FTC’s Block on Kroger-Albertsons Deal: A Win for Walmart?

February 28 2024 - 7:44AM

IH Market News

The Federal Trade Commission’s (FTC) attempt to halt Kroger’s

massive $25 billion acquisition of Albertsons might inadvertently

play into the hands of Walmart, a formidable competitor in the

grocery sector. With a dominant 24% share of the U.S. grocery

market in 2022, as reported by CFRA Research, Walmart’s strategy of

maintaining low grocery prices is a significant draw for consumers

to its extensive network of 4,700 U.S. stores.

Walmart’s influence is further amplified by its substantial

buying power with key suppliers like Procter & Gamble and

Conagra, making up a significant portion of their annual retail

sales. The potential fallout from the FTC’s antitrust challenge

against the Kroger-Albertsons merger could reinforce Walmart’s

position, limiting the bargaining power of major consumer product

companies.

Industry experts and investors view the FTC’s move as a boon for

Walmart, allowing it to maintain its supremacy in the grocery

sector without facing a more formidable consolidated competitor.

The ongoing legal challenge could delay the merger by months, even

as some remain hopeful for its eventual completion.

The concentration of market control among the top grocery chains

has been a point of contention, with the National Grocers

Association highlighting the competitive disadvantages faced by

smaller retailers due to the negotiating leverage of giants like

Walmart (NYSE:WMT) and Kroger (NYSE:KR).

Should the Kroger-Albertsons deal fall through, it could

diversify the market for packaged food manufacturers by increasing

the number of potential buyers. However, Walmart’s expansive store

count and aggressive expansion plans, including opening and

renovating hundreds of stores across the U.S., further solidify its

competitive edge.

The merger’s uncertainty poses significant challenges for

Albertsons, potentially leading to talent attrition and distracting

from growth initiatives. Meanwhile, Walmart continues to attract a

broader customer base, including higher-end shoppers, with its

competitive pricing and convenient shopping options.

The blocked merger raises concerns among the involved parties

that it would further empower retail giants like Amazon and

Walmart, exacerbating the competitive imbalance in the grocery

industry. As the legal proceedings unfold, the grocery market

landscape could witness significant shifts, with Walmart poised to

capitalize on the developments.

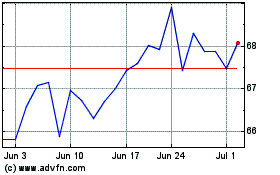

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

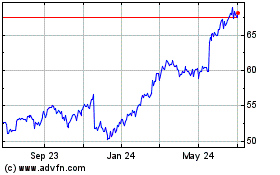

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024