0000948708FALSE00009487082024-02-222024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 22, 2024

Smith Micro Software, Inc.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | 001-35525 | 33-0029027 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

5800 Corporate Drive Pittsburgh, PA | 15237 |

(Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (412) 837-5300

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | SMSI | | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02Results of Operations and Financial Condition

On February 22, 2024, Smith Micro Software, Inc. issued a press release announcing its financial results for the three and twelve months ended December 31, 2023. A copy of the press release is hereby furnished to the Securities and Exchange Commission as Exhibit 99.1 and incorporated by reference herein.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section and will not be incorporated by reference into any filing under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 7.01Regulation FD

The information set forth under Item 2.02 is incorporated into this Item 7.01 by reference.

Item 8.01Other Events

On February 22, 2024, the Company filed a preliminary proxy statement with the Securities and Exchange Commission (the “SEC”) regarding a special stockholders’ meeting currently expected to be held on April 1, 2024 (the “Special Meeting”) to authorize the Company’s Board of Directors (the “Board”) to effect a reverse stock split of the Company’s common stock at an exchange ratio between 1-for-4 to 1-for-10 (the “Reverse Stock Split”).

The primary goal of the Reverse Stock Split is to increase the per share market price of our common stock to meet the minimum per share bid price requirements for continued listing on the Nasdaq Capital Market and to provide additional flexibility with respect to capital raising efforts and general corporate needs. The Board will determine the final split ratio after stockholder approval, based on a number of factors, and would retain the authority to abandon the Reverse Stock Split at any time or to delay or postpone it. The Board believes that the adopted range of Reverse Stock Split ratios provides the Company with the most flexibility to achieve the desired results of the Reverse Stock Split as further described in the preliminary proxy statement. The Board has determined that the Reverse Stock Split is in the best interests of the Company and its stockholders and is therefore seeking approval of the Reverse Stock Split from its stockholders at the Special Meeting.

Completion of the proposed Reverse Stock Split is subject to customary conditions, including obtaining stockholder approval at the Special Meeting. There are no assurances that the Reverse Stock Split will be completed, that it will result in an increased per share price over an extended period of time, or otherwise achieve its other intended effects. The Board reserves the right to elect not to proceed with the Reverse Stock Split if it determines that implementing it is no longer in the best interests of the Company and its stockholders.

Forward-Looking Statements

Certain statements in this Form 8-K are forward-looking statements regarding future events or results within the meaning of the Private Securities Litigation Reform Act, including statements related to the effects of our proposed Reverse Stock Split, including complying with the listing standards of the Nasdaq Capital Market, and other statements using such words as “expect,” “anticipate,” “believe,” “plan,” “intend,” “could,” “will” and other similar expressions. Forward-looking statements involve risks and uncertainties, which could cause actual results to differ materially from those expressed or implied in the forward-looking statements. Important factors that could cause or contribute to such differences are discussed in our filings with the Securities and Exchange Commission, including our filings on Forms 10-K and 10-Q. The forward-looking statements contained in this 8-K are made on the basis of the views and assumptions of management, and we do not undertake any obligation to update these statements to reflect events or circumstances occurring after the date of this 8-K.

Important Additional Information And Where to Find It

In connection with a Special Meeting currently scheduled for April 1, 2024, to approve the Reverse Stock Split, the Company has filed a preliminary proxy statement with the SEC and intends to file a definitive proxy statement with the SEC that will be mailed to its stockholders. This communication is not a substitute for any proxy statement or other document that the Company may file with the SEC in connection with the Special Meeting. INVESTORS AND STOCKHOLDERS OF THE COMPANY ARE URGED TO READ THE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE SPECIAL MEETING CAREFULLY AND IN THEIR ENTIRETY BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED REVERSE STOCK SPLIT AND THE RISKS ASSOCIATED WITH THE REVERSE STOCK SPLIT. Investors and stockholders will be able to obtain, without charge,

a copy of the proxy statement and other relevant documents filed with the SEC (as and when available) from the SEC’s website at www.sec.gov and on the Company’s investor relations website at http://www.smithmicro.com.

Notice

This communication is neither a solicitation of a proxy or consent nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, the Company, its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies with respect to a solicitation by the Company. Information regarding the Company’s directors and executive officers is contained in the Company’s definitive proxy statement in connection with its annual meeting of stockholders held in 2023, which was filed with the SEC on April 27, 2023. You may obtain these documents without charge from the SEC’s website at www.sec.gov and on the Company’s investor relations website at http://www.smithmicro.com.

Item 9.01.Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit | Description |

| 99.1 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| Smith Micro Software, Inc. |

| | |

Date: February 22, 2024 | By: | /s/ James M. Kempton |

| | James M. Kempton |

| | Vice President and Chief Financial Officer |

Exhibit 99.1

IR INQUIRIES:

Charles Messman

Investor Relations

949-362-5800

IR@smithmicro.com

Smith Micro Reports Fourth Quarter and Fiscal Year 2023 Financial Results

PITTSBURGH, PA, February 22, 2024 – Smith Micro Software, Inc. (Nasdaq: SMSI) (“Smith Micro” or the “Company”) today reported financial results for its fourth quarter and fiscal year ended December 31, 2023.

“Looking back at 2023, we faced some challenges and implemented decisive changes to build a new path forward for the Company,” said William W. Smith, Jr., president, chief executive officer, and chairman of the board of Smith Micro. “I believe we are well positioned to capitalize on what is happening in the Family Safety market today, as we see both governmental and societal pressures creating significant momentum in the market and driving the need for technology solutions aimed at providing for our loved ones’ digital and physical safety.”

“I am extremely excited with the further development and current and future expansion of our product suite to deliver meaningful, innovative enhancements in our SafePath® platform, including SafePath Global™, SafePath OS™, and SafePath Premium™.” Smith continued, “Our core vision continues to be the creation of a safe digital experience for families, while allowing operators around the world to add new lines to family accounts, enabling them to build closer and more valuable relationships with their subscribers.”

Fourth Quarter 2023 Financial Results

Smith Micro reported revenue of $8.6 million for the quarter ended December 31, 2023, compared to $11.4 million reported in the quarter ended December 31, 2022.

Gross profit for the quarter ended December 31, 2023 was $6.4 million, compared to $8.1 million for the quarter ended December 31, 2022.

Gross profit as a percentage of revenue was 74.9 percent for the quarter ended December 31, 2023, compared to 70.8 percent for the quarter ended December 31, 2022.

GAAP net loss for the quarter ended December 31, 2023 was $6.7 million, or $0.09 loss per share, compared to GAAP net loss of $8.0 million, or $0.14 loss per share, for the quarter ended December 31, 2022.

Non-GAAP net loss for the quarter ended December 31, 2023 was $1.7 million, or $0.02 income per share, compared to non-GAAP net loss of $4.0 million, or $0.07 loss per share, for the quarter ended December 31, 2022. Non-GAAP net income and net loss excludes the items noted below under "Non-GAAP Measures."

| | | | | |

Smith Micro Software Fourth Quarter and Fiscal 2023 Financial Results | Page 2 |

Fiscal Year 2023 Financial Results

Smith Micro reported revenue of $40.9 million for the twelve months ended December 31, 2023, compared to $48.5 million reported in the twelve months ended December 31, 2022.

Gross profit for the twelve months ended December 31, 2023 was $30.3 million compared to $34.3 million reported for the same period in 2022.

Gross profit as a percentage of revenue was 74.2 percent for the twelve months ended December 31, 2023 compared to 70.7 percent for the twelve months ended December 31, 2022.

GAAP net loss for the twelve months ended December 31, 2023 was $24.4 million, or $0.38 loss per share, compared to GAAP net loss of $29.3 million, or $0.53 loss per share, for the twelve months ended December 31, 2022.

Non-GAAP net loss for the twelve months ended December 31, 2023 was $5.3 million, or $0.08 loss per share, compared to non-GAAP net loss of $17.6 million, or $0.32 loss per share, for the twelve months ended December 31, 2022. Non-GAAP net loss excludes the items noted below under "Non-GAAP Measures."

Total cash and cash equivalents as of December 31, 2023 were $7.1 million.

Non-GAAP Measures

To supplement our financial information presented in accordance with GAAP, the Company considers, and has included in this press release, the following non-GAAP financial measures and a non-GAAP reconciliation from the equivalent GAAP metric: non-GAAP net (loss) income, non-GAAP gross profit, and non-GAAP basic and diluted (loss) earnings per share in the presentation of financial results in this press release. Management believes this non-GAAP presentation may be more meaningful in analyzing the Company's income generation and has therefore excluded the following items from GAAP earnings calculations: stock compensation, intangibles amortization, depreciation, fair value adjustments, amortization of debt issuance costs and discount, and personnel severance and reorganization activities. Additionally, since the Company currently has federal and state net operating loss carryforwards that can be utilized to reduce future cash payments for income taxes, these non-GAAP adjustments have not been tax effected, and the resulting income tax expense reflects actual taxes paid or accrued during each period. This presentation may be considered more indicative of the Company's ongoing operational performance. The table below presents the differences between non-GAAP net loss and net loss on an absolute and per-share basis. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP, and the non-GAAP financial measures as reported by Smith Micro may not be comparable to similarly titled amounts reported by other companies.

Investor Conference Call

Smith Micro will hold an investor conference call today, February 22, 2024, at 4:30 p.m. ET, to discuss the Company’s fourth quarter and fiscal 2023 financial results. To access the call, dial 1-844-701-1164; international participants can call 1-412-317-5492. A passcode is not required to join the call; ask the operator to be placed into the Smith Micro conference. Participants are asked to call the assigned number approximately 10 minutes before the conference call begins. An internet webcast is available at https://event.choruscall.com/mediaframe/webcast.html?webcastid=CqKkUrce. In addition, the conference call will be available on the Smith Micro website in the Investor Relations section.

| | | | | |

Smith Micro Software Fourth Quarter and Fiscal 2023 Financial Results | Page 3 |

About Smith Micro Software, Inc.

Smith Micro develops software to simplify and enhance the mobile experience, providing solutions to some of the leading wireless service providers around the world. From enabling the family digital lifestyle to providing powerful voice messaging capabilities, our solutions enrich today’s connected lifestyles while creating new opportunities to engage consumers via smartphones and consumer IoT devices. The Smith Micro portfolio also includes a wide range of products for creating, sharing, and monetizing rich content, such as visual voice messaging, optimizing retail content display and performing analytics on any product set. For more information, visit www.smithmicro.com.

Smith Micro, the Smith Micro logo and SafePath are registered trademarks or trademarks of Smith Micro Software, Inc. All other trademarks and product names are the property of their respective owners.

Forward-Looking Statements

Certain statements in this press release are, and certain statements on the related conference call may be, forward-looking statements regarding future events or results within the meaning of the Private Securities Litigation Reform Act, including statements related to our financial prospects, goals and other projections of our outlook or performance and our future business plans, and statements using such words as “expect,” “anticipate,” “believe,” “plan,” “intend,” “could,” “will” and other similar expressions. Forward-looking statements involve risks and uncertainties, which could cause actual results to differ materially from those expressed or implied in the forward-looking statements. Among the important factors that could cause or contribute to such differences are customer concentration, given that the majority of our sales depend on a few large customer relationships and the loss of any of them could materially and negatively affect our business, delay or failure of our customers to accept and deploy our products and services or new or upgraded versions thereof, delay or failure of our customers’ end users to adopt our products and services or new or upgraded versions thereof, our reliance on third party operating systems for the proper operation and delivery of our solutions and any barriers to our use of such third party technology, our reliance on third party application stores for the distribution of our software applications to users and any barriers to such distribution, including any delay or failure of such third party to approve new versions of our applications or their implementation and/or application of policies that may be harmful to our business, unanticipated delays or obstacles in our development and release cycles, the degree to which competing business needs may affect our allocation of resources to planned projects, the risk of harm to our business resulting from our recent and any future cost reduction efforts, our ability to attract and retain key technical personnel that are essential to our product development and support efforts, changes in demand for our products from our customers and their end users, changes in requirements for our products imposed by our customers or by the third party providers of software and/or platforms that we use, our ability to effectively integrate, market and sell acquired product lines, new and changing technologies and customer acceptance and timing of deployment of those technologies, and our ability to compete effectively with other software and technology companies. These and other factors discussed in our filings with the Securities and Exchange Commission, including our filings on Forms 10-K and 10-Q, could cause actual results to differ materially from those expressed or implied in any forward-looking statements. The forward-looking statements contained in this release are made on the basis of the views and assumptions of management, and we do not undertake any obligation to update these statements to reflect events or circumstances occurring after the date of this release.

| | | | | |

Smith Micro Software Fourth Quarter and Fiscal 2023 Financial Results | Page 4 |

| | | | | | | | | | | |

| Smith Micro Software, Inc. | | | |

| Consolidated Balance Sheets | | | |

| (in thousands except share and par value data) | | | |

| | | | |

| | December 31,

2023 | | December 31,

2022 |

| | (unaudited) | | (audited) |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 7,125 | | | $ | 14,026 | |

| Accounts receivable, net of related allowances of $3 and $3 at December 31, 2023 and 2022, respectively | 7,912 | | | 10,501 | |

| Prepaid expenses and other current assets | 1,843 | | | 1,983 | |

| Total current assets | 16,880 | | | 26,510 | |

| Equipment and improvements, net | 883 | | | 1,498 | |

| Right-of-use assets | 2,759 | | | 3,722 | |

| Other assets | 482 | | | 490 | |

| Intangible assets, net | 29,532 | | | 36,320 | |

| Goodwill | 35,041 | | | 35,041 | |

| Total assets | $ | 85,577 | | | $ | 103,581 | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 2,522 | | | $ | 3,236 | |

| Accrued payroll and benefits | 2,500 | | | 3,883 | |

| Current operating lease liabilities | 1,483 | | | 1,441 | |

| Other current liabilities | 1,137 | | | 1,589 | |

| Current portion of convertible notes payable | — | | | 9,007 | |

| Derivative liabilities | — | | | 1,575 | |

| Total current liabilities | 7,642 | | | 20,731 | |

| Non-current liabilities: | | | |

| | | |

| Warrant liabilities | 597 | | | 3,317 | |

| Operating lease liabilities | 1,780 | | | 2,976 | |

| | | |

| Deferred tax liabilities, net | 168 | | | 178 | |

| Total non-current liabilities | 2,545 | | | 6,471 | |

| Commitments and contingencies | | | |

| Stockholders' equity: | | | |

Common stock, par value $0.001 per share; 100,000,000 shares authorized; 74,783,834 and 56,197,910 shares issued and outstanding (2023 and 2022, respectively) | 75 | | | 56 | |

| Additional paid-in capital | 381,263 | | | 357,875 | |

| Accumulated comprehensive deficit | (305,948) | | | (281,552) | |

| Total stockholders’ equity | 75,390 | | | 76,379 | |

| Total liabilities and stockholders' equity | $ | 85,577 | | | $ | 103,581 | |

| | | | | |

Smith Micro Software Fourth Quarter and Fiscal 2023 Financial Results | Page 5 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Smith Micro Software, Inc. | | | | | | | |

| Consolidated Statement of Operations | | | | | | | |

| (in thousands except share data) | | | | | | | |

| For the Three Months Ended

December 31, | | For the Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (unaudited) | | (unaudited) | | (unaudited) | | (audited) |

| Revenues | $ | 8,593 | | | $ | 11,405 | | | $ | 40,862 | | | $ | 48,513 | |

Cost of revenues (including depreciation of $11, $20, $50, and $105 in the three and twelve months ended December 31, 2023 and 2022, respectively) | 2,159 | | | 3,328 | | | 10,559 | | | 14,210 | |

| Gross profit | 6,434 | | | 8,077 | | | 30,303 | | | 34,303 | |

| Operating expenses: | | | | | | | |

| Selling and marketing | 2,458 | | | 3,196 | | | 11,089 | | | 12,883 | |

| Research and development | 3,868 | | | 6,632 | | | 17,145 | | | 29,388 | |

| General and administrative | 3,331 | | | 3,623 | | | 12,779 | | | 15,507 | |

| | | | | | | |

| Depreciation and amortization | 2,473 | | | 1,786 | | | 7,345 | | | 7,452 | |

| Total operating expenses | 12,130 | | | 15,237 | | | 48,358 | | | 65,230 | |

| Operating loss | (5,696) | | | (7,160) | | | (18,055) | | | (30,927) | |

| Other income (expense): | | | | | | | |

| Change in fair value of warrant and derivative liabilities | 728 | | | 1,212 | | | 4,214 | | | 4,669 | |

| | | | | | | |

| Loss on derecognition of debt | (1,006) | | | — | | | (3,991) | | | — | |

| Interest expense, net | (614) | | | (1,782) | | | (6,354) | | | (2,680) | |

| Other expense, net | 10 | | | (93) | | | (52) | | | (115) | |

| Loss before provision for income taxes | (6,578) | | | (7,823) | | | (24,238) | | | (29,053) | |

| Provision for income tax expense | 133 | | | 149 | | | 158 | | | 226 | |

| Net loss | $ | (6,711) | | | $ | (7,972) | | | $ | (24,396) | | | $ | (29,279) | |

| | | | | | | |

| Loss per share: | | | | | | | |

| Basic and diluted | $ | (0.09) | | | $ | (0.14) | | | $ | (0.38) | | | $ | (0.53) | |

| | | | | | | |

| Weighted average shares outstanding: | | | | | | | |

| Basic and diluted | 72,689 | | | 56,228 | | | 64,916 | | | 55,422 | |

| | | | | |

Smith Micro Software Fourth Quarter and Fiscal 2023 Financial Results | Page 6 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Smith Micro Software, Inc. | | | | | | | |

| Consolidated Statements of Cash Flows | | | | | | | |

| (in thousands) | | | | | | | |

| | | | | | | | |

| | For the Three Months Ended

December 31, | | For the Year Ended

December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (unaudited) | | (unaudited) | | (unaudited) | | (audited) |

| Operating activities: | | | | | | | |

| Net loss | $ | (6,711) | | | $ | (7,972) | | | $ | (24,396) | | | $ | (29,279) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | |

| Depreciation and amortization | 2,483 | | | 1,805 | | | 7,395 | | | 7,556 | |

| Non-cash lease expense | (31) | | | 68 | | | (191) | | | (306) | |

| Non-cash transaction costs including amortization of debt discount and issuance costs | 595 | | | 1,902 | | | 5,993 | | | 3,324 | |

| Change in fair value of warrant and derivative liabilities | (728) | | | (1,212) | | | (4,214) | | | (4,669) | |

| Loss on derecognition of debt | 1,006 | | | — | | | 3,991 | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Stock based compensation | 1,519 | | | 1,099 | | | 4,835 | | | 4,948 | |

| Deferred income taxes | (10) | | | 61 | | | (10) | | | 61 | |

| Loss on disposal of assets | — | | | (27) | | | 12 | | | 4 | |

| Changes in operating accounts: | | | | | | | |

| Accounts receivable | 2,381 | | | (1,023) | | | 2,589 | | | 85 | |

| Prepaid expenses and other assets | (208) | | | (211) | | | 12 | | | (25) | |

| Accounts payable and accrued liabilities | (604) | | | 406 | | | (2,825) | | | (1,120) | |

| Other liabilities | (717) | | | 321 | | | (164) | | | 160 | |

Net cash used in operating activities | (1,025) | | | (4,783) | | | (6,973) | | | (19,261) | |

| Investing activities: | | | | | | | |

| | | | | | | |

| Capital expenditures, net | 1 | | | 36 | | | (4) | | | (49) | |

| Other investing activities | 66 | | | 70 | | | 136 | | | 164 | |

Net cash provided by investing activities | 67 | | | 106 | | | 132 | | | 115 | |

| Financing activities: | | | | | | | |

| Proceeds from notes and warrants offering | — | | | — | | | — | | | 15,000 | |

| Proceeds from stock and warrants offering | — | | | — | | | — | | | 3,000 | |

| Stock, notes, and warrants offering costs | — | | | — | | | — | | | (1,227) | |

| | | | | | | |

| | | | | | | |

| Proceeds from financing arrangements | — | | | — | | | 981 | | | 1,541 | |

| Repayments of financing arrangements | 120 | | | (300) | | | (1,036) | | | (1,278) | |

| Other financing activities | (19) | | | 2 | | | (5) | | | 58 | |

Net cash provided by (used in) financing activities | 101 | | | (298) | | | (60) | | | 17,094 | |

Net decrease in cash and cash equivalents | (857) | | | (4,975) | | | (6,901) | | | (2,052) | |

| Cash and cash equivalents, beginning of period | $ | 7,982 | | | $ | 19,001 | | | $ | 14,026 | | | $ | 16,078 | |

| Cash and cash equivalents, end of period | $ | 7,125 | | | $ | 14,026 | | | $ | 7,125 | | | $ | 14,026 | |

| | | | | |

Smith Micro Software Fourth Quarter and Fiscal 2023 Financial Results | Page 7 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Smith Micro Software, Inc. | | | | | | | | | | | | | | |

| Reconciliation of GAAP to Non-GAAP Results | | | | | | | | | | | | | | |

| (in thousands, except per share data) - unaudited | | | | | | | | | | | | | | |

| | GAAP | | Stock Compensation | | Intangibles Amortization | | Depreciation | Fair Value Adjustments | | Amortization of Debt Issuance Costs and Discount | | Personnel Severance and Reorganization Activities | | | | | | | | | | Non-GAAP |

Three Months Ended

December 31, 2023 | | | | | | | | | | | | | | | | | | | | | | |

| Gross profit | $ | 6,434 | | | $ | — | | | $ | — | | | $ | 11 | | $ | — | | | $ | — | | | $ | — | | | | | | | | | | | $ | 6,445 | |

| Selling and marketing | 2,458 | | | (302) | | | — | | | — | | — | | | — | | | — | | | | | | | | | | | 2,156 | |

| Research and development | 3,868 | | | (302) | | | — | | | — | | — | | | — | | | — | | | | | | | | | | | 3,566 | |

| General and administrative | 3,331 | | | (915) | | | — | | | — | | — | | | — | | | (155) | | | | | | | | | | | 2,261 | |

| Depreciation and amortization | 2,473 | | | — | | | (2,369) | | | (104) | | — | | | — | | | — | | | | | | | | | | | — | |

| Total operating expenses | 12,130 | | | (1,519) | | | (2,369) | | | (104) | | — | | | — | | | (155) | | | | | | | | | | | 7,983 | |

| | | | | | | | | | | | | | | | | | | | | | |

| (Loss) income before provision for income taxes | (6,578) | | | 1,519 | | | 2,369 | | | 115 | | 278 | | | 595 | | | 155 | | | | | | | | | | | (1,547) | |

| Net (loss) income | (6,711) | | | 1,519 | | | 2,369 | | | 115 | | 278 | | | 595 | | | 155 | | | | | | | | | | | (1,680) | |

| | | | | | | | | | | | | | | | | | | | | | |

| (Loss) earnings per share: diluted | (0.09) | | | 0.02 | | | 0.03 | | | — | | — | | | 0.01 | | | — | | | | | | | | | | | (0.02) | |

| | | | | | | | | | | | | | | | | | | | | | | |

Three Months Ended

December 31, 2022 | | | | | | | | | | | | | | | | | | | | | | |

| Gross profit | $ | 8,077 | | | $ | — | | | $ | — | | | $ | 20 | | $ | — | | | $ | — | | | $ | — | | | | | | | | | | | $ | 8,097 | |

| Selling and marketing | 3,196 | | | (186) | | | — | | | — | | — | | | — | | | (68) | | | | | | | | | | | 2,942 | |

| Research and development | 6,632 | | | (274) | | | — | | | — | | — | | | — | | | (364) | | | | | | | | | | | 5,994 | |

| General and administrative | 3,623 | | | (639) | | | — | | | — | | — | | | — | | | (184) | | | | | | | | | | | 2,800 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | 1,786 | | | — | | | (1,545) | | | (241) | | — | | | — | | | — | | | | | | | | | | | — | |

| Total operating expenses | 15,237 | | | (1,099) | | | (1,545) | | | (241) | | — | | | — | | | (616) | | | | | | | | | | | 11,736 | |

| | | | | | | | | | | | | | | | | | | | | | |

| (Loss) income before provision for income taxes | (7,823) | | | 1,099 | | | 1,545 | | | 261 | | (1,212) | | | 1,661 | | | 616 | | | | | | | | | | | (3,853) | |

| Net (loss) income | (7,972) | | | 1,099 | | | 1,545 | | | 261 | | (1,212) | | | 1,661 | | | 616 | | | | | | | | | | | (4,002) | |

| (Loss) earnings per share: basic and diluted | (0.14) | | | 0.02 | | | 0.03 | | | — | | (0.02) | | | 0.03 | | | 0.01 | | | | | | | | | | | (0.07) | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Note: (Loss) earnings per share: basic and diluted - may be impacted by rounding to allow rows to calculate.

| | | | | |

Smith Micro Software Fourth Quarter and Fiscal 2023 Financial Results | Page 8 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Smith Micro Software, Inc. | | | | | | | | | | | | |

| Reconciliation of GAAP to Non-GAAP Results | | | | | | | | | | | | |

| (in thousands, except per share data) - unaudited | | | | | | | | | | | | |

| GAAP | | Stock Compensation | | Intangibles Amortization | | Depreciation | | Fair Value Adjustments | | Amortization of Debt Issuance Costs and Discount | | Personnel Severance and Reorganization Activities | | | | | | | | Non-GAAP |

Year Ended

December 31, 2023 | | | | | | | | | | | | | | | | | | | | | |

| Gross profit | $ | 30,303 | | | $ | — | | | $ | — | | | $ | 50 | | | $ | — | | | $ | — | | | $ | 183 | | | | | | | | | $ | 30,536 | |

| | | | | | | | | | | | | | | | | | | | | |

| Selling and marketing | 11,089 | | | (955) | | | — | | | — | | | — | | | — | | | (93) | | | | | | | | | 10,041 | |

| Research and development | 17,145 | | | (1,056) | | | — | | | — | | | — | | | — | | | (471) | | | | | | | | | 15,618 | |

| General and administrative | 12,779 | | | (2,823) | | | — | | | — | | | — | | | — | | | (363) | | | | | | | | | 9,593 | |

| Depreciation and amortization | 7,345 | | | — | | | (6,789) | | | (556) | | | — | | | — | | | — | | | | | | | | | — | |

| Total operating expenses | 48,358 | | | (4,834) | | | (6,789) | | | (556) | | | — | | | — | | | (927) | | | | | | | | | 35,252 | |

| | | | | | | | | | | | | | | | | | | | | |

| (Loss) income before provision for income taxes | (24,238) | | | 4,834 | | | 6,789 | | | 606 | | | (223) | | | 5,993 | | | 1,110 | | | | | | | | | (5,129) | |

| Net (loss) income | (24,396) | | | 4,834 | | | 6,789 | | | 606 | | | (223) | | | 5,993 | | | 1,110 | | | | | | | | | (5,287) | |

| (Loss) earnings per share: basic and diluted | (0.38) | | | 0.07 | | | 0.10 | | | 0.01 | | | — | | | 0.09 | | | 0.02 | | | | | | | | | (0.08) | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Year Ended

December 31, 2022 | | | | | | | | | | | | | | | | | | | | | |

| Gross profit | $ | 34,303 | | | $ | 2 | | | $ | — | | | $ | 105 | | | $ | — | | | $ | — | | | $ | — | | | | | | | | | $ | 34,410 | |

| Selling and marketing | 12,883 | | | (522) | | | — | | | — | | | — | | | — | | | (837) | | | | | | | | | 11,524 | |

| Research and development | 29,388 | | | (1,082) | | | — | | | — | | | — | | | — | | | (364) | | | | | | | | | 27,942 | |

| General and administrative | 15,507 | | | (2,764) | | | — | | | — | | | — | | | (630) | | | (183) | | | | | | | | | 11,930 | |

| | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | 7,452 | | | — | | | (6,312) | | | (1,140) | | | — | | | — | | | — | | | | | | | | | — | |

| Total operating expenses | 65,230 | | | (4,368) | | | (6,312) | | | (1,140) | | | — | | | (630) | | | (1,384) | | | | | | | | | $ | 51,396 | |

| | | | | | | | | | | | | | | | | | | | | |

| (Loss) income before provision for income taxes | (29,053) | | | 4,370 | | | 6,312 | | | 1,245 | | | (4,669) | | | 3,083 | | | 1,384 | | | | | | | | | (17,328) | |

| Net (loss) income | (29,279) | | | 4,370 | | | 6,312 | | | 1,245 | | | (4,669) | | | 3,083 | | | 1,384 | | | | | | | | | (17,554) | |

| (Loss) earnings per share: basic and diluted | (0.53) | | | 0.08 | | | 0.11 | | | 0.02 | | | (0.08) | | | 0.06 | | | 0.02 | | | | | | | | | (0.32) | |

Note: (Loss) earnings per share: basic and diluted - may be impacted by rounding to allow rows to calculate.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

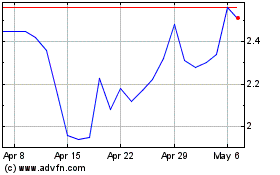

Smith Micro Software (NASDAQ:SMSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Smith Micro Software (NASDAQ:SMSI)

Historical Stock Chart

From Apr 2023 to Apr 2024