Form 8-K - Current report

February 15 2024 - 6:58AM

Edgar (US Regulatory)

false

0001620533

0001620533

2024-02-13

2024-02-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

February 13, 2024

Date

of Report (Date of earliest event reported)

SHAKE

SHACK INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

001-36823 |

47-1941186 |

(State

or other jurisdiction of

incorporation

or organization)

|

(Commission

File

Number) |

(IRS

Employer

Identification

No.) |

| |

225

Varick Street, Suite 301

New

York, New York |

10014 |

| |

(Address

of principal executive offices) |

(Zip

Code) |

(646)

747-7200

(Registrant's

telephone number, including area code)

Not applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| ¨ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered |

| Class A Common Stock, par value $0.001 |

SHAK |

New

York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ¨

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 4.02 Non-Reliance on

Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

In connection with the preparation of Shake Shack

Inc.’s (“Shake Shack” or the “Company”) Annual Report on Form 10-K for the fiscal year ended December 27,

2023 (the “2023 Form 10-K”), the Company concluded that in prior years it had not appropriately accounted for the deferred

tax asset associated with its investment in SSE Holdings, LLC, due primarily to incorrect accounting for state tax depreciation. These

errors led to overstatements of income tax expense and understatement of deferred tax assets during the impacted periods. On February

13, 2024, the Audit Committee (the “Audit Committee”) of the Company’s Board of Directors, after discussion with senior

management and the Company’s independent registered public accountants, concluded that the Company’s previously issued audited

consolidated financial statements as of and for the fiscal years ended December 28, 2022 and December 29, 2021, included in the Company’s

Annual Report on Form 10-K for the fiscal year ended December 28, 2022, (collectively, the “Prior Financial Statements”) should

no longer be relied upon due to the impact of the unintentional errors noted above and will be restated.

The errors and corrective adjustments

identified by the Company are non-cash in nature; and they do not impact results of operations or key metrics used by the Company in

managing operations, such as Shack sales, Total revenue, Shack-level operating profit and Adjusted EBITDA.

We estimate that the impacts to the periods reported

in the Prior Financial Statements result in favorable adjustments to Income tax expense (benefit) by approximately $3.0 million and $4.1

million, respectively, for fiscal 2022 and fiscal 2021, and an opening adjustment to retained earnings in fiscal 2021 of approximately

$10.1 million related to periods prior to fiscal 2021. As a result of these adjustments, Net income (loss) will improve by approximately

$3.0 million and $4.1 million, respectively, for fiscal 2022 and fiscal 2021. These estimated amounts are unaudited and subject to change.

The Company is preparing restatements of the Prior

Financial Statements to be included in the 2023 Form 10-K inclusive of restatements to reflect the adjustments discussed above. We expect

to file the 2023 Form 10-K with the Securities and Exchange Commission on a timely basis, on or prior to the deadline for the 2023 Form

10-K.

The Audit Committee and management have discussed

with Ernst & Young LLP, the Company’s independent registered public accounting firm, the matters disclosed in this filing.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking

statements, within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”), which are subject to known

and unknown risks, uncertainties and other important factors that may cause actual results to be materially different from the statements

made herein. All statements other than statements of historical fact included herein are forward-looking statements.

All forward-looking statements are expressly qualified

in their entirety by these cautionary statements. Some of the factors which could cause results to differ materially from the Company’s

expectations include the continuing impact of the COVID-19 pandemic, including the potential impact of any COVID-19 variants, the Company’

s ability to develop and open new Shacks on a timely basis, increased costs or shortages or interruptions in the supply and delivery of

our products, increased labor costs or shortages, inflationary pressures, the Company’s management of its digital capabilities and

expansion into new channels, including drive-thru and multiple format investments, the Company’s ability to maintain and grow sales

at its existing Shacks, risks relating to the restaurant industry generally, and the impact of any material weakness in our internal controls

over financial reporting identified in connection with the restatement discussed above or otherwise. You should evaluate all forward-looking

statements made herein in the context of the risks and uncertainties disclosed in the Company’s Annual Report of Form 10-K for the

fiscal year ended December 28, 2022 as filed with the Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Shake Shack Inc. |

|

| |

(Registrant) |

|

| |

|

|

| |

|

|

| Dated: February 15, 2024 |

By: |

/s/ Katherine Fogertey |

|

| |

|

Katherine Fogertey |

|

| |

|

Chief Financial Officer |

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

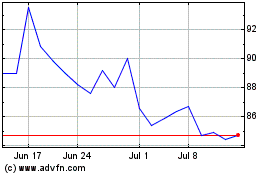

Shake Shack (NYSE:SHAK)

Historical Stock Chart

From Apr 2024 to May 2024

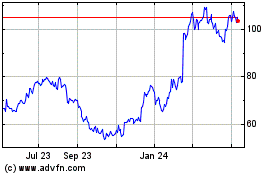

Shake Shack (NYSE:SHAK)

Historical Stock Chart

From May 2023 to May 2024