false

0001659617

0001659617

2024-02-22

2024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): February 22, 2024

MOLECULIN BIOTECH, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

001-37758

|

47-4671997

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(Commission File No.)

|

(I.R.S. Employer Identification

No.)

|

5300 Memorial Drive, Suite 950, Houston, TX 77007

(Address of principal executive offices and zip code)

(713) 300-5160

(Registrant’s telephone number, including area code)

(Former name or former address, if changed from last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-14(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $.001 per share

|

MBRX

|

The NASDAQ Stock Market LLC

|

|

Item 7.01

|

Regulation FD Disclosure

|

On February 22, 2024, Moleculin Biotech, Inc. (the “Company”), held a virtual investor call with the Company’s Chairman and Chief Executive Officer, Walter Klemp. The call can be viewed via the following link: https://www.virtualinvestorco.com/wtm-mbrx-part2.

A copy of the script is attached to this report as Exhibit 99.1 and is incorporated by reference herein.

The information contained in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be “filed” for the purpose of the Securities Exchange Act of 1934, as amended (“Exchange Act”), nor shall it be incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended (“Securities Act”), unless specifically identified therein as being incorporated by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

104

|

Cover page Interactive Data File (formatted as Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MOLECULIN BIOTECH, INC.

|

|

| |

|

|

|

| |

|

|

|

| |

Date:

|

February 22, 2024

|

|

| |

|

|

|

| |

By:

|

/s/ Jonathan P. Foster

|

|

| |

|

Jonathan P. Foster

|

|

Exhibit 99.1

Virtual Investor: What this Means – Three Part Series

Participants:

| |

●

|

Wally Klemp, Chairman and Chief Executive Officer

|

Moleculin Bio (Nasdaq: MBRX)

Jenene Introduction:

| |

●

|

Welcome back for another Virtual Investor – What This Means Segment. My name is Jenene Thomas, CEO of JTC IR, and I will be today’s moderator.

|

| |

|

|

| |

|

Today we are featuring Moleculin Biotech and I am pleased to be joined by Walter Klemp, Chairman and Chief Executive Officer of the Company. |

| |

|

|

| |

|

Before we get started, I just want to inform our audience that Moleculin Bio is listed on the Nasdaq and trades under the ticker M B R X. During today’s discussion, the Company will be making forward-looking statements and actual results could differ materially from these forward-looking statements. Some of the factors that could cause actual results to differ materially from these contemplated by such forward-looking statements are discussed in the periodic reports Moleculin files with the Securities and Exchange Commission. These documents are available in the Investors section of the Company's website and on the Securities and Exchange Commission's website. We encourage you to review these documents carefully. |

Moderated Questions – Part 2

Jenene Introduction: Welcome back Part 2 of our 3-part series dedicated to helping investors understand the significance of Moleculin’s recent announcement in January regarding its development programs with a special emphasis on Annamycin for the treatment of AML. In Part 1 (Replay available at: virtualinvestorco.com) Moleculin’s CEO, Walter Klemp, summarized the importance of Complete Responses (or CR’s) in assessing Annamycin’s performance and likelihood of approval. In this Part 2, we would like to take a deeper dive into the meaning of 2nd line therapy in AML and how Moleculin believes Annamycin will fit into the competitive landscape. This discussion is about the Company’s expectations surrounding this subject. My name is Jenene Thomas, CEO of JTC IR, and I will be today’s moderator.

Before we get started, I just want to inform our audience that Moleculin Bio is listed on the Nasdaq and trades under the ticker M B R X. During today’s discussion, the Company will be making forward-looking statements and actual results could differ materially from these forward-looking statements. Some of the factors that could cause actual results to differ materially from these contemplated by such forward-looking statements are discussed in the periodic reports Moleculin files with the Securities and Exchange Commission. These documents are available in the Investors section of the Company's website and on the Securities and Exchange Commission's website. We encourage you to review these documents carefully.

| |

1.

|

Q: Wally, could you help investors understand the significance of 2nd line therapy in AML and how that relates to the opportunity for Annamycin?

|

| |

a.

|

Sure, Jenene. It is critical that informed investors understand how we see Annamycin fitting into the competitive landscape in AML and that really starts with an understanding of the patient journey and what therapies are currently approved. In simple terms, 2nd line therapy is what patients are treated with if 1st line therapy fails them. If patients don’t respond at all, we call them refractory. More often, though, they may initially achieve a CR, but will then quickly relapse. And, while it can sound as though 2nd line is less important than 1st line, that changes when you realize how many patients are refractory to or relapse from 1st line therapy.

|

| |

b.

|

The patient journey in AML is complicated enough that we created a brief animation to help paint the picture for investors. Let’s play that now.

|

| |

c.

|

Play Animation – Script below:

|

Moleculin

Patient Journey Animation

Outline | Script

“Information in the video is based on Management belief and data shown are preliminary and subject to change. ”

Acute Myeloid Leukemia, or AML is a type of cancer that affects the blood and bone marrow and is characterized by the rapid growth of malignant white blood cells.

There are approximately 160,000 people with AML worldwide with about 20,000 newly diagnosed patients annually in the U.S.

Unfortunately, effective treatment options are limited and only 29% of people diagnosed survive beyond 5 years. In order to improve this overall long-term survival number, we need to focus on giving more patients access to potentially curative treatments.

While the actual course of treatment can be complex and highly individualized, all AML patients are initially categorized based on their ability to undergo intensive chemotherapy. As a result, around 50% of patients are deemed “Fit” for standard intensive first-line treatment and the other 50% are deemed “Un-Fit.”

Those who are deemed “Fit” are most often treated with the “standard” induction therapy of 3 days of intravenous daunorubicin or equivalent anthracycline, and 7 days of intravenous cytarabine, also known as Ara-C.

Only about 36% of these patients, or approximately 18% of overall AML patients, will have a durable Complete Response to first line therapy, meaning the cancerous cells in their bone marrow has been reduced to 5% or less. At this point, they either qualify for a bone marrow transplant or hope for the remission to become long lasting.

Bone marrow transplants can be successful in as many as 80% of eligible patients…

…However, since so few patients actually get to this point, only a minor subset, equaling around only 14% of all AML patients reach this positive outcome, through the standard first-line pathway for “fit” patients.

Looking back at the 50% of patients who were deemed “Un-Fit” for first-line intensive chemotherapy treatment.

… These patients are usually treated with a combination of Venetoclax and azacytidine, also known as “Ven-Aza”

The success rate in this group of patients is only around 37%, or approximately 19% of all AML patients, achieving a durable Complete Response and qualifying for a bone marrow transplant or achieving long-term remission.

Similarly, bone marrow transplants are successful in as many as 80% of these eligible patients…

But again, only a small subset of the deemed “Un-Fit” patients, approximately 15% of all AML patients, achieve this positive outcome.

In recent years, the approval of new targeted therapies were expected to provide renewed hope to 2nd line patients and transform the way AML was treated.

Unfortunately, success here has been relatively limited. Five such drugs have been approved to date, but each is only relevant to a subset of AML patients who happen to have the requisite genetic mutation and response rates are relatively low. Only about 21% of 2nd line patients will achieve a durable Complete Response which means only another 11% of the AML population is given a chance to beat their disease with a successful bone marrow transplant or lasting remission.

…leaving about 58% of all AML patients who will ultimately succumb to their disease.

Moleculin believes this is not an acceptable outcome and is advancing Annamycin, a next-generation, non-cardiotoxic anthracycline for the treatment of AML.

Anthracyclines are an important class of first line tools for physicians and while effective, their maximum dose in patients is limited due to issues with cardiotoxicity.

In multiple clinical studies, Annamycin has shown NO SIGNS of cardiotoxicity, allowing physicians to dose higher than the currently set limits.

Moleculin is working to make this important tool available to the approximately 58% of all AML patients who do not achieve a positive outcome with the two current paths of treatment.

In clinical trials, Annamycin, in combination with Ara-C, also referred to as “AnnAraC”, has demonstrated the ability to generate a Complete Response in APPROXIMATELY 40% or more of 2nd and 3rd line patients.

If approved, Annamycin could nearly triple the number of 2nd Line AML patients who achieve a positive outcome.

Moleculin Believes in Better Treatments and More Tomorrows.

For more information, please visit Moleculin.com.

| |

2.

|

Q: Well, that was super helpful in illuminating the unmet need and the opportunity for Annamycin. Could you now tie together this picture of unmet need and the actual performance numbers you’ve recently announced for Annamycin?

|

| |

a.

|

Yes. That’s precisely where we would like investors to focus and understand. To begin with, let’s look at the actual CR/CRi numbers for all the drugs currently approved for use in 2nd line patients and compare that to the performance we’ve seen so far with Annamycin.

|

| |

b.

|

There’s a lot of information here so don’t worry about digesting it all right now. In fact, all of this information is already public, but we’ve gathered it all into a few simple slides to help investors understand how we see the landscape.

|

| |

c.

|

Also, we’ve posted this on our website so investors can study it in more detail. For now, though, let’s just focus on the big picture. Whether you’re looking at CR’s or the combination of CR’s and CRi’s, Annamycin is currently performing better in its current trial than any of the currently approved 2nd line therapies performed in their respective approval trials. This is based on our current clinical trial in progress, so the results are preliminary and subject to change.

|

| |

d.

|

Now, I need to say that, with this chart, we are comparing results from 6 different trials, each of which had its own unique trial protocol, so this comparison must be considered anecdotal and not a true statistical comparison. Regardless, we believe the history of CR/CRi rates used for approval by the FDA is entirely indicative of the bar we should have to clear to win approval for Annamycin, so this comparison IS relevant when trying to predict our likelihood of success.

|

| |

e.

|

Although, Annamycin is technically performing at a higher level on this chart, you would be within your rights to say that others appear close. For example, Olatusidenib appears pretty close in terms of performance. But there is a detail in this chart that gives Annamycin a tremendous advantage. You see, all of the currently approved 2nd line therapies are targeted therapies. They are targeting certain gene mutations that are only present in a subset of AML patients and that means they are only effective for those patients.

|

| |

f.

|

Once you factor in that limitation, the following chart shows you what percentage of the AML population actually benefits from these therapies.

|

| |

g.

|

The orange bars represent the CR rates from the prior chart and the blue bars reflect the prevalence-weighted benefit expected from each therapy. When you add them all up, all of the targeted therapies combined are only expected to produce CR’s in about 21% of 2nd line AML patients. But Annamycin isn’t a targeted therapy. We’ve been testing it in all AML patients regardless of genetic mutation, so the prevalence-weighted benefit is not limited to any subgroup.

|

| |

h.

|

What that means is the expected percentage of all 2nd line AML patients achieving a CR from Annamycin is double that of all existing targeted therapies combined. So, essentially, if we continue to produce this level of performance after approval, we should triple the number of 2nd line patients who have a shot at curing their AML. We believe we are talking about impacting thousands of lives every year if we can get Annamycin approved.

|

| |

3.

|

Q: This is really exciting, Wally. How do you see this translating into an approval pathway?

|

| |

a.

|

Well, in short, we think these data have radically improved the likelihood of our approval and they are so strong, in fact, we believe we will qualify for an accelerated approval pathway, both here and in the EU. We are about out of time again for today, so I look forward to unpacking our intended approval pathway in Part 3 of this series.

|

Jenene Closing:

| |

●

|

With that, this concludes the Virtual Investor What this Means segment with Moleculin. I would like to thank Wally Klemp, Chairman and CEO of Moleculin for joining us today.

|

| |

●

|

I would also like to thank our viewers for your time and attention. As a reminder, you can access the webcast replay from today’s event at: www.virtualinvestorco.com.

|

v3.24.0.1

Document And Entity Information

|

Feb. 22, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

MOLECULIN BIOTECH, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 22, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-37758

|

| Entity, Tax Identification Number |

47-4671997

|

| Entity, Address, Address Line One |

5300 Memorial Drive, Suite 950

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77007

|

| City Area Code |

713

|

| Local Phone Number |

300-5160

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

MBRX

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001659617

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

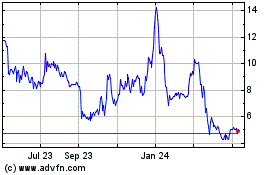

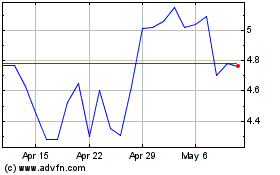

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From Apr 2023 to Apr 2024