false

0000945617

false

false

false

false

false

0000945617

2024-03-01

2024-03-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND

EXCHANGE COMMISSION

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of

the Securities

Exchange Act of 1934

Date of

Report (Date of earliest event reported): March

1, 2024

AMERICAN

CANNABIS COMPANY, INC.

(Exact Name of Registrant

as Specified in its Charter)

Delaware

(State

or other jurisdiction of incorporation or organization) |

Commission

File Number

000-26108 |

90-1116625

(I.R.S.

Employer

Identification

Number) |

1004

S Tejon St Colorado

Springs, CO

80903

(Address of

Principal Executive Offices and Zip Code)

(303)

974-4770

(Issuer's telephone

number)

200

Union St., Suite 200, Lakewood, Colorado 80228

(Former Name

or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[

] Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[

] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[

] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[

] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Trading Symbols |

Name of Exchange on Which Registered |

| Common |

AMMJ |

None |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2

of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company [

]

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

This Current Report

on Form 8-K of American Cannabis Company, Inc., a Delaware Corporation (the “Company”), as well as other filings with the

Securities and Exchange Commission (“SEC”) and the Company’s press releases contain statements relating to future results,

plans, assumptions, assessments, and information, including certain projections and business trends, that constitute “Forward-Looking

Statements” within the meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements

include statements concerning plans, objectives, goals, strategies, expectations, future events, or performance underlying assumptions

and other statements that are other than statements of historical facts. Certain statements contained herein are forward-looking statements

and, accordingly, involve risks and uncertainties that could cause actual results or outcomes to differ materially from those expressed

in such forward-looking statements, including, without limitation, risks related to our business and risks associated with our securities.

The Company’s expectations, beliefs, and projections are expressed in good faith and are believed by the Company to have a reasonable

basis, including, without limitations, management’s examination of historical operating trends and data contained in the Company’s

records and other data available from third parties. There can be no assurance that management’s expectations, beliefs, or projections

will be achieved or accomplished. Certain risks and uncertainties may cause actual results to be materially different from projected results

contained in forward-looking statements in this Current Report and in other disclosures. The Company’s future results will depend

upon various other risks and uncertainties, including, but not limited to, those detailed in the Company’s other filings with the

SEC. Actual results may differ materially from those expressed or implied by forward-looking statements. The Company disclaims any obligation

to revise any forward-looking statements to reflect the occurrence, or lack thereof, of events or circumstances after the date such forward-looking

statements were made, except as required by law.

Section 1 - Registrant’s Business

and Operations

Item 1.01 Entry into a Material Definitive

Agreement - Termination

On March 1, 2024, pursuant to Section 8.1(a)

of the Agreement and Plan of Merger ("Agreement") and Section 12.1(a) of the Separation and Distribution Agreement with HyperScale

Nexus Holding Corporation, previously disclosed on Form 8-K, and Form 14C, the parties mutually agreed to completely terminate the respective

transactions. The terminations are not expected to have any material results on the operations or finances of the Company. The Company

incurred no termination penalties. No legal proceedings are expected to be filed over the respective terminations.

After careful consideration, both parties concluded

that the terms of the agreement couldn't be met within a reasonable timeframe and so didn't align with the Company's objectives and priorities.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated

March 1, 2024

AMERICAN

CANNABIS COMPANY, INC.

(Registrant)

By:

/s/ Ellis Smith

Ellis

Smith

Principal

Executive Officer

Exhibit 10.1

Settlement

Agreement & Release

This

Settlement Agreement & Release ("Agreement"), dated this 1st day of March 2024, is by and between HyperScale

Nexus Holding Corporation. a Nevada Corporation having a principal place of business at 401 Ryland Street, Unit 200-A, Reno, Nevada 89502

("HYPERSCALE"), and American Cannabis Company, Inc., with an address at 200 Union St., Suite 200, Lakewood, Colorado 80228

("AMMJ "). HYPERSCALE and AMMJ may be referred to in the singular as a "Party" or collectively called the “Parties.”

RECITALS:

WHEREAS,

certain material circumstances have arisen between HYPERSCALE and AMMJ concerning the Agreement and

Plan of Merger dated September 5, 2023, and the Separation and Distribution Agreement dated October 30, 2023, and associated transactions,

and the Parties deem it to be in their mutual best interest to avoid the commencement of legal action, including but not limited to (i)

a civil action for damages filed in any court of competent jurisdiction, (ii) an arbitration in any venue, or (iii) any other civil action

of any kind or sort consistent with any applicable law, and to finally and forever resolve any and all disputes between them, including

a mutual agreement to terminate the Agreement and Plan of Merger and the Separation and Distribution Agreement, and any and all related

transactions, to avoid the inconvenience, costs, and expenses related to any and all such legal actions, upon the terms and condition

set forth herein; and,

NOW

THEREFORE, in consideration for the mutual promises and covenants contained herein,

the sufficiency of which is hereby acknowledged, HYPERSCALE and AMMJ hereto agree as follows:

| Section | 1.

Incorporation of the RECITALS clauses. |

1.1.

HYPERSCALE and AMMJ acknowledge that all the representations outlined in the RECITALS clauses of this Agreement are incorporated herein

by reference and made a material part of this Agreement with the same force and effect as if more fully set forth here at. HYPERSCALE

and AMMJ agree to waive any rule of contract construction or legal presumption that would prohibit any court of competent jurisdiction

from construing or enforcing this Agreement based upon the contents of the RECITALS above.

| Section | 2.

Settlement Payment, Document Delivery, Release of All Claims. |

Settlement

Payment. Within five business days of executing this agreement by both Parties, HYPERSCALE will pay AMMJ five thousand dollars ($5,000).

Release

of All Claims. Immediately upon satisfaction of this settlement agreement by means of executing this Agreement and paying AMMJ $5,000,

the remainder of this agreement shall go into effect. Except as provided for herein, and in further consideration of the mutual covenants

hereto, HYPERSCALE and AMMJ agree on behalf of themselves, and their respective successors, assigns, pledgees, officers, directors, shareholders,

attorneys, employees, agents, independent contractors, affiliates, control persons, administrators, and any and all persons or business

entities acting by and through each of them as the case may be, to irrevocably and unconditionally and completely remise, release, acquit,

satisfy and forever discharge each other, specifically including their agents, directors, officers, affiliates, employees representatives,

insurance carriers, attorneys, divisions and subsidiaries, (and all agents, directors, officers, employees, representatives, insurance

carriers, and attorneys of such divisions and subsidiaries), and their predecessors, successors, administrators and assigns, and all

persons acting by, through, under, or in concert with any of them (collectively "Releases"), of and from any and all claims,

actions, causes of action, suits, debts, charges, complaints, claims, liabilities, obligations, promises, agreements, controversies,

damages, and expenses (including attorney fees and costs actually incurred), of any nature whatsoever, known or unknown, in law or equity,

arising out of the facts contained in the RECITALS, as well as any other claims based on constitutional, statutory, common law, or regulatory

grounds.

2.1.

Except as for any specific rights created by virtue of this Agreement, HYPERSCALE and AMMJ promise not to institute any future suits

or proceedings at law or in equity or any arbitration or administrative proceedings

against each other for or on account of any claim or cause of action arising specifically out of the facts in the RECITALS herein.

2.2.

This is intended as a full and complete release and discharge of any or all claims that HYPERSCALE and AMMJ may or might have or had

against each other, and HYPERSCALE and AMMJ do so in full and final settlement, release and discharge of any and all such claims and

the Parties intend to and does forever hereby release and discharge the each other of and from any and all liability of any nature whatsoever

for all damages to each other, specifically including, but not limited to, all past, present and future rights to recover for sums of

money compromised in this Agreement on account of said events alleged in the RECITALS, as well as for all consequences, effects and results

thereto and resulting damages to each other, whether the same or any circumstances pertaining thereto are now known or unknown to HYPERSCALE

or AMMJ or anyone else, expected or unexpected by HYPERSCALE or AMMJ or anyone else, or have already appeared or developed or may now

be latent or may in the future appear or develop or become known to HYPERSCALE or AMMJ or anyone else.

2.5 This

Agreement constitutes a compromise, settlement, and release of disputed claims and is being entered into solely to avoid the burden,

inconvenience, and expense of litigating those claims. No Party to this Agreement admits any liability to the other Party with respect

to any such claim or any other matter. Each Party expressly denies liability as to every claim which the other Party may assert. Therefore,

this Agreement is not to be and shall never be construed or deemed an admission or concession by any of the Parties hereto of liability

or culpability at any time for any purpose concerning any claim being compromised, settled, released, or any other matter.

2.6

AMMJ agrees to file Form 8-K disclosing termination of the Plan and Agreement of Merger and

the Separation and Distribution Agreement not later than four business days after the Effective Date and to provide HYPERSCALE with a

copy of the filing beforehand.

Miscellaneous

Provisions.

3.1.

Notices. All notices, offers of other communications required or permitted to be given pursuant to this Agreement shall be in

writing and shall be considered as properly given or made (i) if delivered personally; or (ii) upon receipt by facsimile transmission

(with written confirmation of receipt) or confirmed electronic mail; or (iii) after the expiration of the second business day following

deposit with documented overnight delivery service; or (iv) five business days of transmission by regular mail. All notices given or

made pursuant hereto shall be so given or made to the parties at the following addresses:

If

to HYPERSCALE: HyperScale Nexus Holding Corporation

Attention:

Mr. Greg Forrest

401

Ryland Street, Unit 200-A

Reno,

Nevada 89502

g.forrest@hyperscalenexus.com

If

to AMMJ: Mr. Ellis Smith

200 Union

St., Suite 200

Lakewood,

Colorado 80228

303-974-4770

smith@americancannabisconsulting.com

The

address of any party hereto may be changed by a notice in writing given in accordance with the provisions hereof.

3.2.

Authority. Each Party has all requisite power and authority to execute, deliver, and perform its obligations under this Agreement,

and, when executed and delivered by the respective parties, shall constitute the valid and binding obligations, enforceable against them

respectively, in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, fraudulent conveyance, moratorium

or other similar laws affecting creditors’ rights and remedies generally, and subject, as to enforceability, to general principles

of equity (regardless of whether enforcement is sought in a proceeding at law or in equity).

| 3.2.1. | Neither

the execution nor delivery of this Agreement, nor any other documents required to be executed

and delivered by the Parties hereunder, nor the consummation of the transaction contemplated

hereby (i) conflicts with or constitutes any violation or breach, or gives

any other person any rights (including, but not limited to, any legal rights to acceleration, termination, cancellation or recession)

under any document or agreement to which either HYPERSCALE or AMMJ is a party. Neither HYPERSCALE nor AMMJ's entry into this Agreement

nor their respective representations made in this Agreement constitute a violation of any order or applicable law that either HYPERSCALE

or AMMJ'S assets are bound by or subject. |

3.3.

Severability. If any provision of this Agreement is held by a court of competent jurisdiction to be invalid, illegal, or unenforceable,

such provision shall be severed and enforced to the extent possible or modified in such a way as to make it enforceable, and the invalidity,

illegality or unenforceability thereof shall not affect the validity, legality or enforceability of the remaining provisions of this

Agreement.

3.4.

Non-Interference and Non-Intervention. AMMJ agrees not to interfere with, circumvent, or damage any current or future business

relationship or contract ('Business Relationship') of HYPERSCALE or with any HYPERSCALE entity, including but not limited to HYPERSCALE

data center contracts, cloud service providers, and similar entities ('Hyperscale Entity'). AMMJ acknowledges that HYPERSCALE's relationships

and contracts are vital to its operations, growth, and financial stability. AMMJ further agrees that any attempt to interfere with, circumvent,

or damage any current or future HYPERSCALE Business Relationship will constitute a material breach of this agreement.

3.5.

Non-Disparagement. AMMJ agrees that he will not disclose to the public or any person any false or misleading information, any

information that reflects negatively upon or otherwise disparages HYPERSCALE (including its officers, directors, contractors, and employees)

or which may harm the reputation of HYPERSCALE including any statements that disparage any product, service, capability, or any other

aspect of the business of HYPERSCALE, including via social media.

3.6.

Binding on Affiliated Third Parties. This Agreement shall inure to the benefit of and shall be binding upon HYPERSCALE and AMMJ

and his respective designees, agents, representatives, executors, administrators,

trustees, pledgees, personal representatives, partners, directors, officers, shareholders, agents, attorneys, insurers, employees, representatives,

predecessors, successors, heirs and assigns.

3.7.

Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Nevada, U.S.A., without

regard to principles of conflict of laws. Any controversy or claim arising from or relating to this Agreement or the Breach thereof

shall first be subject to non-binding arbitration administered by the Superior Court for the State of Nevada, County of Clark. Should

the controversy not be settled at arbitration, either party may elect trial de novo, subject to the Nevada Rules of Civil Procedure.

The prevailing party in any legal action or arbitration shall recover its attorney fees and costs.

3.8.

Counterparts. This Agreement may be executed in multiple counterparts, all of which shall be deemed originals, and with the same

effect as if all Parties had signed the same document. All of such counterparts shall be construed together with and shall constitute

one Agreement, but in making proof, it shall only be necessary to produce one such counterpart. A facsimile transmission shall be as

valid and enforceable as an original.

3.9.

Entire Understanding. This Agreement is the entire, final, and complete agreement of the Parties relating to the subject of this

Agreement and supersedes and replaces all prior or existing written and oral agreements between the Parties or their representatives

relating thereto.

3.10.

Further Assurances. The parties agree to execute and deliver to each other such other documents and do such other acts and things,

all as the other party may reasonably request to carry out the intent of this Agreement.

3.11.

No Admission of Liability. The Parties agree that executing this Settlement Agreement and any payments and issuances made under

its terms shall not be construed as an admission of liability, fault, or wrongdoing by any Party. This Agreement is entered into solely

to resolve the disputes between the Parties and avoid litigation costs, uncertainties, and inconveniences.

3.12.

Amendments. This Agreement shall not be amended or otherwise modified unless in writing signed by all of the parties hereto.

3.13.

Acknowledgment. HYPERSCALE and AMMJ acknowledges (i) They have read this Agreement and have consulted with their respective attorneys

concerning its contents and legal consequences and have requested any change in language necessary or desirable to effectuate their intent

and expectations so that the rule of construction of contracts construing ambiguities against the drafting party shall be inapplicable;

(ii) They have taken all corporate actions and obtained all corporate authorizations, consents and approvals as are conditions precedent

to their authority to execute this Agreement, and thus warrant that they are fully authorized to bind the Parties for which they execute

this Agreement; and, (iii) There has been and will be no assignment or other transfer of any claim released herein, or any part thereof,

and each Party agrees to defend, indemnify and hold harmless the other party from any claims, obligations, or other liabilities, including

specifically attorney’s fees and costs incurred, which result from the assertion by any third party of a right to any claim which

is released by this Agreement. The foregoing warranties and representations shall survive the execution and delivery of this Agreement.

3.14.

Assignment. This Agreement shall be binding upon and inure to the benefit of each party hereto or to such party's heirs, executors,

administrators, successors, pledgees, and assigns and nothing in this Agreement, express or implied, is intended to confer upon any other

person any rights or remedies of any nature whatsoever under or because of this Agreement.

3.15.

Confidentiality. Each of the parties represents and agrees that it will keep the terms, provisions, and amounts in this Agreement

confidential and that it will not, without the consent of the other Party, disclose, divulge or furnish such confidential information

to any person other than their immediate families, their attorney and accountant (all of whom will be informed of and bound by this confidentiality

provision) except as required by law or, if necessary, to any applicable taxing authorities.

IN

WITNESS WHEREOF, the parties have signed this agreement upon the date first written above.

HYPERSCALE NEXUS HOLDING CORPORATION

By: /s/ Greg Forrest

Name: Greg Forrest

Title: Chief Executive Officer

AMERICAN

CANNABIS COMPANY, INC.

By: /s/ Ellis Smith

Name: ELLIS SMITH

Title: Chief Executive Officer

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

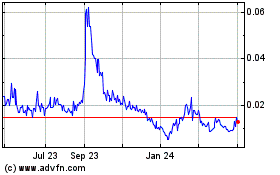

American Cannabis (QB) (USOTC:AMMJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

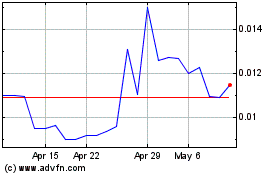

American Cannabis (QB) (USOTC:AMMJ)

Historical Stock Chart

From Apr 2023 to Apr 2024