0001826018false12/3100018260182024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________

FORM 8-K

________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

February 27, 2024

Date of Report (date of earliest event reported)

________________________________________

Rover Group, Inc.

(Exact name of registrant as specified in its charter)

________________________________________

| | | | | | | | |

Delaware | 001-39774 | 85-3147201 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

720 Olive Way, 19th Floor, Seattle, WA | 98101 |

(Address of Principal Executive Offices) | (Zip Code) |

(888) 453-7889

Registrant's telephone number, including area code

(Former name or former address, if changed since last report.)

________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share | ROVR | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

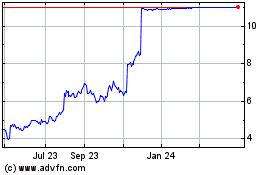

Introductory Note

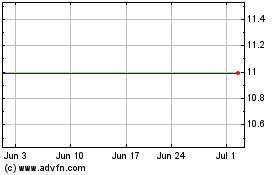

As previously disclosed, on November 29, 2023, Rover Group, Inc. (“Rover” or the “Company”) entered into an Agreement and Plan of Merger (as it may be amended from time to time, the “Merger Agreement”) with Biscuit Parent, LLC (“Parent”) and Biscuit Merger Sub, LLC (“Merger Sub”). On February 27, 2024 (the “Closing Date”), pursuant to the Merger Agreement, Merger Sub merged with and into the Company (collectively with the other transactions contemplated by the Merger Agreement, the “Merger”), with Rover continuing as the surviving corporation of the Merger and a wholly owned subsidiary of Parent. Parent and Merger Sub are affiliates of investment funds managed by Blackstone Inc. (“Blackstone”). Pursuant to the terms of the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each issued and outstanding share of Rover’s Class A common stock, par value $0.0001 per share (“Common Stock”), was canceled and converted into the right to receive $11.00 in cash, without interest and subject to any applicable tax withholdings (the “Merger Consideration”), subject to certain exceptions set forth in the Merger Agreement.

Item 1.01 Entry into a Material Definitive Agreement.

The information set forth in the Introductory Note of this Current Report on Form 8-K is incorporated herein by reference.

Concurrently with the closing of the Merger, on February 27, 2024, Biscuit Intermediate LLC, as holdings, Parent, as the borrower, and Rover, as a guarantor, entered into that certain credit agreement with Golub Capital Markets LLC, as administrative agent, collateral agent and letter of credit issuer, each additional borrower party thereto from time to time, each other guarantor party thereto from time to time, each lender from time to time party thereto and each other letter of credit issuer from time to time party thereto (the “Credit Agreement”), which provides for (i) a term loan facility in an aggregate principal amount equal to $250 million and (ii) a revolving credit facility in an aggregate principal amount equal to $75 million. Certain of Parent’s subsidiaries (including Rover) are guarantors under the Credit Agreement. The obligations under the Credit Agreement are secured on a first priority basis by substantially all assets of the borrower and the guarantors (subject to certain exclusions and exceptions). The Credit Agreement includes representations and warranties, covenants, events of default and other provisions that are customary for facilities of the respective types provided for therein.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The information set forth in the Introductory Note of this Current Report on Form 8-K is incorporated herein by reference.

On the Closing Date, pursuant to the terms of the Merger Agreement, the Merger was consummated. At the Effective Time, each issued and outstanding share of Common Stock (other than shares held by Rover, Parent or Merger Sub immediately prior to the Effective Time, or any shares held by a holder who has properly exercised their demand for appraisal or dissenters’ rights under Delaware law) was cancelled and converted into the right to receive the Merger Consideration.

In addition, pursuant to the terms of the Merger Agreement, at the Effective Time:

•each outstanding Rover stock option (“Company Option”), to the extent vested, was cancelled and automatically converted into the right to receive the product of (1) the aggregate number of shares of Common Stock subject to such vested Company Option, multiplied by (2) the excess, if any, of $11.00 over such vested Company Option’s applicable per share exercise price, subject to any required tax withholdings;

•each unvested Company Option was cancelled and automatically converted into the right to receive an amount in cash, without interest, equal to the product of: (1) the total number of shares of Common Stock subject to such unvested Company Option, multiplied by (2) the excess, if any, of $11.00 over the unvested Company Option’s per share exercise price, subject to any required tax withholdings (the “Cash Replacement Company Option Amounts”), which Cash Replacement Company Option Amounts will be subject to the same vesting conditions (including continued service requirements and any accelerated vesting on specific terminations of employment) that applied to the cancelled unvested Company Option, except for terms rendered inoperative by reason of the Merger or for any applicable administrative or ministerial changes;

•each outstanding Rover restricted stock unit (“Company RSU”), to the extent vested, was cancelled and automatically converted into the right to receive the product of (1) the aggregate number of shares of Common

Stock subject to such vested Company RSU, multiplied by (2) $11.00, subject to any required tax withholdings; and

•each unvested Company RSU was cancelled and automatically converted into the right to receive an amount in cash, without interest, equal to the product of: (1) the total number of shares of Common Stock subject to such unvested Company RSU, multiplied by (2) $11.00, subject to any required tax withholdings (the “Cash Replacement Company RSU Amounts”), which Cash Replacement Company RSU Amounts will be subject to the same vesting conditions (including continued service requirements and any accelerated vesting on specific terminations of employment) that applied to the cancelled unvested Company RSU, except for terms rendered inoperative by reason of the Merger or for any applicable administrative or ministerial changes.

The foregoing description of the Merger Agreement and related transactions (including, without limitation, the Merger) does not purport to be complete and is qualified in its entirety by reference to the Merger Agreement, which was filed by Rover as Exhibit 2.1 to its Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (“SEC”) on November 29, 2023 and is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

The information set forth in the Introductory Note and Item 2.01 of this Current Report on Form 8-K is incorporated herein by reference.

On the Closing Date, Rover notified The Nasdaq Stock Market LLC (“Nasdaq”) of the consummation of the Merger and requested that Nasdaq delist the Common Stock on the Closing Date. As a result, trading of Rover’s Common Stock on Nasdaq was suspended prior to the opening of trading on Nasdaq on the Closing Date. Rover also requested that Nasdaq file a notification of removal from listing and registration on Form 25 with the SEC to effect the delisting of the Common Stock from Nasdaq and the deregistration of the Common Stock under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Following the effectiveness of the Form 25, Rover intends to file with the SEC a certification and notice of termination on Form 15 to terminate the registration of the Common Stock under the Exchange Act and suspend Rover’s reporting obligations under Section 13 and Section 15(d) of the Exchange Act.

Item 3.03 Material Modification to Rights of Security Holders.

The information set forth in the Introductory Note, Item 2.01, Item 3.01 and Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

As a result of the Merger, each share of Common Stock that was issued and outstanding immediately prior to the Effective Time (except as described in Item 2.01 of this Current Report on Form 8-K) was converted, at the Effective Time, into the right to receive the Merger Consideration. Accordingly, at the Effective Time, the holders of such shares of Common Stock ceased to have any rights as stockholders of the Company, other than the right to receive the Merger Consideration.

Item 5.01 Change in Control of Registrant.

The information set forth in the Introductory Note, Item 1.01, Item 2.01, Item 3.01, Item 3.03 and Item 5.02 of this Current Report on Form 8-K is incorporated herein by reference.

As a result of the consummation of the Merger, a change in control of Rover occurred. Following the consummation of the Merger, Rover became a wholly owned subsidiary of Parent. The total amount of consideration payable to Rover’s equityholders in connection with the Merger was approximately $2.35 billion. The funds used by Parent to consummate the Merger and complete the related transactions came from equity contributions made by certain investment funds managed by Blackstone and proceeds received in connection with debt financing arrangements described in Item 1.01 of this Current Report on Form 8-K.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The information set forth in the Introductory Note and Item 2.01 of this Current Report on Form 8-K is incorporated herein by reference.

As a result of the Merger, at the Effective Time, Aaron Easterly, Adam Clammer, Jamie Cohen, Venky Ganesan, Greg Gottesman, Scott Jacobson, Kristina Leslie, Erik Prusch, and Megan Siegler each voluntarily resigned from the board of directors of the Company (the “Board”) and from any and all committees of the Board on which they served, and ceased to be directors of the Company. At the Effective Time, and upon the completion of the Merger, Charlie Wickers and Aaron Easterly were appointed as directors of the Company.

Effective at the completion of the Merger, Aaron Easterly, Brent Turner, and Charlie Wickers, who were each officers of the Company immediately prior to the Merger, will continue to be officers of the Company.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The information set forth in the Introductory Note and Item 2.01 of this Current Report on Form 8-K is incorporated herein by reference.

At the Effective Time, the certificate of incorporation and bylaws of Rover were amended and restated in accordance with the terms of the Merger Agreement. The amended and restated certificate of incorporation and the amended and restated bylaws of Rover are filed as Exhibit 3.1 and Exhibit 3.2, respectively, to this Current Report on Form 8-K, and are incorporated herein by reference.

Item 8.01 Other Events.

On the Closing Date, the Company issued a press release announcing the closing of the Merger. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Exhibit |

| 2.1 | |

| 3.1 | |

| 3.2 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

*All schedules to the Merger Agreement have been omitted pursuant to Item 601(b)(2) of Regulation S-K. The Company hereby agrees to furnish supplementally a copy of any omitted schedule to the SEC upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ROVER GROUP, INC. |

| | |

Date: February 27, 2024 | By: | /s/ Charlie Wickers |

| | Charlie Wickers |

| | Chief Financial Officer |

THIRD AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

ROVER GROUP, INC.

Rover Group, Inc., a corporation incorporated and existing under the laws of the State of Delaware (the “Corporation”), hereby certifies as follows:

ONE: The name of the corporation is Rover Group, Inc. The date of filing its original Certificate of Incorporation of this Corporation with the Secretary of State of the State of Delaware was September 18, 2020 (the “Original Certificate”). The name under which the Corporation filed the Original Certificate was Nebula Caravel Acquisition Corporation.

TWO: The corporation filed its Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware on December 8, 2020 (the “1st A&R Certificate”).

THREE: The corporation changed its name from Nebula Caravel Acquisition Corp. to Rover Group, Inc. by filing its Second Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware on July 30, 2021 (the “2nd A&R Certificate”).

FOUR: This Third Amended and Stated Certificate of Incorporation (this “Certificate”), amends and restates the 2nd A&R Certificate, and was duly adopted in accordance with the provisions of Sections 242 and 245 of the Delaware General Corporation Law (the “DGCL”).

FIVE: The text of the 2nd A&R Certificate is hereby amended and restated in its entirety to read as set forth below:

ARTICLE ONE

The name of the corporation is Rover Group, Inc. (hereinafter called the “Corporation”).

ARTICLE TWO

The address of the Corporation’s registered office in the State of Delaware is 1209 Orange Street, in the City of Wilmington, County of New Castle, Delaware 19801. The name of its registered agent at such address is The Corporation Trust Company.

ARTICLE THREE

The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of the State of Delaware as it now exists or may hereafter be amended and/or supplemented from time to time (the “DGCL”).

ARTICLE FOUR

The total number of shares which the Corporation shall have the authority to issue is one thousand (1,000), all of which shall be shares of common stock, with a par value of $0.0001 per share. Each holder of record of common stock shall be entitled to vote at all meetings of the stockholders and shall have one vote for each share held by such holder of record. The common stock authorized by this Article Four shall be issued for such consideration (if any) as shall be fixed, from time to time, by the board of directors of the Corporation (the “Board”). No stockholder of the Corporation shall have any preemptive rights by virtue of this Certificate of Incorporation. The capital stock of the Corporation shall not be assessable for any purpose, and no stock issued as fully paid shall ever be assessable or assessed. No stockholder of the Corporation, to the fullest extent permitted by applicable law, shall be individually liable for the debts or liabilities of the Corporation.

ARTICLE FIVE

In furtherance and not in limitation of the rights, powers, privileges and discretionary authority granted or conferred by the DGCL or other statutes or laws of the State of Delaware, the Board, by a vote of the majority of the Board, is expressly authorized to make, alter, amend or repeal the bylaws of the Corporation (the “Bylaws”), without any action on the part of the stockholders, but the stockholders by a vote of a majority of the stockholders may make, alter, amend or repeal the Bylaws whether adopted by them or otherwise. The Corporation may in its Bylaws confer powers upon its Board in addition to the foregoing and in addition to the powers and authorities expressly conferred upon the Board by applicable law.

ARTICLE SIX

The Corporation expressly elects not to be governed by Section 203 of the DGCL.

ARTICLE SEVEN

The Corporation eliminates the personal liability of each director and officer of the Corporation to the fullest extent permitted by the DGCL or other statutes or laws of the State of Delaware, as hereinafter amended or supplemented. No amendment or supplement to or repeal of this Article Seven shall apply to or have any effect on the liability or alleged liability of any director or officer for or with respect to any acts or omissions of such director or officer, as applicable, occurring prior to such amendment, supplement or repeal. If the DGCL is amended or supplemented after the date hereof to authorize corporate action further eliminating or limiting the personal liability of directors or officers, then the liability of a director or officer of the

Corporation shall be eliminated or limited to the fullest extent permitted by the DGCL or other statutes or laws of the State of Delaware, as hereinafter amended or supplemented.

ARTICLE EIGHT

Any repeal or modification of the foregoing provisions of Article Seven by the stockholders of the Corporation, or the adoption of any provision of the Corporation’s Third Amended and Restated Certificate of Incorporation inconsistent with Article Seven, shall not adversely affect any right or protection of a director or officer of the Corporation existing at the time of, or increase the liability of any director of the Corporation with respect to any acts or omissions of such director or officer occurring prior to any such repeal or modification of Article Seven or any such adoption of an inconsistent provision.

ARTICLE NINE

SECTION 1. Definitions. For purposes of this Article Nine:

(a) “Corporate Status” describes the status of a person who is serving or has served (i) as a Director of the Corporation, (ii) as an Officer of the Corporation, (iii) as a Non-Officer Employee of the Corporation, or (iv) as a director, partner, trustee, officer, employee or agent of any other corporation, partnership, limited liability company, joint venture, trust, employee benefit plan, foundation, association, organization or other legal entity which such person is or was serving at the request of the Corporation. For purposes of this Section 1(a), a Director, Officer or Non-Officer Employee of the Corporation who is serving or has served as a director, partner, trustee, officer, employee or agent of a Subsidiary shall be deemed to be serving at the request of the Corporation. Notwithstanding the foregoing, “Corporate Status” shall not include the status of a person who is serving or has served as a director, officer, employee or agent of a constituent corporation absorbed in a merger or consolidation transaction with the Corporation with respect to such person’s activities prior to said transaction, unless specifically authorized by the Board or the stockholders of the Corporation;

(b) “Disinterested Director” means, with respect to each Proceeding in respect of which indemnification is sought hereunder, a Director of the Corporation who is not and was not a party to such Proceeding;

(c) “Expenses” means all reasonable, documented and out-of-pocket attorneys’ fees, retainers, court costs, transcript costs, fees of expert witnesses, private investigators and professional advisors (including, without limitation, accountants and investment bankers), travel expenses, duplicating costs, printing and binding costs, costs of preparation of demonstrative evidence and other courtroom presentation aids and devices, costs incurred in connection with document review, organization, imaging and computerization, telephone charges, postage, delivery service fees, and all other disbursements, costs or expenses of the type customarily incurred in connection with prosecuting, defending, preparing to prosecute or defend, investigating, being or preparing to be a witness in, settling or otherwise participating in, a Proceeding;

(d) “Liabilities” means judgments, damages, liabilities, losses, penalties, excise taxes, fines and amounts paid in settlement;

(e) “Non-Officer Employee” means any person who serves or has served as an employee or agent of the Corporation, but who is not or was not a Director or Officer;

(f) “Officer” means any person who serves or has served the Corporation as an officer of the Corporation appointed by the Board;

(g) “Proceeding” means any threatened, pending or completed action, suit, arbitration, alternate dispute resolution mechanism, inquiry, investigation, administrative hearing or other proceeding, whether civil, criminal, administrative, arbitrative or investigative; and

(h) “Subsidiary” shall mean any corporation, partnership, limited liability company, joint venture, trust or other entity of which the Corporation owns (either directly or through or together with another Subsidiary of the Corporation) either (i) a general partner, managing member or other similar interest or (ii) (A) fifty percent (50%) or more of the voting power of the voting capital equity interests of such corporation, partnership, limited liability company, joint venture or other entity, or (B) fifty percent (50%) or more of the outstanding voting capital stock or other voting equity interests of such corporation, partnership, limited liability company, joint venture or other entity.

SECTION 2. Indemnification of Directors and Officers.

(a) Each Director and Officer shall be indemnified and held harmless by the Corporation to the fullest extent authorized by the DGCL, as the same exists or may hereafter be amended (but, in the case of any such amendment, only to the extent that such amendment permits the Corporation to provide broader indemnification rights than such law permitted the Corporation to provide prior to such amendment), and to the extent authorized in this Section 2.

(1) Actions, Suits and Proceedings Other than By or In the Right of the Corporation. Each Director and Officer shall be indemnified and held harmless by the Corporation against any and all Expenses and Liabilities that are incurred or paid by such Director or Officer or on such Director’s or Officer’s behalf in connection with any Proceeding or any claim, issue or matter therein (other than an action by or in the right of the Corporation), which such Director or Officer is, or is threatened to be made, a party to or participant in by reason of such Director’s or Officer’s Corporate Status; provided that, with respect to each Officer, such right to indemnification shall be owed only if such Officer acted in good faith and in a manner such Officer reasonably believed to be in or not opposed to the best interests of the Corporation and, with respect to any criminal proceeding, had no reasonable cause to believe his or her conduct was unlawful.

(2) Actions, Suits and Proceedings By or In the Right of the Corporation. Each Director and Officer shall be indemnified and held harmless by the Corporation against any and all Expenses and Liabilities that are incurred by such Director or Officer or on such Director’s or Officer’s behalf in connection with any Proceeding or any claim,

issue or matter therein by or in the right of the Corporation, which such Director or Officer is, or is threatened to be made, a party to or participant in by reason of such Director’s or Officer’s Corporate Status; provided that, with respect to each Officer, such right to indemnification shall be owed only if such Officer acted in good faith and in a manner such Officer reasonably believed to be in or not opposed to the best interests of the Corporation and no indemnification shall be made under this Section 2(a)(2) in respect of any claim, issue or matter as to which such Officer shall have been finally adjudged by a court of competent jurisdiction to be liable to the Corporation, unless, and only to the extent that, the Court of Chancery or another court in which such Proceeding was brought shall determine upon application that, despite adjudication of liability, but in view of all the circumstances of the case, such Officer is fairly and reasonably entitled to indemnification for such Expenses that such court deems proper.

(3) Survival of Rights. The rights of indemnification provided by this Section 2 shall continue as to a Director or Officer after he or she has ceased to be a Director or Officer and shall inure to the benefit of his or her heirs, executors, administrators and personal representatives.

(4) Actions by Directors or Officers. Notwithstanding the foregoing, the Corporation shall indemnify any Director or Officer seeking indemnification in connection with a Proceeding initiated by such Director or Officer only if such Proceeding was authorized or consented to by the Board, unless such Proceeding was brought to enforce such Officer’s or Director’s rights to indemnification or, in the case of Directors, advancement of Expenses in accordance with the provisions set forth herein.

SECTION 3. Indemnification of Non-Officer Employees. Subject to the operation of Section 3 of this Article Nine, each Non-Officer Employee may, in the discretion of the Board, be indemnified by the Corporation to the fullest extent authorized by the DGCL, as the same exists or may hereafter be amended, against any or all Expenses and Liabilities that are incurred by such Non-Officer Employee or on such Non-Officer Employee’s behalf in connection with any threatened, pending or completed Proceeding, or any claim, issue or matter therein, which such Non-Officer Employee is, or is threatened to be made, a party to or participant in by reason of such Non-Officer Employee’s Corporate Status, if such Non-Officer Employee acted in good faith and in a manner such Non-Officer Employee reasonably believed to be in or not opposed to the best interests of the Corporation and, with respect to any criminal proceeding, had no reasonable cause to believe his or her conduct was unlawful. The rights of indemnification provided by this Section 3 shall exist as to a Non-Officer Employee after he or she has ceased to be a Non-Officer Employee and shall inure to the benefit of his or her heirs, personal representatives, executors and administrators. Notwithstanding the foregoing, the Corporation may indemnify any Non-Officer Employee seeking indemnification in connection with a Proceeding initiated by such Non-Officer Employee only if such Proceeding was authorized in advance by the Board.

SECTION 4. Determination. Unless ordered by a court, no indemnification shall be provided pursuant to this Article Nine to a Non-Officer Employee unless a determination shall

have been made that such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the Corporation and, with respect to any criminal Proceeding, such person had no reasonable cause to believe his or her conduct was unlawful. Such determination shall be made by (a) a majority vote of the Disinterested Directors, even though less than a quorum of the Board, (b) a committee comprised of Disinterested Directors, such committee having been designated by a majority vote of the Disinterested Directors (even though less than a quorum), (c) if there are no such Disinterested Directors, or if a majority of Disinterested Directors so directs, by independent legal counsel in a written opinion, or (d) by the stockholders of the Corporation.

SECTION 5. Advancement of Expenses to Directors Prior to Final Disposition.

(a) The Corporation shall advance all Expenses incurred by or on behalf of any Director in connection with any Proceeding in which such Director is involved by reason of such Director’s Corporate Status within thirty (30) days after the receipt by the Corporation of a written statement from such Director requesting such advance or advances from time to time, whether prior to or after final disposition of such Proceeding. Such statement or statements shall reasonably evidence the Expenses incurred by such Director and shall be preceded or accompanied by an undertaking by or on behalf of such Director to repay any Expenses so advanced if it shall ultimately be determined that such Director is not entitled to be indemnified against such Expenses. Notwithstanding the foregoing, the Corporation shall advance all Expenses incurred by or on behalf of any Director seeking advancement of expenses hereunder in connection with a Proceeding initiated by such Director only if such Proceeding (including any parts of such Proceeding not initiated by such Director) was (i) authorized by the Board, or (ii) brought to enforce such Director’s rights to indemnification or advancement of Expenses under this Third Amended and Restated Certificate of Incorporation.

(b) If a claim for advancement of Expenses hereunder by a Director is not paid in full by the Corporation within thirty (30) days after receipt by the Corporation of documentation of Expenses and the required undertaking, such Director may at any time thereafter bring suit against the Corporation to recover the unpaid amount of the claim and if successful in whole or in part, such Director shall also be entitled to be paid the expenses of prosecuting or defending such suit. The failure of the Corporation (including its Board or any committee thereof, independent legal counsel, or stockholders) to make a determination concerning the permissibility of such advancement of Expenses under this Article Nine shall not be a defense to an action brought by a Director for recovery of the unpaid amount of an advancement claim and shall not create a presumption that such advancement is not permissible. The burden of proving that a Director is not entitled to an advancement of expenses shall be on the Corporation.

(c) In any suit brought by the Corporation to recover an advancement of expenses pursuant to the terms of an undertaking, the Corporation shall be entitled to recover such expenses upon a final adjudication that the Director has not met any applicable standard for indemnification set forth in the DGCL.

SECTION 6. Advancement of Expenses to Officers and Non-Officer Employees Prior to Final Disposition.

(a) The Corporation may, at the discretion of the Board, advance any or all Expenses incurred by or on behalf of any Officer or any Non-Officer Employee in connection with any Proceeding in which such person is involved by reason of his or her Corporate Status as an Officer or Non-Officer Employee upon the receipt by the Corporation of a statement or statements from such Officer or Non-Officer Employee requesting such advance or advances from time to time, whether prior to or after final disposition of such Proceeding. Such statement or statements shall reasonably evidence the Expenses incurred by such Officer or Non-Officer Employee and shall be preceded or accompanied by an undertaking by or on behalf of such person to repay any Expenses so advanced if it shall ultimately be determined that such Officer or Non-Officer Employee is not entitled to be indemnified against such Expenses.

(b) In any suit brought by the Corporation to recover an advancement of expenses pursuant to the terms of an undertaking, the Corporation shall be entitled to recover such expenses upon a final adjudication that the Officer or Non-Officer Employee has not met any applicable standard for indemnification set forth in the DGCL.

SECTION 7. Contractual Nature of Rights.

(a) The provisions of this Article Nine shall be deemed to be a contract between the Corporation and each Director and Officer entitled to the benefits hereof at any time while this Article Nine is in effect, in consideration of such person’s past or current and any future performance of services for the Corporation. Neither amendment, repeal or modification of any provision of this Article Nine inconsistent with this Article Nine shall eliminate or reduce any right conferred by this Article Nine in respect of any act or omission occurring, or any cause of action or claim that accrues or arises or any state of facts existing, at the time of or before such amendment, repeal, modification or adoption of an inconsistent provision (even in the case of a proceeding based on such a state of facts that is commenced after such time), and all rights to indemnification and advancement of Expenses granted herein or arising out of any act or omission shall vest at the time of the act or omission in question, regardless of when or if any proceeding with respect to such act or omission is commenced. The rights to indemnification and to advancement of expenses provided by, or granted pursuant to, this Article Nine shall continue notwithstanding that the person has ceased to be a Director or Officer and shall inure to the benefit of the estate, heirs, executors, administrators, legatees and distributes of such person.

(b) If a claim for indemnification (following final disposition of such Proceeding) or advancement of Expenses hereunder by a Director or Officer is not paid in full by the Corporation within sixty (60) days after receipt by the Corporation of a written claim for indemnification or advancement of Expenses, such Director or Officer may at any time thereafter bring suit against the Corporation to recover the unpaid amount of the claim, and if successful in whole or in part, pursuant to the terms of an undertaking, such Director or Officer shall also be entitled to be paid the expenses of prosecuting or defending such suit. The failure of the Corporation (including its Board or any committee thereof, independent legal counsel, or stockholders) to make a determination concerning the permissibility of such indemnification

under this Article Nine shall not be a defense to an action brought by a Director or Officer for recovery of the unpaid amount of an indemnification claim and shall not create a presumption that such indemnification is not permissible. The burden of proving that a Director or Officer is not entitled to indemnification or advancement of Expenses shall be on the Corporation.

(c) In any suit brought by a Director or Officer to enforce a right to indemnification hereunder, it shall be a defense that such Director or Officer has not met any applicable standard for indemnification set forth in the DGCL, but the burden of proving that a Director or Officer is not entitled to indemnification or advance of Expenses shall be on the Corporation.

SECTION 8. Non-Exclusivity of Rights. The rights to indemnification and to advancement of Expenses set forth in this Article Nine shall not be exclusive of any other right which any Director, Officer, or Non-Officer Employee may have or hereafter acquire under any statute, provision of this Third Amended and Restated Certificate of Incorporation, agreement, vote of stockholders or Disinterested Directors or otherwise.

SECTION 9. Insurance. The Corporation may maintain insurance, at its expense, to protect itself and any Director, Officer or Non-Officer Employee against any liability of any character asserted against or incurred by the Corporation or any such Director, Officer or Non-Officer Employee, or arising out of any such person’s Corporate Status, whether or not the Corporation would have the power to indemnify such person against such liability under the DGCL or the provisions of this Article Nine.

SECTION 10. Other Indemnification. Subject to any other right which any Director, Officer or Non-Officer Employee may have or hereafter acquire under any statute, provision of this Third Amended and Restated Certificate of Incorporation, agreement, vote of stockholders or Disinterested Directors or otherwise to the contrary, the Corporation’s obligation, if any, to indemnify or provide advancement of Expenses to any person under this Article Nine as a result of such person serving, at the request of the Corporation, as a director, partner, trustee, officer, employee or agent of another corporation, partnership, joint venture, trust, employee benefit plan or other enterprise shall be reduced by any amount such person may collect as indemnification or advancement of Expenses from such other corporation, partnership, joint venture, trust, employee benefit plan or enterprise (the “Primary Indemnitor”). Subject to any other right which any Director, Officer or Non-Officer Employee may have or hereafter acquire under any statute, provision of this Third Amended and Restated Certificate of Incorporation, agreement, vote of stockholders or Disinterested Directors or otherwise to the contrary, any indemnification or advancement of Expenses under this Article Nine owed by the Corporation as a result of a person serving, at the request of the Corporation, as a director, partner, trustee, officer, employee or agent of another corporation, partnership, joint venture, trust, employee benefit plan or other enterprise shall only be in excess of, and shall be secondary to, the indemnification or advancement of Expenses available from the applicable Primary Indemnitor(s) and any applicable insurance policies.

ARTICLE TEN

Unless the Corporation consents in writing to the selection of an alternative forum, the Delaware Court of Chancery shall be the sole and exclusive forum for (a) any derivative action or proceeding brought on behalf of the Corporation, (b) any action asserting a claim of breach of a fiduciary duty owed by any director, officer, employee or agent of the Corporation to the Corporation or the Corporation’s stockholders, (c) any action asserting a claim arising pursuant to any provision of the DGCL or (d) any action asserting a claim governed by the internal affairs doctrine, in each such case subject to such Delaware Court of Chancery having personal jurisdiction over the indispensable parties named as defendants therein. Any person or entity purchasing or otherwise acquiring any interest in shares of capital stock of the Corporation shall be deemed to have notice of and consented to the provisions of this Article Ten.

ARTICLE ELEVEN

The Corporation reserves the right to amend or repeal any provisions contained in this Third Amended and Restated Certificate of Incorporation from time to time and at any time in the manner now or hereafter prescribed by the laws of the State of Delaware, and all rights conferred upon stockholders and directors are granted subject to such reservation.

* * * * *

SECOND AMENDED AND RESTATED BYLAWS

OF

ROVER GROUP, INC.

SECTION 1. LAW, CERTIFICATE OF INCORPORATION AND BYLAWS

1.1. These Second Amended and Restated Bylaws (these “Bylaws”) of Rover Group, Inc. (the “Corporation”) are subject to the certificate of incorporation of the Corporation (as may be amended, amended and restated, supplemented, or modified from time to time, the “Certificate”). In these Bylaws, references to law, the Certificate and Bylaws mean the law, the provisions of the Certificate and the Bylaws as from time to time in effect.

SECTION 2. STOCKHOLDERS

2.1. Annual Meeting. The annual meeting of stockholders for the election of directors and for the transaction of such other business as may properly come before the meeting shall be held each year at such date and time, within or without the State of Delaware, as the board of directors shall determine.

2.2. Special Meetings. A special meeting of the stockholders may be called at any time by the chairman of the board, if any, the president, if any, or the board of directors. A special meeting of the stockholders shall be called by the secretary, or in the case of the death, absence, incapacity or refusal of the secretary, by an assistant secretary or some other officer, upon application of a majority of the directors. Any such application shall state the purpose or purposes of the proposed meeting. Any such call shall state the place, date, hour, and purposes of the meeting.

2.3. Place of Meeting. All meetings of the stockholders for the election of directors or for any other purpose shall be held at such place within or without the State of Delaware as may be determined from time to time by the board of directors. Any adjourned session of any meeting of the stockholders shall be held at the place designated in the vote of adjournment.

2.4. Notice of Meetings. Except as otherwise provided by law, a written notice of each meeting of stockholders stating the place, day and hour thereof and, in the case of a special meeting, the purposes for which the meeting is called, shall be given not less than ten nor more than sixty days before the meeting, to each stockholder entitled to vote thereat, and to each stockholder who, by law, by the Certificate or by these Bylaws, is entitled to notice, by leaving such notice with him or at his residence or usual place of business, or by depositing it in the United States mail, postage prepaid, and addressed to such stockholder at his address as it appears in the records of the Corporation. Without limiting the manner by which notice otherwise may be given effectively to stockholders, any notice to stockholders may be given by electronic transmission in the manner provided in Section 232 of the General Corporation Law of the State of Delaware. Such notice shall be given by the secretary, or by an officer or person designated by the board of directors, or in the case of a special meeting by the officer calling the meeting. As to any adjourned session of any meeting of stockholders, notice of the adjourned meeting need not be given if the time and place thereof are announced at the meeting at which

the adjournment was taken except that if the adjournment is for more than thirty days or if after the adjournment a new record date is set for the adjourned session, notice of any such adjourned session of the meeting shall be given in the manner heretofore described. No notice of any meeting of stockholders or any adjourned session thereof need be given to a stockholder if a written waiver of notice, or a waiver by electronic transmission by such stockholder, given before or after the meeting or such adjourned session by such stockholder, is filed with the records of the meeting or if the stockholder attends such meeting without objecting at the beginning of the meeting to the transaction of any business because the meeting is not lawfully called or convened. Neither the business to be transacted at, nor the purpose of, any meeting of the stockholders or any adjourned session thereof need be specified in any written waiver of notice.

2.5. Quorum of Stockholders. At any meeting of the stockholders a quorum as to any matter shall consist of a majority of the votes entitled to be cast on the matter, except where a larger quorum is required by law, by the Certificate or by these Bylaws. Any meeting may be adjourned from time to time by a majority of the votes properly cast upon the question, whether or not a quorum is present. If a quorum is present at an original meeting, a quorum need not be present at an adjourned session of that meeting. Shares of its own stock belonging to the Corporation or to another corporation, if a majority of the shares entitled to vote in the election of directors of such other corporation is held, directly or indirectly, by the Corporation, shall neither be entitled to vote nor be counted for quorum purposes; provided, however, that the foregoing shall not limit the right of any corporation to vote stock, including but not limited to its own stock, held by it in a fiduciary capacity.

2.6. Action by Vote. When a quorum is present at any meeting, a plurality of the votes properly cast for election to any office shall elect to such office and a majority of the votes properly cast upon any question other than an election to an office shall decide the question, except when a larger vote is required by law, by the Certificate or by these Bylaws. No ballot shall be required for any election unless requested by a stockholder present or represented at the meeting and entitled to vote in the election.

2.7. Action without Meetings. Unless otherwise provided in the Certificate, any action required or permitted to be taken by stockholders for or in connection with any corporate action may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted and shall be delivered to the Corporation by delivery to its registered office in Delaware by hand or certified or registered mail, return receipt requested, to its principal place of business or to an officer or agent of the Corporation having custody of the book in which proceedings of meetings of stockholders are recorded. Each such written consent shall bear the date of signature of each stockholder who signs the consent. No written consent shall be effective to take the corporate action referred to therein unless written consents signed by a number of stockholders sufficient to take such action are delivered to the Corporation in the manner specified in this paragraph within sixty days of the earliest dated consent so delivered.

If action is taken by consent of stockholders and in accordance with the foregoing, there shall be filed with the records of the meetings of stockholders the writing or writings comprising such consent.

If action is taken by less than unanimous consent of stockholders, prompt notice of the taking of such action without a meeting shall be given to those who have not consented in writing.

In the event that the action which is consented to is such as would have required the filing of a certificate under any provision of the General Corporation Law of the State of Delaware, if such action had been voted upon by the stockholders at a meeting thereof, the certificate filed under such provision shall state, in lieu of any statement required by such provision concerning a vote of stockholders, that written consent has been given under Section 228 of said General Corporation Law and that written notice has been given as provided in such Section 228.

2.8. Proxy Representation. Every stockholder may authorize another person or persons to act for him by proxy in all matters in which a stockholder is entitled to participate, whether by waiving notice of any meeting, objecting to or voting or participating at a meeting, or expressing consent or dissent without a meeting. Every proxy must be signed by the stockholder or by his attorney-in-fact. No proxy shall be voted or acted upon after three years from its date unless such proxy provides for a longer period. A duly executed proxy shall be irrevocable if it states that it is irrevocable and, if, and only as long as, it is coupled with an interest sufficient in law to support an irrevocable power. A proxy may be made irrevocable regardless of whether the interest with which it is coupled is an interest in the stock itself or an interest in the Corporation generally. The authorization of a proxy may but need not be limited to specified action, provided, however, that if a proxy limits its authorization to a meeting or meetings of stockholders, unless otherwise specifically provided such proxy shall entitle the holder thereof to vote at any adjourned session but shall not be valid after the final adjournment thereof.

2.9. Inspectors. The directors or the person presiding at the meeting may, and shall if required by applicable law, appoint one or more inspectors of election and any substitute inspectors to act at the meeting or any adjournment thereof. Each inspector, before entering upon the discharge of his duties, shall take and sign an oath faithfully to execute the duties of inspector at such meeting with strict impartiality and according to the best of his ability. The inspectors, if any, shall determine the number of shares of stock outstanding and the voting power of each, the shares of stock represented at the meeting, the existence of a quorum, the validity and effect of proxies, and shall receive votes, ballots or consents, hear and determine all challenges and questions arising in connection with the right to vote, count and tabulate all votes, ballots or consents, determine the result, and do such acts as are proper to conduct the election or vote with fairness to all stockholders. On request of the person presiding at the meeting, the inspectors shall make a report in writing of any challenge, question or matter determined by them and execute a certificate of any fact found by them.

2.10. List of Stockholders. The secretary shall prepare and make, at least ten days before every meeting of stockholders, a complete list of the stockholders entitled to vote at such meeting, arranged in alphabetical order and showing the address of each stockholder and the

number of shares registered in his name. The stock ledger shall be the only evidence as to who are stockholders entitled to examine such list or to vote in person or by proxy at such meeting.

SECTION 3. BOARD OF DIRECTORS

3.1. Number. The Corporation shall have one or more directors, the number of directors to be determined from time to time by vote of a majority of the directors then in office. Except in connection with the election of directors at the annual meeting of stockholders, the number of directors may be decreased only to eliminate vacancies by reason of death, resignation or removal of one or more directors. No director need be a stockholder.

3.2. Tenure. Except as otherwise provided by law, by the Certificate or by these Bylaws, each director shall hold office until the next annual meeting and until his successor is elected and qualified, or until he sooner dies, resigns, is removed or becomes disqualified. There shall be no limitation on how many terms a director can serve, except as provided by law.

3.3. Powers. The business and affairs of the Corporation shall be managed by or under the direction of the board of directors who shall have and may exercise all the powers of the Corporation and do all such lawful acts and things as are not by law, the Certificate or these Bylaws directed or required to be exercised or done by the stockholders.

3.4. Vacancies. Vacancies and any newly created directorships resulting from any increase in the number of directors may be filled by vote of the holders of the particular class or series of stock entitled to elect such director at a meeting called for the purpose, or by a majority of the directors then in office, although less than a quorum, or by a sole remaining director, in each case elected by the particular class or series of stock entitled to elect such directors. When one or more directors shall resign from the board, effective at a future date, a majority of the directors then in office, including those who have resigned, who were elected by the particular class or series of stock entitled to elect such resigning director or directors shall have power to fill such vacancy or vacancies, the vote or action by writing thereon to take effect when such resignation or resignations shall become effective. The directors shall have and may exercise all their powers notwithstanding the existence of one or more vacancies in their number, subject to any requirements of law or of the Certificate or of these Bylaws as to the number of directors required for a quorum or for any vote or other actions.

3.5. Committees. The board of directors may, by vote of a majority of the whole board, (a) designate, change the membership of or terminate the existence of any committee or committees, each committee to consist of one or more of the directors; (b) designate one or more directors as alternate members of any such committee who may replace any absent or disqualified member at any meeting of the committee; and (c) determine the extent to which each such committee shall have and may exercise the powers of the board of directors in the management of the business and affairs of the Corporation, including the power to authorize the seal of the Corporation to be affixed to all papers which require it and the power and authority to declare dividends or to authorize the issuance of stock; excepting, however, such powers which by law, by the Certificate or by these Bylaws they are prohibited from so delegating. In the absence or disqualification of any member of such committee and his alternate, if any, the

member or members thereof present at any meeting and not disqualified from voting, whether or not constituting a quorum, may unanimously appoint another member of the board of directors to act at the meeting in the place of any such absent or disqualified member. Except as the board of directors may otherwise determine, any committee may make rules for the conduct of its business, but unless otherwise provided by the board or such rules, its business shall be conducted as nearly as may be in the same manner as is provided by these Bylaws for the conduct of business by the board of directors. Each committee shall keep regular minutes of its meetings and report the same to the board of directors upon request.

3.6. Regular Meetings. Regular meetings of the board of directors may be held without call or notice at such places within or without the State of Delaware and at such times as the board may from time to time determine, provided that notice of the first regular meeting following any such determination shall be given to absent directors. A regular meeting of the directors may be held without call or notice immediately after and at the same place as the annual meeting of stockholders.

3.7. Special Meetings. Special meetings of the board of directors may be held at any time and at any place within or without the State of Delaware designated in the notice of the meeting, when called by the chairman of the board, if any, the president, or by one-third or more in number of the directors, reasonable notice thereof being given to each director by the secretary or by the chairman of the board, if any, the president or any one of the directors calling the meeting.

3.8. Notice. It shall be reasonable and sufficient notice to a director to send notice by mail at least forty-eight hours or by telegram at least twenty-four hours before the meeting addressed to him at his usual or last known business or residence address, by electronic communication or facsimile transmission at least twenty-four hours before the meeting addressed to him at his usual e-mail address or fax number or to give notice to him in person or by telephone at least twenty-four hours before the meeting. Notice of a meeting need not be given to any director if a written waiver of notice, or a waiver by electronic transmission by such director, given by him before or after the meeting, is filed with the records of the meeting, or to any director who attends the meeting without protesting prior thereto or at its commencement the lack of notice to him. Neither notice of a meeting nor a waiver of a notice need specify the purposes of the meeting.

3.9. Quorum. Except as may be otherwise provided by law, by the Certificate or by these Bylaws, at any meeting of the directors a majority of the directors then in office shall constitute a quorum; a quorum shall not in any case be less than one-third of the total number of directors constituting the whole board. Any meeting may be adjourned from time to time by a majority of the votes cast upon the question, whether or not a quorum is present, and the meeting may be held as adjourned without further notice.

3.10. Action by Vote. Except as may be otherwise provided by law, by the Certificate or by these Bylaws, when a quorum is present at any meeting the vote of a majority of the directors present shall be the act of the board of directors.

3.11. Action Without a Meeting. Any action required or permitted to be taken at any meeting of the board of directors or a committee thereof may be taken without a meeting if all the members of the board or of such committee, as the case may be, consent thereto in writing or by electronic transmission, and such writing or writings or electronic transmissions are filed with the records of the meetings of the board or of such committee. Such consent shall be treated for all purposes as the act of the board or of such committee, as the case may be.

3.12. Participation in Meetings by Conference Telephone. Members of the board of directors, or any committee designated by such board, may participate in a meeting of such board or committee by means of conference telephone or similar communications equipment by means of which all persons participating in the meeting can hear each other or by any other means permitted by law. Such participation shall constitute presence in person at such meeting.

3.13. Compensation. In the discretion of the board of directors, each director may be paid such fees for his services as director and be reimbursed for his reasonable expenses incurred in the performance of his duties as director as the board of directors from time to time may determine. Nothing contained in this section shall be construed to preclude any director from serving the Corporation in any other capacity and receiving reasonable compensation therefor.

3.14. Interested Directors and Officers.

(a) No contract or transaction between the Corporation and one or more of its directors or officers, or between the Corporation and any other corporation, partnership, association, or other organization in which one or more of the Corporation’s directors or officers are directors or officers, or have a financial interest, shall be void or voidable solely for this reason, or solely because the director or officer is present at or participates in the meeting of the board or committee thereof which authorizes the contract or transaction, or solely because his or their votes are counted for such purpose, if:

(1) The material facts as to his relationship or interest and as to the contract or transaction are disclosed or are known to the board of directors or the committee, and the board or committee in good faith authorizes the contract or transaction by the affirmative votes of a majority of the disinterested directors, even though the disinterested directors be less than a quorum; or

(2) The material facts as to his relationship or interest and as to the contract or transaction are disclosed or are known to the stockholders entitled to vote thereon, and the contract or transaction is specifically approved in good faith by vote of the stockholders; or

(3) The contract or transaction is fair as to the Corporation as of the time it is authorized, approved or ratified, by the board of directors, a committee thereof, or the stockholders.

(b) Common or interested directors may be counted in determining the presence of a quorum at a meeting of the board of directors or of a committee which authorizes the contract or transaction.

SECTION 4. OFFICERS

4.1. Enumeration; Qualification. The officers of the Corporation shall be a president, a treasurer, a secretary and such other officers, if any, as the board of directors from time to time may in its discretion elect or appoint including without limitation a chairman of the board, one or more vice presidents and a controller. The Corporation may also have such agents, if any, as the board of directors from time to time may in its discretion choose. Any officer may be but none need be a director or stockholder. Any two or more offices may be held by the same person. Any officer may be required by the board of directors to secure the faithful performance of his duties to the Corporation by giving bond in such amount and with sureties or otherwise as the board of directors may determine.

4.2. Powers. Subject to law, to the Certificate and to the other provisions of these Bylaws, each officer shall have, in addition to the duties and powers herein set forth, such duties and powers as are commonly incident to his office and such additional duties and powers as the board of directors may from time to time designate.

4.3. Election. The officers may be elected by the board of directors at their first meeting following the annual meeting of the stockholders or at any other time. At any time or from time to time the directors may delegate to any officer their power to elect or appoint any other officer or any agents.

4.4. Tenure. Each officer shall hold office until the first meeting of the board of directors following the next annual meeting of the stockholders and until his respective successor is chosen and qualified unless a shorter period shall have been specified by the terms of his election or appointment, or in each case until he sooner dies, resigns, is removed or becomes disqualified. There shall be no limit on how many terms an official can serve, except as provided by law. Each agent shall retain his authority at the pleasure of the directors, or the officer by whom he was appointed or by the officer who then holds agent appointive power.

4.5. Chairman of the Board of Directors, President and Vice President. The chairman of the board, if any, shall have such duties and powers as shall be designated from time to time by the board of directors. Unless the board of directors otherwise specifies, the chairman of the board, or if there is none the chief executive officer, shall preside, or designate the person who shall preside, at all meetings of the stockholders and of the board of directors.

Unless the board of directors otherwise specifies, the president shall be the chief executive officer and shall have direct charge of all business operations of the Corporation and, subject to the control of the directors, shall have general charge and supervision of the business of the Corporation.

Any vice presidents shall have such duties and powers as shall be set forth in these Bylaws or as shall be designated from time to time by the board of directors or by the president.

4.6. Treasurer and Assistant Treasurers. Unless the board of directors otherwise specifies, the treasurer shall be the chief financial officer of the Corporation and shall be in

charge of its funds and valuable papers, and shall have such other duties and powers as may be designated from time to time by the board of directors or by the president. If no controller is elected, the treasurer shall, unless the board of directors otherwise specifies, also have the duties and powers of the controller.

Any assistant treasurers shall have such duties and powers as shall be designated from time to time by the board of directors, the president or the treasurer.

4.7. Controller and Assistant Controllers. If a controller is elected, he shall, unless the board of directors otherwise specifies, be the chief accounting officer of the Corporation and be in charge of its books of account and accounting records, and of its accounting procedures. He shall have such other duties and powers as may be designated from time to time by the board of directors, the president or the treasurer.

Any assistant controller shall have such duties and powers as shall be designated from time to time by the board of directors, the president, the treasurer or the controller.

4.8. Secretary and Assistant Secretaries. The secretary shall record all proceedings of the stockholders, of the board of directors and of committees of the board of directors in a book or series of books to be kept therefor and shall file therein all actions by written consent of stockholders or directors. In the absence of the secretary from any meeting, an assistant secretary, or if there be none or he is absent, a temporary secretary chosen at the meeting, shall record the proceedings thereof. Unless a transfer agent has been appointed the secretary shall keep or cause to be kept the stock and transfer records of the Corporation, which shall contain the names and record addresses of all stockholders and the number of shares registered in the name of each stockholder. He shall have such other duties and powers as may from time to time be designated by the board of directors or the president.

Any assistant secretaries shall have such duties and powers as shall be designated from time to time by the board of directors, the president or the secretary.

SECTION 5. RESIGNATIONS AND REMOVALS

5.1. Any director or officer may resign at any time by delivering his resignation in writing to the chairman of the board, if any, the president, or the secretary or to a meeting of the board of directors. Such resignation shall be effective upon receipt unless specified to be effective at some other time, and without in either case the necessity of its being accepted unless the resignation shall so state. Except as may be otherwise provided by law, by the Certificate or by these Bylaws, a director (including persons elected by stockholders or directors to fill vacancies in the board) may be removed from office with or without cause by the vote of the holders of a majority of the issued and outstanding shares of the particular class or series entitled to vote in the election of such directors. The board of directors may at any time remove any officer either with or without cause. The board of directors may at any time terminate or modify the authority of any agent.

SECTION 6. VACANCIES

6.1. If the office of the president or the treasurer or the secretary becomes vacant, the directors may elect a successor by vote of a majority of the directors then in office. If the office of any other officer becomes vacant, any person or body empowered to elect or appoint that officer may choose a successor. Each such successor shall hold office for the unexpired term, and in the case of the president, the treasurer and the secretary until his successor is chosen and qualified or in each case until he sooner dies, resigns, is removed or becomes disqualified. Any vacancy of a directorship shall be filled as specified in Section 3.4 of these Bylaws.

SECTION 7. CAPITAL STOCK

7.1. Certificates for Shares. Unless otherwise provided by the board of directors, shares of stock of the Corporation shall be certificated. Certificates for shares of stock of the Corporation, if any, will be in the form approved by the board of directors. The certificates must be signed by two authorized officers. Any and all signatures on the certificates may be a facsimile and may be sealed with the Corporation seal or a facsimile thereof. If any officer, transfer agent or registrar who has signed, or whose facsimile signature has been placed upon, a certificate has ceased to be an officer, transfer agent or registrar before the certificate is issued, the certificate may be issued by the Corporation with the same effect as if he or she were an officer, transfer agent or registrar at the date of issue. The board of directors may provide by resolution(s) that some or all of any or all classes or series of its stock will be uncertificated shares. However, any such resolution will not apply to shares represented by a certificate until that certificate is surrendered to the Corporation.

7.2. Loss of Certificates. In the case of the alleged theft, loss, destruction or mutilation of a certificate of stock, a duplicate certificate may be issued in place thereof, upon such terms, including receipt of a bond sufficient to indemnify the Corporation against any claim on account thereof, as the board of directors may prescribe.

SECTION 8. TRANSFER OF SHARES OF STOCK

8.1. Transfer on Books. Subject to the restrictions, if any, stated or noted on the stock certificate, shares of stock may be transferred on the books of the Corporation by the surrender to the Corporation or its transfer agent of the certificate therefor properly endorsed or accompanied by a written assignment and power of attorney properly executed, with necessary transfer stamps affixed, and with such proof of the authenticity of signature as the board of directors or the transfer agent of the Corporation may reasonably require. Except as may be otherwise required by law, by the Certificate or by these Bylaws, the Corporation shall be entitled to treat the record holder of stock as shown on its books as the owner of such stock for all purposes, including the payment of dividends and the right to receive notice and to vote or to give any consent with respect thereto and to be held liable for such calls and assessments, if any, as may lawfully be made thereon, regardless of any transfer, pledge or other disposition of such stock until the shares have been properly transferred on the books of the Corporation.

It shall be the duty of each stockholder to notify the Corporation of his post office address.

8.2. Record Date. In order that the Corporation may determine the stockholders entitled to notice of or to vote at any meeting of stockholders or any adjournment thereof, the board of directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted by the board of directors, and which record date shall not be more than sixty nor less than ten days before the date of such meeting. If no such record date is fixed by the board of directors, the record date for determining the stockholders entitled to notice of or to vote at a meeting of stockholders shall be at the close of business on the day next preceding the day on which notice is given, or, if notice is waived, at the close of business on the day next preceding the day on which the meeting is held. A determination of stockholders of record entitled to notice of or to vote at a meeting of stockholders shall apply to any adjournment of the meeting; provided, however, that the board of directors may fix a new record date for the adjourned meeting.

In order that the Corporation may determine the stockholders entitled to consent to corporate action in writing without a meeting, the board of directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted by the board of directors, and which date shall not be more than ten days after the date upon which the resolution fixing the record date is adopted by the board of directors. If no such record date has been fixed by the board of directors, the record date for determining stockholders entitled to consent to corporate action in writing without a meeting, when no prior action by the board of directors is required by the General Corporation Law of the State of Delaware, shall be the first date on which a signed written consent setting forth the action taken or proposed to be taken is delivered to the Corporation by delivery to its registered office in Delaware by hand or certified or registered mail, return receipt requested, to its principal place of business or to an officer or agent of the Corporation having custody of the book in which proceedings of meetings of stockholders are recorded. If no record date has been fixed by the board of directors and prior action by the board of directors is required by the General Corporation Law of the State of Delaware, the record date for determining stockholders entitled to consent to corporate action in writing without a meeting shall be at the close of business on the day on which the board of directors adopts the resolution taking such prior action.

In order that the Corporation may determine the stockholders entitled to receive payment of any dividend or other distribution or allotment of any rights or to exercise any rights in respect of any change, conversion or exchange of stock, or for the purpose of any other lawful action, the board of directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted, and which record date shall be not more than sixty days prior to such payment, exercise or other action. If no such record date is fixed, the record date for determining stockholders for any such purpose shall be at the close of business on the day on which the board of directors adopts the resolution relating thereto.

SECTION 9. CORPORATE SEAL

9.1. Subject to alteration by the directors, the seal of the Corporation shall consist of a flat-faced circular die with the word “Delaware” and the name of the Corporation cut or engraved thereon, together with such other words, dates or images as may be approved from time to time by the directors.

SECTION 10. EXECUTION OF PAPERS

10.1. Except as the board of directors may generally or in particular cases authorize the execution thereof in some other manner, all deeds, leases, transfers, contracts, bonds, notes, checks, drafts or other obligations made, accepted or endorsed by the Corporation shall be signed by the chairman of the board, if any, the president, a vice president or the treasurer.

SECTION 11. FISCAL YEAR

11.1. The fiscal year of the Corporation shall end on the last day of December, or such other date as determined by the board of directors.

SECTION 12. AMENDMENTS

12.1. These Bylaws may be adopted, amended or repealed by vote of a majority of the directors then in office or by vote of a majority of the voting power of the stock outstanding and entitled to vote. Any by-law, whether adopted, amended or repealed by the stockholders or directors, may be amended or reinstated by the stockholders or the directors.

ADOPTED FEBRUARY 27, 2024

Blackstone Completes Acquisition of Rover

Seattle, WA - February 27, 2024 - (GLOBE NEWSWIRE) -- Rover Group, Inc. (“Rover” or the “Company”), the world’s largest online marketplace for pet care, today announced the completion of its acquisition by private equity funds affiliated with Blackstone (“Blackstone”) in an all-cash transaction valued at approximately $2.3 billion.

The transaction was previously announced on November 29, 2023 and was approved by Rover stockholders at Rover’s special meeting of stockholders held on February 22, 2024. With the completion of the acquisition, Rover stockholders are entitled to receive $11.00 in cash for each share of Rover common stock they owned immediately prior to the closing. Rover’s common stock has ceased trading and will be delisted from the Nasdaq Stock Market.

“The closing of this transaction is an important milestone in Rover’s history and marks the start of the next chapter in our story,” said Aaron Easterly, co-founder and CEO of Rover. “We are excited to officially partner with Blackstone to leverage their resources and deep expertise to further our mission of making it possible for everyone to experience the unconditional love of a pet.”

Sachin Bavishi, Senior Managing Director at Blackstone, said, “Aaron and the Rover team have done an incredible job building a leading digital marketplace for pet services. We’re thrilled to embark on this partnership, bringing Blackstone’s scale and resources to further accelerate Rover’s growth and innovation, and enhance Rover’s strong value proposition relative to alternatives.”

Advisors

Goldman Sachs & Co. LLC acted as lead financial advisor to Rover, and Centerview Partners LLC also acted as a financial advisor to Rover and delivered a fairness opinion to Rover’s Board of Directors with respect to the proposed transaction. Wilson Sonsini Goodrich & Rosati, Professional Corporation acted as legal counsel to Rover.

Evercore acted as lead financial advisor and Moelis & Company LLC also acted as a financial advisor to Blackstone, and Kirkland & Ellis LLP acted as legal counsel to Blackstone.

About Rover Group, Inc.

Founded in 2011 and based in Seattle, Rover is the world’s largest online marketplace for pet care. Rover connects pet parents with pet providers who offer overnight services, including boarding and in-home pet sitting, as well as daytime services, including doggy daycare, dog walking, and drop-in visits. To learn more about Rover, please visit www.rover.com.

About Blackstone

Blackstone is the world’s largest alternative asset manager. We seek to deliver compelling returns for institutional and individual investors by strengthening the companies in which we invest. Our more than $1 trillion in assets under management include global investment strategies focused on real estate, private equity, infrastructure, life sciences, growth equity,