false

2024-02-08

0001098880

--12-31

IntelGenx Technologies Corp.

0001098880

2024-02-08

2024-02-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 14, 2024 (

February 8, 2024

)

INTELGENX TECHNOLOGIES CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-31187

|

87-0638336

|

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

6420 Abrams

St- Laurent, Quebec, Canada

H4S 1Y2

(Address of principal executive offices) (ZIP Code)

Registrant’s telephone number, including area code: (514) 331-7440

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

|

Common Stock, $0.00001 par value

|

|

IGXT |

|

OTCQB |

| |

|

IGX |

|

TSX |

| |

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b -2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material Modification to Rights of Security Holders.

To the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On February 8, 2024, IntelGenx Technologies Corp. (the "Company") filed the Certificate of Designations of Preferences, Rights and Limitations of Series A Convertible Cumulative Preferred Stock (the "Certificate of Designation") designating 2,090,000 shares of Series A Preferred Stock of the Company.

The Series A Preferred Stock ranks, as to dividend rights and rights upon our liquidation, dissolution, or winding up, senior to our common stock. The terms of the Series A Preferred Stock do not limit our ability to (i) incur indebtedness or (ii) issue additional equity securities that are equal or junior in rank to the shares of our Series A Preferred Stock as to distribution rights and rights upon our liquidation, dissolution or winding up.

Each share of Series A Preferred Stock has an initial stated value of $10.00, which is equal to the offering price per share, subject to appropriate adjustment in relation to certain events, such as recapitalizations, stock dividends, stock splits, stock combinations, reclassifications or similar events affecting our Series A Preferred Stock.

Dividends on the Series A Preferred Stock will be cumulative and payable quarterly in arrears to all holders of record on the applicable record date. Holders of our Series A Preferred Stock will be entitled to receive cumulative dividends in the amount of $0.20 per share each quarter, which is equivalent to the annual rate of 8.00% of the $10.00 purchase price per share; provided that upon an event of default (generally defined as our failure to pay dividends when due or to redeem shares when requested by a holder), such amount shall be increased to $0.30 per quarter, which is equivalent to the annual rate of 12% of the $10.00 purchase price per share. Dividends on shares of our Series A Preferred Stock will continue to accrue even if any of our agreements prohibit the current payment of dividends or we do not have earnings, all to the extent permitted by Delaware law governing distributions to stockholders. Dividends may be paid in cash or, at the Company's discretion and subject to the prior approval of the Toronto Stock Exchange (the "TSX"), in kind in the form of common stock of the Company at a price equal to the five-day volume-weighted average price of the shares of common stock on the TSX on the day that is two business days before such dividends becomes due and payable.

The liquidation preference for each share of our Series A Preferred Stock is $15.00. In the event of any voluntary or involuntary liquidation, dissolution or winding up of our company, holders of shares of our Series A Preferred Stock then outstanding will be entitled to be paid out of the assets of the Company available for distributions to its stockholders, before any payment is made to the holders of shares of common stock or other classes of shares of the Company ranking junior to the Series A Preferred Stock, the liquidation preference with respect to their shares plus an amount equal to any accrued but unpaid dividends and dividends to, but not including, the date of payment with respect to such shares. After the payment to the holders of the Series A Preferred Stock of the amount so payable to them as above provided, they shall not be entitled to share in any further distribution of the assets or property of the Company.

Commencing on the fifth anniversary of the initial closing of this offering and continuing indefinitely thereafter, we shall have a right to call for redemption the outstanding shares of our Series A Preferred Stock at a call price equal to 150% of the original issue price of our Series A Preferred Stock, and correspondingly, each holder of shares of our Series A Preferred Stock shall have a right to put the shares of Series A Preferred Stock held by such holder back to us at a put price equal to 150% of the original issue purchase price of such shares. Such price will be $15.00 per share.

The foregoing description of the Series A Preferred Stock does not purport to be complete and is qualified in its entirety by reference to the Certificate of Designation, a copy of which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Exhibit 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

INTELGENX TECHNOLOGIES CORP.

Date: February 14, 2024

By: /s/ Andre Godin

Andre Godin

President and CFO

CERTIFICATE OF DESIGNATION OF PREFERENCES,

RIGHTS AND LIMITATIONS

OF

SERIES A CONVERTIBLE CUMULATIVE PREFERRED STOCK

OF

INTELGENX TECHNOLOGIES CORP.

PURSUANT TO SECTION 151 OF THE

DELAWARE GENERAL CORPORATION LAW

The undersigned, Andre Godin, does hereby certify that:

1. He is the Chief Financial Officer of IntelGenx Technologies, Corp., a Delaware corporation (the "Corporation").

2. The Corporation is authorized to issue 20,000,000 shares of preferred stock, none of which have been previously designated.

3. The following resolutions were duly adopted by the board of directors of the Corporation (the "Board"):

WHEREAS, the certificate of incorporation of the Corporation provides for a class of its authorized stock known as preferred stock, consisting of 20,000,000 shares, $0.00001 par value per share, issuable from time to time in one or more series;

WHEREAS, the Board is authorized to fix the powers, designations, preferences and relative, participation, optional or other rights, if any, and the qualifications, limitations or restrictions thereof, if any, of any wholly unissued series of preferred stock, including, without limitation, authority to fix the dividend rights, dividend rate, conversion rights, voting rights, rights and terms of redemption (including, without limitation, sinking fund provisions), redemption price or prices, and liquidation preferences of any such series, and the number of shares constituting any such series and the designation thereof, or any of the foregoing; and

WHEREAS, it is the desire of the Board, pursuant to its authority as aforesaid, to fix the powers, designations, preferences and relative, participation, optional or other rights, if any, and the qualifications, limitations or restrictions relating to a series of the preferred stock, which shall consist of 2,090,000 shares which the Corporation has the authority to issue, as follows:

NOW, THEREFORE, BE IT RESOLVED, that the Board does hereby provide for the issuance of a series of preferred stock for cash or exchange of debt or other securities, rights or property and does hereby fix and determine the powers, designations, preferences and relative, participation, optional or other rights, if any, and the qualifications, limitations or restrictions relating to such series of preferred stock as follows:

SERIES A CONVERTIBLE CUMULATIVE PREFERRED STOCK

1. DEFINITIONS. For purposes of the Shares and as used in this Certificate, the following terms shall have the meanings indicated:

"Board" shall mean the board of directors of the Corporation or any committee of members of the board of directors authorized by such board to perform any of its responsibilities with respect to the Shares.

"Borrowing Agreements" shall have the meaning set forth in paragraph (b)(ii) of Section 4 hereof.

"Business Day" shall mean any day other than a Saturday, Sunday or a day on which state or federally chartered banking institutions in New York, New York are not required to be open.

"Call Date" shall mean the date fixed for redemption of the Shares and specified in the notice to holders required under paragraph (a)(i) of Section 5 hereof as the Call Date.

"Certificate" shall mean this Certificate of Designation of Preferences, Rights and Limitations of the Series A Convertible Cumulate Preferred Stock.

"Common Stock" shall mean the shares of common stock, $0.0001 par value, of the Corporation.

"Corporation" shall mean IntelGenx Technologies Corp., a Delaware corporation.

"Conversion Price" shall have the meaning set forth in subparagraph (a) of Section 6 hereof.

"Corporation Redemption Notice" shall have the meaning set forth in paragraph (a)(i) of Section 5 hereof.

"Corporation Redemption Response" shall have the meaning set forth in paragraph (b)(ii) of Section 5 hereof.

"Conversion Rights" shall have the meaning set forth in Section 6 hereof.

"Dividend Default" shall have the meaning set forth in subparagraph (b) of Section 3 hereof.

"Dividend Payment Date" shall have the meaning set forth in subparagraph (a) of Section 3 hereof.

"Dividend Periods" shall mean quarterly dividend periods commencing on the first day of each of January, April, July and October and ending on and including the day preceding the first day of the next succeeding Dividend Period; provided, however, that any Dividend Period during which any Shares shall be redeemed pursuant to Section 5 hereof shall end on but shall not include the Call Date only with respect to the Shares being redeemed.

"Dividend Rate" is $0.20 per share each quarter, which is equivalent to the annual rate of 8.00% of the Series A Original Issuance Price.

"Dividend Record Date" shall have the meaning set forth in subparagraph (a) of Section 3 hereof.

"Exchange Act" shall mean the U.S. Securities Exchange Act of 1934, as amended.

"Holder Redemption Notice" shall have the meaning set forth in paragraph (b)(ii) of Section 5 hereof

"Issue Date" shall mean the original date of issuance of Shares.

"Junior Shares" shall have the meaning set forth in paragraph (a)(iii) of Section 8 hereof.

"Parity Shares" shall have the meaning set forth in paragraph (a)(ii) of Section 8 hereof.

"Penalty Rate" is $0.30 per quarter, which is equivalent to the annual rate of 12% of the Series A Original Issuance Price.

"Person" shall mean any individual, firm, partnership, limited liability company, corporation or other entity, and shall include any successor (by merger or otherwise) of such entity.

A "Quarterly Dividend Default" shall occur if the Corporation fails to pay dividends on the Shares provided for in Section 3(a) in full for any Dividend Period.

"Redemption Date" shall have the meaning set forth in paragraph (b)(ii) of Section 5 hereof.

"Redemption Price" shall have the meaning set forth in paragraph (a)(i) of Section 5 hereof.

"Series A Original Issuance Price" means, with respect to a share of Series A Preferred Stock, $10.00.

"Series A Preferred Stock" shall have the meaning set forth in Section 2 hereof.

"Senior Shares" shall have the meaning set forth in paragraph (a)(i) of Section 8 hereof.

"Shares" shall have the meaning set forth in Section 2 hereof.

"set apart for payment" shall be deemed to include, without any further action, the following: the recording by the Corporation in its accounting ledgers of any accounting or bookkeeping entry that indicates, pursuant to an authorization by the Board and a declaration of dividends or other distribution by the Corporation, the initial and continued allocation of funds to be so paid on any series or class of shares of stock of the Corporation; provided, however, that if any funds for any class or series of Junior Shares or any class or series of Parity Shares are placed in a separate account of the Corporation or delivered to a disbursing, paying or other similar agent, then "set apart for payment" with respect to the Shares shall mean irrevocably placing such funds in a separate account or irrevocably delivering such funds to a disbursing, paying or other similar agent.

"Voting Stock" shall mean stock of any class or kind having the power to vote generally for the election of directors.

2. DESIGNATION, AMOUNT AND PAR VALUE; RANKING; ASSIGNMENT. The series of preferred stock designated by this Certificate shall be designated as the Corporation's Series A Convertible Cumulative Preferred Stock (the "Series A Preferred Stock") and the number of shares so designated shall be 2,090,000 shares (the "Shares"). The Series A Preferred Stock shall have a par value of $0.0001 per share. Series A Preferred Stock will initially be issued in book-entry form. The Corporation shall register shares of Series A Preferred Stock, upon records to be maintained by the Corporation for that purpose (the "Series A Preferred Stock Register"), in the name of the holders of Series A Preferred Stock thereof from time to time. The Corporation may deem and treat the registered holders of Series A Preferred Stock as the absolute owner thereof for the purpose of any conversion thereof and for all other purposes. Shares of Series A Preferred Stock may be issued solely in book-entry form or, if requested by any holder of Series A Preferred Stock, such holder's shares may be issued in certificated form. The Corporation shall register the transfer of any shares of Series A Preferred Stock in the Series A Preferred Stock Register, upon surrender of the certificates (if applicable) evidencing such shares to be transferred, duly endorsed by the holder thereof, to the Corporation at its address specified herein. Upon any such registration or transfer, a new certificate (or book-entry notation, if applicable) evidencing the shares of Series A Preferred Stock so transferred shall be issued to the transferee and a new certificate (or book-entry notation, if applicable) evidencing the remaining portion of the shares not so transferred, if any, shall be issued to the transferring holder, in each case, within five business days. The provisions of this Certificate of are intended to be for the benefit of all holders of Series A Preferred Stock from time to time and shall be enforceable by any such holder

3. DIVIDENDS.

(a) Holders of Shares shall be entitled to receive cumulative preferential dividends, when, as and if declared by the Board or a duly authorized committee thereof, in its sole discretion, at a rate per annum equal to the Dividend Rate (subject to adjustment as set forth in paragraphs (b) and (c) of this Section 3). At the Corporation's sole discretion, dividends may be paid in cash or, subject to the prior approval of the Toronto Stock Exchange ("TSX"), in kind in the form of Common Stock of the Corporation at a price equal to the five-day volume-weighted average price of the shares of Common Stock on the TSX ending on the day that is the second trading day before the applicable Dividend Payment Date (as defined herein). Such dividends shall accrue without interest and accumulate, whether or not earned or declared, on each issued and outstanding share of the Shares from (and including) the original date of issuance of such share, and shall be payable quarterly in arrears on a date selected by the Corporation each quarter that is no later than twenty (20) days following the end of each Dividend Period (each such day being hereinafter called a "Dividend Payment Date"); provided, that (i) Shares issued during any Dividend Period after the Dividend Record Date for such Dividend Period shall only begin to accrue dividends on the first day of the next Dividend Period; and provided, further, that (ii) if any Dividend Payment Date is not a Business Day, then the dividend that would otherwise have been payable on such Dividend Payment Date (if declared) may be paid on the next succeeding Business Day with the same force and effect as if paid on such Dividend Payment Date, and no interest or additional dividends or other sums shall accrue on the amount so payable from such Dividend Payment Date to such next succeeding Business Day. Any dividend payable on the Shares for any partial Dividend Period shall be prorated and computed on the basis of a 360-day year consisting of twelve 30-day months. Dividends shall be payable to holders of record as they appear in the stock records of the Corporation at the close of business on the applicable record date, which shall be the fifteenth day of the month in which the applicable Dividend Payment Date occurs, or such other date designated by the Board or an officer of the Corporation duly authorized by the Board for the payment of dividends that is not more than thirty (30) nor less than ten (10) days prior to such Dividend Payment Date (each such date, a "Dividend Record Date").

(b) Upon the occurrence of four accumulated, accrued and unpaid Quarterly Dividend Defaults, whether consecutive or non-consecutive (a "Dividend Default"), then:

(i) the Dividend Rate shall increase to the Penalty Rate, commencing on the first day after the Dividend Payment Date on which a Dividend Default occurs and for each subsequent Dividend Payment Date thereafter until such time as the Corporation has paid all accumulated accrued and unpaid dividends on the Shares in full and has paid accrued dividends for all Dividend Periods during the most recently completed Quarterly Dividend Period in full, at which time the Dividend Rate shall be reinstated; and

(ii) when the Dividend Default is cured and the Dividend Rate is reinstated, a second Dividend Default shall not occur until the Corporation has an additional four accumulated, accrued and unpaid Quarterly Dividend Defaults, whether consecutive or non-consecutive after the initial default is cured.

(c) No dividend on the Shares will be declared by the Corporation or paid or set apart for payment by the Corporation at such time as the terms and provisions of Senior Shares or any agreement of the Corporation, including any agreement relating to its indebtedness, prohibit such declaration, payment or setting apart for payment or provide that such declaration, payment or setting apart for payment would constitute a breach thereof or a default thereunder, or if such declaration, payment or setting aside of funds is restricted or prohibited under Delaware law or other applicable law; provided, however, notwithstanding anything to the contrary contained herein, dividends on the Shares shall continue to accrue without interest and accumulate regardless of whether: (i) any or all of the foregoing restrictions exist; (ii) the Corporation has earnings or profits; (iii) there are funds legally available for the payment of such dividends; or (iv) such dividends are authorized by the Board. Accrued and unpaid dividends on the Shares will accumulate as of the Dividend Payment Date on which they first become payable or on the date of redemption of the Shares, as the case may be.

(d) Except as provided in the next sentence, if any Shares are outstanding, no dividends will be declared or paid or set apart for payment on any Parity Shares or Junior Shares, unless all accumulated accrued and unpaid dividends are contemporaneously declared and paid in cash or declared and a sum of cash sufficient for the payment thereof set apart for such payment on the Shares for all past Dividend Periods with respect to which full dividends were not paid on the Shares in cash. When dividends are not paid in full (or a sum sufficient for such full payment is not so set apart for payment) upon the Shares and upon all Parity Shares, all dividends declared, paid or set apart for payment upon the Shares and all such Parity Shares shall be declared and paid pro rata or declared and set apart for payment pro rata so that the amount of dividends declared per share of Shares and per share of such Parity Shares shall in all cases bear to each other the same ratio that accumulated dividends per share of Shares and such other Parity Shares (which shall not include any accumulation in respect of unpaid dividends for prior dividend periods if such other Parity Shares do not bear cumulative dividends) bear to each other. No interest, or sum of money in lieu of interest, shall be payable in respect of any dividend payment or payments on Shares which may be in arrears, whether at the Dividend Rate or at the Penalty Rate.

(e) Except as provided in paragraph (d) of this Section 3, unless all accumulated accrued and unpaid dividends on the Shares are contemporaneously declared and paid in cash or declared and a sum of cash sufficient for the payment thereof is set apart for payment for all past Dividend Periods with respect to which full dividends were not paid on the Shares, no dividends (other than payable in shares of Common Stock or Junior Shares ranking junior to the Shares as to dividends and upon liquidation) may be declared or paid or set apart for payment upon the Common Stock or any Junior Shares or Parity Shares, nor shall any Common Stock or any Junior Shares or Parity Shares be redeemed, purchased or otherwise acquired directly or indirectly for any consideration (or any monies be paid to or made available for a sinking fund for the redemption of any such stock) by the Corporation (except by conversion into or exchange for Junior Shares or by redemption, purchase or acquisition of stock under any employee benefit plan of the Corporation).

(f) Holders of Shares shall not be entitled to any dividend in excess of all accumulated accrued and unpaid dividends on the Shares as described in this Section 3. Any dividend payment made on the Shares shall first be credited against the earliest accumulated accrued and unpaid dividend due with respect to such shares which remains payable at the time of such payment.

4. LIQUIDATION PREFERENCE.

(a) Subject to the rights of the holders of Senior Shares and Parity Shares, in the event of any liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary, before any payment or distribution of the assets of the Corporation (whether capital or surplus) shall be made to or set apart for the holders of Junior Shares as to the distribution of assets on any liquidation, dissolution or winding up of the Corporation, each holder of the Shares shall be entitled to receive an amount of cash equal to $15.00 per Share plus an amount in cash equal to all accumulated accrued and unpaid dividends thereon (whether or not earned or declared) to the date of final distribution to such holders. After the payment to the holders of the Series A Preferred Stock of the amount so payable to them as above provided, they shall not be entitled to share in any further distribution of the assets or property of the Corporation. If, upon any liquidation, dissolution or winding up of the Corporation, the assets of the Corporation, or proceeds thereof, distributable among the holders of the Shares shall be insufficient to pay in full the preferential amount aforesaid and liquidating payments on any other shares of any class or series of Parity Shares as to the distribution of assets on any liquidation, dissolution or winding up of the Corporation, then such assets, or the proceeds thereof, shall be distributed among the holders of Shares and any such other Parity Shares ratably in accordance with the respective amounts that would be payable on such Shares and any such other Parity Shares if all amounts payable thereon were paid in full.

(b) Written notice of any such liquidation, dissolution or winding up of the Corporation, stating the payment date or dates when, and the place or places where, the amounts distributable in such circumstances shall be payable, shall be given by first class mail, postage pre-paid, not less than twenty (20) nor more than sixty (60) days prior to the payment date stated therein, to each record holder of Shares at the respective address of such holders as the same shall appear on the stock transfer records of the Corporation.

(c) Subject to the rights of the holders of Senior Shares and Parity Shares upon liquidation, dissolution or winding up, upon any liquidation, dissolution or winding up of the Corporation, after payment shall have been made in full to the holders of the Shares, as provided in this Section 4, any other series or class or classes of Junior Shares shall, subject to the respective terms and provisions (if any) applying thereto, be entitled to receive any and all assets remaining to be paid or distributed, and the holders of the Shares shall not be entitled to share therein.

5. COMPANY CALL AND HOLDER PUT OPTIONS.

(a) Optional Redemption at Election of Corporation.

(i) The Corporation shall have the right (but not the obligation) to redeem the Shares, in whole or in part at any time after the fifth anniversary of the initial closing of the offering selling the Shares and continuing indefinitely thereafter, at the option of the Corporation, for cash, at $15.00 per Share, plus the amounts indicated in paragraph (d) of this Section 5 (the "Redemption Price"). To exercise this redemption right, the Corporation shall deliver written notice to each Holder that all or part of the Shares will be redeemed (the "Corporation Redemption Notice") on a date that is no earlier than twenty (20) and no later than sixty (60) days after the date of the Corporation Redemption Notice (such date, the "Call Date"). If fewer than all of the outstanding Shares are to be redeemed pursuant to the Corporation's exercise of its redemption right under this Section 5(a), the Shares to be redeemed shall be selected pro rata (as nearly as practicable without creating fractional shares) or by lot or in such other equitable method prescribed by the Corporation.

(ii) On a Call Date and in accordance with this Section 5(a), the Corporation will, at its option (to the extent it may then lawfully do so under Delaware law, and for so long as (A) a redemption is permitted under the Corporation's certificate of incorporation (including all related certificates of designation), and (B) such redemption does not constitute a default under any Borrowing Agreements)), redeem the Shares specified in the Corporation Redemption Notice by paying in cash, via wire transfer of immediately available funds to the respective accounts designated in writing by the applicable Holders, an amount per share equal to the Redemption Price.

(iii) On or before the Corporation Redemption Date, each Holder whose Shares are being redeemed under this Section 5(a) shall deliver to the Corporation a stock power, duly executed (in the form provided by the Corporation together with the Corporation Redemption Notice).

(b) Optional Redemption at Election of Holder.

(i) Once per calendar quarter beginning any time after the fifth-year anniversary of the Issue Date, a Holder of record of Shares may elect to cause the Corporation to redeem all or any portion of their Shares for an amount equal to the Redemption Price, in cash. The Board may, however, suspend cash redemptions at any time in its discretion if it determines that it would not be in the best interests of the Corporation to effectuate cash redemptions at a given time because the Corporation does not have sufficient cash, including because the Board believes that cash on hand should be utilized for other business purposes. Redemptions will be limited to five percent (5%) of the total outstanding Shares per quarter and any redemptions in excess of such limit or to the extent suspended, shall be redeemed in subsequent quarters on a first come, first served, basis. The Corporation shall redeem the specified Shares for cash no later than 365 days, following receipt of such notice. The Corporation may require the surrender and endorsement of the physical share certificates representing the redeemed Shares upon payment of the redemption price.

(ii) Upon receipt of a written notice from a Holder requesting that the Corporation redeem such Holder's Share(s) (the "Holder Redemption Notice"), the Corporation may choose to (but shall not be obligated to) redeem the applicable Shares. Within thirty (30) days after the Corporation's receipt of the Holder Redemption Notice, the Corporation shall provide written notice to such requesting Holder specifying whether all or a portion of the Shares sought to be redeemed pursuant to the Holder Redemption Notice will be purchased by the Corporation (which the Corporation shall determine in its sole discretion) (the "Corporation Redemption Response"). If all or any portion of such Series A Preferred Stock is to be repurchased by the Corporation, then the Corporation Redemption Response shall specify the date on which such repurchase and redemption shall occur (the "Redemption Date"), which date shall be no more than 365 days after the giving of the Holder Redemption Notice, and the Corporation Redemption Response shall include the stock power, if required.

(iii) On any Redemption Date and in accordance with this Section 5(b), the Corporation will, to the extent that it has sufficient funds to consummate a redemption, as determined by the Corporation in its discretion, and to the extent that it may then lawfully do so under Delaware law and such payment is further permitted under the Corporation's certificate of incorporation (including all related certificates of designation), and any borrowing agreements to which it or its subsidiaries are bound (the "Borrowing Agreements"), in connection with the delivery by such Holder of the applicable items required herein, redeem the Shares specified in the Corporation Redemption Response by paying in cash., via wire transfer of immediately available funds to an account designated in writing by the Holder, an amount per share equal to the Redemption Price.

(iv) From and after the Redemption Date, (A) the shares identified in the Corporation Redemption Response shall be cancelled on the books and records of the Corporation, (B) the right to receive dividends thereon shall cease to accrue, and (C) all rights of the Holder of the shares to be redeemed shall cease and terminate, excepting only the right to receive the Redemption Price (which right shall be contingent upon the Holder delivering the stock power required herein); provided, however, that if as of the close of business on the Redemption Date the Corporation has not paid the Redemption Price with respect to such Holder (other than any case in which the Redemption Price has not been paid due to a failure by the Holder to deliver the stock power required herein), then the Shares to be redeemed shall remain issued and outstanding, and all rights of such Holder with respect to such Shares shall continue.

(c) Unpaid Dividends. Upon any redemption of Shares pursuant to this Section 5, the Corporation shall, subject to the next sentence, pay any accumulated accrued and unpaid dividends in arrears for any Dividend Period ending on or prior to the Call Date. If the Call Date falls after a Dividend Record Date and prior to the corresponding Dividend Payment Date, then each holder of Shares at the close of business on such Dividend Record Date shall be entitled to the dividend payable on such shares on the corresponding Dividend Payment Date notwithstanding the redemption of such Shares before such Dividend Payment Date. Except as provided above, the Corporation shall make no payment or allowance for unpaid dividends, whether or not in arrears, on Shares called for redemption.

(d) Additional Limitation on Redemption. If all accumulated accrued and unpaid dividends on the Shares and any other class or series of Parity Shares of the Corporation have not been paid in cash (or, with respect to any Parity Shares, in Parity Shares), declared and set apart for payment in cash (or, with respect to any Parity Shares, in Parity Shares), then the Corporation shall not redeem, purchase or acquire any Shares or Parity Shares, otherwise than (i) pursuant to a purchase or exchange offer made on the same terms to all holders of Shares and Parity Shares, (ii) in exchange for Junior Shares, or (iii) pursuant to paragraph (b) of this Section 5; provided that the holders of not less than 75% of the outstanding Shares have elected to redeem such Shares.

(e) Corporation Redemption Procedures. The Corporation Redemption Notice shall be mailed by first class mail to each holder of record of Shares to be redeemed at the address of each such Holder as shown on the Corporation's records. Neither the failure to mail any notice required by this paragraph (e), nor any defect therein or in the mailing thereof, to any particular holder, shall affect the sufficiency of the notice or the validity of the proceedings for redemption with respect to the other holders. Any notice mailed in the manner herein provided shall be conclusively presumed to have been duly given on the date mailed whether or not the holder receives the notice. Each such mailed notice shall state, as appropriate: (1) the Call Date; (2) the number of Shares to be redeemed and, if fewer than all the Shares held by such holder are to be redeemed, the number of such Shares to be redeemed from such holder; (3) the redemption price per Share (determined as set forth in paragraph (a) of this Section 5) plus accumulated accrued and unpaid dividends through the Call Date (determined as set forth in paragraph (c) of this Section 5); (4) if any Shares are represented by certificates, the place or places at which certificates for such Shares are to be surrendered; (5) that dividends on the Shares to be redeemed shall cease to accrue on such Call Date except as otherwise provided herein; and (6) any other information required by law or by the applicable rules of any exchange or national securities market upon which the Shares may be listed or admitted for trading. Notice having been mailed as aforesaid, from and after the Call Date (unless the Corporation shall fail to make available an amount of cash necessary to effect such redemption), (i) except as otherwise provided herein, dividends on the Shares so called for redemption shall cease to accrue, (ii) said Shares shall no longer be deemed to be outstanding, and (iii) all rights of the holders thereof as holders of Shares shall cease (except the right to receive cash payable upon such redemption, without interest thereon, upon surrender and endorsement of their certificates if so required and to receive any dividends payable thereon).

(f) Set Asides. The Corporation's obligation to provide cash in accordance with the preceding subsection shall be deemed fulfilled if, on or before the Call Date, the Corporation shall irrevocably deposit funds necessary for such redemption, in trust, with a bank or trust company that has, or is an affiliate of a bank or trust company that has, capital and surplus of at least $50 million, with irrevocable instructions that such cash be applied to the redemption of the Shares so called for redemption, in which case the notice to holders of the Shares will (i) state the date of such deposit, (ii) specify the office of such bank or trust company as the place of payment of the redemption price and (iii) require such holders to surrender the certificates, if any, representing such Shares at such place on or about the date fixed in such redemption notice (which may not be later than the Call Date) against payment of the redemption price (including all accumulated accrued and unpaid dividends to the Call Date, determined as set forth in paragraph (c) of this Section 5). No interest shall accrue for the benefit of the holders of Shares to be redeemed on any cash so set aside by the Corporation. Subject to applicable escheat laws, any such cash unclaimed at the end of six months from the Call Date shall revert to the general funds of the Corporation after which reversion the holders of such Shares so called for redemption shall look only to the general funds of the Corporation for the payment of such cash.

6. CONVERSION. The holders of the Shares shall have conversion rights as follows (the "Conversion Rights"):

(a) Right to Convert. Each Share shall be convertible into Common Stock at a price per share of $0.50 (1 Share converts into 20 shares of Common Stock) (the "Conversion Price"), at the option of the holder thereof, at any time following the issuance date of such Share and on or prior to the fifth (5th) day prior to a redemption Date, if any, as may have been fixed in any redemption notice with respect to the Shares, at the office of this Corporation or any transfer agent for such stock.

(b) Mechanics of Conversion. Before any holder of Shares shall be entitled to convert the same into Common Stock, they shall surrender the certificate or certificates therefor, duly endorsed, at the office of this Corporation or of any transfer agent for the Shares, and shall give written notice to this Corporation at its principal corporate office, of the election to convert the same (the "Conversion Notice"). To be considered effective, the Conversion Notice shall state the name or names in which the certificate or certificates for Common Stock are to be issued, the number of shares of Common Stock beneficially owned by the holder, and its associates and affiliates, before giving effect to the Conversion, and include an acknowledgement that:

(i) the Corporation will not issue shares of Common Stock upon conversion of the Shares if the shares of Common Stock proposed to be issued, when aggregated with all other shares of Common Stock then owned beneficially by the holder and its affiliates and associates would result in the holder beneficially owning, together with its affiliates and associates, more than 9.99% of the then issued and outstanding shares of Common Stock unless and until a personal information form is filed and precleared by the TSX in accordance with its rules;

(ii) the Corporation shall not issue shares of Common Stock upon conversion of the Shares if the shares of Common Stock proposed to be issued, when aggregated with all other shares of Common Stock then owned beneficially by the holder and its affiliates and associates would result in the holder beneficially owning, together with its affiliates and associates, more than 19.99% of the then issued and outstanding shares of Common Stock unless and until the Corporation has obtained approval from its holders of shares of Common Stock to proceed with such issuance at a duly called meeting of the holders of shares of Common Stock in accordance with, among others, the rules of the TSX; and

(iii) the Corporation shall not issue Shares of Common Stock upon conversion of the Shares and/or payment of dividend into shares of Common Stock if, after giving effect to the Conversion, the number of shares of Common Stock issued in connection with the Shares (pursuant to the conversion of the Shares and/or the payment of dividends into shares of Common Stock, as the case may be) would be equal or superior to 43,664,524 shares of Common Stock, unless and until the Corporation has obtained approval from its holders of shares of Common Stock to issue shares of Common Stock in excess to such limitation at a duly called meeting of the holders of shares of Common Stock in accordance with, among others, the rules of the TSX.

This Corporation shall, as soon as practicable thereafter, issue and deliver at such office to such holder of Shares, or to the nominee or nominees of such holder, a certificate or certificates for the number of Common Stock to which such holder shall be entitled as aforesaid. Such conversion shall be deemed to have been made immediately prior to the close of business on the date of such surrender of the Shares to be converted, and the person or persons entitled to receive the Common Stock issuable upon such conversion shall be treated for all purposes as the record holder or holders of such Common Stock as of such date.

(c) No Impairment. This Corporation will not, by amendment of its certificate of incorporation or through any reorganization, recapitalization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by this Corporation, but will at all times in good faith assist in the carrying out of all the provisions of this section and in the taking of all such action as may be necessary or appropriate in order to protect the Conversion Rights of the holders of the Shares against impairment.

(d) Reservation of Stock Issuable Upon Conversion. The Corporation shall at all times reserve and keep available out of its authorized but unissued Common Stock, solely for the purpose of effecting the conversion of the Shares, such number of its Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding Shares; and if at any time the number of authorized but unissued Common Stock shall not be sufficient to effect the conversion of all then outstanding Shares, in addition to such other remedies as shall be available to the holder of such Shares, this Corporation will take such corporate action as may, in the opinion of its counsel, be necessary to increase its authorized but unissued Common Stock to such number of shares as shall be sufficient for such purposes, including, without limitation, engaging in best efforts to obtain the requisite stockholder approval of any necessary amendment to the Corporation's certificate of incorporation.

(e) Notice. Any notice required by the provisions of this section to be given to the holders of Shares shall be deemed given if deposited in the United States mail, postage prepaid, and addressed to each holder of record at his address appearing on the books of this Corporation.

7. STATUS OF ACQUIRED SHARES. All Shares issued, redeemed by the Corporation or converted by the holder in accordance with Sections 5 or 6 hereof, or otherwise acquired by the Corporation, shall be restored to the status of authorized but unissued shares of undesignated Preferred Stock of the Corporation.

8. RANKING. Any class or series of shares of stock of the Corporation shall be deemed to rank:

(a) prior to the Shares, as to the payment of dividends and as to distribution of assets upon liquidation, dissolution or winding up, if the holders of such class or series shall be entitled to the receipt of dividends or of amounts distributable upon liquidation, dissolution or winding up, as the case may be, in preference or priority to the holders of Shares ("Senior Shares");

(b) on a parity with the Shares, as to the payment of dividends and as to distribution of assets upon liquidation, dissolution or winding up, whether or not the dividend rates, dividend payment dates or redemption or liquidation prices per share thereof be different from those of the Shares, if the holders of such class or series and the Shares shall be entitled to the receipt of dividends and of amounts distributable upon liquidation, dissolution or winding up in proportion to their respective amounts of accrued and unpaid dividends per share or liquidation preferences, without preference or priority one over the other ("Parity Shares"); and

(c) junior to the Shares, as to the payment of dividends and as to the distribution of assets upon liquidation, dissolution or winding up, if such class or series shall be the Common Stock or any other class or series of shares of stock of the Corporation now or hereafter issued and outstanding over which the Shares have preference or priority in the payment of dividends and in the distribution of assets upon any liquidation, dissolution or winding up of the Corporation ("Junior Shares").

9. VOTING RIGHTS.

(a) So long as any Shares are outstanding, the affirmative vote of the holders of more than two-thirds (66.7%) of the Shares then outstanding, given in person or by proxy, either in writing without a meeting or by vote at any meeting called for the purpose, shall be necessary for effecting or validating:

(i) Any amendment, alteration or repeal of any provisions of the certificate of incorporation or this Certificate that materially and adversely affects the rights, preferences or voting power of the Shares; provided, however, that (a) the amendment of the certificate of incorporation to authorize or create Parity Shares or Junior Shares, or (b) to increase or decrease the authorized amount of, Shares, Senior Shares, Parity Shares or Junior Shares, shall not be deemed to materially or adversely affect the rights, preferences or voting power of the Shares;

(ii) A statutory share exchange, consolidation with or merger of the Corporation with or into another entity or consolidation of the Corporation with or merger of another entity into the Corporation, that in each case materially and adversely affects the rights, preferences or voting power of the Shares, unless in such case each Share shall be converted into or exchanged for an amount of cash equal to or greater than the applicable redemption price called for under Section 5 hereof at the time of such conversion or exchange or preferred shares of the surviving entity having preferences, conversion or other rights, voting powers, restrictions, limitations as to dividends or distributions, qualifications and terms or conditions of redemption thereof that are materially the same as those of a Share; or

(iii) Approving any waiver or amendment of the restrictions set forth in paragraphs (d) or (e) of Section 3 hereof;

provided, however, that no such vote of the holders of Shares shall be required if, at or prior to the time when any of the above actions is to take effect, a deposit is made for the redemption in cash of all Shares at the time outstanding, as provided in paragraph (f) of Section 5 hereof, for a redemption price called for under Section 5 at the time of such redemption.

(b) For purposes of paragraph (a) of this Section 9, each Share shall have one vote per share. Except as required by applicable provisions of Delaware law, the Shares shall not have any relative, participating, optional or other special voting rights and powers other than as set forth herein, and the consent of the holders thereof shall not be required for the taking of any corporate action. No amendment to these terms of the Shares shall require the vote of the holders of Common Stock (except as required by law).

10. OTHER RIGHTS. Except as otherwise stated herein, there are no other rights, privileges, or preferences attendant or relating to in any way to the Shares, including by way of illustration but not limitation, those concerning participation, or anti-dilution rights or preferences.

RESOLVED FURTHER, that the officers of the Corporation be, and they hereby are, authorized and directed, for and in the name and on behalf of the Corporation, to prepare and to file a Certificate of Designation of Preferences, Rights and Limitations of Series A Convertible Cumulative Preferred Stock in accordance with the foregoing resolution and the provisions of the Delaware General Corporation Law and to take such actions as they may deem necessary or appropriate to carry out the intent of the foregoing resolutions."

**********

IN WITNESS WHEREOF, IntelGenx Technologies Corp. has caused this Certificate of Designation of Preferences, Rights and Limitations of Series A Convertible Preferred Stock to be executed by the undersigned this 8th day of February, 2024.

| |

Corporation: |

| |

|

| |

INTELGENX TECHNOLOGIES CORP. |

| |

|

|

| |

|

|

| |

By: |

/s/ Andre Godin |

| |

|

Andre Godin, CFO |

v3.24.0.1

Document and Entity Information Document

|

Feb. 08, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Creation Date |

Feb. 08, 2024

|

| Document Period End Date |

Feb. 08, 2024

|

| Amendment Flag |

false

|

| Entity Registrant Name |

IntelGenx Technologies Corp.

|

| Entity Address, Address Line One |

6420 Abrams

|

| Entity Address, City or Town |

St- Laurent

|

| Entity Address, State or Province |

QC

|

| Entity Address, Country |

CA

|

| Entity Address, Postal Zip Code |

H4S 1Y2

|

| Entity Incorporation, State Country Name |

DE

|

| City Area Code |

514

|

| Local Phone Number |

331-7440

|

| Entity File Number |

000-31187

|

| Entity Central Index Key |

0001098880

|

| Entity Emerging Growth Company |

false

|

| Entity Tax Identification Number |

87-0638336

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Current Fiscal Year End Date |

--12-31

|

| Title of 12(g) Security |

Common Stock, $0.00001 par value

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe date the document was made available and submitted, in YYYY-MM-DD format. The date of submission, date of acceptance by the recipient, and the document effective date are all potentially different.

| Name: |

dei_DocumentCreationDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(g) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection g

| Name: |

dei_Security12gTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

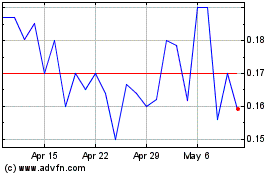

IntelGenx Technologies (QB) (USOTC:IGXT)

Historical Stock Chart

From Mar 2024 to Apr 2024

IntelGenx Technologies (QB) (USOTC:IGXT)

Historical Stock Chart

From Apr 2023 to Apr 2024