false

0000724742

0000724742

2024-02-14

2024-02-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 20, 2024 (February 14, 2024)

Trinity Place Holdings Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-08546 |

|

22-2465228 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

340 Madison Avenue, New York, New York 10173

(Address of principal executive offices) (Zip Code)

(212) 235-2190

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered or to be registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange on which

registered |

| Common Stock $0.01 Par Value Per Share |

|

TPHS |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into

a Material Definitive Agreement.

On

February 14, 2024 (the “Closing Date”), in connection with the closing of the transactions contemplated by the Stock

Purchase Agreement, dated as of January 5, 2024 (as amended, the “Stock Purchase

Agreement”), between Trinity Place Holdings Inc. (the “Company”), TPHS

Lender LLC, the lender under the Company’s corporate credit facility (the “Company Investor”)

and TPHS Investor LLC, an affiliate of Company Investor (the “JV Investor”,

and together with the Company Investor, the “Investor”), the applicable

parties entered into the following agreements:

| · | the Company and the JV Investor entered into an amended and restated

limited liability company operating agreement of TPHGreenwich Holdings LLC (the “JV”) in

substantially the form as previously disclosed (the “JV Operating Agreement”),

pursuant to which the JV Investor was appointed the initial manager of, and acquired a five percent (5%) interest in, the JV, which JV

will continue to own, indirectly, all of the real property assets and liabilities of the Company; |

| · | the JV and a newly formed subsidiary of the Company (the “TPH

Asset Manager”) entered into an asset management agreement in substantially the form as previously disclosed (the “Asset

Management Agreement”), pursuant to which the JV hired the TPH Asset Manager to act as initial asset manager for the JV for

an annual management fee; |

| · | the Company entered into the Borrower Assignment and Assumption Agreement (the “Borrower Assignment

and Assumption Agreement”), pursuant to which the Company assigned all of its rights, interests, duties, obligations and liabilities

in, to and under the Credit Agreement, dated as of December 19, 2019 (as amended, restated, amended and restated, supplemented or otherwise

modified from time to time prior to the date hereof, the “Original CCF”), by and among the Company, as borrower, certain

subsidiaries of the Company as guarantors, and the Company Investor, as initial lender and as administrative agent, and each other

document and instrument related to the CCF to the JV. In connection with the Borrower Assignment and Assumption Agreement, the Company

also entered into a Holdco Pledge Agreement, pursuant to which the Company agreed to pledge all of its membership interests in the JV

to Mount Street US (Georgia) LLP (“Mount Street”), the administrative agent under the Amended and Restated CCF (defined

below); |

| · | the JV entered into an Amended and Restated Credit Agreement, among the JV, as borrower, certain subsidiaries

of the JV party thereto, as guarantors, the Company Investor, as lender and Mount Street, as administrative agent (the “Amended

and Restated CCF”), pursuant to which the Original CCF was amended and restated in its entirety in order to, among other things,

(i) release certain subsidiaries of the Company that were guarantors under the Original CCF from their guarantee obligations thereunder,

(ii) extend the maturity date to June 30, 2026, and (iii) the JV incurred an advance of $272,609; |

| · | TPHGreenwich Owner LLC, the subsidiary of the JV that owns the real property known as 77 Greenwich Street,

New York, New York (the “Mortgage Borrower”), entered into a third amendment

to the Master Loan Agreement, dated as of October 22, 2021, as amended, supplemented or otherwise modified from time to time), by and

between Mortgage Borrower, as borrower, the Company, as guarantor, MPF Greenwich Lender LLC (as successor-in-interest to Macquarie PF

Inc.), as lender, and certain entities affiliated with the Investor, as supplemental guarantors (the “MLA Amendment”),

which, among other things, provides that (i) the original building loan will be reduced to $125,347,878.00, (ii) an additional

project loan will be made in the amount of $2,850,000.00, (iii) the completion date will be extended to December 31, 2024, (iv) the maturity

date will be extended to October 23, 2025 with an option to extend for one year and (v) TPHGreenwich Mezz LLC, the direct parent entity

of Mortgage Borrower, will enter into a new pledge agreement pursuant to which it will pledge 100% of its membership interests in Mortgage

Borrower. The MLA Amendment further provides that the existing Completion Guaranty and Interest and Carry Guaranty by the Company, as

original guarantor, are terminated, and that the existing Recourse Guaranty and Environmental Indemnification Agreement by the Company,

as original guarantor, are only in full force and effect with respect to matters arising prior to the execution of the MLA Amendment;

and |

| · | TPHGreenwich Subordinate Mezz LLC, a subsidiary of the JV (“Mezz Borrower”), entered

into the second amendment to the amended and restated mezzanine loan agreement dated October 22, 2021 by and between Mezz Borrower, as

borrower, TPHS Lender II LLC, an affiliate of the Investor, as agent and lender, and the Company, as guarantor (the “Mezz Loan

Amendment”), which provides for, among other things: the (i) termination of the pledge by TPHGreenwich Mezz LLC of 100% of its

membership interests in the Mortgage Borrower, (ii) extension of the completion date to December 31, 2024, (iii) the extension of the

maturity date to October 23, 2025 with an additional option to extend for 1 year and (iv) termination of the Completion Guaranty, Carry

Guaranty and Equity Funding Guaranty by the Company, as original guarantor; and that the Recourse Guaranty and Environmental Indemnification

Agreement by the Company, as original guarantor, are only in full force and effect with respect to matters arising prior to the execution

of the second amendment. |

Item 1.02. Termination

of a Material Definitive Agreement.

On

the Closing Date, the Company and the Company Investor entered into an agreement pursuant to which the Warrant Agreement, dated as of

December 19, 2019, among the Company and the Company Investor, as amended, was terminated in accordance with the terms of the Stock Purchase

Agreement.

Item 2.01. Completion

of Acquisition or Disposition of Assets.

On

the Closing Date, the Company consummated the transactions contemplated by the Stock Purchase Agreement, including, among other things,

(i) the issuance of 25,112,245 shares of common stock, par value $0.01 per share (the “Common Stock”)

to the Company Investor, (ii) the entry by Company and the JV Investor into the JV Operating Agreement, and (iii) the entry by the JV

and TPH Asset Manager into the Asset Management Agreement (collectively, the “Transactions”).

Item 5.07 Submission

of Matters to a Vote of Security Holders.

As

previously disclosed, the Company filed with the Securities and Exchange Commission (the “SEC”) a definitive consent

solicitation statement on Schedule 14A (the “Consent Solicitation Statement”) seeking consent from stockholders to

the stockholder proposals relating to the Transactions, as described in more detail in the Consent Solicitation Statement (the “Stockholder

Proposals”). The affirmative vote of the Company’s stockholders of record as of the record date of January 2,

2024 holding a majority of the outstanding Common Stock was required to authorize and adopt the Stockholder Proposals (the “Required

Stockholder Consent”). On February 7, 2024, the Company received the Required Stockholder Consent, upon which such stockholder

consents became irrevocable in accordance with the terms of the consent solicitation.

The final voting results

of the consent solicitation as of the Closing Date were as set forth below:

| 1. | Authorization of the Stock Purchase Agreement and the transactions contemplated thereby, as described

in the Consent Solicitation Statement, by adoption of the following resolutions: |

WHEREAS, the Board has adopted,

approved and authorized the Stock Purchase Agreement, JV Operating Agreement and the Transactions contemplated thereby (the “Transactions”)

and has recommended that the Company’s stockholders adopt resolutions authorizing the Stock Purchase Agreement, JV Operating Agreement

and the Transactions.

NOW THEREFORE, BE IT RESOLVED,

that the Stock Purchase Agreement, JV Operating Agreement and the Transactions are hereby authorized in all respects; and be it further

RESOLVED, that, pursuant to Section

271(b) of the Delaware General Corporation Law, notwithstanding the approval of the Stock Purchase Agreement, JV Operating Agreement and

the Transactions, the Board may abandon the Stock Purchase Agreement, JV Operating Agreement and the Transactions without further action

by the Company’s stockholders, subject to the rights, if any, of third parties under any contract relating thereto.

|

For |

|

Against |

|

Abstentions |

|

|

Broker Non-Votes |

|

| 24,731,948 |

|

353,839 |

|

|

399 |

|

|

|

0 |

|

|

| 2. | Approval, pursuant to Section 713(a) of the NYSE American LLC Company Guide, of the issuance of 25,112,245

shares of Common Stock of the Company to the Company Investor in accordance with the terms and conditions of the Stock Purchase Agreement

and as described in the Consent Solicitation Statement. |

|

For |

|

Against |

|

Abstentions |

|

|

Broker Non-Votes |

|

| 24,682,084 |

|

403,703 |

|

|

399 |

|

|

|

0 |

|

|

| 3. | Approval, pursuant to Section 713(b) of the NYSE American LLC Company Guide, of the issuance of 25,112,245

shares of Common Stock of the Company to the Company Investor in accordance with the terms and conditions of the Stock Purchase Agreement

and as described in the Consent Solicitation Statement. |

|

For |

|

Against |

|

Abstentions |

|

|

Broker Non-Votes |

|

| 24,682,068 |

|

403,703 |

|

|

415 |

|

|

|

0 |

|

|

Item 7.01. Regulation

FD Disclosure.

On

February 20, 2024, the Company issued a press release announcing the closing of the Transactions. A copy of the press release is included

herewith as Exhibit 99.1, which is incorporated by reference into this Item 7.01.

The

information under this Item 7.01, including Exhibit 99.1 hereto, is being furnished herewith and shall not be deemed “filed”

for the purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall such information

be deemed incorporated by reference into any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific

reference in such filing. Furthermore, the furnishing of information under Item 7.01 of this Current Report on Form 8-K is not intended

to constitute a determination by the Company that the information contained herein, including the exhibit hereto, is material or that

the dissemination of such information is required by Regulation FD.

Item 9.01. Financial

Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

TRINITY PLACE HOLDINGS INC. |

| |

|

| Date: February 20, 2024 |

/s/ Steven Kahn |

| |

Steven Kahn |

| |

Chief Financial Officer |

Exhibit 99.1

Trinity Place Holdings Inc. Completes Recapitalization

Transactions

New York, New York, February 20, 2024 —

Trinity Place Holdings Inc. (NYSE American: TPHS) (the “Company”) announced that on February 14, 2024 the Company closed its

previously announced recapitalization transactions. In connection with these transactions, the maturity date of each of the mortgage

loan agreement and mezzanine loan agreement for the 77 Greenwich property was extended to October 23, 2025 with an option to extend for

an additional year. At the closing, the lender under the Company’s corporate credit facility purchased 25,112,245 shares

of common stock of the Company and the maturity date of the Company’s corporate credit facility was extended to June 30, 2026. In

addition, an affiliate of the lender acquired a 5% interest in and became the manager of the joint venture that holds the Company’s

real estate assets and related liabilities, including the corporate credit facility, with the Company retaining a 95% interest in the

joint venture, in addition to substantial federal, state and local tax net operating losses and certain intellectual property assets.

The joint venture has additionally engaged the Company to act as asset manager for the joint venture for an annual management fee.

The Company believes that the transactions will allow for an improved structure for a new investor to invest in the Company, which is

less complex as a result of the real estate assets and substantially all liabilities being off-balance sheet. In addition, the parties

have agreed to certain provisions in the stock purchase agreement to accommodate a new strategic partner that may invest in the Company.

About Trinity Place Holdings

Trinity Place Holdings

Inc. is a real estate holding, investment, development and asset management company. As of February 14, 2024, the Company’s real

estate assets and related liabilities are held through an entity owned 95% by the Company, with an affiliate of the lender under the Company’s

corporate credit facility owning a 5% interest in and acting as manager of such entity. These real estate assets include (i) the

property located at 77 Greenwich Street in Lower Manhattan, which is substantially complete as a mixed-use project consisting of a 90-unit

residential condominium tower, retail space and a New York City elementary school, (ii) a 105-unit, 12-story multi-family property located

at 237 11th Street in Brooklyn, New York, and (iii) a property occupied by a retail tenant in Paramus, New Jersey.

The Company controls a variety of intellectual property assets focused on the consumer sector, a legacy of its predecessor, Syms Corp.,

including FilenesBasement.com, its rights to the Stanley Blacker® brand, as well as the intellectual property associated with the

Running of the Brides® event and An Educated Consumer is Our Best Customer® slogan. In addition, the Company had approximately

$305.4 million of federal net operating loss carryforwards at September 30, 2023, as well as approximately $291.7 million of various

state and local NOLs, which can be used to reduce its future taxable income and capital gains.

Forward Looking Statements

This press release includes forward-looking statements

within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act

of 1995. These forward-looking statements are based on current expectations and projections about future events and are not guarantees

of future performance or results and involve risks and uncertainties that cannot be predicted or quantified, and, consequently, the actual

performance of the Company may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties

include the risks and uncertainties, as well as the other factors, described in more detail in the Company’s filings with the SEC,

including its Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as may be updated or supplemented by any subsequent

Quarterly Reports on Form 10-Q or other filings with the SEC. Readers are cautioned not to place undue reliance on such statements which

speak only as of the date they are made. The Company does not undertake any obligation to update or release any revisions to any forward-looking

statement or to report any events or circumstances after the date of this communication or to reflect the occurrence of unanticipated

events except as required by law. The forward-looking statements contained herein speak only as of the date hereof, and the Company

assumes no obligation to update any forward-looking statements, whether as a result of new information, subsequent events or otherwise,

except as required by law.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

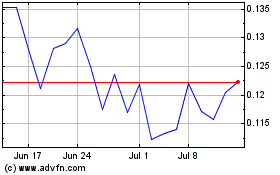

Trinity Place (AMEX:TPHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

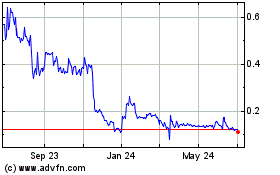

Trinity Place (AMEX:TPHS)

Historical Stock Chart

From Apr 2023 to Apr 2024