0001552797false00015527972024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

February 27, 2024

Date of Report (Date of earliest event reported)

DELEK LOGISTICS PARTNERS, LP

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware | 001-35721 | 45-5379027 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

| | | |

310 Seven Springs Way, Suite 500 | Brentwood | Tennessee | 37027 |

(Address of Principal Executive) | | | (Zip Code) |

(615) 771-6701

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Units Representing Limited Partner Interests | DKL | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 2.02 Results of Operations and Financial Condition

On February 27, 2024, Delek Logistics Partners, LP (the “Partnership”) announced its financial results for the quarter ended December 31, 2023. The full text of the press release is furnished as Exhibit 99.1 hereto.

The information in the attached Exhibit is being furnished pursuant to Item 2.02 “Results of Operations and Financial Condition” on Form 8-K. The information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, each as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| (d) | | Exhibits. |

| | |

| | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

Date: February 27, 2024 | DELEK LOGISTICS PARTNERS, LP |

| By: Delek Logistics GP, LLC |

| its General Partner |

| |

| /s/ Reuven Spiegel |

| Name: Reuven Spiegel |

| Title: Executive Vice President and Chief Financial Officer (Principal Financial Officer) |

Delek Logistics Reports Fourth Quarter 2023 Results and 2024 Capital Program

Fourth Quarter

•Net income attributable to all partners of $22.1 million

•Quarterly EBITDA of $86.1 million, adjusted EBITDA of $100.9 million

•Distributable cash flow of $64.6 million, DCF coverage ratio of 1.40x

•Delivered 44 consecutive quarters of distribution growth with recent increase to $1.055/unit

2023 Full Year

•Net income attributable to all partners of $126.2 million

•EBITDA of $370.3 million, adjusted EBITDA of $385.1 million

•Distributable cash flow of $248.2 million, DCF coverage ratio of 1.37x

•Improved leverage ratio to 4.34x from 4.89x at year-end 2022

•Grew Midland gathering & processing volumes nearly 80%

•Rewarded unitholders with continued distribution growth

2024 Capital Program

•2024 capital expenditures are estimated to be approximately $70 million

BRENTWOOD, Tenn., February 27, 2024 -- Delek Logistics Partners, LP (NYSE: DKL) ("Delek Logistics") today announced its financial results for the fourth quarter 2023, with reported net income attributable to all partners of $22.1 million, or $0.51 per diluted common limited partner unit. This compares to net income attributable to all partners of $42.7 million, or $0.98 per diluted common limited partner unit, in the fourth quarter 2022. The decrease in net income attributable to all partners was driven by higher interest expense and a fourth quarter 2023 goodwill impairment. Net cash provided in operating activities was $114.7 million in the fourth quarter 2023 compared to net cash used in operating activities of $105.3 million in the fourth quarter 2022. Distributable cash flow was $64.6 million in the fourth quarter 2023, compared to $51.4 million in the fourth quarter 2022.

For the fourth quarter 2023, earnings before interest, taxes, depreciation and amortization ("EBITDA") was $86.1 million. Excluding the goodwill impairment, adjusted EBITDA was $100.9 million compared to $92.5 million in the fourth quarter 2022.

“I am pleased to say that Delek Logistics has exceeded quarterly earnings goals, and surpassed last year's strong performance,” said Avigal Soreq, President of Delek Logistics' general partner. “We saw substantial growth from new connections in our Midland gathering operations, further validating our strong position in the Permian Basin. The dedication of our workforce to having safe and reliable operations also contributed to our success. I'm proud of the team that has gone without a lost time injury 4-years in a row and counting. We are excited for Delek Logistics' future and numerous growth opportunities. The business looks to utilize capital investments in 2024 to support customer growth and expand upon existing assets."

“In January, the Board approved the 44th consecutive increase in the quarterly distribution to $1.055 per unit. Delek Logistics has a strong track record of delivering value to unitholders. We feel confident in our ability to maintain competitive distributions to our investors as we head into 2024," Mr. Soreq concluded.

Distribution and Liquidity

On January 24, 2024, Delek Logistics declared a quarterly cash distribution of $1.055 per common limited partner unit for the fourth quarter 2023. This distribution was paid on February 12, 2024 to unitholders of record on February 5, 2024. This represents a 1.0% increase from the third quarter 2023 distribution of $1.045 per common limited partner unit, and a 3.4% increase over Delek Logistics’ fourth quarter 2022 distribution of $1.020 per common limited partner unit. For the fourth quarter 2023, the total cash distribution declared to all partners was approximately $46.0 million, resulting in a distributable cash flow ("DCF") coverage ratio of 1.40x.

As of December 31, 2023, Delek Logistics had total debt of approximately $1.70 billion and cash of $3.8 million. Additional borrowing capacity, subject to certain covenants, under the $1.05 billion third party revolving credit facility was $269.5 million. The total leverage ratio as of December 31, 2023 of approximately 4.34x was within the requirements of the maximum allowable leverage ratio under the credit facility.

Consolidated Operating Results

Fourth quarter 2023 Adjusted EBITDA was $100.9 million compared with $92.5 million in the fourth quarter 2022. The $8.4 million increase reflects

higher contributions from the Midland Gathering and Delaware Gathering systems, terminalling and marketing rate increases, as well as continued strong throughput on joint venture pipelines. The increase was partially offset by higher operating expenses driven by the growth in operations.

Gathering and Processing Segment

Adjusted EBITDA in the fourth quarter 2023 was $53.3 million compared with $48.1 million in the fourth quarter 2022. The increase was primarily due to higher throughput from Permian Basin assets.

During the fourth quarter 2023, Delek Logistics recorded a $14.8 million impairment charge related to the Delaware Gathering reporting unit within the gathering and processing segment. The impairment was primarily driven by the significant increase in interest rates and timing effect of system connections with producer customers. The Partnership's long-term outlook of its Delaware Gathering system remains unchanged.

Wholesale Marketing and Terminalling Segment

Adjusted EBITDA in the fourth quarter 2023 was $28.4 million, compared with fourth quarter 2022 Adjusted EBITDA of $23.3 million. The increase was primarily due to higher terminalling utilization.

Storage and Transportation Segment

Adjusted EBITDA in the fourth quarter 2023 was $17.5 million, compared with $16.1 million in the fourth quarter 2022. The increase was primarily due to increased storage and transportation rates.

Investments in Pipeline Joint Ventures Segment

During the fourth quarter 2023, income from equity method investments was $8.5 million compared to $9.0 million in the fourth quarter 2022.

Corporate

Adjusted EBITDA in the fourth quarter 2023 was a loss of $6.9 million compared to a loss of $4.0 million in the fourth quarter 2022.

Capital Program

Delek Logistics Partners expects the 2024 Capital Program to be approximately $70 million, with approximately $20 million for sustaining and regulatory projects and $50 million for growth projects. The 2024 Capital Program compares with the 2023 Capital Program of $74 million, which includes $7 million of capital partially funded by producers. Excluding these proceeds, 2023 capital expenditures were $81 million.

2024 growth capital will be to advance new connections in both the Midland and Delaware gathering systems, enabling continued volume growth at the Partnership.

| | | | | |

| ($ millions) | Total |

| Delek Logistics | |

| Growth | $ | 50 | |

| Sustaining & Regulatory | 20 |

| 2024 Capital Program | $ | 70 | |

| |

Fourth Quarter 2023 Results | Conference Call Information

Delek Logistics will hold a conference call to discuss its fourth quarter 2023 results on Tuesday, February 27, 2024 at 11:30 a.m. Central Time. Investors will have the opportunity to listen to the conference call live by going to www.DelekLogistics.com. Participants are encouraged to register at least 15 minutes early to download and install any necessary software. An archived version of the replay will also be available at www.DelekLogistics.com for 90 days.

About Delek Logistics Partners, LP

Delek Logistics is a midstream energy master limited partnership headquartered in Brentwood, Tennessee. Through its owned assets and joint ventures located primarily in and around the Permian Basin, the Delaware Basin and other select areas in the Gulf Coast region, Delek Logistics provides gathering, pipeline and other transportation services primarily for crude oil and natural gas customers, storage, wholesale marketing and terminalling services primarily for intermediate and refined product customers, and water disposal and recycling services. Delek US Holdings, Inc. ("Delek US") owns the general partner interest as well as a majority limited partner interest in Delek Logistics, and is also a significant customer.

Safe Harbor Provisions Regarding Forward-Looking Statements

This press release contains forward-looking statements that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under the federal securities laws. These statements contain words such as “possible,” “believe,” “should,” “could,” “would,” “predict,” “plan,” “estimate,” “intend,” “may,” “anticipate,” “will,” “if,” “expect” or similar expressions, as well as statements in the future tense, and can be impacted by numerous factors, including the fact that a significant portion of Delek Logistics' revenue is derived from Delek US, thereby subjecting us to Delek US' business risks; risks relating to the securities markets generally; risks and costs relating to the age and operational hazards of our assets including, without limitation, costs, penalties, regulatory or legal actions and other effects related to releases, spills and other hazards inherent in transporting and storing crude oil and intermediate and finished petroleum products; the impact of adverse market conditions affecting the

utilization of Delek Logistics' assets and business performance, including margins generated by its wholesale fuel business; risks and uncertainties related to the integration of the 3 Bear business following the recent acquisition; uncertainties regarding future decisions by OPEC regarding production and pricing disputes between OPEC members and Russia; an inability of Delek US to grow as expected as it relates to our potential future growth opportunities, including dropdowns, and other potential benefits; projected capital expenditures, scheduled turnaround activity; the results of our investments in joint ventures; adverse changes in laws including with respect to tax and regulatory matters; and other risks as disclosed in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports and filings with the United States Securities and Exchange Commission. Forward-looking statements include, but are not limited to, statements regarding future growth at Delek Logistics; distributions and the amounts and timing thereof; potential dropdown inventory; projected benefits of the Delaware Gathering acquisition; expected earnings or returns from joint ventures or other acquisitions; expansion projects; ability to create long-term value for our unit holders; financial flexibility and borrowing capacity; and distribution growth. Forward-looking statements should not be read as a guarantee of future performance or results and will not be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management's good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Delek Logistics undertakes no obligation to update or revise any such forward-looking statements to reflect events or circumstances that occur, or which Delek Logistics becomes aware of, after the date hereof, except as required by applicable law or regulation.

Non-GAAP Disclosures:

Our management uses certain "non-GAAP" operational measures to evaluate our operating segment performance and non-GAAP financial measures to evaluate past performance and prospects for the future to supplement our GAAP financial information presented in accordance with U.S. GAAP. These financial and operational non-GAAP measures are important factors in assessing our operating results and profitability and include:

•Earnings before interest, taxes, depreciation and amortization ("EBITDA") - calculated as net income before net interest expense, income tax expense, depreciation and amortization expense, including amortization of customer contract intangible assets, which is included as a component of net revenues in our accompanying consolidated statements of income.

•Adjusted Earnings before interest, taxes, depreciation and amortization ("Adjusted EBITDA") - EBITDA adjusted to exclude the impairment of goodwill associated with our Delaware Gathering reporting unit.

•Distributable cash flow - calculated as net cash flow from operating activities plus or minus changes in assets and liabilities, less maintenance capital expenditures net of reimbursements and other adjustments not expected to settle in cash. Delek Logistics believes this is an appropriate reflection of a liquidity measure by which users of its financial statements can assess its ability to generate cash.

•Distributable cash flow, as adjusted for transaction costs, or Distributable cash flow, as adjusted - distributable cash flow adjusted to exclude significant, infrequently occurring transaction costs.

Our EBITDA, Adjusted EBITDA and distributable cash flow measures are non GAAP supplemental financial measures that management and external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies, may use to assess:

•Delek Logistics' operating performance as compared to other publicly traded partnerships in the midstream energy industry, without regard to historical cost basis or, in the case of EBITDA and Adjusted EBITDA, financing methods;

•the ability of our assets to generate sufficient cash flow to make distributions to our unitholders on a current and on-going basis;

•Delek Logistics' ability to incur and service debt and fund capital expenditures; and

•the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities.

We believe that the presentation of EBITDA, Adjusted EBITDA and distributable cash flow measures provide information useful to investors in assessing our financial condition and results of operations and assists in evaluating our ongoing operating performance for current and comparative periods. EBITDA, Adjusted EBITDA and distributable cash flow should not be considered alternatives to net income, operating income, cash flow from operating activities or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. EBITDA, Adjusted EBITDA and distributable cash flow have important limitations as analytical tools because they exclude some, but not all, items that affect net income and net cash provided by operating activities. Additionally, because EBITDA, Adjusted EBITDA and distributable cash flow may be defined differently by other partnerships in our industry, our definitions of EBITDA, Adjusted EBITDA and distributable cash flow may not be comparable to similarly titled measures of other partnerships, thereby diminishing their utility. For a reconciliation of EBITDA, Adjusted EBITDA and distributable cash flow to their most directly comparable financial measures calculated and presented in accordance with U.S. GAAP, please refer to "Results of Operations" below. See the accompanying tables in this earnings release for a reconciliation of these non-GAAP measures to the most directly comparable GAAP measures.

| | | | | | | | | | | |

Delek Logistics Partners, LP |

Consolidated Balance Sheets (Unaudited) |

| (In thousands, except unit data) |

| December 31, 2023 | | December 31, 2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 3,755 | | | $ | 7,970 | |

| Accounts receivable | 41,131 | | | 53,314 | |

| Accounts receivable from related parties | 28,443 | | | — | |

| Inventory | 2,264 | | | 1,483 | |

| Other current assets | 676 | | | 2,463 | |

| Total current assets | 76,269 | | | 65,230 | |

| Property, plant and equipment: | | | |

| Property, plant and equipment | 1,320,510 | | | 1,240,684 | |

| Less: accumulated depreciation | (384,359) | | | (316,680) | |

| Property, plant and equipment, net | 936,151 | | | 924,004 | |

| Equity method investments | 241,337 | | | 257,022 | |

| Customer relationship intangible, net | 181,336 | | | 199,440 | |

| Marketing contract intangible, net | 102,155 | | | 109,366 | |

| Rights-of-way, net | 59,536 | | | 55,990 | |

| Goodwill | 12,203 | | | 27,051 | |

| Operating lease right-of-use assets | 19,043 | | | 24,788 | |

| Other non-current assets | 14,216 | | | 16,408 | |

| Total assets | $ | 1,642,246 | | | $ | 1,679,299 | |

| | | |

| LIABILITIES AND DEFICIT | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 26,290 | | | $ | 57,403 | |

| Accounts payable to related parties | — | | | 6,055 | |

| Current portion of long-term debt | 30,000 | | | 15,000 | |

| Interest payable | 5,805 | | | 5,308 | |

| Excise and other taxes payable | 10,321 | | | 8,230 | |

| Current portion of operating lease liabilities | 6,697 | | | 8,020 | |

| Accrued expenses and other current liabilities | 11,477 | | | 6,202 | |

| Total current liabilities | 90,590 | | | 106,218 | |

| Non-current liabilities: | | | |

| Long-term debt, net of current portion | 1,673,789 | | | 1,646,567 | |

| | | |

| Operating lease liabilities, net of current portion | 8,335 | | | 12,114 | |

| Asset retirement obligations | 10,038 | | | 9,333 | |

| Other non-current liabilities | 21,363 | | | 15,767 | |

| Total non-current liabilities | 1,713,525 | | | 1,683,781 | |

| Total liabilities | 1,804,115 | | | 1,789,999 | |

| Equity (Deficit): | | | |

| Common unitholders - public; 9,299,763 units issued and outstanding at December 31, 2023 (9,257,305 at December 31, 2022) | 160,402 | | | 172,119 | |

| Common unitholders - Delek Holdings; 34,311,278 units issued and outstanding at December 31, 2023 (34,311,278 at December 31, 2022) | (322,271) | | | (282,819) | |

| Total deficit | (161,869) | | | (110,700) | |

| Total liabilities and deficit | $ | 1,642,246 | | | $ | 1,679,299 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Delek Logistics Partners, LP |

Consolidated Statement of Income and Comprehensive Income (Unaudited) |

| (In thousands, except unit and per unit data) | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net revenues: | | | | | | | |

| Affiliate | $ | 149,400 | | | $ | 104,141 | | | $ | 563,803 | | | $ | 479,411 | |

| Third-party | 104,749 | | | 164,910 | | | 456,606 | | | 556,996 | |

| Net revenues | 254,149 | | | 269,051 | | | 1,020,409 | | | 1,036,407 | |

| Cost of sales: | | | | | | | |

| Cost of materials and other - affiliate | 98,071 | | | 121,855 | | | 396,333 | | | 496,184 | |

| Cost of materials and other - third party | 29,707 | | | 39,213 | | | 136,294 | | | 145,179 | |

| Operating expenses (excluding depreciation and amortization presented below) | 30,380 | | | 22,546 | | | 115,682 | | | 85,438 | |

| Depreciation and amortization | 21,642 | | | 18,334 | | | 87,136 | | | 60,210 | |

| Total cost of sales | 179,800 | | | 201,948 | | | 735,445 | | | 787,011 | |

| Operating expenses related to wholesale business (excluding depreciation and amortization presented below) | 1,022 | | | 764 | | | 2,419 | | | 2,869 | |

| General and administrative expenses | 5,100 | | | 3,355 | | | 24,766 | | | 34,181 | |

| Depreciation and amortization | 1,325 | | | 1,357 | | | 5,248 | | | 2,778 | |

| Impairment of goodwill | 14,848 | | | — | | | 14,848 | | | — | |

| (Gain) loss on disposal of assets | (462) | | | 6 | | | (1,266) | | | (114) | |

| Total operating costs and expenses | 201,633 | | | 207,430 | | | 781,460 | | | 826,725 | |

| Operating income | 52,516 | | | 61,621 | | | 238,949 | | | 209,682 | |

| Interest expense, net | 38,663 | | | 28,683 | | | 143,244 | | | 82,304 | |

| Income from equity method investments | (8,536) | | | (9,017) | | | (31,433) | | | (31,683) | |

| Other income, net | (279) | | | (334) | | | (303) | | | (373) | |

| Total non-operating expenses, net | 29,848 | | | 19,332 | | | 111,508 | | | 50,248 | |

| Income before income tax expense | 22,668 | | | 42,289 | | | 127,441 | | | 159,434 | |

| Income tax expense (benefit) | 520 | | | (411) | | | 1,205 | | | 382 | |

| Net income attributable to partners | $ | 22,148 | | | $ | 42,700 | | | $ | 126,236 | | | $ | 159,052 | |

| Comprehensive income attributable to partners | $ | 22,148 | | | $ | 42,700 | | | $ | 126,236 | | | $ | 159,052 | |

| | | | | | | |

| Net income per limited partner unit: | | | | | | | |

| Basic | $ | 0.51 | | | $ | 0.98 | | | $ | 2.90 | | | $ | 3.66 | |

| Diluted | $ | 0.51 | | | $ | 0.98 | | | $ | 2.89 | | | $ | 3.66 | |

| Weighted average limited partner units outstanding: | | | | | | | |

| Basic | 43,599,670 | | | 43,517,906 | | | 43,583,938 | | | 43,487,910 | |

| Diluted | 43,625,012 | | | 43,540,645 | | | 43,611,314 | | | 43,511,650 | |

| Cash distribution per common limited partner unit | $ | 1.055 | | | $ | 1.020 | | | $ | 4.160 | | | $ | 3.975 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Delek Logistics Partners, LP |

| Condensed Consolidated Statements of Cash Flows (In thousands) | Three Months Ended December 31, | | Year Ended December 31, |

| (Unaudited) | 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows from operating activities | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net cash provided by (used in) operating activities | $ | 114,689 | | | $ | (105,314) | | | $ | 225,319 | | | $ | 192,168 | |

| Cash flows from investing activities | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net cash used in investing activities | (33,995) | | | (65,350) | | | (89,629) | | | (770,437) | |

| Cash flows from financing activities | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net cash (used in) provided by financing activities | (81,121) | | | 163,689 | | | (139,905) | | | 581,947 | |

| Net (decrease) increase in cash and cash equivalents | (427) | | | (6,975) | | | (4,215) | | | 3,678 | |

| Cash and cash equivalents at the beginning of the period | 4,182 | | | 14,945 | | | 7,970 | | | 4,292 | |

| Cash and cash equivalents at the end of the period | $ | 3,755 | | | $ | 7,970 | | | $ | 3,755 | | | $ | 7,970 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Delek Logistics Partners, LP |

Reconciliation of Amounts Reported Under U.S. GAAP (Unaudited) |

| (In thousands) |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of Net Income to EBITDA: | | | | | | | |

| Net income | $ | 22,148 | | | $ | 42,700 | | | $ | 126,236 | | | $ | 159,052 | |

| Add: | | | | | | | |

| Income tax expense (benefit) | 520 | | | (411) | | | 1,205 | | | 382 | |

| Depreciation and amortization | 22,967 | | | 19,691 | | | 92,384 | | | 62,988 | |

| Amortization of marketing contract intangible | 1,803 | | | 1,803 | | | 7,211 | | | 7,211 | |

| Interest expense, net | 38,663 | | | 28,683 | | | 143,244 | | | 82,304 | |

| EBITDA | $ | 86,101 | | | $ | 92,466 | | | $ | 370,280 | | | $ | 311,937 | |

| Impairment of goodwill | 14,848 | | | — | | | 14,848 | | | — | |

| Adjusted EBITDA | $ | 100,949 | | | $ | 92,466 | | | $ | 385,128 | | | $ | 311,937 | |

| | | | | | | |

| Reconciliation of net cash from operating activities to distributable cash flow: | | | | | | | |

| Net cash provided by (used in) operating activities | $ | 114,689 | | | $ | (105,314) | | | $ | 225,319 | | | $ | 192,168 | |

| Changes in assets and liabilities | (51,894) | | | 164,781 | | | 29,474 | | | 49,423 | |

| Non-cash lease expense | (2,142) | | | (2,670) | | | (9,549) | | | (16,254) | |

| Distributions from equity method investments in investing activities | 4,525 | | | — | | | 9,002 | | | 1,737 | |

| Regulatory and sustaining capital expenditures not distributable | (1,348) | | | (6,501) | | | (7,272) | | | (9,684) | |

| Reimbursement from Delek Holdings for capital expenditures | 338 | | | 1,171 | | | 1,280 | | | 1,176 | |

| Accretion of asset retirement obligations | (176) | | | (181) | | | (705) | | | (596) | |

| Deferred income taxes | 115 | | | 71 | | | (638) | | | (5) | |

| Gain (loss) on disposal of assets | 462 | | | (6) | | | 1,266 | | | 114 | |

| Distributable Cash Flow | $ | 64,569 | | | $ | 51,351 | | | $ | 248,177 | | | $ | 218,079 | |

| Transaction costs | — | | | — | | | — | | | 10,604 | |

| Distributable Cash Flow, as adjusted | $ | 64,569 | | | $ | 51,351 | | | $ | 248,177 | | | $ | 228,683 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Delek Logistics Partners, LP |

Distributable Coverage Ratio Calculation (Unaudited) |

| (In thousands) |

| | Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Distributions to partners of Delek Logistics, LP | $ | 46,010 | | | $ | 44,440 | | | $ | 181,344 | | | $ | 172,933 | |

| | | | | | | |

| Distributable cash flow | $ | 64,569 | | | $ | 51,351 | | | $ | 248,177 | | | $ | 218,079 | |

Distributable cash flow coverage ratio (1) | 1.40x | | 1.16x | | 1.37x | | 1.26x |

Distributable cash flow, as adjusted (2) | 64,569 | | | 51,351 | | | 248,177 | | | 228,683 | |

Distributable cash flow coverage ratio, as adjusted (3) | 1.40x | | 1.16x | | 1.37x | | 1.32x |

(1) Distributable cash flow coverage ratio is calculated by dividing distributable cash flow by distributions to be paid in each respective period.

(2) Distributable cash flow adjusted to exclude transaction costs associated with the Delaware Gathering Acquisition (formerly 3 Bear).

(3) Distributable cash flow coverage ratio, as adjusted is calculated by dividing distributable cash flow, as adjusted for transaction costs by distributions to be paid in each respective period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Delek Logistics Partners, LP | | | | | |

Segment Data (Unaudited) | | | | | |

| (In thousands) | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2023 |

| | Gathering and Processing | | Wholesale Marketing and Terminalling | | Storage and Transportation | | Investments in Pipeline Joint Ventures | | Corporate and Other | | Consolidated |

| Net revenues: | | | | | | | | | | | | |

| Affiliate | | $ | 55,175 | | | $ | 62,560 | | | $ | 31,665 | | | $ | — | | | $ | — | | | $ | 149,400 | |

| Third party | | 35,441 | | | 64,895 | | | 4,413 | | | — | | | — | | | 104,749 | |

| Total revenue | | $ | 90,616 | | | $ | 127,455 | | | $ | 36,078 | | | $ | — | | | $ | — | | | $ | 254,149 | |

| | | | | | | | | | | | |

| Segment EBITDA | | $ | 38,449 | | | $ | 28,441 | | | $ | 17,534 | | | $ | 8,535 | | | $ | (6,858) | | | $ | 86,101 | |

| Depreciation and amortization | | 17,670 | | | 1,717 | | | 2,730 | | | — | | | 850 | | | 22,967 | |

| Amortization of customer contract intangible | | — | | | 1,803 | | | — | | | — | | | — | | | 1,803 | |

| Interest expense, net | | — | | | — | | | — | | | — | | | 38,663 | | | 38,663 | |

| Income tax expense | | | | | | | | | | | | 520 | |

| Net income | | | | | | | | | | | | $ | 22,148 | |

| | | | | | | | | | | | |

| Capital spending | | $ | 12,515 | | | $ | (416) | | | $ | 615 | | | $ | — | | | $ | — | | | $ | 12,714 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2023 |

| | Gathering and Processing | | Wholesale Marketing and Terminalling | | Storage and Transportation | | Investments in Pipeline Joint Ventures | | Corporate and Other | | Consolidated |

| Segment EBITDA | | $ | 38,449 | | | $ | 28,441 | | | $ | 17,534 | | | $ | 8,535 | | | $ | (6,858) | | | $ | 86,101 | |

| Impairment of goodwill | | 14,848 | | | — | | | — | | | — | | | — | | | 14,848 | |

| Segment Adjusted EBITDA | | $ | 53,297 | | | $ | 28,441 | | | $ | 17,534 | | | $ | 8,535 | | | $ | (6,858) | | | $ | 100,949 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2022 |

| | Gathering and Processing | | Wholesale Marketing and Terminalling | | Storage and Transportation | | Investments in Pipeline Joint Ventures | | Corporate and Other | | Consolidated |

| Net revenues: | | | | | | | | | | | | |

| Affiliate | | $ | 51,530 | | | $ | 29,080 | | | $ | 23,531 | | | $ | — | | | $ | — | | | $ | 104,141 | |

| Third party | | 38,417 | | | 115,623 | | | 10,870 | | | — | | | — | | | 164,910 | |

| Total revenue | | $ | 89,947 | | | $ | 144,703 | | | $ | 34,401 | | | $ | — | | | $ | — | | | $ | 269,051 | |

| | | | | | | | | | | | |

| Segment EBITDA | | $ | 48,121 | | | $ | 23,285 | | | $ | 16,057 | | | $ | 9,017 | | | $ | (4,014) | | | $ | 92,466 | |

| Depreciation and amortization | | 14,946 | | | 1,634 | | | 2,228 | | | — | | | 883 | | | 19,691 | |

| Amortization of customer contract intangible | | — | | | 1,803 | | | — | | | — | | | — | | | 1,803 | |

| Interest expense, net | | — | | | — | | | — | | | — | | | 28,683 | | | 28,683 | |

| Income tax benefit | | | | | | | | | | | | (411) | |

| Net income | | | | | | | | | | | | $ | 42,700 | |

| | | | | | | | | | | | |

| Capital spending | | $ | 56,206 | | | $ | 157 | | | $ | 6,528 | | | $ | — | | | $ | — | | | $ | 62,891 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2023 |

| | Gathering and Processing | | Wholesale Marketing and Terminalling | | Storage and Transportation | | Investments in Pipeline Joint Ventures | | Corporate and Other | | Consolidated |

| Net revenues: | | | | | | | | | | | | |

| Affiliate | | $ | 212,537 | | | $ | 218,997 | | | $ | 132,269 | | | $ | — | | | $ | — | | | $ | 563,803 | |

| Third party | | 158,573 | | | 286,704 | | | 11,329 | | | — | | | — | | | 456,606 | |

| Total revenue | | $ | 371,110 | | | $ | 505,701 | | | $ | 143,598 | | | $ | — | | | $ | — | | | $ | 1,020,409 | |

| | | | | | | | | | | | |

| Segment EBITDA | | $ | 199,463 | | | $ | 106,512 | | | $ | 63,850 | | | $ | 31,424 | | | $ | (30,969) | | | $ | 370,280 | |

| Depreciation and amortization | | 72,181 | | | 7,055 | | | 9,839 | | | — | | | 3,309 | | | 92,384 | |

| Amortization of customer contract intangible | | — | | | 7,211 | | | — | | | — | | | — | | | 7,211 | |

| Interest expense, net | | — | | | — | | | — | | | — | | | 143,244 | | | 143,244 | |

| Income tax expense | | | | | | | | | | | | 1,205 | |

| Net income | | | | | | | | | | | | $ | 126,236 | |

| | | | | | | | | | | | |

| Capital spending | | $ | 74,683 | | | $ | 2,111 | | | $ | 4,548 | | | $ | — | | | $ | — | | | $ | 81,342 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2023 |

| | Gathering and Processing | | Wholesale Marketing and Terminalling | | Storage and Transportation | | Investments in Pipeline Joint Ventures | | Corporate and Other | | Consolidated |

| Segment EBITDA | | $ | 199,463 | | | $ | 106,512 | | | $ | 63,850 | | | $ | 31,424 | | | $ | (30,969) | | | $ | 370,280 | |

| Impairment of goodwill | | 14,848 | | | — | | | — | | | — | | | — | | | 14,848 | |

| Segment Adjusted EBITDA | | $ | 214,311 | | | $ | 106,512 | | | $ | 63,850 | | | $ | 31,424 | | | $ | (30,969) | | | $ | 385,128 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2022 |

| | Gathering and Processing | | Wholesale Marketing and Terminalling | | Storage and Transportation | | Investments in Pipeline Joint Ventures | | Corporate and Other | | Consolidated |

| Net revenues: | | | | | | | | | | | | |

| Affiliate | | $ | 185,845 | | | $ | 173,084 | | | $ | 120,482 | | | $ | — | | | $ | — | | | $ | 479,411 | |

| Third party | | 119,582 | | | 415,800 | | | 21,614 | | | — | | | — | | | 556,996 | |

| Total revenue | | $ | 305,427 | | | $ | 588,884 | | | $ | 142,096 | | | $ | — | | | $ | — | | | $ | 1,036,407 | |

| | | | | | | | | | | | |

| Segment EBITDA | | $ | 175,250 | | | $ | 83,098 | | | $ | 56,269 | | | $ | 31,683 | | | $ | (34,363) | | | $ | 311,937 | |

| Depreciation and amortization | | 47,206 | | | 6,308 | | | 8,591 | | | — | | | 883 | | | 62,988 | |

| Amortization of customer contract intangible | | — | | | 7,211 | | | — | | | — | | | — | | | 7,211 | |

| Interest expense, net | | — | | | — | | | — | | | — | | | 82,304 | | | 82,304 | |

| Income tax expense | | | | | | | | | | | | 382 | |

| Net income | | | | | | | | | | | | $ | 159,052 | |

| | | | | | | | | | | | |

| Capital spending | | $ | 122,594 | | | $ | 1,548 | | | $ | 6,528 | | | $ | — | | | $ | — | | | $ | 130,670 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Delek Logistics Partners, LP |

Segment Capital Spending |

| (In thousands) |

| | Three Months Ended December 31, | | Year Ended December 31, |

| Gathering and Processing | 2023 | | 2022 | | 2023 | | 2022 |

| Regulatory capital spending | $ | — | | | $ | 163 | | | $ | 31 | | | $ | 2,855 | |

| Sustaining capital spending | 1,036 | | | 1,103 | | | 2,016 | | | 1,455 | |

| Growth capital spending | 11,479 | | | 54,940 | | | 72,636 | | | 118,284 | |

| Segment capital spending | $ | 12,515 | | | $ | 56,206 | | | $ | 74,683 | | | $ | 122,594 | |

| Wholesale Marketing and Terminalling | | | | | | | |

| Regulatory capital spending | $ | 553 | | | $ | — | | | 924 | | | 156 | |

| Sustaining capital spending | (591) | | | 5 | | | 163 | | | 24 | |

| Growth capital spending | (378) | | | 152 | | | 1,024 | | | 1,368 | |

| Segment capital spending | $ | (416) | | | $ | 157 | | | $ | 2,111 | | | $ | 1,548 | |

| Storage and Transportation | | | | | | | |

| Regulatory capital spending | $ | 335 | | | $ | — | | | $ | 2,005 | | | $ | — | |

| Sustaining capital spending | 280 | | | 6,528 | | | 2,543 | | | 6,528 | |

| Growth capital spending | — | | | — | | | $ | — | | | $ | — | |

| Segment capital spending | $ | 615 | | | $ | 6,528 | | | $ | 4,548 | | | $ | 6,528 | |

| Consolidated | | | | | | | |

| Regulatory capital spending | $ | 888 | | | $ | 163 | | | $ | 2,960 | | | $ | 3,011 | |

| Sustaining capital spending | 725 | | | 7,636 | | | 4,722 | | | 8,007 | |

| Growth capital spending | 11,101 | | | 55,092 | | | 73,660 | | | 119,652 | |

| Total capital spending | $ | 12,714 | | | $ | 62,891 | | | $ | 81,342 | | | $ | 130,670 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Delek Logistics Partners, LP | | | | |

Segment Operating Data (Unaudited) | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Gathering and Processing Segment: | | | | | | | |

| Throughputs (average bpd) | | | | | | | |

| El Dorado Assets: | | | | | | | |

| Crude pipelines (non-gathered) | 73,438 | | | 68,798 | | | 67,003 | | | 78,519 | |

| Refined products pipelines to Enterprise Systems | 68,552 | | | 35,585 | | | 58,181 | | | 56,382 | |

| El Dorado Gathering System | 13,329 | | | 13,136 | | | 13,782 | | | 15,391 | |

| East Texas Crude Logistics System | 40,798 | | | 25,154 | | | 32,668 | | | 21,310 | |

Midland Gathering System (1) | 229,179 | | | 191,119 | | | 230,471 | | | 128,725 | |

| Plains Connection System | 254,224 | | | 234,164 | | | 250,140 | | | 183,827 | |

Delaware Gathering Assets (2): | | | | | | | |

Natural Gas Gathering and Processing (Mcfd(3)) | 67,292 | | | 60,669 | | | 71,239 | | | 60,971 | |

| Crude Oil Gathering (average bpd) | 112,522 | | | 91,526 | | | 111,335 | | | 87,519 | |

| Water Disposal and Recycling (average bpd) | 94,686 | | | 80,028 | | | 102,340 | | | 72,056 | |

| | | | | | | |

| Wholesale Marketing and Terminalling Segment: | | | | | | | |

East Texas - Tyler Refinery sales volumes (average bpd) (4) | 68,735 | | | 64,825 | | | 60,626 | | | 66,058 | |

| Big Spring marketing throughputs (average bpd) | 76,408 | | | 74,238 | | | 77,897 | | | 71,580 | |

| West Texas marketing throughputs (average bpd) | 10,511 | | | 10,835 | | | 10,032 | | | 10,206 | |

| West Texas gross margin per barrel | $ | 4.73 | | | $ | 5.64 | | | $ | 5.18 | | | $ | 4.45 | |

Terminalling throughputs (average bpd) (5) | 105,933 | | | 127,277 | | | 113,803 | | | 132,262 | |

(1) Formerly known as the Permian Gathering Assets.

(2) Volumes for the year ended December 31, 2022 are for the period from June 1 through December 31, 2022, for which we owned the Delaware Gathering Assets.

(3) Mcfd - average thousand cubic feet per day.

(4) Excludes jet fuel and petroleum coke.

(5) Consists of terminalling throughputs at our Tyler, Big Spring, Big Sandy and Mount Pleasant, Texas, El Dorado and North Little Rock, Arkansas and Memphis and Nashville, Tennessee terminals.

Investor Relations and Media/Public Affairs Contact:

Rosy Zuklic, Vice President of Investor Relations and Market Intelligence

investor.relations@delekus.com; rosy.zuklic@delekus.com; 615-767-4344

Information about Delek Logistics Partners, LP can be found on its website (www.deleklogistics.com), investor relations webpage (https://www.deleklogistics.com/investor-relations), news webpage (https://www.deleklogistics.com/news-releases) and its Twitter account (@DelekLogistics).

v3.24.0.1

Cover Page Document

|

Feb. 27, 2024 |

| Cover [Abstract] |

|

| Entity Central Index Key |

0001552797

|

| Title of 12(b) Security |

Common Units Representing Limited Partner Interests

|

| Local Phone Number |

771-6701

|

| Entity Incorporation, State or Country Code |

DE

|

| Document Period End Date |

Feb. 27, 2024

|

| Document Type |

8-K

|

| Entity Registrant Name |

DELEK LOGISTICS PARTNERS, LP

|

| City Area Code |

615

|

| Entity File Number |

001-35721

|

| Entity Tax Identification Number |

45-5379027

|

| Entity Address, Address Line One |

310 Seven Springs Way, Suite 500

|

| Entity Address, City or Town |

Brentwood

|

| Entity Address, State or Province |

TN

|

| Entity Address, Postal Zip Code |

37027

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Trading Symbol |

DKL

|

| Security Exchange Name |

NYSE

|

| Amendment Flag |

false

|

| Entity Address, Address Line Two |

310 Seven Springs Way, Suite 500

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

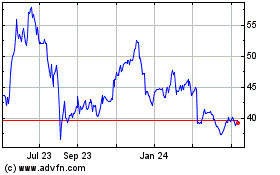

Delek Logistics Partners (NYSE:DKL)

Historical Stock Chart

From Mar 2024 to Apr 2024

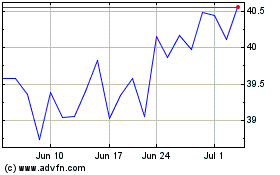

Delek Logistics Partners (NYSE:DKL)

Historical Stock Chart

From Apr 2023 to Apr 2024