UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________________________________

FORM 6-K

_________________________________________________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

February 2024

Commission File Number 1-14728

_________________________________________________________________

LATAM Airlines Group S.A.

(Translation of Registrant’s Name Into English)

_________________________________________________________________

Presidente Riesco 5711, 20th floor

Las Condes

Santiago, Chile

(Address of principal executive offices)

_________________________________________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

LATAM AIRLINES GROUP S.A.

The following exhibit is attached:

| | | | | | | | |

| EXHIBIT NO. | | DESCRIPTION |

| 99.1 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| Date: February 22, 2024 | LATAM AIRLINES GROUP S.A. |

| | |

| By: | /s/ Ramiro Alfonsín |

| Name: | Ramiro Alfonsín |

| Title: | CFO |

LATAM REPORTS STRONG OPERATIONAL AND FINANCIAL RESULTS FOR FULL YEAR 2023, US$582 MILLION OF NET INCOME AND ADJUSTED OPERATING MARGIN OF 11.3%

Santiago, Chile, February 22, 2024 – LATAM Airlines Group S.A.. (SSE: LTM) announced today its consolidated financial results for the fourth quarter ending December 31, 2023. “LATAM” or “the Company” makes reference to the consolidated entity, which includes its passenger and cargo affiliated airlines in Latin America. LATAM prepares its financial statements under IFRS as issued by the IASB, however, for ease of presentation and comparison, the Income Statement in this report is presented in an adapted US Format. On some occasions, adjustments to these Income Statement figures are made for Special Items. A table reconciling the figures adjusted for Special Items to their as-reported IFRS figures can be found at the end of the report. All figures in this report are expressed in U.S. dollars. Percentages and certain U.S. dollar, Chilean peso and Brazilian real amounts contained in this report have been rounded for ease of presentation. Any discrepancies in any table between totals and the sums of the amounts listed are due to rounding. The Brazilian real / U.S. dollar average exchange rate for the quarter was BRL 4.96 per USD.

HIGHLIGHTS

Financial and operational strength marked 2023, a year in which LATAM group continued its network growth regionally and globally. The group achieved US$11.8 billion in operating annual revenues and a double-digit adjusted EBIT margin of 11.3%, driven by growth in its passenger operations and a continued focus on cost containment. Throughout the year, LATAM group transported approximately 74 million passengers, similar to pre-pandemic levels, and noted full year net income of US$582 million. Additionally, LATAM generated US$498 million in cash during the year, leading to a total liquidity of US$2.8 billion and an adjusted net leverage of 2.1x.

| | | | | | | | |

Key Financial Indicators (US$ million) | FY23 | FY22 |

Total revenues | 11,789 | 9,517 |

| Adj. operating margin | 11.3% | 1.4% |

Net income* | 582 | (341) |

| Passenger cask ex-fuel (US$ cents) | 4.3 | 4.3 |

Fleet cash cost | (796) | (741) |

Cash generation | 498 | 170 |

Liquidity | 2,815 | 2,317 |

| Liquidity (as % of LTM revenues) | 23.9% | 24.3% |

| Adj. net leverage | 2.1x | 4.0x |

* Excluding non-operational positive net income impact of U$1,680 million related to the exit from Chapter 11

for full year 2022.

•During the year, LATAM group transported nearly 74 million passengers, throughout its extensive network, which positions the group as an attractive option for a variety of customer segments. This milestone marks the return to passenger figures similar to those observed prior to the pandemic. The number of passengers transported in the domestic markets of LATAM group's affiliates in Chile, Brazil, Colombia, Ecuador and Peru increased by 10.7%, along with a strong increase in international traffic that continues its recovery with a 50.1% increase in passengers transported.

•During the fourth quarter of 2023, LATAM group’s consolidated operations, measured in available seat - kilometers (ASK), increased by 14.7% compared to the same quarter of 2022 (representing 95.5% of 2019 levels), leading to a 20.6% increase in the full year results, in line with the updated 2023 guidance. During 2023, international capacity increased by 36.2%, the domestic capacity of LATAM Airlines Brazil increased by 9.5% and the domestic capacity of the affiliates in Chile, Colombia, Peru and Ecuador increased by 6.8% compared to 2022.

•Total operating revenues amounted to US$3,251 million during the fourth quarter (+18.5% vs 2022), and reached US$11,789 million for the full year (+23.9% vs 2022), which led to a solid annual adjusted operating margin of 11.3%. This increase is mainly explained by the solid growth of passenger revenues both in the quarter (+24.3% vs 2022) and in the full year (+33.8% vs 2022), boosted by the recovery of international air travel demand. During the

year, international revenues represented approximately 46% of total passenger revenues, a result of LATAM's network of 148 destinations in 26 countries. On the other hand, cargo revenues decreased by 17.4% during the year, explained by the softening of cargo yields, however, they still remain above pre-pandemic levels.

•Net income attributable to the owners LATAM Airlines Group S.A. amounted to US$83 million in the fourth quarter, mainly driven by the strong growth in passenger revenues. Full year net income amounted to US$582 million, the highest result achieved by LATAM group, excluding 2022 results, which had positive non-operational impacts on the net income stemming from its Chapter 11 exit. As per Chilean law, LATAM must pay out at least 30% of net income in dividends, subject to shareholder approval.

•LATAM closed the year with US$2,815 million of liquidity, a result of cash generation of US$85 million during the fourth quarter and US$498 million over the last twelve months, without issuing any financial debt.

•LATAM group reported an adjusted net leverage of 2.1x, a reduction from 4.0x at the end of the previous year. LATAM group's current capital structure is unparalleled in the Americas and represents a competitive advantage in the region, especially in post pandemic times.

•These results are a stronger outcome than the 2023 Guidance and anticipate the Updated Business Plan projections by more than a year.

•On December 14, 2023, LATAM group released its 2024 Guidance, which contains operational and financial projections for the year and a continued positive trajectory. LATAM forecasts annual growth in its passenger operations (ASKs) of between 12% and 14%, with a notable improvement in the international segment. Financially, the group forecasts a record adjusted EBITDAR between US$2.6 billion and US$2.9 billion for 2024, which would represent an increase of up to 14.5% year over year. At the same time, the group expects to continue reducing its net leverage during 2024, closing the year with an adjusted net leverage between 1.8x and 2.0x.

•In November, LATAM was included in the MSCI Emerging Markets (EM) Latin America Index. This is a testament to market and investor trust in LATAM group, and highlights is ability to maintain a solid financial performance even in a challenging environment. LATAM group had been previously included into other important indexes during the year, in particular the S&P IPSA in March 2023 and the FTSE Global Equity Index Series and FTSE Minimum Variance Index in September 2023.

MANAGEMENT COMMENTS - FULL YEAR 2023

This year was a reflection of LATAM group's dedication to demonstrating its financial strength, continued network expansion and operational flexibility, and as a result has posted record results that outperformed its 2023 Guidance and its Updated Business Plan published in August 2022.

LATAM group focused on profitable growth throughout the year and continuing to offer the most expansive regional and global network. In this regard, the respective affiliates of the group are ranked first place in three of the five domestic markets where they operate: LATAM Airlines Chile has 61% of the market share, LATAM Airlines Peru has 64% of the market share and LATAM Airlines Brazil achieved a record 39% market share, as of the fourth quarter of 2023. On the other hand, LATAM Airlines Colombia has increased from 24% as of fourth quarter 2022 to 33% as of the fourth quarter of 2023, quickly allocating additional aircraft to accommodate capacity demand in the market. This is a clear demonstration of the group's operational agility and financial flexibility.

In 2023, LATAM group's network continued to expand as the group proudly launched 21 routes, 17 international and 4 domestic, which include 4 routes implemented within the context of the Joint Venture with Delta Air Lines. Importantly, LATAM group and Delta have a combined 36% of capacity share as of the fourth quarter 2023, between the countries where the JV operates connecting South and North America. The JV continues to be a central focus for LATAM group going forward.

On the other hand, the frequent flyer program, LATAM Pass, is a strategic asset and a core source of value that differentiates LATAM group from other carriers, and also a key element of the marketing and loyalty strategy. In 2023, LATAM Pass reached approximately 45 million members, representing an increase of 7.1% compared to 2022, which reinforces customer preference for LATAM group, especially focused in the corporate and premium passenger segment.

“This performance is a reflection of a culture where we prioritize the customer, work to deliver better service, maintain a competitive cost structure, incorporate innovation and technology, strive for a sustainable business, and contribute to the societies where LATAM group companies operate. This focus enables us to deliver a better product, which has translated into very good financial results”, said Roberto Alvo, CEO of LATAM Airlines Group.

With a focus on the passenger experience, in 2023 LATAM group successfully completed the retrofit project for its narrow-body fleet (excluding aircraft available for sale), reaching a full fleet with a homologated and renovated cabin featuring a premium economy cabin.

Regarding its additional fleet investments, LATAM group received 30 aircraft during 2023, 5 wide body and 25 narrow body, including 7 Airbus A321neo. LATAM also placed an order for 5 Boeing 787s to be incorporated into its fleet from 2027 onwards. One of LATAM's advantages is the group's competitive fleet cost. As of December 31, 2023, LATAM group reported a fleet of 333 aircraft and a full year fleet cash cost of US$796 million, which remains unique. The reduced fleet cost competitive advantage stems from the renegotiation of all of the group's fleet contracts during the reorganization process.

Regarding sustainability, LATAM group has reached more than 1,700 ton reduction in single-use plastics since the goal was set in 2020, and additionally was honored with two new sustainability-related awards: "Best for Onboard Sustainability" by Onboard Hospitality Awards, for having most sustainable onboard service, and the "Air Cargo Sustainability Award" by The International Air Cargo Association (TIACA), for having a solid sustainability strategy, reinforcing the pillars of Climate Change, Shared Value, Circular Economy, as well as LATAM's commitment to protecting the strategic ecosystems of South America.

MANAGEMENT DISCUSSION AND ANALYSIS OF FOURTH QUARTER 2023 RESULTS

LATAM group reported total operating revenues of US$3,251 million in the fourth quarter, an increase of 18.5% compared to the same period of 2022, explained by a 24.3% increase in passenger revenues. LATAM group's operations, measured in ASK, increased by 14.7% while passenger yields increased by 3.6%. Cargo revenues reached US$364 million during the quarter. Passenger and cargo revenues accounted for 87.6% and 11.2% of total operating revenues respectively, for the fourth quarter of 2023.

Total revenue for the year reached US$11,789 million, an increase of 23.9% explained by a 33.8% increase in passenger revenues. In the year, 35% of passenger revenues came from domestic operations of the Brazilian affiliate, 19% from the domestic revenues of affiliates in Spanish-speaking countries and 46% from international operations. Cargo revenues amounted to US$1,425 million during 2023. Passenger and cargo revenues accounted for 86.6% and 12.1% of total operating revenues, respectively.

Passenger revenues amounted to US$2,848 million in the fourth quarter, increasing 24.3% versus the same period of 2022, explained by an increase in both capacity and RASK. Capacity increased by 14.7% especially driven by the continued recovery of the international segment (+29.2% versus 4Q22). In the fourth quarter, LATAM group's RASK reached US$7.8 cents, showing an increase of 8.3% compared to the same period of 2022, explained by a strong demand environment, boosted by the consumer preference for LATAM group. During the quarter, the consolidated load factor was 85.1% (a 3.7 p.p. increase from 4Q of 2022), while passenger yields grew 3.6% versus 4Q of 2022.

Cargo revenues decreased 13.4% compared to the fourth quarter of 2022, reaching US$364 million, explained by the softening of cargo yields due to increased industry capacity. Despite the above, cargo revenues compared to the same period of 2019 outperformed it by 29.9%. During full year 2023, cargo revenues amounted to US$1,425 million. In the quarter, cargo yields were US$35.5 cents per RTK, and despite the cyclical softening of the business, were still situated 17.3% above 2019 levels.

Other income amounted to US$40 million, increasing 21.2% versus previous year. This increase can be attributed to the growth in revenue from non-core businesses and the sale of A350 components.

Total adjusted operating expenses were US$2,899 million, increasing 14.8% versus 2022, mainly explained by the increase in passenger capacity, and in particular, international operations. Aircraft fuel costs increased 1.5% versus the same period of 2022. During the quarter, LATAM group reported a passenger CASK ex-fuel of US$4.4 cents, a 10.5% increase compared to the same quarter of 2022, largely affected by FX variations and higher mix of international operations and load factor.

The changes in adjusted operating expenses during the quarter were mainly explained by:

•Wages and benefits increased 17.8% versus the same period of 2022, while there was a 14.7% increase in operations. This increase can be mainly explained by a 9.5% rise in the average headcount of the group (pilots and cabin crew headcount increased 23.7% vs the previous year), an increase in wages and benefits cost due to inflation-linked salary variations and currency appreciations.

•Aircraft fuel costs increased 1.5% compared to the fourth quarter of 2022, explained by the decrease in jet fuel price and, the increase in fuel consumption in line with the growth of operations. During the quarter, average fuel price (excluding hedges) noted a 9.2% decrease versus the same period of 2022. LATAM group recognized a gain of US$13.3 million related to hedging contracts, which compares to a gain of US$2.9 million during the same period of 2022.

•Commissions to agents increased 30.5% versus 2022, associated with the increase in sales by approximately 30% as well as growth of operations, particularly in the international segment.

•Depreciation and amortization increased 7.5% versus 2022, explained by the increase of the fleet from 310 to 333 aircraft.

•Other rental and landing fees increased 39.8% versus 2022, mainly explained by a 25.0% increase in international operations, in addition to a higher number of passengers due to load factor increase.

•Passenger services expenses totaled US$79 million, increasing 20.5% versus the same period of 2022, explained by the increase of operations, in addition, there has been a rise in the number of passengers transported as a result of an increase in the load factor.

•Aircraft rentals expenses, which correspond exclusively to LATAM group’s fleet power-by-the-hour (PBH) contracts, amounted to US$23 million, representing a 15.6% decrease versus 4Q22 since there are currently less aircraft under PBH contracts. This expense is considered a special item since there is a non-cash double counting of fleet PBH in Aircraft Rentals and in the Depreciation & Amortization line, and therefore has been adjusted for in the adjusted financial figures. PBH contracts continued to be in place in 2023 for part of the wide-body fleet and, will remain in effect for part of 2024.

•Aircraft maintenance expenses totaled US$174 million, corresponding to a 20.6% increase versus 2022, mainly due to the increase in operations of 14.7% and to certain additional maintenance tasks to enhance component performance in anticipation of the high season.

•Other operating expenses increased 38.6% compared to 2022 and amounted to US$403 million, partially explained by the increase in operations. Furthermore, this line was impacted by fluctuations in FX rates during this quarter, along with certain compensations associated with cancellations and affected operations.

Non-operating results

•Interest income amounted to US$29 million in the quarter. This represents a US$988 million decrease from the same period of 2022 when gains for US$911.7 million were recognized associated with claims and LATAM's restructuring of its financial liabilities.

•Interest expense decreased 20.9% versus 2022, to US$187 million during the quarter, mainly due to the significant reduction of approximately 40% in the group’s financial debt after LATAM group's exit from Chapter 11, despite the SOFR base rate increase by an average of 1.7 p.p. compared to the same quarter of 2022.

•Other income (expense), registered a US$40 million expense during the quarter versus US$1,716 million gain during 4Q22. During the fourth quarter of 2023, the main expense stems from the reclassification of asset sales, whereas in the previous year gain was mainly attributed to positive non-cash impacts related to the Chapter 11 reorganization process.

•Net income attributable to the owners of the parent company during the quarter was US$83 million and US$582 for year full year 2023.

LIQUIDITY AND FINANCING

For the full year 2023, LATAM group generated US$498 million in cash, increasing liquidity to US$2.8 billion, comprised of US$1.7 billion in cash and cash equivalents, in addition to US$1.1 billion in available and fully undrawn revolving credit facilities (“RCF”). Liquidity as a percentage of revenues of last twelve months reached 23.9%.

LATAM group registered a consolidated fleet debt (operational leases and finance leases) of US$4.3 billion, alongside a non-fleet financial debt of US$2.6 billion. This results in a total gross debt of US$6.9 billion and a net debt of US$5.2 billion. At the end of the period, LATAM group reported adjusted net leverage of 2.1x, demonstrating its strong capital structure after the reorganization process and its robust operations.

With respect to LATAM group’s fuel hedging policy, its main objective is to protect against medium-term liquidity risk from fuel price increases, while benefiting from fuel price reductions. Accordingly, LATAM group hedges a portion of its estimated fuel consumption. Hedge positions per quarter for the next months, as of December 31, 2023, are shown in the table below:

| | | | | | | | | | | | | | |

| 1Q24 | 2Q24 | 3Q24 | 4Q24 |

| Hedge positions | | | | |

| Estimated Fuel consumption hedged | 35% | 32% | 30% | 22% |

LATAM FLEET PLAN

LATAM group’s fleet is composed of 256 Airbus narrow-body aircraft, 57 Boeing wide-body aircraft and 20 Boeing cargo freighters, totaling 333 aircraft. During the fourth quarter, the group received 1 Boeing 787-9, 6 Airbus A321Neo, 4 Airbus A320Neo and 2 Airbus A320 aircraft, totaling 13 additional aircraft in the quarter and 30 additional aircraft throughout 2023. For a breakdown of the current fleet, please see the fleet chart in the reference tables section toward the end of this report. As of the date of publication, LATAM group has fleet commitment agreements with Airbus and Boeing for new aircraft and additionally has signed several contracts with lessors to receive both narrow-body Airbus and wide-body Boeing aircraft in the coming years, as detailed below. These new technology aircraft will allow LATAM group to continue to renew and expand its fleet, reflecting its commitment to a modern fleet and its long-term sustainability strategy toward carbon neutrality by 2050.

| | | | | | | | | | | | | | |

| Fleet Plan | As of end of year |

| 2023 | 2024 | 2025 | 2026 |

| Passenger Aircraft | | | | |

| Narrow Body | | | | |

| Airbus Ceo Family | 225 | 223 | 219 | 206 |

| Airbus Neo Family | 31 | 41 | 55 | 69 |

| Total NB | 256 | 264 | 274 | 275 |

| | | | |

| Wide Body | | | | |

| Boeing 787 | 36 | 37 | 41 | 41 |

| Other Boeing | 21 | 19 | 19 | 19 |

| Total WB | 57 | 56 | 60 | 60 |

| | | | |

| TOTAL | 313 | 320 | 334 | 335 |

| | | | |

| Cargo Aircraft | | | | |

| Boeing 767-300F | 20 | 19 | 19 | 19 |

| TOTAL | 20 | 19 | 19 | 19 |

| TOTAL FLEET | 333 | 339 | 353 | 354 |

| | | | |

AVERAGE FLEET | 316 | 339 | 348 | 351 |

Note: This fleet plan considers LATAM group's committed arrivals and takes into account the group's current decisions regarding aircraft sales, retirements and lease extensions. In the Financial Statements, Note 13 describes the aircraft that are currently held for sale and expected to be sold in 2024.

2024 GUIDANCE

Guidance for the full year 2024 was issued by the Company on December 14, 2023, as detailed below:

| | | | | | | | | | | | | |

| Indicator | Guidance | 2024E | |

| | | | | |

| Operating Indicators | Total ASK Growth vs 2023 | 12 | % - | 14% | | |

| Domestic Brazil ASK Growth vs 2023 | 7 | % - | 9% | | |

| Domestic Spanish Speaking Countries ASK Growth vs 2023 | 12 | % - | 14% | | |

| International ASK Growth vs 2023 | 16 | % - | 18% | | |

| Total ATK Growth vs 2023 | 10 | % - | 12% | | |

| | | | | |

| Financial Indicators | Revenues (US$ billion) | 12.4 - | 12.8 | | |

| CASK ex fuel (US$ cents) | 4.8 - | 5.0 | | |

| Adjusted Passenger CASK ex fuel1 (US$ cents) | 4.3 - | 4.5 | | |

| Adjusted EBIT (US$ billion) | 1.25- | 1.50 | | |

| Adjusted EBIT Margin2 | 10.5 | % - | 12.5% | | |

| Adjusted EBITDAR2 (US$ billion) | 2.6 - | 2.9 | | |

| Adjusted EBITDAR Margin2 | 21 | % | 23% | | |

| Liquidity3 (US$ billion) | 2.8 - | 3.0 | | |

| Financial Net Debt4 (US$ billion) | 5.3 - | 5.5 | | |

| Financial Net Debt4/Adjusted EBITDAR2 (x) | 1.8x - | 2.0x | | |

| | | | | |

| Assumptions | | | |

| Average exchange rate (BRL/USD) | 5.1 | | |

| Jet fuel price (US$/bbl) | 100 | | |

Footnotes:

1) Passenger CASK ex fuel excludes cargo costs associated with belly and freighter operations, variable Aircraft Rental expenses (non-cash P&L effect) and employee compensations associated with the Corporate Incentive Plan.

2) Adjusted EBIT Margin and Adjusted EBITDAR excludes variable Aircraft Rental expenses (non-cash P&L effect) and employee compensations associated with the Corporate Incentive Plan.

3) Liquidity is defined as Cash and Cash Equivalents and undrawn, committed revolving credit facilities. Does not assume Liability Management excercise in 2024.

4) Financial Net Debt includes operating leases liabilities, financial leases and other financial debt, net of Cash and Cash Equivalents.

FINANCIAL STATEMENTS PUBLICATION AND CONFERENCE CALL

LATAM filed its financial statements for the year ended December 31, 2023 with the Comisión para el Mercado Financiero (CMF) of Chile on February 22, 2024. These financial statements are available in Spanish and English at http://www.latamairlinesgroup.net. For further inquiries, please contact the Investor Relations team at InvestorRelations@latam.com.

The Company will hold a conference call to discuss the fourth quarter 2023 financial results on Friday, February 23, 2024, at 8:00 am ET / 10:00 am Santiago.

Webcast Link: click here

Participant Call Link: click here

About LATAM Airlines Group S.A.:

LATAM Airlines Group S.A. and its affiliates are the principal group of airlines in Latin America present in five domestic markets in the region: Brazil, Chile, Colombia, Ecuador and Peru, in addition to international operations within Latin America and to / from Europe, the United States, Oceania, Africa and the Caribbean.

The group has a fleet of Boeing 767, 777, 787, Airbus A321, A321Neo, A320, A320Neo and A319 aircraft.

LATAM Cargo Chile, LATAM Cargo Colombia and LATAM Cargo Brazil are the LATAM group cargo subsidiaries. In addition to having access to the bellies of the passenger affiliates's aircraft, they have a fleet of 20 freighters. They operate on the LATAM group network as well as international routes that are solely used for freighters. They offer modern infrastructure, a wide variety of services and protection options to meet all customer needs.

For LATAM press inquiries, please write to comunicaciones.externas@latam.com. Additional financial information is available at www.latamairlinesgroup.net.

LATAM Airlines Group S.A.

Consolidated Financial Results for the Fourth Quarter 2023 (in thousands of US Dollars)

| | | | | | | | | | | | | | | | | |

| For the three month period ended December 31 |

| 2023 | Adjustments | 2023 Adjusted | 2022 Adjusted | % Change |

| REVENUE | | | | | |

| Passenger | 2,847,672 | | 2,847,672 | 2,291,419 | 24.3% |

| Cargo | 363,829 | | 363,829 | 420,113 | (13.4%) |

| Other Income | 39,694 | | 39,694 | 32,739 | 21.2% |

| TOTAL OPERATING REVENUE | 3,251,195 | | 3,251,195 | 2,744,271 | 18.5% |

| EXPENSES | | | | | |

| Wages and Benefits | (422,980) | 26,040 | (396,940) | (336,986) | 17.8% |

| Aircraft Fuel | (1,088,637) | | (1,088,637) | (1,072,850) | 1.5% |

| Commissions to Agents | (64,880) | | (64,880) | (49,704) | 30.5% |

| Depreciation and Amortization | (322,953) | | (322,953) | (300,364) | 7.5% |

| Other Rental and Landing Fees | (369,396) | | (369,396) | (264,145) | 39.8% |

| Passenger Services | (78,954) | | (78,954) | (65,545) | 20.5% |

| Aircraft Rentals | (22,544) | 22,544 | — | — | n.m. |

| Aircraft Maintenance | (173,753) | | (173,753) | (144,052) | 20.6% |

| Other Operating Expenses | (403,224) | | (403,224) | (290,876) | 38.6% |

| TOTAL OPERATING EXPENSES | (2,947,321) | 48,584 | (2,898,737) | (2,524,522) | 14.8% |

| OPERATING INCOME/(LOSS) | 303,874 | 48,584 | 352,458 | 219,749 | 60.4% |

| Operating Margin | 9.3% | 1.5pp | 10.8% | 8.0% | 2.8pp |

| Interest Income | 29,499 | | 29,499 | 1,017,799 | (97.1%) |

| Interest Expense | (187,472) | | (187,472) | (236,952) | (20.9%) |

| Adjusted Other Income (Expense) | (39,838) | | (39,838) | 1,715,674 | n.m |

| INCOME/(LOSS) BEFORE TAXES | 106,063 | 48,584 | 154,647 | 2,716,270 | (94.3%) |

| Income Taxes | (22,405) | | (22,405) | (97,098) | (76.9%) |

| NET INCOME/(LOSS) | 83,658 | 48,584 | 132,242 | 2,619,172 | (95.0%) |

| Attributable to: | | | | | |

| Owners of the parent | 82,960 | 48,584 | 131,544 | 2,618,457 | (95.0%) |

| Non-controlling interest | 698 | | 698 | 715 | (2.4%) |

| NET INCOME/(LOSS) attributable to the owners of the parent | 82,960 | 48,584 | 131,544 | 2,618,457 | (95.0%) |

| Net Margin attributable to the owners of the parent | 2.6% | 1.5pp | 4.0% | 95.4% | -91.4pp |

| Effective Tax Rate | (21.1%) | 6.6pp | (14.5%) | (3.6%) | (10.9pp) |

| EBITDA | 626,827 | 48,584 | 675,411 | 520,113 | 29.9% |

| EBITDA Margin | 19.3% | 1.5pp | 20.8% | 19.0% | 1.8pp |

| EBITDAR | 649,371 | 26,040 | 675,411 | 520,113 | 29.9% |

| EBITDAR Margin | 20.0% | 0.8pp | 20.8% | 19.0% | 1.8pp |

Note: Adjustments in the quarter include LATAM's variable fleet payments (PBH) accounted for in Aircraft Rentals as well as employee compensation associated with the Corporate Incentive Plan.

LATAM Airlines Group S.A.

Consolidated Financial Results for the twelve-month period ended December (in thousands of US Dollars)

| | | | | | | | | | | | | | | | | |

| For the twelve month period ended December 31 |

| 2023 | Adjustments | 2023 Adjusted | 2022 Adjusted | Var. % |

| REVENUE | | | | | |

| Passenger | 10,215,148 | | 10,215,148 | 7,636,429 | 33.8% |

| Cargo | 1,425,393 | | 1,425,393 | 1,726,092 | (17.4%) |

| Other Income | 148,641 | | 148,641 | 154,286 | (3.7%) |

| TOTAL OPERATING REVENUE | 11,789,182 | | 11,789,182 | 9,516,807 | 23.9% |

| EXPENSES | | | | | |

| Wages and Benefits | (1,583,337) | 66,817 | (1,516,520) | (1,213,036) | 25.0% |

| Aircraft Fuel | (3,947,220) | | (3,947,220) | (3,882,505) | 1.7% |

| Commissions to Agents | (244,160) | | (244,160) | (167,035) | 46.2% |

| Depreciation and Amortization | (1,205,373) | | (1,205,373) | (1,179,512) | 2.2% |

| Other Rental and Landing Fees | (1,322,795) | | (1,322,795) | (1,036,158) | 27.7% |

| Passenger Services | (271,838) | | (271,838) | (184,357) | 47.5% |

| Aircraft Rentals | (91,876) | 91,876 | — | — | n.m. |

| Aircraft Maintenance | (601,804) | | (601,804) | (582,848) | 3.3% |

| Other Operating Expenses | (1,351,571) | | (1,351,571) | (1,136,490) | 18.9% |

| TOTAL OPERATING EXPENSES | (10,619,974) | 158,693 | (10,461,281) | (9,381,940) | 11.5% |

| OPERATING INCOME/(LOSS) | 1,169,208 | 158,693 | 1,327,901 | 134,867 | 884.6% |

| Operating Margin | 9.9% | 1.3pp | 11.3% | 1.4% | 9.8pp |

| Interest Income | 125,356 | | 125,356 | 1,052,295 | (88.1%) |

| Interest Expense | (698,231) | | (698,231) | (942,403) | (25.9%) |

| Adjusted Other Income (Expense) | 159 | | 159 | 1,357,438 | (100.0%) |

| INCOME/(LOSS) BEFORE TAXES | 596,492 | 158,693 | 755,185 | 1,602,197 | (52.9%) |

| Income Taxes | (14,942) | | (14,942) | (8,914) | 67.6% |

| NET INCOME/(LOSS) | 581,550 | 158,693 | 740,243 | 1,593,283 | (53.5%) |

| Attributable to: | | | | | |

| Owners of the parent | 581,831 | 158,693 | 740,524 | 1,595,356 | (53.6%) |

| Non-controlling interest | (281) | | (281) | (2,073) | (86.4%) |

| NET INCOME/(LOSS) attributable to the owners of the parent | 581,831 | 158,693 | 740,524 | 1,595,356 | (53.6%) |

| Net Margin attributable to the owners of the parent | 4.9% | 1.3pp | 6.3% | 16.8% | -10.5pp |

| Effective Tax Rate | (2.5%) | 0.5pp | (2.0%) | (0.6%) | -1.4pp |

| EBITDA | 2,374,581 | 158,693 | 2,533,274 | 1,314,379 | 92.7% |

| EBITDA Margin | 20.1% | 1.3pp | 21.5% | 13.8% | 7.7pp |

| EBITDAR | 2,466,457 | 66,817 | 2,533,274 | 1,314,379 | 92.7% |

| EBITDAR Margin | 20.9% | 0.6pp | 21.5% | 13.8% | 7.7pp |

Note: Adjustments in the quarter include LATAM's variable fleet payments (PBH) accounted for in Aircraft Rentals as well as employee compensation associated with the Corporate Incentive Plan.

LATAM Airlines Group S.A.

Consolidated Operational Statistics

| | | | | | | | | | | | | | | | | | | | | | | |

| For the three month period ended December 31 | | For the twelve month period ended December 31 |

| 2023 | 2022 | % Change | | 2023 | 2022 | % Change |

| | | | | | | |

| System | | | | | | | |

| Costs per ASK (US$ cents) | 8.0 | 8.1 | (1.4%) | | 7.7 | 8.5 | (8.6%) |

| Costs per ASK ex fuel (US$ cents) | 5.1 | 4.8 | 5.8% | | 4.9 | 5.1 | (3.8%) |

| Passenger CASK ex fuel (US$ cents) | 4.4 | 4.0 | 10.5% | | 4.3 | 4.3 | 0.7% |

| Fuel Gallons Consumed (millions) | 319.3 | 283.6 | 12.6% | | 1,194.9 | 1,017.2 | 17.5% |

| Fuel Gallons Consumed per 1,000 ASKs | 8.7 | 8.9 | (1.9%) | | 8.7 | 8.9 | (2.6%) |

| Fuel Price (with hedge) (US$ per gallon) | 3.40 | 3.78 | (10.1%) | | 3.30 | 3.82 | (13.6%) |

| Fuel Price (without hedge) (US$ per gallon) | 3.44 | 3.79 | (9.2%) | | 3.31 | 3.83 | (13.6%) |

| Average Trip Length (km) | 1,554 | 1,516 | 2.5% | | 1,542 | 1,482 | 4.0% |

| Total Number of Employees (average) | 35,359 | 32,206 | 9.8% | | 34,174 | 30,872 | 10.7% |

| Total Number of Employees (end of the period) | 35,568 | 32,493 | 9.5% | | 35,568 | 32,493 | 9.5% |

| | | | | | | |

| Passenger | | | | | | | |

| ASKs (millions) | 36,680 | 31,971 | 14.7% | | 137,251 | 113,852 | 20.6% |

| RPKs (millions) | 31,199 | 26,012 | 19.9% | | 114,007 | 92,588 | 23.1% |

| Passengers Transported (thousands) | 19,734 | 17,153 | 15.0% | | 73,898 | 62,467 | 18.3% |

| Load Factor (based on ASKs) % | 85.1% | 81.4% | 3.7pp | | 83.1% | 81.3% | 1.8pp |

| Yield based on RPKs (US$ cents) | 9.1 | 8.8 | 3.6% | | 9.0 | 8.2 | 8.6% |

| Revenues per ASK (US$ cents) | 7.8 | 7.2 | 8.3% | | 7.4 | 6.7 | 11.0% |

| | | | | | | |

| Cargo | | | | | | | |

| ATKs (millions) | 1,925 | 1,742 | 10.5% | | 7,171 | 6,256 | 14.6% |

| RTKs (millions) | 1,024 | 953 | 7.5% | | 3,704 | 3,532 | 4.9% |

| Tons Transported (thousands) | 261 | 240 | 8.9% | | 946 | 901 | 5.0% |

| Load Factor (based on ATKs) % | 53.2% | 54.7% | -1.5pp | | 51.7% | 56.5% | -4.8pp |

| Yield based on RTKs (US$ cents) | 35.5 | 44.1 | (19.4%) | | 38.5 | 48.9 | (21.3%) |

| Revenues per ATK (US$ cents) | 18.9 | 24.1 | (21.6%) | | 19.9 | 27.6 | (28.0%) |

1) Passenger CASK ex fuel excludes cargo costs associated with belly and freighter operations, variable Aircraft Rental expenses (non-cash P&L effect) and employee compensations associated with the Corporate Incentive Plan.

LATAM Airlines Group S.A.

Consolidated Balance Sheet (in thousands of US Dollars)

| | | | | | | | |

| As of December 31 | As of December 31 |

| 2023 | 2022 |

| | |

| Assets |

| Cash and cash equivalents | 1,714,761 | 1,216,675 |

| Other financial assets | 174,819 | 503,515 |

| Other non-financial assets | 185,264 | 191,364 |

| Trade and other accounts receivable | 1,385,910 | 1,008,109 |

| Accounts receivable from related entities | 28 | 19,523 |

| Inventories | 592,880 | 477,789 |

| Current tax assets | 47,030 | 33,033 |

| Total current assets other than non-current assets (or disposal groups) classified as held for sale | 4,100,692 | 3,450,008 |

| | |

| Non-current assets (or disposal groups) classified as held for sale | 102,670 | 86,416 |

| | |

| Total current assets | 4,203,362 | 3,536,424 |

| | |

| Other financial assets | 34,485 | 15,517 |

| Other non-financial assets | 168,621 | 148,378 |

| Accounts receivable | 12,949 | 12,743 |

| | |

| Intangible assets other than goodwill | 1,151,986 | 1,080,386 |

| Property, plant and equipment | 9,091,130 | 8,411,661 |

| | |

| Deferred tax assets | 4,782 | 5,915 |

| Total non-current assets | 10,463,953 | 9,674,600 |

| Total assets | 14,667,315 | 13,211,024 |

| | |

| Liabilities and shareholders' equity |

| Other financial liabilities | 596,063 | 802,841 |

| Trade and other accounts payables | 1,765,279 | 1,627,992 |

| Accounts payable to related entities | 7,444 | 12 |

| Other provisions | 15,072 | 14,573 |

| Current tax liabilities | 2,371 | 1,026 |

| Other non-financial liabilities | 3,301,906 | 2,642,251 |

| Total current liabilities | 5,688,135 | 5,088,695 |

| | |

| Other financial liabilities | 6,341,669 | 5,979,039 |

| Accounts payable | 418,587 | 326,284 |

| Other provisions | 926,736 | 927,964 |

| Deferred tax liabilities | 382,359 | 344,625 |

| Employee benefits | 122,618 | 93,488 |

| Other non-financial liabilities | 348,936 | 420,208 |

| Total non-current liabilities | 8,540,905 | 8,091,608 |

| Total liabilities | 14,229,040 | 13,180,303 |

| | |

| Share capital | 5,003,534 | 13,298,486 |

| Retained earnings/(losses) | 464,411 | (7,501,896) |

| Treasury Shares | — | (178) |

| Other equity | 39 | 39 |

| Other reserves | (5,017,682) | (5,754,173) |

| Parent’s ownership interest | 450,302 | 42,278 |

| Non-controlling interest | (12,027) | (11,557) |

| Total equity | 438,275 | 30,721 |

| Total liabilities and equity | 14,667,315 | 13,211,024 |

LATAM Airlines Group S.A.

Consolidated Statement of Cash Flow – Direct Method (in thousands of US Dollars)

| | | | | | | | |

| As of December 31, | As of December 31, |

| 2023 | 2022 |

| | |

| Cash flows from operating activities | | |

| Cash collection from operating activities | | |

| Proceeds from sales of goods and services | 13,397,385 | 10,549,542 |

| Other cash receipts from operating activities | 169,692 | 117,118 |

| | |

| Payments for operating activities | | |

| Payments to suppliers for the supply goods and services | (9,689,508) | (9,113,130) |

| Payments to and on behalf of employees | (1,304,696) | (1,039,336) |

| Other payments for operating activities | (270,580) | (272,823) |

| Income taxes (paid) | (18,379) | (14,314) |

| Other cash inflows (outflows) | (20,346) | (130,260) |

| | |

| Net cash (outflow) inflow from operating activities | 2,263,568 | 96,797 |

| | |

| Cash flows from investing activities | | |

| | |

| Other cash receipts from sales of equity or debt instruments of other entities | — | 417 |

| | |

| Other payments to acquire equity or debt instruments of other entities | — | (331) |

| Amounts raised from sale of property, plant and equipment | 46,524 | 56,377 |

| Purchases of property, plant and equipment | (795,787) | (780,538) |

| Purchases of intangible assets | (68,052) | (50,116) |

| Interest received | 98,552 | 18,934 |

| Other cash inflows (outflows) | 59,258 | 6,300 |

| | |

| Net cash (outflow) inflow from investing activities | (659,505) | (748,957) |

| | |

| Cash flows inflow (out flow) from investing activities | | |

| Proceeds from the issuance of shares | — | 549,038 |

| Amounts from the issuance of other equity instruments | — | 3,202,790 |

| Payments for changes in ownership interests in subsidiaries that do not result in loss of control | (23) | — |

| | |

| Amounts raised from long-term loans | — | 2,361,875 |

| Amounts raised from short-term loans | — | 4,856,025 |

| Loans from related entities | — | 770,522 |

| Loans repayments | (342,005) | (8,759,413) |

| Payments of lease liabilities | (225,358) | (131,917) |

| Payments of loans to related entities | — | (1,008,483) |

| | |

| Interest paid | (594,234) | (521,716) |

| Other cash (outflows) inflows | 11,405 | (463,766) |

| | |

| Net cash inflow (outflow) from financing activities | (1,150,215) | 854,955 |

| | |

| Net (decrease) increase in cash and cash equivalents before effect of exchanges rate change | 453,848 | 202,795 |

| Effects of variation in the exchange rate on cash and cash equivalents | 44,238 | (32,955) |

| Net (decrease) increase in cash and cash equivalents | 498,086 | 169,840 |

| | |

| CASH AND CASH EQUIVALENTS AT THE BEGINNING OF THE YEAR | 1,216,675 | 1,046,835 |

| | |

| CASH AND CASH EQUIVALENTS AT THE END OF THE YEAR | 1,714,761 | 1,216,675 |

LATAM Airlines Group S.A.

Adjusted Free Cash Flow (in thousands of US Dollars)

| | | | | | | | |

| Adjusted Free Cash Flow | For the three month period ended December 31 | For the twelve month period ended December 31 |

| | |

| Adjusted EBITDAR | 675,411 | 2,533,274 |

| Income statement adjusted for special items | (26,040) | (66,817) |

| EBITDAR | 649,371 | 2,466,457 |

| | |

| Changes in working capital | 200,395 | 201,915 |

| Cash taxes | (2,928) | (18,379) |

| Operating lease payments | (148,887) | (491,158) |

| Interest Income | 34,625 | 98,552 |

| Adj. Operating cash flow | 732,576 | 2,257,387 |

| | |

| Maintenance Capex | (237,188) | (703,173) |

| Capex for growth & Fleet Capex Net of Financing | (222,001) | (466,908) |

| Adj. Investment cash flow | (459,189) | (1,170,081) |

| | |

| Adj. Unlevered FCF | 273,387 | 1,087,306 |

| Interest on financial debt | (130,789) | (343,813) |

| Interest on finance leases | (19,339) | (76,497) |

| Adj. Levered FCF | 123,259 | 666,996 |

| | |

| Finance lease amortization | (46,554) | (251,388) |

| Non-Fleet Financial debt net amortization | (10,981) | (19,666) |

| Statutory Dividends | — | — |

| Other (Incl. Asset Sale, Fx and others) | 19,544 | 102,144 |

| Adj. Financing & Others cash flow | (188,119) | (589,220) |

| Change in cash | 85,268 | 498,086 |

| | |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF THE PERIOD | 1,629,493 | 1,216,675 |

| CASH AND CASH EQUIVALENTS AT END OF THE PERIOD | 1,714,761 | 1,714,761 |

| | |

| Fleet Cash Cost | (208,986) | (795,766) |

Notes:

1) Income Statement adjustments for special items in the period include provision of the Corporate Incentive Plan (“CIP”).

2) Operating leases includes variable Aircraft Rentals (Pay by the Hour “PBH”) and Operational Leases under IFRS 16 including amortization and interest (both fleet and non-fleet).

3) Maintenance Capex primarily includes engine shop visits, aircraft c-checks and restocking of parts for existing operation, as well as capex associated with fleet projects that do not contribute additional capacity to the group's operations or add new features to the existing offered product.

4) Growth & Fleet capex (net of financing) includes capex associated with additional spare parts and engines, engine shop visits, aircraft c-checks and restocking of parts for additional operation, PDPs, fleet projects that contribute additional capacity or new features to the existing offered product and certain other strategic projects that add value, and fleet arrivals net of their financing.

5) Fleet Cash cost includes Finance lease amortization, interest on finance leases and operating lease payments (Excluding Non-fleet lease liabilities)

LATAM Airlines Group S.A.

Consolidated Balance Sheet Indicators (in thousands of US Dollars)

| | | | | | | | |

| As of December 31, | As of December 31, |

| 2023 | 2022 |

| | |

| Total Assets | 14,667,315 | 13,211,024 |

| Total Liabilities | 14,229,040 | 13,180,303 |

| Total Equity* | 438,275 | 30,721 |

| Total Liabilities and Shareholders equity | 14,667,315 | 13,211,024 |

| | |

| Debt | | |

| Current and long term portion of loans from financial institutions** | 3,066,648 | 3,162,865 |

| Current and long term portion of obligations under capital leases | 901,546 | 1,088,239 |

| Total Financial Debt | 3,968,194 | 4,251,104 |

| Lease liabilities | 2,967,994 | 2,216,454 |

| Total Gross Debt | 6,936,188 | 6,467,558 |

| Cash, cash equivalents and liquid investments | (1,714,761) | (1,216,675) |

| Total Net Debt | 5,221,427 | 5,250,883 |

*Includes non-controlling interest.

**Excluding associated guarantees.

LATAM Airlines Group S.A.

Main Financial Ratios

| | | | | | | | |

| As of December 31, | As of December 31, |

| 2023 | 2022 |

| | |

| Cash, cash equivalents and liquid investments as % of LTM revenues | 14.5% | 12.8% |

| Liquidity* as % of LTM revenues | 23.9% | 24.3% |

| | |

| Gross Debt (US$ thousands) | 6,936,188 | 6,467,558 |

| Gross Debt / EBITDAR (LTM) | 2.8 | 5.1 |

| Gross Debt / Adjusted EBITDAR (LTM) | 2.7 | 4.9 |

| | |

| Net Debt (US$ thousands) | 5,221,427 | 5,250,883 |

| Net Debt / EBITDAR (LTM) | 2.1 | 4.2 |

| Net Debt / Adjusted EBITDAR (LTM) | 2.1 | 4.0 |

Note: Adjusted EBITDAR (LTM) refers to Adjusted EBITDAR (Last Twelve Months) (US$ thousands). For the ratios as of December 31, 2023, and December 31, 2022, it is calculated using the last months as of December 31, 2023 (US$2,533,274) and the full twelve months in 2022 (US$1,314,378).

*Includes "Cash and cash equivalents" and Revolving Credit Facilities fully undrawn (two RCFs of US$600 million and US$500 million with maturities in 2025 and 2026, respectively, as of December 31, 2023).

LATAM Airlines Group S.A.

Consolidated Fleet

| | | | | | | | | | | |

| As of December 31, 2023 |

| Aircraft on Property, Plant & Equipment | Aircraft on Right of Use under IFRS16 | Total |

| | | |

| Passenger Aircraft | | | |

| Boeing 767-300ER | 11 | — | 11 |

| Boeing 777-300ER | 4 | 6 | 10 |

| Boeing 787-8 | 4 | 6 | 10 |

| Boeing 787-9 | 2 | 24 | 26 |

| Airbus A319-100 | 39 | 1 | 40 |

| Airbus A320-200 | 90 | 46 | 136 |

| Airbus A320-Neo | 1 | 23 | 24 |

| Airbus A321-200 | 19 | 30 | 49 |

| Airbus A321-Neo | — | 7 | 7 |

| TOTAL | 170 | 143 | 313 |

| | | |

| Cargo Aircraft | | | |

| Boeing 767-300F | 19 | 1 | 20 |

| TOTAL | 19 | 1 | 20 |

| | | |

| TOTAL FLEET | 189 | 144 | 333 |

| | | |

Note: This table includes 3 Boeing 767-300F, 7 Airbus A320 and 28 Airbus A319 that were reclassified from Property, Plant and Equipment to Assets Held for Sale.

LATAM Airlines Group S.A.

Reconciliation of Reported Amounts to Non-GAAP Items (in thousands of US Dollars)

LATAM Airlines Group S.A. ("LATAM" or "the Company") prepares its financial statements under “International Financial Reporting Standards” (“IFRS”) as issued by the IASB, however, for ease of presentation and comparison, the Income Statement in this report is presented in an Adapted by Nature Format. On some occasions, adjustments to these Income Statement figures are made for Special Items. These adjustments to include or exclude special items allows management an additional tool to understand and analyze its core operating performance and allow for more meaningful comparison in the industry. Therefore, LATAM believes these non-GAAP financial measures, derived from the consolidated financial statements but not presented in accordance with IFRS, may provide useful information to investors and others. In this table, you can find a reconciliation of the IFRS and the Adapted by Nature Format as LATAM reports its Income Statement in this earnings release for ease of comparison and further disclosure, as well as the adjustments made for Special Items.

These non-GAAP items may not be comparable to similarly titled non-GAAP items of other companies and should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. The tables below show these reconciliations:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three month period ended December 31 | | For the twelve month period ended December 31 |

| 2023 | Adjustments | 2023 Adjusted | 2022 Adjusted | % Change | | 2023 | Adjustments | 2023 Adjusted | 2022 Adjusted | % Change |

| | | | | | | | | | | |

| Cost of sales | (2,429,757) | 22,544 | (2,407,213) | (2,124,204) | 13.3% | | (8,816,590) | 91,876 | (8,724,714) | (7,900,638) | 10.4% |

| (+) Distribution costs | (163,294) | | (163,294) | (113,977) | 43.3% | | (587,272) | | (587,272) | (426,599) | 37.7% |

| (+) Administrative expenses | (195,543) | 26,040 | (169,503) | (151,822) | 11.6% | | (683,311) | 66,817 | (616,494) | (523,129) | 17.8% |

| (+) Other expenses | (158,727) | | (158,727) | (134,519) | 18.0% | | (532,801) | | (532,801) | (531,575) | 0.2% |

| TOTAL OPERATING EXPENSES | (2,947,321) | 48,584 | (2,898,737) | (2,524,521) | 14.8% | | (10,619,974) | 158,693 | (10,461,281) | (9,381,940) | 11.5% |

| | | | | | | | | | | |

| Income/(Loss) from operation activities | 282,806 | 48,584 | 331,390 | 1,957,754 | (83.1%) | | 1,078,165 | 158,693 | 1,236,858 | 1,467,723 | (15.7%) |

| (-) Restructuring activities expenses | — | | — | (2,065,703) | n.m. | | — | | — | (1,679,934) | n.m. |

| (-) Other gains/(losses) | 21,068 | | 21,068 | 327,698 | -93.6% | | 91,043 | | 91,043 | 347,077 | -73.8% |

| ADJUSTED OPERATING INCOME/(LOSS) | 303,874 | 48,584 | 352,458 | 219,750 | 60.4% | | 1,169,208 | 158,693 | 1,327,901 | 134,867 | 884.6% |

| | | | | | | | | | | |

| (+) Restructuring activities expenses | — | | — | 2,065,703 | n.m. | | — | | — | 1,679,934 | n.m. |

| (+) Other gains/(losses) | (21,068) | | (21,068) | (327,698) | (93.6%) | | (91,043) | | (91,043) | (347,077) | -73.8% |

| (+) Foreign exchange gains/(losses) | (18,933) | | (18,933) | (23,361) | (19.0%) | | 85,891 | | 85,891 | 25,993 | 230.4% |

| (+) Result of indexation units | 163 | | 163 | 1,030 | -84.2% | | 5,311 | | 5,311 | (1,412) | -476.1% |

| Adjusted Other Income (Expense) | (39,838) | | (39,838) | 1,715,674 | (102.3%) | | 159 | | 159 | 1,357,439 | (100.0%) |

| | | | | | | | | | | |

| NET INCOME/(LOSS) | 83,658 | 48,584 | 132,242 | 2,619,172 | (95.0%) | | 581,550 | 158,693 | 740,243 | 1,593,282 | (53.5%) |

| (-) Income Taxes | 22,405 | | 22,405 | 97,098 | (76.9%) | | 14,942 | | 14,942 | 8,914 | 67.6% |

| (-) Interest Expense | 187,472 | | 187,472 | 236,952 | (20.9%) | | 698,231 | | 698,231 | 942,403 | (25.9%) |

| (-) Interest Income | (29,499) | | (29,499) | (1,017,799) | (97.1%) | | (125,356) | | (125,356) | (1,052,295) | (88.1%) |

| (-) Depreciation and Amortization | 322,953 | | 322,953 | 300,364 | 7.5% | | 1,205,373 | | 1,205,373 | 1,179,512 | 2.2% |

| (-) Adjusted Other Income (Expense) | 39,838 | | 39,838 | (1,715,674) | (102.3%) | | (159) | | (159) | (1,357,439) | (100.0%) |

| EBITDA | 626,827 | 48,584 | 675,411 | 520,113 | 29.9% | | 2,374,581 | 158,693 | 2,533,274 | 1,314,377 | 92.7% |

| | | | | | | | | | | |

| NET INCOME/(LOSS) | 83,658 | 48,584 | 132,242 | 2,619,172 | (95.0%) | | 581,550 | 158,693 | 740,243 | 1,593,282 | (53.5%) |

| (-) Income Taxes | 22,405 | — | 22,405 | 97,098 | (76.9%) | | 14,942 | — | 14,942 | 8,914 | 67.6% |

| (-) Interest Expense | 187,472 | — | 187,472 | 236,952 | (20.9%) | | 698,231 | — | 698,231 | 942,403 | (25.9%) |

| (-) Interest Income | (29,499) | — | (29,499) | (1,017,799) | -97.1% | | (125,356) | — | (125,356) | (1,052,295) | (88.1%) |

| (-) Depreciation and Amortization | 322,953 | — | 322,953 | 300,364 | 7.5% | | 1,205,373 | — | 1,205,373 | 1,179,512 | 2.2% |

| (-) Adjusted Other Income (Expense) | 39,838 | — | 39,838 | (1,715,674) | -102.3% | | (159) | — | (159) | (1,357,439) | (100.0%) |

| (-) Aircraft Rentals | 22,544 | | — | — | - | | 91,876 | | — | — | - |

| EBITDAR | 649,371 | 48,584 | 675,411 | 520,113 | 29.9% | | 2,466,457 | 158,693 | 2,533,274 | 1,314,377 | 92.7% |

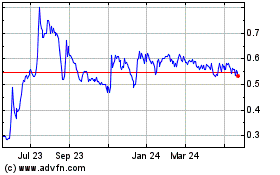

LATAM Airlines (PK) (USOTC:LTMAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

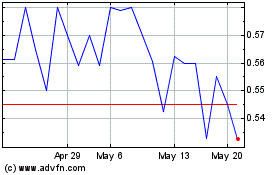

LATAM Airlines (PK) (USOTC:LTMAY)

Historical Stock Chart

From Apr 2023 to Apr 2024