Filed

Pursuant to Rule 424(b)(3)

Registration

No. 333-276796

PROSPECTUS

SUPPLEMENT NO. 1

(to Prospectus

dated February 9, 2024)

13,950,976

Shares of Common Stock

This

prospectus supplement updates, amends, and supplements the prospectus dated February 9, 2024 (as amended and supplemented, the “Prospectus”),

which forms a part of our Registration Statement on Form S-1 (Registration No. 333-276796).

This

prospectus supplement is being filed to update, amend, and supplement the information in the Prospectus with the information contained

in our Current Report on Form 8-K, filed with the Securities and Exchange Commission (the “SEC”) on February 16, 2024

(the “Current Report”), and to disclose the shareholder approval of the issuance of shares of common stock issuable

upon exercise of certain common stock purchase warrants issued by the Company, as more fully described below. Accordingly, we have attached

the Current Report to this prospectus supplement.

Additionally,

as disclosed in the Current Report, the Stockholder Approval (as defined in the Prospectus) was received on February 16, 2024 and as

result the Warrants and the Existing Common Warrants (as defined in the Prospectus) are exercisable until February 16, 2029.

This

prospectus supplement is not complete without the Prospectus. This prospectus supplement should be read in conjunction with the Prospectus,

which is to be delivered with this prospectus supplement, and is qualified by reference thereto, except to the extent that the information

in this prospectus supplement updates or supersedes the information contained in the Prospectus. Please keep this prospectus supplement

with your Prospectus for future reference.

Our

common stock is traded on the Nasdaq Capital Market (“Nasdaq”) under the symbol “ATNF”. On February 15,

2024, the last reported sale price for our common stock as reported on Nasdaq was $0.21 per share.

INVESTING

IN OUR SECURITIES INVOLVES SUBSTANTIAL RISKS. SEE THE SECTION TITLED “RISK FACTORS” BEGINNING ON PAGE 5 OF THE PROSPECTUS

TO READ ABOUT FACTORS YOU SHOULD CONSIDER BEFORE BUYING OUR SECURITIES.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED

UPON THE ADEQUACY OR ACCURACY OF THE PROSPECTUS OR THIS PROSPECTUS SUPPLEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The

date of this prospectus supplement is February 16, 2024.

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION

13 OR 15(d) OF THE

SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date of

earliest event reported): February 16, 2024

180 LIFE SCIENCES

CORP.

(Exact Name of Registrant

as Specified in Charter)

| Delaware |

|

001-38105 |

|

90-1890354 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

3000 El Camino Real, Bldg. 4, Suite

200

Palo

Alto, CA |

|

94306 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone

number, including area code: (650) 507-0669

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ATNF |

|

The NASDAQ Stock Market LLC |

| Warrants to purchase shares of Common Stock |

|

ATNFW |

|

The NASDAQ Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On

February 16, 2024, at a Special Meeting (the “Special Meeting”) of the stockholders of 180 Life Sciences Corp. (the

“Company,” “we,” “our,” or “us”), the stockholders

of the Company approved the Second Amendment (“Second Amendment”) to the First Amended and Restated 180 Life Sciences

Corp. 2022 Omnibus Incentive Plan (the First Amended and Restated 2022 Omnibus Incentive Plan, as amended by the Second Amendment, the

“OIP”) in accordance with the voting results set forth below under Item 5.07. The Second Amendment

was originally approved by the Board of Directors of the Company on December 13, 2023, subject to stockholder approval and the Second

Amendment became effective at the time of stockholder approval.

The material terms of the

OIP, as amended by the Second Amendment, were described in the Company’s Definitive Proxy Statement on Schedule 14A (the

“Proxy Statement”) under the caption “Proposal 2 – Adoption of the Second Amendment to the 180 Life

Sciences Corp. 2022 Omnibus Incentive Plan” filed with the Securities and Exchange Commission (SEC) on December 26, 2023. Awards

under the OIP may be made in the form of performance awards, restricted stock, restricted stock units, stock options, which may be either

incentive stock options or non-qualified stock options, stock appreciation rights, other stock-based awards and dividend equivalents.

Awards are generally non-transferable. Subject to adjustment in connection with the payment of a stock dividend, a stock split or subdivision

or combination of the shares of common stock, or a reorganization or reclassification of the Company’s common stock, the aggregate

number of shares of common stock which may be issued pursuant to awards under the OIP is 4,249,933. The 4,249,933 share limit also applies

to the total number of incentive stock options which may be awarded pursuant to the terms of the OIP. The Second Amendment increased the

maximum number of shares available to be issued under the OIP from 470,000 shares to 4,249,933 shares.

Employees, non-employee

directors, and consultants of the Company and its subsidiaries are eligible to participate in the OIP. Incentive stock options may be

granted under the OIP only to employees of our company and its subsidiaries. Employees, directors and consultants of our company and its

affiliates are eligible to receive all other types of awards under the OIP.

The above description of

the Second Amendment and the OIP does not purport to be complete, and is qualified in its entirety by reference to the full text of the

Second Amendment and the OIP as amended by the Second Amendment, which are attached hereto as Exhibits 10.1 and 10.2,

and are incorporated by reference into this Item 5.02.

Item 5.07. Submission of Matters to a Vote of Security Holders.

At

the Special Meeting, stockholders representing 4,319,708 shares of the Company’s capital stock entitled to vote at the

Special Meeting were present in person or by proxy representing 43.1% of the voting shares issued and outstanding on the record date

of December 18, 2023, and constituting a quorum to conduct business at the Special Meeting. The following sets forth the matters that

were voted upon by the Company’s stockholders at the Special Meeting and the voting results for such matters. These matters are

described in more detail in the Proxy Statement.

At the Special Meeting, stockholders

approved the following proposals, which are set forth in their entirety below.

| 1. | Proposal No. 1: Approval

of an amendment to our Second Amended and Restated Certificate of Incorporation, as amended, to effect a reverse stock split of our issued

and outstanding shares of our common stock, par value $0.0001 per share, by a ratio of between one-for-four to one-for-forty, inclusive,

with the exact ratio to be set at a whole number to be determined by our Board of Directors or a duly authorized committee thereof in

its discretion, at any time after approval of the amendment and prior to February 16, 2025: |

| For | | |

Against | | |

Abstentions | | |

Broker Non-Votes | |

| | 3,662,372 | | |

| 653,782 | | |

| 3,554 | | |

| — | |

More votes were cast for approval

of Proposal No. 1, then against Proposal No. 1, and as such Proposal No. 1 was approved at the Special Meeting.

| 2. | Proposal No. 2: Approval

of the adoption of the Second Amendment to the 180 Life Sciences Corp. 2022 Omnibus Incentive Plan: |

| For | | |

Against | | |

Abstentions | | |

Broker Non-Votes | |

| | 531,011 | | |

| 256,738 | | |

| 4,263 | | |

| 792,012 |

Proposal No. 2 was approved

by approximately 67.0% of the votes cast on the proposal at the Special Meeting, and as such Proposal No. 2 was approved at the Special

Meeting.

| 3. | Proposal No. 3: Approval

of the issuance of shares of our common stock, $0.0001 par value per share, in excess of 19.99% of the issued and outstanding shares

of our common stock, upon the exercise of pre-funded warrants to purchase up to 4,886,878 shares of common stock, with an exercise price

of $0.0001 per share; and warrants to purchase up to 18,128,196 shares of common stock, with an exercise price of $0.17 per share (collectively,

the “Warrants”), at a price less than the Minimum Price as defined by and in accordance with Nasdaq Listing Rule 5635(d): |

| For | | |

Against | | |

Abstentions | | |

Broker Non-Votes | |

| | 611,576 | | |

| 175,457 | | |

| 4,979 | | |

| 792,012 | |

Proposal No. 3 was approved

by approximately 77.2% of the votes cast on the proposal at the Special Meeting, and as such Proposal No. 3 was approved at the Special

Meeting.

| 4. | Proposal No. 4: Approval

of the adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time

of the Special Meeting to approve Proposal Nos. 1 and 3 above: |

| For | | |

Against | | |

Abstentions | | |

Broker Non-Votes | |

| | 3,762,247 | | |

| 552,370 | | |

| 5,091 | | |

| — | |

While Proposal No. 4 was approved,

because Proposal Nos. 1 and 3 were also approved, the approval of Proposal No. 4 had no effect.

Item 8.01. Other Events

The

information provided in Item 5.03 is hereby incorporated by reference.

As

a result of the approval of Proposal No. 3 above, the Warrants are now exercisable.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

180 LIFE SCIENCES CORP. |

| |

|

|

| Date: February 16, 2024 |

By: |

/s/ James N. Woody, M.D., Ph.D. |

| |

|

James N. Woody, M.D., Ph.D. |

| |

|

Chief Executive Officer |

4

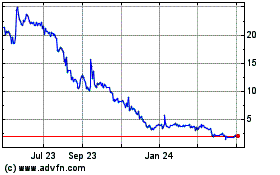

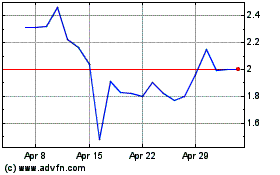

180 Life Sciences (NASDAQ:ATNF)

Historical Stock Chart

From Mar 2024 to Apr 2024

180 Life Sciences (NASDAQ:ATNF)

Historical Stock Chart

From Apr 2023 to Apr 2024