LOWES COMPANIES INC0000060667false00000606672024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2024

LOWE’S COMPANIES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| North Carolina | 1-7898 | 56-0578072 |

(State or other jurisdiction

of incorporation) | (Commission File

Number) | (IRS Employer

Identification No.) |

| | | | | | | | |

1000 Lowes Blvd., Mooresville, NC | | 28117 |

| (Address of principal executive offices) | | (Zip Code) |

| | |

| Registrant’s telephone number, including area code: | | (704) 758-1000 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.50 per share | LOW | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | |

| ☐ | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

Item 2.02 Results of Operations and Financial Condition.

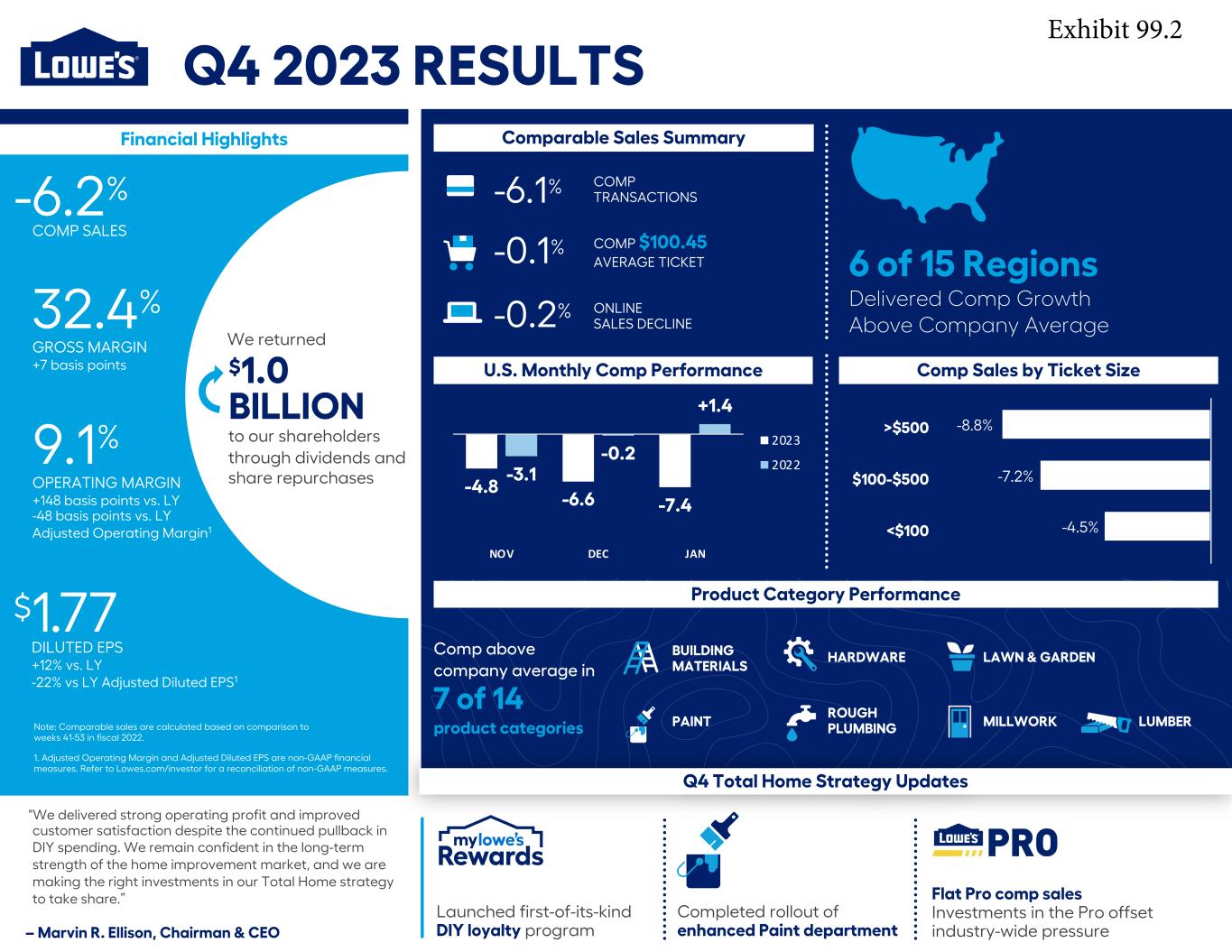

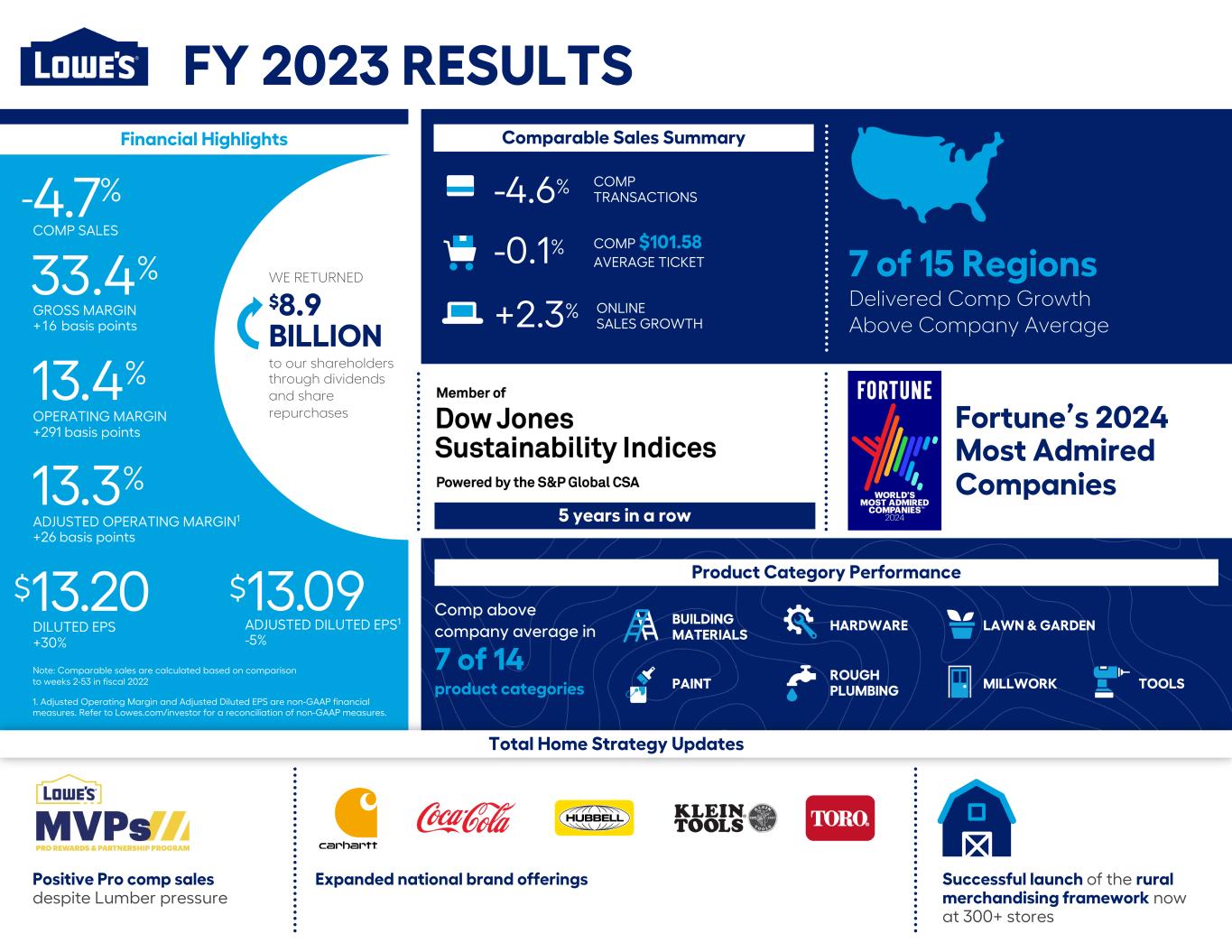

On February 27, 2024, Lowe’s Companies, Inc. (the “Company”) issued a press release and related infographic, furnished as Exhibits 99.1 and 99.2, respectively, and incorporated herein by reference, announcing the Company’s financial results for its fourth quarter and year ended February 2, 2024.

The information provided pursuant to Item 2.02, including the exhibits attached hereto, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in any such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| LOWE’S COMPANIES, INC. |

| | |

Date: February 27, 2024 | By: | /s/ Dan C. Griggs, Jr. |

| Name: | Dan C. Griggs, Jr. |

| Title: | Senior Vice President, Tax and Chief Accounting Officer |

Exhibit 99.1

February 27, 2024

For 6:00 a.m. ET Release

LOWE’S REPORTS FOURTH QUARTER 2023 SALES AND EARNINGS RESULTS

— Comparable Sales Decreased 6.2%; Diluted EPS of $1.77—

— Provides Full Year 2024 Outlook —

MOORESVILLE, N.C., Feb. 27, 2024 – Lowe’s Companies, Inc. (NYSE: LOW) today reported net earnings of $1.0 billion and diluted earnings per share (EPS) of $1.77 for the quarter ended Feb. 2, 2024, compared to diluted EPS of $1.58 in the fourth quarter of 2022, which included pre-tax transaction costs of $441 million associated with the sale of our Canadian retail business. Excluding the transaction costs in the prior year, fourth quarter 2022 adjusted diluted EPS1 was $2.28.

Total sales for the quarter were $18.6 billion,2 compared to $22.4 billion in the prior year quarter. Prior-year quarterly sales included approximately $1.4 billion from the additional 53rd week, as well as $958 million generated from our Canadian retail business.

Comparable sales3 for the quarter decreased 6.2% due to a slowdown in DIY demand and unfavorable January winter weather, while Pro customer comparable sales were flat for the quarter.

“This quarter we delivered strong operating profit and improved customer satisfaction, despite the continued pullback in DIY spending,” commented Marvin R. Ellison, Lowe's chairman, president and CEO. “We remain confident in the long-term strength of the home improvement market, and we are making the right investments in our Total Home strategy to take share. We are also pleased to award $140 million in discretionary bonuses to our frontline associates in recognition of their exceptional customer service in 2023.”

As of Feb. 2, 2024, Lowe's operated 1,746 stores representing 194.9 million square feet of retail selling space.

Capital Allocation

The company remains committed to a best-in-class capital allocation strategy focused on driving long-term, sustainable shareholder value. During the quarter, the company repurchased approximately 1.9 million shares for $404 million, and it repurchased 29.9 million shares for $6.3 billion for the year.

The company also paid $633 million in dividends in the fourth quarter and $2.5 billion in dividends for the year. In total, the company returned $8.9 billion to shareholders through share repurchases and dividends in fiscal 2023.

1 Adjusted diluted earnings per share is a non-GAAP financial measure. Refer to the “Non-GAAP Financial Measures Reconciliation” section of this release for additional information, as well as reconciliations between the Company’s GAAP and non-GAAP financial results.

2 Total fourth quarter sales includes an approximately $200 million headwind related to a timing shift in our fiscal calendar as we cycle over a 53-week year.

3 Comparable sales are based on comparison to weeks 41-53 in 2022.

The company is introducing its outlook for full year 2024, which reflects near-term macroeconomic uncertainty.

Full Year 2024 Outlook

•Total sales of $84 to $85 billion

•Comparable sales expected to be down -2 to -3% as compared to prior year

•Operating income as a percentage of sales (operating margin) of 12.6% to 12.7%

•Interest expense of approximately $1.4 billion

•Effective income tax rate of approximately 25%

•Diluted earnings per share of approximately $12.00 to $12.30

•Capital expenditures of approximately $2 billion

A conference call to discuss fourth quarter 2023 operating results is scheduled for today, Tuesday, Feb. 27, at 9 a.m. ET. The conference call will be available by webcast and can be accessed by visiting Lowe’s website at ir.lowes.com and clicking on Lowe’s Fourth Quarter 2023 Earnings Conference Call Webcast. Supplemental slides will be available approximately 15 minutes prior to the start of the conference call. A replay of the call will be archived at ir.lowes.com.

Lowe’s Companies, Inc. (NYSE: LOW) is a FORTUNE® 50 home improvement company serving approximately 16 million customer transactions a week in the United States. With total fiscal year 2023 sales of more than $86 billion, Lowe’s operates over 1,700 home improvement stores and employs approximately 300,000 associates. Based in Mooresville, N.C., Lowe’s supports the communities it serves through programs focused on creating safe, affordable housing and helping to develop the next generation of skilled trade experts. For more information, visit Lowes.com.

| | |

| Disclosure Regarding Forward-Looking Statements |

This press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements including words such as “believe”, “expect”, “anticipate”, “plan”, “desire”, “project”, “estimate”, “intend”, “will”, “should”, “could”, “would”, “may”, “strategy”, “potential”, “opportunity”, “outlook”, “scenario”, “guidance”, and similar expressions are forward-looking statements. Forward-looking statements involve, among other things, expectations, projections, and assumptions about future financial and operating results, objectives (including objectives related to environmental, social, and governance matters), business outlook, priorities, sales growth, shareholder value, capital expenditures, cash flows, the housing market, the home improvement industry, demand for products and services including customer acceptance of new offerings and initiatives, share repurchases, Lowe’s strategic initiatives, including those relating to acquisitions and dispositions and the impact of such transactions on our strategic and operational plans and financial results. Such statements involve risks and uncertainties, and we can give no assurance that they will prove to be correct. Actual results may differ materially from those expressed or implied in such statements.

A wide variety of potential risks, uncertainties, and other factors could materially affect our ability to achieve the results either expressed or implied by these forward-looking statements including, but not limited to, changes in general economic conditions, such as volatility and/or lack of liquidity from time to time in U.S. and world financial markets and the consequent reduced availability and/or higher cost of borrowing to Lowe’s and its customers, slower rates of growth in real disposable personal income that could affect the rate of growth in consumer spending, inflation and its impacts on discretionary spending and on our costs, shortages, and other disruptions in the labor supply, interest rate and currency fluctuations, home price appreciation or decreasing housing turnover, age of housing stock, the availability of consumer credit and of mortgage financing, trade policy changes or additional tariffs, outbreaks of pandemics, fluctuations in fuel and energy costs, inflation or deflation of commodity prices, natural disasters, armed conflicts, acts of both domestic and international terrorism, and other factors that can negatively affect our customers.

Investors and others should carefully consider the foregoing factors and other uncertainties, risks and potential events including, but not limited to, those described in “Item 1A - Risk Factors” in our most recent Annual Report on Form 10-K and as may be updated from time to time in Item 1A in our quarterly reports on Form 10-Q or other subsequent filings with the SEC. All such forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update these statements other than as required by law.

LOW-IR

###

| | | | | | | | | | | |

| Contacts: | Shareholder/Analyst Inquiries: | | Media Inquiries: |

| Kate Pearlman | | Steve Salazar |

| 704-775-3856 | | steve.j.salazar@lowes.com |

| kate.pearlman@lowes.com | | |

Lowe’s Companies, Inc.

Consolidated Statements of Current Earnings and Accumulated Deficit (Unaudited)

In Millions, Except Per Share and Percentage Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Fiscal Year Ended |

| February 2, 2024 | | February 3, 2023 | | February 2, 2024 | | February 3, 2023 |

| Current Earnings | Amount | | % Sales | | Amount | | % Sales | | Amount | | % Sales | | Amount | | % Sales |

| Net sales | $ | 18,602 | | | 100.00 | | | $ | 22,445 | | | 100.00 | | | $ | 86,377 | | | 100.00 | | | $ | 97,059 | | | 100.00 | |

| Cost of sales | 12,576 | | | 67.60 | | | 15,189 | | | 67.67 | | | 57,533 | | | 66.61 | | | 64,802 | | | 66.77 | |

| Gross margin | 6,026 | | | 32.40 | | | 7,256 | | | 32.33 | | | 28,844 | | | 33.39 | | | 32,257 | | | 33.23 | |

| Expenses: | | | | | | | | | | | | | | | |

| Selling, general and administrative | 3,897 | | | 20.95 | | | 5,131 | | | 22.86 | | | 15,570 | | | 18.02 | | | 20,332 | | | 20.94 | |

| Depreciation and amortization | 442 | | | 2.38 | | | 421 | | | 1.88 | | | 1,717 | | | 1.99 | | | 1,766 | | | 1.82 | |

| Operating income | 1,687 | | | 9.07 | | | 1,704 | | | 7.59 | | | 11,557 | | | 13.38 | | | 10,159 | | | 10.47 | |

| Interest – net | 348 | | | 1.87 | | | 322 | | | 1.43 | | | 1,382 | | | 1.60 | | | 1,123 | | | 1.16 | |

| | | | | | | | | | | | | | | |

| Pre-tax earnings | 1,339 | | | 7.20 | | | 1,382 | | | 6.16 | | | 10,175 | | | 11.78 | | | 9,036 | | | 9.31 | |

| Income tax provision | 319 | | | 1.72 | | | 425 | | | 1.90 | | | 2,449 | | | 2.83 | | | 2,599 | | | 2.68 | |

| Net earnings | $ | 1,020 | | | 5.48 | | | $ | 957 | | | 4.26 | | | $ | 7,726 | | | 8.95 | | | $ | 6,437 | | | 6.63 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Weighted average common shares outstanding – basic | 574 | | | | | 603 | | | | | 582 | | | | | 629 | | | |

Basic earnings per common share (1) | $ | 1.77 | | | | | $ | 1.58 | | | | | $ | 13.23 | | | | | $ | 10.20 | | | |

Weighted average common shares outstanding – diluted | 575 | | | | | 605 | | | | | 584 | | | | | 631 | | | |

Diluted earnings per common share (1) | $ | 1.77 | | | | | $ | 1.58 | | | | | $ | 13.20 | | | | | $ | 10.17 | | | |

Cash dividends per share | $ | 1.10 | | | | | $ | 1.05 | | | | | $ | 4.35 | | | | | $ | 3.95 | | | |

| | | | | | | | | | | | | | | |

| Accumulated Deficit | | | | | | | | | | | | | | | |

| Balance at beginning of period | $ | (15,744) | | | | | $ | (13,313) | | | | | $ | (14,862) | | | | | $ | (5,115) | | | |

| | | | | | | | | | | | | | | |

| Net earnings | 1,020 | | | | | 957 | | | | | 7,726 | | | | | 6,437 | | | |

| Cash dividends declared | (633) | | | | | (633) | | | | | (2,531) | | | | | (2,466) | | | |

| Share repurchases | (280) | | | | | (1,873) | | | | | (5,970) | | | | | (13,718) | | | |

| Balance at end of period | $ | (15,637) | | | | | $ | (14,862) | | | | | $ | (15,637) | | | | | $ | (14,862) | | | |

| | | | | | | | | | | | | | | |

(1) Under the two-class method, earnings per share is calculated using net earnings allocable to common shares, which is derived by reducing net earnings by the earnings allocable to participating securities. Net earnings allocable to common shares used in the basic and diluted earnings per share calculation were $1,017 million for the three months ended February 2, 2024, and $954 million for the three months ended February 3, 2023. Net earnings allocable to common shares used in the basic and diluted earnings per share calculation were $7,706 million for the fiscal year ended February 2, 2024, and $6,416 million for the fiscal year ended February 3, 2023.

Lowe’s Companies, Inc.

Consolidated Statements of Comprehensive Income (Unaudited)

In Millions, Except Percentage Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Fiscal Year Ended |

| | February 2, 2024 | | February 3, 2023 | | February 2, 2024 | | February 3, 2023 |

| | Amount | | % Sales | | Amount | | % Sales | | Amount | | % Sales | | Amount | | % Sales |

| Net earnings | $ | 1,020 | | | 5.48 | | | $ | 957 | | | 4.26 | | | $ | 7,726 | | | 8.95 | | | $ | 6,437 | | | 6.63 | |

Foreign currency translation adjustments – net of tax | — | | | — | | | 209 | | | 0.93 | | | 5 | | | 0.01 | | | 36 | | | 0.04 | |

| Cash flow hedges – net of tax | (4) | | | (0.02) | | | (43) | | | (0.19) | | | (14) | | | (0.02) | | | 309 | | | 0.32 | |

Other | 2 | | | 0.01 | | | 2 | | | 0.01 | | | 2 | | | — | | | (2) | | | — | |

| Other comprehensive (loss)/income | (2) | | | (0.01) | | | 168 | | | 0.75 | | | (7) | | | (0.01) | | | 343 | | | 0.36 | |

| Comprehensive income | $ | 1,018 | | | 5.47 | | | $ | 1,125 | | | 5.01 | | | $ | 7,719 | | | 8.94 | | | $ | 6,780 | | | 6.99 | |

| | | | | | | | | | | | | | | |

Lowe’s Companies, Inc.

Consolidated Balance Sheets (Unaudited)

In Millions, Except Par Value Data

| | | | | | | | | | | | | | | | |

| | | | | | |

| | February 2, 2024 | | February 3, 2023 | | |

| Assets | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | | $ | 921 | | | $ | 1,348 | | | |

| Short-term investments | | 307 | | | 384 | | | |

| Merchandise inventory – net | | 16,894 | | | 18,532 | | | |

| Other current assets | | 949 | | | 1,178 | | | |

| Total current assets | | 19,071 | | | 21,442 | | | |

| Property, less accumulated depreciation | | 17,653 | | | 17,567 | | | |

| Operating lease right-of-use assets | | 3,733 | | | 3,518 | | | |

| Long-term investments | | 252 | | | 121 | | | |

| Deferred income taxes – net | | 248 | | | 250 | | | |

| Other assets | | 838 | | | 810 | | | |

| Total assets | | $ | 41,795 | | | $ | 43,708 | | | |

| | | | | | |

| Liabilities and shareholders' deficit | | | | | | |

| Current liabilities: | | | | | | |

| Short-term borrowings | | $ | — | | | $ | 499 | | | |

| Current maturities of long-term debt | | 537 | | | 585 | | | |

| Current operating lease liabilities | | 487 | | | 522 | | | |

| Accounts payable | | 8,704 | | | 10,524 | | | |

| Accrued compensation and employee benefits | | 954 | | | 1,109 | | | |

| Deferred revenue | | 1,408 | | | 1,603 | | | |

| Income taxes payable | | 33 | | | 1,181 | | | |

| Other current liabilities | | 3,445 | | | 3,488 | | | |

| Total current liabilities | | 15,568 | | | 19,511 | | | |

| Long-term debt, excluding current maturities | | 35,384 | | | 32,876 | | | |

| Noncurrent operating lease liabilities | | 3,737 | | | 3,512 | | | |

| Deferred revenue – Lowe's protection plans | | 1,225 | | | 1,201 | | | |

| Other liabilities | | 931 | | | 862 | | | |

| Total liabilities | | 56,845 | | | 57,962 | | | |

| | | | | | |

| Shareholders' deficit: | | | | | | |

| Preferred stock, $5 par value: Authorized – 5.0 million shares; Issued and outstanding – none | | — | | | — | | | |

| Common stock, $0.50 par value: Authorized – 5.6 billion shares; Issued and outstanding – 574 million and 601 million, respectively | | 287 | | | 301 | | | |

| | | | | | |

| Accumulated deficit | | (15,637) | | | (14,862) | | | |

| Accumulated other comprehensive income | | 300 | | | 307 | | | |

| Total shareholders' deficit | | (15,050) | | | (14,254) | | | |

| Total liabilities and shareholders' deficit | | $ | 41,795 | | | $ | 43,708 | | | |

| | | | | | |

Lowe’s Companies, Inc.

Consolidated Statements of Cash Flows (Unaudited)

In Millions

| | | | | | | | | | | |

| Fiscal Year Ended |

| February 2, 2024 | | February 3, 2023 |

| Cash flows from operating activities: | | | |

| Net earnings | $ | 7,726 | | | $ | 6,437 | |

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | |

| Depreciation and amortization | 1,923 | | | 1,981 | |

| Noncash lease expense | 499 | | | 530 | |

| Deferred income taxes | 6 | | | (239) | |

| Asset impairment and loss on property – net | 83 | | | 2,118 | |

| | | |

| | | |

| | | |

| (Gain)/loss on sale of business | (79) | | | 421 | |

| Share-based payment expense | 210 | | | 223 | |

| Changes in operating assets and liabilities: | | | |

| Merchandise inventory – net | 1,637 | | | (2,594) | |

| Other operating assets | 182 | | | 56 | |

| Accounts payable | (1,820) | | | (549) | |

| Deferred revenue | (170) | | | (183) | |

| Other operating liabilities | (2,057) | | | 388 | |

| Net cash provided by operating activities | 8,140 | | | 8,589 | |

| | | |

| Cash flows from investing activities: | | | |

| Purchases of investments | (1,785) | | | (1,189) | |

| Proceeds from sale/maturity of investments | 1,722 | | | 1,174 | |

| Capital expenditures | (1,964) | | | (1,829) | |

| Proceeds from sale of property and other long-term assets | 53 | | | 45 | |

| | | |

| Proceeds from sale of business | 100 | | | 491 | |

| Other – net | (27) | | | (1) | |

| Net cash used in investing activities | (1,901) | | | (1,309) | |

| | | |

| Cash flows from financing activities: | | | |

| Net change in commercial paper | (499) | | | 499 | |

| Net proceeds from issuance of debt | 2,983 | | | 9,667 | |

| Repayment of debt | (601) | | | (867) | |

| Proceeds from issuance of common stock under share-based payment plans | 141 | | | 151 | |

| Cash dividend payments | (2,531) | | | (2,370) | |

| Repurchases of common stock | (6,138) | | | (14,124) | |

| Other – net | (21) | | | (5) | |

| Net cash used in financing activities | (6,666) | | | (7,049) | |

| | | |

| Effect of exchange rate changes on cash | — | | | (16) | |

| | | |

| Net (decrease)/increase in cash and cash equivalents | (427) | | | 215 | |

| Cash and cash equivalents, beginning of period | 1,348 | | | 1,133 | |

| Cash and cash equivalents, end of period | $ | 921 | | | $ | 1,348 | |

| | | |

Lowe’s Companies, Inc.

Non-GAAP Financial Measure Reconciliation (Unaudited)

To provide additional transparency, the Company has presented a comparison to the non-GAAP financial measure of adjusted diluted earnings per share for the three months ended February 3, 2023. This measure excludes the impact of a certain item, further described below, not contemplated in Lowe’s Business Outlook to assist analysts and investors in understanding the comparison of operational performance to the fourth quarter of fiscal 2022.

Fiscal 2022 Impacts

During fiscal 2022, the Company recognized financial impacts from the following, not contemplated in the Company's Business Outlook for fiscal 2022:

•In the fourth quarter of fiscal 2022, the Company recognized pre-tax transaction costs totaling $441 million, consisting of the loss on the sale and other closing costs associated with the sale of the Canadian retail business (Canadian retail business transaction).

Adjusted diluted earnings per share should not be considered an alternative to, or more meaningful indicator of, the Company’s diluted earnings per share as prepared in accordance with GAAP. The Company’s methods of determining non-GAAP financial measures may differ from the method used by other companies and may not be comparable.

A reconciliation between the Company’s GAAP and non-GAAP financial results is shown below and available on the Company’s website at ir.lowes.com.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Three Months Ended |

| | | |

| | | February 3, 2023 |

| | | | | | | Pre-Tax Earnings | | Tax1 | | Net Earnings |

| Diluted earnings per share, as reported | | | | | | | | | | | $ | 1.58 | |

Non-GAAP adjustments – per share impacts | | | | | | | | | | | |

| | | | | | | | | | | |

| Canadian retail business transaction | | | | | | | 0.73 | | | (0.03) | | | 0.70 | |

| | | | | | | | | | | |

| Adjusted diluted earnings per share | | | | | | | | | | | $ | 2.28 | |

1 Represents the corresponding tax benefit or expense specifically related to the item excluded from adjusted diluted earnings per share.

Financial Highlights Comparable Sales Summary Product Category Performance Comp above company average in 7 of 14 product categories "We delivered strong operating profit and improved customer satisfaction despite the continued pullback in DIY spending. We remain confident in the long-term strength of the home improvement market, and we are making the right investments in our Total Home strategy to take share.” – Marvin R. Ellison, Chairman & CEO Q4 2023 RESULTS -4.8 -6.6 -7.4 -3.1 -0.2 +1.4 NOV DEC JAN 2023 2022 U.S. Monthly Comp Performance Comp Sales by Ticket Size Launched first-of-its-kind DIY loyalty program -6.2% COMP SALES Note: Comparable sales are calculated based on comparison to weeks 41-53 in fiscal 2022. 1. Adjusted Operating Margin and Adjusted Diluted EPS are non-GAAP financial measures. Refer to Lowes.com/investor for a reconciliation of non-GAAP measures. We returned $1.0 BILLION to our shareholders through dividends and share repurchases 32.4% GROSS MARGIN +7 basis points $1.77 DILUTED EPS +12% vs. LY -22% vs LY Adjusted Diluted EPS1 Completed rollout of enhanced Paint department Flat Pro comp sales Investments in the Pro offset industry-wide pressure 9.1% OPERATING MARGIN +148 basis points vs. LY -48 basis points vs. LY Adjusted Operating Margin1 Q4 Total Home Strategy Updates COMP TRANSACTIONS COMP $100.45 AVERAGE TICKET ONLINE SALES DECLINE -6.1% -0.1% -0.2% -4.5% -7.2% -8.8%>$500 $100-$500 <$100 6 of 15 Regions Delivered Comp Growth Above Company Average BUILDING MATERIALS HARDWARE LAWN & GARDEN PAINT ROUGH PLUMBING MILLWORK LUMBER Exhibit 99.2

Product Category Performance Positive Pro comp sales despite Lumber pressure Successful launch of the rural merchandising framework now at 300+ stores Fortune’s 2024 Most Admired Companies Expanded national brand offerings WE RETURNED $8.9 BILLION to our shareholders through dividends and share repurchases 33.4% GROSS MARGIN +16 basis points COMP SALES $13.20 DILUTED EPS +30% 13.4% OPERATING MARGIN +291 basis points Financial Highlights COMP TRANSACTIONS COMP $101.58 AVERAGE TICKET -4.6% -0.1% +2.3% FY 2023 RESULTS -4.7% 5 years in a row Total Home Strategy Updates BUILDING MATERIALS HARDWARE LAWN & GARDEN PAINT ROUGH PLUMBING 13.3% ADJUSTED OPERATING MARGIN1 +26 basis points $13.09 ADJUSTED DILUTED EPS1 -5% Note: Comparable sales are calculated based on comparison to weeks 2-53 in fiscal 2022 1. Adjusted Operating Margin and Adjusted Diluted EPS are non-GAAP financial measures. Refer to Lowes.com/investor for a reconciliation of non-GAAP measures. 7 of 15 Regions Delivered Comp Growth Above Company Average MILLWORK TOOLS Comp above company average in 7 of 14 product categories ONLINE SALES GROWTH Comparable Sales Summary

Total Home Strategy Providing a full complement of products and services for Pros and Consumers alike, enabling a Total Home solution for every need in the home Market Share Acceleration Drive Pro penetration Accelerate online business Expand installation services Drive localization Elevate assortment

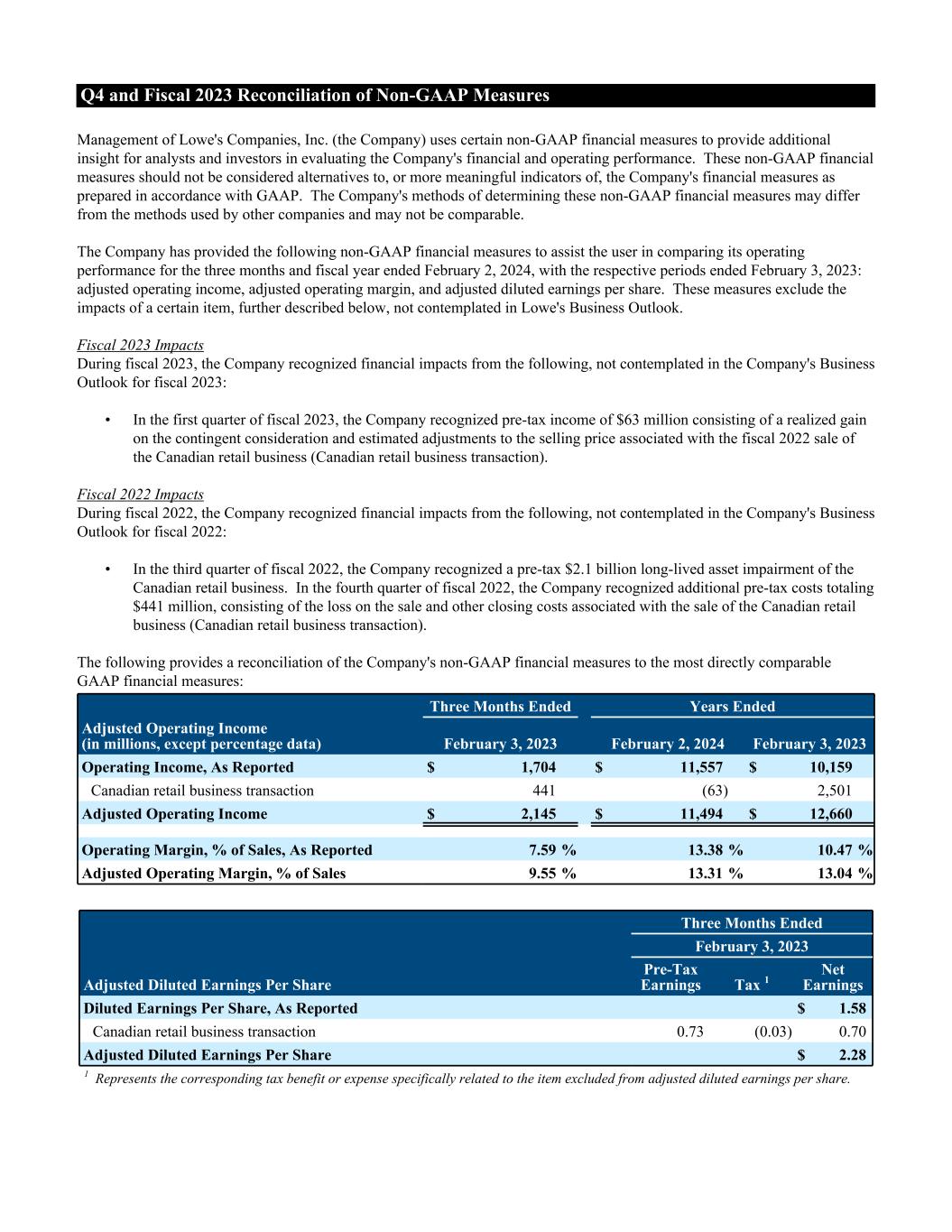

Q4 and Fiscal 2023 Reconciliation of Non-GAAP Measures Management of Lowe's Companies, Inc. (the Company) uses certain non-GAAP financial measures to provide additional insight for analysts and investors in evaluating the Company's financial and operating performance. These non-GAAP financial measures should not be considered alternatives to, or more meaningful indicators of, the Company's financial measures as prepared in accordance with GAAP. The Company's methods of determining these non-GAAP financial measures may differ from the methods used by other companies and may not be comparable. The Company has provided the following non-GAAP financial measures to assist the user in comparing its operating performance for the three months and fiscal year ended February 2, 2024, with the respective periods ended February 3, 2023: adjusted operating income, adjusted operating margin, and adjusted diluted earnings per share. These measures exclude the impacts of a certain item, further described below, not contemplated in Lowe's Business Outlook. Fiscal 2023 Impacts During fiscal 2023, the Company recognized financial impacts from the following, not contemplated in the Company's Business Outlook for fiscal 2023: • In the first quarter of fiscal 2023, the Company recognized pre-tax income of $63 million consisting of a realized gain on the contingent consideration and estimated adjustments to the selling price associated with the fiscal 2022 sale of the Canadian retail business (Canadian retail business transaction). Fiscal 2022 Impacts During fiscal 2022, the Company recognized financial impacts from the following, not contemplated in the Company's Business Outlook for fiscal 2022: • In the third quarter of fiscal 2022, the Company recognized a pre-tax $2.1 billion long-lived asset impairment of the Canadian retail business. In the fourth quarter of fiscal 2022, the Company recognized additional pre-tax costs totaling $441 million, consisting of the loss on the sale and other closing costs associated with the sale of the Canadian retail business (Canadian retail business transaction). The following provides a reconciliation of the Company's non-GAAP financial measures to the most directly comparable GAAP financial measures: Three Months Ended Years Ended Adjusted Operating Income (in millions, except percentage data) February 3, 2023 February 2, 2024 February 3, 2023 Operating Income, As Reported $ 1,704 $ 11,557 $ 10,159 Canadian retail business transaction 441 (63) 2,501 Adjusted Operating Income $ 2,145 $ 11,494 $ 12,660 Operating Margin, % of Sales, As Reported 7.59 % 13.38 % 10.47 % Adjusted Operating Margin, % of Sales 9.55 % 13.31 % 13.04 % Three Months Ended February 3, 2023 Adjusted Diluted Earnings Per Share Pre-Tax Earnings Tax 1 Net Earnings Diluted Earnings Per Share, As Reported $ 1.58 Canadian retail business transaction 0.73 (0.03) 0.70 Adjusted Diluted Earnings Per Share $ 2.28 1 Represents the corresponding tax benefit or expense specifically related to the item excluded from adjusted diluted earnings per share.

Years Ended February 2, 2024 February 3, 2023 Adjusted Diluted Earnings Per Share Pre-Tax Earnings Tax 1 Net Earnings Pre-Tax Earnings Tax 1 Net Earnings Diluted Earnings Per Share, As Reported $ 13.20 $ 10.17 Canadian retail business transaction (0.11) — (0.11) 3.95 (0.31) 3.64 Adjusted Diluted Earnings Per Share $ 13.09 $ 13.81 1 Represents the corresponding tax benefit or expense specifically related to the item excluded from adjusted diluted earnings per share.

Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements including words such as “believe”, “expect”, “anticipate”, “plan”, “desire”, “project”, “estimate”, “intend”, “will”, “should”, “could”, “would”, “may”, “strategy”, “potential”, “opportunity”, “outlook”, “scenario”, “guidance”, and similar expressions are forward-looking statements. Forward-looking statements involve, among other things, expectations, projections, and assumptions about future financial and operating results, objectives (including objectives related to environmental, social, and governance matters), business outlook, priorities, sales growth, shareholder value, capital expenditures, cash flows, the housing market, the home improvement industry, demand for products and services including customer acceptance of new offerings and initiatives, share repurchases, Lowe’s strategic initiatives, including those relating to acquisitions and dispositions and the impact of such transactions on our strategic and operational plans and financial results. Such statements involve risks and uncertainties, and we can give no assurance that they will prove to be correct. Actual results may differ materially from those expressed or implied in such statements. A wide variety of potential risks, uncertainties, and other factors could materially affect our ability to achieve the results either expressed or implied by these forward-looking statements including, but not limited to, changes in general economic conditions, such as volatility and/or lack of liquidity from time to time in U.S. and world financial markets and the consequent reduced availability and/or higher cost of borrowing to Lowe’s and its customers, slower rates of growth in real disposable personal income that could affect the rate of growth in consumer spending, inflation and its impacts on discretionary spending and on our costs, shortages, and other disruptions in the labor supply, interest rate and currency fluctuations, home price appreciation or decreasing housing turnover, age of housing stock, the availability of consumer credit and of mortgage financing, trade policy changes or additional tariffs, outbreaks of pandemics, fluctuations in fuel and energy costs, inflation or deflation of commodity prices, natural disasters, armed conflicts, acts of both domestic and international terrorism, and other factors that can negatively affect our customers. Investors and others should carefully consider the foregoing factors and other uncertainties, risks and potential events including, but not limited to, those described in “Item 1A - Risk Factors” in our most recent Annual Report on Form 10-K and as may be updated from time to time in Item 1A in our quarterly reports on Form 10-Q or other subsequent filings with the SEC. All such forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update these statements other than as required by law.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Apr 2023 to Apr 2024