BuzzFeed (NASDAQ:BZFD) –

BuzzFeed shares surged over 80% in Thursday’s

pre-market after announcing the sale of Complex and planning staff

cuts. Complex was sold for $108.6 million to NTWRK, while

BuzzFeed will lay off 16% of its staff to save

costs. New details will be shared on February 28th.

Amazon (NASDAQ:AMZN),

Walgreens (NASDAQ:WBA) – Amazon

is set to join the Dow Jones Industrial Average, replacing

Walgreens Boots Alliance next week, announced

S&P Dow Jones Indices. The change reflects the diversity of

commerce in the US.

Alphabet (NASDAQ:GOOGL) – Google announced on

Wednesday that its artificial intelligence tools will be powered by

“Gemini” models and offered at lower prices, aiming to compete with

companies backed by Microsoft and OpenAI. “Duet AI in Workspace” is

now “Gemini for Google Workspace,” available for $20-30 per month.

Moreover, Reddit has struck a deal with Google to provide its

content to train the search giant’s AI models, according to

sources. Valued at about $60 million annually, the contract

highlights Reddit’s efforts to generate revenue and prepare for its

initial public offering.

Apple (NASDAQ:AAPL) – Apple is

launching the PQ3 protocol on its iMessage messaging platform to

protect against future advances in quantum computing. The company

rebuilt the cryptographic protocol from scratch to bolster defenses

against potential threats amid concerns about “Q-Day.”

Intel (NASDAQ:INTC), Microsoft

(NASDAQ:MSFT) – Intel revealed plans to partner

with Microsoft to manufacture a custom chip,

aiming to surpass TSMC by 2025. New technologies, including Intel

14A, are expected to maintain leadership until 2026.

Intel seeks recovery with subsidies and geographic

diversification, attracting external customers.

Arm Holdings (NASDAQ:ARM) – Arm

Holdings unveiled a set of chip manufacturing designs that

could shorten the development of data center processors to less

than a year. The announcement highlights competition with

Intel and AMD, while companies like

Amazon and Microsoft are already

adopting the technology. This could speed up innovation in the

sector.

ASML (NASDAQ:ASML) – South Korea’s

Samsung Electronics (KOSPI:005930) sold its entire

remaining stake in ASML, a semiconductor equipment

manufacturer, in the last quarter of 2023. A total of 1.58 million

shares were sold, amounting to 0.4% of ASML.

Despite the sale, the companies will continue to collaborate, as

agreed in a previously signed memorandum of understanding.

General Motors (NYSE:GM) – General

Motors announced on Wednesday that its Cadillac Lyriq

regained eligibility for the $7,500 electric vehicle tax credit,

following battery source adjustments. The change comes due to new

US Treasury rules, reducing the number of eligible EVs. GM expects

more models to qualify after the change.

Ford Motor (NYSE:F) – The United Auto Workers

(UAW) union announced on Wednesday an agreement with

Ford for a local contract covering workers at the

Kentucky truck plant. With 9,251 employees, the plant produces

Ford‘s profitable F-series trucks. This agreement

is separate from the contracts previously signed by Detroit’s three

automakers – Ford, General

Motors, and Stellantis – with the UAW, which included

record wage increases for about 150,000 members.

Stellantis (NYSE:STLA) –

Stellantis announced the start of electric van

production at its Luton, UK, plant from 2025, providing stability

for the 92-year-old facility. The plant will produce five electric

models, in addition to continuing with combustion models.

Nikola (NASDAQ:NKLA) – Stephen Girsky,

Nikola‘s executive chairman, was appointed interim

chief financial officer on February 14, replacing Anastasiya

Pasterick, who resigned in November. Girsky, a former

General Motors executive, took over following

Pasterick’s resignation, becoming the company’s fourth CEO in three

years. Nikola is set to release its quarterly

results soon.

Boeing (NYSE:BA) – Boeing

fired Ed Clark, the leader of the 737 Max program, following an

in-air explosion. Katie Ringgold will take his place. Elizabeth

Lund was promoted to senior vice president of quality. The company

faces criticism for manufacturing defects, pressing for

reforms.

JD.com (NASDAQ:JD) – If JD.com

acquires British retailer Currys, it would represent a strategic

move for the Chinese e-commerce giant, providing a unique

opportunity to expand its presence in the UK and Europe.

Additionally, it would be an effective alternative to tackle the

challenges of the saturated domestic market and intense

competition.

TotalEnergies (NYSE:TTE) – The

TotalEnergies refinery in Port Arthur, Texas, with

a capacity of 238,000 barrels per day, is facing operational

issues, running at minimal production due to failures in the crude

oil distillation unit heaters. Other units, including vacuum

distillation and the coker, were also affected. Furthermore,

TotalEnergies signed a strategic partnership with

Airbus (USOTC:EADSY), providing sustainable

aviation fuel for over half of the airplane manufacturer’s needs in

Europe. The agreement aims to reduce CO2 emissions from aviation,

in line with carbon neutrality goals by 2050.

Chesapeake Energy (NASDAQ:CHK) –

Chesapeake Energy announced spending and natural

gas production cuts due to market oversupply. The company will

reduce wells and expenses, anticipating a production of 2.7 billion

cubic feet per day in 2024. The acquisition of Southwestern

Energy is ongoing.

Earnings

Nvidia (NASDAQ:NVDA) – Nvidia

exceeded Wall Street’s expectations in the fourth quarter, with an

adjusted earnings per share of $5.16 (expected $4.64) and revenue

of $22.10 billion (expected $20.62 billion). Net income was $12.29

billion, a 769% increase from last year’s $1.41 billion. For the

current quarter, revenue of $24 billion is expected. Shares rose

14.55% in Thursday’s pre-market.

Rivian Automotive (NASDAQ:RIVN) – After

reporting significant losses and announcing 10% cuts in its

salaried workforce, shares of the electric vehicle company

plummeted 14.4% in Thursday’s pre-market. Rivian

forecasts electric vehicle production this year well below Wall

Street’s expectations. Last quarter, Rivian

recorded a loss of $1.36 per share, slightly below the LSEG

estimate. Despite this, its revenue of $1.32 billion exceeded

expectations.

Lucid Group (NASDAQ:LCID) – After reporting an

increase in losses, shares of the electric vehicle company fell

about 9% in pre-market trading. Lucid reported

revenue of $157 million in the last quarter, below the LSEG

estimate of $180 million.

Royal Caribbean (NYSE:RCL) – Royal

Caribbean raised its earnings forecast for the year,

driven by strong demand and a solid start to 2024 cruises. RCL

shares rose 4.45% in Thursday’s pre-market, reflecting optimism

about demand. The company expects an adjusted EPS between $9.90 and

$10.10, while analysts anticipate $9.73 per share for the year.

SunRun (NASDAQ:RUN) – Shares of SunRun

Inc. fell 6% in Thursday’s pre-market trading due to

fourth-quarter results falling short of Wall Street’s expectations.

The company reported a net loss of $535.4 million and revenue of

$516.6 million, below estimates. The company faces challenges with

weaker demand and higher interest rates.

Synopsys (NASDAQ:SNPS) – Shares of the software

company rose 4.13% in pre-market trading after reporting earnings

of $3.56 per share, excluding items, beating the LSEG estimate of

$3.43 per share. Moreover, the company forecasts second-quarter

revenues and earnings above expectations.

Etsy (NASDAQ:ETSY) – Shares of the online

commerce company fell 8% in pre-market trading after reporting

earnings per share of 62 cents, below the LSEG estimate of 78

cents. However, Etsy‘s revenue exceeded

expectations.

Lloyds Banking Group (NYSE:LYG) –

Lloyds Banking Group reported a 57% increase in

annual profit, reaching $9.5 billion (£7.5 billion), exceeding

analysts’ expectations. The bank provisioned £450 million for

regulatory costs and announced the appointment of Nathan Bostock to

the board. The group also announced a final dividend of 1.84 pence

and a £2 billion share buyback.

Berkshire Hathaway (NYSE:BRK.B) –

Berkshire Hathaway investors await the release of

fourth-quarter earnings, Warren Buffett’s letter to shareholders,

and the 2023 annual report. Class B shares have risen over 14% this

year, outperforming the S&P 500, as investors analyze details

such as share buybacks, Geico results, and book value.

AssetMark (NYSE:AMK) – In the fourth quarter,

AssetMark saw an increase in advisors and assets,

but revenue fell to $158 million from $164 million the previous

year, due to a decrease in spread-based revenue. Despite this,

adjusted earnings per share rose to 59 cents, surpassing analysts’

expectations.

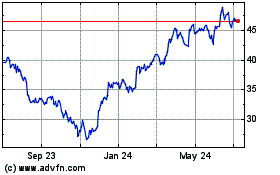

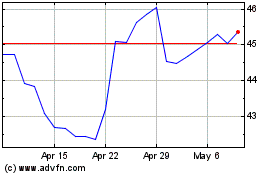

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024