U.S. Futures Edge Higher Ahead of Key Economic Data Release, Oil Prices See Modest Declines

February 15 2024 - 6:35AM

IH Market News

On Thursday morning, U.S. index futures indicate a modestly

positive opening, in anticipation of the release of important

economic indicators from the retail and industrial sectors.

At 05:55 AM, the futures for the Dow Jones (DOWI:DJI) rose by 50

points, or 0.13%. The S&P 500 futures increased by 0.09%, and

the Nasdaq-100 futures went up by 0.07%. The yield on 10-year

Treasury notes was at 4.228%.

In the commodities market, the West Texas Intermediate crude oil

for March fell by 0.59%, to $76.19 per barrel. Brent crude for

April dropped by 0.60%, near $81.11 per barrel.

The U.S. economic agenda is filled with important indicators

that could influence market expectations.

Starting at 08:30 AM, data on weekly unemployment insurance

claims will be released, with the LSEG consensus anticipating about

220,000 requests, reflecting the current labor market conditions.

At the same time, attention will turn to January’s retail sales,

with an expected slight monthly decrease of 0.1%, which may signal

consumers’ willingness to spend amidst an uncertain economic

landscape. January’s import prices will also be announced, offering

insights into external inflationary pressures.

At 09:15 AM, January’s industrial production will be revealed,

with the LSEG consensus projecting modest growth of 0.3%,

indicative of the health of the industrial sector. Finally, at 10

AM, December’s business inventories will be published, providing a

view on the balance between supply and demand in the business

sector.

At Wednesday’s close, U.S. stocks saw a turnaround, with indices

recovering some of the earlier losses. The Nasdaq led the gains,

while the Dow Jones rose by 0.40% and the S&P 500 gained 0.96%.

The recovery reflected the search for buying opportunities, despite

inflation concerns. The technology sector led the rebound, while

individual stocks like Lyft (NASDAQ:LYFT) and

Robinhood (NASDAQ:HOOD) recorded significant

gains. On the other hand, Akamai Technologies

(NASDAQ:AKAM) saw its shares plunge after reporting revenues below

expectations. The computer hardware and tobacco sectors showed

strength, pushing the market upward.

Asian markets presented mixed results, with the highlight being

Japan’s Nikkei 225, which rose by 1.21%, surpassing 38,000 points

for the first time since 1990. This achievement comes amid news

that Japan lost its position as the world’s third-largest economy

to Germany, after entering a technical recession. South Korea’s

Kospi experienced a slight decline, the Shanghai stock exchange

remained closed for a holiday, while Hong Kong’s Hang Seng and

Australia’s ASX 200 rose by 0.41% and 0.77%, respectively.

European markets are showing gains as investors assess the UK’s

fourth-quarter GDP and monitor corporate earnings. The British

economy contracted by 0.3% at the end of 2023, leading the country

into a technical recession after a negative revision of

third-quarter growth.

For Thursday’s quarterly earnings front, financial reports are

scheduled to be presented by Crocs (NASDAQ:CROX),

John Deere (NYSE:DE), Yeti

(NYSE:YETI), Wendy’s (NASDAQ:WEN), Penn

National Gaming (NASDAQ:PENN), Oatly

(NASDAQ:OTLY), InterDigital (NASDAQ:IDCC), among

others, before the market opens.

After the close, results from Draftkings

(NASDAQ:DKNG), Coinbase (NASDAQ:COIN),

Roku (NASDAQ:ROKU), TheTradeDesk

(NASDAQ:TTD), Applied Materials (NASDAQ:AMAT),

DoorDash (NYSE:DASH), Opendoor

Technologies (NASDAQ:OPEN), Toast

(NYSE:TOST), Agnico Eagle Mines (NYSE:AEM), and

more, are expected.

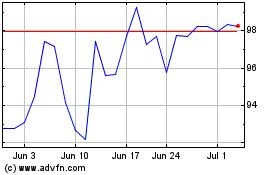

The Trade Desk (NASDAQ:TTD)

Historical Stock Chart

From Mar 2024 to Apr 2024

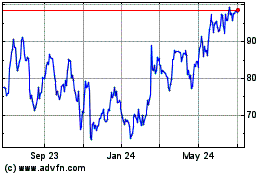

The Trade Desk (NASDAQ:TTD)

Historical Stock Chart

From Apr 2023 to Apr 2024