Okeanis Eco Tankers Corp. – Unaudited Condensed Financial Statements for the Fourth Quarter and Twelve Month Period of 2023

February 29 2024 - 12:00AM

Okeanis Eco Tankers Corp. (“OET” or “Company”) (NYSE:ECO / OSE:OET)

today reported unaudited condensed financial statements for the

fourth quarter and twelve month period of 2023, which

are attached to this press release.

Selected Q4 2023 and Recent Highlights:

- Time charter equivalent ("TCE", a non-IFRS measure*) revenue

and Adjusted EBITDA (a non-IFRS measure*) of $58.4 million and

$44.2 million, respectively. Adjusted profit and Adjusted earnings

per share (non-IFRS measures*) for the period of $20.4 million or

$0.63 per basic & diluted share.

- Fleetwide daily TCE rate of $45,400 per operating day; VLCC and

Suezmax TCE rates of $45,200 and $45,600 per operating day,

respectively.

- Daily vessel operating expenses (“opex”, a non-IFRS measure*)

of $9,105 per calendar day, including management fees.

- In Q1 2024 to date, 76% of the available VLCC spot days have

been booked at an average TCE rate of $73,900 per day and 88% of

the available Suezmax spot days have been booked at an average TCE

rate of $58,800 per day.

- The Company paid an amount of approximately $19.3 million or

$0.60 per share in November 2023 as a dividend classified for

accounting purposes as a return of paid-in capital.

- On January 26, 2024, we entered into amendments to the existing

sale and leaseback agreements for the VLCC vessels Nissos Kea and

Nissos Nikouria (the “Existing Leases Amendments”) with CMB

Financial Leasing. The Existing Leases Amendments, effective from

the first quarter of 2024, provide for a reduction of the pricing

of the variable amount of charterhire payable thereunder to 200

basis points over the applicable Term SOFR on both vessels, extend

maturities to December 2030 for the Nissos Kea and March 2031 for

the Nissos Nikouria, and eliminate the previously stipulated early

prepayment fees in the case of exercise of the purchase options by

the Company after the first year.

- On January 29, 2024, we entered into a new sale and leaseback

agreement of approximately $73.5 million for the VLCC vessel Nissos

Anafi (the “Anafi Lease”) with CMB Financial Leasing. The

agreement provides for a bareboat charter with the charterhire

being paid on a quarterly basis, is priced at 190 basis points over

the applicable Term SOFR and matures in seven years. The Anafi

Lease includes purchase options for the Company after the first

year and throughout the tenor of the lease and is guaranteed by the

Company.

- On January 31, 2024, we entered into a new $34.7 million senior

secured credit facility with a syndicate led by Kexim Asia Limited

to finance the option to purchase back, in February 2024, the

Suezmax vessel Milos from its current sale and lease back

financier. The facility is repaid quarterly, matures in six years,

is priced at 175 basis points over the applicable Term SOFR, is

secured by the Milos, and is guaranteed by the Company.

*The Company uses certain financial information

calculated on a basis other than in accordance with generally

accepted accounting principles, including TCE, Adjusted EBITA,

Adjusted profit, Adjusted earnings per share, and opex. For a

reconciliation of these non-IFRS measures please refer to the end

of the attached report.

Declaration of Q4 2023 capital return:

The Board of Directors declared a dividend of

$0.66 per share to shareholders. Dividends payable to shares

registered in the Euronext VPS will be distributed in NOK. The cash

payment will be recorded for accounting purposes as a return of

paid-in-capital and will be paid on March 22, 2024 to shareholders

of record as of March 11, 2024. The shares will be traded

ex-capital distribution as from and including March 8, 2024. Due to

the implementation of Central Securities Depository Regulation

(CSDR) in Norway, dividends payable on shares registered with

Euronext VPS are expected to be distributed to Euronext VPS

shareholders on or about March 27, 2024.

A presentation related to our results can be found on our

website: http://www.okeanisecotankers.com/reports/.

Information found on our website is not incorporated by

reference into this press release.

OET will be hosting a conference call and

webcast at 13:30 CET on Thursday February 29, 2024, to discuss the

Q4 2023 results. Participants may access the conference call using

the below dial-in details:

- Norway: +47 2 156 3318

- USA: +1 786 697 3501

- Standard International Access: +44 (0) 33 0551 0200

- Password: Okeanis

The webcast will include a slide presentation

and will be available on the following link:

https://channel.royalcast.com/landingpage/okeanis/20240229_1/

An audio replay of the conference call will be available on our

website:

http://www.okeanisecotankers.com/reports/

Contacts

Company:Iraklis Sbarounis, CFO Tel: +30 210 480 4200

ir@okeanisecotankers.com

Investor Relations / Media Contact: Nicolas Bornozis, President

Capital Link, Inc. 230 Park Avenue, Suite 1540, New York, N.Y.

10169 Tel: +1 (212) 661-7566 okeanisecotankers@capitallink.com

About OET

OET is a leading international tanker company

providing seaborne transportation of crude oil and refined

products. The Company was incorporated on April 30, 2018 under the

laws of the Republic of the Marshall Islands and is listed on Oslo

Børs under the symbol OET and the New York Stock Exchange under the

symbol ECO. The sailing fleet consists of six modern

scrubber-fitted Suezmax tankers and eight modern scrubber-fitted

VLCC tankers.

Forward-Looking Statements

This communication contains “forward-looking

statements”, including as defined under U.S. federal securities

laws. Forward-looking statements provide the Company’s current

expectations or forecasts of future events. Forward-looking

statements include statements about the Company’s expectations,

beliefs, plans, objectives, intentions, assumptions and other

statements that are not historical facts or that are not present

facts or conditions. Words or phrases such as “anticipate,”

“believe,” “continue,” “estimate,” “expect,” “hope,” “intend,”

“may,” “ongoing,” “plan,” “potential,” “predict,” “project,”

“should,” “will” or similar words or phrases, or the negatives of

those words or phrases, may identify forward-looking statements,

but the absence of these words does not necessarily mean that a

statement is not forward-looking. Forward-looking statements are

subject to known and unknown risks and uncertainties and are based

on potentially inaccurate assumptions that could cause actual

results to differ materially from those expected or implied by the

forward-looking statements. The Company’s actual results could

differ materially from those anticipated in forward-looking

statements for many reasons, including as described in the

Company’s filings with the U.S. Securities and Exchange Commission.

Accordingly, you should not unduly rely on these forward-looking

statements, which speak only as of the date of this communication.

Factors that could cause actual results to differ materially

include, but are not limited to, the Company's operating or

financial results; the Company's liquidity, including its ability

to service its indebtedness; competitive factors in the market in

which the Company operates; shipping industry trends, including

charter rates, vessel values and factors affecting vessel supply

and demand; future, pending or recent acquisitions and

dispositions, business strategy, areas of possible expansion or

contraction, and expected capital spending or operating expenses;

risks associated with operations; broader market impacts arising

from war (or threatened war) or international hostilities; risks

associated with pandemics (including COVID-19), including effects

on demand for oil and other products transported by tankers and the

transportation thereof; and other factors listed from time to time

in the Company's filings with the U.S. Securities and Exchange

Commission. Except to the extent required by law, the Company

expressly disclaims any obligations or undertaking to release

publicly any updates or revisions to any forward-looking statements

contained herein to reflect any change in the Company's

expectations with respect thereto or any change in events,

conditions or circumstances on which any statement is based. You

should, however, review the factors and risks the Company describes

in the reports it files and furnishes from time to time with the

U.S. Securities and Exchange Commission, which can be obtained free

of charge on the U.S. Securities and Exchange Commission’s website

at www.sec.gov.

This information is subject to the disclosure

requirements pursuant to Section 5-12 of the Norwegian Securities

Trading Act.

PDF

available: http://ml.globenewswire.com/Resource/Download/e653ca19-8435-4d82-89b9-b9a13c1c5c04

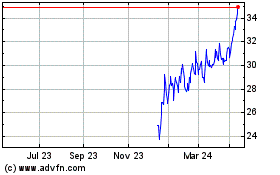

Okeanis Eco Tankers (NYSE:ECO)

Historical Stock Chart

From Mar 2024 to Apr 2024

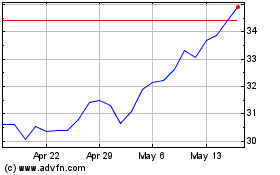

Okeanis Eco Tankers (NYSE:ECO)

Historical Stock Chart

From Apr 2023 to Apr 2024