Filed by APA Corporation

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed Pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Form S-4 No. 333-276797

Subject

Company: Callon Petroleum Company

Commission File No. 001-14039

The following investor presentation was posted on APA Corporation’s investor website on February 26, 2024.

A Top-Tier Permian Operator February 2024

Notice to Investors This presentation contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by words such as “anticipates,” “intends,”

“plans,” “seeks,” “believes,” “continues,” “could,” “estimates,” “expects,” “goals,” “guidance,” “may,” “might,”

“outlook,” “possibly,” “potential,” “projects,” “prospects,” “should,” “will,” “would,” and similar references to future periods, but the absence of

these words does not mean that a statement is not forward-looking. These statements include, but are not limited to, statements about future plans, expectations, and objectives for operations of APA and the expected benefits of the proposed

acquisition of Callon. While forward-looking statements are based on assumptions and analyses made by us that we believe to be reasonable under the circumstances, whether actual results and developments will meet our expectations and predictions

depend on a number of risks and uncertainties which could cause our actual results, performance, and financial condition to differ materially from our expectations, including the following: uncertainties as to whether the potential transaction will

be consummated on the expected time period or at all, or if consummated, will achieve its anticipated benefits and projected synergies within the expected time period or at all; APA’s ability to integrate Callon’s operations in a

successful manner and in the expected time period; the occurrence of any event, change, or other circumstance that could give rise to the termination of the transaction; risks that the anticipated tax treatment of the potential transaction is not

obtained; unforeseen or unknown liabilities; customer, shareholder, regulatory, and other stakeholder approvals and support; unexpected future capital expenditures; potential litigation relating to the potential transaction that could be instituted

against APA and Callon or their respective directors; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; the effect of the announcement, pendency, or

completion of the potential transaction on the parties’ business relationships and business generally; risks that the potential transaction disrupts current plans and operations of APA or Callon and their respective management teams and

potential difficulties in Callon’s ability to retain employees as a result of the transaction; negative effects of the announcement and the pendency or completion of the proposed acquisition on the market price of APA’s or Callon’s

common stock and/or operating results; rating agency actions and APA’s and Callon’s ability to access short-and long-term debt markets on a timely and affordable basis; various events that could disrupt operations, including severe

weather, such as droughts, floods, avalanches, and earthquakes, and cybersecurity attacks, as well as security threats and governmental response to them, and technological changes; labor disputes; changes in labor costs and labor difficulties; the

effects of industry, market, economic, political, or regulatory conditions outside of APA’s or Callon’s control; and legislative, regulatory, and economic developments targeting public companies in the oil and gas industry. See

“Risk Factors” in APA’s Form 10-K for the year ended December 31, 2023 and in APA’s definitive proxy statement/prospectus, dated February 16, 2024, relating to the transaction, for a discussion of risk factors that could

affect the proposed transaction and our and Callon’s businesses. Any forward-looking statement made in this news release speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge

from time to time, and it is not possible for us to predict all of them. APA and its subsidiaries undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future development or otherwise,

except as may be required by law. Cautionary Note to Investors: The United States Securities and Exchange Commission (SEC) permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable, and possible reserves that

meet the SEC's definitions for such terms. We may use certain terms in this presentation, such as “resource,” “resource potential,” “net resource potential,” “potential resource,” “resource

base,” “identified resources,” “potential net recoverable,” “potential reserves,” “unbooked resources,” “economic resources,” “net resources,” “undeveloped

resource,” “net risked resources,” “inventory,” “upside,” and other similar terms that the SEC guidelines strictly prohibit us from including in filings with the SEC. Such terms do not take into account the

certainty of resource recovery, which is contingent on exploration success, technical improvements in drilling access, commerciality, and other factors, and are therefore not indicative of expected future resource recovery and should not be relied

upon. Investors are urged to consider carefully the disclosure in APA’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 available at www.apacorp.com or by writing at: 2000 Post Oak Blvd., Suite 100, Houston, Texas 77056

(Attn: Corporate Secretary). You can also obtain this report from the SEC by calling 1-800-SEC-0330 or from the SEC's website at www.sec.gov. Certain information may be provided in this presentation that includes financial measurements that are not

required by, or presented in accordance with, generally accepted accounting principles (GAAP). These non- GAAP measures should not be considered as alternatives to GAAP measures, such as net income, total debt or net cash provided by operating

activities, and may be calculated differently from, and therefore may not be comparable to, similarly titled measures used at other companies. For a reconciliation to the most directly comparable GAAP financial measures, please refer to APA’s

fourth quarter 2023 earnings release at www.apacorp.com. None of the information contained in this document has been audited by any independent auditor. This presentation is prepared as a convenience for securities analysts and investors and may be

useful as a reference tool. We may elect to modify the format or discontinue publication at any time, without notice to securities analysts or investors. APA CORPORATION 2

Disclaimer No Offer or Solicitation This communication is not intended to

and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer,

solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended. Additional Information about the Merger and Where to Find It In connection with the proposed acquisition of Callon Petroleum Company, APA has filed with the SEC a registration statement on Form S-4 that includes a

joint proxy statement of APA and Callon and that also constitutes a prospectus of APA common stock. The registration statement was declared effective on February 15, 2024, and APA filed a prospectus on February 16, 2024, and Callon filed a

definitive proxy statement on February 16, 2024. APA and Callon commenced mailing of the definitive joint proxy statement/prospectus to their respective shareholders on or about February 16, 2024. Each of APA and Callon may also file other relevant

documents with the SEC regarding the proposed transaction. This document is not a substitute for the definitive joint proxy statement/prospectus or registration statement or any other document that APA or Callon may file with the SEC. INVESTORS AND

SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR

ENTIRETY IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration statement and the definitive

joint proxy statement/prospectus and other documents containing important information about APA, Callon, and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies

of the documents filed with the SEC by APA will be available free of charge on APA's website at https://investor.apacorp.com. Copies of the documents filed with the SEC by Callon will be available free of charge on Callon’s website at

https://callon.com/investors. Participants in the Solicitation APA, Callon, and certain of their respective directors, executive officers, and other members of management and employees may be deemed to be participants in the solicitation of proxies

in respect of the proposed transaction. Information about the directors and executive officers of APA, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in (i) APA’s proxy statement

for its 2023 Annual Meeting of Shareholders, which was filed with the SEC on April 11, 2023 (and which is available at https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1841666/000119312523097278/d434054ddef14a.htm), including under the

headings “Corporate Governance”, “Election of Directors (Proposal Nos. 1–10)”, “Information about Our Executive Officers”, “Executive and Director Compensation”, “Securities Ownership and

Principal Holders”, (ii) APA’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 22, 2024 (and which is available at

https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/0001841666/000178403124000003/apa-20231231.htm), including under the headings “Item 10. Directors, Executive Officers and Corporate Governance”, “Item 11. Executive

Compensation”, “Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters”, “Item 13. Certain Relationships and Related Transactions and Director Independence”, and (iii) to

the extent holdings of APA’s securities by its directors or executive officers have changed since the amounts set forth in APA’s proxy statement for its 2023 Annual Meeting of Shareholders, such changes have been or will be reflected on

Initial Statement of Beneficial Ownership of Securities on Form 3, Statement of Changes in Beneficial Ownership on Form 4, or Annual Statement of Changes in Beneficial Ownership on Form 5 filed with the SEC, which are available at EDGAR Search

Results (https://www.sec.gov/cgi-bin/browse- edgar?action=getcompany&CIK=1841666&type=&dateb=&owner=only&count=40&search_text=). Information about the directors and executive officers of Callon, including a description of

their direct or indirect interests, by security holdings or otherwise, is set forth in (i) Callon’s definitive proxy statement for the proposed merger (available at

https://www.sec.gov/Archives/edgar/data/928022/000119312524038126/d694457ddefm14a.htm), including under the headings “Board of Directors After Completion of the Merger” and “Interests of Callon’s Directors and Executive

Officers in the Merger” (including the documents incorporated by reference therein), (ii) Callon’s proxy statement for its 2023 Annual Meeting of Shareholders, which was filed with the SEC on March 13, 2023 (and which is available at

https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/928022/000092802223000047/cpe-20230309.htm), including under the headings “Proposal 1 – Election of Class II Directors”, “Executive Officers”,

“Executive Compensation”, “Beneficial Ownership of Securities”, “Principal Shareholders and Management”, “Certain Relationships and Related Party Transactions”, (iii) Callon’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 26, 2024 (and which is available at https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/0000928022/000092802224000031/cpe-20231231.htm),

including under the headings “Item 10. Directors, Executive Officers and Corporate Governance”, “Item 11. Executive Compensation”, “Item 12. Security Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters”, “Item 13. Certain Relationships and Related Transactions and Director Independence”; and (iv) to the extent holdings of Callon’s securities by its directors or executive officers have changed since the

amounts set forth in Callon’s definitive proxy statement for its 2023 Annual Meeting of Shareholders, such changes have been or will be reflected on Initial Statement of Beneficial Ownership of Securities on Form 3, Statement of Changes in

Beneficial Ownership on Form 4, or Annual Statement of Changes in Beneficial Ownership on Form 5 filed with the SEC, which are available at EDGAR Search Results

(https://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=928022&type=&dateb=&owner=only&count=40&search_text=). Other information regarding the participants in the proxy solicitations and a description of their direct

and indirect interests, by security holdings or otherwise, are contained in the definitive joint proxy statement/prospectus and will be contained in other relevant materials to be filed with the SEC regarding the proposed transaction when such

materials become available. Investors should read these materials carefully before making any voting or investment decisions. You may obtain free copies of these documents from APA or Callon using the sources indicated above. APA CORPORATION

3

Summary ⎻ Over the past three years, APA has delivered high returns

and strong oil volume growth, achieving top-tier well results and best-in-class productivity improvements in both the Midland and Delaware Basins ⎻ Performance driven by differential development planning / execution and substantial drilling

efficiency gains ⎻ APA developed a proprietary neural network to identify and simulate hundreds of development scenarios with a goal of optimizing NPV per section and per well capital efficiency ⎻ Eliminates inefficient and costly field

testing and iteration from sub-optimal designs ⎻ Proven extremely successful in optimizing project economics while delivering top-tier productivity ⎻ Callon transaction represents a strategic and accretive addition to APA’s

long-standing presence in the Permian Basin ⎻ Recent Callon performance improvements have demonstrated that their acreage has more potential than previously perceived, and APA will apply their unconventional technical expertise and proprietary

workflows to drive further significant improvement ⎻ Additional overhead, cost of capital and operational synergies will further enhance corporate returns of the acquired Callon assets APA CORPORATION 4

APA’s Top-Tier Permian Performance APA CORPORATION 5

APA has Returned to Strong Permian Oil Growth Midland / Delaware Oil

Production, Mbo/d (APA Standalone) APA’s Permian Progression 80 ⎻ APA emerged from the 2015 / 2016 72 67 70 65 downturn in a rapid testing / learning mode; 60 54 54 in 2020 that was interrupted by Covid- 53 ~20% growth 50 50 45 from 4Q23

to 4Q24 related shutdowns 40 Activity ramp ⎻ Post-Covid oil CAGR significantly higher 30 drives growth than pre-Covid at roughly half the drilling 20 Post-Covid and completion pace activity decline 10 - ⎻ 4Q24 production expected to

eclipse pre- 4Q16 4Q17 4Q18 4Q19 4Q20 4Q21 4Q22 4Q23 4Q24(E) pandemic levels ⎻ Transformational approach to development Midland / Delaware Oil-Focused Activity 150 10 has been the key driver to results ⎻ Well productivity has improved to

top-tier 120 8 ⎻ NPV per section and per well capital efficiency 6 90 boosted by wider spacing and larger fracs 60 4 ⎻ Drilled feet per day has increased 34% in the Midland and 24% in the Delaware compared 30 2 to 2018-2020 averages - -

⎻ APA consistently meets or exceeds U.S. FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24(E) Permian Oil Well Completions Average Permian Oil Rigs production guidance APA CORPORATION 6 Completions Rigs

Midland Basin Performance APA is a Leader in Midland Basin Well Productivity

Midland Basin Oil Productivity (Source: Enverus) APA outperforming 2023 group avg. by 37% 2023 Avg: 50 MBO per 1,000’ APA CORPORATION 7 Source: Enverus. 360 Month EUR (MBO / 1,000’)

Delaware Basin Performance APA’s Delaware Performance has Improved

Significantly on both an Absolute and Relative Basis Delaware Basin Oil Productivity (Source: Enverus) APA outperforming 2023 group avg. by 19% 2023 Avg: 69 MBO per 1,000’ APA CORPORATION 8 Source: Enverus. 360 Month EUR (MBO /

1,000’)

APA Making Impressive Drilling Progress Average Feet Drilled per Day

Realizing drilling efficiencies while significantly increasing lateral length: (1) Midland Basin Delaware Basin ⎻ Rotary steerable systems materially improving drilling pace ⎻ Drilling both 2- & 3-mile laterals with one-run curve /

lateral 33% assemblies Increase 24% Increase ⎻ Materially reducing non-productive rig time ⎻ Optimizing drilling parameters with real time data 2018-2020 2023 2018-2020 2023 Average Days on Well & Lateral Length (1) Midland Basin

Delaware Basin 7% 47% 9% Increase Increase Decrease 82% Increase 2018-2020 2023 2018-2020 2023 2018-2020 2023 2018-2020 2023 Days on Well Lateral Length Days on Well Lateral Length APA CORPORATION 9 (1) Excludes Alpine High.

APA’s Approach to Unconventional Development APA CORPORATION

10

APA’s Approach to Unconventional Development Proprietary APA Workflow

‾ Neural network runs hundreds of customized development Outcome scenarios for each drilling spacing unit (DSU) Prediction & 3 ‾ Identifies the best development scenarios to optimize the Optimization balance between capital

efficiency and NPV (Top Tier Performance) Leading Edge ‾ APA proprietary neural network model quantifies key 2 performance drivers (geology, well spacing, frac size, etc.) Data Integration ‾ Calibrated hydraulic fracture models (Neural

Network & Frac Modeling) ‾ Dataset is foundational to APA’s workflows Extensive Data Catalog from Past ‾ Aggregate seismic, logs and core 1 and New Developments ‾ Perform interference and pressure tests (The Foundation of

APA’s Workflow) ‾ Utilize fiberoptic and oil fingerprinting frac measurements APA CORPORATION 11

Leading Edge Data Integration Two Step Process: Physics-Based Modeling /

Machine Learning and Advanced Frac Modeling Step 1: Physics-Based Modeling & Machine Learning Workflow ⎻ APA has an extensive data catalog from past and new developments to enable leading edge integration Physics ⎻ APA integrates

multifactor physics-based modeling with traditional type curve analysis Based to improve production predictability Modeling Machine ⎻ Each APA well has a unique reservoir model capable of normalizing productivity with Learning pressure data

and cataloged reservoir characteristics ⎻ Neural network utilizes machine learning to optimize capital efficiency and NPV in future development Advanced Frac Modeling Step 2: Advanced Frac Modeling Workflow ⎻ Starting point is the

high-graded outcomes from the neural network model ⎻ Each operating area has a unique integrated frac model that includes geomechanics & geologic features ⎻ Enables stage-by-stage frac design modifications in near real-time Optimized

DSU development & ⎻ Minimizes parent / child interactions predictable production performance ⎻ Calibrated models and the integrated workflow influence ideal well spacing and frac design on future developments APA CORPORATION

12

Outcome Prediction and Optimization APA Workflow Used to Optimize

Development Hypothetical DSU Optimization Output Different hypothetical Optimal spacing ⎻ Primary Objective: Identify optimal combination of & frac design frac sizes wells per section and frac size Wells per Section ⎻ Trained neural

network generates type curves for any 2X possible scenario, coupled with a tool to estimate 3X capital costs 4X 2018 spacing 5X & frac design 6X ⎻ Processes hundreds of possible development 7X outcomes based on unique multi-variable inputs

for 8X each DSU ⎻ Economics optimized for capital efficiency and NPV NPV per Section From 2016 to 2019, APA conducted iterative testing in the field on a well-by-well basis, which was not capitally efficient Since 2020, APA has leveraged its

learnings and neural network to optimize each DSU prior to drilling APA CORPORATION 13 Per Well Capital Efficiency

APA’s Midland County Wolfcamp B Case Study Optimized Development of

Wolfcamp B in the Wildfire Field Demonstrates APA’s Proprietary Workflow Midland County Wolfcamp B Performance APA Wildfire vs. All Other Operators, CUM MBO per 1,000’ APA Wildfire: 2018-20 20 APA Wildfire: 2021-23 APA Wildfire Field

Other Operators: 2018-20 Wolfcamp B Wells 45% Uplift Other Operators 2021-23 15 10 5 0 Wider spacing and larger fracs have improved 0 1 2 3 4 5 6 7 8 9 productivity, capital efficiency and NPV per section Months Source: Enverus. Note: All other

operator data reflects peer Midland County, Wolfcamp B wells. APA CORPORATION 14 Cumulative Oil (MBO / 1,000’)

APA’s Glasscock County Wolfcamp D Case Study Deploying APA Workflows;

Top-Tier Performance in a Zone Previously Unfamiliar to APA Outside the Proven Fairway G Gllassco asscock ck C Cou ountry nty W Wolf olfcamp D Perf camp D Performance ormance APA vs. All Other Operators, CUM MBO per Well 250 APA (2021-23) All Other

Operators (2021-23) 200 150 ⎻ APA’s early Wolfcamp D wells screen top-tier in an 100 area previously considered outside of the proven APA WCD wells outperforming 50 Glasscock County peers by 67% fairway 0 0 1 2 3 4 5 6 7 8 9 10 11 12

⎻ APA’s proprietary workflows enabled it to move up Months the learning curve quickly avoiding capital APA vs. All Other Operators, CUM MBO per 1,000’ inefficiency of field testing 16 APA (2021-23) All Other Operators (2021-23)

⎻ Indicative of APA’s potential to high-grade second 12 tier acreage and emerging landing zones 8 APA WCD wells outperforming 4 Glasscock County peers by 11% 0 0 1 2 3 4 5 6 7 8 9 10 11 12 Months Source: Enverus. APA CORPORATION 15 Note:

All operator data reflects all Midland Basin Wolfcamp D wells online from 2021–2023. Cumulative Oil (MBO / 1,000’) Cumulative Oil (MBO)

Callon Acquisition Substantial Value Creation Opportunity APA CORPORATION

16

Strategic Rationale for Texas Delaware Expansion Combined TX Delaware

Position Acquisition of Callon is Complementary to APA Assets & Strategy ⎻ APA has a long history operating in the Texas Delaware ⎻ Position bolstered with bolt-on acquisition in 2022 ⎻ APA’s Delaware well productivity

has improved significantly over the past three years, driven by APA’s unconventional workflows ⎻ While Callon had some early miscues, recent performance is much improved and demonstrates the acreage’s potential ⎻ Combination

of APA & Callon delivers scale in a basin where APA has proven success ⎻ Value creation opportunities: productivity uplift, capital efficiencies, D&C cost reduction, base production management, midstream / marketing ⎻ Cost

Synergies: Overhead, cost of capital, supply chain APA Callon APA CORPORATION 17

Pro Forma Permian Footprint APA & Callon Pro Forma Permian Acreage The

combination of APA’s Midland-focused footprint, with Callon’s Delaware-focused footprint results in a balanced acreage position across two of the world’s most prolific oil-producing basins Net Permian Unconventional Acres

(000’s) APA APA Pro Asset Standalone Forma Callon (1) Midland Basin 197 223 Delaware Basin 84 203 Alpine High 41 41 Permian 322 467 Unconventional Note: APA’s Legacy position is comprised of ~420,000 net acres (1) Excludes ~30,000 net

acres in Irion County APA CORPORATION 18

Balance and Scale in the Permian (1) (1) APA Standalone APA Pro Forma

Callon Net Prod. Active Net Prod. Active % Oil % Oil (MBOE/D) Rigs (MBOE/D) Rigs Midland 93 47% 3 118 50% 4 (2) Delaware 49 44% 3 124 51% 7 Mid. / Del. Total 142 46% 6 242 51% 11 Other U.S. 84 22% -- 85 22% -- (2) Total U.S. 226 37% 6 327 43% 11

Combination pro-forma results in a balanced and scaled profile across the Midland and Delaware Basins while increasing the % oil of the production stream (1) Reflects 3Q23 production data. APA CORPORATION 19 (2) Other U.S. includes production from:

Alpine High, CBP, Eagle Ford, and Gulf of Mexico.

APA / CPE Synergy Assumptions Screen Conservative APA will Aggressively

Pursue All Sources of Synergy G&A Synergies: Operational Synergies: (% of the Target’s Cash G&A) (% of the Target’s LOE + D&C Capital) 13% 73% 54% 4% APA - Callon Other Other P Public ublic E -Publi &P T cra Ens &P a

M& ctions A Other Public E&P Transactions APA - Callon Other Public-Public E&P M&A (Median) (Median) Significant Potential Upside: ⎻ Ranking of inventory ⎻ Spacing and frac size optimization ⎻ Drilling and

completion technologies ⎻ Processing and transportation infrastructure ⎻ Marketing ⎻ Supply chain / service costs savings with operational scale APA CORPORATION 20 Source: Citi. Public filings.

Realizing Operating Cost Synergies LOE ($/BOE) Workovers / Uptime / Lift

Optimization (1) (2) (2) APA TX Delaware vs. CPE Permian Midland / Delaware Unplanned Downtime (%) Midland / Delaware Workover Expense ($/BOE) $10 10% $1.00 $8 $0.75 $6 5% $0.50 $4 $0.25 $2 0% $0.00 $0 Callon APA Callon APA Callon APA ⎻

Accelerate CPE’s LOE reduction ⎻ Reduce unplanned downtime and initiatives within larger organization workover costs ⎻ Supply chain savings on everything from ⎻ Optimizing lift strategy: ESP vs. gas lift rig and frac

contracting to chemical and consumables (1) Excludes Alpine High. Company guidance / projections. APA CORPORATION 21 (2) Data reflects FY23 for APA & YTD through 9/30/23 for CPE.

APA + CPE: Sell Side Analysts See Significant Potential ⎻ Jefferies:

“We believe the market is over-discounting APA’s capacity to add value to Callon’s acreage that has been historically overcapitalized.” ⎻ J.P. Morgan: “The ultimate success of this transaction could reflect

‘self help’ and APA’s ability to improve [Callon’s] productivity consistent with its overall program.” ⎻ Piper Sandler: “[Callon’s] operational performance has not tracked favorably compared to APA and

Delaware peers, which could imply the greatest synergy, using Callon cash flow to develop better performing assets.” ⎻ Raymond James: “APA’s well performance has been meaningfully better than Callon’s; APA management

has the opportunity to employ operational efficiencies across Callon’s legacy position.” ⎻ TD Cowen: “Callon provides APA with underappreciated inventory depth, though with inferior well productivity (APA first among public

operators on recent productivity screen) which perhaps suggest low-hanging fruit for APA to drive synergies even higher.” APA CORPORATION 22

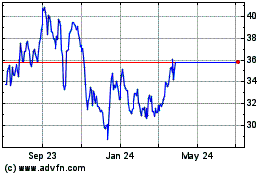

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Apr 2023 to Apr 2024