UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G/A

Under the Securities Exchange Act of

1934

(Amendment No. 1)*

| CELLECTAR BIOSCIENCES, INC. |

| (Name of Issuer) |

| COMMON STOCK, $0.00001 PAR VALUE |

| (Title of Class of Securities) |

| 15117F500 |

| (CUSIP Number) |

| December 31, 2023 |

|

(Date of Event Which Requires Filing of

this Statement) |

Check the appropriate box to designate

the rule pursuant to which this Schedule is filed:

| |

¨ |

Rule 13d-1(b) |

| |

x |

Rule 13d-1(c) |

| |

¨ |

Rule 13d-1(d) |

|

(Page 1 of 13 Pages) |

* The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter the disclosures provided in a prior cover page.

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of

1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

SCHEDULE 13G

| CUSIP NO. 15117F500 |

Page 2 of 13 |

| 1 |

NAMES OF REPORTING PERSONS

Lincoln Park Capital Fund, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨

(b)

¨ |

| 3 |

SEC USE ONLY |

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Illinois |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

5 |

SOLE VOTING POWER

0 |

| 6 |

SHARED VOTING POWER

1,307,049(1)/847,647(2) |

| 7 |

SOLE DISPOSITIVE POWER

0 |

| 8 |

SHARED DISPOSITIVE POWER

1,307,049(1)/847,647(2) |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,307,049(1)/847,647(2) |

| 10 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.676%(1)/2.709%(2) |

| 12 |

TYPE OF REPORTING PERSON

OO |

(1) Represents the beneficial ownership of Common Stock as of December 31, 2023.

(2) Represents the beneficial ownership of Common Stock

as of February 9, 2024.

SCHEDULE 13G

| CUSIP NO. 15117F500 |

Page 3 of 13 |

| 1 |

NAMES OF REPORTING PERSONS

Lincoln Park Capital, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨

(b)

¨ |

| 3 |

SEC USE ONLY |

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Illinois |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

5 |

SOLE VOTING POWER

0 |

| 6 |

SHARED VOTING POWER

1,307,049(1)/847,647(2) |

| 7 |

SOLE DISPOSITIVE POWER

0 |

| 8 |

SHARED DISPOSITIVE POWER

1,307,049(1)/847,647(2) |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,307,049(1)/847,647(2) |

| 10 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.676%(1)/2.709%(2) |

| 12 |

TYPE OF REPORTING PERSON

OO |

(1) Represents the beneficial ownership of Common Stock as of December 31, 2023.

(2) Represents the beneficial ownership of Common Stock

as of February 9, 2024.

SCHEDULE 13G

| CUSIP NO. 15117F500 |

Page 4 of 13 |

| 1 |

NAMES OF REPORTING PERSONS

Rockledge Capital Corporation |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨

(b)

¨ |

| 3 |

SEC USE ONLY |

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Texas |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

5 |

SOLE VOTING POWER

0 |

| 6 |

SHARED VOTING POWER

1,307,049(1)/847,647(2) |

| 7 |

SOLE DISPOSITIVE POWER

0 |

| 8 |

SHARED DISPOSITIVE POWER

1,307,049(1)/847,647(2) |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,307,049(1)/847,647(2) |

| 10 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.676%(1)/2.709%(2) |

| 12 |

TYPE OF REPORTING PERSON

CO |

(1) Represents the beneficial ownership of Common Stock as of December 31, 2023.

(2) Represents the beneficial ownership of Common Stock

as of February 9, 2024.

SCHEDULE 13G

| CUSIP NO. 15117F500 |

Page 5 of 13 |

| 1 |

NAMES OF REPORTING PERSONS

Joshua B. Scheinfeld |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨

(b)

¨ |

| 3 |

SEC USE ONLY |

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

5 |

SOLE VOTING POWER

0 |

| 6 |

SHARED VOTING POWER

1,307,049(1)/847,647(2) |

| 7 |

SOLE DISPOSITIVE POWER

0 |

| 8 |

SHARED DISPOSITIVE POWER

1,307,049(1)/847,647(2) |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,307,049(1)/847,647(2) |

| 10 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.676%(1)/2.709%(2) |

| 12 |

TYPE OF REPORTING PERSON

IN |

(1) Represents the beneficial ownership of Common Stock as of December 31, 2023.

(2) Represents the beneficial ownership of Common Stock

as of February 9, 2024.

SCHEDULE 13G

| CUSIP NO. 15117F500 |

Page 6 of 13 |

| 1 |

NAMES OF REPORTING PERSONS

Alex Noah Investors, Inc. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨

(b)

¨ |

| 3 |

SEC USE ONLY |

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Illinois |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

5 |

SOLE VOTING POWER

0 |

| 6 |

SHARED VOTING POWER

1,307,049(1)/847,647(2) |

| 7 |

SOLE DISPOSITIVE POWER

0 |

| 8 |

SHARED DISPOSITIVE POWER

1,307,049(1)/847,647(2) |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,307,049(1)/847,647(2) |

| 10 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.676%(1)/2.709%(2) |

| 12 |

TYPE OF REPORTING PERSON

CO |

(1) Represents the beneficial ownership of Common Stock as of December 31, 2023.

(2) Represents the beneficial ownership of Common Stock

as of February 9, 2024.

SCHEDULE 13G

| CUSIP NO. 15117F500 |

Page 7 of 13 |

| 1 |

NAMES OF REPORTING PERSONS

Jonathan I. Cope |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨

(b)

¨ |

| 3 |

SEC USE ONLY |

| 4 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

5 |

SOLE VOTING POWER

0 |

| 6 |

SHARED VOTING POWER

1,307,049(1)/847,647(2) |

| 7 |

SOLE DISPOSITIVE POWER

0 |

| 8 |

SHARED DISPOSITIVE POWER

1,307,049(1)/847,647(2) |

| 9 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,307,049(1)/847,647(2) |

| 10 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ¨ |

| 11 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.676%(1)/2.709%(2) |

| 12 |

TYPE OF REPORTING PERSON

IN |

(1) Represents the beneficial ownership of Common Stock as of December 31, 2023.

(2) Represents the beneficial ownership of Common Stock

as of February 9, 2024.

SCHEDULE 13G

|

CUSIP NO. 15117F500 |

Page 8 of 13 |

| |

|

| Item 1. |

|

| |

(a) |

Name of Issuer:

|

| |

|

Cellectar Biosciences, Inc., a Delaware

corporation (the “Issuer”)

|

| |

(b) |

Address of Issuer’s Principal

Executive Offices:

|

| |

|

100 Campus Drive |

| |

|

Florham Park, New Jersey 07932 |

| Item 2. |

|

| |

(a) |

Name of Person Filing:

|

| |

|

Lincoln Park Capital Fund, LLC (“LPC Fund”) |

| |

|

Lincoln Park Capital, LLC (“LPC”) |

| |

|

Rockledge Capital Corporation (“RCC”) |

| |

|

Joshua B. Scheinfeld (“Mr. Scheinfeld”) |

| |

|

Alex Noah Investors, Inc. (“Alex Noah”) |

| |

|

Jonathan I. Cope (“Mr. Cope”

and, collectively with LPC Fund, LPC, RCC, Mr. Scheinfeld and Alex Noah, the “Reporting Persons”)

|

| |

(b) |

Address of Principal Business Office,

or if None, Residence:

|

| |

|

The address of the principal business office of each of the Reporting Persons is: |

| |

|

440 North Wells, Suite 410 |

| |

|

Chicago, Illinois 60654

|

| |

(c) |

Citizenship:

|

| |

|

LPC Fund is an Illinois limited liability company |

| |

|

LPC is an Illinois limited liability company |

| |

|

RCC is a Texas corporation |

| |

|

Mr. Scheinfeld is a United States citizen |

|

|

|

|

| |

|

|

|

|

|

|

SCHEDULE 13G

| CUSIP NO. 15117F500 |

Page 9 of 13 |

| |

|

| |

|

Alex Noah is an Illinois corporation |

| |

|

Mr. Cope is a United States citizen

|

| |

(d) |

Title of Class of Securities:

|

| |

|

Common Stock, $0.00001 par value

(“Common Stock”)

|

| |

(e) |

CUSIP Number:

|

| |

|

15117F500

|

| Item 3. |

|

| |

|

|

|

|

If this statement is filed pursuant to §§240.13d-1(b),

or 240.13d-2(b) or (c), check whether the person filing is a:

| |

(a) |

¨ |

Broker or dealer registered under Section 15 of the Act (15 U.S.C. 78o). |

| |

(b) |

¨ |

Bank as defined in Section 3(a)(6) of the Act (15 U.S.C. 78c). |

| |

(c) |

¨ |

Insurance company as defined in Section 3(a)(19) of the Act (15 U.S.C. 78c). |

| |

(d) |

¨ |

Investment company registered under Section 8 of the Investment Company Act of 1940 (15 U.S.C. 80a-8). |

| |

(e) |

¨ |

An investment adviser in accordance with §240.13d-1(b)(1)(ii)(E); |

| |

(f) |

¨ |

An employee benefit plan or endowment fund in accordance with §240. 13d-1(b)(1)(ii)(F); |

| |

(g) |

¨ |

A parent holding company or control person in accordance with §240.13d-1(b)(1)(ii)(G); |

| |

(h) |

¨ |

A savings associations as defined in Section 3(b) of the Federal Deposit Insurance Act (12 U.S.C. 1813); |

| |

(i) |

¨ |

A church plan that is excluded from the definition of an investment company under section 3(c)(14) of the Investment Company Act of 1940 (15 U.S.C. 80a-3); |

| |

(j) |

¨ |

A non-U.S. institution in accordance with §240.13d-1(b)(1)(ii)(J); |

| |

(k) |

¨ |

Group, in accordance with §240.13d-1(b)(1)(ii)(K).

|

| |

If filing as a non-U.S. institution in accordance with §240.13d-1(b)(1)(ii)(J), please specify the type of institution ______________________ |

SCHEDULE 13G

|

CUSIP NO. 15117F500 |

Page 10 of 13 |

Reporting

person |

|

Amount

beneficially

owned: |

|

|

Percent

of class: |

|

|

Sole

power

to vote

or

direct

the

vote: |

|

|

Shared

power to

vote or to

direct

the vote3: |

|

|

Sole power

to

dispose or to

direct the

disposition

of: |

|

|

Shared power

to dispose or to

direct the

disposition of: |

|

| Lincoln Park Capital Fund, LLC |

|

|

1,307,049(1)/847,647(2) |

|

|

|

9.676%(3)/2.709% (4) |

|

|

|

0 |

|

|

|

1,307,049(1)/847,647(2) |

|

|

|

0 |

|

|

|

1,307,049(1)/847,647(2) |

|

| Lincoln Park Capital, LLC |

|

|

1,307,049(1)/847,647(2) |

|

|

|

9.676%(3)/2.709% (4) |

|

|

|

0 |

|

|

|

1,307,049(1)/847,647(2) |

|

|

|

0 |

|

|

|

1,307,049(1)/847,647(2) |

|

| Rockledge Capital Corporation |

|

|

1,307,049(1)/847,647(2) |

|

|

|

9.676%(3)/2.709% (4) |

|

|

|

0 |

|

|

|

1,307,049(1)/847,647(2) |

|

|

|

0 |

|

|

|

1,307,049(1)/847,647(2) |

|

| Joshua B. Scheinfeld |

|

|

1,307,049(1)/847,647(2) |

|

|

|

9.676%(3)/2.709% (4) |

|

|

|

0 |

|

|

|

1,307,049(1)/847,647(2) |

|

|

|

0 |

|

|

|

1,307,049(1)/847,647(2) |

|

| Alex Noah Investors, Inc. |

|

|

1,307,049(1)/847,647(2) |

|

|

|

9.676%(3)/2.709% (4) |

|

|

|

0 |

|

|

|

1,307,049(1)/847,647(2) |

|

|

|

0 |

|

|

|

1,307,049(1)/847,647(2) |

|

| Jonathan I. Cope |

|

|

1,307,049(1)/847,647(2) |

|

|

|

9.676%(3)/2.709% (4) |

|

|

|

0 |

|

|

|

1,307,049(1)/847,647(2) |

|

|

|

0 |

|

|

|

1,307,049(1)/847,647(2) |

|

|

1 |

As of December 31, 2023, LPC Fund beneficially owned, directly: (i) 86,905 shares of Common Stock purchased by LPC Fund directly from the Issuer; (ii) 282,575 shares of Common Stock underlying a warrant purchased by LPC Fund from the Issuer (the “Preferred Series E-3 Warrant); (iii) 146,520 shares of Common Stock underlying a warrant purchased by LPC Fund from the Issuer (the “Preferred Series E-4 Warrant”); (iv) 10,407 shares of Common Stock underlying a currently exercisable warrant purchased by LPC Fund from the Issuer (the “Series D Warrant”); (v) 19,820 shares of Common Stock underlying a currently exercisable warrant purchased by LPC Fund from the Issuer (the “Series F Warrant”); (vi) 20,180 shares of Common Stock underlying a currently exercisable warrant purchased by LPC Fund from the Issuer (the “Series G Warrant”); (vii) 54,348 shares of Common Stock underlying a currently exercisable warrant purchased by LPC Fund from the Issuer (the “Series H Warrant”); and (viii) 686,294 shares of Common Stock underlying a currently exercisable warrant purchased by LPC Fund from the Issuer (the “2022 Warrant”). In the case of each of the warrants described in clauses (ii) through (viii) above (collectively, the “Warrants”), the warrant amounts are in addition to the 86,905 outstanding shares of Common Stock referred to in clause (i) above. |

|

2 |

Pursuant to §240.13d-1, which states that “any person, in determining the amount of outstanding securities of a class of equity

securities, may rely upon information set forth in the issuer’s most recent quarterly or annual report, and any current report subsequent

thereto, filed with the Commission pursuant to this Act, unless he knows or has reason to believe that information contained therein is

inaccurate,” the Reporting Persons are including updated information in connection with the Issuer’s current report on Form

8-K, filed February 2, 2024. As of February 9, 2024, LPC Fund beneficially owned, directly: (i) 10,078 shares of Common Stock purchased

by LPC Fund directly from the Issuer; (ii) 146,520 shares of Common Stock underlying the Preferred Series E-4 Warrant; (iii) 10,407 shares

of Common Stock underlying the Series D Warrant; (iv) 19,820 shares of Common Stock underlying the Series F Warrant; (v) 20,180 shares

of Common Stock underlying the Series G Warrant; (vi) 54,348 shares of Common Stock underlying the Series H Warrant; and (vii) 586,294

shares of Common Stock underlying the 2022 Warrant. |

The Preferred Series E-3 Warrant will be exercisable upon the earlier

date of (i) September 8, 2026 and (ii) ten (10) trading days following the date of the Issuer’s public announcement of the Positive

Topline Data from its CLOVER-WaM Phase 2 study, as described in the Issuer’s Form S-3, filed October 5, 2023 (the “October

2023 Prospectus”). The Preferred Series E-4 Warrant will be exercisable upon the earlier date of (i) September 8, 2026 and (ii)

ten (10) trading days following the date of the Issuer’s public announcement of its receipt of written approval from the FDA

of its New Drug Application for iopofosine I 131 as described in the October 2023 Prospectus. The Series D Warrant is currently exercisable

at a price of $178.00 per share (subject to adjustment as provided in the Series D Warrant), subject to a 9.99% beneficial ownership cap

that prohibits the issuance of shares of Common Stock upon exercise of the Series D Warrant to the extent such issuance would cause the

holder’s beneficial ownership of Common Stock (as calculated pursuant to Section 13(d) of the Act and Rule 13d-3 promulgated thereunder)

to exceed 9.99% of the outstanding Common Stock, and expires on October 14, 2024. The Series F Warrant is currently exercisable at a price

of $24.00 per share (subject to adjustment as provided in the Series F Warrant), subject to a 9.99% beneficial ownership cap that prohibits

the issuance of shares of Common Stock upon exercise of the Series F Warrant to the extent such issuance would cause the holder’s

beneficial ownership of Common Stock (as calculated pursuant to Section 13(d) of the Act and Rule 13d-3 promulgated thereunder) to exceed

9.99% of the outstanding Common Stock, and expires on May 20, 2024. The Series G Warrant is currently exercisable at a price of $24.00

per share (subject to adjustment as provided in the Series G Warrant), subject to a 9.99% beneficial ownership cap that prohibits the

issuance of shares of Common Stock upon exercise of the Series G Warrant to the extent such issuance would cause the holder’s beneficial

ownership of Common Stock (as calculated pursuant to Section 13(d) of the Act and Rule 13d-3 promulgated thereunder) to exceed 9.99% of

the outstanding Common Stock, and expires on May 20, 2024. The Series H Warrant is currently exercisable at a price of $12.075 per share

(subject to adjustment as provided in the Series H Warrant), subject to a 9.99% beneficial ownership cap that prohibits the issuance of

shares of Common Stock upon exercise of the Series H Warrant to the extent such issuance would cause the holder’s beneficial ownership

of Common Stock (as calculated pursuant to Section 13(d) of the Act and Rule 13d-3 promulgated thereunder) to exceed 9.99% of the outstanding

Common Stock, and expires on June 5, 2025. The 2022 Warrant is currently exercisable at a price of $1.96 per share (subject to adjustment

as provided in the 2022 Warrant), subject to a 9.99% beneficial ownership cap that prohibits the issuance of shares of Common Stock upon

exercise of the 2022 Warrant to the extent such issuance would cause the holder’s beneficial ownership of Common Stock (as calculated

pursuant to Section 13(d) of the Act and Rule 13d-3 promulgated thereunder) to exceed 9.99% of the outstanding Common Stock, and expires

October 25, 2027.

| 3. | As of December 31, 2023, LPC Fund owned 9.676% of the outstanding

shares of Common Stock. Based on the information provided by the Issuer in its Quarterly Report on Form 10-Q, filed with the Securities

Exchange Commission on November 13, 2023, there was a total of 12,288,325 shares of Common Stock outstanding as of November 10, 2023,

which includes the 86,905 shares of Common Stock previously issued to LPC Fund. Pursuant to Rule 13d-3(d)(1)(i) under the Act, the denominator

used in the calculation for the percentage of class owned by the Reporting Persons, assumes the issuance 10,407 shares of Common Stock

underlying the Series D Warrant, 19,820 shares of Common Stock underlying the Series F Warrant, 20,180 shares of Common Stock underlying

the Series G Warrant, 54,348 shares of Common Stock underlying the Series H Warrant, 586,294 shares of Common Stock underlying the 2022

Warrant, 282,575 shares of Common Stock under the Preferred Series E-3 Warrant, and 146,520 shares of Common Stock underlying the Preferred

Series E-4 Warrant. In each case representing the approximate maximum number of shares (in addition to the 86,905 outstanding shares

of Common Stock referred to in the prior sentence) that may be acquired by LPC Fund upon exercise of such warrant without exceeding the

9.99% beneficial ownership limitation contained in such warrant. The Reporting Persons may be deemed to beneficially own an aggregate

of 1,307,049 shares of Common Stock (as calculated pursuant to Section 13(d) of the Act, and Rule 13d-3 promulgated thereunder), representing

9.676% of the outstanding shares of Common Stock (based on such information regarding the outstanding shares of Common Stock supplied

by the Issuer to LPC Fund). |

| |

4 |

As of February 9, 2024, LPC Fund owned 2.709% of the outstanding shares of Common Stock. Based on the information provided by the Issuer in its Current Report on Form 8-K, filed with the Securities Exchange Commission on February 2, 2024, there was a total of 30,452,042 shares of Common Stock outstanding as of January 31, 2024, which includes the 10,078 shares of Common Stock previously issued to LPC Fund. Pursuant to Rule 13d-3(d)(1)(i) under the Act, the denominator used in the calculation for the percentage of class owned by the Reporting Persons, assumes the issuance 10,407 shares of Common Stock underlying the Series D Warrant, 19,820 shares of Common Stock underlying the Series F Warrant, 20,180 shares of Common Stock underlying the Series G Warrant, 54,348 shares of Common Stock underlying the Series H Warrant, 586,294 shares of Common Stock underlying the 2022 Warrant, and 146,520 shares of Common Stock underlying the Preferred Series E-4 Warrant. In each case representing the approximate maximum number of shares (in addition to the 10,078 outstanding shares of Common Stock referred to in the prior sentence) that may be acquired by LPC Fund upon exercise of such warrant without exceeding the 9.99% beneficial ownership limitation contained in such warrant. The Reporting Persons may be deemed to beneficially own an aggregate of 847,647 shares of Common Stock (as calculated pursuant to Section 13(d) of the Act, and Rule 13d-3 promulgated thereunder), representing 2.709% of the outstanding shares of Common Stock (based on such information regarding the outstanding shares of Common Stock supplied by the Issuer to LPC Fund). The updated disclosure as of February 9, 2024 is included solely to reflect the beneficial ownership by the Reporting Persons of less than 5% of the outstanding shares of Common Stock and cessation of further reporting thereby on Schedule 13G. |

SCHEDULE 13G

| CUSIP NO. 15117F500 |

Page 11 of 13 |

As of December 31, 2023, LPC

Fund beneficially owned, directly, the following securities of the Issuer: (i) 86,905 shares of Common Stock, (ii) 282,575 shares of Common

Stock not currently exercisable under the Preferred Series E-3 Warrant, (iii) 146,520 shares of Common Stock not currently exercisable

under the Preferred Series E-4 Warrant, (iv) 10,407 shares of Common Stock currently exercisable under the Series D Warrant, (v) 19,820

shares of Common Stock currently exercisable under the Series F Warrant, (vi) 20,180 shares of Common Stock currently exercisable under

the Series G Warrant, (vii) 54,348 shares of Common Stock currently exercisable under the Series H Warrant, and (viii) 686,294 shares

of Common Stock currently exercisable under the 2022 Warrant. In the case of each of the Warrants, the warrant amounts are in addition

to the 86,905 outstanding shares of Common Stock issued to LPC Fund and referred to in clause (i) above and are subject to a 9.99% beneficial

ownership cap that prohibits the issuance of shares of Common Stock upon exercise of any Warrants to the extent such issuance would cause

the holder’s beneficial ownership of Common Stock (as calculated pursuant to Section 13(d) of the Act and Rule 13d-3 promulgated

thereunder) to exceed 9.99% of the outstanding Common Stock.

As

of February 9, 2024, LPC Fund beneficially owned, directly the following securities from the Issuer: (i) 10,078 shares of Common Stock

purchased by LPC Fund directly from the Issuer; (ii) 146,520 shares of Common Stock underlying the Preferred Series E-4 Warrant; (iii)

10,407 shares of Common Stock underlying the Series D Warrant; (iv) 19,820 shares of Common Stock underlying the Series F Warrant; (v)

20,180 shares of Common Stock underlying the Series G Warrant; (vi) 54,348 shares of Common Stock underlying the Series H Warrant; and

(vii) 586,294 shares of Common Stock underlying the 2022 Warrant. In the case of each of the Warrants, the warrant amounts are

in addition to the 10,078 outstanding shares of Common Stock issued to LPC Fund and referred to in clause (i) above and are subject to

a 9.99% beneficial ownership cap that prohibits the issuance of shares of Common Stock upon exercise of any Warrants to the extent such

issuance would cause the holder’s beneficial ownership of Common Stock (as calculated pursuant to Section 13(d) of the Act and Rule

13d-3 promulgated thereunder) to exceed 9.99% of the outstanding Common Stock.

The Series D Warrant, Series

F Warrant, Series G Warrant, Series H Warrant and 2022 Warrant each include a customary “cashless” exercise provision, which

may be used to acquire underlying shares of Common Stock if at the time of exercise an effective registration statement registering the

resale of such shares under the Act is not available to the warrant holders.

LPC is the Managing Member

of LPC Fund. RCC and Alex Noah are the Managing Members of LPC. Mr. Scheinfeld is the president and sole shareholder of RCC, as well as

a principal of LPC. Mr. Cope is the president and sole shareholder of Alex Noah, as well as a principal of LPC. As a result of the foregoing,

Mr. Scheinfeld and Mr. Cope have shared voting and shared investment power over the shares of Common Stock of the Issuer held directly

by LPC Fund.

Pursuant to Section 13(d)

of the Act and the rules thereunder, each of LPC, RCC, Mr. Scheinfeld, Alex Noah, and Mr. Cope may be deemed to be a beneficial owner

of the shares of Common Stock of the Issuer beneficially owned directly by LPC Fund.

The foregoing should not be

construed in and of itself as an admission by any Reporting Person as to beneficial ownership of any shares of Common Stock owned by another

Reporting Person. Pursuant to Rule 13d-4 of the Act, each of LPC, RCC, Mr. Scheinfeld, Alex Noah, and Mr. Cope disclaims beneficial ownership

of the shares of Common Stock of the Issuer held directly by LPC Fund.

SCHEDULE 13G

|

CUSIP NO. 15117F500

|

Page 12 of 13 |

| Item 5. |

Ownership of Five Percent or Less of a Class. |

| |

|

|

If

this statement is being filed to report the fact that as of the date hereof the reporting person has ceased to be the beneficial owner

of more than five percent of the class of securities, check the following x.

| Item 6. |

Ownership of More Than Five Percent on Behalf of Another

Person.

|

| |

Not applicable.

|

Item 7. |

Identification and Classification of Subsidiary Which Acquired

the Security Being Reported on by the Parent Holding Company or Control Person.

|

| |

Not applicable.

|

| Item 8. |

Identification and Classification of

Members of the Group.

|

| |

Not applicable.

|

| Item 9. |

Notice of Dissolution of Group.

|

| |

Not applicable.

|

| Item 10. |

Certifications. |

By signing below I

certify that, to the best of my knowledge and belief, the securities referred to above were not acquired and are not held for the

purpose of or with the effect of changing or influencing the control of the issuer of the securities and were not acquired and

are not held in connection with or as a participant in any transaction having that purpose or effect.

SCHEDULE 13G

| CUSIP NO. 15117F500 |

Page 13 of 13 |

SIGNATURE

After reasonable inquiry and to the best

of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: February 14, 2024

| LINCOLN PARK CAPITAL FUND, LLC |

|

LINCOLN PARK CAPITAL, LLC |

| |

|

|

| BY: |

LINCOLN PARK CAPITAL, LLC |

|

BY: |

ROCKLEDGE CAPITAL CORPORATION |

| |

|

|

| BY: |

ROCKLEDGE CAPITAL CORPORATION |

|

|

| |

|

|

|

| |

|

|

| By: |

/s/ Joshua B. Scheinfeld |

|

By: |

/s/ Joshua B. Scheinfeld |

| |

Name: |

Joshua B. Scheinfeld |

|

|

Name: |

Joshua B. Scheinfeld |

| |

Title: |

President |

|

|

Title: |

President |

| |

|

|

| LINCOLN PARK CAPITAL FUND, LLC |

|

LINCOLN PARK CAPITAL, LLC |

| |

|

|

| BY: |

LINCOLN PARK CAPITAL, LLC |

|

BY: |

ALEX NOAH INVESTORS, INC. |

| |

|

|

| BY: |

ALEX NOAH INVESTORS, INC. |

|

|

| |

|

|

|

| |

|

|

| By: |

/s/ Jonathan I. Cope |

|

By: |

/s/ Jonathan I. Cope |

| |

Name: |

Jonathan I. Cope |

|

|

Name: |

Jonathan I. Cope |

| |

Title: |

President |

|

|

Title: |

President |

| |

|

|

| ROCKLEDGE CAPITAL CORPORATION |

|

ALEX NOAH INVESTORS, INC. |

| |

|

|

| |

|

|

| By: |

/s/ Joshua B. Scheinfeld |

|

By: |

/s/ Jonathan I. Cope |

| |

Name: |

Joshua B. Scheinfeld |

|

|

Name: |

Jonathan I. Cope |

| |

Title: |

President |

|

|

Title: |

President |

| |

|

|

| JOSHUA B. SCHEINFELD |

|

JONATHAN I. COPE |

| |

|

|

| |

|

|

| By: |

/s/ Joshua B. Scheinfeld |

|

By: |

/s/ Jonathan I. Cope |

| |

Name: |

Joshua B. Scheinfeld |

|

|

Name: |

Jonathan I. Cope |

| |

Title: |

President |

|

|

Title: |

President |

LIST OF EXHIBITS

EXHIBIT 1

Joint Filing Agreement

The undersigned hereby agree

that they are filing this statement jointly pursuant to Rule 13d-1(k)(1). Each of them is responsible for the timely filing of such Schedule

13G, and for the completeness and accuracy of the information concerning such person contained therein; but none of them is responsible

for the completeness or accuracy of the information concerning the other persons making the filing, unless such person knows or has reason

to believe that such information is inaccurate.

In accordance with Rule 13d-1(k)(1)

promulgated under the Securities and Exchange Act of 1934, as amended, the undersigned hereby agree to the joint filing with each other

on behalf of each of them of such Schedule 13G with respect to the Common Stock of the Issuer, beneficially owned by each of them. This

Joint Filing Agreement shall be included as an exhibit to such Schedule 13G.

[Signature Page Follows]

IN WITNESS WHEREOF, the undersigned hereby execute

this Agreement as of February 14, 2023.

| LINCOLN PARK CAPITAL FUND, LLC |

|

LINCOLN PARK CAPITAL, LLC |

| |

|

|

| BY: |

LINCOLN PARK CAPITAL, LLC |

|

BY: |

ROCKLEDGE CAPITAL CORPORATION |

| |

|

|

| BY: |

ROCKLEDGE CAPITAL CORPORATION |

|

|

| |

|

|

|

| |

|

|

| By: |

/s/ Joshua B. Scheinfeld |

|

By: |

/s/ Joshua B. Scheinfeld |

| |

Name: |

Joshua B. Scheinfeld |

|

|

Name: |

Joshua B. Scheinfeld |

| |

Title: |

President |

|

|

Title: |

President |

| |

|

|

| LINCOLN PARK CAPITAL FUND, LLC |

|

LINCOLN PARK CAPITAL, LLC |

| |

|

|

| BY: |

LINCOLN PARK CAPITAL, LLC |

|

BY: |

ALEX NOAH INVESTORS, INC. |

| |

|

|

| BY: |

ALEX NOAH INVESTORS, INC. |

|

|

| |

|

|

|

| |

|

|

| By: |

/s/ Jonathan I. Cope |

|

By: |

/s/ Jonathan I. Cope |

| |

Name: |

Jonathan I. Cope |

|

|

Name: |

Jonathan I. Cope |

| |

Title: |

President |

|

|

Title: |

President |

| |

|

|

| ROCKLEDGE CAPITAL CORPORATION |

|

ALEX NOAH INVESTORS, INC. |

| |

|

|

| |

|

|

| By: |

/s/ Joshua B. Scheinfeld |

|

By: |

/s/ Jonathan I. Cope |

| |

Name: |

Joshua B. Scheinfeld |

|

|

Name: |

Jonathan I. Cope |

| |

Title: |

President |

|

|

Title: |

President |

| |

|

|

| JOSHUA B. SCHEINFELD |

|

JONATHAN I. COPE |

| |

|

|

| |

|

|

| By: |

/s/ Joshua B. Scheinfeld |

|

By: |

/s/ Jonathan I. Cope |

| |

Name: |

Joshua B. Scheinfeld |

|

|

Name: |

Jonathan I. Cope |

| |

Title: |

President |

|

|

Title: |

President |

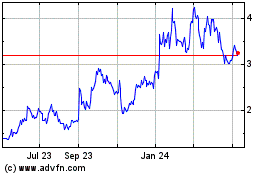

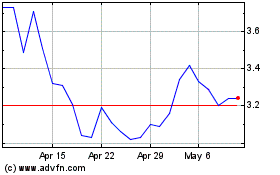

Cellectar Biosciences (NASDAQ:CLRB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cellectar Biosciences (NASDAQ:CLRB)

Historical Stock Chart

From Apr 2023 to Apr 2024