Form SC 13D - General statement of acquisition of beneficial ownership

February 22 2024 - 4:16PM

Edgar (US Regulatory)

| SECURITIES AND EXCHANGE COMMISSION |

|

| Washington, D.C. 20549 |

|

| |

|

| SCHEDULE 13D |

| |

| Under the Securities Exchange Act of 1934 |

| (Amendment No. __)* |

| |

|

Trinity Place Holdings

Inc. |

| (Name of Issuer) |

| |

|

Common stock, par

value $0.01 per share |

| (Title of Class of Securities) |

| |

|

89656D101 |

| (CUSIP Number) |

| |

| Shulamit Leviant, Esq. |

| c/o Davidson Kempner Capital Management LP |

| 520 Madison Avenue, 30th Floor |

| New York, New York 10022 |

| (212) 446 4053 |

| |

| With a copy to: |

| |

|

Eleazer Klein, Esq.

Adriana Schwartz, Esq. |

| Schulte Roth & Zabel LLP |

| 919 Third Avenue |

| New York, NY 10022 |

|

(212) 756-2000 |

| (Name, Address and Telephone Number of Person |

| Authorized to Receive Notices and Communications) |

| |

|

February 14, 2024 |

| (Date of Event Which Requires Filing of This Statement) |

| |

If the filing person has previously filed a statement on Schedule 13G to

report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or

Rule 13d-1(g), check the following box. ¨

(Page 1 of 13 Pages)

______________________________

* The remainder of this cover page shall be filled out for a reporting

person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not

be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 89656D101 | SCHEDULE 13D | Page 2 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

TPHS Lender LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF; OO (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

25,862,245 |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

25,862,245 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

25,862,245 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

40.6% |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

|

| CUSIP No. 89656D101 | SCHEDULE 13D | Page 3 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

Davidson Kempner Capital Management LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF; OO (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

25,862,245 |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

25,862,245 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

25,862,245 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

40.6% |

| 14 |

TYPE OF REPORTING PERSON

PN |

| |

|

|

|

|

| CUSIP No. 89656D101 | SCHEDULE 13D | Page 4 of 13 Pages |

| 1 |

NAME OF REPORTING PERSON

Anthony A. Yoseloff |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF; OO (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

25,862,245 |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

25,862,245 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

25,862,245 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

40.6% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

| CUSIP No. 89656D101 | SCHEDULE 13D | Page 5 of 13 Pages |

| Item 1. |

SECURITY AND ISSUER |

| |

|

| |

This statement on Schedule 13D (the "Schedule 13D") relates to the shares of common stock, par value $0.01 per share (the "Common Stock") of Trinity Place Holdings Inc., a Delaware corporation ("Issuer"). The Issuer's principal executive offices are located at 340 Madison Avenue, New York, NY 10173. |

| Item 2. |

IDENTITY AND BACKGROUND |

| |

|

| (a) |

This Statement is filed by each of the entities and persons listed below, all of whom together are referred to herein as the "Reporting Persons": |

| |

|

| |

(i) |

TPHS Lender LLC, a Delaware limited liability company ("TPHS Lender"). DKCM (as defined below) is the investment manager of the ultimate members of TPHS Lender. DKCM is responsible for the voting and investment decisions of TPHS Lender; |

| |

|

|

| |

(ii) |

Davidson Kempner Capital Management LP, a Delaware limited partnership and a registered investment adviser with the U.S. Securities and Exchange Commission (the “SEC”), acts as investment manager ("DKCM") to TPHS Lender. DKCM GP LLC, a Delaware limited liability company, is the general partner of DKCM. The managing members of DKCM are Anthony A. Yoseloff, Conor Bastable, Shulamit Leviant, Morgan P. Blackwell, Patrick W. Dennis, Gabriel T. Schwartz, Zachary Z. Altschuler, Joshua D. Morris and Suzanne K. Gibbons (collectively, the "DKCM Managing Members"); and |

| |

|

|

| |

(iii) |

Mr. Anthony A. Yoseloff, through DKCM, is responsible for the voting and investment decisions relating to the securities held by TPHS Lender reported herein. |

| |

|

|

| |

Any disclosures herein with respect to persons other than the Reporting Persons are made on information and belief after making inquiry to the appropriate party. |

| |

|

| |

The filing of this statement should not be construed in and of itself as an admission by any Reporting Person as to beneficial ownership of the securities reported herein. |

| |

|

| (b) |

The address of the principal business office of each of the Reporting Persons is c/o Davidson Kempner Capital Management LP, 520 Madison Avenue, 30th Floor, New York, New York 10022. |

| |

|

| (c) |

The principal business of TPHS Lender is to act as a lender and invest in securities. The principal business of DKCM is the management of the affairs of TPHS Lender and investment funds. The principal business of Mr. Anthony A. Yoseloff is to invest for funds and accounts under his management. |

| CUSIP No. 89656D101 | SCHEDULE 13D | Page 6 of 13 Pages |

| |

|

| (d) |

None of the Reporting Persons has, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors). |

| |

|

| (e) |

None of the Reporting Persons has, during the last five years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and, as a result of such proceeding, was, or is subject to, a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, Federal or State securities laws or finding any violation with respect to such laws. |

| |

|

| |

Schedule A attached hereto sets forth the information required by Instruction C of the instructions to Schedule 13D. |

| |

|

| (f) |

(i) |

TPHS Lender – a Delaware limited liability company |

| |

|

|

| |

(ii) |

DKCM – a Delaware limited partnership |

| |

|

|

| |

(iii) |

Anthony A. Yoseloff – United States |

| Item 3. |

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION |

| |

|

| |

Funds for the

purchase of 25,112,245 of the shares of Common Stock reported herein were derived from the general working capital of the ultimate

members of TPHS Lender. A total of approximately $7,533,674 was paid to acquire such shares of Common Stock reported herein. The

other 750,000 shares of Common Stock reported herein were acquired by the Reporting Persons in connection with the CCF Amendment and

in exchange for warrants to purchase 750,000 shares of Common Stock, as defined and as described in the Issuer’s Current

Report on Form 8-K filed with the SEC on June 15, 2023. |

| Item 4. |

PURPOSE OF TRANSACTION |

| |

|

| |

Stock Purchase Agreement |

| |

|

| |

The Issuer entered into a Stock Purchase Agreement, dated as of January 5, 2024 (the “Effective Date”), as amended on January 30, 2024 (collectively, the “Stock Purchase Agreement”), with TPHS Lender and TPHS Investor LLC, an affiliate of TPHS Lender (the “JV Investor”, and together with the TPHS Lender, the “Investor”), pursuant to which TPHS Lender acquired 25,112,245 shares of Common Stock (the “Investor Shares”) on February 14, 2024 (the “Closing”) in accordance with the terms and conditions of the Stock Purchase Agreement. |

| CUSIP No. 89656D101 | SCHEDULE 13D | Page 7 of 13 Pages |

| |

|

| |

At the Closing, the Issuer and the JV Investor entered into an amended and restated limited liability company operating agreement of TPH Greenwich Holdings LLC (the “JV” and the “JV Operating Agreement”, respectively), pursuant to which the JV Investor was appointed the initial manager of, and acquired a five percent (5%) interest in, the JV, which the JV will continue to own, indirectly, all of the real property assets and liabilities of the Issuer upon the consummation of the transactions contemplated by the Stock Purchase Agreement and the JV Operating Agreement, and hire a newly formed subsidiary of the Issuer to act as asset manager for the JV for an annual management fee. |

| |

|

| |

Pursuant to the Stock Purchase Agreement, at the Closing, the Issuer issued and sold to the Investor the Investor Shares for a purchase price of $0.30 per share (the “Purchase Price”). The Purchase Price was deposited into a bank account of the Issuer (the “Purchase Price Reserve Account”) controlled by the Investor and to be used as set forth in the Stock Purchase Agreement. At the Closing, the Investor paid from the Purchase Price Reserve Account, on behalf of the Issuer, certain outstanding transaction expenses of the Issuer’s advisors (approximately $3.0 million in the aggregate). Following the Closing, the permitted uses for the funds in the Purchase Price Reserve Account include (i) payment of the transactions expenses described below, (ii) payment of any operating costs less than $25,000 individually, or $75,000 in the aggregate, or (iii) any other payments with the Investor’s prior written consent; provided that until the occurrence of a dissolution event of the Issuer, $200,000 will be available to the Issuer to fulfill its indemnification obligations to current and/or former directors and officers. |

| |

|

| |

Certain provisions of the Stock Purchase Agreement require the reconstitution, and reduction in size of the board of directors to five persons, in accordance with the terms of the Stock Purchase Agreement. In connection with such reduction in size, the Investor has the right to appoint two directors and, together with the Issuer, to agree on the appointment of one independent director. |

| |

|

| |

The Stock Purchase Agreement also contemplates the Issuer pursuing the delisting of its publicly-traded shares of Common Stock from the NYSE American LLC, and subsequent to such delisting, deregistration from the reporting obligations under Sections 12 and 15 of the Act. |

| |

|

| |

The foregoing descriptions of the Stock

Purchase Agreement and the JV Operating Agreement do not purport to be complete and are qualified in their entireties by reference

to the full texts of the Stock Purchase Agreement and the JV Operating Agreement. For further information regarding the Stock

Purchase Agreement and the JV Operating Agreement, reference is made to the full texts of the Stock Purchase Agreement, and the JV

Operating Agreement, which have been filed as Exhibit 99.1 and Exhibit 99.2 hereto, respectively, and incorporated by

reference herein. |

| CUSIP No. 89656D101 | SCHEDULE 13D | Page 8 of 13 Pages |

| |

Amended and Restated Credit Agreement |

| |

|

| |

Concurrently with the Closing, under the Stock Purchase Agreement, the Issuer assigned all of its rights and obligations as borrower under the Credit Agreement, dated as of December 19, 2019, as amended (the “Amended and Restated Credit Agreement”), originally entered into by the Issuer, as borrower, and TPHS Lender, as lender, to the JV. Simultaneously with such assignment, such corporate credit facility was amended and restated in its entirety. |

| |

|

| |

The foregoing description of the Amended

and Restated Credit Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the

Amended and Restated Credit Agreement. For further information regarding the Credit Agreement, reference is made to the full text of

the Amended and Restated Credit Agreement, which has been filed as Exhibit 99.3 hereto and incorporated by reference

herein. |

| |

|

| |

Registration Rights Agreement |

| |

|

| |

Pursuant to a Registration Rights

Agreement dated February 16, 2024 (the “Registration Rights Agreement”), as between the Issuer and TPHS Lender,

TPHS Lender has been granted registration rights with respect to the Investor Shares. |

| |

|

| |

The foregoing description of the

Registration Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the

Registration Rights Agreement. For further information regarding the Registration Rights Agreement, reference is made to the full

text of the Registration Rights Agreement, which has been filed as Exhibit 99.4 hereto and incorporated by reference

herein. |

| |

Letter Agreement |

| |

|

| |

The Issuer and TPHS Lender entered into a letter agreement, dated as of December 19, 2019 (the “December 19, 2019 Letter Agreement”), pursuant to which, among other things, the Issuer granted to TPHS Lender the right to appoint either (i) a member of the Issuer’s and, if applicable, its subsidiaries’ board of directors, or (ii) a board observer for such board of directors and/or applicable subsidiaries. TPHS Lender opted to appoint an employee of DKCM as a board observer. Such board observer continues in such role after the Closing. |

| |

|

| |

The foregoing description of the December 19, 2019 Letter Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the December 19, 2019 Letter Agreement. For further information regarding the December 19, 2019 Letter Agreement, reference is made to the full text of the December 19, 2019 Letter Agreement, which has been filed as Exhibit 99.5 hereto and incorporated by reference herein. |

| CUSIP No. 89656D101 | SCHEDULE 13D | Page 9 of 13 Pages |

| |

Other Matters |

| |

|

| |

The Reporting Persons intend to review their investment in the Issuer on a continuing basis and expect to engage in discussions with the Issuer's management, the Board, other holders of shares of Common Stock, financing sources, and other relevant parties, including other industry participants (including companies in which the Reporting Persons may have an investment) concerning the business, operations, governance, strategy, capitalization, ownership and future plans of the Issuer and the management and Board composition or commercial or strategic transactions with, or relating, to the Issuer. The Reporting Persons may change their plans or proposals in the future. Depending on various factors including, without limitation, the Issuer's financial position, strategic direction, business and prospects, anticipated future developments, existing and anticipated market conditions from time to time, actions taken by the Issuer's management and Board, price levels of the shares of Common Stock, general economic conditions and regulatory matters, the Reporting Persons may in the future take such actions with respect to their investment in the Issuer as they deem appropriate including, without limitation, purchasing additional shares of Common Stock or other securities of the Issuer (which may include rights or securities exercisable or convertible into securities of the Issuer), selling or otherwise disposing (which may include, but is not limited to, transferring some or all of such securities to its affiliates or distributing some or all of such securities to such Reporting Person's respective partners, members or beneficiaries, as applicable) some or all of their shares of Common Stock or engaging in short selling of or any hedging or similar transaction with respect to the Common Stock, in each case, in open market or private transactions, block sales or otherwise to the extent permitted under applicable law, or engage, discuss, participate in, negotiate, or approve a transaction (including commercial or strategic transactions with, or relating to, the Issuer) with the purpose or effect of changing or influencing the control of the Issuer, including by entering into one or more confidentiality agreements, standstill agreements, voting or support agreements, or other similar agreements with the purpose or effect of facilitating such a transaction. Any such transactions, if they occur at all, may take place at any time and without prior notice. Except for the foregoing, the Reporting Persons do not have, as of the date of this filing, any plans or proposals that relate to or would result in any of the actions or events specified in clauses (a) through (j) of Item 4 of Schedule 13D; provided, that the Reporting Persons at any time and from time to time, may review or reconsider and change their position and/or change their purpose and/or develop such plans and may seek to influence Issuer's management or Board with respect to the business and affairs of the Issuer, and may from time to time consider pursuing or proposing any such transactions with advisors, the Issuer or other persons. |

| |

|

| Item 5. |

INTEREST IN SECURITIES OF THE ISSUER |

| |

|

| (a) |

See rows (11) and (13) of the cover pages to

this Schedule 13D for the aggregate number of shares of Common Stock and percentages of the shares of Common Stock beneficially

owned by each of the Reporting Persons. The percentages used in this Schedule 13D are calculated based upon an aggregate of

63,674,891 shares of Common Stock reported to be outstanding, which is the sum of the (i) 38,562,646 shares of Common Stock

outstanding as of January 5, 2024, as disclosed in the Stock Purchase Agreement; and (ii) 25,112,245 shares of Common Stock issued

by the Issuer to TPHS Lender on February 14, 2024, as reported in Issuer's Current Report on Form 8-K filed with the SEC on February

20, 2024. |

| |

|

| (b) |

See rows (7) through (10) of the cover pages to this Schedule 13D for the number of shares of Common Stock as to which each Reporting Person has the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition. |

| |

|

| (c) |

Other than as described in Item 4, no transactions in the shares of Common Stock were effected by the Reporting Persons during the past sixty (60) days. |

| |

|

| |

|

|

| CUSIP No. 89656D101 | SCHEDULE 13D | Page 10 of 13 Pages |

| |

|

|

| (d) |

No person other than the Reporting Persons is known to have the right to receive, or the power to direct the receipt of dividends from, or proceeds from the sale of, such shares of Common Stock. |

| |

|

| (e) |

Not applicable. |

| |

|

| Item 6. |

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER |

| |

|

| |

The information set forth in Item 4 is incorporated herein by reference. |

| |

|

| |

Other than as described in this Schedule 13D and the Joint Filing Agreement attached as Exhibit 99.6 hereto, there are no contracts, arrangements, understandings or similar relationships with respect to the securities of the Issuer between any of the Reporting Persons or Instruction C Persons and any other person or entity. |

| CUSIP No. 89656D101 | SCHEDULE 13D | Page 11 of 13 Pages |

| Item 7. |

MATERIAL TO BE FILED AS EXHIBITS |

| |

|

| Exhibit 99.1 |

Stock Purchase Agreement, dated as of January 5, 2024 (incorporated by reference to Exhibit 10.1 of the Issuer's Current Report on Form 8-K filed with the SEC on January 10, 2024). |

| |

|

| Exhibit 99.2 |

JV Operating Agreement, dated as of February 14, 2024

(incorporated by reference to Exhibit A of Exhibit 10.1 of the Issuer’s Current Report on Form 8-K filed with the

SEC on January 10, 2024). |

| |

|

| Exhibit 99.3 |

Amended and Restated Credit Agreement, dated as of February 14, 2024 (incorporated by reference to Exhibit C of Exhibit 10.1 of the Issuer's Current Report on Form 8-K filed with the SEC on January 10, 2024). |

| |

|

| Exhibit 99.4 |

Registration Rights Agreement, dated as of February 14,

2024 (incorporated by reference to Exhibit D of Exhibit 10.1 of the Issuer's Current Report on Form 8-K filed with the SEC on

January 10, 2024). |

| |

|

| Exhibit 99.5 |

Letter Agreement, dated as of December 19, 2019 (incorporated by reference to Exhibit 10.4 of the Issuer's Current Report on Form 8-K filed with the SEC on December 20, 2019). |

| |

|

| Exhibit 99.6 |

Joint Filing Agreement Statement as required by Rule 13d-1(k)(1) under the Act. |

| |

|

| CUSIP No. 89656D101 | SCHEDULE 13D | Page 12 of 13 Pages |

SIGNATURES

After reasonable inquiry and to the best of his

or its knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and

correct.

| DATE: February 22, 2024 |

/s/ Anthony A. Yoseloff |

| |

ANTHONY A. YOSELOFF, (i)

individually, (ii) as Executive Managing Member of: (a) Davidson Kempner Capital Management LP and (b) Midtown

Acquisitions, GP LLC, as Manager of TPHS Lender LLC. |

| CUSIP No. 89656D101 | SCHEDULE 13D | Page 13 of 13 Pages |

SCHEDULE A

GENERAL PARTNERS, CONTROL PERSONS, DIRECTORS AND EXECUTIVE

OFFICERS OF CERTAIN REPORTING PERSONS

The following sets forth the

name, position, address, principal occupation and citizenship of each general partner, control person, director and/or executive officer

of the applicable Reporting Persons (the "Instruction C Persons"). To the best of the Reporting Persons' knowledge, (i)

none of the Instruction C Persons during the last five years has been convicted in a criminal proceeding (excluding traffic violations

or other similar misdemeanors) or been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and

as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or

mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws and (ii) none of

the Instruction C Persons owns any shares of Common Stock or is party to any contract or agreement as would require disclosure in this

Schedule 13D, except to the extent such Instruction C Person is a Reporting Person in which case such Instruction C Person's beneficial

ownership is as set forth in Item 5 of the Schedule 13D.

REPORTING PERSON: TPHS LENDER

LLC ("TPHS LENDER")

Midtown Acquisitions GP LLC (“Midtown GP”)

serves as the manager of TPHS Lender. Its business address is c/o Davidson Kempner Capital Management LP, 520 Madison Avenue, 30th Floor,

New York, New York 10022. Its principal occupation is serving as the manager of TPHS Lender. Midtown GP is a Delaware limited liability

company.

Anthony A. Yoseloff serves as the Executive Managing

Member of Midtown GP. Gabriel T. Schwartz and Patrick W. Dennis are Co-Deputy Executive Managing Members of Midtown GP. Joshua D. Morris,

Morgan P. Blackwell, Conor Bastable and Suzanne K. Gibbons serve as Managers of Midtown GP. The business address of each of the foregoing

persons is c/o Davidson Kempner Capital Management LP, 520 Madison Avenue, 30th Floor, New York, New York 10022. The other information

with respect to the DKCM Managing Members required by Instruction C of the instructions to Schedule 13D is set forth below.

REPORTING PERSON: DAVIDSON KEMPNER CAPITAL MANAGEMENT LP ("DKCM")

DKCM GP LLC ("DKCM GP") serves as the general partner

of DKCM. Its business address is c/o Davidson Kempner Capital Management LP, 520 Madison Avenue, 30th Floor, New York, New York 10022.

Its principal occupation is serving as the general partner of DKCM. DKCM GP is a Delaware limited liability company.

The DKCM Managing Members serve as the managing members

of DKCM. The business address of each DKCM Managing Member is c/o Davidson Kempner Capital Management LP, 520 Madison Avenue, 30th Floor,

New York, New York 10022. The principal occupation of each DKCM Managing Member is to invest for funds and accounts under their management.

Each DKCM Managing Member is a United States citizen.

EXHIBIT 99.6

JOINT FILING AGREEMENT

PURSUANT TO RULE 13d-1(k)

The undersigned acknowledge

and agree that the foregoing statement on Schedule 13D is filed on behalf of each of the undersigned and that all subsequent amendments

to this statement on Schedule 13D shall be filed on behalf of each of the undersigned without the necessity of filing additional joint

filing agreements. The undersigned acknowledge that each shall be responsible for the timely filing of such amendments, and for the completeness

and accuracy of the information concerning him or it contained herein and therein, but shall not be responsible for the completeness and

accuracy of the information concerning the others, except to the extent that he or it knows or has reason to believe that such information

is inaccurate.

| DATE: February 22, 2024 |

/s/ Anthony A. Yoseloff |

| |

ANTHONY A. YOSELOFF, (i)

individually, (ii) as Executive Managing Member of: (a) Davidson Kempner Capital Management LP and (b) Midtown

Acquisitions GP LLC, as Manager of TPHS Lender LLC. |

| |

|

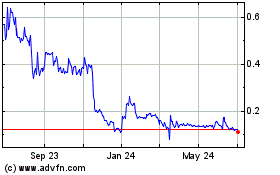

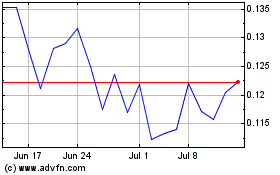

Trinity Place (AMEX:TPHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trinity Place (AMEX:TPHS)

Historical Stock Chart

From Apr 2023 to Apr 2024