to a qualified domestic relations order or in connection with a divorce settlement;

(11) any shares of our common stock or our other securities acquired in open market transactions after completion of this offering; provided that, no filing by any party under the Exchange Act or other public announcement shall be required or shall be voluntarily made in connection with such transfer;

(12) any transfer of lock-up securities pursuant to a bona fide third-party tender offer, merger, consolidation, liquidation or other similar transaction made to all holders of our capital stock involving a change of control of our Company; provided that (i) the per-share consideration for the lock-up securities transferred as described above shall be greater than the public offering price per share in this offering, (ii) all lock-up securities subject to the lock-up agreement that are not so transferred, sold, tendered or otherwise disposed of remain subject to the lock-up agreement and (iii) it shall be a condition of transfer, sale, tender or other disposition that if such tender offer, merger, consolidation or other such transaction is not completed, the lock-up party’s lock-up securities shall remain subject to the restrictions set forth in the lock-up agreement;

(13) any transfer of lock-up securities to us as forfeitures or other transfers, sales or dispositions to satisfy tax withholding obligations of the lock-up party in connection with the vesting or exercise of equity awards or similar rights to purchase shares of our common stock or any securities convertible into or exercisable or exchangeable for shares of our common stock pursuant to our equity incentive plans or outstanding warrants; provided that any lock-up securities acquired in connection with such vesting or exercise of equity awards or warrants described in this clause shall be subject to the restrictions set forth in the lock-up agreement;

(14) any transfer of lock-up securities to us pursuant to an exercise, including a net exercise or cashless exercise, by the lock-up party of outstanding equity awards pursuant to our equity incentive plans or outstanding warrants; provided that any lock-up securities acquired upon the net exercise or cashless exercise of equity awards described in this clause shall be subject to the restrictions set forth in the lock-up agreement;

(15) in connection with sales of the lock-up party’s shares of our common stock made pursuant to a 10b5-1 trading plan, or 10b5-1 trading plan that is designed to comply with Rule 10b5-1 under the Exchange Act (as such rule was in effect at the time any such trading plan was adopted) that has been entered into by the lock-up party prior to the date of the lock-up agreement and provided to Morgan Stanley & Co. LLC and Leerink Partners LLC and their counsel, provided that to the extent a public announcement or filing under the Exchange Act, if any, is required of the lock-up party or our Company regarding any such sales, such announcement or filing shall include a statement to the effect that any sales were effected pursuant to such 10b5-1 trading plan and no other public announcement shall be made voluntarily in connection with such sales; or

(16) any transfer in connection with the repurchase of the lock-up securities or other securities by us pursuant to agreements providing for the right of said repurchase in connection with the termination of the lock-up party’s employment or consulting service with us;

provided that in the case of any transfer, gift or other disposition pursuant to clauses (2), (3), (4), (5), (6), (7), (8), (9) or (10) above, the transferee, trust, donee or other recipient agrees to be bound in writing by the terms of the lock-up agreement prior to such transfer and no filing by any party (donor, donee, transferor or transferee) under the Exchange Act shall be required or shall be voluntarily made in connection with such transfer (other than required filings under Section 16(a) and Section 13(d) or 13(g) of the Exchange Act, and any filings made after the expiration of the restricted period); and provided further that in the case of clauses (13) or (14) above, any report filed by the lock-up party in connection with such transactions under Section 16(a) of the Exchange Act shall include a statement in such report to the effect that the purpose of such transfer was either (A) to cover tax withholding obligations of the lock-up party in connection with such vesting or exercise, or (B) in connection with a cashless or net exercise of equity awards.

Notwithstanding anything herein to the contrary, nothing herein shall prevent the lock-up party from establishing a 10b5-1 trading plan or from amending an existing 10b5-1 trading plan so long as there are no sales of lock-up securities under such new plan or amended plan during the restricted period.

In addition, each lock-up party agrees that, without the prior written consent of Morgan Stanley & Co. LLC and Leerink Partners LLC on behalf of the underwriters, the lock-up party will not, and will not publicly disclose an intention to, during the restricted period, make any demand for, or exercise any right with respect to, the registration of any shares of our common stock or any security convertible into or exercisable or exchangeable for shares of our common stock. The lock-up party agrees and consents to the entry of stop transfer instructions with our transfer agent and registrar against the transfer of their shares of our common stock except in compliance with the foregoing restrictions.

In order to facilitate this offering of shares of the common stock, the underwriters may engage in transactions that stabilize, maintain or otherwise affect the price of the common stock. Specifically, the underwriters may sell more shares than they are obligated to purchase under the underwriting agreement, creating a short position. A short sale is covered if the short position is no greater than the number of shares available for purchase by the underwriters under the option to purchase additional shares. The underwriters can close out a covered short sale by exercising the option to purchase additional shares or purchasing shares in the open market. In determining the source of shares to close out a covered short sale, the underwriters will consider, among other things, the open market price of shares compared to the price available under the option to purchase additional shares. The underwriters may also sell shares in excess of the option, creating a naked short position. The underwriters must close out any naked short position by purchasing shares in the open market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward pressure on the price of the common stock in the open market after pricing that could adversely affect investors who purchase in this offering. As an additional means of facilitating this offering, the underwriters may bid for, and purchase, shares of the common stock in the open market to stabilize the price of the common stock. These activities may raise or maintain the market price of the common stock above independent market levels or prevent or retard a decline in the market price of the common stock. The underwriters are not required to engage in these activities and may end any of these activities at any time.

We and the underwriters have agreed to indemnify each other against certain liabilities, including liabilities under the Securities Act.

A prospectus supplement in electronic format may be made available on websites maintained by one or more underwriters, or selling group members, if any, participating in this offering. The representatives may agree to allocate a number of shares of the common stock to underwriters for sale to their online brokerage account holders. Internet distributions will be allocated by the representatives to underwriters that may make Internet distributions on the same basis as other allocations.

The underwriters and their respective affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities. Certain of the underwriters and their respective affiliates have, from time to time, performed, and may in the future perform, various financial advisory and investment banking services for us, for which they received or will receive customary fees and expenses. For example, Stifel, Nicolaus & Company, Incorporated, Truist Securities, Inc. and H.C. Wainwright & Co., LLC are the agents under the Sales

Agreement, pursuant to which we may offer and sell shares of our common stock for remaining gross proceeds of up to $151.9 million from time to time in at-the-market offerings.

In addition, in the ordinary course of their various business activities, the underwriters and their respective affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers and may at any time hold long and short positions in such securities and instruments. Such investment and securities activities may involve our securities and instruments. The underwriters and their respective affiliates may also make investment recommendations or publish or express independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long or short positions in such securities and instruments.

Selling Restrictions

Notice to Prospective Investors in the European Economic Area

In relation to each Member State of the European Economic Area, or, each a Member State, no shares of common stock have been offered or will be offered pursuant to the offering to the public in that Member State prior to the publication of a prospectus in relation to the shares of common stock which has been approved by the competent authority in that Member State or, where appropriate, approved in another Member State and notified to the competent authority in that Member State, all in accordance with the Prospectus Regulation, except that offers of common stock shares may be made to the public in that Member State at any time under the following exemptions under the Prospectus Regulation:

(i)to any legal entity which is a qualified investor as defined under the Prospectus Regulation;

(ii)to fewer than 150 natural or legal persons (other than qualified investors as defined under the Prospectus Regulation), subject to obtaining the prior consent of the underwriters; or

(iii)in any other circumstances falling within Article 1(4) of the Prospectus Regulation,

provided that no such offer of shares of common stock shall require us or any underwriter to publish a prospectus pursuant to Article 3 of the Prospectus Regulation or supplement a prospectus pursuant to Article 23 of the Prospectus Regulation and each person who initially acquires any shares or to whom any offer is made will be deemed to have represented, acknowledged and agreed to and with each of the underwriters and us that it is a “qualified investor” within the meaning of Article 2(e) of the Prospectus Regulation. In the case of any shares of common stock being offered to a financial intermediary as that term is used in the Prospectus Regulation, each such financial intermediary will be deemed to have represented, acknowledged and agreed that the shares of common stock acquired by it in the offer have not been acquired on a non-discretionary basis on behalf of, nor have they been acquired with a view to their offer or resale to, persons in circumstances which may give rise to an offer of any shares of common stock to the public other than their offer or resale in a Member State to qualified investors as so defined or in circumstances in which the prior consent of the underwriters have been obtained to each such proposed offer or resale.

For the purposes of this provision, the expression an “offer to the public” in relation to shares in any Member State means the communication in any form and by any means of sufficient information on the terms of the offer and any shares of common stock to be offered so as to enable an investor to decide to purchase or subscribe for any shares of common stock, and the expression “Prospectus Regulation” means Regulation (EU) 2017/1129.

Notice to Prospective Investors in the United Kingdom

No shares of common stock have been offered or will be offered pursuant to the offering to the public in the United Kingdom prior to the publication of a prospectus in relation to the common stock which has been approved by the Financial Conduct Authority, except that the common stock may be offered to the public in the United Kingdom at any time:

(i)to any legal entity which is a qualified investor as defined under Article 2 of the U.K. Prospectus Regulation;

(ii)to fewer than 150 natural or legal persons (other than qualified investors as defined under Article 2 of the U.K. Prospectus Regulation), subject to obtaining the prior consent of the representatives of the underwriters for any such offer; or

(iii)in any other circumstances falling within Section 86 of the FSMA,

provided that no such offer of the common stock shall require our Company or any underwriter to publish a prospectus pursuant to Section 85 of the FSMA or supplement a prospectus pursuant to Article 23 of the U.K. Prospectus Regulation. For the purposes of this provision, the expression an “offer to the public” in relation to the common stock in the United Kingdom means the communication in any form and by any means of sufficient information on the terms of the offer and any shares of common stock to be offered so as to enable an investor to decide to purchase or subscribe for any shares of common stock and the expression “U.K. Prospectus Regulation” means Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018.

In addition, in the United Kingdom, this prospectus supplement is being distributed only to, and is directed only at, and any offer subsequently made may only be directed at persons who are “qualified investors” (as defined in the Prospectus Regulation) (i) who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended, or the Order, and/or (ii) who are high net worth companies (or persons to whom it may otherwise be lawfully communicated) falling within Article 49(2)(a) to (d) of the Order, or, all such persons together being referred to as relevant persons, or otherwise in circumstances which have not resulted and will not result in an offer to the public of the shares in the United Kingdom within the meaning of the Financial Services and Markets Act 2000.

Any person in the United Kingdom that is not a relevant person should not act or rely on the information included in this prospectus supplement or use it as basis for taking any action. In the United Kingdom, any investment or investment activity that this prospectus supplement relates to may be made or taken exclusively by relevant persons.

Notice to Prospective Investors in Canada

The common stock may be sold only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in National Instrument 45-106 Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and are permitted clients, as defined in National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations. Any resale of the common stock must be made in accordance with an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities laws.

Securities legislation in certain provinces or territories of Canada may provide a purchaser with remedies for rescission or damages if this prospectus supplement (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser within the time limit prescribed by the securities legislation of the purchaser’s province or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser’s province or territory for particulars of these rights or consult with a legal advisor.

Pursuant to section 3A.3 of National Instrument 33-105 Underwriting Conflicts (NI 33-105), the underwriters are not required to comply with the disclosure requirements of NI 33-105 regarding underwriter conflicts of interest in connection with this offering.

Notice to Prospective Investors in Russia

Under Russian law, shares of common stock may be considered securities of a foreign issuer. Neither we, nor this prospectus supplement, nor shares of our common stock have been, or are intended to be, registered with the Central Bank of the Russian Federation under the Federal Law No. 39-FZ “On Securities Market” dated April 22, 1996 (as amended, the “Russian Securities Law”), and none of the shares of our common stock are intended to be, or may be offered, sold or delivered, directly or indirectly, or offered or sold to any person for reoffering or re-sale, directly or indirectly, in the territory of the Russian Federation or to any resident of the Russian Federation, except pursuant to the applicable laws and regulations of the Russian Federation.

The information provided in this prospectus supplement does not constitute any representation with respect to the eligibility of any recipients of this prospectus supplement to acquire shares of our common stock under the laws of the Russian Federation, including, without limitation, the Russian Securities Law and other applicable legislation.

This prospectus supplement is not to be distributed or reproduced (in whole or in part) in the Russian Federation by the recipients of this prospectus supplement. Recipients of this prospectus supplement undertake not to offer, sell or deliver, directly or indirectly, or offer or sell to any person for reoffering or re-sale, directly or indirectly, shares of common stock in the territory of the Russian Federation or to any resident of the Russian Federation, except pursuant to the applicable laws and regulations of the Russian Federation.

Recipients of this prospectus supplement understand that respective receipt/acquisition of shares of our common stock is subject to restrictions and regulations applicable from the Russian law perspective.

Notice to Prospective Investors in Switzerland

The common stock may not be publicly offered in Switzerland and will not be listed on the SIX Swiss Exchange, or SIX, or on any other stock exchange or regulated trading facility in Switzerland. This prospectus supplement does not constitute a prospectus within the meaning of, and has been prepared without regard to the disclosure standards for issuance prospectuses under art. 652a or art. 1156 of the Swiss Code of Obligations or the disclosure standards for listing prospectuses under art. 27 ff. of the SIX Listing Rules or the listing rules of any other stock exchange or regulated trading facility in Switzerland. Neither this prospectus supplement nor any other offering or marketing material relating to the common stock or the offering may be publicly distributed or otherwise made publicly available in Switzerland.

Neither this prospectus supplement, nor any other offering or marketing material relating to the offering, us or the common stock have been or will be filed with or approved by any Swiss regulatory authority. In particular, this prospectus supplement will not be filed with, and the offer of common stock will not be supervised by, the Swiss Financial Market Supervisory Authority, or FINMA, and the offer of common stock has not been and will not be authorized under the Swiss Federal Act on Collective Investment Schemes, or CISA. The investor protection afforded to acquirers of interests in collective investment schemes under the CISA does not extend to acquirers of common stock.

Notice to Prospective Investors in the Dubai International Financial Centre (DIFC)

This prospectus supplement relates to an Exempt Offer in accordance with the Markets Rules 2012 of the Dubai Financial Services Authority (DFSA). This prospectus supplement is intended for distribution only to persons of a type specified in the Markets Rules 2012 of the DFSA. It must not be delivered to, or relied on by, any other person. The DFSA has no responsibility for reviewing or verifying any documents in connection with Exempt Offers. The DFSA has not approved this prospectus supplement nor taken steps to verify the information set forth herein and has no responsibility for this prospectus supplement The securities to which this prospectus supplement relates may be illiquid and/or subject to restrictions on their resale. Prospective purchasers of the securities offered should conduct their own due diligence on the securities. If you do not understand the contents of this prospectus supplement you should consult an authorized financial advisor.

In relation to its use in the DIFC, this prospectus supplement is strictly private and confidential and is being distributed to a limited number of investors and must not be provided to any person other than the original recipient, and may not be reproduced or used for any other purpose. The interests in the securities may not be offered or sold directly or indirectly to the public in the DIFC.

Notice to Prospective Investors in Hong Kong

The shares of common stock have not been offered or sold and will not be offered or sold in Hong Kong, by means of any document, other than (i) to “professional investors” as defined in the Securities and Futures Ordinance (Cap. 571 of the Laws of Hong Kong), or the SFO, of Hong Kong and any rules made thereunder; or (ii) in other circumstances which do not result in the document being a “prospectus” as defined in the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32) of Hong Kong, or the CO, or which do not constitute an offer to the public within the meaning of the CO. No advertisement, invitation or document relating to the common stock has been or may be issued or has been or may be in the possession of any person for the purposes of issue, whether in Hong Kong or elsewhere, which is directed at, or the contents