UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 001-36206

BIT Mining Limited

428 South Seiberling Street

Akron, Ohio 44306

United States of America

+1 (346) 204-8537

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

TABLE OF CONTENTS

TABLE OF CONTENTS

Exhibit

99.1 - BIT Mining Limited Announces Unaudited Financial Results for the Fourth Quarter and Full Year ended December 31, 2023

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

BIT Mining Limited |

| |

|

|

| |

By: |

/s/ Xianfeng Yang |

| |

Name: |

Xianfeng Yang |

| |

Title: |

Chief Executive Officer |

Date: February 23, 2024

Exhibit 99.1

BIT Mining Limited

Announces Unaudited Financial Results

for the Fourth

Quarter and Full Year ended December 31, 2023

AKRON, Ohio, February 23,

2024/PRNewswire/—BIT Mining Limited (NYSE: BTCM) (“BIT Mining,” “the Company,” “we,” “us,”

or “our company”), a leading technology-driven cryptocurrency mining company, today reported its unaudited financial results

for the fourth quarter ended December 31, 2023.

On December 28, 2023, the Company entered into

an agreement with Esport – Win Limited, a Hong Kong limited liability company, to sell its entire mining pool business for a total

consideration of US$5 million. The sale does not include or affect any of BIT Mining’s other businesses. The disposal of the mining

pool business represents a strategic shift and has a major effect on the Company’s results of operations. Accordingly, the Company’s

consolidated financial statements for the period ended December 31, 2023 and the comparable periods have been reclassified to reflect

the mining pool business segment as discontinued operations.

Fourth

Quarter 2023 Highlights for Continuing Operations

| · |

Revenues were US$10.4 million for the fourth quarter of 2023, representing

an increase of US$3.2 million from US$7.2 million for the fourth quarter of 2022, and a decrease of US$1.2 million from US$11.6

million for the third quarter of 2023. |

| · |

Operating loss was US$1.6 million for the fourth quarter of 2023, representing

a significant decrease of US$36.7 million from US$38.3 million for the fourth quarter of 2022, and

a decrease of US$2.5 million from US$4.1 million for the third quarter of 2023.

|

| · |

Non-GAAP operating loss1 was US$1.3 million for the fourth quarter of 2023, compared with non-GAAP

operating loss of US$15.7 million for the fourth quarter of 2022, and non-GAAP operating loss of US$4.1 million for the third quarter

of 2023.

|

| · |

Net loss attributable to BIT Mining

was US$0.8 million for the fourth quarter of 2023, compared with net loss attributable to BIT Mining

of US$40.0 million for the fourth quarter of 2022, and net loss attributable to BIT Mining of US$4.7

million for the third quarter of 2023.

|

| · |

Non-GAAP net loss1 attributable to BIT Mining was US$0.9 million

for the fourth quarter of 2023, compared with non-GAAP net loss attributable to BIT Mining of US$15.1 million for the fourth quarter

of 2022, and non-GAAP net loss attributable to BIT Mining of US$3.9 million for the third quarter of 2023.

|

| · |

Basic and diluted losses per American

Depositary Share (“ADS”)2 attributable to BIT Mining Limited including from

continuing operations and discontinued operations for the fourth quarter of 2023 were US$0.38.

|

| · |

Non-GAAP

basic and diluted losses per ADS2 attributable to BIT Mining Limited including from continuing

operations and discontinued operations for the fourth quarter of 2023 were US$0.39. |

Full Year 2023 Highlights for Continuing Operations

| · |

Revenues were US$43.1 million for the full year 2023,

compared with revenues of US$57.0 million for the full year 2022. |

| · |

Operating loss was US$12.9 million for the full year

2023, compared with operating loss of US$88.1 million for the full year 2022. |

| · |

Non-GAAP operating loss1 was US$11.9 million

for the full year 2023, compared with non-GAAP operating loss of US$42.1 million for the full year 2022. |

| · |

Net loss attributable to BIT Mining was US$11.1 million

for the full year 2023, compared with net loss attributable to BIT Mining of US$74.8 million for the full year 2022. |

| · |

Non-GAAP net loss1 attributable to BIT

Mining was US$9.9 million for the full year 2023, compared with non-GAAP net loss attributable to BIT Mining of US$26.6 million for

the full year 2022. |

| · |

Basic and diluted

losses per ADS2 attributable to BIT Mining Limited including from continuing operations

and discontinued operations for the full year 2023 were US$1.31. |

| · |

Non-GAAP basic

and diluted losses per ADS2 attributable to BIT Mining Limited including from

continuing operations and discontinued operations for the full year 2023 were US$1.21. |

Full Year 2023 Highlights for Discontinued

Operations

| · |

Net loss from discontinued operations, net of taxes was US$3.4 million

for the full year 2023, compared with net loss from discontinued operations, net of taxes of US$80.6 million for the full year 2022.

The year-over-year decrease of US$77.2 million was mainly attributable to the impairment of intangible assets in the amount of US$48.6

million and impairment of goodwill in the amount of US$26.6 million in the year of 2022 associated with the discontinued operations.

|

1 Non-GAAP

financial measures exclude the impact of share-based compensation expenses, impairment of intangible assets, impairment of property and

equipment, impairment of equity investments, changes in fair value of contingent considerations, and changes in fair value of derivative

instruments. Reconciliations of non-GAAP financial measures to U.S. GAAP financial measures are set forth in the table at the end of

this release.

2 The

Company changed the ratio of ADSs to its Class A ordinary shares (the “ADS Ratio”), par value US$0.00005 per share,

from the former ADS Ratio of one (1) ADS to ten (10) Class A ordinary shares, to the current ADS Ratio of one (1) ADS

to one hundred (100) Class A ordinary shares (the “ADS Ratio Change”). The ADS Ratio Change was effective on December 23,

2022.

Fourth Quarter 2023 Financial Results for Continuing Operations

Revenues

Revenues were mainly

comprised of US$4.7 million from the self-mining business and US$5.7 million from the data center business.

Self-mining

As of today, the total hash rate capacity of

our DOGE/LTC mining machines in operation is approximately 24,766.0 GH/s. For the three months ended December 31, 2023, we produced 38.3

million DOGE and 10,615 LTC from our DOGE/LTC cryptocurrency mining operations and recognized revenue of approximately US$3.6 million.

Considerable uncertainty persists in the market

despite the recent modest recovery and narrow growth in cryptocurrency asset prices. Facing this current environment, we remain determined

to improve our quality and efficiency. As of today, the total hash rate capacity of our BTC mining machines in operation is approximately

56.63 PH/s. For the three months ended December 31, 2023, we produced 21 BTC from our BTC cryptocurrency mining operations and recognized

revenue of approximately US$0.8 million. We also recognized revenue of approximately US$0.3 million from our ETC cryptocurrency mining

operations.

Data Center Operation

During the fourth quarter of 2023, our 82.5

megawatt space (the “82.5 Megawatt Space”) at the Ohio Mining Site recognized approximately $5.7 million in service fee

revenue, representing a decrease of US$0.7 million compared with the third quarter of 2023, primarily due to one of our customers

entered into arrangement directly with the utility service provider. As a result, our service fee revenue from the customer

decrease during the fourth quarter of 2023.

Overall

Revenues were US$10.4 million for the fourth

quarter of 2023, representing an increase of US$3.2 million, or 44.4%, from US$7.2 million for the fourth quarter of 2022, and a decrease

of US$1.2 million, or 10.3%, from US$11.6 million for the third quarter of 2023. The year-over-year increase was mainly attributable

to an increase of US$3.6 million in the DOGE/LTC cryptocurrency production, due to an increase in hash power related to new mining machines

that were put into operation in 2023. The sequential decrease was mainly attributable to higher computing power of the whole network

in the fourth quarter of 2023 compared with the computing power in the third quarter of 2023, resulting in an increased difficulty

in cryptocurrency mining activities.

Operating Costs and Expenses

Operating costs and expenses were US$13.2 million

for the fourth quarter of 2023, representing a decrease of US$9.7 million, or 42.4%, from US$22.9 million for the fourth quarter of 2022,

and a decrease of US$1.8 million, or 12.0%, from US$15.0 million for the third quarter of 2023.

Cost of revenue was US$8.9 million for the fourth quarter of 2023,

representing a decrease of US$7.5 million, or 45.7%, from US$16.4 million for the fourth quarter of 2022, and a decrease of US$1.9 million,

or 17.6%, from US$10.8 million for the third quarter of 2023. The sequential decrease was mainly attributable to the decrease in electricity

fees payable to the utility service provider as one of our customers entered into arrangement directly with the utility service provider.

The year-over-year decrease was mainly attributable to the decrease in electricity fees payable mentioned above, and the overall year-over-year

decrease in electricity rates charged by the utility service provider. Cost of revenue was comprised of the direct cost of revenue of

US$6.0 million and depreciation and amortization of US$2.9 million. The direct cost of revenue mainly included direct costs relating

to (i) the cryptocurrency mining business of US$1.3 million, and (ii) the data center business of US$4.7 million.

Sales

and marketing expenses were US$0.3 million for the fourth quarter of 2023, compared with US$0.03 million for the fourth quarter

of 2022 and US$0.03 million for the third quarter of 2023.

General

and administrative expenses were US$4.1 million for the fourth quarter of 2023, representing a decrease of US$1.9 million, or 31.7%,

from US$6.0 million for the fourth quarter of 2022 and a slight decrease of US$0.1 million, or 2.4%, from US$4.2 million for the third

quarter of 2023. The year-over-year decrease was mainly due to a decrease of US$1.0 million in technical service fee.

Service

development expenses were nil for the fourth quarter of 2023, compared with US$0.5 million for the fourth quarter of 2022 and

US$0.04 million for the third quarter of 2023. The year-over-year decrease was mainly due to a decrease in staff costs, benefits, share-based

compensation and other related expenses as a result of a decrease in headcount.

Net Gain on Disposal of Cryptocurrency

Assets

Net gain on disposal of cryptocurrency assets

was US$1.5 million for the fourth quarter of 2023, representing a decrease of US$2.2 million from US$3.7 million for the fourth quarter

of 2022, and an increase of US$0.6 million from US$0.9 million for the third quarter of 2023, by using the first-in-first-out (“FIFO”)

method to calculate the cost of disposition during the fourth quarter of 2023.

Impairment

of Cryptocurrency Assets

Impairment of cryptocurrency assets was US$0.2 million for the fourth

quarter of 2023, representing a decrease of US$1.9 million from US$2.1 million for the fourth quarter of 2022, and a decrease of US$0.5

million from US$0.7 million for the third quarter of 2023, mainly due to less provision recorded for impairment of cryptocurrency

assets held as a result of generally increasing cryptocurrency prices.

Impairment of Property and Equipment

Impairment of property

and equipment was nil for the third and fourth quarters of 2023 and was US$22.6 million for the fourth quarter of 2022, which was mainly

due to the provision for impairment of mining machines in Kazakhstan and the U.S.

Operating

Loss from continuing operations

Operating loss from continuing operations was

US$1.6 million for the fourth quarter of 2023, compared with operating loss from continuing operations of US$38.3 million for the fourth

quarter of 2022, and operating loss from continuing operations of US$4.1 million for the third quarter of 2023.

Non-GAAP operating loss from continuing operations was US$1.3 million

for the fourth quarter of 2023, compared with non-GAAP operating loss from continuing operations of US$15.7 million for the fourth quarter

of 2022, and non-GAAP operating loss from continuing operations of US$4.1 million for the third quarter of 2023. The year-over-year decrease

in non-GAAP operating loss from continuing operations was mainly due to (i) an increase of US$2.8 million in revenue of the self-mining

business, due to increases in cryptocurrency prices and mining machine, (ii) a decrease of US$1.9 million in impairment of cryptocurrency

assets, (iii) a decrease of US$4.4 million in depreciation and amortization expenses due to impairment of mining machines and intangible

asset in 2022, and (iv) a decrease of US$1.2 million in cloud computing power rental costs. The sequential decrease in non-GAAP operating

loss from continuing operations was mainly due to (i) a decrease of US$0.5 million in impairment of cryptocurrency assets

and an increase of US$0.6 million in net gain on disposal of cryptocurrency assets resulting from increases in cryptocurrency

prices, and (ii) a decrease of US$0.8 million in other operating expenses.

Net Loss Attributable to BIT Mining including from continuing

operations and discontinued operations

Net loss attributable to BIT Mining was US$4.2

million for the fourth quarter of 2023, compared with net loss attributable to BIT Mining of US$109.2 million for the fourth quarter

of 2022, and net loss attributable to BIT Mining of US$4.4 million for the third quarter of 2023. The year-over-year decrease in net

loss attributable to BIT Mining was mainly due to (i) a decrease of US$22.6 million in impairment of property and equipment, (ii)

decrease in net loss from discontinued operations resulting from a decrease of US$48.6 million in impairment of intangible assets and

a decrease of US$26.6 million in impairment of goodwill, and (iii) a decrease of US$2.3 million in impairment of long-term investments.

Non-GAAP net loss attributable to BIT Mining

was US$4.4 million for the fourth quarter of 2023, compared with non-GAAP net loss attributable to BIT Mining of US$9.1 million

for the fourth quarter of 2022, and non-GAAP net loss attributable to BIT Mining of US$3.6 million for the third quarter of 2023. The

year-over-year decrease in non-GAAP net loss attributable to BIT Mining was mainly due to the reasons related to the decrease in net

loss from discontinued operations mentioned above. The sequential increase in non-GAAP net loss attributable to BIT Mining was mainly

due to the increase in net loss from discontinued operations of US$3.8 million.

Cash and Cash Equivalents, Restricted

Cash and Short-term Investment

As

of December 31, 2023, the Company had cash and cash equivalents of US$3.6 million, compared with cash and cash equivalents of

US$5.4 million, restricted cash3 of US$0.1 million, and short-term investment4 of US$2.4 million as of December 31,

2022.

Cryptocurrency Assets

As of December 31, 2023, the Company had cryptocurrency

assets of US$7.6 million in aggregate, which comprised of 22.6 BTC, 12.2 million DOGE, 11,955 LTC, and various other cryptocurrency assets,

which were generated from its cryptocurrency mining businesses, without regard to its mining pool businesses.

3 Restricted

cash represents deposits in merchant banks yet to be withdrawn.

4

Short-term investment represents fixed coupon notes with original maturities of greater than three months but less than

a year.

About BIT Mining Limited

BIT Mining (NYSE: BTCM) is a leading technology-driven

cryptocurrency mining company with operations in cryptocurrency mining, data center operation and mining machine manufacturing. The Company

is strategically creating long-term value across the industry with its cryptocurrency ecosystem. Anchored by its cost-efficient data

centers that strengthen its profitability with steady cash flow, the Company also conducts self-mining operations that enhance its marketplace

resilience by leveraging self-developed and purchased mining machines to seamlessly adapt to dynamic cryptocurrency pricing. The Company

also owns 7-nanometer BTC chips and has strong capabilities in the development of LTC/DOGE miners and ETC miners.

Safe Harbor Statements

This

news release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended,

and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology

such as “will”, “expects”, “anticipates”, “future”, “intends”, “plans”,

“believes”, “estimates”, “target”, “going forward”, “outlook” and similar

statements. Such statements are based upon management’s current expectations and current market and operating conditions and relate

to events that involve known or unknown risks, uncertainties and other factors, all of which are difficult to predict and many of which

are beyond the Company’s control, which may cause the Company’s actual results, performance or achievements to differ materially

from those in the forward-looking statements. Further information regarding these and other risks, uncertainties or factors is included

in the Company’s filings with the U.S. Securities and Exchange Commission. The Company does not undertake any obligation to update

any forward-looking statement as a result of new information, future events or otherwise, except as required under law.

About Non-GAAP Financial Measures

As a supplement to net loss, we use the non-GAAP

financial measure of adjusted net loss which is U.S. GAAP net loss as adjusted to exclude the impact of share-based compensation expenses,

impairment of intangible assets, impairment of equity investments, impairment of property and equipment, changes in fair value of contingent

considerations, and changes in fair value of derivative instruments. All adjustments are non-cash and we believe they are not reflective

of our general business performance. This non-GAAP financial measure is provided as additional information to help our investors compare

business trends among different reporting periods on a consistent basis and to enhance investors’ overall understanding of our

current financial performance and prospects for the future. This non-GAAP financial measure should not be considered in addition to or

as a substitute for or superior to U.S. GAAP net loss. In addition, our definition of adjusted net loss may be different from the definition

of such term used by other companies, and therefore comparability may be limited.

For more information:

BIT Mining

Limited

ir@btcm.group

ir.btcm.group

www.btcm.group

Piacente Financial

Communications

Brandi Piacente

Tel: +1 (212)

481-2050

Email: BITMining@thepiacentegroup.com

BIT

Mining Limited

Condensed Consolidated Balance Sheets

(Amounts in thousands of U.S. dollars ("US$"), except for number

of shares)

(Unaudited)

| |

|

December

31, 2022 |

|

|

December

31, 2023 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

5,371 |

|

|

|

3,575 |

|

| Restricted cash |

|

|

126 |

|

|

|

- |

|

| Short-term investment |

|

|

2,360 |

|

|

|

- |

|

| Accounts receivable |

|

|

3,575 |

|

|

|

2,873 |

|

| Prepayments and other current assets |

|

|

8,310 |

|

|

|

12,723 |

|

| Cryptocurrency assets |

|

|

5,573 |

|

|

|

7,629 |

|

| Current assets of discontinued operations |

|

|

10,021 |

|

|

|

13,712 |

|

| Total current assets |

|

|

35,336 |

|

|

|

40,512 |

|

| |

|

|

|

|

|

|

|

|

| Non-current assets: |

|

|

|

|

|

|

|

|

| Property and equipment, net |

|

|

27,209 |

|

|

|

22,833 |

|

| Intangible assets, net |

|

|

3,299 |

|

|

|

2,033 |

|

| Deposits |

|

|

2,387 |

|

|

|

2,467 |

|

| Long-term investments |

|

|

8,049 |

|

|

|

6,307 |

|

| Right-of-use assets |

|

|

4,135 |

|

|

|

3,752 |

|

| Long-term prepayments and other non-current assets |

|

|

6,363 |

|

|

|

47 |

|

| Non-current assets of discontinued operations |

|

|

26 |

|

|

|

- |

|

| Total non-current assets |

|

|

51,468 |

|

|

|

37,439 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

|

86,804 |

|

|

|

77,951 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

|

3,672 |

|

|

|

2,291 |

|

| Accrued payroll and welfare payable |

|

|

747 |

|

|

|

458 |

|

| Accrued expenses and other current liabilities |

|

|

4,825 |

|

|

|

4,335 |

|

| Income tax payable |

|

|

73 |

|

|

|

76 |

|

| Operating lease liabilities - current |

|

|

1,367 |

|

|

|

1,413 |

|

| Current liabilities of discontinued operations |

|

|

20,155 |

|

|

|

27,605 |

|

| Total current liabilities |

|

|

30,839 |

|

|

|

36,178 |

|

| |

|

|

|

|

|

|

|

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

| Operating lease liabilities - non-current |

|

|

2,837 |

|

|

|

2,339 |

|

| Total non-current liabilities |

|

|

2,837 |

|

|

|

2,339 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES |

|

|

33,676 |

|

|

|

38,517 |

|

| |

|

|

|

|

|

|

|

|

| Shareholders’ equity: |

|

|

|

|

|

|

|

|

| Class A ordinary shares, par value US$0.00005 per share; 1,599,935,000

shares authorized as of December 31, 2022 and December 31, 2023; 1,063,813,210 and 1,111,232,210 shares issued and outstanding as

of December 31, 2022 and December 31, 2023, respectively |

|

|

54 |

|

|

|

54 |

|

| Class A preference shares, par value US$0.00005 per share; 65,000 shares

authorized as of December 31, 2022 and December 31, 2023; 65,000 shares issued and outstanding as of December 31, 2022 and December

31, 2023 |

|

|

- |

|

|

|

- |

|

| Class B ordinary shares, par value US$0.00005 per share; 400,000,000

shares authorized as of December 31, 2022 and December 31, 2023; 99 shares issued and outstanding as of December 31, 2022 and December

31, 2023 |

|

|

- |

|

|

|

- |

|

| Additional paid-in capital |

|

|

620,807 |

|

|

|

621,837 |

|

| Treasury shares |

|

|

(21,604 |

) |

|

|

(21,604 |

) |

| Accumulated deficit and statutory reserve |

|

|

(542,169 |

) |

|

|

(556,597 |

) |

| Accumulated other comprehensive loss |

|

|

(3,960 |

) |

|

|

(4,256 |

) |

| Total shareholders' equity |

|

|

53,128 |

|

|

|

39,434 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

86,804 |

|

|

|

77,951 |

|

BIT

Mining Limited

Condensed Consolidated Statements of Comprehensive Loss

(Amounts in thousands of U.S. dollars (“US$”),

except for number of shares, per share (or ADS) data)

(Unaudited)

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December

31,

2022 |

|

|

September

30,

2023 |

|

|

December

31,

2023 |

|

|

December

31,

2022 |

|

|

December

31,

2023 |

|

| Revenues |

|

|

7,168 |

|

|

|

11,639 |

|

|

|

10,407 |

|

|

|

57,025 |

|

|

|

43,101 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

|

(16,417 |

) |

|

|

(10,763 |

) |

|

|

(8,935 |

) |

|

|

(61,195 |

) |

|

|

(39,147 |

) |

| Sales and marketing expenses |

|

|

(27 |

) |

|

|

(33 |

) |

|

|

(256 |

) |

|

|

(336 |

) |

|

|

(378 |

) |

| General and administrative expenses |

|

|

(5,951 |

) |

|

|

(4,184 |

) |

|

|

(4,054 |

) |

|

|

(21,946 |

) |

|

|

(19,153 |

) |

| Service development expenses |

|

|

(481 |

) |

|

|

(38 |

) |

|

|

- |

|

|

|

(2,213 |

) |

|

|

(874 |

) |

| Total operating costs and expenses |

|

|

(22,876 |

) |

|

|

(15,018 |

) |

|

|

(13,245 |

) |

|

|

(85,690 |

) |

|

|

(59,552 |

) |

| Other operating income |

|

|

135 |

|

|

|

- |

|

|

|

86 |

|

|

|

115 |

|

|

|

220 |

|

| Government grant |

|

|

2 |

|

|

|

- |

|

|

|

- |

|

|

|

29 |

|

|

|

- |

|

| Other operating expenses |

|

|

(1,750 |

) |

|

|

(995 |

) |

|

|

(197 |

) |

|

|

(3,234 |

) |

|

|

(1,494 |

) |

| Net gain (loss) on disposal of cryptocurrency assets |

|

|

3,711 |

|

|

|

932 |

|

|

|

1,531 |

|

|

|

(5,384 |

) |

|

|

7,074 |

|

| Impairment of cryptocurrency assets |

|

|

(2,097 |

) |

|

|

(691 |

) |

|

|

(163 |

) |

|

|

(9,396 |

) |

|

|

(2,280 |

) |

| Changes in fair value of contingent considerations |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,247 |

|

|

|

- |

|

| Impairment of property and equipment |

|

|

(22,641 |

) |

|

|

- |

|

|

|

- |

|

|

|

(35,224 |

) |

|

|

- |

|

| Impairment of intangible assets |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(7,539 |

) |

|

|

- |

|

| Operating loss |

|

|

(38,348 |

) |

|

|

(4,133 |

) |

|

|

(1,581 |

) |

|

|

(88,051 |

) |

|

|

(12,931 |

) |

| Other income (expense), net |

|

|

531 |

|

|

|

(5 |

) |

|

|

395 |

|

|

|

9,031 |

|

|

|

797 |

|

| Interest income |

|

|

25 |

|

|

|

200 |

|

|

|

- |

|

|

|

150 |

|

|

|

242 |

|

| Interest expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(218 |

) |

|

|

- |

|

| Gain from equity method investments |

|

|

8 |

|

|

|

- |

|

|

|

- |

|

|

|

164 |

|

|

|

939 |

|

| Impairment of long-term investments |

|

|

(2,250 |

) |

|

|

- |

|

|

|

- |

|

|

|

(2,250 |

) |

|

|

- |

|

| Gain from disposal of subsidiaries |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

3,340 |

|

|

|

- |

|

| Changes in fair value of derivative instruments |

|

|

- |

|

|

|

(808 |

) |

|

|

423 |

|

|

|

- |

|

|

|

(110 |

) |

| Loss before income tax from continuing operations |

|

|

(40,034 |

) |

|

|

(4,746 |

) |

|

|

(763 |

) |

|

|

(77,834 |

) |

|

|

(11,063 |

) |

| Income tax benefits |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Net loss from continuing operations |

|

|

(40,034 |

) |

|

|

(4,746 |

) |

|

|

(763 |

) |

|

|

(77,834 |

) |

|

|

(11,063 |

) |

| Net (loss) income from discontinued operations, net of applicable income

taxes |

|

|

(69,123 |

) |

|

|

387 |

|

|

|

(3,455 |

) |

|

|

(80,593 |

) |

|

|

(3,365 |

) |

| Net loss |

|

|

(109,157 |

) |

|

|

(4,359 |

) |

|

|

(4,218 |

) |

|

|

(158,427 |

) |

|

|

(14,428 |

) |

| Less: Net loss attributable to noncontrolling interests |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(3,012 |

) |

|

|

- |

|

| Net loss attributable to BIT Mining Limited |

|

|

(109,157 |

) |

|

|

(4,359 |

) |

|

|

(4,218 |

) |

|

|

(155,415 |

) |

|

|

(14,428 |

) |

| Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation gain (loss) |

|

|

236 |

|

|

|

(44 |

) |

|

|

188 |

|

|

|

(1,735 |

) |

|

|

(296 |

) |

| Other comprehensive income (loss), net of tax |

|

|

236 |

|

|

|

(44 |

) |

|

|

188 |

|

|

|

(1,735 |

) |

|

|

(296 |

) |

| Comprehensive loss |

|

|

(108,921 |

) |

|

|

(4,403 |

) |

|

|

(4,030 |

) |

|

|

(160,162 |

) |

|

|

(14,724 |

) |

| Less: comprehensive loss attributable to noncontrolling interests |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(3,142 |

) |

|

|

- |

|

| Comprehensive loss attributable to BIT Mining Limited |

|

|

(108,921 |

) |

|

|

(4,403 |

) |

|

|

(4,030 |

) |

|

|

(157,020 |

) |

|

|

(14,724 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of Class A and Class B ordinary shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

1,063,813,210 |

|

|

|

1,111,232,309 |

|

|

|

1,111,232,309 |

|

|

|

871,036,499 |

|

|

|

1,102,373,814 |

|

| Diluted |

|

|

1,063,813,210 |

|

|

|

1,111,232,309 |

|

|

|

1,111,232,309 |

|

|

|

871,036,499 |

|

|

|

1,102,373,814 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Losses per share attributable to BIT Mining Limited-Basic and Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss from continuing operations |

|

|

(0.04 |

) |

|

|

(0.00 |

) |

|

|

(0.00 |

) |

|

|

(0.09 |

) |

|

|

(0.01 |

) |

| Net (loss) income from discontinued operations |

|

|

(0.06 |

) |

|

|

0.00 |

|

|

|

(0.00 |

) |

|

|

(0.09 |

) |

|

|

(0.00 |

) |

| Net loss |

|

|

(0.10 |

) |

|

|

(0.00 |

) |

|

|

(0.00 |

) |

|

|

(0.18 |

) |

|

|

(0.01 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Losses per ADS* attributable to BIT Mining Limited-Basic and Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss from continuing operations |

|

|

(3.76 |

) |

|

|

(0.43 |

) |

|

|

(0.07 |

) |

|

|

(8.59 |

) |

|

|

(1.00 |

) |

| Net (loss) income from discontinued operations |

|

|

(6.50 |

) |

|

|

0.04 |

|

|

|

(0.31 |

) |

|

|

(9.25 |

) |

|

|

(0.31 |

) |

| Net loss |

|

|

(10.26 |

) |

|

|

(0.39 |

) |

|

|

(0.38 |

) |

|

|

(17.84 |

) |

|

|

(1.31 |

) |

* American Depositary Shares, which are traded

on the NYSE. Each ADS represents 100 Class A ordinary shares of the Company.

BIT

Mining Limited

Reconciliation of non-GAAP results of operations measures to the nearest comparable GAAP measures

(Amounts in

thousands of U.S. dollars (“US$”),

except for number of shares, per share (or ADS) data)

(Unaudited)

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 31,

2022 |

|

|

September 30,

2023 |

|

|

December 31,

2023 |

|

|

December 31,

2022 |

|

|

December 31,

2023 |

|

| Operating loss from continuing operations |

|

|

(38,348 |

) |

|

|

(4,133 |

) |

|

|

(1,581 |

) |

|

|

(88,051 |

) |

|

|

(12,931 |

) |

| Adjustment for share-based compensation expenses |

|

|

- |

|

|

|

- |

|

|

|

276 |

|

|

|

4,474 |

|

|

|

1,030 |

|

| Adjustment for impairment of intangible assets |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

7,539 |

|

|

|

- |

|

| Adjustment for impairment of property and equipment |

|

|

22,641 |

|

|

|

- |

|

|

|

- |

|

|

|

35,224 |

|

|

|

- |

|

| Adjustment for changes in fair value of contingent

considerations |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,247 |

) |

|

|

- |

|

| Adjusted operating loss (non-GAAP) from continuing operations |

|

|

(15,707 |

) |

|

|

(4,133 |

) |

|

|

(1,305 |

) |

|

|

(42,061 |

) |

|

|

(11,901 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable to BIT Mining Limited |

|

|

(109,157 |

) |

|

|

(4,359 |

) |

|

|

(4,218 |

) |

|

|

(155,415 |

) |

|

|

(14,428 |

) |

| Net (loss) income attributable to BIT Mining Limited from discontinued operations,

net of applicable income taxes |

|

|

(69,123 |

) |

|

|

387 |

|

|

|

(3,455 |

) |

|

|

(80,593 |

) |

|

|

(3,365 |

) |

| Net loss attributable to BIT Mining Limited from

continuing operations |

|

|

(40,034 |

) |

|

|

(4,746 |

) |

|

|

(763 |

) |

|

|

(74,822 |

) |

|

|

(11,063 |

) |

| Adjustment for share-based compensation expenses |

|

|

- |

|

|

|

- |

|

|

|

276 |

|

|

|

4,474 |

|

|

|

1,030 |

|

| Adjustment for impairment of intangible assets |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

7,539 |

|

|

|

- |

|

| Adjustment for impairment of equity investments |

|

|

2,250 |

|

|

|

- |

|

|

|

- |

|

|

|

2,250 |

|

|

|

- |

|

| Adjustment for impairment of property and equipment |

|

|

22,641 |

|

|

|

- |

|

|

|

- |

|

|

|

35,224 |

|

|

|

- |

|

| Adjustment for changes in fair value of derivative instruments |

|

|

- |

|

|

|

808 |

|

|

|

(423 |

) |

|

|

- |

|

|

|

110 |

|

| Adjustment for changes in fair value of contingent

considerations |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,247 |

) |

|

|

- |

|

| Adjusted net loss attributable to BIT Mining Limited (non-GAAP)

from continuing operations |

|

|

(15,143 |

) |

|

|

(3,938 |

) |

|

|

(910 |

) |

|

|

(26,582 |

) |

|

|

(9,923 |

) |

| Net loss from discontinued operations, net of applicable income taxes |

|

|

(69,123 |

) |

|

|

387 |

|

|

|

(3,455 |

) |

|

|

(80,593 |

) |

|

|

(3,365 |

) |

| Adjustment for impairment of intangible assets |

|

|

48,555 |

|

|

|

- |

|

|

|

- |

|

|

|

48,555 |

|

|

|

- |

|

| Adjustment for impairment of goodwill |

|

|

26,569 |

|

|

|

- |

|

|

|

- |

|

|

|

26,569 |

|

|

|

- |

|

| Adjusted net income (loss) attributable to BIT Mining Limited

(non-GAAP) from discontinued operations |

|

|

6,001 |

|

|

|

387 |

|

|

|

(3,455 |

) |

|

|

(5,469 |

) |

|

|

(3,365 |

) |

| Adjusted net loss attributable to BIT Mining

Limited (non-GAAP) |

|

|

(9,142 |

) |

|

|

(3,551 |

) |

|

|

(4,365 |

) |

|

|

(32,051 |

) |

|

|

(13,288 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of Class A and Class B ordinary shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

1,063,813,210 |

|

|

|

1,111,232,309 |

|

|

|

1,111,232,309 |

|

|

|

871,036,499 |

|

|

|

1,102,378,814 |

|

| Diluted |

|

|

1,063,813,210 |

|

|

|

1,111,232,309 |

|

|

|

1,111,232,309 |

|

|

|

871,036,499 |

|

|

|

1,102,373,814 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Losses per share attributable to BIT Mining Limited (non-GAAP)-Basic

and Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net loss from continuing operations (non-GAAP) |

|

|

(0.01 |

) |

|

|

(0.00 |

) |

|

|

(0.00 |

) |

|

|

(0.03 |

) |

|

|

(0.01 |

) |

| Adjusted net (loss) income from discontinued operations (non-GAAP) |

|

|

0.00 |

|

|

|

0.00 |

|

|

|

(0.00 |

) |

|

|

(0.01 |

) |

|

|

(0.00 |

) |

| Adjusted net loss (non-GAAP) |

|

|

(0.01 |

) |

|

|

(0.00 |

) |

|

|

(0.00 |

) |

|

|

(0.04 |

) |

|

|

(0.01 |

) |

| Losses per ADS* attributable to BIT Mining Limited (non-GAAP)-Basic

and Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net loss from continuing operations (non-GAAP) |

|

|

(1.42 |

) |

|

|

(0.35 |

) |

|

|

(0.08 |

) |

|

|

(3.05 |

) |

|

|

(0.90 |

) |

| Adjusted net (loss) income from discontinued operations (non-GAAP) |

|

|

0.56 |

|

|

|

0.03 |

|

|

|

(0.31 |

) |

|

|

(0.63 |

) |

|

|

(0.31 |

) |

| Adjusted net loss (non-GAAP) |

|

|

(0.86 |

) |

|

|

(0.32 |

) |

|

|

(0.39 |

) |

|

|

(3.68 |

) |

|

|

(1.21 |

) |

*

American Depositary Shares, which are traded on the NYSE. Each ADS represents 100 Class A ordinary shares of the Company.

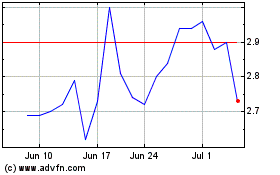

Bit Mining (NYSE:BTCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bit Mining (NYSE:BTCM)

Historical Stock Chart

From Apr 2023 to Apr 2024