false

0001455365

0001455365

2024-02-15

2024-02-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 15, 2024

Cognition

Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40886 |

|

13-4365359 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification No.) |

2500 Westchester Ave.

Purchase, NY |

|

10577 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (412) 481-2210

Not

Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of Exchange on Which

Registered |

| Common Stock, par value $0.001 per share |

|

CGTX |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On February 15,

2024, the Board of Directors of Cognition Therapeutics, Inc. (the “Company”), based upon the recommendation of

the Compensation Committee, granted certain Performance Restricted Stock Units (“PSUs”) to employees and officers of

the Company, including (i) Lisa Ricciardi, the Company’s Chief Executive Officer, (ii) John Doyle, the Company’s

Chief Financial Officer, and (iii) Anthony Caggiano, the Company’s Chief Medical Officer. Ms. Ricciardi was awarded 150,000

PSUs, Mr. Doyle was awarded 60,000 PSUs and Dr. Caggiano was awarded 130,000 PSUs. The PSUs will vest in two equal installments,

in each case, upon the one year anniversary of the achievement of certain clinical milestones.

The foregoing description of the PSUs does not

purport to be complete and is subject to, and qualified in its entirety by, the form of Performance Restricted Stock Unit Award Agreement,

which is filed and attached hereto as Exhibit 10.1, and is incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits |

The following exhibits are being filed herewith:

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 20, 2024

| |

COGNITION THERAPEUTICS, INC. |

| |

|

|

| |

By: |

/s/ Lisa Ricciardi |

| |

|

Name: Lisa Ricciardi |

| |

|

Title: President and Chief Executive Officer |

Exhibit 10.1

COGNITION THERAPEUTICS, INC.

2021 EQUITY INCENTIVE PLAN

PERFORMANCE RESTRICTED

STOCK UNIT

GRANT NOTICE

AND AWARD AGREEMENT

Cognition Therapeutics, Inc.,

a Delaware corporation (the “Company”), pursuant to its 2021 Equity Incentive Plan (the “Plan”),

hereby grants to the individual listed below (the “Participant”) the number of performance restricted stock units

set forth below (the “Performance Restricted Stock Units” or “PRSUs”). The PRSUs described in this

Grant Notice (the “Grant Notice”) are subject to the terms and conditions set forth in the Award Agreement attached

hereto as Exhibit A (the “Agreement”) and the Plan, each of which is incorporated herein by reference.

Unless otherwise defined herein, capitalized terms used in this Grant Notice and the Agreement will have the meanings defined in the

Plan.

| Name of Participant: |

|

|

| |

|

|

| Grant Date: |

|

|

| |

|

|

| No. of Performance Restricted Stock Units |

|

|

| for Milestone 1 Award (as defined below): |

|

|

| |

|

|

| No. of Performance Restricted Stock Units |

|

|

| for Milestone 2 Award (as defined below): |

|

|

| |

|

|

| Vesting Schedule: |

|

See Appendix A attached to the Agreement |

By

signing below, Participant agrees to be bound by the terms and conditions of the Plan, the Agreement and this Grant Notice. This document

may be executed, including by electronic means, in multiple counterparts, each of which will be deemed an original, and all of which

together will be deemed a single instrument.

| COGNITION THERAPEUTICS, INC. |

PARTICIPANT |

EXHIBIT A

TO

PERFORMANCE RESTRICTED STOCK UNIT GRANT NOTICE

AWARD AGREEMENT

1. Award

of Performance Restricted Stock Units. Effective as of the Grant Date set forth in the Grant Notice, the Company has granted to Participant

the number of PRSUs set forth in the Grant Notice, subject to the restrictions and on the terms and conditions set forth in the Grant

Notice, the Plan and this Agreement. Each PRSU represents the right to receive one Share at the times and subject to the conditions set

forth herein.

2. Restrictions

on Transfer of Award. This Award may not be sold, transferred, pledged, assigned or otherwise encumbered or disposed of by the Participant,

and any shares of Stock issuable with respect to the Award may not be sold, transferred, pledged, assigned or otherwise encumbered or

disposed of until (i) the PRSUs have vested as provided in Section 2 of this Agreement and (ii) shares of Stock have been

issued to the Participant in accordance with the terms of the Plan and this Agreement.

3. Earning

of Performance Restricted Stock Units. Each Milestone Award (as such term is defined on on Appendix A, attached hereto, shall

become earned based on the achievement of certain clinical milestones as described on Appendix A. The number of PRSUs determined to be

earned shall be referred to herein as “Earned PRSUs.”

4. Vesting

of Performance Restricted Stock Units. With respect to any Earned PRSUs underlying the Milestone 1 Award and Milestone 2 Award, the

restrictions and conditions of Section 1 of this Agreement shall lapse once the PRSUs become vested as set forth in Appendix A.

The Administrator may at any time accelerate the vesting schedule specified in Appendix A or Paragraphs 3 and 4 of this Agreement.

Upon Participant’s death during his or her continuous service with the Company, any PRSUs that are outstanding and unvested immediately

prior to Participant’s death will remain outstanding for ninety (90) days, during which time the Committee may, in its sole discretion,

vest all or a portion of such PRSUs. If the Committee decides to vest any PRSUs under this Section 4 it may condition such vesting

on the execution by the Participant’s estate and/or beneficiaries of a general release of claims against the Company and its affiliates,

in such form as the Company may prescribe (a “Release”). Upon the ninetieth (90th) day following Participant’s

death, any portion of the unvested PRSUs that the Committee has not determined to vest in accordance with this Section 4 will be

forfeited.

5. Change

in Control. Subject to the Participant’s continued service relationship with the Company through the consummation of any Change

in Control (as defined in the Plan), all time-based vesting conditions of the earned PRSUs shall be deemed fully satisfied immediately

prior to the consummation of the Change in Control.

6. Termination

of Service Relationship. If the Participant’s service relationship with the Company and its affiliated companies terminates

for any reason (including death or disability) prior to the satisfaction of the earning or vesting conditions set forth in Sections 3

and 4 above, any PRSUs that have not become Earned PRSUs or have not otherwise vested as of such date shall automatically and without

notice terminate and be forfeited, and neither the Participant nor any of his or her successors, heirs, assigns, or personal representatives

will thereafter have any further rights or interests in such unvested Performance Restricted Stock Units.

7. Settlement.

(a) Shares

will be issued in respect of Vested PRSUs within sixty (60) days following the applicable vesting date. For avoidance of doubt, this

settlement timing is intended to comply with the “short-term deferral” exemption from Section 409A of the Code.

(b) The

PRSUs will not confer on Participant any rights as a stockholder of the Company until Shares are actually issued in settlement of such

PRSUs.

(c) Notwithstanding

the foregoing, to the extent provided in Prop. Treas. Reg. § 1.409A-1(b)(4)(ii) or any successor provision, the Company may

delay settlement of PRSUs if it reasonably determines that such settlement would violate federal securities laws or any other applicable

law.

8. Incorporation

of Plan. Notwithstanding anything herein to the contrary, this Agreement shall be subject to and governed by all the terms and conditions

of the Plan, including the powers of the Administrator set forth in Section 2 of the Plan. Capitalized terms in this Agreement shall

have the meaning specified in the Plan, unless a different meaning is specified herein.

9. Tax

Withholding. The Participant shall, not later than the date or dates as of which the receipt or vesting of this Award becomes a taxable

event for Federal income tax purposes, pay to the Company or make arrangements satisfactory to the Administrator for payment of any Federal,

state, and local taxes required by law to be withheld on account of such taxable event. The Company shall have the authority to cause

the required tax withholding obligation to be satisfied, in whole or in part, by withholding from shares of Stock to be issued to the

Participant a number of shares of Stock with an aggregate Fair Market Value that would satisfy the withholding amount due.

10.

Section 409A of the Code. This Agreement shall be interpreted in such a manner

that all provisions relating to the settlement of the Award are exempt from the requirements of Section 409A of the Code as “short-term

deferrals” as described in Section 409A of the Code.

11. Section 409A.

The grant of PRSUs is intended to be exempt from Section 409A of the Code and should be interpreted accordingly. Nonetheless, the

Company does not guarantee the tax treatment of the PRSUs.

12. No

Continuation of Service. Neither the Plan nor this Agreement will confer upon Participant any right to continue in the employment

or service of the Company or any of its Affiliates, or limit in any respect the right of the Company or its Affiliates to discharge Participant

at any time, for any reason.

13. The

Plan. Participant has received a copy of the Plan, has read the Plan and is familiar with its terms, and hereby accepts the Award

subject to the terms and provisions of the Plan. Pursuant to the Plan, the Committee is authorized to interpret the Plan and to adopt

rules and regulations not inconsistent with the Plan as it deems appropriate. Participant hereby agrees to accept as binding, conclusive

and final all decisions or interpretations of the Committee with respect to questions arising under the Plan, the Grant Notice or this

Agreement.

14. Company

Policies. Participant agrees, in consideration for the grant of the Performance Restricted Stock Units, to be subject to any policies

of the Company and its Affiliates regarding clawbacks, securities trading, and hedging or pledging of securities that may be in effect

from time to time, or as may otherwise be required by applicable law, regulation or exchange listing standard.

15. Entire

Agreement. The Grant Notice and this Agreement, together with the Plan, represent the entire agreement between the parties with respect

to the subject matter hereof and supersede any prior agreement, written or otherwise, relating to the subject matter hereof.

16. Amendment.

This Agreement may only be amended by a writing signed by each of the parties hereto; provided that the Company may amend this Agreement

without Participant’s consent, if the amendment does not materially impair Participant’s rights hereunder.

17. Governing

Law. This Agreement will be construed in accordance with the laws of the State of Delaware, without regard to the application of

the principles of conflicts of laws.

18. Headings.

The headings in this Agreement are for convenience only. They form no part of the Agreement and will not affect its interpretation.

19. Tax

Withholding. Participant acknowledges that the issuance of Shares hereunder will give rise to taxable income subject to required

withholding. In accordance with Section 15 of the Plan, the obligations of the Company hereunder are conditioned on the Participant

timely paying, or otherwise making arrangements satisfactory to the Company regarding the timely satisfaction of, such required withholding.

20. Electronic

Delivery of Documents. Participant authorizes the Company to deliver electronically any prospectuses or other documentation related

to the Option and any other compensation or benefit plan or arrangement in effect from time to time (including, without limitation, reports,

proxy statements or other documents that are required to be delivered to participants in such arrangements pursuant to federal or state

laws, rules or regulations). For this purpose, electronic delivery will include, without limitation, delivery by means of e-mail

or e-mail notification that such documentation is available on the Company’s Intranet site. Upon written request, the Company will

provide to Participant a paper copy of any document also delivered to Participant electronically. The authorization described in this

paragraph may be revoked by Participant at any time by written notice to the Company.

21. Data

Privacy Consent. In order to administer the Plan and this Agreement and to implement or structure future equity grants, the Company,

its subsidiaries and affiliates and certain agents thereof (together, the “Relevant Companies”) may process any and

all personal or professional data, including but not limited to Social Security or other identification number, home address and telephone

number, date of birth and other information that is necessary or desirable for the administration of the Plan and/or this Agreement (the

“Relevant Information”). By entering into this Agreement, the Participant (i) authorizes the Company to collect,

process, register and transfer to the Relevant Companies all Relevant Information; (ii) waives any privacy rights the Participant

may have with respect to the Relevant Information; (iii) authorizes the Relevant Companies to store and transmit such information

in electronic form; and (iv) authorizes the transfer of the Relevant Information to any jurisdiction in which the Relevant Companies

consider appropriate. The Participant shall have access to, and the right to change, the Relevant Information. Relevant Information will

only be used in accordance with applicable law.

22. Notices.

Notices hereunder shall be mailed or delivered to the Company at its principal place of business and shall be mailed or delivered to

the Participant at the address on file with the Company or, in either case, at such other address as one party may subsequently furnish

to the other party in writing.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

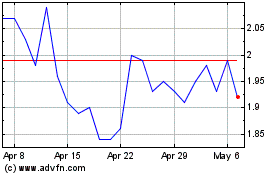

Cognition Therapeutics (NASDAQ:CGTX)

Historical Stock Chart

From Apr 2024 to May 2024

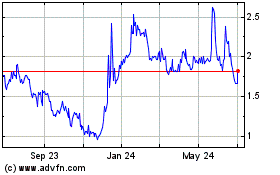

Cognition Therapeutics (NASDAQ:CGTX)

Historical Stock Chart

From May 2023 to May 2024