0001318568false00013185682024-02-292024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

February 29, 2024

Date of Report (Date of earliest event reported)

Everi Holdings Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-32622 | | 20-0723270 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

7250 S. Tenaya Way, Suite 100, Las Vegas, Nevada, 89113

(Address of principal executive offices) (800) 833-7110

(Registrant’s telephone number, including area code) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value | EVRI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 29, 2024, the Company issued a press release announcing its results of operations for the three and twelve months ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1.

The results of operations information in this Item 2.02 and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of such section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Document |

| | | |

| 99.1 | | |

| 104 | | The cover page of this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | EVERI HOLDINGS INC. |

| | | | |

Date: February 29, 2024 | By: | | /s/ Todd A. Valli |

| | | | Todd A. Valli, Senior Vice President, Corporate Finance & Tax and Chief Accounting Officer |

Exhibit 99.1

EVERI REPORTS FOURTH QUARTER AND FULL YEAR 2023 RESULTS

Announced Strategic Merger with IGT's Global Gaming and PlayDigital

Las Vegas – February 29, 2024 - Everi Holdings Inc. (NYSE: EVRI) (“Everi” or the “Company”) today announced results for the fourth quarter and full year ended December 31, 2023.

Fourth Quarter 2023 Highlights

•Revenues of $192.0 million compared to $205.4 million a year ago.

◦FinTech segment revenues rose 3% to $94.9 million, reflecting a 25% increase in software and other revenues and a 6% rise in financial access revenues, partially offset by lower hardware revenues due to strong kiosk sales in the prior year.

◦Games segment revenues declined to $97.1 million, as a result of declines in both gaming operations and gaming equipment and systems revenues reflecting near-term headwinds while transitioning to new family of cabinets and roll-out of new content.

◦Recurring revenues grew 3% to $147.9 million and represented 77% of total revenues; non-recurring revenues declined to $44.1 million due to lower gaming equipment and systems and FinTech hardware sales.

•Operating income of $21.5 million and net income of $1.9 million, or $0.02 per diluted share, including an $11.7 million or $0.13 per share impairment charge, compared to $27.0 million, or $0.28 per diluted share, in the 2022 fourth quarter.

•Adjusted EBITDA, a non-GAAP financial measure, of $82.2 million compared to $93.4 million in the 2022 fourth quarter.

•Free Cash Flow, a non-GAAP financial measure, was $19.8 million compared to $44.2 million in the 2022 fourth quarter.

•Repurchased 2.3 million shares of stock for $26.1 million in the 2023 fourth quarter.

Full Year 2023 Highlights

•Revenues increased to $807.8 million from $782.5 million in 2022, reflecting a 9% increase in FinTech segment revenues partially offset by a 2% decline in Games segment revenues. Organic growth was essentially flat and acquisitions contributed 6%, or $45.4 million to total revenues. Recurring revenues rose 7% to $602.7 million and represented 75% of total revenues.

•Net income was $84.0 million, or $0.91 per diluted share, compared to $120.5 million, or $1.24 per diluted share in 2022.

•Adjusted EBITDA, a non-GAAP financial measure, decreased to $367.0 million compared to $374.1 million in 2022.

•Free Cash Flow, a non-GAAP financial measure, was $141.9 million compared to $190.5 million generated in 2022.

•During the second quarter of 2023 Everi's Board of Directors authorized a new $180 million, 18-month share repurchase program under which 7.5 million shares of stock were repurchased for $100 million in 2023.

Announced Strategic Merger with IGT's Gaming & Digital Businesses

•This morning Everi and International Game Technology PLC (“IGT”) announced plans to merge a spinout of IGT’s Global Gaming and PlayDigital Businesses into Everi to create a global leader in gaming equipment, FinTech services and casino systems.

•The combination is expected to create a comprehensive and diverse portfolio of high-performing land-based, digital, and FinTech gaming products and services.

Randy Taylor, Chief Executive Officer of Everi, said, “This morning we announced the strategic combination of Everi with IGT’s Gaming and Digital businesses. We are excited about the opportunity to bring together the two companies to create a world class leader in gaming solutions for our customers.

“After several years of rapid growth, 2023 was a transitional year in our gaming business as we executed on our roadmap which included the introduction of four new cabinets and new content. Our FinTech business continues to perform well, adding new products and services to our suite of financial access, RegTech and loyalty solutions.

"We generated strong Free Cash Flow of $141.9 million after investing $67.6 million in research and development and $145.1 million in capital investments and returning $100 million to shareholders through share repurchases."

Consolidated Full Quarter Comparative Results (unaudited)

| | | | | | | | | | | |

| | As of and for the Three Months Ended December 31, |

| | 2023 | | 2022 |

| | (in millions, except per share amounts) |

| Revenues | $ | 192.0 | | | $ | 205.4 | |

| | | |

Operating income(1) | $ | 21.5 | | | $ | 51.6 | |

| | | |

Net income(1) | $ | 1.9 | | | $ | 27.0 | |

| | | |

Net earnings per diluted share(1) | $ | 0.02 | | | $ | 0.28 | |

| | | |

Adjusted EPS (2) | $ | 0.30 | | | $ | 0.40 | |

| | | |

| Weighted average diluted shares outstanding | 88.5 | | | 95.1 | |

| | | |

Adjusted EBITDA (3) | $ | 82.2 | | | $ | 93.4 | |

| | | |

Free Cash Flow (3) | $ | 19.8 | | | $ | 44.2 | |

| | | |

| Cash and cash equivalents | $ | 267.2 | | | $ | 293.4 | |

| | | |

Net Cash Position (4) | $ | 46.1 | | | $ | 89.2 | |

(1) Operating income, net income, and earnings per diluted share for the three months ended December 31, 2023, included $11.7 million in impairment costs related to certain intangible assets associated with the acquisition of Intuicode, $4.3 million for office and warehouse consolidation costs, $1.2 million in other non-recurring charges, $1.1 million in professional fees associated with acquisitions and non-recurring legal and litigation costs, $0.7 million in employee severance costs, and partially offset by a $1.8 million adjustment to contingent consideration related to an acquisition. Operating income for the three months ended December 31, 2022, included a gain of $0.2 million from certain non-recurring litigation settlements, $0.5 million in litigation fees, and $0.1 million for non-recurring professional fees.

(2) For a reconciliation of net earnings per diluted share to Adjusted EPS, see the Unaudited Reconciliation of net earnings per diluted share to Adjusted EPS provided toward the end of this release.

(3) For a reconciliation of net income to Adjusted EBITDA and Free Cash Flow, see the Unaudited Reconciliation of Selected Financial GAAP to Non-GAAP Measures provided toward the end of this release.

(4) For a reconciliation of Net Cash Position to Cash and Cash Equivalents, see the Unaudited Reconciliation of Cash and Cash Equivalents to Net Cash Position and Net Cash Available toward the end of this release.

Fourth Quarter 2023 Results Overview

Revenues for the three-month period ended December 31, 2023 declined to $192.0 million compared to $205.4 million in the fourth quarter of 2022. Recurring revenues increased 3% to $147.9 million from $142.9 million in the prior-year period driven by growth in financial access and software recurring revenues from our FinTech segment while Games segment recurring revenues were relatively flat. Revenues from lower-margin, non-recurring sales declined to $44.1 million from $62.5 million in the prior year period as a result of both lower gaming equipment sales and lower FinTech hardware sales.

Operating income decreased to $21.5 million compared to $51.6 million in the prior-year period. Operating expenses were higher in the 2023 fourth quarter compared to the prior-year period as a result of the April 2023 acquisition of Video King, higher employee wages and benefit costs, and expenses incurred due to the consolidation of assembly facilities in Las Vegas during the fourth quarter. Additionally, the Company recorded an $11.7 million non-cash impairment charge related to the write-down of certain intangible customer relationship assets acquired in connection with the May 2022 Intuicode acquisition. Changes in the historic horse racing system providers contract terms with one of their significant customers reduced the expected revenues to be earned by the Company in future periods which reduced the expected recoverability from these assets. Higher research and development expense and depreciation costs reflect the impact of the Video King acquisition earlier in the year and a full quarter of expense from the Venuetize acquisition in the prior year fourth quarter as well incremental development costs to support ongoing growth initiatives.

Net income was $1.9 million, or $0.02 per diluted share, compared to $27.0 million, or $0.28 per diluted share, in the fourth quarter of 2022.

Adjusted EBITDA decreased to $82.2 million from $93.4 million in the prior-year period, due to lower revenues and higher operating and research and development expenses.

Free Cash Flow was $19.8 million compared with $44.2 million in the year-ago period.

Outlook

Everi today initiated a full year outlook for 2024 in which it expects revenue growth in both the Games and FinTech segments. Adjusted EBITDA is expected to be up slightly compared to 2023, while Free Cash Flow is expected to be flat to slightly down as cash paid for capital expenditures and cash paid for taxes are expected to be up modestly.

For our FinTech business, we expect continued growth driven by our expectation for low-single-digit industry growth and the addition of new products and services to both new and existing customers. In our Games business, we expect to see continued pressure in game sales and declines in the installed base in the first half of the year as we continue to roll-out next family of cabinets and content and remove lower-performing gaming operations units to maximize our return from invested capital primarily in the early part of 2024.

Other factors in our outlook to consider include:

•Consolidated Operating expenses, excluding non-cash compensation expense and any non-recurring acquisition and legal costs is expected to be between 28% - 29% of consolidated revenues.

•R&D expense is expected to remain at 8% to 8.5% of consolidated revenues.

•Capital expenditures are expected to remain flat to up slightly from the $145 million spent in 2023 as the Company plans to increase investment in our installed base by replacing older and underperforming games with units from our next generation of cabinets.

•Cash interest is expected to be consistent with the prior year.

•Free Cash Flow is expected to remain strong, but decline slightly due to the growth in capital expenditures and increasing cash taxes.

Games Segment Full Quarter Comparative Results (unaudited)

| | | | | | | | | | | |

| Three Months Ended December 31, |

| | 2023 | | 2022 |

| | (in millions, except unit amounts and prices) |

| Games revenues | | | |

| Gaming operations - Land-based casinos | $ | 66.0 | | | $ | 67.2 | |

| Gaming operations - Digital iGaming | 6.6 | | | 6.2 | |

| Gaming operations - Total | 72.6 | | | 73.4 | |

| Gaming equipment and systems | 24.5 | | | 39.8 | |

| Games total revenues | $ | 97.1 | | | $ | 113.2 | |

| | | |

Operating (loss) income (1) | $ | (7.4) | | | $ | 25.2 | |

| | | |

Adjusted EBITDA (2) | $ | 43.7 | | | $ | 56.7 | |

| | | |

| Research and development expense | $ | 12.5 | | | $ | 12.0 | |

| | | |

| Capital expenditures | $ | 37.4 | | | $ | 23.3 | |

| | | |

| Gaming operations information: | | | |

| Units installed at period end: | | | |

| Class II | 10,558 | | | 10,342 | |

| Class III | 6,954 | | | 7,633 | |

| Total installed base at period end | 17,512 | | | 17,975 | |

| | | |

| Average units installed during period | 17,583 | | | 17,837 | |

| | | |

Daily win per unit ("DWPU") (3) | $ | 34.67 | | | $ | 37.76 | |

| | | |

| Unit sales information: | | | |

| Units sold | 1,043 | | | 1,944 | |

| Average sales price ("ASP") | $ | 20,270 | | | $ | 19,631 | |

(1) Operating income, net income, and earnings per diluted share for the three months ended December 31, 2023, included $11.7 million in impairment costs related to certain intangible assets associated with the acquisition of Intuicode, $4.2 million for office and warehouse consolidation costs, $1.2 million in other non-recurring charges, $0.8 million in professional fees associated with acquisitions and non-recurring legal and litigation costs, $0.6 million in employee severance costs, and partially offset by a $1.8 million adjustment to contingent consideration related to an acquisition. Operating income for the three months ended December 31, 2022, included a gain of $0.2 million from certain non-recurring litigation settlements.

(2) For a reconciliation of net income and operating income to Adjusted EBITDA, see the Unaudited Reconciliation of Selected Financial GAAP to Non-GAAP measures provided toward the end of this release.

(3) Daily win per unit excludes the impact of the direct costs associated with the Company’s wide-area progressive jackpot expense.

Fourth Quarter 2023 Games Segment Highlights

Games segment revenues declined to $97.1 million compared to $113.2 million in the fourth quarter of 2022, reflecting a decrease in revenues from gaming machine sales and gaming operations. The new for-sale Dynasty Sol was launched in the fourth quarter and sales of the for-sale Dynasty Vue launched in the second quarter continued to ramp. Gaming operation revenues declined modestly from the prior year period as the contribution from the acquisition of Video King was offset by declines in the installed base and DWPU as the transition to new premium cabinets and content continued.

Operating loss was $7.4 million compared to $25.2 million of operating income in the fourth quarter of 2022, reflecting lower revenues and higher operating expenses including an $11.7 million impairment charge related to certain intangible assets acquired as part of the acquisition of Intuicode as well as higher payroll and benefit expenses. Adjusted EBITDA declined to $43.7 million, from $56.7 million in the fourth quarter of 2022.

Gaming operations revenues were $72.6 million, essentially flat with a year ago.

•As anticipated, the installed base declined to 17,512 units as of December 31, 2023 from 17,975 a year ago. The premium portion of the installed base represented 49% of the installed base consistent with the prior year. Dynasty Dynamic and Player Classic Reserve were introduced at the end of the third quarter and as of December 31, 2023 there were 360 units deployed. Early performance and feedback has been positive.

•We expect units in the first half of 2024 to decline slightly as we manage our capital spending by removing certain underperforming units where we do not believe that the increased investment from new cabinets will justify the return.

Gaming equipment and systems revenues generated from the sale of gaming machines, including HHR units and other related parts and equipment, decreased to $24.5 million compared to $39.8 million in the fourth quarter of 2022.

•The Company sold 1,043 gaming machines at an average selling price ("ASP") of $20,270 in the 2023 fourth quarter compared to 1,944 units sold at an ASP of $19,631 in the 2022 fourth quarter.

•The Company continues to transition to the new family of for-sale video cabinets with the lower profile Dynasty Vue, which was launched in the second quarter, and the larger profile Dynasty Sol, which was launched in the fourth quarter. Early performance of several new titles including "The Mask" and "Dynamite Pop" has been strong.

Financial Technology Solutions Segment Full Quarter Comparative Results (unaudited)

| | | | | | | | | | | |

| Three Months Ended December 31, |

| | 2023 | | 2022 |

| | (in millions, unless otherwise noted) |

| FinTech revenues | | | |

| Financial access services | $ | 56.0 | | | $ | 52.8 | |

| Software and other | 26.4 | | | 21.2 | |

| Hardware | 12.5 | | | 18.2 | |

| FinTech total revenues | $ | 94.9 | | | $ | 92.2 | |

| | | |

Operating income(1) | $ | 28.9 | | | $ | 26.4 | |

| | | |

Adjusted EBITDA (2) | $ | 38.5 | | | $ | 36.7 | |

| | | |

| Research and development expenses | $ | 6.3 | | | $ | 5.1 | |

| | | |

| Capital expenditures | $ | 10.2 | | | $ | 12.0 | |

| | | |

| Value of financial access transactions: | | | |

| Funds advanced | $ | 3,058.9 | | | $ | 2,749.1 | |

| Funds dispensed | 8,324.4 | | | 7,566.4 | |

| Check warranty | 467.0 | | | 426.3 | |

| Total value processed | $ | 11,850.3 | | | $ | 10,741.8 | |

| | | |

| Number of financial access transactions: | | | |

| Funds advanced | 4.7 | | | 3.6 | |

| Funds dispensed | 31.7 | | | 28.9 | |

| Check warranty | 0.9 | | | 0.8 | |

| Total transactions completed | 37.3 | | | 33.3 | |

(1)Operating income, net income, and earnings per diluted share for the three months ended December 31, 2023, included $0.2 million for asset acquisition expense and non-recurring professional fees, $0.1 million for office and warehouse consolidation costs, $0.1 million in litigation fees, and $0.1 million for employee severance costs and related expenses. Operating income for the three months ended December 31, 2022, included $0.5 million in litigation fees and $0.1 million for non-recurring professional fees.

(2)For a reconciliation of net income and operating income to Adjusted EBITDA, see the Unaudited Reconciliation of Selected Financial GAAP to Non-GAAP Measures provided toward the end of this release.

Fourth Quarter 2023 Financial Technology Solutions ("FinTech") Segment Highlights

FinTech revenues for the 2023 fourth quarter increased to $94.9 million compared to $92.2 million in the fourth quarter of 2022, reflecting 6% growth in financial access services, a 25% gain in software and other revenues, and a 31% decrease in hardware sales.

Operating income increased 9% to $28.9 million compared to $26.4 million in the prior-year period, reflecting a more favorable mix of higher margin revenue. Adjusted EBITDA was $38.5 million compared to $36.7 million in the 2022 fourth quarter.

•Financial access services revenues, which include cashless and cash-dispensing debit and credit card transactions and check services, increased 6% versus the 2022 fourth quarter to $56.0 million, reflecting higher same-store financial funding transactions, as well as continued growth from new customer additions. Funds delivered to casino floors increased 10% to $11.9 billion on a

12% increase in the number of completed financial transactions. While representing less than 5% of funding transactions, cashless transactions (including both digital wallet and paper gaming voucher transactions) increased 50% over the 2022 fourth quarter.

•Software and other revenues, which include Loyalty and RegTech software, kiosk maintenance services, product subscriptions, and other revenues, rose 25% to $26.4 million in the fourth quarter of 2023 compared to $21.2 million in the fourth quarter 2022. Approximately 73% and 79% of software and other revenues were of a recurring nature in the 2023 and 2022 fourth quarter periods, respectively.

•Hardware sales revenues decreased to $12.5 million compared to $18.2 million in the fourth quarter of 2022. Hardware sales often consist of large purchases where the timing can shift resulting in volatility in quarterly results. The fourth quarter in 2022 experienced significantly higher hardware sales due to new casino openings compared to the fourth quarter in 2023 where some sales shifted to 2024.

Balance Sheet, Liquidity and Cash Flow

•As of December 31, 2023, the Company had $267.2 million of cash and cash equivalents compared with $293.4 million as of December 31, 2022. The Net Cash Position was $46.1 million compared with $89.2 million as of December 31, 2022.

•Cash paid for interest, net was $14.4 million in the 2023 fourth quarter compared with $10.2 million in the year-ago period, primarily due to the impact of rising interest rates on the Company's variable-rate term debt and third-party commercial cash arrangements associated with certain of the Company's funding of financial access services. The interest expense on the commercial arrangements was $5.1 million for the 2023 fourth quarter on a daily average balance of $308.0 million and $20.4 million interest expense for the full year on an average daily balance of $309.6 million.

•During the 2023 fourth quarter, the Company repurchased 2.3 million shares of its common stock for $26.1 million, and as of December 31, 2023, had $80 million remaining under the existing $180 million share repurchase program approved by the Board in the 2023 second quarter.

Investor Conference Call and Webcast

Due to the merger announcement, the Company will no longer host an investor conference call to discuss its 2023 fourth quarter and full year results. The Company will host a joint call with IGT leadership at 8:00 a.m. EST (5:00 a.m. PST) today. The conference call may be accessed live by phone by dialing in the US/Canada (800) 715-9871 and outside the US/Canada +1(646) 307-1963, Conference ID: 7675016. The call also will be webcast live and archived on www.everi.com (select “Investors” followed by “Events & Contact”)

Non-GAAP Financial Information

To provide for better comparability between periods and a better understanding of underlying trends, this press release includes Adjusted EBITDA, Free Cash Flow, Adjusted EPS, Net Cash Position and Net Cash Available, which are not measures of our financial performance or position under United States Generally Accepted Accounting Principles (“GAAP”). Accordingly, these measures should not be considered in isolation or as a substitute for measures prepared in accordance with GAAP. These measures should be read in conjunction with our net earnings, operating income, and cash flow data prepared in accordance with GAAP. With respect to Net Cash Position and Net Cash Available, these measures should be read in conjunction with cash and cash equivalents prepared in accordance with GAAP.

We define Adjusted EBITDA as earnings before interest, taxes, depreciation and amortization, non-cash stock compensation expense, accretion of contract rights, impairment of intangible assets, employee severance costs, non-recurring litigation costs net of settlements and insurance proceeds received,

facilities consolidation costs, asset acquisition expense including the reduction of contingent consideration and other non-recurring professional fees, debt amendment costs and other one-time charges and benefits. We present Adjusted EBITDA, as we use this measure to manage our business and consider this measure to be supplemental to our operating performance. We also make certain compensation decisions based, in part, on our operating performance, as measured by Adjusted EBITDA; and our credit facility and senior unsecured notes require us to comply with a consolidated secured leverage ratio that includes performance metrics substantially similar to Adjusted EBITDA.

We define Free Cash Flow as Adjusted EBITDA less cash paid for interest net of cash received for interest income, cash paid for capital expenditures, cash paid for placement fees, and cash paid for taxes net of refunds. We present Free Cash Flow as a measure of performance. It should not be inferred that the entire Free Cash Flow amount is available for discretionary expenditures.

A reconciliation of the Company’s net income per GAAP to Adjusted EBITDA and Free Cash Flow is included in the Unaudited Reconciliation of Selected Financial GAAP to Non-GAAP Measures provided at the end of this release. Additionally, a reconciliation of each segment’s operating income to EBITDA and Adjusted EBITDA is also included. On a segment level, operating income per GAAP, rather than net earnings per GAAP, is reconciled to EBITDA and Adjusted EBITDA as the Company does not report net earnings by segment. Management believes that this presentation is meaningful to investors in evaluating the performance of the Company’s segments.

We define Adjusted EPS as earnings per diluted share before non-cash stock compensation expense, accretion of contract rights, amortization of acquired intangible assets, non-recurring litigation costs net of settlements and insurance proceeds received, facilities consolidation costs, asset acquisition expense, non-recurring professional fees, and one-time charges and benefits. We consider Adjusted EPS as a supplemental measure to our operating performance and believe it provides investors with another indicator of our operating performance. A reconciliation of the Company’s earnings per diluted share per GAAP to Adjusted EPS is included in the Unaudited Reconciliation of Earnings per Diluted Share to Adjusted EPS provided at the end of this release.

We define Net Cash Position as cash and cash equivalents plus settlement receivables less settlement liabilities and Net Cash Available as Net Cash Position plus undrawn amounts available under our revolving credit facility. We present Net Cash Position because our cash position, as measured by cash and cash equivalents, depends upon changes in settlement receivables and the timing of payments related to settlement liabilities. As such, our cash and cash equivalents can change substantially based upon the timing of our receipt of payments for settlement receivables and payments we make to customers for our settlement liabilities. We present Net Cash Available as management monitors this amount in connection with its forecasting of cash flows and future cash requirements.

A reconciliation of the Company’s cash and cash equivalents per GAAP to Net Cash Position and Net Cash Available is included in the Unaudited Reconciliation of Cash and Cash Equivalents to Net Cash Position and Net Cash Available provided at the end of this release.

Cautionary Note Regarding Forward-Looking Statements

This press release contains “forward-looking statements” as defined in the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are neither historical facts nor assurances of future performance, but instead are based only on our current beliefs, expectations, and assumptions regarding the future of our business, plans and strategies, projections, anticipated events and trends, the economy, and other future conditions, as of the date this press release is issued. Forward-looking statements often, but do not always, contain words such as “expect,” “anticipate,” “aim to,” “designed to,” “intend,” “plan,” “believe,” “goal,” “target,” “future,” “assume,” “estimate,” “indication,” “seek,” “project,” “may,” “can,” “could,” “should,” “favorably positioned,” or “will” and other words and terms of similar meaning. Readers are cautioned not to place undue reliance on the forward-looking statements contained herein, which are based only on information currently available to us and only as of the date hereof. We undertake no obligation to update or publicly revise any forward-looking statements as a result of new information, future developments or otherwise, except required by law.

Examples of such forward-looking statements include, among others, statements regarding the potential strategic combination of Everi with IGT’s Gaming and Digital businesses and the anticipated benefits thereof and opportunities related thereto; Everi’s outlook, including, among other matters, its outlook for 2024 financial and operating metrics (including revenue, Adjusted EBITDA, Free Cash Flow, cash paid for capital expenditures, and cash paid for taxes), Everi’s FinTech and Games businesses (including expectations regarding revenue growth in both the Games and FinTech segments, the performance and growth of Everi’s FinTech business, continued pressure in game sales and declines in the installed base in the first half of 2024 in Everi’s Games business, and factors affecting the same), and other factors to consider with respect to its outlook (such as expenses, capital expenditures, cash interest, and Free Cash Flow); Everi's mission with respect to its leadership position in the gaming industry; its expanding focus in adjacent industries; and Everi’s repurchase program.

Forward-looking statements are subject to inherent risks, uncertainties, and changes in circumstances that are often difficult to predict and many of which are beyond our control, including, but not limited to, the following: macro-economic impacts on consumer discretionary spending, interest rates and interest expense; global supply chain disruption; inflationary impact on supply chain costs; inflationary impact on labor costs and retention; equity incentive activity and compensation expense; our ability to maintain revenue, earnings, and cash flow momentum or lack thereof; changes in global market, business and regulatory conditions whether as a result of a pandemic or other economic or geopolitical developments around the world, including availability of discretionary spending income of casino patrons as well as expectations for the closing or re-opening of casinos; product and technological innovations that address customer needs in a new and evolving operating environment; to enhance shareholder value in the long-term; trends in gaming establishment and patron usage of our products; benefits realized by using our products and services; benefits and/or costs associated with mergers, acquisitions, and/or strategic alliances; (including the proposed strategic combination with IGT's Gaming and Digital businesses; product development, including the benefits from the release of new products, new product features, product enhancements, or product extensions; regulatory approvals and changes; gaming, financial regulatory, legal, card association, and statutory compliance and changes; the implementation of new or amended card association and payment network rules or interpretations; consumer collection activities; competition (including consolidations); tax liabilities; borrowings and debt repayments; goodwill impairment charges; international expansion or lack thereof; resolution of litigation or government investigations; our share repurchase and dividend policy; new customer contracts and contract renewals or lack thereof; and financial performance and results of operations (including revenue, expenses, margins, earnings, cash flow, and capital expenditures).

Our actual results and financial condition may differ materially from those indicated in these forward-looking statements as a result of various risks, uncertainties, and changes in circumstances, including, but not limited to, the following: the risk that the closing conditions and the consummation of the proposed strategic combination with IGT’s Gaming and Digital businesses will not be satisfied or occur in the anticipated timeframe or at all; risks related to the ability to realize the anticipated benefits, synergies and operating efficiencies of the proposed strategic combination, or to successfully separate and/or integrate IGT’s Gaming and Digital businesses, within the expected timeframes or at all; the ability to retain key personnel; the perception and impact of the announcement of the proposed strategic combination on the market price of the capital stock of Everi and on Everi’s operations, including the diversion of management’s attention and resources; the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; our ability to generate profits in the future and to create incremental value for shareholders; our ability to withstand economic slowdowns, inflationary and other economic factors that pressure discretionary consumer spending; our ability to execute on mergers, acquisitions and/or strategic alliances, including our ability to integrate and operate such acquisitions or alliances consistent with our forecasts in order to achieve future growth; our ability to execute on key initiatives and deliver ongoing improvements; expectations regarding growth for the Company’s installed base and daily win per unit; expectations regarding placement fee agreements; inaccuracies in underlying operating assumptions; our ability to withstand direct and indirect impacts of a pandemic outbreak or other public health crisis of uncertain duration on our business and the businesses of our customers and suppliers, including as a result of actions taken in response to governments, regulators, markets and

individual consumers; changes in global market, business, and regulatory conditions arising as a result of economic, geopolitical and other developments around the world, including a global pandemic, increased conflict and political turmoil, capital market disruptions and instability of financial institutions; climate change or currently unexpected crises or natural disasters; our leverage and the related covenants that restrict our operations; our ability to comply with our debt covenants and our ability to generate sufficient cash to service all of our indebtedness, fund working capital, and capital expenditures; our ability to withstand the loss of revenue during a closure of our customers’ facilities; our ability to maintain our current customers; our ability to replace revenue associated with terminated contracts or margin degradation from contract renewals: expectations regarding customers’ preferences and demands for future product and service offerings; our ability to successfully introduce new products and services, including third-party licensed content; gaming establishment and patron preferences; failure to control product development costs and create successful new products; the overall growth or contraction of the gaming industry; anticipated sales performance; our ability to prevent, mitigate, or timely recover from cybersecurity breaches, attacks, and compromises or other security vulnerabilities; national and international economic and industry conditions including the prospect of a shutdown of the U.S. federal government; changes in gaming regulatory, financial regulatory, legal, card association, and statutory requirements; the impact of evolving legal and regulatory requirements, including emerging environmental, social and governance requirements; regulatory and licensing difficulties; competitive pressures and changes in the competitive environment; operational limitations; changes to tax laws; uncertainty of litigation outcomes; interest rate fluctuations; business prospects; unanticipated expenses or capital needs; technological obsolescence and our ability to adapt to evolving technologies, including artificial intelligence, employee hiring, turnover, and retention; our ability to comply with regulatory requirements under the Payment Card Industry (“PCI”) Data Security Standards and maintain our certified status; and those other risks and uncertainties discussed in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the year ended December 31. 2023 (the “Annual Report”). Given these risks and uncertainties, there can be no assurance that the forward-looking information contained in this press release will in fact transpire or prove to be accurate.

This press release should be read in conjunction with our Annual Report and with the information included in our other press releases, reports and other filings with the Securities and Exchange Commission. Understanding the information contained in these filings is important in order to fully understand our reported financial results and our business outlook for future periods.

Additional Information and Where to Find It

In connection with the proposed transaction (the “Proposed Transaction”) between Everi, IGT, Ignite Rotate LLC (“Spinco”) and Ember Sub LLC (“Merger Sub”), Everi, IGT and Spinco will file relevant materials with the Securities and Exchange Commission (“SEC”). Everi will file a registration statement on Form S-4 that will include a joint proxy statement/prospectus relating to the Proposed Transaction, which will constitute a proxy statement and prospectus of Everi and a proxy statement of IGT. A definitive proxy statement/prospectus will be mailed to stockholders of Everi and a definitive proxy statement will be mailed to shareholders of IGT. INVESTORS AND SECURITY HOLDERS OF EVERI ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, AND INVESTORS AND SECURITY HOLDERS OF IGT ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT EVERI, IGT AND SPINCO, AND THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by Everi or IGT through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Everi will be available free of charge on Everi’s website at www.everi.com or by contacting Everi’s Investor Relations Department at Everi Holdings Inc., Investor Relations, 7250 S. Tenaya Way, Suite 100, Las Vegas, NV 89113. Copies of the documents filed with the SEC by IGT will be available free of charge on

IGT’s website at www.igt.com or by contacting IGT’s Investor Relations Department at International Game Technology PLC, Investor Relations, 10 Memorial Boulevard, Providence, RI 02903.

No Offer or Solicitation

This communication is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell, any securities of Everi, IGT, Spinco or Merger Sub, or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the Proposed Transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”), and otherwise in accordance with applicable law.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any security holder of Everi or IGT. However, Everi and IGT and each of their respective directors and executive officers may be considered participants in the solicitation of proxies in connection with the Proposed Transaction. Information about the directors and executive officers of Everi may be found in its most recent Annual Report on Form 10-K and in its most recent proxy statement for its annual meeting of stockholders, in each case as filed with the SEC. Information about the directors, executive officers and members of senior management of IGT is set forth in its most recent Annual Report on Form 20-F as filed with the SEC. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

About Everi

Everi's mission is to lead the gaming industry through the power of people, imagination, and technology. As one of the largest suppliers of technology solutions for the casino floor that also has an expanding focus in adjacent industries, our commitment is to continually develop products and services that provide gaming entertainment, improve our customers' patron engagement, and help our customers operate their businesses more efficiently. We develop entertaining game content, gaming machines, and gaming systems to serve our land-based, iGaming and bingo operators. Everi is a leading innovator and provider of trusted financial technology solutions that power casino floors, improve casinos' operational efficiencies, and fulfill regulatory compliance requirements. The Company also develops and supplies player loyalty tools and mobile-first applications that drive increased patron engagement for our customers and venues in the casino, sports, entertainment, and hospitality industries. For more information, please visit www.everi.com.

Investor Relations Contacts:

Everi Holdings Inc. JCIR

Jennifer Hills Richard Land, James Leahy

VP Investor Relations evri@jcir.com

jennifer.hills@everi.com

Join Everi on Social Media

Twitter: https://twitter.com/everi_inc

LinkedIn: https://www.linkedin.com/company/everi

Facebook: https://www.facebook.com/EveriHoldingsInc/

Instagram: https://www.instagram.com/everi_inc

EVERI HOLDINGS INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME

(In thousands, except earnings per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues | | | | | | | | |

| Games revenues | | | | | | | | |

| Gaming operations | | $ | 72,642 | | | $ | 73,436 | | | $ | 304,132 | | | $ | 292,873 | |

| Gaming equipment and systems | | 24,468 | | | 39,787 | | | 125,022 | | | 143,553 | |

| Games total revenues | | 97,110 | | | 113,223 | | | 429,154 | | | 436,426 | |

| FinTech revenues | | | | | | | | |

| Financial access services | | 56,022 | | | 52,809 | | | 225,054 | | | 206,860 | |

| Software and other | | 26,442 | | | 21,176 | | | 99,490 | | | 80,232 | |

| Hardware | | 12,458 | | | 18,155 | | | 54,123 | | | 59,001 | |

| FinTech total revenues | | 94,922 | | | 92,140 | | | 378,667 | | | 346,093 | |

| Total revenues | | 192,032 | | | 205,363 | | | 807,821 | | | 782,519 | |

| Costs and expenses | | | | | | | | |

| Games cost of revenues | | | | | | | | |

| Gaming operations | | 9,648 | | | 6,479 | | | 35,205 | | | 25,153 | |

| Gaming equipment and systems | | 13,562 | | | 23,917 | | | 72,191 | | | 86,638 | |

| Games total cost of revenues | | 23,210 | | | 30,396 | | | 107,396 | | | 111,791 | |

| FinTech cost of revenues | | | | | | | | |

| Financial access services | | 2,543 | | | 2,781 | | | 11,064 | | | 10,186 | |

| Software and other | | 1,329 | | | 1,141 | | | 6,159 | | | 4,125 | |

| Hardware | | 8,695 | | | 12,146 | | | 36,621 | | | 39,220 | |

| FinTech total cost of revenues | | 12,567 | | | 16,068 | | | 53,844 | | | 53,531 | |

Operating expenses | | 79,335 | | | 55,729 | | | 260,931 | | | 216,959 | |

Research and development | | 18,780 | | | 17,141 | | | 67,633 | | | 60,527 | |

Depreciation | | 20,318 | | | 18,459 | | | 78,691 | | | 66,801 | |

Amortization | | 16,303 | | | 15,976 | | | 60,042 | | | 59,558 | |

| Total costs and expenses | | 170,513 | | | 153,769 | | | 628,537 | | | 569,167 | |

| Operating income | | $ | 21,519 | | | $ | 51,594 | | | $ | 179,284 | | | $ | 213,352 | |

| Other expenses | | | | | | | | |

Interest expense, net of interest income | | 19,662 | | | 17,230 | | | 77,693 | | | 55,752 | |

Total other expenses | | 19,662 | | | 17,230 | | | 77,693 | | | 55,752 | |

| Income before income tax | | 1,857 | | | 34,364 | | | 101,591 | | | 157,600 | |

| Income tax (benefit) provision | | (35) | | | 7,327 | | | 17,594 | | | 37,111 | |

| Net income | | 1,892 | | | 27,037 | | | 83,997 | | | 120,489 | |

| Foreign currency translation gain (loss) | | 2,400 | | | 1,923 | | | 730 | | | (2,742) | |

| Comprehensive income | | 4,292 | | | 28,960 | | | 84,727 | | | 117,747 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Earnings per share | | | | | | | | |

| Basic | | $ | 0.02 | | | $ | 0.30 | | | $ | 0.96 | | | $ | 1.33 | |

| Diluted | | $ | 0.02 | | | $ | 0.28 | | | $ | 0.91 | | | $ | 1.24 | |

| Weighted average common shares outstanding | | | | | | | | |

| Basic | | 84,954 | | | 88,879 | | | 87,176 | | | 90,494 | |

| Diluted | | 88,479 | | | 95,128 | | | 91,985 | | | 97,507 | |

EVERI HOLDINGS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except par value amounts)

| | | | | | | | | | | |

| | At December 31, |

| | 2023 | | 2022 |

| ASSETS | | | |

| Current assets | | | |

Cash and cash equivalents | $ | 267,215 | | | $ | 293,394 | |

Settlement receivables | 441,852 | | | 263,745 | |

Trade and other receivables, net of allowances for credit losses of $5,210 and $4,855 at December 31, 2023 and December 31, 2022, respectively | 107,933 | | | 118,895 | |

Inventory | 70,624 | | | 58,350 | |

Prepaid expenses and other current assets | 43,906 | | | 38,822 | |

| Total current assets | 931,530 | | | 773,206 | |

| Non-current assets | | | |

| Property and equipment, net | 152,704 | | | 133,645 | |

| Goodwill | 737,804 | | | 715,870 | |

| Other intangible assets, net | 234,138 | | | 238,275 | |

| Other receivables | 29,015 | | | 27,757 | |

| Deferred tax assets, net | 598 | | | 1,584 | |

| Other assets | 38,081 | | | 27,906 | |

| Total non-current assets | 1,192,340 | | | 1,145,037 | |

| Total assets | $ | 2,123,870 | | | $ | 1,918,243 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities | | | |

| Settlement liabilities | $ | 662,967 | | | $ | 467,903 | |

| Accounts payable and accrued expenses | 215,530 | | | 217,424 | |

| Current portion of long-term debt | 6,000 | | | 6,000 | |

| Total current liabilities | 884,497 | | | 691,327 | |

| Non-current liabilities | | | |

| Deferred tax liabilities, net | 13,762 | | | 5,994 | |

| Long-term debt, less current portion | 968,465 | | | 971,995 | |

| Other accrued expenses and liabilities | 31,004 | | | 31,286 | |

| Total non-current liabilities | 1,013,231 | | | 1,009,275 | |

| Total liabilities | 1,897,728 | | | 1,700,602 | |

| Commitments and contingencies | | | |

| Stockholders’ equity | | | |

Convertible preferred stock, $0.001 par value, 50,000 shares authorized and no shares outstanding at December 31, 2023 and December 31, 2022, respectively | — | | | — | |

Common stock, $0.001 par value, 500,000 shares authorized and 123,179 and 83,738 shares issued and outstanding at December 31, 2023, respectively, and 119,390 and 88,036 shares issued and outstanding at December 31, 2022, respectively | 123 | | | 119 | |

| Additional paid-in capital | 560,945 | | | 527,465 | |

| Retained earnings (accumulated deficit) | 62,731 | | | (21,266) | |

| Accumulated other comprehensive loss | (3,467) | | | (4,197) | |

Treasury stock, at cost, 39,441 and 31,353 shares at December 31, 2023 and December 31, 2022, respectively | (394,190) | | | (284,480) | |

| Total stockholders’ equity | 226,142 | | | 217,641 | |

| Total liabilities and stockholders’ equity | $ | 2,123,870 | | | $ | 1,918,243 | |

EVERI HOLDINGS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

| | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| | | |

| Cash flows from operating activities | | | |

| Net income | $ | 83,997 | | | $ | 120,489 | |

| Adjustments to reconcile net income to cash provided by operating activities: | | | |

| Depreciation | 78,691 | | | 66,801 | |

| Amortization | 60,042 | | | 59,558 | |

| Non-cash lease expense | 6,096 | | | 4,847 | |

| Amortization of financing costs and discounts | 2,854 | | | 2,854 | |

| Loss on sale or disposal of assets | 1,467 | | | 591 | |

| Accretion of contract rights | 9,340 | | | 9,578 | |

| Provision for credit losses | 11,623 | | | 10,115 | |

| Deferred income taxes | 8,754 | | | 32,618 | |

| Reserve for inventory obsolescence | 1,220 | | | 792 | |

| Write-down of assets | 13,629 | | | — | |

| Stock-based compensation | 18,711 | | | 19,789 | |

Adjustment to acquisition contingent consideration | (1,766) | | | — | |

| Changes in operating assets and liabilities: | | | |

| Settlement receivables | (177,947) | | | (174,604) | |

| Trade and other receivables | 91 | | | (30,974) | |

| Inventory | (11,954) | | | (26,314) | |

| Prepaid expenses and other assets | 374 | | | (25,717) | |

| Settlement liabilities | 194,878 | | | 176,274 | |

| Accounts payable and accrued expenses | (7,870) | | | 25,944 | |

| Placement fee agreements | — | | | (547) | |

| Net cash provided by operating activities | 292,230 | | | 272,094 | |

| Cash flows from investing activities | | | |

| Capital expenditures | (145,108) | | | (127,568) | |

| Acquisitions, net of cash acquired | (59,405) | | | (51,450) | |

| Proceeds from sale of property and equipment | 206 | | | 227 | |

| Net cash used in investing activities | (204,307) | | | (178,791) | |

| Cash flows from financing activities | | | |

| Repayments of new term loan | (6,000) | | | (6,000) | |

| Proceeds from exercise of stock options | 13,739 | | | 1,921 | |

| Treasury stock - equity award activities, net of shares withheld | (8,151) | | | (11,969) | |

| Treasury stock - repurchase of shares | (100,000) | | | (84,347) | |

| Payment of acquisition contingent consideration | (10,529) | | | (173) | |

| Net cash used in financing activities | (110,941) | | | (100,568) | |

| Effect of exchange rates on cash and cash equivalents | 461 | | | (1,398) | |

| Cash, cash equivalents and restricted cash | | | |

| Net decrease for the period | (22,557) | | | (8,663) | |

| Balance, beginning of the period | 295,063 | | | 303,726 | |

| Balance, end of the period | $ | 272,506 | | | $ | 295,063 | |

EVERI HOLDINGS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands) | | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| Supplemental cash disclosures | | | |

| Cash paid for interest | $ | 86,528 | | | $ | 54,749 | |

| Cash paid for income tax, net of refunds | 5,481 | | | 4,522 | |

| Supplemental non-cash disclosures | | | |

| Accrued and unpaid capital expenditures | $ | 4,408 | | | $ | 3,222 | |

| Transfer of leased gaming equipment to inventory | 6,719 | | | 9,588 | |

EVERI HOLDINGS INC. AND SUBSIDIARIES

UNAUDITED RECONCILIATION OF CASH AND CASH EQUIVALENTS

TO NET CASH POSITION AND NET CASH AVAILABLE

(In thousands)

| | | | | | | | | | | |

| At December 31, |

| 2023 | | 2022 |

| Cash available | | | |

Cash and cash equivalents (1) | $ | 267,215 | | | $ | 293,394 | |

| Settlement receivables | 441,852 | | | 263,745 | |

| Settlement liabilities | (662,967) | | | (467,903) | |

| Net Cash Position | 46,100 | | | 89,236 | |

| | | |

| Undrawn revolving credit facility | 125,000 | | | 125,000 | |

| Net Cash Available | $ | 171,100 | | | $ | 214,236 | |

(1) Cash and cash equivalents does not include $5.3 million and $1.7 million of restricted cash at each of December 31, 2023 and 2022, respectively.

EVERI HOLDINGS INC. AND SUBSIDIARIES

UNAUDITED RECONCILIATION OF EARNINGS PER DILUTED SHARE

TO ADJUSTED EPS

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | Year Ended December 31, |

| | 2023 | | 2022 | 2023 | | 2022 |

| Net income | $ | 1,892 | | | $ | 27,037 | | $ | 83.997 | | | $ | 120.489 | |

| Weighted average common shares - diluted | 88,479 | | | 95,128 | | 91,985 | | | 97,507 | |

| Earnings per diluted share | $ | 0.02 | | | $ | 0.28 | | $ | 0.91 | | | $ | 1.24 | |

| | | | | | |

| Non-cash stock compensation expense | 0.05 | | | 0.05 | | 0.20 | | | 0.20 | |

| Accretion of contract rights | 0.03 | | | 0.02 | | 0.10 | | | 0.10 | |

| Impairment of acquired intangible assets | 0.13 | | | — | | 0.13 | | | — | |

Acquisition related earnout reduction | (0.02) | | | — | | (0.02) | | | — | |

| Litigation fees | — | | | — | | — | | | 0.02 | |

| Employee severance costs and other expenses | 0.01 | | | — | | 0.02 | | | — | |

| Office and warehouse consolidation | 0.05 | | | — | | 0.05 | | | 0.01 | |

| Debt amendment | — | | | — | | — | | | — | |

| Asset acquisition and non-recurring professional fees | 0.01 | | | — | | 0.03 | | | 0.02 | |

Amortization of acquired intangible assets (1) | 0.08 | | | 0.09 | | 0.31 | | | 0.33 | |

Other non-recurring charges | 0.01 | | | — | | 0.01 | | | — | |

Income tax impact on adjustments (2) | (0.07) | | | (0.04) | | (0.15) | | | (0.16) | |

Adjusted EPS (3) | $ | 0.30 | | | $ | 0.40 | | $ | 1.59 | | | $ | 1.76 | |

(1) Includes amortization of developed technology and software, customer contracts, trademarks and other similar items that the Company acquired through business combinations with fair values assigned in connection with the purchase accounting valuation process.

(2) The income tax impact of non-GAAP adjustments is calculated utilizing the 2024 effective tax rate for the respective non-GAAP adjustments.

(3) Adjusted EPS is calculated based on diluted shares outstanding. The financial measure calculated under GAAP, which is most directly comparable to Adjusted EPS is earnings per diluted share.

EVERI HOLDINGS INC. AND SUBSIDIARIES

UNAUDITED RECONCILIATION OF SELECTED FINANCIAL GAAP TO NON-GAAP MEASURES

(In thousands)

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

| | Games | | FinTech | | Total |

| Net income | | | | | $ | 1,892 | |

| Income tax benefit | | | | | (35) | |

| | | | | |

| Interest expense, net of interest income | | | | | 19,662 | |

| Operating income | $ | (7,401) | | | $ | 28,920 | | | $ | 21,519 | |

| | | | | |

| Plus: depreciation and amortization | 29,733 | | | 6,888 | | | 36,621 | |

| EBITDA | $ | 22,332 | | | $ | 35,808 | | | $ | 58,140 | |

| | | | | |

| Non-cash stock-based compensation expense | 2,262 | | | 2,264 | | | 4,526 | |

| Accretion of contract rights | 2,335 | | | — | | | 2,335 | |

| Impairment of acquired intangible assets | 11,680 | | | — | | | 11,680 | |

Acquisition related earnout reduction | (1,766) | | | — | | | (1,766) | |

| Litigation fees, net of settlements received | — | | | 58 | | | 58 | |

| Employee severance costs and other expenses | 620 | | | 50 | | | 670 | |

| Office and warehouse consolidation costs | 4,222 | | | 78 | | | 4,300 | |

| Debt amendment costs | — | | | 36 | | | 36 | |

| Asset acquisition expense, non-recurring professional fees and other | 827 | | | 221 | | | 1,048 | |

Other non-recurring charges | 1,197 | | | — | | | 1,197 | |

| Adjusted EBITDA | $ | 43,709 | | | $ | 38,515 | | | $ | 82,224 | |

| | | | | |

Cash paid for interest, net (1) | | | | | (14,397) | |

| Cash paid for capital expenditures | | | | | (47,585) | |

| Cash paid for income taxes, net | | | | | (405) | |

| Free Cash Flow | | | | | $ | 19,837 | |

(1) Cash paid for interest, net includes the cash received for interest income of $3.1 million.

EVERI HOLDINGS INC. AND SUBSIDIARIES

UNAUDITED RECONCILIATION OF SELECTED FINANCIAL GAAP TO NON-GAAP MEASURES

(In thousands)

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2022 |

| | Games | | FinTech | | Total |

| Net income | | | | | $ | 27,037 | |

| Income tax provision | | | | | 7,327 | |

| Interest expense, net of interest income | | | | | 17,230 | |

| Operating income | $ | 25,174 | | | $ | 26,420 | | | $ | 51,594 | |

| | | | | |

| Plus: depreciation and amortization | 27,084 | | | 7,351 | | | 34,435 | |

| EBITDA | $ | 52,258 | | | $ | 33,771 | | | $ | 86,029 | |

| | | | | |

| Non-cash stock-based compensation expense | 2,464 | | | 2,313 | | | 4,777 | |

| Accretion of contract rights | 2,210 | | | — | | | 2,210 | |

| Facilities consolidation costs | 8 | | | — | | | 8 | |

| Litigation fees, net of settlements received | (194) | | | 508 | | | 314 | |

| Non-recurring professional fees and other | — | | | 63 | | | 63 | |

| Adjusted EBITDA | $ | 56,746 | | | $ | 36,655 | | | $ | 93,401 | |

| | | | | |

Cash paid for interest, net (1) | | | | | (10,172) | |

| Cash paid for capital expenditures | | | | | (35,343) | |

| Cash paid for income taxes, net | | | | | (3,676) | |

| Free Cash Flow | | | | | $ | 44,210 | |

(1) Cash paid for interest, net includes the cash received for interest income of $2.5 million, as compared to the previously reported cash paid for interest of $12.7 million for the three months ended December 31, 2022.

EVERI HOLDINGS INC. AND SUBSIDIARIES

UNAUDITED RECONCILIATION OF SELECTED FINANCIAL GAAP TO NON-GAAP MEASURES

(In thousands)

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2023 |

| | Games | | FinTech | | Total |

| Net income | | | | | $ | 83,997 | |

| Income tax provision | | | | | 17,594 | |

| Interest expense, net of interest income | | | | | 77,693 | |

| Operating income | $ | 60,693 | | | $ | 118,591 | | | $ | 179,284 | |

| | | | | |

| Plus: depreciation and amortization | 113,034 | | | 25,699 | | | 138,733 | |

| EBITDA | $ | 173,727 | | | $ | 144,290 | | | $ | 318,017 | |

| | | | | |

| Non-cash stock-based compensation expense | 9,505 | | | 9,206 | | | 18,711 | |

| Accretion of contract rights | 9,340 | | | — | | | 9,340 | |

Impairment of acquired intangible assets | 11,680 | | | — | | | 11,680 | |

Acquisition related earnout reduction | (1,766) | | | — | | | (1,766) | |

| Litigation fees, net of settlements received | — | | | (166) | | | (166) | |

| Employee severance costs and other expenses | 967 | | | 1,014 | | | 1,981 | |

| Office and warehouse consolidation costs | 4,703 | | | 78 | | | 4,781 | |

| Debt amendment costs | — | | | 92 | | | 92 | |

| Asset acquisition expense, non-recurring professional fees and other | 2,662 | | | 473 | | | 3,135 | |

Other non-recurring charges | 1,197 | | | — | | | 1,197 | |

| Adjusted EBITDA | $ | 212,015 | | | $ | 154,987 | | | $ | 367,002 | |

| | | | | |

Cash paid for interest, net (1) | | | | | (74,500) | |

| Cash paid for capital expenditures | | | | | (145,108) | |

| Cash paid for income taxes, net | | | | | (5,481) | |

| Free Cash Flow | | | | | $ | 141,913 | |

(1) Cash paid for interest, net includes the cash received for interest income of $12.0 million.

EVERI HOLDINGS INC. AND SUBSIDIARIES

UNAUDITED RECONCILIATION OF SELECTED FINANCIAL GAAP TO NON-GAAP MEASURES

(In thousands)

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2022 |

| | Games | | FinTech | | Total |

| Net income | | | | | $ | 120,489 | |

| Income tax provision | | | | | 37,111 | |

| Interest expense, net of interest income | | | | | 55,752 | |

| Operating income | $ | 107,636 | | | $ | 105,716 | | | $ | 213,352 | |

| | | | | |

| Plus: depreciation and amortization | 100,150 | | | 26,209 | | | 126,359 | |

| EBITDA | $ | 207,786 | | | $ | 131,925 | | | $ | 339,711 | |

| | | | | |

| Non-cash stock-based compensation expense | 10,178 | | | 9,611 | | | 19,789 | |

| Accretion of contract rights | 9,578 | | | — | | | 9,578 | |

| Litigation settlement, net | (194) | | | 2,485 | | | 2,291 | |

| Facilities consolidation costs | 686 | | | — | | | 686 | |

| Non-recurring professional fees and other | 38 | | | 1,989 | | | 2,027 | |

| Adjusted EBITDA | $ | 228,072 | | | $ | 146,010 | | | $ | 374,082 | |

| | | | | |

Cash paid for interest, net (1) | | | | | (50,942) | |

| Cash paid for capital expenditures | | | | | (127,568) | |

| Cash paid for placement fees | | | | | (547) | |

| Cash paid for income taxes, net | | | | | (4,522) | |

| Free Cash Flow | | | | | $ | 190,503 | |

(1) Cash paid for interest, net includes the cash received for interest income of $3.8 million, as compared to the previously reported cash paid for interest of $54.7 million for the year ended December 31, 2022.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

evri_CoverPageAbstract |

| Namespace Prefix: |

evri_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

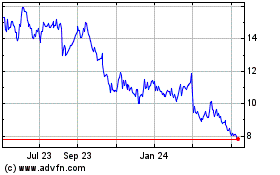

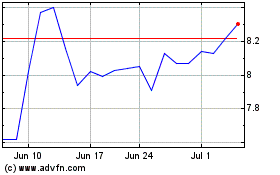

Everi (NYSE:EVRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Everi (NYSE:EVRI)

Historical Stock Chart

From Apr 2023 to Apr 2024