0001258602false00012586022024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

February 27, 2024

NELNET, INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Nebraska | | 001-31924 | | 84-0748903 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | |

121 South 13th Street, Suite 100 | | |

| Lincoln, | Nebraska | | 68508 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code (402) 458-2370

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

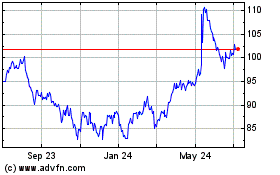

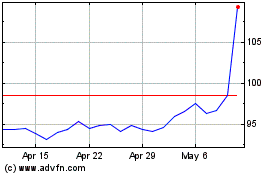

| Class A Common Stock, Par Value $0.01 per Share | NNI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 27, 2024, Nelnet, Inc. (the “Company”) issued a press release with respect to its financial results for the quarter ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this report. In addition, a copy of the supplemental financial information for the quarter ended December 31, 2023, which was made available on the Company's website at www.nelnetinvestors.com on February 27, 2024 in connection with the press release, is furnished as Exhibit 99.2 to this report. A copy of the 2023 letter to the Company's shareholders from the Chief Executive Officer of the Company is also furnished as Exhibit 99.3 to this report.

The above information and Exhibits 99.1, 99.2, and 99.3 shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), nor shall such information and Exhibits be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. In addition, information on the Company's website is not incorporated by reference into this report and should not be considered part of this report.

Certain statements contained in the exhibits furnished with this report may be considered forward looking in nature and are subject to various risks, uncertainties, and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, the Company's actual results may vary materially from those anticipated, estimated, or expected. Among the key risks and uncertainties that may have a direct bearing on the Company's future operating results, performance, or financial condition expressed or implied by the forward-looking statements are the matters discussed in the Risk Factors section of the Company's Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on February 27, 2024. Although the Company may from time to time voluntarily update its prior forward-looking statements, it disclaims any commitment to do so except as required by securities laws.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are furnished as part of this report:

| | | | | | | | |

Exhibit No. | | Description |

| | |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 99.3 | | |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL and included as Exhibit 101). |

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 27, 2024

NELNET, INC.

By: /s/ JAMES D. KRUGER

Name: James D. Kruger

Title: Chief Financial Officer

Nelnet Reports Fourth Quarter 2023 Results

LINCOLN, Neb., February 27, 2024 - Nelnet (NYSE: NNI) today reported a GAAP net loss of $8.6 million, or $0.23 per share, for the fourth quarter of 2023, compared with GAAP net income of $30.8 million, or $0.83 per share, for the same period a year ago.

Excluding derivative market value adjustments1, the company's net loss was $1.3 million, or $0.04 per share, for the fourth quarter of 2023, compared with net income of $36.4 million, or $0.98 per share, for the same period in 2022.

During the fourth quarter of 2023, the company recognized a net loss after taxes and noncontrolling interest from its Nelnet Renewable Energy division of $40.3 million (or $1.08 per share) that included operating losses and impairment charges related to its solar construction business and investment losses on tax equity investments.

"Our commitment has always been dedicated to the creation of long-term value and making strategic decisions aimed at maximizing long-term cash flow,” said Jeff Noordhoek, chief executive officer of Nelnet. "Our solar engineering and construction company, acquired in the summer of 2022, has experienced several challenges resulting in costly lessons that are included in this quarter's results. While we realign our solar construction business for success, I'm pleased to report that our core fee-based businesses performed exceptionally well in 2023 and are well-positioned for a promising future along with our asset generation strategy within Nelnet Financial Services.”

Operating Segments

Nelnet has four reportable operating segments, earning interest income on loans in its Asset Generation and Management (AGM) and Nelnet Bank segments, both part of the company's Nelnet Financial Services division, and fee-based revenue in its Loan Servicing and Systems and Education Technology Services and Payments segments.

Asset Generation and Management

The AGM operating segment reported net interest income of $35.6 million during the fourth quarter of 2023, compared with $58.5 million for the same period a year ago. The decrease in 2023 was due to the expected runoff of the loan portfolio and a decrease in loan spread2. The average balance of loans outstanding decreased from $14.8 billion for the fourth quarter of 2022 to $12.5 billion for the same period in 2023.

AGM recognized a provision for loan losses in the fourth quarter of 2023 of $8.3 million ($6.3 million after tax), compared with $27.4 million ($20.8 million after tax) in the fourth quarter of 2022. Provision for loan losses is primarily impacted by loans acquired during the period. The company acquired $196.4 million in loans in the fourth quarter of 2023, compared with $926.3 million for the same period in 2022.

AGM recognized net income after tax of $17.2 million for the three months ended December 31, 2023, compared with $22.9 million for the same period in 2022.

Nelnet Bank

As of December 31, 2023, Nelnet Bank had a $432.9 million loan portfolio and total deposits, including intercompany deposits, of $847.6 million. Nelnet Bank recognized a net loss after tax for the quarter ended December 31, 2023 of $3.3 million, compared with net income of $1.4 million for the same period in 2022.

Loan Servicing and Systems

Revenue from the Loan Servicing and Systems segment was $128.8 million for the fourth quarter of 2023, compared with $140.0 million for the same period in 2022.

As of December 31, 2023, the company was servicing $532.6 billion in government-owned, FFEL Program, private education, and consumer loans for 16.1 million borrowers, compared with $587.5 billion in servicing volume for 17.6 million borrowers as of December 31, 2022.

The Loan Servicing and Systems segment reported net income after tax of $8.4 million for the three months ended December 31, 2023, compared with $12.9 million for the same period in 2022.

1 Net income, excluding derivative market value adjustments, is a non-GAAP measure. See "Non-GAAP Performance Measures" at the end of this press release and the "Non-GAAP Disclosures" section below for explanatory information and reconciliations of GAAP to non-GAAP financial information.

2 Loan spread represents the spread between the yield earned on loan assets and the costs of the liabilities and derivative instruments used to fund the assets.

Education Technology Services and Payments

For the fourth quarter of 2023, revenue from the Education Technology Services and Payments operating segment was $106.1 million, an increase from $98.3 million for the same period in 2022. Revenue less direct costs to provide services for the fourth quarter of 2023 was $66.7 million, compared with $59.0 million for the same period in 2022.

Net income after tax for the Education Technology Services and Payments segment was $10.1 million for the three months ended December 31, 2023, compared with $5.8 million for the same period in 2022.

Corporate Activities

Included in corporate activities is the operating results of the Nelnet Renewable Energy (NRE) division. NRE recognized operating losses in the fourth quarter of 2023 related to its solar construction business (excluding impairments) of $17.9 million ($11.7 million or $0.31 per share after taxes and noncontrolling interest) and an impairment charge on goodwill and intangible assets of $20.6 million ($12.5 million or $0.34 per share after taxes and noncontrolling interest). In addition, NRE recognized losses of $36.1 million ($16.1 million or $0.43 per share after taxes and noncontrolling interest) in the fourth quarter of 2023 on solar tax equity investments. For NRE's solar tax equity investments, the company recognizes losses in the initial year of the investment, however it expects to recognize a positive return over the life of the investment. NRE funded almost $70 million in solar tax equity investments during the fourth quarter of 2023.

Also included in corporate activities is the operating results of the company's 45 percent voting membership interest in ALLO Holdings LLC, a holding company for ALLO Communications LLC (ALLO). During the fourth quarter of 2023, the company recognized a loss of $15.6 million ($11.9 million or $0.32 per share after tax), compared with a loss of $20.3 million ($15.4 million or $0.41 per share after tax) for the same period in 2022.

Year-End Results

GAAP net income for the year ended December 31, 2023 was $91.5 million, or $2.45 per share, compared with GAAP net income of $407.3 million, or $10.83 per share, for 2022. Net income in 2023, excluding derivative market value adjustments1, was $123.3 million, or $3.29 per share, compared with $231.3 million, or $6.15 per share, for 2022.

Forward-Looking and Cautionary Statements

This press release contains forward-looking statements within the meaning of federal securities laws. The words “anticipate,” “assume," "believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “future,” “intend,” “may,” “plan,” “potential,” “predict,” "scheduled," “should,” “will,” “would,” and similar expressions, as well as statements in future tense, are intended to identify forward-looking statements. These statements are based on management's current expectations as of the date of this release and are subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause the actual results and performance to be materially different from any future results or performance expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to: risks related to the ability to successfully maintain and increase allocated volumes of student loans serviced by the company under existing and future servicing contracts with the Department, including the company’s level of service as the result of the unprecedented event of all borrowers returning to repayment in October 2023 which has generated extraordinary call volume and web traffic, and risks related to the company's ability to comply with agreements with third-party customers for the servicing of Federal Direct Loan Program, FFEL Program, private education, and consumer loans; loan portfolio risks, such as credit risk, interest rate basis and repricing risk, risks related to the use of derivatives to manage exposure to interest rate fluctuations, uncertainties regarding the expected benefits from purchased securitized and unsecuritized FFEL Program, private education, consumer, and other loans, or investment interests therein, and initiatives to purchase additional FFEL Program, private education, consumer, and other loans, and risks from changes in levels of loan prepayment or default rates; financing and liquidity risks, including risks of changes in the interest rate environment; risks from changes in the terms of education loans and in the educational credit and services markets resulting from changes in applicable laws, regulations, and government programs and budgets; risks related to a breach of or failure in the company's operational or information systems or infrastructure, or those of third-party vendors, including disclosure of confidential or personal information and/or damage to reputation resulting from cyber-breaches; uncertainties inherent in forecasting future cash flows from student loan assets and related asset-backed securitizations; risks and uncertainties related to the operations of Nelnet Bank, including the ability to successfully conduct banking operations and achieve expected market penetration; risks related to the expected benefits to the company from its continuing investment in ALLO and Hudl, and risks related to investments in solar projects, including risks of not being able to realize tax credits which remain subject to recapture by taxing authorities and rising construction costs; risks and uncertainties related to other initiatives to pursue additional strategic investments (and anticipated income therefrom), acquisitions, and other activities, including activities that are intended to diversify the company both within and outside of its historical core education-related businesses; risks and uncertainties associated with climate change; risks from changes in economic conditions and consumer behavior; risks

related to the company's ability to adapt to technological change, including artificial intelligence; risks related to the company's reinsurance business; risks related to the exclusive forum provisions in the company's articles of incorporation; risks related to the company's executive chairman's ability to control matters related to the company through voting rights; risks related to related party transactions; risks related to natural disasters, terrorist activities, or international hostilities; and risks and uncertainties associated with litigation matters and with maintaining compliance with the extensive regulatory requirements applicable to the company's businesses.

For more information, see the "Risk Factors" sections and other cautionary discussions of risks and uncertainties included in documents filed or furnished by the company with the Securities and Exchange Commission. All forward-looking statements in this release are as of the date of this release. Although the company may voluntarily update or revise its forward-looking statements from time to time to reflect actual results or changes in the company's expectations, the company disclaims any commitment to do so except as required by law.

Non-GAAP Performance Measures

The company prepares its financial statements and presents its financial results in accordance with U.S. GAAP. However, it also provides additional non-GAAP financial information related to specific items management believes to be important in the evaluation of its operating results and performance. Reconciliations of GAAP to non-GAAP financial information, and a discussion of why the company believes providing this additional information is useful to investors, is provided in the "Non-GAAP Disclosures" section below.

Consolidated Statements of Operations

(Dollars in thousands, except share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Year ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Interest income: | | | | | | | | | |

| Loan interest | $ | 227,234 | | | 236,423 | | | 228,878 | | | 931,945 | | | 651,205 | |

| Investment interest | 48,019 | | | 48,128 | | | 34,012 | | | 177,855 | | | 91,601 | |

| Total interest income | 275,253 | | | 284,551 | | | 262,890 | | | 1,109,800 | | | 742,806 | |

| Interest expense on bonds and notes payable and bank deposits | 205,335 | | | 207,159 | | | 181,790 | | | 845,091 | | | 430,137 | |

| Net interest income | 69,918 | | | 77,392 | | | 81,100 | | | 264,709 | | | 312,669 | |

| Less provision for loan losses | 10,924 | | | 10,659 | | | 27,801 | | | 65,450 | | | 46,441 | |

| Net interest income after provision for loan losses | 58,994 | | | 66,733 | | | 53,299 | | | 199,259 | | | 266,228 | |

| Other income (expense): | | | | | | | | | |

| Loan servicing and systems revenue | 128,816 | | | 127,892 | | | 140,021 | | | 517,954 | | | 535,459 | |

| Education technology services and payments revenue | 106,052 | | | 113,796 | | | 98,332 | | | 463,311 | | | 408,543 | |

| Solar construction revenue | 11,982 | | | 6,301 | | | 15,186 | | | 31,669 | | | 24,543 | |

| Other, net | (27,493) | | | (211) | | | 735 | | | (48,787) | | | 25,486 | |

| Gain (loss) on sale of loans, net | 6,987 | | | 5,362 | | | (2,713) | | | 39,673 | | | 2,903 | |

| Impairment expense | (26,951) | | | (4,974) | | | (9,361) | | | (31,925) | | | (15,523) | |

| Derivative market value adjustments and derivative settlements, net | (8,654) | | | 3,957 | | | 13,424 | | | (16,701) | | | 264,634 | |

| Total other income (expense), net | 190,739 | | | 252,123 | | | 255,624 | | | 955,194 | | | 1,246,045 | |

| Cost of services: | | | | | | | | | |

| Cost to provide education technology services and payments | 39,379 | | | 43,694 | | | 39,330 | | | 171,183 | | | 148,403 | |

| Cost to provide solar construction services | 23,371 | | | 7,783 | | | 14,004 | | | 48,576 | | | 19,971 | |

| Total cost of services | 62,750 | | | 51,477 | | | 53,334 | | | 219,759 | | | 168,374 | |

| Operating expenses: | | | | | | | | | |

| Salaries and benefits | 152,917 | | | 141,204 | | | 151,568 | | | 591,537 | | | 589,579 | |

| Depreciation and amortization | 22,004 | | | 21,835 | | | 20,099 | | | 79,118 | | | 74,077 | |

| Other expenses | 51,697 | | | 51,370 | | | 50,481 | | | 189,851 | | | 170,778 | |

| Total operating expenses | 226,618 | | | 214,409 | | | 222,148 | | | 860,506 | | | 834,434 | |

| (Loss) income before income taxes | (39,635) | | | 52,970 | | | 33,441 | | | 74,188 | | | 509,465 | |

| Income tax benefit (expense) | 9,722 | | | (10,734) | | | (5,459) | | | (19,753) | | | (113,224) | |

| Net (loss) income | (29,913) | | | 42,236 | | | 27,982 | | | 54,435 | | | 396,241 | |

| Net loss attributable to noncontrolling interests | 21,359 | | | 3,096 | | | 2,791 | | | 37,097 | | | 11,106 | |

| Net (loss) income attributable to Nelnet, Inc. | $ | (8,554) | | | 45,332 | | | 30,773 | | | 91,532 | | | 407,347 | |

| Earnings per common share: | | | | | | | | | |

| Net (loss) income attributable to Nelnet, Inc. shareholders - basic and diluted | $ | (0.23) | | | 1.21 | | | 0.83 | | | 2.45 | | | 10.83 | |

Weighted average common shares outstanding -

basic and diluted | 37,354,406 | | | 37,498,073 | | | 37,290,293 | | | 37,416,621 | | | 37,603,033 | |

Condensed Consolidated Balance Sheets

(Dollars in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | |

| As of | | As of | | As of |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| Assets: | | | | | |

| Loans and accrued interest receivable, net | $ | 13,108,204 | | | 13,867,557 | | | 15,243,889 | |

| Cash, cash equivalents, and investments | 2,039,080 | | | 2,133,378 | | | 2,230,063 | |

| Restricted cash and investments | 875,348 | | | 604,855 | | | 1,239,470 | |

| Goodwill and intangible assets, net | 202,848 | | | 228,812 | | | 240,403 | |

| Other assets | 511,165 | | | 388,080 | | | 420,219 | |

| Total assets | $ | 16,736,645 | | | 17,222,682 | | | 19,374,044 | |

| Liabilities: | | | | | |

| Bonds and notes payable | $ | 11,828,393 | | | 12,448,109 | | | 14,637,195 | |

| Bank deposits | 743,599 | | | 718,053 | | | 691,322 | |

| Other liabilities | 942,738 | | | 797,365 | | | 845,625 | |

| Total liabilities | 13,514,730 | | | 13,963,527 | | | 16,174,142 | |

| Equity: | | | | | |

| Total Nelnet, Inc. shareholders' equity | 3,262,621 | | | 3,294,981 | | | 3,198,959 | |

| Noncontrolling interests | (40,706) | | | (35,826) | | | 943 | |

| Total equity | 3,221,915 | | | 3,259,155 | | | 3,199,902 | |

| Total liabilities and equity | $ | 16,736,645 | | | 17,222,682 | | | 19,374,044 | |

Contacts:

Media, Ben Kiser, 402.458.3024, or Investors, Phil Morgan, 402.458.3038, both of Nelnet, Inc.

Non-GAAP Disclosures

(Dollars in thousands, except share data)

(unaudited)

Non-GAAP financial measures disclosed by management are meant to provide additional information and insight relative to business trends to investors and, in certain cases, to present financial information as measured by rating agencies and other users of financial information. These measures are not in accordance with, or a substitute for, GAAP and may be different from, or inconsistent with, non-GAAP financial measures used by other companies. The company reports this non-GAAP information because the company believes that it provides additional information regarding operational and performance indicators that are closely assessed by management. There is no comprehensive, authoritative guidance for the presentation of such non-GAAP information, which is only meant to supplement GAAP results by providing additional information that management utilizes to assess performance.

Net income, excluding derivative market value adjustments

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Year ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| GAAP net (loss) income attributable to Nelnet, Inc. | $ | (8,554) | | | 30,773 | | | 91,532 | | | 407,347 | |

| Realized and unrealized derivative market value adjustments (a) | 9,507 | | | 7,434 | | | 41,773 | | | (231,691) | |

| Tax effect (b) | (2,282) | | | (1,784) | | | (10,026) | | | 55,606 | |

| Non-GAAP net (loss) income attributable to Nelnet, Inc., excluding derivative market value adjustments | $ | (1,329) | | | 36,423 | | | 123,279 | | | 231,262 | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| GAAP net (loss) income attributable to Nelnet, Inc. | $ | (0.23) | | | 0.83 | | | 2.45 | | | 10.83 | |

| Realized and unrealized derivative market value adjustments (a) | 0.25 | | | 0.20 | | | 1.12 | | | (6.16) | |

| Tax effect (b) | (0.06) | | | (0.05) | | | (0.28) | | | 1.48 | |

| Non-GAAP net (loss) income attributable to Nelnet, Inc., excluding derivative market value adjustments | $ | (0.04) | | | 0.98 | | | 3.29 | | | 6.15 | |

(a) "Derivative market value adjustments" includes both the realized portion of gains and losses (corresponding to variation margin received or paid on derivative instruments that are settled daily at a central clearinghouse) and the unrealized portion of gains and losses that are caused by changes in fair values of derivatives which do not qualify for "hedge treatment" under GAAP. "Derivative market value adjustments" does not include "derivative settlements" that represent the cash paid or received during the current period to settle with derivative instrument counterparties the economic effect of the company's derivative instruments based on their contractual terms.

The accounting for derivatives requires that changes in the fair value of derivative instruments be recognized currently in earnings, with no fair value adjustment of the hedged item, unless specific hedge accounting criteria is met. Management has structured all of the company’s derivative transactions with the intent that each is economically effective; however, the company’s derivative instruments do not qualify for hedge accounting in the consolidated financial statements. As a result, the change in fair value of derivative instruments is reported in current period earnings with no consideration for the corresponding change in fair value of the hedged item. Under GAAP, the cumulative net realized and unrealized gain or loss caused by changes in fair values of derivatives in which the company plans to hold to maturity will equal zero over the life of the contract. However, the net realized and unrealized gain or loss during any given reporting period fluctuates significantly from period to period.

The company believes these point-in-time estimates of asset and liability values related to its derivative instruments that are subject to interest rate fluctuations are subject to volatility mostly due to timing and market factors beyond the control of management, and affect the period-to-period comparability of the results of operations. Accordingly, the company’s management utilizes operating results excluding these items for comparability purposes when making decisions regarding the company’s performance and in presentations with credit rating agencies, lenders, and investors.

(b) The tax effects are calculated by multiplying the realized and unrealized derivative market value adjustments by the applicable statutory income tax rate.

For Release: February 27, 2024

Investor Contact: Phil Morgan, 402.458.3038

Nelnet, Inc. supplemental financial information for the fourth quarter 2023

(All dollars are in thousands, except per share amounts, unless otherwise noted)

The following information should be read in connection with Nelnet, Inc.'s (the “Company's”) press release for fourth quarter 2023 earnings, dated February 27, 2024, and the Company's Annual Report on Form 10-K for the year ended December 31, 2023.

Forward-looking and cautionary statements

This report contains forward-looking statements and information that are based on management's current expectations as of the date of this document. Statements that are not historical facts, including statements about the Company's plans and expectations for future financial condition, results of operations or economic performance, or that address management's plans and objectives for future operations, and statements that assume or are dependent upon future events, are forward-looking statements. The words “anticipate,” “assume,” “believe,” “continue,” “could,” “ensure,” “estimate,” “expect,” “forecast,” “future,” “intend,” “may,” “plan,” “potential,” “predict,” “scheduled,” “should,” “will,” “would,” and similar expressions, as well as statements in future tense, are intended to identify forward-looking statements.

The forward-looking statements are based on assumptions and analyses made by management in light of management's experience and its perception of historical trends, current conditions, expected future developments, and other factors that management believes are appropriate under the circumstances. These statements are subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause the actual results and performance to be materially different from any future results or performance expressed or implied by such forward-looking statements. These factors include, among others, the risks and uncertainties set forth in the “Risk Factors” section of the Company's Annual Report on Form 10-K for the year ended December 31, 2023 (the "2023 Annual Report"), and include such risks and uncertainties as:

•risks related to the ability to successfully maintain and increase allocated volumes of student loans serviced by the Company under existing and future servicing contracts with the U.S. Department of Education (the "Department"), risks related to unfavorable contract modifications or interpretations, and risks related to the Company's ability to comply with agreements with third-party customers for the servicing of Federal Direct Loan Program, Federal Family Education Loan Program (the "FFEL Program" or FFELP), private education, and consumer loans;

•loan portfolio risks such as prepayment risk, credit risk, interest rate basis and repricing risk, risks related to the use of derivatives to manage exposure to interest rate fluctuations, uncertainties regarding the expected benefits from purchased securitized and unsecuritized FFELP, private education, consumer, and other loans, or investment interests therein, and initiatives to purchase additional FFELP, private education, consumer, and other loans;

•financing and liquidity risks, including risks of changes in the interest rate environment;

•risks from changes in the terms of education loans and in the educational credit and services markets resulting from changes in applicable laws, regulations, and government programs and budgets;

•risks related to a breach of or failure in the Company's operational or information systems or infrastructure, or those of third-party vendors;

•risks related to use of artificial intelligence;

•uncertainties inherent in forecasting future cash flows from student loan assets and related asset-backed securitizations;

•risks related to the ability of Nelnet Bank to achieve its business objectives and effectively deploy loan and deposit strategies and achieve expected market penetration;

•risks related to the expected benefits to the Company from its continuing investment in ALLO Holdings, LLC (referred to collectively with its subsidiary ALLO Communications LLC as "ALLO"), and risks related to investments in solar projects, including risks of not being able to realize tax credits which remain subject to recapture by taxing authorities and rising construction costs;

•risks and uncertainties related to other initiatives to pursue additional strategic investments (and anticipated income therefrom) including venture capital and real estate investments, acquisitions, and other activities (including risks associated with errors that occasionally occur in converting loan servicing portfolios to a new servicing platform), including activities that are intended to diversify the Company both within and outside of its historical core education-related businesses;

•risks and uncertainties associated with climate change; and

•risks and uncertainties associated with litigation matters and maintaining compliance with the extensive regulatory requirements applicable to the Company's businesses, and uncertainties inherent in the estimates and assumptions about future events that management is required to make in the preparation of the Company’s consolidated financial statements.

All forward-looking statements contained in this report are qualified by these cautionary statements and are made only as of the date of this document. Although the Company may from time to time voluntarily update or revise its prior forward-looking statements to reflect actual results or changes in the Company's expectations, the Company disclaims any commitment to do so except as required by law.

Consolidated Statements of Operations

(Dollars in thousands, except share data)

(unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Year ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Interest income: | | | | | | | | | |

| Loan interest | $ | 227,234 | | | 236,423 | | | 228,878 | | | 931,945 | | | 651,205 | |

| Investment interest | 48,019 | | | 48,128 | | | 34,012 | | | 177,855 | | | 91,601 | |

| Total interest income | 275,253 | | | 284,551 | | | 262,890 | | | 1,109,800 | | | 742,806 | |

| Interest expense on bonds and notes payable and bank deposits | 205,335 | | | 207,159 | | | 181,790 | | | 845,091 | | | 430,137 | |

| Net interest income | 69,918 | | | 77,392 | | | 81,100 | | | 264,709 | | | 312,669 | |

| Less provision for loan losses | 10,924 | | | 10,659 | | | 27,801 | | | 65,450 | | | 46,441 | |

| Net interest income after provision for loan losses | 58,994 | | | 66,733 | | | 53,299 | | | 199,259 | | | 266,228 | |

| Other income (expense): | | | | | | | | | |

| Loan servicing and systems revenue | 128,816 | | | 127,892 | | | 140,021 | | | 517,954 | | | 535,459 | |

| Education technology services and payments revenue | 106,052 | | | 113,796 | | | 98,332 | | | 463,311 | | | 408,543 | |

| Solar construction revenue | 11,982 | | | 6,301 | | | 15,186 | | | 31,669 | | | 24,543 | |

| Other, net | (27,493) | | | (211) | | | 735 | | | (48,787) | | | 25,486 | |

| Gain (loss) on sale of loans, net | 6,987 | | | 5,362 | | | (2,713) | | | 39,673 | | | 2,903 | |

| Impairment expense | (26,951) | | | (4,974) | | | (9,361) | | | (31,925) | | | (15,523) | |

| Derivative settlements, net | 853 | | | 817 | | | 20,858 | | | 25,072 | | | 32,943 | |

| Derivative market value adjustments, net | (9,507) | | | 3,140 | | | (7,434) | | | (41,773) | | | 231,691 | |

| Total other income (expense), net | 190,739 | | | 252,123 | | | 255,624 | | | 955,194 | | | 1,246,045 | |

| Cost of services: | | | | | | | | | |

| Cost to provide education technology services and payments | 39,379 | | | 43,694 | | | 39,330 | | | 171,183 | | | 148,403 | |

| Cost to provide solar construction services | 23,371 | | | 7,783 | | | 14,004 | | | 48,576 | | | 19,971 | |

| Total cost of services | 62,750 | | | 51,477 | | | 53,334 | | | 219,759 | | | 168,374 | |

| Operating expenses: | | | | | | | | | |

| Salaries and benefits | 152,917 | | | 141,204 | | | 151,568 | | | 591,537 | | | 589,579 | |

| Depreciation and amortization | 22,004 | | | 21,835 | | | 20,099 | | | 79,118 | | | 74,077 | |

| Other expenses | 51,697 | | | 51,370 | | | 50,481 | | | 189,851 | | | 170,778 | |

| Total operating expenses | 226,618 | | | 214,409 | | | 222,148 | | | 860,506 | | | 834,434 | |

| (Loss) income before income taxes | (39,635) | | | 52,970 | | | 33,441 | | | 74,188 | | | 509,465 | |

| Income tax benefit (expense) | 9,722 | | | (10,734) | | | (5,459) | | | (19,753) | | | (113,224) | |

| Net (loss) income | (29,913) | | | 42,236 | | | 27,982 | | | 54,435 | | | 396,241 | |

| Net loss attributable to noncontrolling interests | 21,359 | | | 3,096 | | | 2,791 | | | 37,097 | | | 11,106 | |

| Net (loss) income attributable to Nelnet, Inc. | $ | (8,554) | | | 45,332 | | | 30,773 | | | 91,532 | | | 407,347 | |

| Earnings per common share: | | | | | | | | | |

| Net (loss) income attributable to Nelnet, Inc. shareholders - basic and diluted | $ | (0.23) | | | 1.21 | | | 0.83 | | | 2.45 | | | 10.83 | |

| Weighted average common shares outstanding - basic and diluted | 37,354,406 | | | 37,498,073 | | | 37,290,293 | | | 37,416,621 | | | 37,603,033 | |

Condensed Consolidated Balance Sheets

(Dollars in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | |

| As of | | As of | | As of |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| Assets: | | | | | |

| Loans and accrued interest receivable, net | $ | 13,108,204 | | | 13,867,557 | | | 15,243,889 | |

| Cash, cash equivalents, and investments | 2,039,080 | | | 2,133,378 | | | 2,230,063 | |

| Restricted cash and investments | 875,348 | | | 604,855 | | | 1,239,470 | |

| Goodwill and intangible assets, net | 202,848 | | | 228,812 | | | 240,403 | |

| Other assets | 511,165 | | | 388,080 | | | 420,219 | |

| Total assets | $ | 16,736,645 | | | 17,222,682 | | | 19,374,044 | |

| Liabilities: | | | | | |

| Bonds and notes payable | $ | 11,828,393 | | | 12,448,109 | | | 14,637,195 | |

| Bank deposits | 743,599 | | | 718,053 | | | 691,322 | |

| Other liabilities | 942,738 | | | 797,365 | | | 845,625 | |

| Total liabilities | 13,514,730 | | | 13,963,527 | | | 16,174,142 | |

| Equity: | | | | | |

| Total Nelnet, Inc. shareholders' equity | 3,262,621 | | | 3,294,981 | | | 3,198,959 | |

| Noncontrolling interests | (40,706) | | | (35,826) | | | 943 | |

| Total equity | 3,221,915 | | | 3,259,155 | | | 3,199,902 | |

| Total liabilities and equity | $ | 16,736,645 | | | 17,222,682 | | | 19,374,044 | |

Overview

The Company is a diverse, innovative company with a purpose to serve others and a vision to make dreams possible. The largest operating businesses engage in loan servicing and education technology services and payments. A significant portion of the Company's revenue is net interest income earned on a portfolio of federally insured student loans. The Company also makes investments to further diversify both within and outside of its historical core education-related businesses including, but not limited to, investments in a fiber communications company (ALLO), early-stage and emerging growth companies (venture capital investments), real estate, and renewable energy (solar).

The Company was formed as a Nebraska corporation in 1978 to service federal student loans for two local banks. The Company built on this initial foundation as a servicer to become a leading originator, holder, and servicer of federal student loans, principally consisting of loans originated under the FFEL Program.

The Health Care and Education Reconciliation Act of 2010 discontinued new loan originations under the FFEL Program in 2010, and requires all new federal student loan originations be made directly by the Department through the Federal Direct Loan Program. Subsequent to the Reconciliation Act of 2010, the Company no longer originates FFELP loans. However, a significant portion of the Company's income continues to be derived from its existing FFELP student loan portfolio. Interest income on the Company's existing FFELP loan portfolio will decline over time as the portfolio is paid down. To reduce its reliance on interest income from FFELP loans, the Company has expanded its services and products. This expansion has been accomplished through internal growth and innovation as well as business and certain investment acquisitions. The Company is also actively expanding its private education, consumer, and other loan portfolios, or investment interests therein, and as part of this strategy launched Nelnet Bank in 2020. In addition, the Company has been servicing federally owned student loans for the Department since 2009.

GAAP Net Income and Non-GAAP Net Income, Excluding Adjustments

The Company prepares its financial statements and presents its financial results in accordance with GAAP. However, it also provides additional non-GAAP financial information related to specific items management believes to be important in the evaluation of its operating results and performance. A reconciliation of the Company's GAAP net income to Non-GAAP net income, excluding derivative market value adjustments, and a discussion of why the Company believes providing this additional information is useful to investors, is provided below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Year ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| GAAP net (loss) income attributable to Nelnet, Inc. | $ | (8,554) | | | 45,332 | | | 30,773 | | | 91,532 | | | 407,347 | |

| Realized and unrealized derivative market value adjustments | 9,507 | | | (3,140) | | | 7,434 | | | 41,773 | | | (231,691) | |

| Tax effect (a) | (2,282) | | | 754 | | | (1,784) | | | (10,026) | | | 55,606 | |

| Non-GAAP net (loss) income attributable to Nelnet, Inc., excluding derivative market value adjustments (b) | $ | (1,329) | | | 42,946 | | | 36,423 | | | 123,279 | | | 231,262 | |

| | | | | | | | | |

| Earnings per share: | | | | | | | | | |

| GAAP net (loss) income attributable to Nelnet, Inc. | $ | (0.23) | | | 1.21 | | | 0.83 | | | 2.45 | | | 10.83 | |

| Realized and unrealized derivative market value adjustments | 0.25 | | | (0.08) | | | 0.20 | | | 1.12 | | | (6.16) | |

| Tax effect (a) | (0.06) | | | 0.02 | | | (0.05) | | | (0.28) | | | 1.48 | |

| Non-GAAP net (loss) income attributable to Nelnet, Inc., excluding derivative market value adjustments (b) | $ | (0.04) | | | 1.15 | | | 0.98 | | | 3.29 | | | 6.15 | |

(a) The tax effects are calculated by multiplying the realized and unrealized derivative market value adjustments by the applicable statutory income tax rate.

(b) "Derivative market value adjustments" includes both the realized portion of gains and losses (corresponding to variation margin received or paid on derivative instruments that are settled daily at a central clearinghouse) and the unrealized portion of gains and losses that are caused by changes in fair values of derivatives which do not qualify for "hedge treatment" under GAAP. "Derivative market value adjustments" does not include "derivative settlements" that represent the cash paid or received during the current period to settle with derivative instrument counterparties the economic effect of the Company's derivative instruments based on their contractual terms.

The accounting for derivatives requires that changes in the fair value of derivative instruments be recognized currently in earnings, with no fair value adjustment of the hedged item, unless specific hedge accounting criteria is met. Management has structured all of the Company’s derivative transactions with the intent that each is economically effective; however, the Company’s derivative instruments do not qualify for hedge accounting in the consolidated financial statements. As a result, the change in fair value of derivative instruments is reported in current period earnings with no consideration for the corresponding change in fair value of the hedged item. Under GAAP, the cumulative net realized and unrealized gain or loss caused by changes in fair values of derivatives in which the Company plans to hold to maturity will equal zero over the life of the contract. However, the net realized and unrealized gain or loss during any given reporting period fluctuates significantly from period to period.

The Company believes these point-in-time estimates of asset and liability values related to its derivative instruments that are subject to interest rate fluctuations are subject to volatility mostly due to timing and market factors beyond the control of management, and affect the period-to-period comparability of the results of operations. Accordingly, the Company’s management utilizes operating results excluding these items for comparability purposes when making decisions regarding the Company’s performance and in presentations with credit rating agencies, lenders, and investors. Consequently, the Company reports this non-GAAP information because the Company believes that it provides additional information regarding operational and performance indicators that are closely assessed by management. There is no comprehensive, authoritative guidance for the presentation of such non-GAAP information, which is only meant to supplement GAAP results by providing additional information that management utilizes to assess performance.

Operating Segments

A description of the Company's reportable operating segments is included in note 1 of the notes to consolidated financial statements included in the Company's 2023 Annual Report. The Company's reportable operating segments include:

•Loan Servicing and Systems (LSS) - referred to as Nelnet Diversified Services (NDS)

•Education Technology Services and Payments (ETSP) - referred to as Nelnet Business Services (NBS)

•Asset Generation and Management (AGM), part of the Nelnet Financial Services (NFS) division

•Nelnet Bank, part of the NFS division

The Company earns fee-based revenue through its NDS and NBS reportable operating segments. The Company earns net interest income on its loan portfolio, consisting primarily of FFELP loans, in its AGM reportable operating segment. This segment is expected to generate significant amounts of cash as the FFELP portfolio amortizes. The Company actively works to maximize the amount and timing of cash flows generated from its FFELP portfolio and seeks to acquire additional loan assets to leverage its servicing scale and expertise to generate incremental earnings and cash flow. Nelnet Bank operates as an internet industrial bank franchise focused on the private education and unsecured consumer loan markets, with a home office in Salt Lake City, Utah.

The Company formally established the Nelnet Financial Services division in 2023 intended to focus on the Company’s key objective to maximize the amount and timing of cash flows generated from its FFELP portfolio and reposition itself for the post-FFELP environment by expanding its private education, consumer, and other loan portfolios.

The creation of NFS resulted in financial results grouped and reported differently to the Company’s chief operating decision maker. In addition to AGM and Nelnet Bank being part of the NFS division, NFS’s other operating segments that are not reportable (that were previously included in Corporate and Other Activities) include:

•The operating results of Whitetail Rock Capital Management, LLC (WRCM), the Company's U.S. Securities and Exchange Commission (SEC)-registered investment advisor subsidiary

•The operating results of Nelnet Insurance Services, which primarily includes multiple reinsurance treaties on property and causality policies

•The operating results of the Company’s investment activities in real estate

•The operating results of the Company’s investment debt securities (primarily student loan and other asset-backed securities) and interest expense incurred on debt used to finance such investments

Other business activities and operating segments that are not reportable and not part of the NFS division are combined and included in Corporate and Other Activities ("Corporate"). Corporate includes the following items:

•Shared service activities related to internal audit, human resources, accounting, legal, enterprise risk management, information technology, occupancy, and marketing. These costs are allocated to each operating segment based on estimated use of such activities and services

•Corporate costs and overhead functions not allocated to operating segments, including executive management, investments in innovation, and other holding company organizational costs

•The operating results of Nelnet Renewable Energy, which include solar tax equity investments made by the Company, administrative and management services provided by the Company on tax equity investments made by third parties, and solar construction and development

•The operating results of certain of the Company’s investment activities, including its investment in ALLO and early-stage and emerging growth companies (venture capital investments)

•Interest income earned on cash balances held at the corporate level and interest expense incurred on unsecured corporate related debt transactions

•Other product and service offerings that are not considered reportable operating segments

The following table presents the operating results (net income (loss) before taxes) for each of the Company’s reportable and certain other operating segments reconciled to the consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Year ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| NDS | $ | 10,999 | | | 24,469 | | | 16,962 | | | 77,714 | | | 64,456 | |

| NBS | 13,297 | | | 22,123 | | | 7,651 | | | 91,101 | | | 74,105 | |

| Nelnet Financial Services division: | | | | | | | | | |

| AGM | 22,591 | | | 40,562 | | | 30,077 | | | 80,636 | | | 454,725 | |

| Nelnet Bank | (4,319) | | | 2,299 | | | 1,869 | | | (368) | | | 4,357 | |

| NFS Other Operating Segments: | | | | | | | | | |

| WRCM | 1,733 | | | 1,503 | | | 1,509 | | | 6,203 | | | 5,448 | |

| Nelnet Insurance Services | 2,770 | | | 74 | | | 2,147 | | | 4,115 | | | 6,136 | |

| Real estate investments | (316) | | | (31) | | | 8,481 | | | (8) | | | 24,301 | |

| Investment securities | 15,365 | | | 7,674 | | | 9,251 | | | 40,562 | | | 15,617 | |

| Corporate: | | | | | | | | | |

| Unallocated corporate costs | (15,190) | | | (20,915) | | | (18,817) | | | (63,223) | | | (72,183) | |

| Nelnet Renewable Energy | (74,651) | | | (10,736) | | | (2,104) | | | (108,991) | | | (11,639) | |

| ALLO investment | (13,444) | | | (15,559) | | | (23,624) | | | (57,972) | | | (65,245) | |

| Venture capital investments | (2,845) | | | (900) | | | (1,985) | | | (6,008) | | | 12,449 | |

| Other corporate activities | 4,372 | | | 2,408 | | | 2,025 | | | 10,428 | | | (3,065) | |

| Net (loss) income before taxes | (39,635) | | | 52,970 | | | 33,441 | | | 74,188 | | | 509,465 | |

| Income tax benefit (expense) | 9,722 | | | (10,734) | | | (5,459) | | | (19,753) | | | (113,224) | |

| Net loss attributable to noncontrolling interests (a) | 21,359 | | | 3,096 | | | 2,791 | | | 37,097 | | | 11,106 | |

| Net (loss) income | $ | (8,554) | | | 45,332 | | | 30,773 | | | 91,532 | | | 407,347 | |

(a) For the periods presented, the majority of noncontrolling interests represents losses attributed to minority membership interests in the Company’s Nelnet Renewable Energy operating segment, which were $21.5 million, $3.3 million, and $2.9 million for the three months ended December 31, 2023, September 30, 2023, and December 31, 2022, respectively, and $37.6 million and $11.6 million for the years ended December 31, 2023 and 2022, respectively.

2023 Operating and Liquidity Highlights

See below for a summary of (i) certain highlights of the Company’s 2023 operating results; (ii) a description of significant and/or unusual events and transactions in 2023 that impacted and may potentially impact the Company’s operating results; and (iii) a summary of the Company’s current liquidity, including certain items that impacted the Company’s liquidity in 2023.

Loan Servicing and Systems

Effective April 1, 2023, the Department modified the loan servicing contract between the Department and Nelnet Servicing to reduce the monthly fee under the servicing contract by $0.19 per borrower. In addition, beginning in the second quarter of 2023, the Department transferred one million of the Company’s existing Department servicing borrowers to another third-party servicer. These items negatively impacted LSS’s government servicing revenue in 2023.

In the first quarter of 2023, the Company reduced staff to manage expenses due to (i) the delays in the government’s student debt relief and return to repayment programs under the CARES Act, (ii) the April 2023 monthly fee reduction on the government contract, and (iii) the transfer of government borrowers from the Company to another servicer. The staff reductions resulted in salaries and benefits expense being reduced in 2023 as compared with 2022. In 2022, the Company was fully staffed in preparation of the expiration of the student loan payment pause under the CARES Act. In August 2023, the Company began to hire additional associates to support borrowers returning to repayment on September 1, 2023.

In April 2023, the Company and four other third-party servicers were awarded servicing contracts to provide continued servicing for the Department under a new Unified Servicing and Data Solutions (USDS) contract which will replace the existing Department student loans servicing contracts. The Company’s new contract has a five year base period, with 5 years of possible extensions. The new USDS servicing contracts have multiple revenue components with tiered pricing based on borrower volume, while revenue earned under the legacy servicing contract is primarily based on borrower status. Assuming borrower volume remains consistent

under the USDS servicing contract, the Company expects revenue earned on a per borrower blended basis will decrease under the USDS contract versus the current legacy contract.

Education Technology Services and Payments

Education technology services and payments revenue grew to $463.3 million in 2023. The growth was from existing and new customers. Operating margin decreased from recent historical periods as a result of continued investments in the development of new services and technologies and superior customer service. Due to an increase in interest rates, the Company recognized $27.0 million in interest income on tuition funds held in custody for schools, an increase from $9.4 million in 2022.

Asset Generation and Management

Net interest income was negatively impacted in 2023 due to the expected continued amortization of the Company’s FFELP student loan portfolio. The average balance of student loans decreased $2.7 billion from $16.0 billion in 2022 to $13.3 billion in 2023. Since late 2021, the Company has experienced accelerated run-off of its FFELP portfolio due to initiatives offered by the Department for FFELP borrowers to consolidate their loans to qualify for loan forgiveness, income-driven repayment plans, and other programs. Interest income was also negatively impacted by an increase in interest rates. As a result of an increase in interest rates, gross fixed rate floor income recognized by the Company was only $2.2 million in 2023 compared with $57.4 million in 2022. Based on current interest rates, the Company does not anticipate earning a significant amount of fixed rate floor income in the foreseeable future.

In the second quarter of 2023, the Company redeemed certain asset-backed debt securities prior to their maturity, resulting in the recognition of $25.9 million in interest expense from the write-off of the remaining unamortized debt discount associated with these bonds at the time of redemption.

Nelnet Renewable Energy

Nelnet Renewable Energy includes solar tax equity investments made by the Company, administrative and management services provided by the Company on tax equity investments made by third parties, and solar construction and development. During 2023, the Company invested a total of $185.1 million (which included $94.5 million syndicated to third-party investors) in solar tax equity investments. Due to the management and control of each of these investment partnerships, such partnerships that invest in tax equity investments are consolidated on the Company’s consolidated financial statements, with the co-investor’s portion being presented as noncontrolling interests. Included in the Company’s operating results is the Company's share of income or loss from solar investments accounted for under the Hypothetical Liquidation at Book Value (HLBV) method of accounting. For the majority of the Company's solar investments, the HLBV method of accounting results in accelerated losses in the initial years of investment. Nelnet Renewable Energy recognized pre-tax losses on its tax equity investments of $46.7 million in 2023, which includes $26.4 million attributable to noncontrolling interests.

In periods in which the Company makes significant investments in solar tax equity investments, operating results are negatively impacted due to the accelerated losses recognized in the initial years of investment. However, given the timing and amount of cash flows expected to be generated over the life of these investments, the Company considers these investments a good use of capital. Through December 31, 2023, the Company has recognized cumulative pre-tax losses (excluding noncontrolling interests) of approximately $56 million on its tax equity investments. The Company expects its current investments (assuming no additional investments are made subsequent to December 31, 2023) to generate approximately $78 million of pre-tax earnings (excluding noncontrolling interests) over the life of the investments. Accordingly, the Company expects to recognize approximately $134 million in pre-tax income (excluding noncontrolling interests) over the remaining years of its current investments.

In addition to solar tax equity investments, the Company has a strategy to own solar energy project assets. Accordingly, the Company has begun to execute a multi-faceted approach to construct, finance, own, and operate these assets. As part of this strategy, on July 1, 2022, the Company acquired 80% of GRNE Solar, a solar construction company that provides full-service engineering, procurement, and construction (EPC) services to residential homes and commercial entities. Since the acquisition of GRNE, it has incurred low and, in some cases, negative margins on certain projects. In addition, higher interest rates reduced residential demand and made community solar projects more costly. GRNE Solar recognized a net loss of $34.2 million in 2023. In the fourth quarter of 2023, the Company recognized an impairment charge of $20.6 million related to goodwill and certain intangible assets initially recognized from the GRNE Solar acquisition. Due to the complexity and long-term nature of GRNE’s existing construction contracts, GRNE may continue to incur low and/or negative margins to complete projects currently under contract.

Investments - ALLO and Hudl

The Company has a 45% voting membership interests in ALLO. The Company accounts for its ALLO voting membership interests investment under the HLBV method of accounting that resulted in the recognition of a net loss of $65.3 million during the year

ended December 31, 2023. As of December 31, 2023, the carrying amount of the Company’s investment in ALLO was $10.7 million. The Company expects to fully expense the remaining investment balance of ALLO during the first quarter of 2024.

The Company has an investment in Agile Sports Technologies, Inc. (doing business as “Hudl.”) During the first quarter of 2023, the Company acquired additional ownership interests in Hudl for $31.5 million from existing Hudl investors. This transaction was not considered an observable market transaction (not orderly) because it was not subject to customary marketing activities. Accordingly, the Company did not adjust its carrying value of its Hudl investment to the transaction value. As of December 31, 2023, the carrying amount of the Company's investment in Hudl is $165.5 million.

Certain investments, including solar tax equity, ALLO, and Hudl, may be recorded at a carrying value that is less than its market value due to HLBV (solar investments and ALLO) and the measurement alternative (Hudl) method of accounting. Future operating results of solar and ALLO or an observable transaction of Hudl could impact the valuation on our financial statements or our investments in them and may result in significant fluctuations of the Company’s earnings.

Liquidity

The Company had a significant portfolio of derivative instruments, in which the Company paid a fixed rate and received a floating rate to economically hedge loans earning fixed rate floor income. On March 15, 2023, to minimize the Company's exposure to market volatility and increase liquidity, the Company terminated its entire derivative portfolio hedging loans earning fixed rate floor income and retained the $183.2 million of cash (representing the termination date fair value of the derivatives) from its clearinghouse.

As of December 31, 2023, the Company had $740.0 million of unencumbered cash and investments. In addition, the Company has a $495.0 million unsecured line of credit that matures in September 2026. No amounts were outstanding on the line of credit as of December 31, 2023. In addition, as of December 31, 2023, the Company expects to generate future undiscounted cash flows from its AGM loan portfolio of approximately $1.30 billion, including approximately $850.0 million in the next five years.

The Company intends to use its liquidity position to capitalize on market opportunities, including FFELP, private education, consumer, and other loan acquisitions (or investment interests therein); strategic acquisitions and investments; and capital management initiatives, including stock repurchases, debt repurchases, and dividend distributions. The timing and size of these opportunities will vary and will have a direct impact on the Company's cash and investment balances.

Segment Reporting

The following tables include the results of each of the Company's reportable operating segments reconciled to the consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, 2023 |

| | | | | Nelnet Financial Services | | | | | | |

| Loan Servicing and Systems | | Education Technology Services and Payments | | Asset

Generation and

Management | | Nelnet Bank | | NFS Other Operating Segments | | Corporate and Other Activities | | Eliminations | | Total |

| Total interest income | $ | 1,651 | | | 6,725 | | | 239,798 | | | 16,767 | | | 20,376 | | | 3,315 | | | (13,379) | | | 275,253 | |

| Interest expense | — | | | — | | | 204,179 | | | 9,863 | | | 4,887 | | | (216) | | | (13,379) | | | 205,335 | |

| Net interest income | 1,651 | | | 6,725 | | | 35,619 | | | 6,904 | | | 15,489 | | | 3,531 | | | — | | | 69,918 | |

| Less provision for loan losses | — | | | — | | | 8,286 | | | 2,638 | | | — | | | — | | | — | | | 10,924 | |

| Net interest income after provision for loan losses | 1,651 | | | 6,725 | | | 27,333 | | | 4,266 | | | 15,489 | | | 3,531 | | | — | | | 58,994 | |

| Other income (expense): | | | | | | | | | | | | | | | |

| Loan servicing and systems revenue | 128,816 | | | — | | | — | | | — | | | — | | | — | | | — | | | 128,816 | |

| Intersegment revenue | 6,931 | | | 55 | | | — | | | — | | | — | | | — | | | (6,986) | | | — | |

| Education technology services and payments revenue | — | | | 106,052 | | | — | | | — | | | — | | | — | | | — | | | 106,052 | |

| Solar construction revenue | — | | | — | | | — | | | — | | | — | | | 11,982 | | | — | | | 11,982 | |

| Other, net | 688 | | | — | | | 4,329 | | | (298) | | | 11,561 | | | (43,774) | | | — | | | (27,493) | |

| Gain (loss) on sale of loans, net | — | | | — | | | 6,987 | | | — | | | — | | | — | | | — | | | 6,987 | |

| Impairment expense | — | | | (4,310) | | | — | | | — | | | — | | | (22,641) | | | — | | | (26,951) | |

| Derivative settlements, net | — | | | — | | | 648 | | | 205 | | | — | | | — | | | — | | | 853 | |

| Derivative market value adjustments, net | — | | | — | | | (4,927) | | | (4,580) | | | — | | | — | | | — | | | (9,507) | |

| Total other income (expense), net | 136,435 | | | 101,797 | | | 7,037 | | | (4,673) | | | 11,561 | | | (54,433) | | | (6,986) | | | 190,739 | |

| Cost of services: | | | | | | | | | | | | | | | |

| Cost to provide education technology services and payments | — | | | 39,379 | | | — | | | — | | | — | | | — | | | — | | | 39,379 | |

| Cost to provide solar construction services | — | | | — | | | — | | | — | | | — | | | 23,371 | | | — | | | 23,371 | |

| Total cost of services | — | | | 39,379 | | | — | | | — | | | — | | | 23,371 | | | — | | | 62,750 | |

| Operating expenses: | | | | | | | | | | | | | | | |

| Salaries and benefits | 83,874 | | | 39,256 | | | 1,099 | | | 2,194 | | | 413 | | | 26,844 | | | (763) | | | 152,917 | |

| Depreciation and amortization | 4,858 | | | 2,895 | | | — | | | 259 | | | — | | | 13,993 | | | — | | | 22,004 | |

| Other expenses | 17,757 | | | 8,070 | | | 2,645 | | | 1,298 | | | 6,949 | | | 14,980 | | | — | | | 51,697 | |

| Intersegment expenses, net | 20,598 | | | 5,625 | | | 8,035 | | | 161 | | | 136 | | | (28,332) | | | (6,223) | | | — | |

| Total operating expenses | 127,087 | | | 55,846 | | | 11,779 | | | 3,912 | | | 7,498 | | | 27,485 | | | (6,986) | | | 226,618 | |

| Income (loss) before income taxes | 10,999 | | | 13,297 | | | 22,591 | | | (4,319) | | | 19,552 | | | (101,758) | | | — | | | (39,635) | |

| Income tax (expense) benefit | (2,640) | | | (3,190) | | | (5,422) | | | 1,066 | | | (4,656) | | | 24,565 | | | — | | | 9,722 | |

| Net income (loss) | 8,359 | | | 10,107 | | | 17,169 | | | (3,253) | | | 14,896 | | | (77,193) | | | — | | | (29,913) | |

| Net (income) loss attributable to noncontrolling interests | — | | | (4) | | | — | | | — | | | (151) | | | 21,514 | | | — | | | 21,359 | |

| Net income (loss) attributable to Nelnet, Inc. | $ | 8,359 | | | 10,103 | | | 17,169 | | | (3,253) | | | 14,745 | | | (55,679) | | | — | | | (8,554) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, 2023 |

| | | | | Nelnet Financial Services | | | | | | |

| Loan Servicing and Systems | | Education Technology Services and Payments | | Asset

Generation and

Management | | Nelnet Bank | | NFS Other Operating Segments | | Corporate and Other Activities | | Eliminations | | Total |

| Total interest income | $ | 1,098 | | | 8,934 | | | 248,878 | | | 15,171 | | | 13,021 | | | 3,232 | | | (5,783) | | | 284,551 | |

| Interest expense | — | | | — | | | 197,393 | | | 9,456 | | | 5,661 | | | 431 | | | (5,783) | | | 207,159 | |

| Net interest income | 1,098 | | | 8,934 | | | 51,485 | | | 5,715 | | | 7,360 | | | 2,801 | | | — | | | 77,392 | |

| Less provision for loan losses | — | | | — | | | 8,732 | | | 1,927 | | | — | | | — | | | — | | | 10,659 | |

| Net interest income after provision for loan losses | 1,098 | | | 8,934 | | | 42,753 | | | 3,788 | | | 7,360 | | | 2,801 | | | — | | | 66,733 | |

| Other income (expense): | | | | | | | | | | | | | | | |

| Loan servicing and systems revenue | 127,892 | | | — | | | — | | | — | | | — | | | — | | | — | | | 127,892 | |

| Intersegment revenue | 6,944 | | | 77 | | | — | | | — | | | — | | | — | | | (7,021) | | | — | |

| Education technology services and payments revenue | — | | | 113,796 | | | — | | | — | | | — | | | — | | | — | | | 113,796 | |

| Solar construction revenue | — | | | — | | | — | | | — | | | — | | | 6,301 | | | — | | | 6,301 | |

| Other, net | 687 | | | — | | | 2,776 | | | 565 | | | 9,861 | | | (14,099) | | | — | | | (211) | |

| Gain (loss) on sale of loans, net | — | | | — | | | 5,362 | | | — | | | — | | | — | | | — | | | 5,362 | |

| Impairment expense | (296) | | | — | | | — | | | — | | | — | | | (4,678) | | | — | | | (4,974) | |

| Derivative settlements, net | — | | | — | | | 621 | | | 196 | | | — | | | — | | | — | | | 817 | |

| Derivative market value adjustments, net | — | | | — | | | 1,192 | | | 1,948 | | | — | | | — | | | — | | | 3,140 | |

| Total other income (expense), net | 135,227 | | | 113,873 | | | 9,951 | | | 2,709 | | | 9,861 | | | (12,476) | | | (7,021) | | | 252,123 | |

| Cost of services: | | | | | | | | | | | | | | | |

| Cost to provide education technology services and payments | — | | | 43,694 | | | — | | | — | | | — | | | — | | | — | | | 43,694 | |

| Cost to provide solar construction services | — | | | — | | | — | | | — | | | — | | | 7,783 | | | — | | | 7,783 | |

| Total cost of services | — | | | 43,694 | | | — | | | — | | | — | | | 7,783 | | | — | | | 51,477 | |

| Operating expenses: | | | | | | | | | | | | | | | |

| Salaries and benefits | 73,310 | | | 39,776 | | | 1,242 | | | 2,520 | | | 288 | | | 24,731 | | | (663) | | | 141,204 | |

| Depreciation and amortization | 5,023 | | | 3,030 | | | — | | | 259 | | | — | | | 13,522 | | | — | | | 21,835 | |

| Other expenses | 15,629 | | | 8,309 | | | 2,952 | | | 1,290 | | | 7,522 | | | 15,670 | | | — | | | 51,370 | |

| Intersegment expenses, net | 17,894 | | | 5,875 | | | 7,948 | | | 129 | | | 191 | | | (25,679) | | | (6,358) | | | — | |

| Total operating expenses | 111,856 | | | 56,990 | | | 12,142 | | | 4,198 | | | 8,001 | | | 28,244 | | | (7,021) | | | 214,409 | |

| Income (loss) before income taxes | 24,469 | | | 22,123 | | | 40,562 | | | 2,299 | | | 9,220 | | | (45,702) | | | — | | | 52,970 | |

| Income tax (expense) benefit | (5,872) | | | (5,307) | | | (9,735) | | | (552) | | | (2,177) | | | 12,909 | | | — | | | (10,734) | |

| Net income (loss) | 18,597 | | | 16,816 | | | 30,827 | | | 1,747 | | | 7,043 | | | (32,793) | | | — | | | 42,236 | |

| Net (income) loss attributable to noncontrolling interests | — | | | (6) | | | — | | | — | | | (149) | | | 3,251 | | | — | | | 3,096 | |

| Net income (loss) attributable to Nelnet, Inc. | $ | 18,597 | | | 16,810 | | | 30,827 | | | 1,747 | | | 6,894 | | | (29,542) | | | — | | | 45,332 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, 2022 |

| | | | | Nelnet Financial Services | | | | | | |

| Loan Servicing and Systems | | Education Technology Services and Payments | | Asset

Generation and

Management | | Nelnet Bank | | NFS Other Operating Segments | | Corporate and Other Activities | | Eliminations | | Total |

| Total interest income | $ | 1,578 | | | 4,457 | | | 234,631 | | | 10,181 | | | 19,946 | | | 1,543 | | | (9,446) | | | 262,890 | |

| Interest expense | — | | | — | | | 176,180 | | | 5,263 | | | 11,637 | | | (1,845) | | | (9,446) | | | 181,790 | |

| Net interest income | 1,578 | | | 4,457 | | | 58,451 | | | 4,918 | | | 8,309 | | | 3,388 | | | — | | | 81,100 | |

| Less provision for loan losses | — | | | — | | | 27,423 | | | 378 | | | — | | | — | | | — | | | 27,801 | |

| Net interest income after provision for loan losses | 1,578 | | | 4,457 | | | 31,028 | | | 4,540 | | | 8,309 | | | 3,388 | | | — | | | 53,299 | |

| Other income (expense): | | | | | | | | | | | | | | | |

| Loan servicing and systems revenue | 140,021 | | | — | | | — | | | — | | | — | | | — | | | — | | | 140,021 | |

| Intersegment revenue | 8,028 | | | 64 | | | — | | | — | | | — | | | — | | | (8,092) | | | — | |

| Education technology services and payments revenue | — | | | 98,332 | | | — | | | — | | | — | | | — | | | — | | | 98,332 | |

| Solar construction revenue | — | | | — | | | — | | | — | | | — | | | 15,186 | | | — | | | 15,186 | |

| Other, net | 597 | | | — | | | 4,898 | | | 402 | | | 11,953 | | | (17,114) | | | — | | | 735 | |

| Gain (loss) on sale of loans, net | — | | | — | | | (2,712) | | | — | | | — | | | — | | | — | | | (2,713) | |

| Impairment expense | (5,511) | | | (2,239) | | | — | | | (214) | | | — | | | (1,397) | | | — | | | (9,361) | |

| Derivative settlements, net | — | | | — | | | 20,858 | | | — | | | — | | | — | | | — | | | 20,858 | |

| Derivative market value adjustments, net | — | | | — | | | (7,434) | | | — | | | — | | | — | | | — | | | (7,434) | |

| Total other income (expense), net | 143,135 | | | 96,157 | | | 15,610 | | | 188 | | | 11,953 | | | (3,325) | | | (8,092) | | | 255,624 | |

| Cost of services: | | | | | | | | | | | | | | | |

| Cost to provide education technology services and payments | — | | | 39,330 | | | — | | | — | | | — | | | — | | | — | | | 39,330 | |

| Cost to provide solar construction services | — | | | — | | | — | | | — | | | — | | | 14,003 | | | — | | | 14,004 | |

| Total cost of services | — | | | 39,330 | | | — | | | — | | | — | | | 14,003 | | | — | | | 53,334 | |

| Operating expenses: | | | | | | | | | | | | | | | |

| Salaries and benefits | 87,550 | | | 35,072 | | | 666 | | | 1,866 | | | 222 | | | 26,193 | | | — | | | 151,568 | |

| Depreciation and amortization | 8,199 | | | 2,639 | | | — | | | 4 | | | — | | | 9,258 | | | — | | | 20,099 | |

| Other expenses | 13,299 | | | 10,555 | | | 6,910 | | | 916 | | | 424 | | | 18,378 | | | — | | | 50,481 | |

| Intersegment expenses, net | 18,703 | | | 5,367 | | | 8,985 | | | 73 | | | (1,772) | | | (23,264) | | | (8,092) | | | — | |

| Total operating expenses | 127,751 | | | 53,633 | | | 16,561 | | | 2,859 | | | (1,126) | | | 30,565 | | | (8,092) | | | 222,148 | |

| Income (loss) before income taxes | 16,962 | | | 7,651 | | | 30,077 | | | 1,869 | | | 21,388 | | | (44,505) | | | — | | | 33,441 | |

| Income tax (expense) benefit | (4,071) | | | (1,838) | | | (7,219) | | | (439) | | | (5,100) | | | 13,207 | | | — | | | (5,459) | |

| Net income (loss) | 12,891 | | | 5,813 | | | 22,858 | | | 1,430 | | | 16,288 | | | (31,298) | | | — | | | 27,982 | |

| Net (income) loss attributable to noncontrolling interests | — | | | 5 | | | — | | | — | | | (138) | | | 2,924 | | | — | | | 2,791 | |

| Net income (loss) attributable to Nelnet, Inc. | $ | 12,891 | | | 5,818 | | | 22,858 | | | 1,430 | | | 16,150 | | | (28,374) | | | — | | | 30,773 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year ended December 31, 2023 |

| | | | | Nelnet Financial Services | | | | | | |

| Loan Servicing and Systems | | Education Technology Services and Payments | | Asset

Generation and

Management | | Nelnet Bank | | NFS Other Operating Segments | | Corporate and Other Activities | | Eliminations | | Total |

| Total interest income | $ | 4,845 | | | 26,962 | | | 977,158 | | | 57,859 | | | 74,857 | | | 12,141 | | | (44,021) | | | 1,109,800 | |

| Interest expense | — | | | — | | | 823,084 | | | 34,704 | | | 29,747 | | | 1,578 | | | (44,021) | | | 845,091 | |

| Net interest income | 4,845 | | | 26,962 | | | 154,074 | | | 23,155 | | | 45,110 | | | 10,563 | | | — | | | 264,709 | |

| Less provision for loan losses | — | | | — | | | 56,975 | | | 8,475 | | | — | | | — | | | — | | | 65,450 | |

| Net interest income after provision for loan losses | 4,845 | | | 26,962 | | | 97,099 | | | 14,680 | | | 45,110 | | | 10,563 | | | — | | | 199,259 | |

| Other income (expense): | | | | | | | | | | | | | | | |

| Loan servicing and systems revenue | 517,954 | | | — | | | — | | | — | | | — | | | — | | | — | | | 517,954 | |

| Intersegment revenue | 28,911 | | | 253 | | | — | | | — | | | — | | | — | | | (29,164) | | | — | |

| Education technology services and payments revenue | — | | | 463,311 | | | — | | | — | | | — | | | — | | | — | | | 463,311 | |

| Solar construction revenue | — | | | — | | | — | | | — | | | — | | | 31,669 | | | — | | | 31,669 | |

| Other, net | 2,587 | | | — | | | 11,269 | | | 1,095 | | | 26,648 | | | (90,385) | | | — | | | (48,787) | |

| Gain (loss) on sale of loans, net | — | | | — | | | 39,673 | | | — | | | — | | | — | | | — | | | 39,673 | |

| Impairment expense | (296) | | | (4,310) | | | — | | | — | | | — | | | (27,319) | | | — | | | (31,925) | |

| Derivative settlements, net | — | | | — | | | 24,588 | | | 484 | | | — | | | — | | | — | | | 25,072 | |

| Derivative market value adjustments, net | — | | | — | | | (40,250) | | | (1,523) | | | — | | | — | | | — | | | (41,773) | |

| Total other income (expense), net | 549,156 | | | 459,254 | | | 35,280 | | | 56 | | | 26,648 | | | (86,035) | | | (29,164) | | | 955,194 | |

| Cost of services: | | | | | | | | | | | | | | | |

| Cost to provide education technology services and payments | — | | | 171,183 | | | — | | | — | | | — | | | — | | | — | | | 171,183 | |

| Cost to provide solar construction services | — | | | — | | | — | | | — | | | — | | | 48,576 | | | — | | | 48,576 | |

| Total cost of services | — | | | 171,183 | | | — | | | — | | | — | | | 48,576 | | | — | | | 219,759 | |

| Operating expenses: | | | | | | | | | | | | | | | |

| Salaries and benefits | 317,885 | | | 155,296 | | | 4,191 | | | 9,074 | | | 1,130 | | | 105,531 | | | (1,571) | | | 591,537 | |

| Depreciation and amortization | 19,257 | | | 11,319 | | | — | | | 574 | | | — | | | 47,969 | | | — | | | 79,118 | |

| Other expenses | 60,517 | | | 34,133 | | | 14,728 | | | 4,994 | | | 19,172 | | | 56,307 | | | — | | | 189,851 | |

| Intersegment expenses, net | 78,628 | | | 23,184 | | | 32,824 | | | 462 | | | 584 | | | (108,089) | | | (27,593) | | | — | |

| Total operating expenses | 476,287 | | | 223,932 | | | 51,743 | | | 15,104 | | | 20,886 | | | 101,718 | | | (29,164) | | | 860,506 | |

| Income (loss) before income taxes | 77,714 | | | 91,101 | | | 80,636 | | | (368) | | | 50,872 | | | (225,766) | | | — | | | 74,188 | |

| Income tax (expense) benefit | (18,651) | | | (21,891) | | | (19,353) | | | 153 | | | (12,073) | | | 52,061 | | | — | | | (19,753) | |