- Fourth quarter revenue of $230.7 million, net loss of $9.4

million and Adjusted EBITDA of $48.8 million

- 2023 full year revenue of $1.1 billion, net income of $255.8

million and Adjusted EBITDA of $222.5 million

- In January 2024 completed $213.5 million sale of the Nevada

distributed gaming business; combined with non-core divestitures in

2023, generated over $600 million total proceeds

- Over $60 million of debt repaid in the fourth quarter; $239

million of total debt repaid in 2023

- Initiated recurring quarterly cash dividend of $0.25 per

share

Golden Entertainment, Inc. (NASDAQ: GDEN) (“Golden

Entertainment” or the “Company”) today reported financial results

for the fourth quarter and full year ended December 31, 2023. In

addition, on February 27, 2024, the Company’s Board of Directors

declared a recurring quarterly cash dividend of $0.25 per share of

the Company’s outstanding common stock, the first of which is

payable on April 4, 2024 to shareholders of record as of March 18,

2024.

Blake Sartini, Chairman and Chief Executive Officer of Golden,

commented, “In January, we completed the sale of our Nevada

distributed gaming business, completing a year-long process of

divesting our non-core assets that also included the sale of our

casino resort in Maryland and our Montana distributed gaming

business. Following these transactions, our portfolio is comprised

of Nevada casino resorts, Nevada locals casinos and Nevada’s

largest branded tavern portfolio, all of which are expected to

benefit from Nevada’s positive economic trends. The completion of

our non-core divestitures generated significant cash proceeds,

which strengthened our balance sheet, created strategic and

financial flexibility, and facilitates returning capital to our

shareholders.”

On January 10, 2024, the Company completed the previously

disclosed sale of its distributed gaming operations in Nevada to an

affiliate of J&J Ventures Gaming, LLC for cash consideration of

approximately $213.5 million, subject to customary working capital

and other adjustments, plus purchased cash (comprised of cash and

cash equivalents related to such operations at the time of closing)

of approximately $37.5 million.

During the fourth quarter of 2023, the Company repurchased $59.0

million in principal amount of its senior unsecured notes in open

market transactions, thereby reducing the aggregate principal

amount of the senior unsecured notes outstanding to $276.5 million.

The Company repaid $238.6 million of its debt obligations in

2023.

Consolidated Results

Fourth quarter 2023 revenues were $230.7 million, compared to

$279.7 million for the fourth quarter of 2022. Net loss for the

fourth quarter of 2023 was $9.4 million, or a loss of $0.33 per

share, primarily as a result of an asset impairment charge of $12.1

million related to the Colorado Belle Casino Resort, the operations

of which remain suspended. Fourth quarter of 2022 net income was

$11.1 million, or $0.35 per fully diluted share. Fourth quarter

2023 Adjusted EBITDA was $48.8 million, compared to Adjusted EBITDA

of $63.7 million for the fourth quarter of 2022. The year-over-year

declines in revenues and Adjusted EBITDA were primarily due to the

exclusion in the 2023 fourth quarter of results for the Company’s

Rocky Gap Casino Resort and distributed gaming operations in

Montana that were sold on July 25, 2023 and September 13, 2023,

respectively.

For both the full year 2023 and 2022, revenues were $1.1

billion. Net income for the full year 2023 was $255.8 million, or

$8.31 per fully diluted share, compared to net income of $82.3

million, or $2.61 per fully diluted share, for the full year 2022.

Net income and diluted earnings per share for the full year 2023

include the benefit of the $303.2 million gain on the sales of the

Rocky Gap Casino Resort and distributed gaming operations in

Montana. During 2023, the Company incurred transaction costs of

$8.3 million and $0.8 million on the sales of the Rocky Gap Casino

Resort and distributed gaming operations in Montana, respectively,

and $0.4 million in transaction costs related to the sale of the

Nevada distributed gaming operations sold subsequent to the fiscal

year end. Full year 2023 Adjusted EBITDA of $222.5 million declined

from Adjusted EBITDA of $267.1 million for the full year 2022

primarily due to the exclusion of the results for the businesses

sold in 2023.

Debt and Liquidity

As of December 31, 2023, the Company’s total principal amount of

debt outstanding was $677.7 million, consisting primarily of $398.0

million in outstanding term loan borrowings and $276.5 million of

senior unsecured notes. As of December 31, 2023, the Company had

cash and cash equivalents of $197.6 million, which excludes the

proceeds from the sale of the Company’s distributed gaming

operations in Nevada that closed on January 10, 2024. There

continues to be no outstanding borrowings under the Company’s $240

million revolving credit facility.

Investor Conference Call and

Webcast

The Company will host a webcast and conference call today,

February 29, 2024 at 5:00 p.m. Eastern Time (2:00 p.m. Pacific

Time), to discuss the 2023 fourth quarter and full year results.

The conference call may be accessed live over the phone by dialing

(833) 816-1405 or (412) 317-0498 for international callers. A

replay will be available beginning at 7:00 p.m. Eastern Time today

and may be accessed by dialing (844) 512-2921 or (412) 317-6671 for

international callers; the passcode is 10185511. The replay will be

available until March 7, 2024. The call will also be webcast live

through the “Investors” section of the Company’s website,

www.goldenent.com. A replay of the audio webcast will also be

archived on the Company’s website, www.goldenent.com.

Forward-Looking

Statements

This press release contains forward-looking statements regarding

future events and the Company’s future results that are subject to

the safe harbors created under the Securities Act of 1933 and the

Securities Exchange Act of 1934. Forward-looking statements can

generally be identified by the use of words such as “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “plan,” “project,” “potential,” “seek,” “should,”

“think,” “will,” “would” and similar expressions, or they may use

future dates. In addition, forward-looking statements in this press

release include, without limitation statements regarding: the

Company’s strategies, objectives, business opportunities and plans;

anticipated future growth and trends in the Company’s business or

key markets; the payment of recurring quarterly cash dividends;

projections of future financial condition, operating results or

other financial items; and other characterizations of future events

or circumstances as well as other statements that are not

statements of historical fact. Forward-looking statements are based

on the Company’s current expectations and assumptions regarding its

business, the economy and other future conditions. These

forward-looking statements are subject to assumptions, risks and

uncertainties that may change at any time, and readers are

therefore cautioned that actual results could differ materially

from those expressed in any forward-looking statements. Factors

that could cause the actual results to differ materially include:

changes in national, regional and local economic and market

conditions; legislative and regulatory matters (including the cost

of compliance or failure to comply with applicable laws and

regulations); increases in gaming taxes and fees in the

jurisdictions in which the Company operates; litigation; increased

competition; reliance on key personnel (including our Chief

Executive Officer, President and Chief Financial Officer, and Chief

Operating Officer); the level of the Company’s indebtedness and its

ability to comply with covenants in its debt instruments; terrorist

incidents; natural disasters; severe weather conditions (including

weather or road conditions that limit access to the Company’s

properties); the effects of environmental and structural building

conditions; the effects of disruptions to the Company’s information

technology and other systems and infrastructure; factors affecting

the gaming, entertainment and hospitality industries generally; and

other risks and uncertainties discussed in the Company’s filings

with the SEC, including the “Risk Factors” sections of the

Company’s most recent Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q. The Company undertakes no obligation to

update any forward-looking statements as a result of new

information, future developments or otherwise. All forward-looking

statements in this press release are qualified in their entirety by

this cautionary statement.

Non-GAAP Financial

Measures

To supplement the Company’s consolidated financial statements

presented in accordance with United States generally accepted

accounting principles (“GAAP”), the Company uses Adjusted EBITDA

because it is the primary metric used by its chief operating

decision makers and investors in measuring both the Company’s past

and future expectations of performance. Adjusted EBITDA provides

useful information to the users of the Company’s financial

statements by excluding specific expenses and gains that the

Company believes are not indicative of its core operating results.

Further, the Company’s annual performance plan used to determine

compensation for its executive officers and employees is tied to

the Adjusted EBITDA metric. It is also a measure of operating

performance widely used in the gaming industry.

The presentation of this additional information is not meant to

be considered in isolation or as a substitute for measures of

financial performance prepared in accordance with GAAP. In

addition, other companies in gaming industry may calculate Adjusted

EBITDA differently than the Company does.

The Company defines “Adjusted EBITDA” as earnings before

interest and other non-operating income (expense), income taxes,

depreciation and amortization, impairment of assets, severance

expenses, preopening and related expenses, gain or loss on disposal

of assets and businesses, share-based compensation expenses,

non-cash lease expense, and other non-cash charges that are deemed

to be not indicative of the Company’s core operating results,

calculated before corporate overhead (which is not allocated to

each reportable segment).

About Golden

Entertainment

Golden Entertainment owns and operates a diversified

entertainment platform, consisting of a portfolio of gaming and

hospitality assets that focus on casino and branded tavern

operations. Golden Entertainment owns eight casinos and 69 gaming

taverns in Nevada, operating over 5,600 slots, 100 table games, and

over 6,000 hotel rooms. For more information, visit

www.goldenent.com.

Golden Entertainment,

Inc.

Consolidated Statements of

Operations

(Unaudited, in thousands, except

per share data)

Three Months Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

Revenues

Gaming

$

138,682

$

185,020

$

674,301

$

760,906

Food and beverage

45,096

45,421

182,408

175,363

Rooms

31,737

32,639

124,649

122,324

Other

15,176

16,630

71,791

63,126

Total revenues

230,691

279,710

1,053,149

1,121,719

Expenses

Gaming

72,803

105,553

379,929

428,984

Food and beverage

34,130

34,770

135,373

131,863

Rooms

16,179

15,787

62,297

56,414

Other operating

5,193

6,036

22,415

19,889

Selling, general and administrative

58,709

57,818

255,565

235,404

Depreciation and amortization

21,758

24,229

88,933

100,123

(Gain) loss on disposal of assets

(103

)

(1

)

(228

)

934

Loss (gain) on sale of businesses

2,650

—

(303,179

)

—

Preopening expenses

185

100

760

161

Impairment of assets

12,072

—

12,072

—

Total expenses

223,576

244,292

653,937

973,772

Operating income

7,115

35,418

399,212

147,947

Non-operating expense

Interest expense, net

(13,170

)

(17,925

)

(65,515

)

(63,490

)

Loss on debt extinguishment and

modification

(1,329

)

(178

)

(1,734

)

(1,590

)

Total non-operating expense,

net

(14,499

)

(18,103

)

(67,249

)

(65,080

)

(Loss) income before income tax

provision

(7,384

)

17,315

331,963

82,867

Income tax provision

(1,988

)

(6,258

)

(76,207

)

(521

)

Net (loss) income

$

(9,372

)

$

11,057

$

255,756

$

82,346

Weighted-average common shares

outstanding

Basic

28,627

28,507

28,653

28,662

Diluted

28,627

31,230

30,781

31,514

Net (loss) income per share

Basic

$

(0.33

)

$

0.39

$

8.93

$

2.87

Diluted

$

(0.33

)

$

0.35

$

8.31

$

2.61

Golden Entertainment,

Inc.

Reconciliation of Adjusted

EBITDA

(Unaudited, in thousands)

Three Months Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

Revenues

Nevada Casino Resorts (1)

$

104,796

$

104,161

$

413,058

$

406,950

Nevada Locals Casinos (2)

38,467

40,105

157,435

157,514

Maryland Casino Resort (3)

—

17,948

43,456

78,010

Nevada Taverns (4)

27,763

26,884

109,215

109,965

Distributed Gaming (5)

59,323

90,316

320,680

365,472

Corporate and other

342

296

9,305

3,808

Total Revenues

$

230,691

$

279,710

$

1,053,149

$

1,121,719

Adjusted EBITDA

Nevada Casino Resorts (1)

$

29,664

$

32,515

$

120,256

$

135,104

Nevada Locals Casinos (2)

17,337

19,197

73,846

75,848

Maryland Casino Resort (3)

—

5,123

12,652

25,383

Nevada Taverns (4)

8,175

7,872

32,682

37,610

Distributed Gaming (5)

6,370

10,667

34,545

44,021

Corporate and other

(12,786

)

(11,690

)

(51,459

)

(50,886

)

Total Adjusted EBITDA

$

48,760

$

63,684

$

222,522

$

267,080

Adjustments

Depreciation and amortization

(21,758

)

(24,229

)

(88,933

)

(100,123

)

Non-cash lease expense

29

(52

)

15

(165

)

Share-based compensation

(2,851

)

(3,164

)

(13,476

)

(13,433

)

Gain (loss) on disposal of assets

103

1

228

(934

)

(Loss) gain on sale of businesses

(2,650

)

—

303,179

—

Loss on debt extinguishment and

modification

(1,329

)

(178

)

(1,734

)

(1,590

)

Preopening and related expenses (6)

(185

)

(100

)

(760

)

(161

)

Severance expenses

(21

)

(83

)

(149

)

(378

)

Impairment of assets

(12,072

)

—

(12,072

)

—

Other, net

(2,240

)

(639

)

(11,342

)

(3,939

)

Interest expense, net

(13,170

)

(17,925

)

(65,515

)

(63,490

)

Income tax provision

(1,988

)

(6,258

)

(76,207

)

(521

)

Net (loss) income

$

(9,372

)

$

11,057

$

255,756

$

82,346

(1)

Comprised of The STRAT Hotel, Casino &

Tower, Aquarius Casino Resort and Edgewater Casino Resort.

(2)

Comprised of Arizona Charlie’s Boulder,

Arizona Charlie’s Decatur, Gold Town Casino, Lakeside Casino &

RV Park and Pahrump Nugget Hotel Casino.

(3)

Comprised of the operations of the Rocky

Gap Casino Resort, which was sold on July 25, 2023.

(4)

Comprised of the operations of the

Company’s 69 branded tavern locations.

(5)

Comprised of distributed gaming operations

in Nevada and Montana. On September 13, 2023, the Company completed

the sale of its distributed gaming operations in Montana.

Subsequent to the fiscal year end, the Company completed the sale

of its distributed gaming operations in Nevada on January 10,

2024.

(6)

Preopening and related expenses consist of

labor, food, utilities, training, initial licensing, rent and

organizational costs incurred in connection with the opening of

branded tavern and casino locations as well as food and beverage

and other venues within the Company’s casino locations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240229128609/en/

Golden Entertainment, Inc. Charles H. Protell President and

Chief Financial Officer (702) 893-7777

Investor Relations Richard Land JCIR (212) 835-8500 or

gden@jcir.com

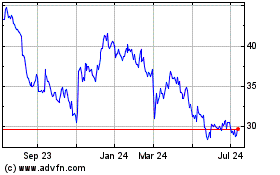

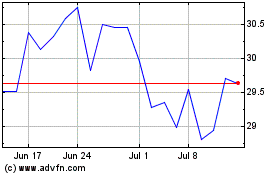

Golden Entertainment (NASDAQ:GDEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Golden Entertainment (NASDAQ:GDEN)

Historical Stock Chart

From Apr 2023 to Apr 2024