0001599298FALSE00015992982024-02-202024-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 20, 2024

| | | | | | | | |

| Summit Therapeutics Inc. |

| (Exact Name of Registrant as Specified in Its Charter) |

| | | |

| Delaware | 001-36866 | 37-1979717 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| |

601 Brickell Key Drive, Suite 1000, Miami, FL | 33131 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (650) 460-8308

| | |

| Not applicable |

| (Former Name or Former Address, If Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common stock, $0.01 par value per share | SMMT | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On February 20, 2024, Summit Therapeutics Inc. (the “Company”) issued a press release announcing its financial results and operational progress for the fourth quarter and full year ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 2.02 as if fully set forth herein.

The information in this Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | |

Exhibit Number | Description |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| | SUMMIT THERAPEUTICS INC. |

| | |

| | |

| Date: February 20, 2024 | By: | /s/ Ankur Dhingra |

| | | Chief Financial Officer |

| | | (Principal Financial Officer) |

Summit Therapeutics Reports Financial Results and Operational Progress

for the Fourth Quarter and Year Ended December 31, 2023

Actively Enrolling Two Phase III Clinical Studies in NSCLC for Ivonescimab: HARMONi and HARMONi-3

Updated Phase II Data Announced for Ivonescimab Highlighting 24-Month OS Rate of 64.8% in 1L Squamous NSCLC Patients and mOS of 22.5 Months in 2L+ EGFRm, TKI-progressed NSCLC Patients

SITC 2023 Poster Presentation Featured Novel Cooperative Binding Characteristics of Ivonescimab,

Enabling Higher Affinity and Avidity in the Tumor Microenvironment

Updated Guidance to Extend Cash Runway for Operations into Q1 2025, versus Prior Guidance of Q3 2024

Miami, Florida, February 20, 2024 - Summit Therapeutics Inc. (NASDAQ: SMMT) ("Summit," "we," or the "Company") today reports its financial results and provides an update on its operational progress for the fourth quarter and year-ended December 31, 2023.

Operational & Corporate Updates

•Our operational progress continues with ivonescimab (SMT112), an investigational, potentially first-in-class bispecific antibody combining the effects of immunotherapy via a blockade of PD-1 with the anti-angiogenesis effects associated with blocking VEGF into a single molecule:

◦We are actively engaged in development activities for ivonescimab. In just over one year since we closed our in-licensing transaction for ivonescimab, we have:

▪Held multiple meetings with the US Food & Drug Administration (FDA) regarding our planned Phase III clinical program and incorporated this feedback accordingly.

▪Begun our clinical development in non-small cell lung cancer (NSCLC) and are actively enrolling two Phase III trials in the following proposed indications:

•HARMONi Phase III Trial: Ivonescimab combined with chemotherapy in patients with epidermal growth factor receptor (EGFR)-mutated, locally advanced or metastatic non-squamous NSCLC who have progressed after treatment with a third-generation EGFR tyrosine kinase inhibitor (TKI), with enrollment completion expected in the second half of 2024, and

•HARMONi-3 Phase III Trial: Ivonescimab combined with chemotherapy in first-line metastatic squamous NSCLC patients, with the first patient having been treated in the fourth quarter of 2023.

◦In November 2023, a poster presentation was featured at the 38th Annual Meeting of the Society for Immunotherapy of Cancer (SITC) highlighting the novel mechanism of action and enhanced binding characteristics of ivonescimab. The tetravalent structure (four binding sites) of ivonescimab enables higher avidity (accumulated strength of multiple binding interactions) in the tumor microenvironment with over 18-fold increased binding affinity to PD-1 in the presence of VEGF in vitro, and over 4-times increased binding affinity to VEGF in the presence of PD-1 in vitro.1

◦In addition to promising Phase II data presented at the 2023 American Society of Clinical Oncology (ASCO) Annual Meeting, Akeso announced updates to the Phase II data in January 2024. Notably, in patients with first line advanced or metastatic NSCLC without actionable genomic alterations (Cohort 1, n=63), a 24-month overall survival (OS) rate of 64.8% was observed. Additionally, in patients with advanced or metastatic NSCLC whose tumors are positive for EGFR mutations and have progressed following an EGFR TKI (Cohort 2, n=19), median OS of 22.5 months was achieved. Treatment-related adverse events leading to discontinuation of ivonescimab was 11% and 0% in the two populations,

1Zhong, et al, SITC 2023

respectively; there were no treatment related adverse events leading to a patient's death in either setting.2 AK112-201 is a study of Chinese subjects conducted and analyzed by our partners, Akeso, of which the updated data supports Summit's HARMONi and HARMONi-3 Phase III clinical trials.

◦Recapping our Collaboration and License Agreement with Akeso Inc. (Akeso) for ivonescimab (SMT112):

▪On December 5, 2022, Summit and Akeso entered into a Collaboration and License Agreement for ivonescimab, which closed on January 17, 2023.

▪Summit received the rights to develop and commercialize ivonescimab in the United States, Canada, Europe, and Japan. Akeso retains the development and commercialization rights for the rest of the world, including China.

•In exchange for these rights, Summit made an upfront payment of $500 million in 2023.

•Akeso will be eligible to receive regulatory and commercial milestones of up to $4.5 billion. In addition, Akeso will receive low double-digit royalties on net sales in the Summit territories.

▪Over 1,600 patients have been treated with ivonescimab in clinical studies globally.

▪Akeso has a rich and diversified antibody drug pipeline with over 30 internally discovered drug candidates in various stages of development, including at least six bispecific antibodies. Akeso has taken part in over 120 clinical trials for 19 drug candidates. Akeso has two drugs approved for oncology indications in China: a PD-1 inhibitor and a novel PD-1 / CTLA-4 bispecific antibody. Akeso has over 2,800 employees.

Financial Highlights

Cash and Cash Equivalents, Restricted Cash, & Short-term Investments

•Aggregate cash and cash equivalents, restricted cash, and short-term investments were $186.2 million and $648.6 million at December 31, 2023 and 2022 respectively. Accounts receivable and research and development tax credits were $1.8 million and $6.1 million at December 31, 2023 and 2022, respectively.

◦Our short-term investments consist of U.S. treasury securities.

◦Our current notes payable balance as of December 31, 2023 was $100.0 million, and matures April 1, 2025. On February 17, 2024, this $100.0 million note from Robert W. Duggan, Chairman & CEO, was amended, extending the maturity date from September 6, 2024 to April 1, 2025, and making interest payments due at maturity. For all applicable periods commencing February 17, 2024, interest shall accrue on the outstanding principal balance at the greater of 12% or the US prime interest rate, as reported in the Wall Street Journal, plus 350 basis points, adjusted monthly, compounded quarterly.

◦Operating cash outflow for 2023 and 2022 was $76.8 million and $41.6 million, respectively.

Updated Cash Guidance

•With the extension of the $100.0 million note, we updated our cash guidance such that we now have sufficient cash to operate into the first quarter of 2025. Our prior cash guidance was to have sufficient funds going into September 2024.

GAAP and Non-GAAP Research and Development (R&D) Expenses

2Akeso, Inc. Press Release, January 8, 2024.

•R&D expenses according to generally accepted accounting principles in the U.S. (“GAAP”) were $24.8 million for the fourth quarter of 2023, as compared to $5.4 million for the same period of the year prior. The increase is due to increases in clinical study and development costs related to ivonescimab and increases in people cost, including stock-based compensation, as we continue to build out R&D team.

•Non-GAAP R&D expenses were $22.4 million for the fourth quarter of 2023, as compared to $4.4 million for the same period of the year period.

GAAP and Non-GAAP General and Administrative (G&A) Expenses

•GAAP G&A expenses were $11.6 million for the fourth quarter of 2023, as compared to $7.6 million for the same period of the year prior. The increase is due to increase in stock-based compensation as we continue to build our team.

•Non-GAAP G&A expenses were $5.3 million for the fourth quarter of 2023, as compared to $5.9 million for the same period of the year prior.

GAAP and Non-GAAP Net Loss

•GAAP net loss in the fourth quarter of 2023 and 2022 was $36.6 million or $0.05 per basic and diluted share, and $19.3 million or $0.07 per basic and diluted share, respectively. Non-GAAP net loss in the fourth quarter of 2023 and 2022 was $27.9 million or $0.04 per basic and diluted share, and $8.1 million or $0.03 per basic and diluted share, respectively.

•GAAP net loss in 2023 and 2022 was $614.9 million, or $0.99 per basic and diluted share, and $78.8 million, or $0.41 per basic and diluted share, respectively. The increase from prior year was primarily related to IPR&D expenses associated with the in-licensing of ivonescimab from Akeso and investments in the development of ivonescimab. Non-GAAP net loss in 2023 and 2022 was $79.9 million, or $0.13 per basic and diluted share, and $58.4 million, or $0.30 per basic and diluted share, respectively.

Use of Non-GAAP Financial Results

This release includes measures that are not in accordance with U.S. generally accepted accounting principles (“Non-GAAP measures”). These Non-GAAP measures should be viewed in addition to, and not as a substitute for, Summit's reported GAAP results, and may be different from Non-GAAP measures used by other companies. In addition, these Non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Summit management uses these non-GAAP measures for internal budgeting and forecasting purposes and to evaluate Summit’s financial performance. Summit management believes the presentation of these Non-GAAP measures is useful to investors for comparing prior periods and analyzing ongoing business trends and operating results. For further information regarding these Non-GAAP measures, please refer to the tables presenting reconciliations of our Non-GAAP results to our U.S. GAAP results and the “Notes on our Non-GAAP Financial Information” at the end of this press release.

Fourth Quarter and Year-end 2023 Earnings Call

Summit will host an earnings call this morning, Tuesday, February 20, 2024, at 9:00am ET. The conference call will be accessible by dialing (888) 210-3702 (toll-free domestic) or (646) 960-0191 (international) using conference code 5785899. A live webcast and instructions for joining the call are accessible through Summit’s website www.smmttx.com. An archived edition of the webcast will be available on our website after the call.

About Ivonescimab

Ivonescimab, known as SMT112 in Summit’s license territories, the United States, Canada, Europe, and Japan, and as AK112 in China and Australia, is a novel, potential first-in-class investigational bispecific antibody combining the effects of immunotherapy via a blockade of PD-1 with the anti-angiogenesis effects associated with blocking VEGF into a single molecule. Ivonescimab displays unique cooperative binding to each of its intended targets with higher affinity when in the presence of both PD-1 and VEGF.

This could differentiate ivonescimab as there is potentially higher expression (presence) of both PD-1 and VEGF in tumor tissue and the tumor microenvironment (TME) as compared to normal tissue in the body. Ivonescimab’s tetravalent structure (four binding sites) enables higher avidity (accumulated strength of multiple binding interactions) in the tumor microenvironment with over 18-fold increased binding affinity to PD-1 in the presence of VEGF in vitro, and over 4-times increased binding affinity to VEGF in the presence of PD-1 in vitro.3 This tetravalent structure, the intentional novel design of the molecule, and bringing these two targets into a single bispecific antibody with cooperative binding qualities have the potential to direct ivonescimab to the tumor tissue versus healthy tissue. The intent of this design is to improve upon previously established efficacy thresholds, in addition to side effects and safety profiles associated with these targets.

Ivonescimab was discovered by Akeso Inc. (HKEX Code: 9926.HK) and is currently engaged in multiple Phase III clinical trials. Summit has begun its clinical development of ivonescimab in NSCLC, commencing enrollment in 2023 in its two Phase III clinical trials. Over 1,600 patients have been treated with ivonescimab in clinical studies globally.

Ivonescimab is an investigational therapy that is not approved by any regulatory authority.

About Lung Cancer

Lung cancer is believed to impact approximately 600,000 people across the United States, United Kingdom, Spain, France, Italy, Germany, and Japan.4 NSCLC is the most prevalent type of lung cancer and represents approximately 80% to 85% of all incidences.5 Among patients with non-squamous NSCLC, approximately 15% have EGFR-sensitizing mutations in the United States and Europe.6 Patients with squamous histology represent approximately 25% to 30% of NSCLC patients.7

About Summit Therapeutics

Summit was founded in 2003 and our shares are listed on the Nasdaq Global Market (symbol ‘SMMT’). We are headquartered in Miami, Florida, and we have additional offices in Menlo Park, California and Oxford, United Kingdom.

Summit’s mission, in part, is to develop patient, physician, caregiver, and societal-friendly medicinal therapies intended to improve quality of life, increase potential duration of life, and resolve serious unmet medical needs.

For more information, please visit https://www.smmttx.com and follow us on X (formerly Twitter) @summitplc.

Contact Summit Investor Relations:

Dave Gancarz

3Zhong, et al, SITC 2023

4American Cancer Society: www.cancer.org/cancer/types/lung-cancer/about/key-statistics.html (Accessed Jan 2024); World Health Organization: International Agency for Research on Cancer, Globocan data by country (UK, Spain, France, Italy, Germany); Japan National Cancer Registry.

5Schabath MB, Cote ML. Cancer Progress and Priorities: Lung Cancer. Cancer Epidemiology, Biomarkers & Prevention. (2019).

6 About EGFR-Positive Lung Cancer | Navigating EGFR (lungevity.org)

7Schabath MB, Cote ML. Cancer Progress and Priorities: Lung Cancer. Cancer Epidemiology, Biomarkers & Prevention. (2019).

Chief Business & Strategy Officer

Nathan LiaBraaten

Senior Director, Investor Relations

investors@smmttx.com

Summit Forward-looking Statements

Any statements in this press release about the Company’s future expectations, plans and prospects, including but not limited to, statements about the clinical and preclinical development of the Company’s product candidates, entry into and actions related to the Company’s partnership with Akeso Inc., the Company's anticipated spending and cash runway, the therapeutic potential of the Company’s product candidates, the potential commercialization of the Company’s product candidates, the timing of initiation, completion and availability of data from clinical trials, the potential submission of applications for marketing approvals, potential acquisitions, and other statements containing the words "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "plan," "potential," "predict," "project," "should," "target," "would," and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including the results of our evaluation of the underlying data in connection with the development and commercialization activities for ivonescimab, the outcome of discussions with regulatory authorities, including the Food and Drug Administration, the uncertainties inherent in the initiation of future clinical trials, availability and timing of data from ongoing and future clinical trials, the results of such trials, and their success, and global public health crises, that may affect timing and status of our clinical trials and operations, whether preliminary results from a clinical trial will be predictive of the final results of that trial or whether results of early clinical trials or preclinical studies will be indicative of the results of later clinical trials, whether business development opportunities to expand the Company’s pipeline of drug candidates, including without limitation, through potential acquisitions of, and/or collaborations with, other entities occur, expectations for regulatory approvals, laws and regulations affecting government contracts and funding awards, availability of funding sufficient for the Company’s foreseeable and unforeseeable operating expenses and capital expenditure requirements and other factors discussed in the "Risk Factors" section of filings that the Company makes with the Securities and Exchange Commission. Any change to our ongoing trials could cause delays, affect our future expenses, and add uncertainty to our commercialization efforts, as well as to affect the likelihood of the successful completion of clinical development of ivonescimab. Accordingly, readers should not place undue reliance on forward-looking statements or information. In addition, any forward-looking statements included in this press release represent the Company’s views only as of the date of this release and should not be relied upon as representing the Company’s views as of any subsequent date. The Company specifically disclaims any obligation to update any forward-looking statements included in this press release.

Summit Therapeutics Inc.

GAAP Condensed Consolidated Statements of Operations

In millions, except per share data

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | — | | | $ | — | | | $ | — | | | $ | 0.7 | |

| Operating expenses: | | | | | | | |

| Research and development | 24.8 | | | 5.4 | | | 59.4 | | | 52.0 | |

| General and administrative | 11.6 | | | 7.6 | | | 30.3 | | | 26.7 | |

| In-process research and development | — | | | — | | | 520.9 | | | — | |

| Impairment of intangible assets | | | 8.5 | | | — | | | 8.5 | |

| Total operating expenses | 36.4 | | | 21.5 | | | 610.6 | | | 87.2 | |

Other operating income, net | 0.2 | | | 1.1 | | | 1.0 | | | 14.4 | |

| Operating loss | (36.2) | | | (20.4) | | | (609.6) | | | (72.1) | |

Other (expense) income, net | (0.4) | | | 1.1 | | | (5.3) | | | (6.7) | |

| | | | | | | |

| | | | | | | |

| Net loss | $ | (36.6) | | | $ | (19.3) | | | $ | (614.9) | | | $ | (78.8) | |

| | | | | | | |

| Basic and diluted loss per share | $ | (0.05) | | | $ | (0.07) | | | $ | (0.99) | | | $ | (0.41) | |

Summit Therapeutics Inc.

GAAP Condensed Consolidated Balance Sheet Information

In millions

| | | | | | | | | | | | | | |

| | December 31, 2023 | | December 31, 2022 |

Cash and cash equivalents, restricted cash, and short-term investments | | $ | 186.2 | | | $ | 648.6 | |

| Total assets | | $ | 202.9 | | | $ | 664.2 | |

| Total liabilities | | $ | 125.3 | | | $ | 537.5 | |

| Total stockholders' equity | | $ | 77.7 | | | $ | 126.7 | |

Summit Therapeutics Inc.

GAAP Condensed Consolidated Statement of Cash Flows Information

In millions

| | | | | | | | | | | | | | |

| | Twelve Months Ended December 31, |

| | 2023 | | 2022 |

| Net cash used in operating activities | | $ | (76.8) | | | $ | (41.6) | |

| Net cash used in investing activities | | (587.8) | | | (0.6) | |

| Net cash provided by financing activities | | 86.5 | | | 620.2 | |

| Effect of exchange rate changes on cash | | 0.8 | | | (1.2) | |

| | | | |

| (Decrease) increase in cash and cash equivalents | | $ | (577.3) | | | $ | 576.8 | |

Summit Therapeutics Inc.

Schedule Reconciling Selected Non-GAAP Financial Measures

(in millions, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of GAAP to Non-GAAP Research and Development Expense | | | | | | | |

| GAAP Research and Development | $ | 24.8 | | | $ | 5.4 | | | $ | 59.4 | | | $ | 52.0 | |

| Stock-based compensation (Note 1) | (2.4) | | | (1.0) | | | (4.4) | | | (4.3) | |

| Non-GAAP Research and Development | $ | 22.4 | | | $ | 4.4 | | | 55.0 | | | $ | 47.7 | |

| | | | | | | |

| Reconciliation of GAAP to Non-GAAP General and Administrative Expenses | | | | | | | |

| GAAP General and administrative | $ | 11.6 | | | $ | 7.6 | | | $ | 30.3 | | | $ | 26.7 | |

| Stock-based compensation (Note 1) | (6.3) | | | (1.7) | | | (9.7) | | | (7.6) | |

| Non-GAAP General and administrative | $ | 5.3 | | | $ | 5.9 | | | 20.6 | | | $ | 19.1 | |

| | | | | | | |

| Reconciliation of GAAP to Non-GAAP In-Process Research and Development Expenses | | | | | | | |

| GAAP In-process research and development | $ | — | | | $ | — | | | $ | 520.9 | | | $ | — | |

| In-process research and development (Note 2) | — | | | — | | | (520.9) | | | — | |

| Non-GAAP In-process research and development | $ | — | | | $ | — | | | — | | | $ | — | |

| | | | | | | |

| Reconciliation of GAAP to Non-GAAP Impairment of Intangible Assets | | | | | | | |

| GAAP Impairment of intangible assets | $ | — | | | $ | 8.5 | | | $ | — | | | $ | 8.5 | |

| Impairment of intangible assets (Note 3) | — | | | (8.5) | | | — | | | (8.5) | |

| Non-GAAP Impairment of intangible assets | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | |

| Reconciliation of GAAP to Non-GAAP Operating Expenses | | | | | | | |

| GAAP Operating expenses | $ | 36.4 | | | $ | 21.4 | | | $ | 610.6 | | | $ | 87.2 | |

| Stock-based compensation (Note 1) | (8.7) | | | (2.7) | | | (14.1) | | | (11.9) | |

| In-process research and development (Note 2) | — | | | — | | | (520.9) | | | — | |

| Impairment of intangible assets (Note 3) | — | | | (8.5) | | | — | | | (8.5) | |

| Non-GAAP Operating expense | $ | 27.7 | | | $ | 10.3 | | | $ | 75.6 | | | $ | 66.8 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of GAAP Net Loss to Non-GAAP Net Loss | | | | | | | |

| GAAP Net Loss | $ | (36.6) | | | $ | (19.3) | | | $ | (614.9) | | | $ | (78.8) | |

| Stock-based compensation (Note 1) | 8.7 | | | 2.7 | | | 14.1 | | | 11.9 | |

| In-process research and development (Note 2) | — | | | — | | | 520.9 | | | — | |

| Impairment of intangible assets (Note 3) | — | | | 8.5 | | | — | | | 8.5 | |

| Non-GAAP Net Loss | $ | (27.9) | | | $ | (8.1) | | | $ | (79.9) | | | $ | (58.4) | |

| | | | | | | |

| Reconciliation of GAAP EPS to Non-GAAP EPS | | | | | | | |

| GAAP Loss Per Share | $ | (0.05) | | | $ | (0.07) | | | $ | (0.99) | | | $ | (0.41) | |

| Stock-based compensation (Note 1) | 0.01 | | | 0.01 | | | 0.02 | | | 0.06 | |

| In-process research and development (Note 2) | — | | | — | | | 0.84 | | | — | |

| Impairment of intangible assets (Note 3) | — | | | 0.03 | | | — | | | 0.04 | |

| Non-GAAP Loss Per Share | $ | (0.04) | | | $ | (0.03) | | | $ | (0.13) | | | $ | (0.30) | |

| Basic and Diluted Weighted Average Shares Outstanding | 700.6 | | | 286.8 | | 619.6 | | 193.3 | |

Summit Therapeutics, Inc.

Notes on our Non-GAAP Financial Information

Non-GAAP financial measures adjust GAAP financial measures for the items listed below. These Non-GAAP measures should be viewed in addition to, and not as a substitute for Summit's reported GAAP results, and may be different from Non-GAAP measures used by other companies. In addition, these Non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Summit management uses these non-GAAP measures for internal budgeting and forecasting purposes and to evaluate Summit’s financial performance. Summit management believes the presentation of these Non-GAAP measures is useful to investors for comparing prior periods and analyzing ongoing business trends and operating results.

Each of non-GAAP Research and Development Expense, non-GAAP General and Administrative Expenses, non-GAAP Operating Expenses, Non-GAAP Net Loss and Non-GAAP EPS differ from GAAP in that such measures exclude the non-cash charges and costs associated with stock-based compensation. In addition, (i) non-GAAP Operating Expenses, non-GAAP Net Loss and non-GAAP EPS each exclude certain one-time charges associated with in-process research and development and impairment of intangible assets, (ii) non-GAAP In-Process Research and Development Expenses excludes certain in-process research and development charges and (iii) non-GAAP Impairment of Intangible Assets excludes certain one-time impairment charges, in each case as described further in the notes below and as expressed in the tabular reconciliation presented above.

Note 1: Stock-based compensation is a non-cash charge and costs calculated for this expense can vary year-over-year depending on the stock price of awards on the date of grant as well as the timing of compensation award arrangements.

Note 2: In-process research and development represents a one-time charge associated with the Company's in-licensing of ivonescimab from Akeso.

Note 3: The Company determined that it would cease investment in the Discuva Platform in 2022 and focus on the therapeutic area of oncology and as such recognized an impairment charge for the carrying value.

Appendix: Glossary of Critical Terms Contained Herein

Affinity – Affinity is the strength of binding of a molecule, such as a protein or antibody, to another molecule, such as a ligand.

Avidity – Avidity is the accumulated strength of multiple binding interactions.

Angiogenesis – Angiogenesis is the development, formation, and maintenance of blood vessel structures. Without sufficient blood flow, tissue may experience hypoxia (insufficient oxygen) or lack of nutrition, which may cause cell death.8

Cooperative binding – Cooperative binding occurs when the number of binding sites on the molecule that can be occupied by a specific ligand (e.g., protein) is impacted by the ligand’s concentration. For example, this can be due to an affinity for the ligand that depends on the amount of ligand bound or the binding strength of the molecule to one ligand based on the concentration of another ligand, increasing the chance of another ligand binding to the compound.9

Immunotherapy – Immunotherapy is a type of treatment, including cancer treatments, that help a person’s immune system fight cancer. Examples include anti-PD-1 therapies.10

PD-1 – Programmed cell Death protein 1 is a protein on the surface of T cells and other cells. PD-1 plays a key role in reducing the regulation of ineffective or harmful immune responses and maintaining immune tolerance. However, with respect to cancer tumor cells, PD-1 can act as a stopping mechanism (a brake or checkpoint) by binding to PD-L1 ligands that exist on tumor cells and preventing the T cells from targeting cancerous tumor cells.11

PD-L1 – Programmed cell Death Ligand 1 is expressed by cancerous tumor cells as an adaptive immune mechanism to escape anti-tumor responses, thus believed to suppress the immune system’s response to the presence of cancer cells.12

PD-L1 TPS – PD-L1 Tumor Proportion Score represents the percentage of tumor cells that express PD-L1 proteins.

PFS – Progression-Free Survival.

SQ-NSCLC – Non-small cell lung cancer tumors of squamous histology.

T Cells – T cells are a type of white blood cell that is a component of the immune system that, in general, fights against infection and harmful cells like tumor cells.13

Tetravalent – A tetravalent molecule has four binding sites or regions.

Tumor Microenvironment – The tumor microenvironment is the ecosystem that surrounds a tumor inside the body. It includes immune cells, the extracellular matrix, blood vessels and other cells, like fibroblasts. A tumor and its microenvironment constantly interact and influence each other, either positively or negatively.14

VEGF – Vascular Endothelial Growth Factor is a signaling protein that promotes angiogenesis.15

8Shibuya M. Vascular Endothelial Growth Factor (VEGF) and Its Receptor (VEGFR) Signaling in Angiogenesis: A Crucial Target for Anti- and Pro-Angiogenic Therapies. Genes Cancer. 2011 Dec;2(12):1097-105.

9Stefan MI, Le Novère N. Cooperative binding. PLoS Comput Biol. 2013;9(6)

10US National Cancer Institute, a part of the National Institute of Health (NIH). https://www.cancer.gov/about-cancer/treatment/types/immunotherapy. Accessed October 2023.

11Han Y, et al. PD-1/PD-L1 Pathway: Current Researches in Cancer. Am J Cancer Res. 2020 Mar 1;10(3):727-742.

12Han Y, et al. PD-1/PD-L1 Pathway: Current Researches in Cancer. Am J Cancer Res. 2020 Mar 1;10(3):727-742.

13Cleveland Clinic. https://my.clevelandclinic.org/health/body/24630-t-cells. Accessed October 2023.

14MD Anderson Cancer Center. https://www.mdanderson.org/cancerwise/what-is-the-tumor-microenvironment-3-things-to-know.h00-159460056.html. Accessed October 2023.

15Shibuya M. Vascular Endothelial Growth Factor (VEGF) and Its Receptor (VEGFR) Signaling in Angiogenesis: A Crucial Target for Anti- and Pro-Angiogenic Therapies. Genes Cancer. 2011 Dec;2(12):1097-105.

Summit Therapeutics Q4 & Full Year 2023 Earnings Call February 20, 2024 9:00am ET

Forward Looking Statement Ivonescimab is an investigational therapy that is not approved by any regulatory authority. It is currently being investigated in Phase III clinical studies. 2 Summit Proprietary Information - Do Not Copy, Photograph or Distribute Oppenheimer 34th Annual Healthcare Life Sciences Conference, February 2024 Any statements in this presentation about the Company’s future expectations, plans and prospects, including but not limited to, statements about the clinical and preclinical development of the Company’s product candidates, entry into and actions related to the Company’s partnership with Akeso Inc., the therapeutic potential of the Company’s product candidates, the potential commercialization of the Company’s product candidates, the timing of initiation, completion and availability of data from clinical trials, the potential submission of applications for marketing approvals, potential acquisitions and other statements containing the words "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "plan," "potential," "predict," "project," "should," "target," "would," and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including the results of our evaluation of the underlying data in connection with the development and commercialization activities for ivonescimab, the outcome of discussions with regulatory authorities, including the Food and Drug Administration, the uncertainties inherent in the initiation of future clinical trials, availability and timing of data from ongoing and future clinical trials, the results of such trials, and their success, and global public health crises that may affect timing and status of our clinical trials and operations, whether preliminary results from a clinical trial will be predictive of the final results of that trial or whether results of early clinical trials or preclinical studies will be indicative of the results of later clinical trials, whether business development opportunities to expand the Company’s pipeline of drug candidates, including without limitation, through potential acquisitions of, and/or collaborations with, other entities occur, expectations for regulatory approvals, laws and regulations affecting government contracts and funding awards, availability of funding sufficient for the Company’s foreseeable and unforeseeable operating expenses and capital expenditure requirements and other factors discussed in the "Risk Factors" section of filings that the Company makes with the Securities and Exchange Commission. Any change to our ongoing trials could cause delays, affect our future expenses, and add uncertainty to our commercialization efforts, as well as to affect the likelihood of the successful completion of clinical development of ivonescimab. Accordingly, the audience should not place undue reliance on forward-looking statements or information. In addition, any forward-looking statements included in this presentation represent the Company’s views only as of the date of this presentation and should not be relied upon as representing the Company’s views as of any subsequent date. The Company specifically disclaims any obligation to update any forward-looking statements included in this presentation.

Company Details Focus ONCOLOGY Partnership Akeso Inc. Summit License Territories United States, Canada, Europe, Japan Chief Executive Officers Bob Duggan Chairman & CEO Dr. Maky Zanganeh CEO & President NASDAQ SMMT Market Cap $3.55B† Cash $186M** Employees 110+† Offices Miami, FL Menlo Park, CA Oxford, UK …Improve quality of life, increase potential duration of life, and resolve serious medical healthcare needs… MISSION Unmatched high-speed execution, proven track record FOCUSED ON PATIENTS FIRST LEADERSHIP Lead Compound: Ivonescimab Only Phase III PD-1/VEGF Bispecific Antibody in Summit’s License Territories* 2024 Focus Execute on Phase III clinical trials Expand clinical development plan Summit Therapeutics 3 Summit Proprietary Information - Do Not Copy, Photograph or Distribute Summit Therapeutics Q4 & FY 2023 Earnings Call, February 2024 Ivonescimab is an investigational therapy that is not approved by any regulatory authority. It is currently being investigated in Phase III clinical studies. *There are no known PD-1-based bispecific antibodies approved by the U.S. Food and Drug Administration (“FDA”) or the European Medicines Agency (“EMA”). *As of December 31, 2023; †As of February 16, 2024

Trial Indication Histology/Population Regimen Phase III NSCLC EGFRm+ 2L+ Advanced or Metastatic Combo ivonescimab + chemo vs. placebo + chemo NSCLC Squamous 1L Metastatic Combo ivonescimab + chemo vs. pembro + chemo Indication Regimen Phase I Phase II Phase III NSCLC: 2L EGFRm+ Randomized: Combo (chemo) vs. chemo NSCLC: 1L PD-L1 TPS>1% Randomized: Monotherapy vs. pembro (PD-1) NSCLC: 1L Squamous Randomized: Combo (chemo) vs. tislelizumab (PD-1) + chemo NSCLC: 1L Squamous Randomized: Combo (chemo) vs. pembro (PD-1) + chemo Advanced Solid Tumors Monotherapy NSCLC Combo (chemo) NSCLC Monotherapy GYN Tumors Monotherapy Ovarian Cancer Combination (PARPi) NSCLC Monotherapy & Combo (chemo) CRC Combo (CD47 + chemo) HCC Monotherapy NSCLC Combo (PD-1 / CTLA-4 bsAb + chemo) HNSCC Combo (CD47) Advanced Solid Tumors** Combo (CD47, CD47 + chemo, chemo) TNBC Comb (chemo, CD47 + chemo) NSCLC Combo (CD73 + chemo) Advanced Solid Tumors Monotherapy ES-SCLC Combo (chemo) Ivonescimab Global Oncology Clinical Trials These ivonescimab cl inical trials are being conducted in China and/or Australia and are ful ly sponsored and managed by Akeso. NSCLC: Non-Small-cell Lung Cancer, EGFRm+: Epidermal Growth Factor Receptor mutant positives, Combo: Combination, Chemo: Chemotherapy, pembro: pembrolizumab, CRC: Colorectal Cancer, HCC: Hepatocellular Carcinoma, HNSCC: Head & Neck Squamous Cell Carcinoma, BTC: Biliary Tract Cancer, TNBC: Triple Negative Breast Cancer, ES-SCLC: Extensive Stage Small Cell Lung Cancer, PD-1: Programmed Cell Death Protein 1, PARPi: poly(ADP-ribose) polymerase inhibitors Ivonescimab is an investigational therapy that is not approved by any regulatory authority. It is currently being investigated in Phase III clinical studies. **Includes Gastric, BTC, Pancreatic, NSCLC Same Subset Patient Population 1,600+ Patients Treated with Ivonescimab 19 Clinical Trials 4 Phase III 13 Phase II 2 Phase I 7 Dedicated Trials Outside NSCLC 4 Summit Proprietary Information - Do Not Copy, Photograph or Distribute Summit Therapeutics Q4 & FY 2023 Earnings Call, February 2024 Same Subset Patient Population

Designed to Potentially Improve the Balance of Anti-tumor Activity & Safety1,2 *There are no known PD-1-based bispecific antibodies approved by the U.S. Food and Drug Administration (“FDA”) or the European Medicines Agency (“EMA”). Ivonescimab is an investigational therapy that is not approved by any regulatory authority. Ivonescimab is currently being investigated in Phase III clinical studies. Ivonescimab First-in-Class* PD-1/VEGF Brings two validated oncologic mechanisms into ONE novel tetravalent molecule3,4,5 Potential to Steer to Tumor vs. Healthy Tissue Where there are higher levels of PD-1 & VEGF1,2,7,8 Only Phase III PD-1/VEGF Bispecific In clinical development in North America, Europe and Japan* Cooperative Binding Simultaneous blocking of PD-1 & VEGF 1,3,6 Increased: Avidity in TME7 Activity of T Cells7,8 (in vitro) 5 Summit Proprietary Information - Do Not Copy, Photograph or Distribute Summit Therapeutics Q4 & FY 2023 Earnings Call, February 2024 1. Zhao Y, et al. eClinicalMedicine. 2023; 3(62): 102106. 2. Zhou C, et al. J Clin Oncol. 2022;40:16_suppl, 9040. 3. Manegold C, et al. J Thorac Oncol 2017;12(2):194-207 4. Pardoll, D. Nat Rev Cancer 2012;12(4):252-64 5.Tamura R, et al. Med Oncol 2020;37(1):2 6.Data on File. [14, 15] Summit Therapeutics Inc. 7. Zhong T, et al. AACR- NCI-EORTC International Conference 2023.Poster #B123, Abstract #35333, Boston, MA, USA, 8. Zhong T, et al. JITC 2022;10(2):521 TME: Tumor Microenvironment Anti-VEGF Anti-PD-1 Linkers

VEGF Dimer PD-1 Receptor in T Cell Increased Avidity in TME VEGF increases affinity to PD-1 by >18X4 PD-1 increases affinity to VEGF by >4X4 (in vitro) Enhanced Activity of T Cells VEGF dimer leads to potential interconnection of ivonescimab molecules, which may increase activity of T cells4,5 Ivonescimab is an investigational therapy that is not approved by any regulatory authority. Ivonescimab is currently being investigated in Phase III clinical studies Simultaneous blocking of PD-1 & VEGF1,2,3 Ivonescimab 6 Summit Proprietary Information - Do Not Copy, Photograph or Distribute Summit Therapeutics Q4 & FY 2023 Earnings Call, February 2024 Cooperative Binding Greater Than the Sum of Its Parts 1. Zhao Y. et al., eClinicalMedicine. 2023; 3(62): 102106.,; 2. Manegold C, et al. J Thorac Oncol 2017;12(2):194-207 ; 3. Data on File. [14, 15] Summit Therapeutics Inc.; 4. Zhong T, et al. AACR-NCI-EORTC International Conference 2023.Poster #B123,Abstract #35333, Boston, MA, USA,; 5. Zhong T, et al. JITC 2022;10(2):521.

Ivonescimab Phase III Trials – Expected 2024 Short-Term Catalysts Ivonescimab is an investigational therapy that is not approved by any regulatory authority. It is currently being investigated in Phase III clinical studies. CDE: Centre for Drug Evaluation *NDA Filing by Akeso with the CDE for Marketing Approval in China, 2023 Head-to-Head vs. Pembrolizumab Same Subset Patient Population 7 Summit Proprietary Information - Do Not Copy, Photograph or Distribute Summit Therapeutics Q4 & FY 2023 Earnings Call, February 2024 AK112-301 CDE Decision Expected* & Topline Data AK112-303 Interim Analysis Randomized Phase III Trial vs. Pembrolizumab Last Patient In H1 H2

Summit Confidential & Proprietary Information - Do Not Copy or Distribute Summit Therapeutics Q4 & FY 2023 Earnings Call, February 2024 8 Financial Update and Guidance Cash and Cash Equivalents Updated Cash Guidance GAAP Operating Expenses $186M (as of Dec 31, 2023) UPDATED: Into Q1 2025 Previously: Into Q3 2023 $36.4M (Three months ended Dec 31, 2023) Non-GAAP Operating Expenses(1) $27.7M (Three months ended Dec 31, 2023) 1. Refer to Appendix for reconciliation of GAAP to Non-GAAP Financial Statements

APPENDIX

Summit Confidential & Proprietary Information - Do Not Copy or Distribute 10 Statement Regarding Use of Non-GAAP Financial Measures Non-GAAP financial measures adjust GAAP financial measures for the items listed below. These Non-GAAP measures should be viewed in addition to, and not as a substitute for Summit's reported GAAP results, and may be different from Non-GAAP measures used by other companies. In addition, these Non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Summit management uses these non-GAAP measures for internal budgeting and forecasting purposes and to evaluate Summit’s financial performance. Summit management believes the presentation of these Non-GAAP measures is useful to investors for comparing prior periods and analyzing ongoing business trends and operating results. Each of non-GAAP Research and Development Expense, non-GAAP General and Administrative Expenses, non-GAAP Operating Expenses, Non-GAAP Net Loss and Non- GAAP EPS differ from GAAP in that such measures exclude the non-cash charges and costs associated with stock-based compensation. In addition, (i) non-GAAP Operating Expenses, non-GAAP Net Loss and non-GAAP EPS each exclude certain one-time charges associated with in-process research and development and impairment of intangible assets, (ii) non-GAAP In-Process Research and Development Expenses excludes certain in-process research and development charges and (iii) non-GAAP Impairment of Intangible Assets excludes certain one-time impairment charges, in each case as described further in the notes below and as expressed in the tabular reconciliation presented in following slides. Note 1: Stock-based compensation is a non-cash charge and costs calculated for this expense can vary year-over-year depending on the stock price of awards on the date of grant as well as the timing of compensation award arrangements. Note 2: In-process research and development represents a one-time charge associated with the Company's in-licensing of ivonescimab from Akeso. Note 3: The Company determined that it would cease investment in the Discuva Platform in 2022 and focus on the therapeutic area of oncology and as such recognized an impairment charge for the carrying value.

Condensed Consolidated Statements of Operations 11 Summit Confidential & Proprietary Information - Do Not Copy or Distribute Summit Therapeutics Q4 & FY 2023 Earnings Call, February 2024

12 Condensed Consolidated Statements of Cash Flows and Balance Sheet Summit Confidential & Proprietary Information - Do Not Copy or Distribute Summit Therapeutics Q4 & FY 2023 Earnings Call, February 2024

13 Reconciling Selected Non-GAAP Financial Measures, Operating Expenses Summit Confidential & Proprietary Information - Do Not Copy or Distribute Summit Therapeutics Q4 & FY 2023 Earnings Call, February 2024 2023 2022 2023 2022 Reconciliation of GAAP to Non-GAAP Research and Development Expense GAAP Research and Development $ 24.8 $ 5.4 $ 59.4 $ 52.0 Stock-based compensation (Note 1) (2.4) (1.0) (4.4) (4.3) Non-GAAP Research and Development $ 22.4 $ 4.4 $ 55.0 $ 47.7 Reconciliation of GAAP to Non-GAAP General and Administrative Expenses GAAP General and administrative $ 11.6 $ 7.6 $ 30.3 $ 26.7 Stock-based compensation (Note 1) (6.3) (1.7) (9.7) (7.6) Non-GAAP General and administrative $ 5.3 $ 5.9 $ 20.6 $ 19.1 Reconciliation of GAAP to Non-GAAP In-Process Research and Development Expenses GAAP In-process research and development $ - $ - $ 520.9 $ - In-process research and development (Note 2) - - (520.9) - Non-GAAP In-process research and development $ - $ - $ - $ - Reconciliation of GAAP to Non-GAAP Impairment of Intangible Assets GAAP Impairment of intangible assets $ - $ 8.5 $ - $ 8.5 Impairment of intangible assets (Note 3) - (8.5) - (8.5) Non-GAAP Impairment of intangible assets $ - $ - $ - $ - Reconciliation of GAAP to Non-GAAP Operating Expenses GAAP Operating expenses $ 36.4 $ 21.4 $ 610.6 $ 87.2 Stock-based compensation (Note 1) (8.7) (2.7) (14.1) (11.9) In-process research and development (Note 2) - - (520.9) - Impairment of intangible assets (Note 3) - (8.5) - (8.5) Non-GAAP Operating expense $ 27.7 $ 10.3 $ 75.6 $ 66.8 Three Months Ended December Twelve Months Ended December Summit Therapeutics Inc Schedule Reconciling Selected Non-GAAP Financial Measures (in millions, except shares and per share data)

14 Reconciling Selected Non-GAAP Financial Measures, Net loss and EPS Summit Confidential & Proprietary Information - Do Not Copy or Distribute Summit Therapeutics Q4 & FY 2023 Earnings Call, February 2024

Summit Therapeutics Q4 & Full Year 2023 Earnings Call February 20, 2024 9:00am ET

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

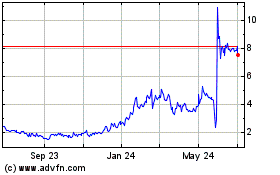

Summit Therapeutics (NASDAQ:SMMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

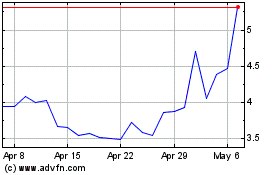

Summit Therapeutics (NASDAQ:SMMT)

Historical Stock Chart

From Apr 2023 to Apr 2024