UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

RULE 13d-2(a)

(Amendment No. 9)1

Comscore, Inc.

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

20564W204

(CUSIP Number)

DANIEL B. WOLFE

180 DEGREE CAPITAL CORP.

7 N. Willow Street, Suite 4B

Montclair, NJ 07042

Telephone: 973-746-4500

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

February 20, 2024

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. ☒

Note. Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

1 The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 20564W204

| | | | | | | | | | | |

| 1 | NAME OF REPORTING PERSONS:

180 Degree Capital Corp. |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) X (b)

|

| 3 | SEC USE ONLY

|

| 4 | SOURCE OF FUNDS (SEE INSTRUCTIONS)

WC, OO |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

New York |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

0 |

| 8 | SHARED VOTING POWER

340,366 shares* |

| 9 | SOLE DISPOSITIVE POWER

0 |

| 10 | SHARED DISPOSITIVE POWER

340,366 shares* |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

340,366 shares* |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

| 13 | PERCENT OF CLASS REPRESENTED IN ROW (11)

7.2%* |

| 14 | TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IV |

* Reflects a reverse stock split of the Common Stock of the Issuer at a ratio of 1-for-20.

CUSIP No. 20564W204

| | | | | | | | | | | |

| 1 | NAME OF REPORTING PERSONS:

Matthew F. McLaughlin |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) X (b)

|

| 3 | SEC USE ONLY

|

| 4 | SOURCE OF FUNDS (SEE INSTRUCTIONS)

PF |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

100,000 shares* |

| 8 | SHARED VOTING POWER

0 |

| 9 | SOLE DISPOSITIVE POWER

100,000 shares* |

| 10 | SHARED DISPOSITIVE POWER

0 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

100,000 shares* |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

| 13 | PERCENT OF CLASS REPRESENTED IN ROW (11)

2.1%* |

| 14 | TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN |

* Reflects a reverse stock split of the Common Stock of the Issuer at a ratio of 1-for-20.

CUSIP No. 20564W204

| | | | | | | | | | | |

| 1 | NAME OF REPORTING PERSONS:

Kevin M. Rendino |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) X (b)

|

| 3 | SEC USE ONLY

|

| 4 | SOURCE OF FUNDS (SEE INSTRUCTIONS)

PF |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

0 |

| 8 | SHARED VOTING POWER

26,125 shares* |

| 9 | SOLE DISPOSITIVE POWER

0 |

| 10 | SHARED DISPOSITIVE POWER

26,125 shares* |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

26,125 shares* |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

| 13 | PERCENT OF CLASS REPRESENTED IN ROW (11)

Less than 1%* |

| 14 | TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN |

* Reflects a reverse stock split of the Common Stock of the Issuer at a ratio of 1-for-20.

CUSIP No. 20564W204

The following constitutes Amendment No. 9 to the Schedule 13D filed by the undersigned ("Amendment No. 9"). This Amendment No. 9 amends the Schedule 13D as specifically set forth herein.

Item 3. Source and Amount of Funds or Other Consideration.

Item 3 is hereby amended and restated as follows:

(1) The aggregate purchase price of the 340,366 shares of Common Stock of the Issuer beneficially owned by 180 Degree Capital is $12,501,940, including brokerage commissions. The source of funds for acquiring the foregoing shares of Common Stock was working capital from each of 180 Degree Capital and a separate account which is managed by 180 Degree Capital.

(2) The aggregate purchase price of the 100,000 shares of Common Stock of the Issuer beneficially owned by Mr. McLaughlin is $2,188,816, including brokerage commissions. The source of funds for acquiring the foregoing shares of Common Stock was personal funds of this Reporting Person.

(3) The aggregate purchase price of the 26,125 shares of Common Stock of the Issuer beneficially and jointly owned by Mr. Rendino and his spouse is $731,195, including brokerage commissions. The source of funds for acquiring the foregoing shares of Common Stock was personal funds of this Reporting Person.

Item 4. Purpose of the Transaction.

Item 4 is hereby amended to add the following:

On February 1, 2024, 180 Degree Capital issued a press release (the “Press Release”) and a letter to the shareholders of 180 Degree Capital (the "Shareholder Letter"), which each discussed 180 Degree Capital's nomination of Matthew F. McLaughlin for election to the Board at the Annual Meeting. Furthermore, 180 Degree Capital reiterated its belief that the Board requires significant improvements in corporate governance and fresh perspectives from individuals with deep industry experience in the Issuer's markets. The full text of the Press Release and the Shareholder Letter are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated herein by reference.

Item 5. Interest in the Securities of the Issuer

Item 5(c) is hereby amended and restated as follows:

(c) The following shares of Common Stock of the Issuer were acquired in open market purchases within 60 days of the filing date of this Schedule 13D:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class of Security | | Shares Purchased | | Price Per Share | | Date of Purchase | | Reporting Person |

| Common Stock | | 4,170 | | $18.2202 | | 1/22/2024 | | Kevin M. Rendino |

| Common Stock | | 1,125 | | $17.4314 | | 2/13/2024 | | Kevin M. Rendino |

| Common Stock | | 5,000 | | $16.7900 | | 2/20/2024 | | Kevin M. Rendino |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Item 7. Material to be Filed as Exhibits

Item 7 is hereby amended to add the following exhibits:

SIGNATURE

After reasonable inquiry and to the best of each signatories knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: February 22, 2024

180 DEGREE CAPITAL CORP.

By: /s/ Daniel B. Wolfe

Name: Daniel B. Wolfe

Title: President

MATTHEW F. MCLAUGHLIN

By: /s/ Matthew F. McLaughlin

Name: Matthew F. McLaughlin

KEVIN M. RENDINO

By: /s/ Kevin M. Rendino

Name: Kevin M. Rendino

180 DEGREE CAPITAL CORP. REPORTS NET ASSET VALUE PER SHARE (“NAV”) OF $5.02, COMPRISED OF 99% CASH AND PUBLIC SECURITIES1, AS OF DECEMBER 31, 2023

MONTCLAIR, NJ – February 20, 2024 – 180 Degree Capital Corp. (NASDAQ:TURN) (“180 Degree Capital” and the “Company”), today reported its financial results as of December 31, 2023, and noted additional developments from the first quarter of 2024. The Company also published a letter to shareholders that can be viewed at https://ir.180degreecapital.com/financial-results.

“The fourth quarter of 2023 was the start of what we believe will be a return to risk asset classes, including the microcapitalization stocks in which we invest,” said Kevin M. Rendino, Chief Executive Officer of 180 Degree Capital. “Our +6.9% gross total return in our public portfolio was the primary contributor to the growth of our net asset value per share (“NAV”) from $4.91 to $5.02. Our assets on our balance sheet are now almost 100% comprised of investments in public companies and cash.1 On the macroeconomic front, the resilience of the US economy combined with the apparent end of the Fed’s tightening cycle and likely future reductions in interest rates should be one tailwind for our investments in general in 2024. For 180, we believe 2024 will be a year defined by our constructive activism and by long-awaited catalysts at certain of our portfolio companies that together could lead to material value creation for 180 Degree Capital’s stockholders.”

“180 Degree Capital’s constructive activism focuses on working with management teams and/or boards of directors of our portfolio companies to build value for all stakeholders in those businesses,” said Daniel B. Wolfe, President of 180 Degree Capital. “We do not have the hubris to believe we know the businesses of our investee companies better than their management teams and boards. We believe we have a complementary skill set and contacts that can help unlock trapped value. We believe this complementarity is what led to the invitation to join the Board of Directors of Synchronoss Technologies, Inc. (“SNCR”). We have rolled up our sleeves to help SNCR’s management and board wherever possible and could not be more excited about the opportunity for value creation that we believe exists for SNCR. It is unfortunate that the Board of Directors of comScore, Inc. (“SCOR”), does not have the same openness and humility to recognize they do not have all the answers to fixing the destruction of value that has occurred under their watch. We believe our nominee, Matthew F. McLaughlin, the former COO of DoubleVerify Holdings, Inc., has both relevant industry experience for where SCOR is heading with its business and can be an advocate for proper corporate governance, particularly for common stockholders, as a significant common stockholder himself. We believe our constructive activism is not only a differentiated investment approach, but also can be an important part of the ultimate unlocking of value for our portfolio holdings and the creation of value for 180 Degree Capital’s stockholders.”

Mr. Rendino continued, “As we noted in a press release on February 1, 2024, the discount of our NAV to our stock price was approximately 26% as of the end of January 2024. This discount equates to a NAV as of the end of January 2024 that was approximately 8% higher than at the end of 2023. We established the Discount Management Program to make it clear that the management and Board of Directors of 180 Degree Capital are serious about our intentions to narrow this discount. We collectively own almost 12% of 180 Degree Capital’s outstanding shares, and this ownership continues to grow solely through open market purchases. We are laser-focused on creating value for all stockholders of 180 Degree Capital through growth of our NAV and the narrowing of the discount.”

The table below summarizes 180 Degree Capital’s performance over periods of time through the end of Q4 20232:

| | | | | | | | | | | | | | | | | |

| Quarter | 1 Year | 3 Year | 5 Year | Inception to Date |

| Q4 2023 | Q4 2022- Q4 2023 | Q4 2020- Q4 2023 | Q4 2018- Q4 2023 | Q4 2016- Q4 2023 |

| TURN Public Portfolio Gross Total Return (Excluding SMA Carried Interest) | 6.9% | -7.3% | -22.0% | 51.0% | 182.8% |

| TURN Public Portfolio Gross Total Return (Including SMA Carried Interest) | 6.9% | -7.3% | -20.0% | 61.2% | 201.4% |

| | | | | |

| Change in NAV | 2.2% | -20.6% | -45.9% | -36.6% | -28.5% |

| | | | | |

| Change in Stock Price | -3.3% | -22.3% | -38.4% | -21.9% | -1.0% |

| | | | | |

| Russell Microcap Index | 16.1% | 9.3% | 1.8% | 50.6% | 48.3% |

| Russell Microcap Value Index | 16.8% | 9.5% | 25.9% | 64.8% | 62.1% |

| Russell Microcap Growth Index | 15.7% | 7.1% | -25.8% | 28.9% | 28.6% |

| Russell 2000 | 14.0% | 16.9% | 6.7% | 60.6% | 63.8% |

Mr. Rendino and Mr. Wolfe will host a conference call tomorrow, Wednesday, February 21, 2024, at 9am Eastern Time, to discuss the results from Q4 2023 and developments to date during Q1 2024. The call can be accessed by phone at (609) 746-1082 passcode 415049 or via the web at https://www.freeconferencecall.com/wall/180degreecapital. Additionally, slides that will be referred to during the presentation can be found on 180’s investor relations website at https://ir.180degreecapital.com/ir-calendar.

About 180 Degree Capital Corp.

180 Degree Capital Corp. is a publicly traded registered closed-end fund focused on investing in and providing value-added assistance through constructive activism to what we believe are substantially undervalued small, publicly traded companies that have potential for significant turnarounds. Our goal is that the result of our constructive activism leads to a reversal in direction for the share price of these investee companies, i.e., a 180-degree turn. Detailed information about 180 Degree Capital and its holdings can be found on its website at www.180degreecapital.com.

Press Contact:

Daniel B. Wolfe

180 Degree Capital Corp.

973-746-4500

ir@180degreecapital.com

Mo Shafroth

Peaks Strategies

mshafroth@peaksstrategies.com

Forward-Looking Statements

This press release may contain statements of a forward-looking nature relating to future events. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. These statements reflect the Company's current beliefs, and a number of important factors could cause actual results to differ materially from those expressed in this press release. Please see the Company's securities filings filed with the Securities and Exchange Commission for a more detailed discussion of the risks and uncertainties associated with the Company's business and other significant factors that could affect the Company's actual results. Except as otherwise required by Federal securities laws, the Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. The reference and link to the website www.180degreecapital.com has been provided as a convenience, and the information contained on such website is not incorporated by reference into this press release. 180 Degree Capital is not responsible for the contents of third-party websites.

1. Cash including our holdings in money-market cash sweep funds and the expected receipt of $1.3 million in April 2024 related to the sale of TARA Biosystems, Inc., to Valo Health LLC.

2. Past performance is not an indication or guarantee of future performance. Gross unrealized and realized total returns of 180 Degree Capital's cash and securities of publicly traded companies are compounded on a quarterly basis, and intra-quarter cash flows from investments in or proceeds received from privately held investments are treated as inflows or outflows of cash available to invest or withdrawn, respectively, for the purposes of this calculation. 180 Degree Capital is an internally managed registered closed-end fund that has a portion of its assets in legacy privately held companies that are fair valued on a quarterly basis by the Valuation Committee of its Board of Directors, and 180 Degree Capital does not have an external manager that is paid fees based on assets and/or returns. Please see 180 Degree Capital's filings with the SEC, including its 2023 Annual Report on Form N-CSR for information on its expenses and expense ratios.

Q4 2023 Shareholder Letter

Fellow Shareholders:

This “recession," which has been one of the drivers of capital away from risk assets to perceived safer assets, has been the most fun and awesome one ever. Persistent predictions of a return to arguably more normal interest rates have not led to an economic calamity. Instead, GDP rose 3.1%, wages and salaries grew 4.7%, real private fixed investment in manufacturing structures reached all-time highs and employment remains strong. I didn’t live through the 1929 recession, but I did experience the near depression in 2008, and 2023 seemed eerily similar to those years…. NOT!

Despite strong macroeconomic trends in 2023, somehow a basket of microcap companies that comprise the Russell Microcap Index underperformed the NASDAQ 100 by over 4600 basis points! In our last shareholder letter, we incorporated a plethora of charts showing that microcap companies are historically inexpensive and undervalued relative to larger-sized companies. While substantially all of those data and charts remain applicable today, I’m not going to regurgitate what was in that letter that you can find at https://ir.180degreecapital.com/financial-results. Instead, I’ll note commentary regarding Q4 2023 from Royce Investment Partners, who we hold in high regard:

Valuations for Small-Cap Are Highly Attractive vs. Large-Cap

We think it bears repeating that, even with a terrific 4Q23 and a positive return in 2023, the Russell 2000 finished the year well shy of its 11/8/21 peak—while large-caps continued to establish new highs in 4Q23. In fact, it’s been 563 days since the current cycle low for the Russell 2000—the third longest span without recovering the prior peak on record.

Fallout from the Internet Bubble saw small-caps need 456 days from their trough to match their previous peak, while it took 704 days for small-caps to recover their prior peak following their trough in the 2008-09 Financial Crisis. Each of these periods saw dramatic developments: the implosion of high-flying technology stocks in 2000-02 and a global financial catastrophe in 2008-09. The current period has seen ample uncertainty, and a record pace of interest rate increases yet lacks the existential threats that characterized the Internet Bubble and, even more so, the Financial Crisis. The latter period also saw less bifurcation between small- and large-cap returns. Yet based on our preferred index valuation metric of enterprise value to earnings before interest and taxes, or EV/EBIT, the Russell 2000 finished 2023 not far from its 25-year low relative to the Russell 1000.

Russell 2000 vs. Russell 1000 Median LTM EV/EBIT¹ (ex. Negative EBIT Companies)

12/31/98-12/31/23

1Last twelve months Enterprise Value/Earnings Before Interest and Taxes

Similarly, small-cap value continued to sell at a below average valuation relative to small-cap growth at the end of the year, as measured by EV/EBIT. Micro-cap stocks also remained very attractively valued relative to large-cap based on EV/EBIT. As small-cap specialists, we see these gaps in valuation and long-

1

Note: Past performance is no guarantee of future results.

term performance as revealing the considerable long-term opportunities that still exist within the small- and micro-cap asset classes—especially when stacked against their large- and mega-cap counterparts.

Here is one chart we shared in last quarter’s shareholder letter that we thought would be worth updating and showing again.

Even with the increases in small and microcapitalization stocks in Q4 2023, the IWM/SPY ratio remains at historical lows. We continue to believe that this ratio says nothing about the fundamentals of the businesses that comprise each index, given those fundamentals have held up better for many microcap companies than the index performance would suggest.

We think we are at the end of the Fed hiking cycle. We are not in the camp that the Fed will be cutting rates anytime soon, because we believe the economy will continue to show the resilience that it showed last year. That, in our view, is a positive rather than a negative. Our portfolio companies do not require lower rates to execute and build value for shareholders. They benefit from the types of positive economic trends we saw in 2023 and continue to see in the beginning of 2024. And against that backdrop, we expect that many of our holdings which are trading at historically low valuation levels, have a long runway to rise in value and help us increase our net asset value per share (“NAV”). Let’s look at a few of our current favorite names.

Potbelly Corporation (PBPB)

We have been investors in PBPB since 2019. PBPB is a fast-casual restaurant chain that sells sandwiches, salads, soups and other lunch focused items at company-owned and franchised locations. We have discussed PBPB in detail in prior shareholder letters and whitepapers, so we won’t rehash the entire story here aside from saying we believe PBPB has strong brand recognition, high-quality products, a healthy balance sheet and one of the best management teams we have ever invested in. PBPB has 425 locations, including 75 franchised in 33 states plus the District of Columbia. Additionally, PBPB recently announced that it has development agreements for almost 200 additional shops.

For 2024, we see several potential value-creating catalysts that we believe could push the stock price substantially higher. First, the company has said that it expects to open 40 new franchise stores this coming year, which represents close to 10% growth. Additionally, PBPB is projecting continued growth in average unit volume, shop level margins and adjusted EBITDA margins. Lastly, management expects material generation of positive cash flows that will enable various options for capital allocation including repayment of expensive debt, stock buybacks and/or other forms of return of capital.

Investors are starting to wake up to PBPB’s momentum entering 2024. Should this momentum continue, we believe that PBPB will command a common franchise-level multiple of enterprise value to EBITDA in the mid-to-high

2

Note: Past performance is no guarantee of future results.

teens from its current low teens multiple. This multiple expansion combined with the cash flow and earnings power of the remade business could lead to further material appreciation in PBPB’s common stock.

Synchronoss Technologies, Inc. (SNCR)

SNCR provides white-label technology that enables large corporations to offer customers cloud-based storage of personal data. SNCR’s platform powers the personal cloud offerings of a number of Tier 1 companies including Verizon, SoftBank, AT&T, Assurant, British Telecom and Tracfone under long term contracts. We first invested in SNCR as part of an underwritten financing in June of 2021 that allowed SNCR to pay off its punitive preferred stock and recapitalize the company with reduced interest expense, while also providing flexibility going forward to execute on strategic options for the business. The first of these strategic alternatives was completed in Q4 2023 with the sale of SNCR’s non-core messaging and digital businesses. SNCR is now a pure-play, cloud-focused business with high margins and is on the cusp of generating significant free cash flows.

Our bullish view for 2024 is centered around a number of catalysts that we believe will improve SNCR’s balance sheet and demonstrate the operating leverage of the business. First, SNCR has stated that it expects to receive approximately $28 million from a tax refund at some point in 2024. This inflow of capital will allow SNCR to pay down a portion of its relatively expensive outstanding preferred stock and/or debt that matures in June 2026. Second, SNCR is expecting to return to top-line revenue growth after the runoff of historical deferred revenue and continued growth in subscribers at its largest customer, Verizon, and its newest customer, Softbank. Third, the end of non-recurring charges related to restructuring and prior litigation and corresponding settlements coupled with revenue growth and a material reduction in interest paid on its outstanding debt should lead to material free cash flow generation in 2024 that we believe could grow substantially in 2025. Lastly, we should note that in December 2023 we were asked to join SNCR’s Board of Directors to help with the company’s execution of its next phase of growth.

As we look at what this might mean for the stock price of SNCR, it ended 2023 at $6.21, which equated to a multiple of enterprise value to estimated 2024 EBITDA of approximately 5.6x. This multiple declines to approximately 5.2x if SNCR receives the tax refund and uses it primarily to pay down debt. We do not believe a cloud-focused business with 85-90% recurring revenue, 70-75% gross margins, 25%+ EBITDA margins that also generates positive free cash flow should command such a low multiple. In our opinion, a more appropriate multiple would be in the double digits. SNCR recently reported the completion of significant cost savings initiatives along with strong performance in Q4 2023 and the stock responded positively. We believe this is just the start for SNCR and that 2024 will be a turning point for SNCR both in terms of its business and how investors value SNCR’s common stock.

comScore, Inc. (SCOR)

Our initial investment in SCOR took place in 2021, following its recapitalization by Charter, Cerberus and Liberty Media (Qurate). Our original thesis for our investment was centered on multiple factors including our beliefs that: (i) SCOR was a company with uniquely competitive media measurement offerings and proprietary data; (ii) SCOR’s new investors could help with improved execution, financial performance and overall growth; and (iii) SCOR traded at a significant discount to its peers.

While SCOR’s business has improved dramatically under new management with 33% EBITDA growth over the last two years, SCOR’s stock has declined precipitously. We believe this is due to poor corporate governance and uncertainty around SCOR’s capital structure. As a result, we have ramped up our activism significantly through the nomination of Matthew F. McLaughlin as a director nominee for consideration at SCOR’s upcoming annual meeting of stockholders. Matt is a retired advertising technology executive and Naval officer. Most recently, he served as Chief Operating Officer of DoubleVerify Holdings, Inc. (NYSE: DV) (“DoubleVerify”), a software platform for digital media measurement and analytics, from 2011 to March 2022. As COO of DoubleVerify, Matt directed its Product, Engineering and Sales Operations activity, including managing over half the company’s employees. Given SCOR’s struggles with, and focus on, improving its digital offerings, we could think of nobody more useful to the SCOR Board and management than Matt. Matt is available and happy to speak with any SCOR stockholder that wishes to speak with him so they can judge for themselves whether he is qualified and should serve on SCOR’s Board. While we are actively preparing to run a competitive proxy campaign to support his candidacy, we hope SCOR’s Board will realize the complementary skill set that we believe he can bring to help build value for all of SCOR’s stakeholders and that a competitive proxy contest will not be required.

As we look forward to 2024, we see a number of potential value-creating catalysts (in addition to our activism) that could lead to material appreciation in the stock. These potential catalysts include: (i) SCOR’s preferred stockholders taking steps to demonstrate an alignment of interests across all stakeholders of the company; (ii) SCOR demonstrating the ability to consistently generate double-digit EBITDA margins; and (iii) a return to growth for SCOR’s digital business. Assuming SCOR can continue to generate mid-teens EBITDA in 2024, then its common

3

Note: Past performance is no guarantee of future results.

stock is trading at just 4.7x enterprise value to EBITDA and 0.75x enterprise value to revenue; we believe this will ultimately prove to be an attractive entry price. We do not believe that either of these multiples are appropriate for a company with unique data assets that generate positive cash flows. We believe a more appropriate multiple would be in the double-digit range. We firmly believe that improvements in SCOR’s corporate governance combined with improving financial metrics and the demonstration of alignment of all stakeholders can lead to material appreciation in SCOR’s common stock.

The Arena Group Holdings, Inc. (AREN)

We have been significant shareholders of AREN since June 2019. AREN is a media company that employs a technology platform that allows creators and publishers to publish and monetize content alongside anchor brands including Sports Illustrated, TheStreet, Parade, Men’s Journal, and HubPages to build their businesses. AREN’s content is distributed across a diverse portfolio of over 265 brands, reaching over 100 million users monthly. Throughout the history of our investment there have been periods where we engaged in constructive activism that resulted in what we believe were improvements in management and corporate governance. The advertising market in 2023 was challenging, but AREN’s business held up better than many other companies.

In November 2023, AREN signed a definitive agreement to merge with Bridge Media Networks, LLC (“Bridge Media”), a media group that includes a portfolio of over-the-air television stations, national television networks, streaming platforms and websites for delivering news, sports, automotive and travel content. Bridge Media is a wholly owned subsidiary of Simplify Inventions, LLC, which is owned by Manoj Bhargava, the founder of 5-hour Energy®. Under the terms of the merger, entities associated with Mr. Bhargava will invest $50 million in the combined entity and the consumer brands owned by Mr. Bhargava will commit to approximately $60 million in guaranteed advertising revenue for AREN. Subsequent to the signing of this definitive agreement, Mr. Bhargava purchased the debt and equity of AREN owned by B. Riley and then invested an additional $12 million for working capital purposes while the company seeks the required shareholder and regulatory approvals to complete the merger.

While the start of 2024 has presented additional challenges for AREN, Mr. Bhargava has a history of building significant value across multiple industries. We have had opportunities to speak with both Mr. Bhargava and the new CEO of AREN, Cavitt Randall, and appreciate their candor and desire to build a sustainable business that grows profitably. AREN was the largest source of declines in our portfolio in 2023. We look forward to the completion of the merger in 2024 and to what we believe can be significant value creation under new management led by Mr. Bhargava and Mr. Randall.

Conclusion

I have been managing money for over 30 years and have been an investor or portfolio manager since 1988. Never in my life have I been more convinced that we own a collection of companies that I believe have the potential to rise materially in value as much as the portfolio TURN has put together as we start 2024. We are also at a point where I believe our constructive activism will make a difference in this value creation. While the last 2 years have been incredibly frustrating and disappointing, I have had the 30+ year experience of knowing that challenging performance periods happen. During these periods, it is crucial that you don’t shy away from talking about them, you don’t become over-emotional about them, and you stick to your knitting and process no matter how painful the period can be. My dear friend Phil Appel, who I believe to be one of Merrill Lynch’s best financial advisors and one of the smartest people I have ever met (also a heck of a driver of the golf ball, though not a great putter) sent me a quote years ago that I hold near and dear to my heart:

“The one willing to look stupidest the longest wins.”

We feel stupid on the one hand, yet on the other, we couldn’t be more optimistic about what we own and convinced significant value appreciation is possible in the next few years.

The fourth quarter of 2023 was the start of what we believe will be a return to risk asset classes, including the microcapitalization stocks in which we invest. Our +6.9% gross total return in our public portfolio was the primary contributor to the growth of our NAV per share from $4.91 to $5.02. Our assets on our balance sheet are now almost 100% comprised of investments in public companies and cash. Please see slides that we have posted on our website at https://ir.180degreecapital.com/financial-results for details of the sources of change in our portfolio during Q4 2023, the full year and inception to date. On the macroeconomic front, the resilience of the US economy combined with the apparent end of the Fed’s tightening cycle and likely future reductions in interest rates should be one tailwind for our investments in general in 2024. For 180, we believe 2024 will be a year defined by our constructive activism and by long-awaited catalysts at certain of our portfolio companies that together could lead to material value creation for 180 Degree Capital’s stockholders.

4

Note: Past performance is no guarantee of future results.

180 Degree Capital’s constructive activism means working with management teams and/or boards of directors of our portfolio companies to build value for all stakeholders in those businesses. We do not have the hubris to believe we know the businesses of our investee companies better than their management teams and boards. We do have complementary skill sets and contacts that can help unlock stunted value. We believe this complementarity is what led to the invitation to join the Board of Directors of SNCR. We have rolled up our sleeves to help SNCR’s management and board wherever possible and could not be more excited about the opportunity for value creation that we believe exists for SNCR. It is unfortunate that the Board of Directors of SCOR does not have the same openness and humility to understand they do not have all the answers in regard to fixing the destruction of value that has occurred under their watch. We believe our nominee, Matt McLaughlin, has both relevant industry experience for where SCOR is heading with its business and can be an advocate for proper corporate governance, particularly for common stockholders, as a significant common stockholder himself. We believe our constructive activism is not only a differentiated investment approach, but also can be an important part of the ultimate unlocking of value for our portfolio holdings and creation of value for 180 Degree Capital’s stockholders.

As we noted in a press release on February 1, 2024, the discount of our NAV to our stock price was approximately 26% as of the end of January 2024. This discount equates to a NAV as of the end of January 2024 that was approximately 8% higher than at the end of 2023. We established the Discount Management Program to make it clear that TURN’s management and Board are serious about our intentions to narrow this discount. We collectively own almost 12% of outstanding shares, and this ownership continues to grow solely through open market purchases. We are laser-focused on creating value for all stockholders of TURN through growth of our NAV and the narrowing of the discount.

As always, thank you for your support.

Best Regards,

Kevin Rendino

Chief Executive Officer

Forward-Looking Statements and Disclaimers

This shareholder letter may contain statements of a forward-looking nature relating to future events. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. These statements reflect the Company's current beliefs, and a number of important factors could cause actual results to differ materially from those expressed in this press release. Please see the Company's securities filings filed with the Securities and Exchange Commission for a more detailed discussion of the risks and uncertainties associated with the Company's business and other significant factors that could affect the Company's actual results. Except as otherwise required by Federal securities laws, the Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. The reference and link to any websites have been provided as a convenience, and the information contained on such website is not incorporated by reference into this shareholder letter. 180 Degree Capital Corp. is not responsible for the contents of third-party websites. The information discussed above is solely the opinion of 180 Degree Capital Corp. Any discussion of past performance is not an indication of future results. Investing in financial markets involves a substantial degree of risk. Investors must be able to withstand a total loss of their investment. The information herein is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the information and opinions.

5

Note: Past performance is no guarantee of future results.

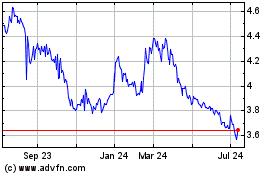

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Mar 2024 to Apr 2024

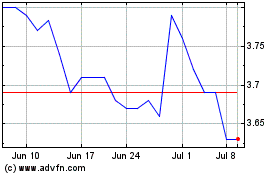

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Apr 2023 to Apr 2024