false000168037800016803782024-02-212024-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 21, 2024

SenesTech, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-37941 | | 20-2079805 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

23460 N. 19th Avenue, Suite 110 Phoenix, AZ | | 85027 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (928) 779-4143

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value | | SNES | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 21, 2024, we announced our financial results for the fourth quarter and fiscal year ended December 31, 2023. A copy of our press release announcing these financial results and certain other information is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

The information in this Item 2.02 (including Exhibit 99.1) is furnished pursuant to Item 2.02 and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

We do not have, and expressly disclaim, any obligation to release publicly any updates or any changes in our expectations or any changes in events, conditions, or circumstances on which any forward-looking statement is based.

The text included with this Current Report on Form 8-K is available on our website at www.senestech.com, although we reserve the right to discontinue the availability at any time.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| Exhibit Number | | Exhibits |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: February 21, 2024 | SENESTECH, INC. |

| | |

| By: | /s/ Thomas C. Chesterman |

| | Thomas C. Chesterman |

| | Vice President, Chief Financial Officer, Treasurer and Secretary |

SenesTech Announces 2023 Financial Results

YTD 2024 total revenue up more than 80% compared

to YTD 2023 driven by orders for EvolveTM soft bait

PHOENIX, Ariz., February 21, 2024. SenesTech, Inc. (NASDAQ: SNES, “SenesTech” or the “Company”), the rodent fertility control experts and inventors of the only EPA-registered contraceptive for male and female rats, ContraPest®, today announced 2023 financial results.

“During 2023, we executed on a number of key initiatives that will be the foundation to drive growth into the future, most notably was the development of Evolve, our all-new soft bait product that was launched on a limited basis at the end of 2023,” commented Joel Fruendt, President and CEO of SenesTech. “Since the full launch of Evolve in January 2024, we have seen a significant uptick in interest and orders from a wide range of sales channels and geographies. For instance, we were recently approved as a vendor for a major nationwide hardware retailer; we have signed distribution and stocking agreements for grain management and open field agricultural applications; and we have expanded our geographical reach outside the United States, including Hong Kong, Macau, the United Arab Emirates, Singapore, Australia, New Zealand and The Netherlands.”

Year-to-date 2024 total revenue (through mid-February 2024) is up more than 80% compared to the same period in 2023, driven by orders for Evolve, which represented more than 50% of total revenue and included international revenue for the first time in the Company’s history.

“It is increasingly clear that Evolve is a game changing product that will be a key driver to our revenue growth in 2024,” Fruendt continued.

Looking back at 2023, revenue was $1.2 million compared to $1.0 million in 2022, an increase of 17%. Growth during the year was driven primarily by agribusiness and new distribution agreements and was slowed temporarily in the fourth quarter due to the allocation of resources required for the launch of Evolve. Revenue rapidly increased once full launch happened in January 2024.

Following the successful launch of Evolve for rats, the Company is working on an enhanced form factor and dosing of a soft bait contraceptive product for mice. The product is expected to utilize the same active ingredient with its documented record of efficacy and be designated under the EPA’s minimum risk rules.

“A product for the control of mice is a logical extension of our rodent fertility control solutions,” Fruendt continued. “Our product development team is hard at work with a goal to have a product on the market by mid-2024.”

Tom Chesterman, CFO of SenesTech, added, “We continue to focus on driving operational efficiencies across the organization. Over the course of 2023, we improved operating expenses by nearly $2.0 million compared with 2022. We also improved the balance sheet through a $5.0 million public offering of common stock and warrants in November 2023, of which $1.0 million in warrants have been exercised so far. We are optimistic that as we continue to execute our business plan, the remaining warrants will be a source of cash over the coming quarters.”

Year End 2023 Highlights

•Revenue during 2023 was $1.2 million compared to $1.0 million in 2022, an increase of 17%.

•Gross profit during 2023 was $539,000 compared to $464,000 in 2022, with gross profit margin at 45.2% in 2023 compared to 45.5% in 2022. Gross profit margin for 2023 excluding the impact from new product introductions was 49.3%.

•Net loss during 2023 was $7.7 million, compared to a net loss of $9.7 million for 2022, an improvement of $1.9 million.

•Adjusted EBITDA loss, which is a non-GAAP measure of operating performance, for 2023 was $6.9 million compared to $8.5 million in 2022, an improvement of $1.5 million.

•Cash at the end of December 2023 was $5.4 million.

Use of Non-GAAP Measure

Adjusted EBITDA is a non-GAAP measure. However, this measure is not intended to be a substitute for those financial measures reported in accordance with GAAP. Adjusted EBITDA has been included because management believes that, when considered together with the GAAP figures, it provides meaningful information related to our operating performance and liquidity and can enhance an overall understanding of financial results and trends. Adjusted EBITDA may be calculated by us differently than other companies that disclose measures with the same or similar term. See our attached financials for a reconciliation of this non-GAAP measure to the nearest GAAP measure.

Conference Call Details

Date and Time: Wednesday, February 21, 2024, at 5:00 pm ET

Call-in Information: Interested parties can access the conference call by dialing (844) 308-3351 or (412) 317-5407.

Live Webcast Information: Interested parties can access the conference call via a live Internet webcast, which is available in the Investor Relations section of the Company’s website at https://app.webinar.net/KODd6Vn6ApQ or http://senestech.investorroom.com/.

Replay: A teleconference replay of the call will be available for seven days at (877) 344-7529 or (412) 317-0088, replay access code 3232725. A webcast replay will be available in the Investor Relations section of the Company’s website at http://senestech.investorroom.com/ for 90 days.

About SenesTech

We are committed to improving the health of the world by humanely managing animal pest populations through fertility control. We are experts in fertility control to manage animal pest populations. We invented ContraPest, the only U.S. EPA-registered contraceptive for male and female rats, and Evolve, an EPA-designated minimum-risk contraceptive currently offered for rats. ContraPest and Evolve fit seamlessly into all integrated pest management programs, significantly improving the overall goal of effective pest management. We strive for clean cities, efficient businesses and happy households – with a product designed to be humane, effective and sustainable.

For more information visit https://senestech.com/.

Safe Harbor Statement

This press release contains “forward-looking statements” within the meaning of federal securities laws, and we intend that such forward-looking statements be subject to the safe harbor created thereby. Such forward-looking statements include, among others, our belief that our execution on a number of key initiatives during 2023, will be the foundation to drive growth into the future, most notably was the development of Evolve, our all-new soft bait product that was launched on a limited basis at the end of 2023; our belief that it is increasingly clear that Evolve is a game-changing product that will be a key driver to our sales growth in 2024; our development of a soft bait contraceptive product for mice, which is expected to utilize the same active ingredient with its documented record of efficacy and be designated under the EPA’s minimum risk rules; our belief that a product for the control of mice is a logical extension of our rodent fertility control solutions; our goal to have a contraceptive product for mice on the market by mid-2024; our continued focus on driving operational efficiencies across the organization; and our optimism that as we continue to execute our business plan, the remaining warrants from the November 2023 offering will be a source of cash over the coming quarters. Forward-looking statements may describe future expectations, plans, results or strategies and are often, but not always, made through the use of words such as “believe,” “may,” “future,” “plan,” “will,” “should,” “expect,” “anticipate,” “eventually,” “project,” “estimate,” “continuing,” “intend” and similar words or phrases. You are cautioned that such statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from those reflected by such forward-looking statements. Such factors include, among others, the successful commercialization of our products; market acceptance of our products; our financial performance, including our ability to fund operations; our ability to regain and maintain compliance with Nasdaq’s continued listing requirements; regulatory approval and regulation of our products; and other factors and risks identified from time to time in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. All forward-looking statements contained in this press release speak only as of the date on which they were made and are based on management's assumptions and estimates as of such date. Except as required by law, we do not undertake any obligation to publicly update any forward-looking statements, whether as a result of the receipt of new information, the occurrence of future events or otherwise.

CONTACT:

Investors: Robert Blum, Lytham Partners, LLC, 602-889-9700, senestech@lythampartners.com

Company: Tom Chesterman, Chief Financial Officer, SenesTech, Inc., 928-779-4143

SENESTECH, INC.

BALANCE SHEETS

(In thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | |

| As of December 31, |

| 2023 | | 2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 5,395 | | | $ | 4,775 | |

| Accounts receivable, net | 95 | | | 113 | |

| Prepaid expenses | 388 | | | 378 | |

| Inventory, net | 795 | | | 853 | |

| | | |

| Total current assets | 6,673 | | | 6,119 | |

| Right to use assets, operating leases | 210 | | | 347 | |

| Property and equipment, net | 388 | | | 294 | |

| Other noncurrent assets | 22 | | | 22 | |

| Total assets | $ | 7,293 | | | $ | 6,782 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 150 | | | $ | 540 | |

| Accrued expenses | 368 | | | 560 | |

| Current portion of operating lease liability | 217 | | | 180 | |

| Current portion of notes payable | 33 | | | — | |

| Deferred revenue | 18 | | | 44 | |

| Total current liabilities | 786 | | | 1,324 | |

| Operating lease liability, less current portion | — | | | 179 | |

| Notes payable, less current portion | 156 | | | — | |

| Total liabilities | 942 | | | 1,503 | |

| Stockholders’ equity: | | | |

| Common stock | 5 | | | — | |

| Additional paid-in capital | 136,259 | | | 127,482 | |

| Accumulated deficit | (129,913) | | | (122,203) | |

| Total stockholders’ equity | 6,351 | | | 5,279 | |

| Total liabilities and stockholders’ equity | $ | 7,293 | | | $ | 6,782 | |

SENESTECH, INC.

STATEMENTS OF OPERATIONS

(In thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, |

| | | | | 2023 | | 2022 |

| | | | | | | |

| Product sales, net | | | | | $ | 1,193 | | | $ | 1,019 | |

| Cost of sales | | | | | 654 | | | 555 | |

| Gross profit | | | | | 539 | | | 464 | |

| Operating expenses: | | | | | | | |

| Research and development | | | | | 1,228 | | | 1,859 | |

| Selling, general and administrative | | | | | 7,043 | | | 8,279 | |

| Total operating expenses | | | | | 8,271 | | | 10,138 | |

| Loss from operations | | | | | (7,732) | | | (9,674) | |

| Other income (expense): | | | | | | | |

| Interest income | | | | | 26 | | | 7 | |

| Interest expense | | | | | (4) | | | (2) | |

| Miscellaneous expense | | | | | — | | | (26) | |

| Other income (expense), net | | | | | 22 | | | (21) | |

| Net loss | | | | | $ | (7,710) | | | $ | (9,695) | |

| Weighted average shares outstanding — basic and diluted | | | | | 669,861 | | 65,473 |

| Loss per share — basic and diluted | | | | | $ | (11.51) | | | $ | (148.08) | |

SenesTech Inc.

Itemized Reconciliation Between Net Loss and Adjusted EBITDA (non-GAAP)

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, |

| | | | | 2023 | | 2022 |

| Net loss (as reported, GAAP) | | | | | $ | (7,710) | | | $ | (9,695) | |

| Non-GAAP adjustments: | | | | | | | |

| Interest income, net | | | | | (22) | | | (5) | |

| Stock-based compensation expense | | | | | 555 | | | 711 | |

| Severance costs | | | | | 119 | | | 311 | |

| Loss on sale of assets | | | | | — | | | 28 | |

| Depreciation expense | | | | | 135 | | | 183 | |

| Total non-GAAP adjustments | | | | | 788 | | | 1,227 | |

| Adjusted EBITDA loss (non-GAAP) | | | | | $ | (6,922) | | | $ | (8,467) | |

Cover

|

Feb. 21, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 21, 2024

|

| Entity Registrant Name |

SenesTech, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37941

|

| Entity Tax Identification Number |

20-2079805

|

| Entity Address, Address Line One |

23460 N. 19th Avenue

|

| Entity Address, Address Line Two |

Suite 110

|

| Entity Address, City or Town |

Phoenix

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85027

|

| City Area Code |

928

|

| Local Phone Number |

779-4143

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

SNES

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001680378

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

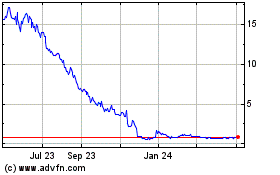

SenesTech (NASDAQ:SNES)

Historical Stock Chart

From Mar 2024 to Apr 2024

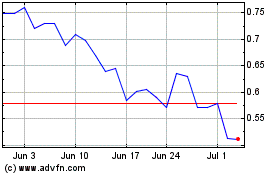

SenesTech (NASDAQ:SNES)

Historical Stock Chart

From Apr 2023 to Apr 2024