Nike (NYSE:NKE) – Nike will cut over 1,600

jobs, about 2% of its workforce, to reduce costs after forecasting

lower profits. Nike outlined a $2 billion cost-saving plan over the

next three years, including measures such as supply optimization,

supply chain improvement, and automation, with layoff costs

estimated between $400 million and $450 million in the third

quarter. The staff cuts will not affect store employees,

distribution center workers, or innovation teams.

Nvidia (NASDAQ:NVDA) – Options traders in the

US are optimistic about Nvidia, anticipating a significant impact

following its next earnings report on February 21. An up to 11%

movement in the stock is predicted, the largest in three years,

reflecting a potential $200 billion increase in its market

capitalization. The demand for call options remains high, even as

the company has already appreciated 50% this year. Nvidia is on the

verge of surpassing Alphabet (NASDAQ:GOOGL) as the

third most valuable company in the US, with earnings and revenue

estimates rising for the next quarter.

Taiwan Semiconductor Manufacturing (NYSE:TSM) –

TSMC is on the brink of reclaiming its spot among the world’s 10

most valuable companies, driven by a $42 billion rally on Thursday,

fueled by optimism regarding artificial intelligence. Investors are

bullish on its role in supplying AI chips.

Alphabet (NASDAQ:GOOGL) – Google plans to

launch an anti-disinformation campaign in five European Union (EU)

countries ahead of the parliamentary elections. With the European

Digital Services Act, this initiative aims to combat the spread of

illegal content online and influence voters. Moreover, Google

unveiled an initiative to strengthen online security with

artificial intelligence (AI) tools and investments. It will launch

an open-source AI-driven feature to detect malware and publish a

white paper at the Munich Security Conference in Germany, proposing

advanced AI research for cyber defense.

Apple (NASDAQ:AAPL) – Apple plans to launch an

artificial intelligence tool to complete software code, akin to

Microsoft’s Copilot. The tool will be available in Xcode later this

year. Additionally, the company considers integrating AI features

into its products, such as automatic playlists for Apple Music.

Meta Platforms (NASDAQ:META) – Meta has updated

its guidelines to help small businesses avoid Apple’s extra fees

when purchasing ads on Facebook and Instagram for iPhone. This has

intensified the rivalry between the companies, with Meta

criticizing Apple’s policy, while Apple questions Meta’s data

usage.

Nokia (NYSE:NOK), Dell

Technologies (NYSE:DELL) – Nokia and Dell Technologies

have formed a partnership to deploy private 5G networks and adapt

infrastructures to the cloud. The agreement involves migrating

customers from Nokia AirFrame to Dell’s PowerEdge servers, aiming

to meet the increasing demands of modern networks and private 5G

use cases.

Walt Disney (NYSE:DIS) – India’s Reliance

Industries is in talks to acquire Disney’s stake in the satellite

TV provider Tata Play, aiming to expand its media presence. The

company seeks to offer its JioCinema content to Tata customers,

according to Reuters.

Herbalife (NYSE:HLF) – Herbalife shares are up

2% in pre-market trading, after plummeting 32% on Thursday,

reaching a 14-year low. Activist investor Bill Ackman has revived

his rivalry with the company, once again labeling it a “pyramid

scheme.” Despite sales improvements, analysts remain cautious, with

positive projections for the future.

Coca-Cola (NYSE:KO) – Coca-Cola has reinforced

its position as a dividend leader with a 5.4% increase, raising the

quarterly payment to 48.5 cents per share. With 62 years of

dividend increases, Coca-Cola stands out among the few companies

with such a record, including Procter & Gamble

(NYSE:PG) and Johnson & Johnson

(NYSE:JNJ).

JPMorgan Chase (NYSE:JPM), State

Street (NYSE:STT) – JPMorgan Chase and State Street have

exited a global climate coalition, followed by

BlackRock (NYSE:BLK), which transferred its

membership to its international subsidiary, reducing the total

involvement by about $14 trillion. The move comes amid political

criticisms and pressures on their independence.

NatWest (NYSE:NWG) – NatWest confirmed Paul

Thwaite as the permanent CEO on Friday, reporting a profit for 2023

above forecasts. Its shares rose 3.3% in pre-market trading. The

pre-tax profit was £6.2 billion, with a £300 million share buyback

announced. Thwaite will lead the planned government share sale.

General Motors (NYSE:GM) – Carl Jenkins, GM’s

head of hardware, announced his resignation on Thursday, following

a series of departures since the suspension of the autonomous unit

Cruise’s operations in the US in October. Jenkins led the

development of Cruise’s autonomous hardware over the past six

years.

Ford Motor (NYSE:F), General

Motors (NYSE:GM) – The CEOs of Ford and General Motors

expressed interest in partnerships to cut electric vehicle

technology costs amid growing competition from Chinese

manufacturers. Ford projects significant EV losses this year,

seeking competitive alternatives.

Lucid Group (NASDAQ:LCID) – Lucid Group has

reduced the prices of its luxury Air sedans by up to 10% to boost

demand in a weak electric vehicle market. In the US, prices now

start at $69,900 for the Air Pure, with additional incentives

announced for accessories and maintenance.

Lockheed Martin (NYSE:LMT) – Lockheed Martin

stated on Thursday that it is accelerating the production of its

weapon systems to meet growing demand, driven by global security

concerns, including the war in Ukraine, the conflict in the Middle

East, and tensions with China.

Exxon Mobil (NYSE:XOM) – Exxon Mobil plans to

choose by the end of the year the lithium filtration technology for

Arkansas, aiming to become a major global producer of the metal for

batteries. The company has tested various direct extraction

technologies and expects to start production by 2026. In related

news, the New York State Retirement Fund will limit investments in

oil and gas companies, partially divesting from Exxon Mobil,

following a review on readiness for a low-carbon economy. The fund

will continue to hold Exxon passively, while restricting other

sector companies.

Shell (NYSE:SHEL) – Shell, a leading energy

company, may abandon bidding for Norway’s first commercial offshore

wind farm due to uncertainties about its profitability. The contest

conditions are challenging, raising doubts about participation. The

global wind industry faces cost and inflation challenges.

General Electric (NYSE:GE) – General Electric

filed the anticipated Form 10 on Thursday, detailing the future

split into GE Aerospace and GE Vernova. Vernova will start

debt-free, with $4.2 billion in cash. It will operate in three

segments: power, wind, and electrification, aiming to lead the

energy transition.

Earnings

The Trade Desk (NASDAQ:TTD) – After the digital

advertising company reported a quarterly revenue of $606 million,

exceeding Wall Street’s $582 million estimate, shares soared 19.2%

in pre-market trading. Additionally, the company’s first-quarter

revenue forecast also surpassed analysts’ expectations,

highlighting confidence in continued growth and boosting investor

optimism.

Coinbase (NASDAQ:COIN) – The cryptocurrency

exchange’s shares surged 13.2% in pre-market trading, driven by a

fourth-quarter earnings announcement of $1.04 per share and revenue

of $954 million. These results surprised analysts, who had

predicted a 1 cent per share loss on $822 million in revenue, as

reported by LSEG.

Doordash (NYSE:DASH) – DASH shares are down

6.8% in pre-market trading following the food delivery company’s

mixed fourth-quarter results. Despite a 27% revenue increase to

$2.3 billion, surpassing LSEG’s expectations, the 39-cent per share

loss was greater than anticipated. The total number of orders rose

23% to 574 million, above the expected 561 million.

Toast (NYSE:TOST) – Following the

fourth-quarter results announcement, shares of the restaurant

point-of-sale system manufacturer rose 5.2% in pre-market trading.

The company reported a 7-cent per share loss, below analysts’

11-cent per share loss expectation, as informed by LSEG.

Additionally, the $1.04 billion revenue was nearly in line with the

$1.02 billion expectation.

DraftKings (NASDAQ:DKNG) – After the sports

betting company reported an unexpected fourth-quarter loss of 10

cents per share, contrasting with analysts’ 8-cent per share

earnings expectation as reported by LSEG, shares fell 3.3% in

pre-market trading. Moreover, revenue slightly missed analysts’

estimates, totaling $1.23 billion compared to the expected $1.24

billion, adding more pressure on the company’s performance.

Roku (NASDAQ:ROKU) – After the streaming

provider reported a larger-than-expected fourth-quarter loss of 55

cents per share, compared to the 52 cents per share expected by

LSEG analysts, shares fell 14.1% in pre-market trading. However,

the $984 million revenue exceeded the $968 million estimate.

Dropbox (NASDAQ:DBX) – After the file hosting

service operator reported fourth-quarter adjusted earnings of 50

cents per share on $635 million in revenue, shares fell 9% in

pre-market trading. Analysts had expected earnings of 48 cents per

share on $631 million in revenue, according to LSEG.

Yelp (NYSE:YELP) – After announcing projections

below analysts’ expectations for the first quarter, both for

adjusted EBITDA and revenue, shares fell about 9.2% in pre-market

trading. Additionally, the fourth-quarter earnings per share also

fell short of forecasts, as reported by LSEG. During the period,

Yelp recorded a profit of 37 cents per share and revenue of $342.4

million.

Applied Materials (NASDAQ:AMAT) – Shares of the

semiconductor equipment manufacturer surged 12% in pre-market

trading, driven by beating earnings estimates and an optimistic

outlook for the fiscal second quarter. In the first quarter,

earnings per share reached $2.13, excluding items, surpassing

LSEG’s $1.90 per share expectation. Additionally, the period’s

revenue reached $6.71 billion, exceeding the $6.48 billion

estimate.

Texas Roadhouse (NASDAQ:TXRH) – In the fourth

quarter, earnings per share exceeded consensus analyst estimates as

reported by FactSet. Moreover, Texas Roadhouse announced a

significant increase in its dividends, raising them by 11%.

Oatly (NASDAQ:OTLY) – Oatly shares fell 3.3%,

with the fourth-quarter net loss widening to $298.7 million, or 50

cents per share, more than doubling from the previous year. Revenue

reached $204.1 million, surpassing estimates. The company faces

financial challenges, with debt of about $444 million, but

approximately $454 million in liquidity.

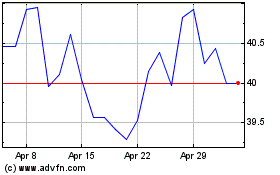

Yelp (NYSE:YELP)

Historical Stock Chart

From Mar 2024 to Apr 2024

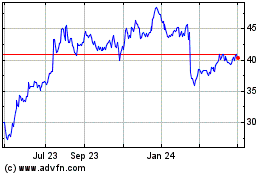

Yelp (NYSE:YELP)

Historical Stock Chart

From Apr 2023 to Apr 2024