UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 3)1

LifeVantage Corporation

(Name

of Issuer)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

53222K205

(CUSIP Number)

Dayton Judd

Sudbury Capital Fund, LP

136 Oak Trail

Coppell, Texas 75019

(972) 304-5000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

February 14, 2024

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box ¨.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Sudbury Capital Fund, LP |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☒ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Delaware |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

749,325 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

749,325 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

749,325 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

5.8% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Sudbury Capital GP, LP |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☒ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

AF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Texas |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

749,325 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

749,325 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

749,325 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

5.8% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Sudbury Holdings, LLC |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☒ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

AF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Texas |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

749,325 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

749,325 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

749,325 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

5.8% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

OO, HC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Sudbury Capital Management, LLC |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☒ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

AF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Texas |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

749,325 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

749,325 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

749,325 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

5.8% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

OO, IA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Dayton Judd |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☒ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

AF, PF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

United States |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

13,416 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

749,325 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

13,416 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

749,325 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

762,741 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

5.9% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN, HC |

|

The following constitutes

Amendment No. 3 to the Schedule 13D filed by the undersigned (“Amendment No. 3”). This Amendment No. 3 amends the Schedule

13D as specifically set forth herein.

| Item 2. | Identity and Background. |

Item 2 is hereby amended

to add the following:

In connection with the entry

into the Cooperation Agreement, as defined and described in Item 4 below, on February 14, 2024, the Reporting Persons and Radoff (as defined

in Amendment No. 2 to the Schedule 13D) terminated the Group Agreement (as defined in Amendment No. 2 to the Schedule 13D). Accordingly,

Radoff is no longer a member of a Section 13(d) group with the Reporting Persons. The Reporting Persons will continue filing statements

on Schedule 13D with respect to their beneficial ownership of securities of the Issuer to the extent required by applicable law. Each

of the Reporting Persons is party to the Joint Filing Agreement, as defined and further described in Item 6 below.

| Item 4. | Purpose of Transaction. |

Item 4 is hereby amended

to add the following:

On February 14, 2024 (the

“Effective Date”), the Reporting Persons and Radoff (collectively, the “Stockholder Parties”) entered into a Cooperation

Agreement (the “Cooperation Agreement”) with the Issuer pursuant to which, among other things, the Issuer immediately (i)

increased the size of its board of directors (the “Board”) by one (1) seat, to a total of eight (8) directors, and (ii) appointed

Dayton Judd to the Board, with a term expiring at the Issuer’s fiscal year 2025 annual meeting of stockholders (the “2025

Annual Meeting”). Pursuant to the Cooperation Agreement, the Board also appointed Mr. Judd to the Audit Committee and the Nominating

and Corporate Governance Committee of the Board.

Pursuant to the Cooperation

Agreement, the Issuer also agreed to nominate Mr. Judd for election to the Board at the 2025 Annual Meeting, at the Issuer’s fiscal

year 2026 annual meeting of stockholders (the “2026 Annual Meeting”) and at any other meeting of the Issuer’s stockholders

held during the Standstill Period at which directors are to be elected. The Issuer also agreed not to (i) nominate any incumbent directors

serving on the Board as of the Effective Date other than Michael A. Beindorff, Steven R. Fife, Raymond B. Greer, Cynthia Latham, Darwin

K. Lewis and Garry Mauro at the 2025 Annual Meeting, (ii) nominate any incumbent directors serving on the Board as of the Effective Date

other than Messrs. Beindorff, Fife, Greer and Lewis and Ms. Latham at the 2026 Annual Meeting and (iii) unless there is a vacancy on the

Board, nominate any incumbent directors serving on the Board as of the Effective Date other than Messrs. Fife, Greer and Lewis and Ms.

Latham at the Issuer’s fiscal year 2027 annual meeting of stockholders (the “2027 Annual Meeting”).

Pursuant to the Cooperation

Agreement, the Issuer has further agreed that from the Effective Date until the commencement of the 2026 Annual Meeting, the size of the

Board shall be no greater than eight (8) directors and from the closing of the 2026 Annual Meeting until the expiration of the Standstill

Period (as defined below), the size of the Board shall be no greater than seven (7) directors, in each case without the consent of the

Stockholder Parties.

Pursuant to the Cooperation

Agreement, the Stockholder Parties irrevocably withdrew their demand to inspect certain books and records of the Issuer pursuant to Section

220 of the Delaware General Corporation Law (the “220 Demand”) and any and all related materials and notices submitted to

the Issuer in connection therewith or related thereto, and the Stockholder Parties are subject to certain standstill restrictions from

the Effective Date until the earlier of (x) 30 days prior to the opening of the window for submissions of stockholder nominations for

the 2027 Annual Meeting and (y) 120 days prior to the first anniversary of the 2026 Annual Meeting (the “Standstill Period”).

During the Standstill Period, the Stockholder Parties also agreed to vote all shares of Common Stock beneficially owned by the Stockholder

Parties in accordance with the Board’s recommendations with respect to (i) the election, removal and replacement of directors (a

“Director Proposal”) and (ii) any other proposal submitted to the stockholders; provided, however, that in the event Institutional

Shareholder Services Inc. (“ISS”) and Glass, Lewis & Co. LLC (“Glass Lewis”) recommend otherwise with respect

to any proposals (other than a Director Proposal and certain other proposals as described in the Cooperation Agreement), the Stockholder

Parties may vote in accordance with the ISS and Glass Lewis recommendation; provided, further, that the Stockholder Parties are permitted

to vote in their sole discretion with respect to any Extraordinary Transaction (as defined in the Cooperation Agreement). In addition,

under the Cooperation Agreement, the Stockholder Parties and the Issuer have agreed to a release of certain claims against each other,

including those arising out of or related to the Issuer’s fiscal year 2024 annual meeting of stockholders and the 220 Demand.

The foregoing description

of the Cooperation Agreement does not purport to be complete and is qualified in its entirety by reference to the Cooperation Agreement,

which is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

| Item 5. | Interest in Securities of the Issuer. |

Items 5(a) and (c) are hereby

amended and restated to read as follows:

(a) The

aggregate percentage of shares of Common Stock reported owned by each person named herein is based upon 12,868,462 shares of Common Stock

outstanding as of January 29, 2024, which is the total number of shares of Common Stock outstanding as reported in the Issuer’s

Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on January 30, 2024.

As of the date hereof, Sudbury

Fund directly beneficially owned 749,325 shares of Common Stock, constituting approximately 5.8% of the outstanding shares.

As of the date hereof, Mr.

Judd directly beneficially owned 13,416 shares of Common Stock, constituting less than 1% of the outstanding shares.

Sudbury GP, as the general

partner of Sudbury Fund, may be deemed to beneficially own the 749,325 shares of Common Stock beneficially owned by Sudbury Fund, constituting

approximately 5.8% of the outstanding shares. Sudbury Holdings, as the general partner of Sudbury GP, may be deemed to beneficially own

the 749,325 shares of Common Stock beneficially owned by Sudbury Fund, constituting approximately 5.8% of the outstanding shares. Sudbury

Management, as the investment adviser to Sudbury Fund, may be deemed to beneficially own the 749,325 shares of Common Stock beneficially

owned by Sudbury Fund, constituting approximately 5.8% of the outstanding shares. Mr. Judd, as the Sole Member of Sudbury Holdings and

Managing Member of Sudbury Management, may be deemed to beneficially own the 749,325 shares of Common Stock beneficially owned by Sudbury

Fund, which, together with the 13,416 shares of Common Stock he beneficially owns directly, constitutes an aggregate of 762,741 shares

of Common Stock, constituting approximately 5.9% of the outstanding shares.

The filing of this Schedule

13D shall not be deemed an admission that the Reporting Persons are, for purposes of Section 13(d) of the Exchange Act, the beneficial

owners of any securities of the Issuer that he or it does not directly own. Each Reporting Person disclaims beneficial ownership of the

Shares that he or it does not directly own.

(c) There

have been no transactions in securities of the Issuer by the Reporting Persons during the past 60 days.

| Item 6. | Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer. |

Item 6 is hereby amended

to add the following:

On February 14, 2024, the

Stockholder Parties and the Issuer entered into the Cooperation Agreement, as defined and described in Item 4 above and attached as Exhibit

99.1 hereto.

On February 14, 2024, the

Stockholder Parties terminated the Group Agreement, effective immediately.

On February 15, 2024, the

Reporting Persons entered into a Joint Filing Agreement (the “Joint Filing Agreement”) pursuant to which the Reporting Persons

agreed to the joint filing on behalf of each of them of statements on Schedule 13D with respect to the securities of the Issuer to the

extent required by applicable law. A copy of the Joint Filing Agreement is attached hereto as Exhibit 99.2 and is incorporated herein

by reference.

| Item 7. | Material to be Filed as Exhibits. |

Item 7 is hereby amended

to add the following exhibits:

| 99.1 | Cooperation Agreement, dated February 14, 2024 (incorporated by reference to Ex. 10.1 to the Issuer’s

Current Report on Form 8-K, filed with the Securities and Exchange Commission on February 15, 2024). |

| 99.2 | Joint Filing Agreement, dated February 15, 2024. |

SIGNATURES

After reasonable inquiry

and to the best of his knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true,

complete and correct.

Dated: February 15, 2024

| |

Sudbury Capital Fund, LP |

| |

|

| |

By: |

Sudbury Capital GP, LP |

| |

|

General Partner |

| |

|

| |

By: |

Sudbury Holdings, LLC |

| |

|

General Partner |

| |

|

|

| |

By: |

/s/ Dayton Judd |

| |

|

Name: |

Dayton Judd |

| |

|

Title: |

Sole Member |

| |

Sudbury Capital GP, LP |

| |

|

| |

By: |

Sudbury Holdings, LLC |

| |

|

General Partner |

| |

|

|

| |

By: |

/s/ Dayton Judd |

| |

|

Name: |

Dayton Judd |

| |

|

Title: |

Sole Member |

| |

Sudbury Holdings, LLC |

| |

|

| |

By: |

/s/ Dayton Judd |

| |

|

Name: |

Dayton Judd |

| |

|

Title: |

Sole Member |

| |

Sudbury Capital Management, LLC |

| |

|

| |

By: |

/s/ Dayton Judd |

| |

|

Name: |

Dayton Judd |

| |

|

Title: |

Managing Member |

| |

/s/ Dayton Judd |

| |

Dayton Judd |

Exhibit 99.2

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k)(1)(iii) under the

Securities Exchange Act of 1934, as amended, the persons named below agree to the joint filing on behalf of each of them of a Statement

on Schedule 13D (including additional amendments thereto) with respect to the shares of Common Stock, par value $0.0001, of LifeVantage

Corporation, a Delaware corporation. This Joint Filing Agreement shall be filed as an Exhibit to such Statement.

Dated: February 15, 2024

| |

Sudbury Capital Fund, LP |

| |

|

| |

By: |

Sudbury Capital GP, LP |

| |

|

General Partner |

| |

|

| |

By: |

Sudbury Holdings, LLC |

| |

|

General Partner |

| |

|

|

| |

By: |

/s/ Dayton Judd |

| |

|

Name: |

Dayton Judd |

| |

|

Title: |

Sole Member |

| |

Sudbury Capital GP, LP |

| |

|

| |

By: |

Sudbury Holdings, LLC |

| |

|

General Partner |

| |

|

|

| |

By: |

/s/ Dayton Judd |

| |

|

Name: |

Dayton Judd |

| |

|

Title: |

Sole Member |

| |

Sudbury Holdings, LLC |

| |

|

| |

By: |

/s/ Dayton Judd |

| |

|

Name: |

Dayton Judd |

| |

|

Title: |

Sole Member |

| |

Sudbury Capital Management, LLC |

| |

|

| |

By: |

/s/ Dayton Judd |

| |

|

Name: |

Dayton Judd |

| |

|

Title: |

Managing Member |

| |

/s/ Dayton Judd |

| |

Dayton Judd |

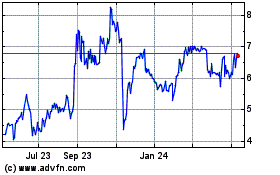

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

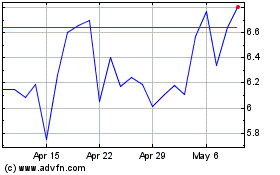

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Apr 2023 to Apr 2024