Form 8-K - Current report

February 15 2024 - 9:15AM

Edgar (US Regulatory)

false

0001659617

0001659617

2024-02-15

2024-02-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): February 15, 2024

MOLECULIN BIOTECH, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

001-37758

|

47-4671997

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(Commission File No.)

|

(I.R.S. Employer Identification

No.)

|

5300 Memorial Drive, Suite 950, Houston, TX 77007

(Address of principal executive offices and zip code)

(713) 300-5160

(Registrant’s telephone number, including area code)

(Former name or former address, if changed from last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-14(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $.001 per share

|

MBRX

|

The NASDAQ Stock Market LLC

|

|

Item 7.01

|

Regulation FD Disclosure

|

On February 15, 2024, Moleculin Biotech, Inc. (the “Company”), held a virtual investor call with the Company’s Chairman and Chief Executive Officer, Walter Klemp. The call can be viewed via the following link: https://www.virtualinvestorco.com/wtm-mbrx-part1.

A copy of the script is attached to this report as Exhibit 99.1 and is incorporated by reference herein.

The information contained in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be “filed” for the purpose of the Securities Exchange Act of 1934, as amended (“Exchange Act”), nor shall it be incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended (“Securities Act”), unless specifically identified therein as being incorporated by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

104

|

Cover page Interactive Data File (formatted as Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MOLECULIN BIOTECH, INC.

|

|

| |

|

|

|

| |

|

|

|

| |

Date:

|

February 15, 2024

|

|

| |

|

|

|

| |

By:

|

/s/ Jonathan P. Foster

|

|

| |

|

Jonathan P. Foster

|

|

Exhibit 99.1

Virtual Investor: What this Means – Three Part Series

Participants:

| |

●

|

Wally Klemp, Chairman and Chief Executive Officer

|

Moleculin Bio (Nasdaq: MBRX)

Jenene Introduction:

| |

●

|

Welcome back for another Virtual Investor – What This Means Segment. My name is Jenene Thomas, CEO of JTC IR, and I will be today’s moderator.

|

Today we are featuring Moleculin Biotech and I am pleased to be joined by Walter Klemp, Chairman and Chief Executive Officer of the Company.

Before we get started, I just want to inform our audience that Moleculin Bio is listed on the Nasdaq and trades under the ticker M B R X. During today’s discussion, the Company will be making forward-looking statements and actual results could differ materially from these forward-looking statements. Some of the factors that could cause actual results to differ materially from these contemplated by such forward-looking statements are discussed in the periodic reports Moleculin files with the Securities and Exchange Commission. These documents are available in the Investors section of the Company's website and on the Securities and Exchange Commission's website. We encourage you to review these documents carefully.

Moderated Questions – Part 1

Jenene Intro: Moleculin recently released a press release on January 24th discussing its accomplishments in 2023 and expectations for 2024. The Company appears to be at a major inflection point in its development program and it’s one that Management feels investors need to understand thoroughly. In order to facilitate this, we’ll be hosting a 3-part What This Means series with Moleculin’s CEO, Walter Klemp, in order to really understand the opportunity.

| |

1.

|

Q: What do you hope to accomplish with your communications with investors right now?

|

| |

a.

|

Jenene, given the low trading range of our stock right now, I believe the public does not understand the importance of the data we have recently announced and the significance of what will happen this year. My hope is that we can use this “What This Means” series to bridge this information gap for the investing public.

|

| |

2.

|

Q: Maybe you could start by summarizing your recent progress?

|

| |

a.

|

Absolutely. Let me start with our other drug candidate programs and I’ll make this quick since we believe the true value inflection opportunity right now is with Annamycin.

|

| |

b.

|

That said, our WP1066 Portfolio, otherwise known as our STAT3 inhibitor program has been quietly gaining momentum. We have been steadily advancing the development of an IV formulation of WP1066. I’ll remind folks that even though the oral version of this drug presented some bioavailability challenges, we still saw clinical improvement in two children with DIPG, something that is virtually unheard of with any therapeutic. These data are preliminary and should be covered in more detail in an investigator publication expected in 2024. And, right now, we have the potential for two different prestigious universities preparing to fund additional brain tumor trials and we expect at least one of these to kick off this year.

|

| |

c.

|

Our antimetabolite program, that we refer to as the WP1122 Portfolio, is at a turning point. We are in discussions with several research institutions to help fund further development of both WP1122 and WP1096, but our clear priority is to push Annamycin over the finish line, so almost all our internal resources are focused only on Annamycin.

|

| |

3.

|

Q: Well, it sounds like the game has really changed regarding Annamycin. Can you describe why that is?

|

| |

a.

|

It really has, Jenene. Until last year, we were grinding away to establish safety and efficacy for Annamycin in AML as a single agent. That process was slow and frustrating because we could only get access to some of the most desperate patients, those who were on average coming off of their 6th line of prior failed therapy.

|

| |

b.

|

But once we established that Annamycin is not only safe but appeared to show efficacy at the recommended Phase 2 dose level, we were then able to shift into a combination therapy with Cytarabine, one of the most common drugs used for combination therapies in AML. We call that combination “AnnAraC.” When that shift happened, everything changed.

|

| |

c.

|

Clinicians started to see the real potential for Annamycin and began enrolling more and more patients who were 2nd or 3rd line instead of 5th line or greater. And, we started seeing Complete Response after Complete Response. And, this became a virtuous cycle in that the more patients responded, the more investigators wanted to get their best patients enrolled. Our enrollment rate went from one a month to one or more a week. We just announced in January that 15 subjects had been recruited, which is why we are indicating we should be fully recruited soon.

|

| |

d.

|

We expect to provide a further update on our AML trial recruitment and results along with our year-end numbers in late March. And, you know, at our current pace, we’ll likely be done with recruitment by then.

|

| |

4.

|

Q: So, it’s clear you’re excited about the recent turn of events. Can you help investors understand how significant this is?

|

| |

a.

|

Yes, I’d be happy to. First, it’s important to understand that despite the approval of several new drugs over the last few years, there remains a significant unmet need in AML. What you see here is a simplified map of the AML patient journey. Before the approval of Venetoclax, only patients who were fit enough for intensive chemotherapy at a decent shot at lasting remission, usually through a bone marrow transplant. Combining Venetoclax with Azacytidine finally gave unfit patients an equal chance but that still left a lot of patients without a good option. Finally, provided 2nd line patients with some hope but only if they had the right genetic mutation. Despite all of the progress to date, well more than half of all AML patients are still left without a good chance at beating their disease. That represents a tremendous unmet medical need.

|

| |

5.

|

Q: So, it sounds like understanding the unmet need for 2nd line patients is important to understanding the opportunity for Annamycin.

|

| |

a.

|

It is. In fact, it’s so important that we’d like to dedicate Part 2 of this series to unpacking the unmet need and quantifying the opportunity. For now, though, let’s just use Venetoclax as a proxy for the unmet need. That drug was only approved for combination use in AML in 2019. Today, it represents $2 billion in annual revenues for AbbVie largely due to just two indications: AML and CLL. And, let’s not forget the Jazz Pharma acquisition of Vyxeos, which is only used in a subset of AML patients, yet Jazz paid $1.5 billion for that opportunity.

|

| |

b.

|

Yet despite the introduction of Venetoclax and all the progress we’ve seen with targeted therapies recently, as you can see from this chart, more than half of all AML patients are still left without an effective treatment. We think this presents a huge opportunity for Annamycin to significantly impact patients’ lives and to generate returns for our investors.

|

| |

6.

|

Q: Understood, but what should investors be focused on to gauge Annamycin’s relative opportunity compared with existing therapies.

|

| |

a.

|

Jenene, that is THE question that every investor should be focused on. In fact, I believe if the investing public really understood where we are right now, our stock price would be significantly greater than it currently is.

|

| |

b.

|

Let me explain. AML is an unforgiving disease. The average 5-year survival rate for patients over 20 is just 28%. The best chance patients have to beat their disease is to undergo a therapy designed to reduce the leukemic cells in their bone marrow to below 5% such that their bone marrow can begin overcoming the leukemia by producing healthy white blood cells, either naturally or through a bone marrow transplant.

|

| |

c.

|

These are often referred to as “induction therapies” as they are designed to “induce” remission of the leukemic cells. And, the holy grail for induction therapies is what we call a durable complete response or CR. That’s where the cancer cells in your bone marrow are reduced to below 5% and your circulating blood makeup returns to normal levels. Now, if we get your bone marrow to the right level but we aren’t able to get complete recovery of the peripheral blood counts, we call that a CRi. CRi’s are still an indication of efficacy but they are not as likely as CR’s to result in lasting remission.

|

| |

d.

|

CR’s are considered durable if they last beyond 3 or 4 months or until the patient can undergo a bone marrow transplant. All of the recent approvals in the AML space have been on the basis of combined CR/CRi rate stated as a percentage of the total number of patients in the approval trial. That said, if you are talking with a clinician in AML practice, they are much more impressed with CR’s than CRi’s, so the CR rate is really the acid test for induction performance.

|

| |

e.

|

We recently announced preliminary data showing a CR rate of 40% and a CR/CRi rate of 47% in our most recent Phase 2 clinical trial. That rate is higher than ANY drug ever approved for treating relapsed or refractory AML. That means patients for whom one or more prior therapies have failed. And, when you look at just the CR rate, we are nearly double the performance of the CR rates of the majority of existing 2nd line therapies that have been approved so far.

|

| |

7.

|

Q: This sounds almost too good to be true. Are there any caveats investors should keep in mind?

|

| |

a.

|

The biggest caveat is the size of the sample set. The data we’ve released so far are based on an N of 15 and we intend to get that number closer to 20 before submitting the data to FDA. Also, this is not an approval trial. This is what we call a Phase 2a and it’s just intended to determine how to power our pivotal approval trial, which we expect to begin before the end of this year. That trial will likely be in more than 100 patients.

|

| |

b.

|

Jenene, I know it sounds too good to be true, but this IS happening, and we believe that, if the results of the pivotal trial track the results we’ve seen so far, it means that Annamycin will be approved once we complete the upcoming pivotal trial. And, it’s why it is SO important that investors stop, listen and understand where we really are. Just getting into a pivotal trial is a massive milestone for any biotech company.

|

| |

8.

|

Q: Fantastic! What’s the impact of this data on Moleculin’s prospects for new drug approval and for potential partnerships?

|

| |

a.

|

Well, I know we are running out of time for today’s session so let me just add that we would like to use Part 3 of this series to talk about the most likely trial design, our process with the FDA and EMA and the timeline for running our pivotal trial.

|

Jenene Closing:

| |

●

|

With that, this concludes the Virtual Investor What this Means segment with Moleculin. I would like to thank Wally Klemp, Chairman and CEO of Moleculin for joining us today.

|

| |

●

|

I would also like to thank our viewers for your time and attention. As a reminder, you can access the webcast replay from today’s event at: www.virtualinvestorco.com.

|

v3.24.0.1

Document And Entity Information

|

Feb. 15, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

MOLECULIN BIOTECH, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 15, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-37758

|

| Entity, Tax Identification Number |

47-4671997

|

| Entity, Address, Address Line One |

5300 Memorial Drive, Suite 950

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77007

|

| City Area Code |

713

|

| Local Phone Number |

300-5160

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

MBRX

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001659617

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

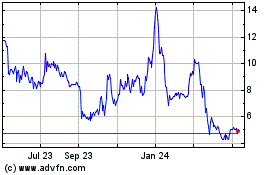

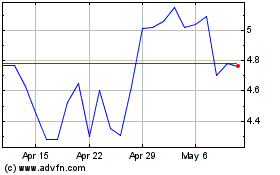

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From Apr 2023 to Apr 2024