Filed pursuant to Rule 253(g)(2)

File No. 024-12314

SUPPLEMENT DATED FEBRUARY 16, 2024

TO OFFERING CIRCULAR DATED SEPTEMBER 29, 2023

Knightscope, Inc.

This document supplements, and should be read

in conjunction with, the offering circular (the “Offering Circular”) dated September 29, 2023 of Knightscope, Inc. (the “Company”).

Unless otherwise defined in this supplement, capitalized terms used in this supplement shall have the same meanings as set forth in the

Offering Circular.

The Offering Circular dated September 29, 2023 is available here.

The purpose of this supplement is to:

| |

· |

Announce the Company’s intention to terminate the offering described in the Offering Circular such that the last day on which subscriptions will be accepted is March 14, 2024, as qualified by reference to the description of the Company’s intentions below. |

| |

· |

Add OpenDeal Broker LLC as a broker-dealer for the Company’s offering under Regulation A. |

| |

· |

Add the biography of the Company’s new CFO. |

Offering Termination Date

The Company intends to terminate the offering

for its Public Safety Infrastructure Bonds described in the Offering Circular. No further subscriptions will be accepted for the current

offering after March 14, 2024 (the “Termination Date”). Subscriptions in the offering will be accepted up through that date

and processed as promptly as possible. None of the terms of the offering have been changed. In addition, as described in the Offering

Circular, the Company retains the right to continue the offering beyond the Termination Date, in its sole discretion.

Addition of Broker

The Company has engaged OpenDeal Broker LLC to assist with processing

investments in the Offering. As a result, the Company amends and restates the cover page and the following sections of its Offering Circular:

COVER PAGE:

Knightscope, Inc.

1070 Terra Bella Avenue

Mountain View, CA 94043

www.knightscope.com

UP TO $10,000,000 IN

PUBLIC SAFETY INFRASTRUCTURE BOND

PRICE $1,000 PER BOND

MINIMUM INDIVIDUAL INVESTMENT: $1,000

SEE “SECURITIES BEING OFFERED” AT PAGE

57

| Public Safety Infrastructure Bonds | |

Price to Public | | |

Underwriting

Discount and

Commissions * | | |

Proceeds to

Issuer

Before Expenses | |

| Price Per Bond | |

$ | 1,000.00 | | |

$ | 83.00 | | |

$ | 917.00 | |

| Total Maximum | |

$ | 10,000,000 | | |

$ | 830,000 | | |

$ | 9,170,000 | |

* The Company has engaged DealMaker Securities, LLC, member FINRA/SIPC

(the “Broker”), as broker-dealer of record, to perform broker-dealer administrative and compliance related functions in connection

with this offering, but not for underwriting or placement agent services. Once the SEC has qualified the Offering Statement and this offering

commences, the Broker, affiliates, and OpenDeal Broker LLC will receive compensation not to exceed $830,000 (8.3%) of the amount raised

in the offering, if fully subscribed. See “Plan of Distribution” on page 61 for details of compensation payable to Broker

in connection with the offering.

In addition, the Company has engaged OpenDeal Broker LLC (“OpenDeal

Broker”), Member FINRA/SIPC, to assist with processing of investments through the online investment platform at www.republic.com

maintained for OpenDeal Broker’s benefit by its affiliates (the “Republic Platform”). CRD # 291387.

The Republic Platform will be used to communicate the offering to certain

investors originated by OpenDeal Broker. As compensation, the Company will pay to OpenDeal Broker a commission equal to 6% of the amount

raised through the Republic Platform. OpenDeal Broker and DealMaker Securities LLC have entered into a Commission Sharing Agreement with

respect to fees payable by the Company in connection with the Republic Platform. As a result, the maximum compensation payable to DealMaker

Securities will not exceed the maximum described above. See “Plan of Distribution” for details of compensation payable to

OpenDeal Broker in connection with the offering.

The Company has engaged BankProv as agent (the “Escrow Agent”)

to hold any funds that are tendered by investors who invest through the Republic Platform.

This offering (the “Offering”) will terminate at the earlier

of the date at which the maximum offering amount has been sold or March 14, 2024. At least every 12 months after this offering has been

qualified by the Securities and Exchange Commission (the “SEC”), the Company will file a post-qualification amendment to include

the Company’s recent financial statements. The Offering covers an amount of securities that we reasonably expect to offer and sell

within two years, although the Offering Statement of which this Offering Circular is a part may be used for up to three years and 180

days under certain conditions.

The offering is being conducted on a best-efforts basis without any

minimum target. Provided that an investor purchases Bonds in the amount of the minimum investment, there is no minimum dollar amount of

Bonds that needs to be sold in order for funds to be released to the Company and for this offering to close, which may mean that the Company

does not receive sufficient funds to cover the cost of this offering. The Company may undertake one or more closings on a rolling basis.

After each closing, funds tendered by investors will be made available to the Company. After the initial closing of this offering, we

expect to hold closings on at least a monthly basis.

The Company expects that the amount of expenses of the offering that

it will pay will be approximately $900,000, not including commissions or state filing fees.

We are an “emerging growth company” as defined in the Jumpstart

Our Business Startups Act of 2012, and as such, we have elected to take advantage of certain reduced public company reporting requirements

for this Offering Circular and future filings. See “Risk Factors” and “Summary -- Implications of Being an Emerging

Growth Company.”

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS

UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS

OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH

THE COMMISSION; HOWEVER THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION

GENERALLY NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE

AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED

INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE

YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov.

This offering is inherently risky. See “Risk Factors”

on page 9.

Sales of these securities will commence on approximately September

29, 2023.

The Company is following the format of Part I of Form S-1

pursuant to the general instructions of Part II(a)(1)(ii) of Form 1-A.

Page 62 – PLAN OF DISTRIBUTION:

PLAN OF DISTRIBUTION

Plan of Distribution

The Company is offering up to $10,000,000 Bonds, as described in this

Offering Circular on a best efforts basis.

The minimum investment in this offering is 1 Bond, or $1,000.00.

The Company has engaged DealMaker Securities LLC (the “Broker”),

a broker-dealer registered with the U.S. Securities and Exchange Commission (the “SEC”) and a member of Financial Industry

Regulatory Authority (“FINRA”), to perform certain administrative and compliance related functions in connection with this

offering, but not for underwriting or placement agent services. Broker will receive a commission fee equal to four and one half percent

(4.5%) of the amount raised in the offering, which is part of the maximum compensation to be received of eight point three percent (8.3%),

if fully subscribed. The Broker is not participating as an underwriter or placement agent in this offering and will not solicit any investments,

recommend our securities, provide investment advice to any prospective investor, or distribute this Offering Circular or other offering

materials to potential investors. All inquiries regarding this offering should be made directly to the Company.

Broker and its affiliates provide separate services to the Company

to help facilitate the offering, from establishment of the platform to be used for subscription processing, through back-office operations/compliance,

and marketing. Although orchestrated through the Broker, each of the affiliates have separate fees, and agreements embedded into the Broker’s

services agreement. Once the offering is qualified, Investors will subscribe via the Company’s website and investor funds will

be processed via DealMaker’s integrated payment solutions.

Fees, Commissions and Discounts

The following table shows the maximum discounts, commissions and fees

payable to Broker and its affiliates, as well as certain other fees, in connection with this offering by the Company, assuming a fully

subscribed offering (the “Maximum Dollar Compensation”). There will not be any compensation that exceeds this dollar amount

associated with the offering.

| | |

Per Bond | | |

Total | |

| Public offering price | |

$ | 1,000.00 | | |

$ | 10,000,000.00 | |

| Anticipated broker and affiliate commissions and fees | |

$ | 83.00 | | |

$ | 830,000.00 | |

| | |

| | | |

| | |

| Proceeds, before other expenses | |

$ | 917.00 | | |

$ | 9,170,000.00 | |

Other Terms

With the services provided by the Broker and its affiliates there are

different fee types associated with the specific services, which are routine for those service providers. None of the fees for the services

are indeterminant in nature, and therefore have their own set maximum fees, and as described above none of these fees will exceed the

Maximum Dollar Compensation. The aggregate fees payable to the Broker and its affiliates are described in more detail below.

The aggregate fees payable to the Broker and its affiliates are described

below.

a.) Administrative and Compliance

Related Functions

DealMaker Securities, LLC will provide administrative and compliance

related functions in connection with this offering, including:

| |

· |

Reviewing investor information, including identity verification, performing Anti-Money Laundering (“AML”) and other compliance background checks, and providing the Company with information on an investor in order for the Company to determine whether to accept such investor into the offering; |

| |

|

|

| |

· |

If necessary, discussions with us regarding additional information or clarification on a Company-invited investor; |

| |

|

|

| |

· |

Coordinating with third party agents and vendors in connection with performance of services; |

| |

|

|

| |

· |

Reviewing each investor’s subscription agreement to confirm such investor’s participation in the offering and provide a recommendation to us whether or not to accept the subscription agreement for the investor’s participation; |

| |

|

|

| |

· |

Contacting and/or notifying us, if needed, to gather additional information or clarification on an investor; |

| |

|

|

| |

· |

Providing a dedicated account manager; |

| |

|

|

| |

· |

Providing ongoing advice to us on compliance of marketing material and other communications with the public, including with respect to applicable legal standards and requirements; |

| |

|

|

| |

· |

Reviewing and performing due diligence on the Company and the Company’s management and principals and consulting with the Company regarding same; |

| |

|

|

| |

· |

Consulting with the Company on best business practices regarding this raise in light of current market conditions and prior self-directed capital raises; |

| |

|

|

| |

· |

Providing white labelled platform customization to capture investor acquisition through the Broker’s platform’s analytic and communication tools; |

| |

|

|

| |

· |

Consulting with the Company on question customization for investor questionnaire; |

| |

|

|

| |

· |

Consulting with the Company on selection of webhosting services; |

| |

|

|

| |

· |

Consulting with the Company on completing template for the offering campaign page; |

| |

|

|

| |

· |

Advising us on compliance of marketing materials and other communications with the public with applicable legal standards and requirements; |

| |

|

|

| |

· |

Providing advice to the Company on preparation and completion of this Offering Circular; |

| |

|

|

| |

· |

Advising the Company on how to configure our website for the offering working with prospective investors; |

| |

|

|

| |

· |

Providing extensive review, training and advice to the Company and Company personnel on how to configure and use the electronic platform for the offering powered by Novation Solutions Inc. O/A DealMaker (“DealMaker”), an affiliate of the Broker; |

| |

|

|

| |

· |

Assisting the Company in the preparation of state, SEC and FINRA filings related to the offering; and |

| |

|

|

| |

· |

Working with Company personnel and counsel in providing information to the extent necessary. |

Such services shall not include providing any investment advice or

any investment recommendations to any investor.

For these services, we have agreed to pay Broker:

| |

· |

A one-time $22,500 advance against accountable expenses for the provision of compliance consulting services and pre-offering analysis, and |

| |

· |

A cash commission equal to four and one half percent (4.5%) of the amount raised in the offering. |

For the avoidance of doubt, total aggregate fees payable to Broker

will not exceed $472,500 (4.725%) of proceeds if the offering is fully subscribed.

b) Technology Services

The Company has also engaged Novation Solutions Inc. O/A DealMaker

(“DealMaker”), an affiliate of Broker, to create and maintain the online subscription processing platform for the offering.

After the qualification by the SEC of the Offering Statement of which

this Offering Circular is a part, this offering will be conducted using the online subscription processing platform of DealMaker through

our website at https://bond.knightscope.com, whereby investors will receive, review, execute and deliver subscription agreements electronically

as well as make payment of the purchase price through a third party processor by ACH debit transfer or wire transfer or credit card to

an account we designate. There is no escrow established for this offering. We will hold closings upon the receipt of investors’

subscriptions and our acceptance of such subscriptions.

For these services, we have agreed to pay DealMaker:

| |

· |

A one-time $7,500 advance against accountable expenses for the provision of compliance consulting services and pre-offering analysis; and |

| |

|

|

| |

· |

A monthly fee of $2,000 in cash. |

For the avoidance of doubt, fees payable to DealMaker will not exceed

$25,500 (0.26% of proceeds if the offering is fully subscribed).

c) Marketing and Advisory

Services

The Company has also engaged DealMaker Reach, LLC (“Reach”),

an affiliate of Broker, for certain marketing advisory and consulting services. Reach will consult and advise on the design and messaging

on creative assets, website design and implementation, paid media and email campaigns, advise on optimizing the Company’s campaign

page to track investor progress, and advise on strategic planning, implementation, and execution of Company’s capital raise

marketing budget.

For these services, we have agreed to pay Reach:

| |

· |

A one-time $30,000 advance against accountable expenses for the provision of compliance consulting services, |

| |

|

|

| |

· |

A monthly fee of $8,000 in cash up to a maximum of $96,000; and |

| |

|

|

| |

· |

Up to $200,000 in fees for supplementary marketing services and media management, as we may authorize on a case-by-case basis during the offering |

For the avoidance of doubt, fees payable to Reach will not exceed $326,000

(3.26% of proceeds if the offering is fully subscribed)

OpenDeal Broker LLC Agreement

In addition, the Company has engaged OpenDeal Broker LLC (CRD #291387)

to assist with processing of investments through the online investment platform at www.republic.co maintained for OpenDeal Broker LLC

(“OpenDeal Broker”) benefit by its affiliates. (the “Republic Platform”). OpenDeal Broker LLC will perform substantially

the same services as DealMaker Securities LLC, but only for those subscriptions received through the Republic Platform. These services

include:

| |

● |

Provide a landing page on the Republic Platform for our offering of the Bonds and perform related services; |

| |

|

|

| |

● |

Review investor information, including KYC (“Know Your Customer”) data, AML (“Anti Money Laundering”) and other compliance background checks, including Regulation Best Interest compliance, and provide a recommendation to the Company whether or not to accept investor as a customer; |

| |

|

|

| |

● |

Provide technical services to allow us to execute and deliver evidence of the executed subscription agreement to the investor, |

The Company does not intend to actively promote the offering on Republic,

and OpenDeal Broker will not act as an underwriter or placement agent for this offering.

As compensation, the Company will pay to OpenDeal Broker a $6,000 business

advisory fee as well as a commission equal to 6% of the amount raised through the Republic Platform.

The Administrative and Compliance fees, the Technology Services Fees,

and the Marketing and Advisory Services described above in a.), b.) and c.) payable to Broker and affiliates as well as the compensation

payable to OpenDeal Broker, will, in aggregate, not exceed $830,000 (8.3% of proceeds if the offering is fully subscribed). In the event

the Offering is partially subscribed, the fees described above shall not exceed the following maximums:

| If the Total Offering Amount is | |

Maximum Compensation to Broker and affiliates

would be

(as % of Total Offering Amount) | |

| Up to $2,500,000 | |

| 10 | % |

| Between $2,500,000 and $5,000,000 | |

| 9 | % |

| Between $5,000,000 and $7,500,000 | |

| 8.35 | % |

| Between $7,500,000 and $10,000,000 (maximum) | |

| 8.3 | % |

DealMaker Securities LLC and OpenDeal Broker will ensure that the aggregate

total compensation, which includes commissions, out of pocket expenses, consulting fees, securities and any other fees paid for the services

described in this section will not exceed the maximums set forth above.

Subscription Procedures

After the Offering Statement has been qualified by the SEC, the Company

will accept tenders of funds to purchase the Bonds. The Company may close on investments on a “rolling” basis (so not all

investors will receive their shares on the same date). Investors may subscribe by tendering funds via wire, credit or debit card, or ACH

only, and checks will not be accepted. Investors will subscribe via the Company’s website and investor funds will be processed via

DealMaker’s integrated payment solutions. Funds will be held in the Company’s payment processor account until the Broker has

reviewed the proposed subscription, and the Company has accepted the subscription. Funds released to the Company’s bank account

will be net funds (investment less payment for processing fees and a holdback equivalent to 5% for 90 days).

The Company will be responsible for payment processing fees. Upon each

closing, funds tendered by investors will be made available to the Company for its use.

In order to invest you will be required to subscribe to the offering

via the Company’s website integrating DealMaker’s technology and agree to the terms of the offering, Subscription Agreement,

and any other relevant exhibit attached thereto.

Investors will be required to complete a subscription agreement in

order to invest. The subscription agreement includes a representation by the investor to the effect that, if the investor is not an “accredited

investor” as defined under securities law, the investor is investing an amount that does not exceed the greater of 10% of his or

her annual income or 10% of their net worth (excluding the investor’s principal residence).

Any potential investor will have ample time to review the subscription

agreement, along with their counsel, prior to making any final investment decision. Broker will review all subscription agreements completed

by the investor. After Broker has completed its review of a subscription agreement for an investment in the Company, and the Company has

elected to accept the investor into the offering, the funds may be released to the Company.

The Company maintains the right to accept or reject subscriptions in

whole or in part, for any reason or for no reason, including, but not limited to, in the event that an investor fails to provide all necessary

information, even after further requests from the Company, in the event an investor fails to provide requested follow up information to

complete background checks or fails background checks, and in the event the Company receives oversubscriptions in excess of the maximum

offering amount.

In the interest of allowing interested investors as much time as possible

to complete the paperwork associated with a subscription, the Company has not set a maximum period of time to decide whether to accept

or reject a subscription. If a subscription is rejected, funds will not be accepted by wire transfer or ACH, and payments made by debit

card or credit card will be returned to subscribers within 30 days of such rejection without deduction or interest.

DealMaker Securities LLC (the “Broker”) has not investigated

the desirability or advisability of investment in the Bonds, nor approved, endorsed or passed upon the merits of purchasing the Bonds.

Broker is not participating as an underwriter and under no circumstance will it recommend the Company’s securities or provide investment

advice to any prospective investor, or make any securities recommendations to investors. Broker is not distributing any offering circulars

or making any oral representations concerning this Offering Circular or this offering. Based upon Broker’s anticipated limited role

in this offering, it has not and will not conduct extensive due diligence of this offering and no investor should rely on the involvement

of Broker in this offering as any basis for a belief that it has done extensive due diligence. Broker does not expressly or impliedly

affirm the completeness or accuracy of the Offering Statement and/or Offering Circular presented to investors by the Company. All inquiries

regarding this offering should be made directly to the Company.

Great Lakes will serve as Bond registrar to maintain Bondholder information

on a book-entry basis. We will not issue Bonds in physical or paper form. Instead, our Bonds will be recorded and maintained on our Bond

register by the Bond registrar.

In the event that it takes some time for the Company to raise funds

in this offering, the Company will rely on its cash and cash equivalent balances, cash generated through the At The Market Equity facility

and agreement with Dimension Funding, and borrowings to meet its liquidity needs and capital expenditure requirements for at least the

next 12 months.

Payment Processing

The Company expects to incur third-party payment processing costs in

relation to this Offering. Costs are estimated to be approximately 2% of total proceeds.

OpenDeal Broker Subscription Process

Investors subscribing through the Republic Platform, as facilitated

by OpenDeal Broker, may also access the Company’s offering through an offering page hosted on the Republic Platform. Investors may

follow the instructions provided through the Republic Platform to review the Company’s offering materials, including the offering

circular and subscription agreement, as well as submit payment which will be deposited into an escrow account at the Escrow Agent for

the benefit of the Company. Credit card transactions will be processed through a payment processing platform integrated with the Republic

Platform.

OpenDeal Broker has not investigated the desirability or

advisability of investment in the Bonds nor approved, endorsed or passed upon the merits of purchasing the Bonds. OpenDeal Broker is

not participating as an underwriter and under no circumstance will it solicit any investment in the Company, recommend the

Company’s securities or provide investment advice to any prospective investor, or make any securities recommendations to

investors. OpenDeal Broker is not distributing any offering circulars or making any oral representations concerning this Offering

Circular or this offering. Based upon OpenDeal Broker ’s anticipated limited role in this offering, it has not and will not

conduct extensive due diligence of this offering and no investor should rely on the involvement of OpenDeal Broker in this offering

as any basis for a belief that it has done extensive due diligence. OpenDeal Broker does not expressly or impliedly affirm the

completeness or accuracy of the Offering Statement and/or Offering Circular. All inquiries regarding this offering should be made

directly to the Company.

Perks

Investors in this offering are eligible to receive certain perks depending

on their investment amount.

Investors that meet the following criteria will receive the following

perks:

| $1,000 - $19,999 |

Knightscope Merchandise |

| |

|

| $20,000 - $49,999 |

+ Knightscope Art |

| |

|

| $50,000+ |

+ Robot Roadshow Pod Landing |

Provisions of Note in Our Subscription Agreement

Jury Trial Waiver

The subscription agreement provides that subscribers waive the right

to a jury trial of any claim they may have against us arising out of or relating to the agreement, including any claim under federal securities

laws. By signing the subscription agreement an investor will warrant that the investor has reviewed this waiver with the investor’s

legal counsel, and knowingly and voluntarily waives his or her jury trial rights following consultation with the investor’s legal

counsel. If we opposed a jury trial demand based on the waiver, a court would determine whether the waiver was enforceable given the facts

and circumstances of that case in accordance with applicable case law. In addition, by agreeing to the provision, subscribers will not

be deemed to have waived the Company’s compliance with the federal securities laws and the rules and regulations promulgated

thereunder.

Forum Selection Provisions

The subscription agreement that investors will execute in connection

with the offering includes a forum selection provision that requires any claims against the Company based on the agreement to be brought

in a state or federal court of competent jurisdiction in the State of Delaware, for the purpose of any suit, action or other proceeding

arising out of or based upon the agreement. Although we believe the provision benefits us by providing increased consistency in the application

of Delaware law in the types of lawsuits to which it applies and in limiting our litigation costs, to the extent it is enforceable, the

forum selection provision may limit investors’ ability to bring claims in judicial forums that they find favorable to such disputes

and may discourage lawsuits with respect to such claims. The Company has adopted the provision to limit the time and expense incurred

by its management to challenge any such claims. As a company with a small management team, this provision allows its officers to not lose

a significant amount of time travelling to any particular forum so they may continue to focus on operations of the Company. Section 22

of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability

created by the Securities Act or the rules and regulations thereunder. We believe that the exclusive forum provision applies to claims

arising under the Securities Act, but there is uncertainty as to whether a court would enforce such a provision in this context. Section 27

of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange

Act or the rules and regulations thereunder. As a result, the exclusive forum provision will not apply to suits brought to

enforce any duty or liability created by the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction.

Investors will not be deemed to have waived the Company’s compliance with the federal securities laws and the rules and regulations

thereunder.

Appointment of CFO

As previously disclosed in a Current Report on Form 8-K filed on December

6, 2023, on December 1, 2023, Mallorie Burak, President and Chief Financial Officer of the Company and its principal financial officer

and principal accounting officer, resigned from her positions at the Company to pursue another professional opportunity, effective as

of January 11, 2024 (the “Effective Date”). On the Effective Date, the board of directors of the Company appointed Apoorv

S. Dwivedi, 43, as the Executive Vice President and Chief Financial Officer of the Company and designated Mr. Dwivedi as the Company’s

principal financial officer and principal accounting officer. Mr. Dwivedi’s biography is set forth below.

Apoorv S. Dwivedi, Executive Vice President and Chief Financial

Officer

With extensive finance and corporate strategy experience, Mr. Dwivedi

most recently served as the Chief Financial Officer of Nxu, Inc. (NXU). He joined the company in 2022 and helped to take it public on

Nasdaq in the same year. He then led the company’s strategy around capital markets, investor relations, finance operations and corporate

growth. Prior to his CFO role at Nxu, Mr. Dwivedi served as Director of Finance for Cox Automotive from 2019 to 2022 where he successfully

ran the Manheim Logistics business. From 2018 to 2019, he was the Director of Presales at the SaaS company Workiva, and from 2010 to 2017

Mr. Dwivedi served in several corporate finance roles of increasing responsibility at the General Electric Company across both the GE

Capital and GE Industrial businesses. Mr. Dwivedi began his career at ABN-AMRO, N.A. and was instrumental in building one of the first

data analytics teams at Sears Holdings Company. Mr. Dwivedi earned his Bachelors in Finance from Loyola University – Chicago and

his MBA from Yale School of Management.

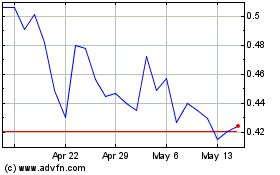

Knightscope (NASDAQ:KSCP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Knightscope (NASDAQ:KSCP)

Historical Stock Chart

From Apr 2023 to Apr 2024