false0001226616FYP7Y1133http://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrentP1YP1Y0001226616srt:MaximumMemberus-gaap:CertificatesOfDepositMember2023-01-012023-12-310001226616mnov:BRileyFBRIncMembermnov:TwoThousandNineteenAtMarketIssuanceSalesAgreementMember2019-08-232019-08-230001226616mnov:ProductDevelopmentMember2023-12-310001226616mnov:CommercializationMilestoneMember2023-12-310001226616country:US2023-01-012023-12-3100012266162022-12-310001226616mnov:ResearchAndDevelopmentAndPatentsExpenseMember2023-01-012023-12-310001226616us-gaap:AdditionalPaidInCapitalMember2023-12-3100012266162022-01-012022-12-310001226616mnov:GenzymeCorporationMember2023-01-012023-12-310001226616us-gaap:RetainedEarningsMember2022-12-310001226616mnov:MutualFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001226616mnov:AtMarketIssuanceSalesAgreementMember2022-01-012022-12-310001226616srt:MinimumMember2023-12-310001226616us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001226616us-gaap:EmployeeStockOptionMembermnov:TwoThousandTwentyThreeEquityIncentivePlanMember2023-01-012023-12-310001226616us-gaap:RetainedEarningsMember2021-12-3100012266162021-12-310001226616us-gaap:EmployeeStockOptionMembersrt:MinimumMembermnov:TwoThousandTwentyThreeEquityIncentivePlanMember2023-01-012023-12-310001226616us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001226616us-gaap:LicenseAgreementTermsMember2022-01-012022-12-310001226616us-gaap:EmployeeStockOptionMembermnov:TwoThousandThirteenEquityIncentivePlanMembersrt:MinimumMember2023-01-012023-12-310001226616us-gaap:CommonStockMember2022-12-310001226616us-gaap:RetainedEarningsMember2022-01-012022-12-310001226616us-gaap:DomesticCountryMember2023-01-012023-12-310001226616srt:MaximumMember2023-12-3100012266162024-02-1200012266162023-10-012023-12-310001226616mnov:ResearchAndDevelopmentAndPatentsExpenseMember2022-01-012022-12-310001226616us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001226616us-gaap:PerformanceSharesMember2023-01-012023-12-310001226616mnov:TwoThousandThirteenEquityIncentivePlanMember2023-12-310001226616us-gaap:WarrantMemberus-gaap:StockCompensationPlanMember2023-12-310001226616us-gaap:AdditionalPaidInCapitalMember2022-12-310001226616us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001226616srt:MaximumMemberus-gaap:EmployeeStockOptionMembermnov:TwoThousandTwentyThreeEquityIncentivePlanMember2023-01-012023-12-310001226616us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310001226616us-gaap:LicenseAgreementTermsMember2023-01-012023-12-310001226616us-gaap:StateAndLocalJurisdictionMember2023-01-012023-12-310001226616us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CertificatesOfDepositMember2022-12-310001226616mnov:MutualFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001226616us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-3100012266162023-06-300001226616us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001226616us-gaap:LeaseholdImprovementsMember2023-12-310001226616country:JP2023-12-310001226616us-gaap:CommonStockMember2022-01-012022-12-310001226616mnov:AtMarketIssuanceSalesAgreementMember2023-01-012023-12-310001226616us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001226616us-gaap:AdditionalPaidInCapitalMember2021-12-310001226616country:JP2023-01-012023-12-310001226616us-gaap:EmployeeStockOptionMember2023-12-310001226616us-gaap:RetainedEarningsMember2023-01-012023-12-310001226616mnov:TwoThousandThirteenEquityIncentivePlanMember2013-06-300001226616country:US2023-12-310001226616us-gaap:EmployeeStockOptionMembermnov:TwoThousandThirteenEquityIncentivePlanMember2023-01-012023-12-310001226616us-gaap:DomesticCountryMember2023-12-310001226616srt:MaximumMembermnov:BRileyFBRIncMembermnov:TwoThousandNineteenAtMarketIssuanceSalesAgreementMember2019-08-230001226616us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001226616us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001226616us-gaap:WarrantMembermnov:TwoThousandTwentyThreeEquityIncentivePlanMember2023-12-310001226616us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001226616srt:MinimumMember2023-01-012023-12-3100012266162023-01-012023-12-310001226616us-gaap:CommonStockMember2021-12-310001226616us-gaap:StateAndLocalJurisdictionMember2023-12-310001226616us-gaap:CommonStockMember2023-12-310001226616us-gaap:SubsequentEventMemberus-gaap:PerformanceSharesMember2024-01-012024-01-310001226616srt:MaximumMember2023-01-012023-12-310001226616srt:MinimumMemberus-gaap:CertificatesOfDepositMember2023-01-012023-12-310001226616mnov:TwoThousandTwentyThreeEquityIncentivePlanMember2023-12-310001226616mnov:DevelopmentMilestoneMember2023-12-310001226616us-gaap:RetainedEarningsMember2023-12-310001226616srt:MaximumMemberus-gaap:EmployeeStockOptionMembermnov:TwoThousandThirteenEquityIncentivePlanMember2023-01-012023-12-3100012266162023-12-31xbrli:puremnov:Segmentxbrli:sharesmnov:Reporting_unitiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Form 10-K

(Mark One)

|

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

or

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from. to

Commission file number: 001-33185

MEDICINOVA, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

Delaware |

|

33-0927979 |

(State or Other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

4275 Executive Square, Suite 300, La Jolla, CA |

|

92037 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

(858) 373-1500

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

Common Stock, par value $0.001 per share |

MNOV |

The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

|

|

|

|

|

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☒ |

|

Smaller reporting company |

☒ |

|

Emerging growth company |

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ☐ No ☒

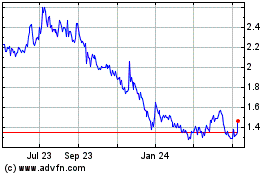

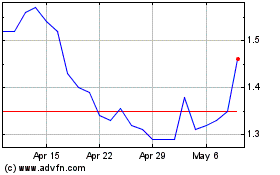

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $109,440,898 based on the closing price of the registrant’s common stock on the NASDAQ Global Market of $2.30 per share on June 30, 2023. Shares of common stock held by each executive officer and director and each affiliated entity has been excluded from this calculation. This determination of affiliate status may not be conclusive for other purposes.

The number of outstanding shares of the registrant’s common stock, par value $0.001 per share, as of February 12, 2024 was 49,046,246.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the registrant’s 2024 Annual Meeting of Stockholders, which will be filed subsequent to the date hereof, are incorporated by reference into Part III of this Form 10-K.

MEDICINOVA, INC.

FORM 10-K—ANNUAL REPORT

For the Fiscal Year Ended December 31, 2023

Table of Contents

The MediciNova logo is a registered trademark of MediciNova, Inc. All other product and company names are registered trademarks or trademarks of their respective companies.

PART I

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes forward-looking statements that involve a number of risks and uncertainties, many of which are beyond our control. The forward-looking statements are contained principally in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” but are also contained elsewhere in this report. Forward-looking statements include all statements that are not historical facts and, in some cases, can be identified by terms such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “design,” “intend,” “expect,” “could,” “plan,” “potential,” “predict,” “seek,” “should,” “would” or the negative version of these words and similar expressions.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including those described in "Risk Factors" and elsewhere in this report. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our beliefs and assumptions only as of the date of this report. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. You should read this report completely and with the understanding that our actual future results may be materially different from what we expect.

The following factors are among those that may cause actual results to differ materially from our forward-looking statements:

•Inability to raise additional capital if needed;

•Inability to generate revenues from product sales to continue business operations;

•Inability to develop and commercialize our product candidates;

•Failure or delay in completing clinical trials or obtaining FDA or foreign regulatory approval for our product candidates in a timely manner;

•Unsuccessful clinical trials stemming from clinical trial designs, failure to enroll a sufficient number of patients, undesirable side effects and other safety concerns;

•Inability to demonstrate sufficient efficacy of product candidates;

•Reliance on the success of our MN-166 (ibudilast) and MN-001 (tipelukast) product candidates;

•Delays in commencement or completion of clinical trials or suspension or termination of clinical trials;

•Loss of our licensed rights to develop and commercialize a product candidate as a result of the termination of the underlying licensing agreement;

•Competitors may develop products rendering our product candidates obsolete and noncompetitive;

•The widespread outbreak of an illness or any other communicable disease, such as COVID-19, which has led to key employees becoming ill for a period of time;

•Inability to successfully attract partners and enter into collaborations on acceptable terms;

•Dependence on third parties to conduct clinical trials and to manufacture product candidates;

•Dependence on third parties to market and distribute products;

•Our product candidates, if approved, may not gain market acceptance or obtain adequate coverage for third party reimbursement;

•Disputes or other developments concerning our intellectual property rights;

•Actual and anticipated fluctuations in our quarterly or annual operating results;

•Price and volume fluctuations in the overall stock markets;

•Litigation or public concern about the safety of our potential products;

•International trade or foreign exchange restrictions, increased tariffs, foreign currency exchange;

•High quality material for our products may become difficult to obtain or expensive;

•Strict government regulations on our business;

•Regulations governing the production or marketing of our product candidates;

•Loss of, or inability to attract, key personnel; and

•Economic, political, foreign exchange and other risks associated with international operations.

Unless the context requires otherwise, references in this Annual Report on Form 10-K to “MediciNova,” “we,” “us” and “our” refer to MediciNova, Inc.

Summary Risk Factors

The following is a summary of the principal risks and uncertainties that could adversely affect our business, cash flows, financial condition and/or results of operations, and these adverse impacts may be material. This summary is qualified in its entirety by reference to the more detailed descriptions of the risks and uncertainties included in Item 1A below and you should read this summary together with those more detailed descriptions.

These principal risks and uncertainties relate to, among other things:

Risks Related to Our Business and our Industry:

•the significant operating losses we have incurred and expect to incur for the foreseeable future;

•our ability to obtain the capital necessary to fund our operations;

•we do not have any products that are approved for commercial sale and do not expect to generate any revenues from product sales for the foreseeable future, if ever;

•our dependence on the success of our MN-166 (ibudilast) and MN-001 (tipelukast) product candidates and uncertainty that these product candidates will receive regulatory approval or be successfully commercialized;

•the complexity and uncertainty relating to progressing product candidates through the various stages of clinical trials and obtaining regulatory approval;

•our attempts to develop MN-001 (tipelukast) in NASH, NAFLD, and IPF may detract from our efforts to develop other product candidates;

•the complexity, high cost and uncertainty of obtaining regulatory approval;

•the stringent regulation of our product candidates;

•future development and regulatory difficulties even if we are successful in receiving regulatory approval of one or more of our product candidates;

•undesirable side effects of any product candidate experienced during clinical trials could delay or prevent regulatory approval or commercialization or limit its commercial potential;

•delays in the commencement or completion of clinical trials, or suspension or termination of our clinical trials;

•the loss of any rights to develop and market any of our product candidates;

•the impact of the COVID-19 pandemic or any other illness or communicable disease, or any other public health crisis on our business;

•our dependence on strategic collaborations with third parties to develop and commercialize product candidates;

•our reliance on third parties to conduct our clinical trials;

•our reliance on third party manufacturers to produce our product candidates;

•our, or our third-party manufacturer's ability to manufacture our product candidates in commercial quantities;

•the commercial availability of materials necessary to manufacture our product candidates;

•the acceptance among physicians, patients and the medical community of our product candidates;

•the ability of users of our products to obtain adequate coverage of and reimbursement for our products from government and other third party payers;

•our ability to retain, motivate and attract key personnel;

•our ability to establish sales, marketing and distribution capabilities;

•health care reform measures could adversely affect our business;

•the impact of any product liability lawsuits against us;

•the impact of fluctuations in our results of operations;

•the cost of and management attention required to operate as a public company;

•information technology systems failures, network disruptions, breaches in data security and computer crime and cyber-attacks;

•the complexity of operating our business and marketing our products internationally;

Risks Related to Our Intellectual Property:

•our ability to compete depends on the adequate protection of our proprietary rights;

•the potential disclosure of our trade secrets and other proprietary information;

•the costs and uncertainties of any dispute concerning the infringement or misappropriation of our proprietary rights or the proprietary rights of others, including trade secrets;

Risks Related to the Securities Markets and Investments in Our Common Stock

•volatility in our stock price;

•the potential delisting of our common stock on the Nasdaq Global Market or the Standard Market of the Tokyo Stock Exchange;

•the possibility of substantial dilution to our existing stockholders and/or the decline in price of our common stock if we were to sell additional shares of our common stock, including under our existing at-the-market issuance sales agreement;

•the cost of and management distraction if we were to face securities class action litigation; and

•the anti-takeover provisions in our charter documents and under Delaware law may make it difficult for third parties to acquire us or remove and replace our directors and management.

Item 1. Business

Overview

We are a biopharmaceutical company focused on developing novel therapeutics for the treatment of serious diseases with unmet medical needs and a commercial focus on the United States market. Our current strategy is to focus our development activities on MN-166 (ibudilast) for neurological and other disorders such as progressive multiple sclerosis (MS), amyotrophic lateral sclerosis (ALS), chemotherapy-induced peripheral neuropathy, degenerative cervical myelopathy, glioblastoma, substance dependence and addiction (e.g., methamphetamine dependence, opioid dependence, and alcohol dependence), prevention of acute respiratory distress syndrome (ARDS), and Long COVID, and MN-001 (tipelukast) for fibrotic and other diseases such as nonalcoholic fatty liver disease (NAFLD) and idiopathic pulmonary fibrosis (IPF). Our pipeline also includes MN-221 (bedoradrine) for the treatment of acute exacerbation of asthma and MN-029 (denibulin) for solid tumor cancers. MN-166 (ibudilast) is in development for several different neurological diseases and other diseases as described below.

Progressive Multiple Sclerosis:

We completed a Phase 2b clinical trial of MN-166 (ibudilast) for the treatment of relapsing multiple sclerosis (MS), in which positive safety and neuroprotective efficacy indicators were observed. The data from this trial indicated that MN-166 (ibudilast) may have potential in the treatment of progressive MS.

We partnered with investigators on a Phase 2b clinical trial of MN-166 (ibudilast) in primary progressive and secondary progressive MS which was conducted by NeuroNEXT and funded by the National Institute of Health’s (NIH) National Institute of Neurological Diseases and Stroke (NINDS). This progressive MS trial, known as SPRINT-MS, completed randomization of 255 subjects in 2015, which exceeded the goal of 250 subjects that were planned for participation. In October 2017, we announced the presentation of positive top-line results from the SPRINT-MS Phase 2b clinical trial of MN-166 (ibudilast) in progressive MS. The trial achieved both primary endpoints of whole brain atrophy and safety and tolerability. MN-166 (ibudilast) demonstrated a statistically significant 48% reduction in the rate of progression of whole brain atrophy compared to placebo (p=0.04) as measured by MRI analysis using brain parenchymal fraction (BPF) and there was not an increased rate of serious adverse events in the MN-166 (ibudilast) group compared to the placebo group. In February 2018, we announced the presentation of positive clinical efficacy trends from this trial regarding the important secondary endpoint of confirmed disability progression. MN-166 (ibudilast) demonstrated a 26% reduction in the risk of confirmed disability progression compared to placebo (hazard ratio=0.74), as measured by EDSS (Expanded Disability Status Scale). Results of the SPRINT-MS Phase 2b clinical trial of MN-166 (ibudilast) in progressive MS were published in the New England Journal of Medicine in August 2018. In April 2019, we announced results from a subgroup analysis of the SPRINT-MS Phase 2b trial of MN-166 (ibudilast) in progressive MS which showed that the trends for reduction in the risk of confirmed disability progression were highest for the subgroup of subjects with Secondary Progressive MS without Relapse, in which MN-166 (ibudilast) demonstrated a 46% risk reduction compared to placebo. Additional data from the completed SPRINT-MS Phase 2b trial of MN-166 (ibudilast) in progressive MS was presented in May 2019 at the American Academy of Neurology (AAN) 71st Annual Meeting in Philadelphia, Pennsylvania. In November 2020, we announced that positive Optical Coherence Tomography (OCT) results from the SPRINT-MS Phase 2b trial of MN-166 (ibudilast) in progressive MS were published in Multiple Sclerosis Journal. In July 2021, we received a Notice of Allowance from the U.S. Patent and Trademark Office for a new patent which covers MN-166 (ibudilast) for the treatment of an ophthalmic disease/disorder or injury associated with a neurodegenerative disease/disorder or a neuro-ophthalmologic disorder.

The United States Food and Drug Administration (FDA) has granted Fast Track designation for the development of MN-166 (ibudilast) for the treatment of patients with progressive MS.

Amyotrophic Lateral Sclerosis (ALS):

We initiated a clinical trial of MN-166 (ibudilast) in amyotrophic lateral sclerosis (ALS) in the second half of 2014, and this trial was completed during the second half of 2017. In December 2017, we announced positive top-line results from this trial. The trial achieved the primary endpoint of safety and tolerability. In addition, there was a higher rate of responders on the Amyotrophic Lateral Sclerosis Functional Rating Scale-Revised (ALSFRS-R) total score, a measure of functional activity, in the MN-166 (ibudilast) group compared to the placebo group. In September 2018, we received feedback from the FDA regarding our clinical development plan for MN-166 (ibudilast) in ALS. In January 2019, we received a Notice of Allowance from the U.S. Patent and Trademark Office for a new patent which covers the combination of MN-166 (ibudilast) and riluzole for the treatment of ALS and other neurodegenerative diseases. In April 2019, we announced that the FDA completed its review of the protocol and determined that we may proceed with a Phase 2b/3 clinical trial of MN-166 (ibudilast) in ALS. In June 2019, we announced a kick-off meeting for the Phase 2b/3 clinical trial of MN-166 (ibudilast) in ALS. In December 2019, we announced that additional analyses of the completed clinical trial of MN-166 (ibudilast) in

ALS was presented at the 30th International Symposium on ALS/MND (amyotrophic lateral sclerosis/motor neurone disease) in Perth, Australia. In December 2021, we announced that a poster with an overview of our ongoing Phase 2b/3 clinical trial of MN-166 (ibudilast) in ALS was presented at the 32nd International Symposium on ALS/MND.

The FDA has granted Fast Track designation to MN-166 (ibudilast) for the treatment of ALS as well as Orphan-Drug designation for the treatment of ALS, which will provide seven years of marketing exclusivity if it is approved for ALS. The European Commission also granted Orphan Medicinal Product Designation for MN-166 (ibudilast) for the treatment of ALS.

Substance Dependence and Addiction:

In the area of addiction, the National Institute on Drug Abuse (NIDA) funded a Phase 2 clinical trial of MN-166 (ibudilast) for the treatment of methamphetamine addiction. In collaboration with the University of California, Los Angeles (UCLA), this clinical trial commenced in 2013 and enrollment was completed in September 2017. In March 2018, we announced that this trial did not meet the primary endpoint of methamphetamine abstinence confirmed via urine drug screens during the final two weeks of treatment. In November 2017, we announced a collaboration with Oregon Health & Science University to initiate a biomarker study for evaluating MN-166 (ibudilast) in methamphetamine use disorder and this trial is ongoing.

Investigators at Columbia University and the New York State Psychiatric Institute (NYSPI) previously completed a Phase 1b/2a clinical trial of MN-166 (ibudilast) in opioid withdrawal that was funded by NIDA. Investigators at Columbia University and the NYSPI also conducted a NIDA-funded, Phase 2a clinical trial to evaluate the efficacy of MN-166 (ibudilast) in the treatment of patients addicted to prescription opioids or heroin. In March 2016, we announced that positive findings from the results of this completed study in opioid dependence were presented at the Behavior, Biology and Chemistry: Translational Research in Addiction Meeting.

Researchers at UCLA were granted approval and funding by the National Institute on Alcoholism and Alcohol Abuse (NIAAA) for a clinical trial to evaluate MN-166 (ibudilast) for the treatment of alcohol dependence. This clinical trial has been completed and results were presented at the American College of Neuropsychopharmacology (ACNP)’s 54th Annual Meeting in December 2015. In May 2018, we announced a new NIDA-funded clinical trial of MN-166 (ibudilast) in alcohol dependence and withdrawal in collaboration with researchers at UCLA. This clinical trial has been completed and positive findings were presented at the American Psychological Association 2020 Annual Convention which was held online in August 2020. Results from this clinical trial were published in June 2021 in Nature’s Translational Psychiatry. In August 2018, we announced a new NIAAA-funded Phase 2b clinical trial of MN-166 (ibudilast) to evaluate heavy drinking days in subjects with alcohol dependence in collaboration with researchers at UCLA and this trial has been completed. In February 2022, we announced that MN-166 (ibudilast) was discussed as one of the promising pharmacological agents for the treatment of alcohol use disorder in the journal Drugs. In April 2022, we announced that a secondary analysis of a Phase 2 clinical trial of MN-166 (ibudilast) in alcohol use disorder was published in the journal Alcoholism: Clinical and Experimental Research. In December 2022, we announced that positive results from a secondary analysis of a Phase 2 trial of MN-166 (ibudilast) in alcohol use disorder were published in The American Journal of Drug and Alcohol Abuse. In January 2023, we announced that the Phase 2b clinical trial of MN-166 (ibudilast) for the treatment of alcohol use disorder had completed enrollment. In June 2023, we announced results of the Phase 2b clinical trial of MN-166 (ibudilast) in alcohol use disorder which were presented at the 46th Annual Research Society on Alcoholism (RSA) Scientific Meeting.

Chemotherapy-Induced Peripheral Neuropathy: In March 2018, we announced plans to initiate a clinical trial to evaluate MN-166 (ibudilast) as a treatment for prevention of chemotherapy-induced peripheral neuropathy (CIPN) which was funded by the University of Sydney Concord Cancer Centre in Australia. In September 2020, we announced that positive clinical findings from this clinical trial were published in Cancer Chemotherapy and Pharmacology. In October 2020, we announced plans to initiate a multi-center, placebo-controlled, randomized Phase 2b trial to evaluate MN-166 (ibudilast) in CIPN, which is funded by the Australasian Gastro-Intestinal Trials Group (AGITG), and this trial is ongoing.

Degenerative Cervical Myelopathy: In August 2018, we announced plans to initiate a clinical trial of MN-166 (ibudilast) in degenerative cervical myelopathy (DCM) in collaboration with the University of Cambridge. The trial is funded by a grant from the National Institute for Health Research (NIHR) in the United Kingdom (UK). In May 2019, we announced our participation at the Kick-off Meeting for the Phase 3 clinical trial in DCM, “REgeneration in CErvical DEgenerative Myelopathy (RECEDE Myelopathy)” in collaboration with University of Cambridge researchers. In February 2022, we announced that MN-166 (ibudilast) was discussed as a potential beneficial pharmacological agent for the treatment of DCM in Global Spine Journal.

Glioblastoma: We have initiated clinical development to evaluate MN-166 (ibudilast) for the treatment of glioblastoma. In June 2017, we announced positive results from an animal model study that examined the potential clinical efficacy of MN-166 (ibudilast) for the treatment of glioblastoma. These results were presented at the 2017 American Society of Clinical Oncology (ASCO) Annual Meeting. In May 2018, we announced that the Investigational New Drug Application (IND) for MN-166 (ibudilast) for treatment of glioblastoma was accepted and opened with the FDA. In October 2018, we announced that the FDA granted orphan-drug designation to MN-166 (ibudilast) as adjunctive therapy to temozolomide for the treatment of glioblastoma. In January 2019, we announced the initiation of enrollment in a clinical trial of MN-166 (ibudilast) in combination with temozolomide for the treatment of glioblastoma at the Dana-Farber Cancer Institute in Boston. In February 2019, we announced that Scientific Reports published results from the animal model study evaluating MN-166 (ibudilast) in glioblastoma. In June 2020, we announced that positive preclinical findings were published in Frontiers in Immunology regarding the prospect of MN-166 (ibudilast) as an adjunctive treatment for glioblastoma. In August 2021, we announced completion of a safety review of Part 1 of the Phase 2 clinical trial of MN-166 (ibudilast) in combination with temozolomide, which enrolled 15 subjects with recurrent glioblastoma. There were no concerning safety signals observed in Part 1 and there were no serious adverse events related to MN-166 (ibudilast). Five out of 15 subjects completed cycle 6 without disease progression, i.e. 33% of the subjects were progression-free at six months. In April 2022, we announced that data demonstrating that MN-166 (ibudilast) prevents metastasis in a uveal melanoma (UM) animal model was published in the journal Molecular Cancer Research. In January 2023, we announced that the Phase 2 clinical trial evaluating MN-166 (ibudilast) in combination with temozolomide in glioblastoma at the Dana-Farber Cancer Institute had completed enrollment. In February 2023, we announced the presentation of new data regarding a tumor tissue analysis from this clinical trial at the 20th Annual World Congress of SBMT (Society for Brain Mapping and Therapeutics). In November 2023, we announced new data and results of the Phase 2 clinical trial of MN-166 (ibudilast) in glioblastoma patients at the 28th Annual Meeting of the Society for Neuro-Oncology (SNO). The presentation also included data from preclinical studies which evaluated the combination of MN-166 (ibudilast) and anti-PD1 or anti-PD-L1 therapy in glioblastoma models.

Prevention of ARDS in patients with COVID-19: In March 2020, we announced plans to initiate development of MN-166 (ibudilast) for severe pneumonia and ARDS based on positive results of a preclinical study in an animal model of ARDS. In April 2020, we announced plans to initiate a clinical trial of MN-166 (ibudilast) for ARDS caused by COVID-19. In July 2020, we announced that the IND for MN-166 (ibudilast) for prevention of ARDS was accepted and opened with the FDA. We were also informed by the FDA that the proposed clinical investigation of MN-166 (ibudilast) for the prevention of ARDS in patients with COVID-19 may proceed. In April

2022, we announced that the Phase 2 clinical trial of MN-166 (ibudilast) in hospitalized COVID-19 patients at risk for developing ARDS had completed enrollment. In June 2022, we announced positive top-line results from this Phase 2 clinical trial. MN-166 (ibudilast) demonstrated large improvements compared to placebo for all four clinical endpoints analyzed. The trial achieved statistical significance for one of the co-primary endpoints, the proportion of subjects free of respiratory failure. The trial also achieved statistical significance for the proportion of subjects discharged from the hospital. There were two deaths in the placebo group and no deaths in the MN-166 (ibudilast) group. In July 2022, we announced the initiation of a first-in-human clinical study to evaluate a new parenteral (injectable) formulation of MN-166 (ibudilast). In January 2023, we announced that this Phase I clinical trial of MN-166 (ibudilast) 10 mg intravenous (IV) infusion in healthy volunteers was completed with a favorable safety profile and was well tolerated.

Chlorine Gas-Induced Lung Injury: In March 2021, we announced a partnership with the Biomedical Advanced Research and Development Authority (BARDA), part of the Administration for Strategic Preparedness and Response (ASPR) in the U.S. Department of Health and Human Services, to develop MN-166 (ibudilast) as a potential medical countermeasure (MCM) against chlorine gas-induced lung damage such as ARDS and acute lung injury (ALI). BARDA agreed to provide federal funding for proof-of-concept studies of MN-166 (ibudilast) in preclinical models of chlorine gas-induced acute lung injury under Contract No. 75A50121C00022. In September 2023, we announced the results of the studies conducted under our contract with BARDA. The primary endpoint of the first nonclinical efficacy study was the pulmonary function measure PaO2/FiO2, which is the ratio of arterial oxygen partial pressure to fractional inspired oxygen. In the pilot design single-dose treatment regimen, MN-166 (ibudilast) high dose and the positive control rolipram were more efficacious than MN-166 (ibudilast) low dose and the negative control until 12 hours after chlorine exposure but this did not yield statistically significant results for overall pulmonary function. In the multi-dose study, each treatment was given every 12 hours with a total of four doses after the chlorine gas challenge. Treatment with MN-166 (ibudilast) high dose resulted in greater improvement (p=0.0001) in the mean PaO2/FiO2 ratio than MN-166 (ibudilast) low dose, rolipram, and the negative control. MN-166 (ibudilast) was well tolerated and no safety concerns were observed in the first nonclinical efficacy study. After multiple attempts by our subcontractor to establish the feasibility of the second chlorine-gas induced lung injury model, it was not deemed to be a feasible model to evaluate a drug candidate and there are no evaluable efficacy results.

Long COVID: In August 2022, we announced plans to participate in RECLAIM (Recovering from COVID-19 Lingering Symptoms Adaptive Integrative Medicine Trial), a grant-funded, multi-center, randomized, clinical trial to evaluate MN-166 (ibudilast) and other therapies for the treatment of Long COVID, the lingering symptoms of COVID-19. In February 2023, we announced that Health Canada completed its review of the clinical trial application and granted authorization to commence the RECLAIM trial and this study is ongoing.

MN-001 (tipelukast) is in development for fibrotic and other diseases as described below.

Nonalcoholic Steatohepatitis (NASH) and Nonalcoholic Fatty Liver Disease (NAFLD): We announced positive results of MN-001 (tipelukast) in two different NASH mouse models in 2014 and we opened the IND (Investigational New Drug) application for MN-001 (tipelukast) for the treatment of NASH with the FDA in 2015. The FDA subsequently granted Fast Track designation to MN-001 (tipelukast) for the treatment of patients with NASH with fibrosis. We then initiated a clinical trial to investigate MN-001 (tipelukast) for the treatment of hypertriglyceridemia in NASH and NAFLD patients. In April 2018, we announced that we would terminate this trial early after positive results from an interim analysis in which MN-001 (tipelukast) significantly reduced mean serum triglycerides, a primary endpoint. This data was presented at the International Liver Congress 2018, the 53rd annual meeting of the European Association for the Study of the Liver (EASL) in Paris, France in April 2018. In November 2020, we announced positive results of in-vitro and in-vivo studies that evaluated MN-001 (tipelukast) for its anti-liver fibrotic effect in human hepatic stellate cells (HSCs) and in an acute liver injury model at the annual meeting of the American Association for the Study of Liver Diseases (AASLD). In November 2021, we

announced new findings from a study that investigated the mechanism by which MN-001 (tipelukast) alters triglyceride metabolism in hepatocytes at the Annual Meeting of the American Association for the Study of Liver Diseases (AASLD). In April 2022, we announced that the FDA completed its review of a proposed Phase 2 clinical trial to evaluate MN-001 (tipelukast) for the treatment of patients with NAFLD, type 2 diabetes mellitus, and hypertriglyceridemia and the study may proceed. In July 2022, we announced the initiation of a Phase 2 clinical trial to evaluate MN-001 (tipelukast) for the treatment of patients with NAFLD, type 2 diabetes mellitus, and hypertriglyceridemia. In December 2022, we announced the presentation of positive results from a subgroup analysis of the completed Phase 2 clinical trial which evaluated MN-001 (tipelukast) in participants with NAFLD and hypertriglyceridemia (HTG) at the International Diabetes Federation (IDF) World Diabetes Congress 2022.

Idiopathic Pulmonary Fibrosis (IPF): In 2014, we announced positive results of MN-001 (tipelukast) in a mouse model of pulmonary fibrosis. The FDA subsequently granted Orphan-Drug designation to MN-001 (tipelukast) for treatment of IPF which will provide seven years of marketing exclusivity if MN-001 (tipelukast) is approved for IPF. The FDA granted Fast Track designation to MN-001 (tipelukast) for the treatment of patients with IPF in September 2015. We then initiated a Phase 2 clinical trial of MN-001 (tipelukast) to treat IPF and we announced results of this trial in August 2021. Although there were no clinically meaningful trends in favor of MN-001 (tipelukast) for the majority of the clinical outcome measures in this small study, there were no worsening IPF events (acute IPF exacerbation or hospitalization due to respiratory symptoms) in the MN-001 (tipelukast) group compared to one worsening IPF event in the placebo group. MN-001 (tipelukast) demonstrated a substantial reduction in LOXL2, a biomarker for IPF, whereas LOXL2 increased in the placebo group. MN-001 (tipelukast) was safe and well tolerated.

We completed a Phase 2 clinical trial of MN-221 (bedoradrine) for the treatment of acute exacerbations of asthma treated in the emergency room and conducted an End-of-Phase 2 meeting with the FDA in October 2012. In that meeting, the FDA identified the risk/benefit profile of MN-221 (bedoradrine) as a focal point for further development and advised that a clinical outcome, such as a reduction in hospitalizations, would need to be a primary endpoint in a pivotal trial. We believe the appropriate clinical development for MN-221 (bedoradrine) would involve conducting dose regimen and acute exacerbations of asthma trial design optimization studies prior to commencing pivotal trials. We plan to identify a partner for financial support before further clinical development is commenced.

We acquired licenses to MN-166 (ibudilast), MN-001 (tipelukast), MN-221 (bedoradrine), and MN-029 (denibulin) for the development of these product candidates. The MN-221 (bedoradrine) license agreement was terminated in October 2022. We have pursued development of these product candidates in various indications including prevention of acute respiratory distress syndrome, Long COVID, progressive MS, ALS, chemotherapy-induced peripheral neuropathy, degenerative cervical myelopathy, glioblastoma, various addictions, NASH and NAFLD, IPF, acute exacerbations of asthma, and solid tumor cancers.

Our Strategy

Our goal is to build a sustainable biopharmaceutical business through the successful development of differentiated products for the treatment of serious diseases with unmet medical needs in high-value therapeutic areas. Key elements of our strategy are as follows:

•Pursue the development of MN-166 (ibudilast) for multiple potential indications with the support of non-dilutive financings.

We intend to advance our diverse MN-166 (ibudilast) program through a combination of investigator-sponsored clinical trials, trials funded through government grants or other grants, and trials funded by us. We intend to pursue additional strategic alliances to help support further clinical development of MN-166 (ibudilast).

•Pursue the development of MN-001 (tipelukast) for fibrotic and other diseases.

We intend to advance development of MN-001 (tipelukast) through a variety of means, which may include investigator-sponsored trials with or without grant funding as well as trials funded by us.

•Consider strategic partnerships with one or more leading pharmaceutical companies to complete product development and successfully commercialize our products.

We develop and maintain relationships with pharmaceutical companies that are therapeutic category leaders. We intend to discuss strategic alliances with leading pharmaceutical companies who seek product candidates, such as MN-166 (ibudilast), MN-001 (tipelukast), MN-221 (bedoradrine), and MN-029 (denibulin), which could support our clinical development and product commercialization.

Our Product Candidates and Programs

Our product development programs address diseases that we believe are not well served by currently available therapies and represent significant commercial opportunities. We believe that we have product candidates that offer innovative therapeutic approaches that may provide significant advantages relative to current therapies.

Our product acquisitions have focused primarily on product candidates with significant preclinical and early clinical testing data that have been developed by the licensors outside of the United States. We utilize the existing data in preparing IND Applications or their foreign equivalents, and in designing and implementing additional preclinical or clinical trials to advance the development programs in the United States or abroad.

Following are the details of our product development programs:

MN-166 (ibudilast)

MN-166 (ibudilast) is a novel, first-in-class, oral, anti-inflammatory and neuroprotective agent. MN-166 (ibudilast) inhibits macrophage migration inhibitory factor (MIF) and certain phosphodiesterases (PDEs). MN-166 (ibudilast) also attenuates activated glia cells, which play a major role in certain neurological conditions. While it has been in use for more than 20 years in Japan and Korea for the treatment of asthma and post-stroke dizziness, we are developing MN-166 (ibudilast) for the treatment of progressive MS, ALS, chemotherapy-induced peripheral neuropathy, degenerative cervical myelopathy, glioblastoma, substance dependence, prevention of acute respiratory distress syndrome, and Long COVID. We licensed MN-166 (ibudilast) from Kyorin Pharmaceuticals (Kyorin) in 2004.

The FDA has granted Fast Track designations to MN-166 (ibudilast) for three separate indications: the treatment of progressive MS, the treatment of ALS, and the treatment of methamphetamine dependence. Fast track designation is a process designed to facilitate the development and expedite the review of drugs that are intended to treat serious diseases and have the potential to fill an unmet medical need. An important feature of the FDA’s Fast Track program is that it emphasizes early and frequent communication between the FDA and the sponsor throughout the entire drug development and review process to improve the efficiency of product development. Accordingly, Fast Track status can potentially lead to a shortened timeline to ultimate drug approval.

The FDA has granted Orphan-Drug designation to MN-166 (ibudilast) for the treatment of ALS, which will provide seven years of marketing exclusivity if it is approved for ALS in the U.S. The European Commission also granted Orphan Medicinal Product Designation for MN-166 (ibudilast) for the treatment of ALS which offers potential benefits including ten years of marketing exclusivity if it is approved for ALS in Europe. The FDA has also granted Orphan-Drug designation to MN-166 (ibudilast) as adjunctive therapy to temozolomide for the treatment of glioblastoma.

We have filed patent applications for multiple uses of MN-166 (ibudilast) for the treatment of neurological conditions. Some of the patent estate has received allowance in the United States and foreign countries. For example, we have been granted separate U.S. patents that cover the use of MN-166 (ibudilast) for the treatment of progressive MS, for the treatment of ALS, for the treatment of glioblastoma, for the treatment of drug addiction or dependence, and for the treatment of neuropathic pain.

Progressive Multiple Sclerosis: MS is a complex disease with predominantly unknown etiology and affects approximately 2.8 million people worldwide, according to the National Multiple Sclerosis Society, or NMSS. Also, according to NMSS, approximately 85 percent of people with MS are initially diagnosed with relapsing-remitting MS, or RRMS, and some people who are initially diagnosed with RRMS will eventually transition to secondary progressive MS, or SPMS. About 15 percent of people with MS are diagnosed with primary progressive MS, or PPMS. There is only one approved drug for PPMS and it is administered by intravenous infusion. Although several drugs have been approved for SPMS with relapses, there are no approved drugs generally considered safe and efficacious for SPMS in the absence of relapses. There is a significant medical need for a safe, effective, and conveniently administered therapy for patients with PPMS and SPMS and the unmet medical need is highest in patients with SPMS without relapses. MN-166 (ibudilast) may meet these needs.

Based on promising results from a Phase 2 trial in relapsing MS completed in 2008, investigators from NeuroNEXT, a NIH-funded Phase 2 clinical trial network, evaluated MN-166 (ibudilast) in PPMS and SPMS patients in the United States. SPRINT-MS is the name of the Phase 2b, randomized, double-blind, placebo-controlled trial that evaluated the safety and tolerability of MN-166 (ibudilast) (up to 100 mg/day) in PPMS and SPMS patients. Recruitment and enrollment at 28 medical centers in the United States commenced in late 2013 and randomization of 255 subjects was completed in June 2015. In October 2017, we announced the presentation of positive top-line results from the SPRINT-MS Phase 2b clinical trial of MN-166 (ibudilast) in progressive MS. The trial achieved both primary endpoints of whole brain atrophy and safety and tolerability. MN-166 (ibudilast) demonstrated a statistically significant 48% reduction in the rate of progression of whole brain atrophy compared to placebo (p=0.04) as measured by MRI analysis using brain parenchymal fraction (BPF) and there was not an increased rate of serious adverse events in the MN-166 (ibudilast) group compared to the placebo group. In February 2018, we announced the presentation of positive clinical efficacy trends from this trial regarding the important secondary endpoint of confirmed disability progression. MN-166 (ibudilast) demonstrated a 26% reduction in the risk of confirmed disability progression compared to placebo (hazard ratio=0.74), as measured by EDSS (Expanded Disability Status Scale).

Results of the SPRINT-MS Phase 2b clinical trial of MN-166 (ibudilast) in progressive MS were published in the New England Journal of Medicine in August 2018. In April 2019, we announced results from a subgroup analysis of the SPRINT-MS Phase 2b trial of MN-166 (ibudilast) in progressive MS. The purpose of the subgroup analysis was to provide information about which types of progressive MS subjects responded best to MN-166 (ibudilast) treatment in terms of the clinically significant endpoint of the risk of confirmed disability progression compared to placebo, as measured by EDSS. The trends for reduction in the risk of confirmed disability progression were highest for the subgroup of subjects with Secondary Progressive MS without Relapse, in which MN-166 (ibudilast) demonstrated a 46% risk reduction compared to placebo as indicated by the hazard ratio of 0.538. Additional data from the completed SPRINT-MS Phase 2b trial of MN-166 (ibudilast) in progressive MS was presented in May 2019 at the American Academy of Neurology (AAN) 71st Annual Meeting in Philadelphia. In November 2020, we announced that positive Optical Coherence Tomography (OCT) results from the SPRINT-MS Phase 2b trial of MN-166 (ibudilast) in progressive MS were published in Multiple Sclerosis Journal. OCT measures included macular volume, pRNFL (peripapillary retinal nerve fiber layer) thickness, and ganglion cell-inner plexiform (GCIP) layer thickness. All of these OCT measures showed less loss of retinal tissue for MN-166 (ibudilast) compared to placebo. In July 2021, we received a Notice of Allowance from the U.S. Patent and Trademark Office for a new patent which covers MN-166 (ibudilast) for the treatment of an ophthalmic

disease/disorder or injury associated with a neurodegenerative disease/disorder or a neuro-ophthalmologic disorder. We were granted Fast Track designation from the FDA for MN-166 (ibudilast) for the treatment of progressive MS in 2016.

Amyotrophic Lateral Sclerosis (ALS): ALS, also known as Lou Gehrig’s disease, is a progressive neurodegenerative disease that affects nerve cells in the brain and the spinal cord. The nerves lose the ability to trigger specific muscles, which causes the muscles to become weak. As a result, ALS affects voluntary movement and patients in the later stages of the disease may become totally paralyzed. Mean survival time of an ALS patient is two to five years. According to the ALS Association, there are at least 16,000 ALS patients in the United States and approximately 5,000 people in the United States are diagnosed with ALS each year.

We have worked with Carolinas Neuromuscular/ALS-MDA Center at Carolinas HealthCare System Neurosciences Institute, which has conducted a clinical trial of MN-166 (ibudilast) in ALS. The trial was a randomized, double-blind, placebo-controlled study which included a six-month treatment period followed by a six-month open-label extension. The study evaluated the safety and tolerability of MN-166 (ibudilast) 60 mg/day versus placebo when administered in combination with riluzole in subjects with ALS, as well as several efficacy endpoints. Subject enrollment began in October 2014. In April 2016, we announced that interim efficacy data from a mid-study analysis of the clinical trial of MN-166 (ibudilast) in ALS was presented at the American Academy of Neurology (AAN) 68th Annual Meeting.

In December 2017, we announced positive top-line results from the ALS trial at Carolinas Neuromuscular/ALS-MDA Center. The trial achieved the primary endpoint of safety and tolerability. In addition, there was a higher rate of responders on the ALSFRS-R total score in the MN-166 (ibudilast) group compared to the placebo group. The Amyotrophic Lateral Sclerosis Functional Rating Scale-Revised (ALSFRS-R) total score measures the functional activity of an ALS subject. There was also a higher rate of responders on the ALSAQ-5 score in the MN-166 (ibudilast) group compared to the placebo group. The Amyotrophic Lateral Sclerosis Assessment Questionnaire (ALSAQ-5) score measures the physical mobility, activities of daily living and independence, eating and drinking, communication, and emotional functioning of an ALS subject. In July 2018, we announced data from ad-hoc subgroup analyses in subjects who had either bulbar onset or upper limb onset in the ALS trial at Carolinas Neuromuscular/ALS-MDA Center. In September 2018, we received feedback from the FDA regarding our clinical development plan for MN-166 (ibudilast) in ALS. In April 2019, we announced that the FDA completed its review of the protocol and determined that we may proceed with a Phase 2b/3 clinical trial of MN-166 (ibudilast) in ALS. In June 2019, we announced that a kick-off meeting for the Phase 2b/3 clinical trial of MN-166 (ibudilast) in ALS was held our headquarters in La Jolla, California. In December 2019, we announced that additional analyses of the completed clinical trial of MN-166 (ibudilast) in ALS was presented at the 30th International Symposium on ALS/MND (amyotrophic lateral sclerosis/motor neurone disease) in Perth, Australia. These analyses evaluated the potential background factors of patients’ characteristics that could reasonably predict both ALS disease progression and treatment efficacy. The results of these analyses indicate that the efficacy of MN-166 (ibudilast) is expected to be more robust in patients with a short ALS history. We have incorporated the conclusions from these analyses into the design of our Phase 2b/3 clinical trial. In December 2021, we announced that a poster with an overview of our ongoing Phase 2b/3 clinical trial of MN-166 (ibudilast) in ALS was presented at the 32nd International Symposium on ALS/MND.

In December 2015, we announced that the FDA granted Fast Track designation to MN-166 (ibudilast) for the treatment of patients with ALS. In March 2016, we announced that we received a Notice of Allowance from the United States Patent and Trademark Office (PTO) for a new patent which covers MN-166 (ibudilast) for the treatment of ALS. In October 2016, we announced that the FDA granted Orphan-Drug designation to MN-166 (ibudilast) for the treatment of ALS, which will provide seven years of marketing exclusivity if it is approved for ALS. In December 2016, we announced that the European Commission granted Orphan Medicinal Product

Designation for MN-166 (ibudilast) for the treatment of ALS. In January 2019, we received a Notice of Allowance from the U.S. PTO for a new patent which covers the combination of MN-166 (ibudilast) and riluzole for the treatment of ALS and other neurodegenerative diseases.

In February 2016, we entered into an agreement to collaborate with Massachusetts General Hospital (MGH) to study the effects of MN-166 (ibudilast) on reducing brain microglial activation in ALS subjects measured by a positron emission tomography (PET) biomarker. Results of this clinical trial, which we refer to as the ALS / Biomarker study, were presented at the 30th International Symposium on ALS/MND (amyotrophic lateral sclerosis/motor neurone disease) in Perth, Australia in December 2019. In this small study, there was no detectable effect on PBR28-PET uptake or serum NFl but there was a significant reduction in serum MIF, a marker of neuroinflammation. However, because of the open-label design of this study, there was no placebo group to compare with the MN-166 (ibudilast) group, so it is not possible to draw any definitive conclusions from this study.

Methamphetamine Addiction: Methamphetamine is a central nervous system stimulant drug that is similar in structure to amphetamine. It is a Schedule II drug, meaning that it has high abuse potential and low therapeutic potential. According to the Substance Abuse and Mental Health Services Administration’s (SAMHSA) 2022 National Survey on Drug Use and Health, there are approximately 1.8 million people aged 12 or older with methamphetamine use disorder in the United States. The Rand Corporation has estimated that the economic burden of methamphetamine use in the United States is approximately $23.4 billion. Currently, there is no pharmaceutical treatment approved for methamphetamine dependence. Based on non-clinical results of the effects of MN-166 (ibudilast) in an animal model of methamphetamine relapse, investigators at UCLA conducted a Phase 1b clinical trial funded by NIDA to examine the safety and preliminary efficacy of MN-166 (ibudilast) in non-treatment-seeking, methamphetamine-dependent users in an inpatient trial that was completed in 2012. Subsequently, UCLA investigators received NIDA grant funding for a Phase 2 clinical trial to evaluate MN-166 (ibudilast) in methamphetamine-dependent users in an outpatient trial setting that commenced in 2013. In March 2018, we announced that this trial did not meet the primary endpoint of methamphetamine abstinence confirmed via urine drug screens during the final two weeks of treatment. In November 2017, we announced a collaboration with Oregon Health & Science University to initiate a biomarker study to evaluate MN-166 (ibudilast) in methamphetamine use disorder and this study is ongoing. We were granted Fast Track designation from the FDA for MN-166 (ibudilast) for the treatment of methamphetamine dependence in 2013.

Opioid Withdrawal and Dependency: According to the SAMHSA’s 2022 National Survey on Drug Use and Health, there are approximately 5.6 million people aged 12 or older with prescription pain reliever use disorder and approximately 0.9 million people aged 12 or older with heroin use disorder in the United States. Access to prescription opioids has recently become more difficult due to more stringent policies on prescribing opioids. An unintended consequence of this policy is increased use of heroin. Heroin is attractive to prescription opioid addicts because it is less expensive and more accessible than prescription opioids. Heroin poses serious health issues, such as risk of HIV and Hepatitis C infection, overdose, and death. There is an urgent, significant unmet medical need for a safe, effective non-addictive, non-opioid therapy for the treatment of prescription opioid and heroin addiction. Investigators at Columbia University and NYSPI previously completed a NIDA-funded, randomized, double-blind, placebo-controlled in-unit Phase 1b/2a clinical trial to evaluate the ability of MN-166 (ibudilast) to reduce opioid withdrawal symptoms in humans. Subsequently, investigators at Columbia University and NYSPI conducted a NIDA-funded Phase 2a clinical trial of MN-166 (ibudilast) for the treatment of prescription opioid or heroin dependence. In March 2016, we announced that positive findings from the results of this completed study in opioid dependence were presented at the Behavior, Biology and Chemistry: Translational Research in Addiction Meeting.

Alcohol Addiction: According to SAMHSA’s 2022 National Survey on Drug Use and Health, there are approximately 29.5 million people aged 12 or older in the United States with alcohol use disorder. The Centers for Disease Control and Prevention (CDC) has reported that excessive alcohol use costs the United States $249 billion

per year. Medicines that have been approved by the FDA to treat alcohol dependence include Antabuse® (disulfiram), Vivitrol (naltrexone), Campral® (acamprosate) and Revia® (naltrexone). However, the search for a safe and effective drug remains elusive due to limited success of these FDA-approved compounds (Witkiewitz et al., 2012). In a non-clinical trial (Bell et al., 2013), MN-166 (ibudilast) was examined in rats and mice and was found to reduce alcohol drinking in alcohol-preferring P rats and high-alcohol drinking (HAD1) rats by 50%, and in mice made dependent on alcohol at doses which had no effect on non-dependent mice. Investigators at UCLA received funding from the NIAAA to conduct a study to evaluate MN-166 (ibudilast) with a randomized, double-blind, placebo-controlled within-subject crossover design to determine the safety, tolerability and initial human laboratory efficacy of MN-166 (ibudilast) in a sample of 24 non-treatment seeking individuals with either alcohol abuse or dependence. Results of the alcohol dependence study were presented at the American College of Neuropsychopharmacology (ACNP)’s 54th Annual Meeting in December 2015. MN-166 (ibudilast), but not placebo, significantly decreased basal, daily alcohol craving over the course of the study (p<0.05). MN-166 (ibudilast) did not affect cue- and stress-induced alcohol craving. However, MN-166 (ibudilast) increased positive mood during both the cue reactivity and stress procedures. MN-166 (ibudilast) was safe and well-tolerated during the study. In May 2018, we announced plans to initiate an NIH-funded clinical trial of MN-166 (ibudilast) in alcohol dependence and withdrawal in collaboration with researchers at UCLA. This study was a randomized, double-blind, placebo-controlled Phase 2 trial to evaluate the effect of 14 days of ibudilast treatment on mood, heavy drinking, and neural reward signals in 52 patients with alcohol use disorder (AUD). Positive results of this Phase 2 clinical trial were presented at the American Psychological Association 2020 Annual Convention which was held online in August 2020. Results from this clinical trial were published in June 2021 in Nature’s Translational Psychiatry which included the following: (1) MN-166 (ibudilast) did not have a significant effect on negative mood; (2) MN-166 (ibudilast), relative to placebo, reduced the odds of heavy drinking across time by 45% (p=0.04); (3) MN-166 (ibudilast) attenuated alcohol cue-elicited activation in the ventral striatum (VS) (i.e. reduced the rewarding response to alcohol in the brain) compared to placebo (p=0.01); (4) alcohol cue-elicited activation in the VS predicted subsequent drinking in the MN-166 (ibudilast) group (p=0.02), such that individuals who had attenuated VS activation and took MN-166 (ibudilast) had the fewest number of drinks per drinking day in the week following the scan; and (5) MN-166 (ibudilast) reduced alcohol craving compared to placebo on non-drinking days (p=0.02). These findings extend preclinical and human laboratory studies of the utility of ibudilast to treat AUD and suggest a biobehavioral mechanism through which ibudilast acts, namely, by reducing the rewarding response to alcohol cues in the brain leading to a reduction in heavy drinking. In August 2018, we announced a new NIAAA-funded Phase 2b clinical trial of MN-166 (ibudilast) in alcohol dependence in collaboration with researchers at UCLA. This clinical trial, which has been completed, evaluated whether MN-166 (ibudilast) would decrease the percentage of heavy drinking days (defined as ≥ 5 drinks for men and ≥ 4 drinks for women), as compared to placebo, over the course of the 12-week trial.

In February 2022, we announced that MN-166 (ibudilast) was discussed as one of the promising pharmacological agents for the treatment of AUD in the journal Drugs. The publication, which was written by researchers at UCLA, discussed the beneficial effects of MN-166 (ibudilast) in treating AUD and noted that these effects are thought to be driven by its anti-inflammatory and pro-neurotrophic properties. In April 2022, we announced that a secondary analysis of a Phase 2 clinical trial of MN-166 (ibudilast) in AUD was published in the journal Alcoholism: Clinical and Experimental Research. The publication, which was written by researchers at UCLA, discussed the results of the secondary analysis and noted that reductions in alcohol craving may represent a primary mechanism of MN-166 (ibudilast). In December 2022, we announced that positive results from a secondary analysis of a Phase 2 trial of MN-166 (ibudilast) in AUD were published in The American Journal of Drug and Alcohol Abuse. These results showed that the high baseline C-reactive protein (CRP) group, i.e. the participants with high inflammation, who received MN-166 (ibudilast) had significantly fewer drinks per drinking day compared to the low baseline CRP group who received MN-166 (ibudilast) (p=0.007). In January 2023, we announced that the Phase 2b clinical trial of MN-166 (ibudilast) for the treatment of alcohol use disorder had completed enrollment. In June 2023, we announced results of the Phase 2b clinical trial of MN-166 (ibudilast) in alcohol use disorder which

were presented at the 46th Annual Research Society on Alcoholism (RSA) Scientific Meeting. This study was a randomized, double-blind, placebo-controlled, Phase 2b clinical trial in 102 treatment-seeking men and women with moderate or severe alcohol use disorder. MN-166 (ibudilast) was not superior to placebo for the primary objective of reducing percent heavy drinking days. Also, MN-166 (ibudilast) was not superior to placebo for the secondary endpoints of 1) the number of drinks consumed per day, 2) the number of drinks consumed per drinking day, 3) the percentage of days abstinent, 4) the percentage of subjects with no heavy drinking days, and 5) the percentage of subjects who are abstinent. This trial showed a placebo effect in which both the placebo and MN-166 (ibudilast) decreased heavy drinking.

Chemotherapy-Induced Peripheral Neuropathy: Peripheral neuropathy is a set of symptoms caused by damage to peripheral nerves, the nerves that are away from the brain and spinal cord. Some of the chemotherapy and other drugs used to treat cancer can damage peripheral nerves which carry sensations to the brain and control the movement of the arms and legs. This damage results in chemotherapy-induced peripheral neuropathy (CIPN) which can be a disabling side effect of cancer treatment. Common symptoms of CIPN include pain, burning, tingling, loss of feeling, coordination and balance problems, muscle weakness, trouble swallowing and passing urine, constipation, and blood pressure changes. Severe CIPN may require chemotherapy dose reduction or cessation. According to a meta-analysis which included more than 4,000 patients, CIPN prevalence was 68% when measured in the first month after chemotherapy, 60% at 3 months, and 30% at 6 months or more (“Incidence, prevalence, and predictors of chemotherapy-induced peripheral neuropathy: A systematic review and meta-analysis,” Seretny M et al 2014). In March 2018, we announced plans to initiate a clinical trial to evaluate MN-166 (ibudilast) as a treatment for prevention of CIPN which was funded by the University of Sydney Concord Cancer Centre in Australia. This open-label, sequential cross-over pilot study assessed acute neurotoxicity, CIPN, and drug interactions of MN-166 (ibudilast) in patients with metastatic gastrointestinal cancer (colorectal cancer and upper gastrointestinal cancers) who were receiving oxaliplatin. In September 2020, we announced that positive clinical findings from this clinical trial were published in Cancer Chemotherapy and Pharmacology. Co-administration of MN-166 (ibudilast) with oxaliplatin resulted in improvement or stabilization of oxaliplatin-induced neurotoxicity in the majority of participants treated with oxaliplatin. According to the Oxaliplatin-Specific Neurotoxicity Scale (OSNS) assessments, 12 out of 14 participants reported acute neurotoxicity (Grade 1 or 2) in both cycles. Of those, ten out of 12 participants were unchanged and two participants had improved symptoms from Grade 2 to Grade 1 with MN-166 (ibudilast) co-treatment. Acute neurotoxicity, which predicts chronic CIPN, is expected to worsen in patients with continued chemotherapy. Pharmacokinetic analysis indicated no effect of MN-166 (ibudilast) on systemic exposure of oxaliplatin. In October 2020, we announced plans to initiate a multi-center, placebo-controlled, randomized Phase 2b trial to evaluate MN-166 (ibudilast) in CIPN, which is funded by the Australasian Gastro-Intestinal Trials Group (AGITG). This clinical trial is evaluating MN-166 (ibudilast) as a potential treatment to reduce acute neurotoxicity severity and CIPN in patients with metastatic colorectal cancer.

Degenerative Cervical Myelopathy: Degenerative cervical myelopathy (DCM), also known as cervical spondylotic myelopathy, involves spinal cord dysfunction from compression in the neck. Degenerative cervical myelopathy is the most common form of spinal cord impairment in adults and results in disability and reduced quality of life. Patients report neurological symptoms such as pain and numbness in limbs, poor coordination, imbalance, and bladder problems. According to the American Association of Neurological Surgeons, more than 200,000 cervical procedures are performed each year to relieve compression on the spinal cord or nerve roots. There are no pharmaceuticals approved for the treatment of DCM. In August 2018, we announced plans to initiate a clinical trial of MN-166 (ibudilast) in DCM in collaboration with the University of Cambridge. The trial, which is funded by a grant from the National Institute for Health Research (NIHR) in the United Kingdom (UK), is evaluating MN-166 (ibudilast) as an adjuvant treatment for DCM following spinal surgery to determine whether MN-166 (ibudilast) is more effective than placebo in improving outcomes after spinal surgery. The two co-primary endpoints are (1) the modified Japanese Orthopaedic Association (mJOA) Score, which evaluates motor dysfunction in upper and lower extremities, loss of sensation, and bladder sphincter dysfunction, at six months after

surgery; and (2) Visual Analogue Scale (VAS) measure of neck pain at six months after surgery. In May 2019, we announced our participation at the Kick-off Meeting for this Phase 3 clinical trial in DCM, “REgeneration in CErvical DEgenerative Myelopathy (RECEDE Myelopathy)” in collaboration with University of Cambridge researchers. In February 2022, we announced that MN-166 (ibudilast) was discussed as a potential beneficial pharmacological agent for the treatment of DCM in Global Spine Journal. The publication, which was written by researchers at the University of Cambridge, discussed contemporary therapies that may hold therapeutic value and the attributes of MN-166 (ibudilast) that support its use in DCM. The publication noted that the combination of anti-inflammatory, neuroprotective, and neuroregenerative properties of MN-166 (ibudilast) leads to attenuation of glial cell activation and is the basis for the ongoing RECEDE Myelopathy trial.

Glioblastoma: According to the American Association of Neurological Surgeons, glioblastoma is an aggressive brain tumor that develops from glial cells (astrocytes and oligodendrocytes), grows rapidly, and commonly spreads into nearby brain tissue. The American Brain Tumor Association reports that glioblastomas represent about 14% of all primary brain tumors. More than 12,000 cases of glioblastoma are diagnosed each year in the U.S. According to the Glioblastoma Foundation, average life expectancy for glioblastoma patients who undergo treatment is 12 - 15 months and only four months for those who do not receive treatment. In June 2017, we announced positive results from an animal model study that examined the potential clinical efficacy of MN-166 (ibudilast) for the treatment of glioblastoma which were presented at the 2017 American Society of Clinical Oncology (ASCO) Annual Meeting. Results of the glioblastoma mouse model study showed that median survival was higher in the group that received combination treatment with MN-166 (ibudilast) plus temozolomide compared to the group that received temozolomide alone. In May 2018, we announced that the Investigational New Drug Application (IND) for MN-166 (ibudilast) for treatment of glioblastoma was accepted and opened with the FDA. We were also informed by the FDA that the proposed clinical investigation of MN-166 (ibudilast) in combination with temozolomide for treatment of glioblastoma may proceed. In October 2018, we announced that the FDA granted orphan-drug designation to MN-166 (ibudilast) as adjunctive therapy to temozolomide for the treatment of glioblastoma. In January 2019, we announced the initiation of enrollment in a clinical trial of MN-166 (ibudilast) in combination with temozolomide (TMZ, Temodar®) for the treatment of glioblastoma at the Dana-Farber Cancer Institute in Boston. In February 2019, we announced that Scientific Reports published results from the animal model study evaluating MN-166 (ibudilast) in glioblastoma. The article, “Ibudilast sensitizes glioblastoma to temozolomide by targeting Macrophage Migration Inhibitory Factor (MIF),” is the first publication reporting the potential clinical utility of MN-166 (ibudilast) for glioblastoma. In June 2020, we announced that positive preclinical findings were published in Frontiers in Immunology regarding the prospect of MN-166 (ibudilast) as an adjunctive treatment for glioblastoma. The publication, entitled “Glioblastoma myeloid-derived suppressor cell subsets express differential macrophage migration inhibitory factor receptor profiles that can be targeted to reduce immune suppression”, was based on our collaboration with the Cleveland Clinic. In August 2021, we announced completion of a safety review of Part 1 of the Phase 2 clinical trial of MN-166 (ibudilast) in combination with temozolomide, which enrolled 15 subjects with recurrent glioblastoma. There were no concerning safety signals observed in Part 1 and there were no serious adverse events related to MN-166 (ibudilast). Five out of 15 subjects completed cycle 6 without disease progression, i.e. 33% of subjects were progression-free at six months.

In January 2023, we announced that the Phase 2 clinical trial evaluating MN-166 (ibudilast) in combination with temozolomide in glioblastoma at the Dana-Farber Cancer Institute had completed enrollment. In February 2023, we announced the presentation of new data regarding a tumor tissue analysis from this clinical trial at the 20th Annual World Congress of SBMT (Society for Brain Mapping and Therapeutics). In November 2023, we announced new data and results of the Phase 2 clinical trial of MN-166 (ibudilast) in glioblastoma patients at the 28th Annual Meeting of the Society for Neuro-Oncology (SNO). The primary endpoints of this Phase 2 clinical trial were safety and tolerability of MN-166 (ibudilast) and temozolomide (TMZ) combination treatment and efficacy of

the combination treatment defined as progression-free survival rate at 6 months using the RANO criteria. MN-166 (ibudilast) and TMZ combination treatment was safe and well-tolerated, and no unexpected adverse effects were reported. The trial enrolled a total of 62 patients, including 36 newly diagnosed glioblastoma patients and 26 recurrent glioblastoma patients. Progression-Free Survival at 6 months (PFS6) was 44% for newly diagnosed glioblastoma patients and 31% for recurrent glioblastoma patients. Immunohistochemistry evaluation determined that CD3 expression was a good predictor for tumor progression at five months in recurrent glioblastoma patients treated with MN-166 (ibudilast) and TMZ as patients with progression had higher CD3 tumor infiltration than patients with no progression (p<0.05). The presentation also included data from preclinical studies which evaluated the combination of MN-166 (ibudilast) and anti-PD1 or anti-PD-L1 therapy in glioblastoma models. In the first preclinical glioblastoma model study, median survival was 17 days for the vehicle and 28 days for the anti-PD1 inhibitor treatment alone. The addition of MN-166 (ibudilast) to the anti-PD1 inhibitor treatment significantly extended survival to a median of 66 days (p<0.001) for the combination therapy. In the second preclinical glioblastoma model study, median survival was 18 days for the vehicle and 26 days for the anti-PD-L1 inhibitor treatment alone. The addition of MN-166 (ibudilast) to the anti-PD-L1 inhibitor treatment significantly extended survival to a median of 34 days (p<0.05) for the combination therapy.

In April 2022, we announced that data demonstrating that MN-166 (ibudilast) prevents metastasis in a uveal melanoma (UM) animal model was published in the journal Molecular Cancer Research. The publication, which was written by researchers at Columbia University Medical Center, discussed the metastatic UM mouse model study in which quantified bioluminescence signal intensity in the abdominal region was dramatically reduced by MN-166 (ibudilast) treatment (p<0.05). The publication also noted that histological analysis of the liver tissues of control mice showed the presence of tumor cell clusters which were not present in the liver tissues of mice treated with MN-166 (ibudilast).