false0000023194COMSTOCK RESOURCES INC00000231942024-02-132024-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 13, 2024 |

COMSTOCK RESOURCES, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Nevada |

001-03262 |

94-1667468 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

5300 Town and Country Blvd. Suite 500 |

|

Frisco, Texas |

|

75034 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (972) 668-8800 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.50 (per share) |

|

CRK |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 13, 2024, Comstock Resources, Inc. ("Comstock" or the "Company") announced financial results for the quarter and year ended December 31, 2023. A copy of the press release announcing Comstock's earnings and operating results for these periods and other matters is attached hereto as Exhibit 99.1.

The earnings press release contains financial measures that are not in accordance with generally accepted accounting principles in the United States ("GAAP"). Comstock has provided reconciliations within the earnings release of the non-GAAP financial measures to the most directly comparable GAAP financial measures. The non-GAAP financial measures should be considered in addition to, but not as a substitute for, measures of financial performance prepared in accordance with GAAP that are presented in the earnings release.

The information in this Form 8-K and the Exhibit attached hereto shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act") or otherwise subject to the liability of that section, and shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

COMSTOCK RESOURCES, INC. |

|

|

|

|

Date: |

February 13, 2024 |

By: |

/s/ ROLAND O. BURNS |

|

|

|

Roland O. Burns

President and Chief Financial Officer |

Exhibit 99.1

|

|

|

5300 Town and Country Blvd., Suite 500 |

Frisco, Texas 75034 |

Telephone: (972) 668-8834 |

Contact: Ron Mills |

VP of Finance and Investor Relations |

Web Site: www.comstockresources.com |

|

NEWS RELEASE |

For Immediate Release

COMSTOCK RESOURCES, INC. REPORTS

FOURTH QUARTER 2023 FINANCIAL AND OPERATING RESULTS

FRISCO, TEXAS, February 13, 2024 – Comstock Resources, Inc. ("Comstock" or the "Company") (NYSE: CRK) today reported financial and operating results for the quarter and year ended December 31, 2023.

Highlights of 2023's Fourth Quarter

•Continued weak natural gas prices weighed heavily on the fourth quarter results.

•Natural gas and oil sales, including realized hedging gains, were $354 million.

•Adjusted EBITDAX for the quarter was $244 million.

•Operating cash flow was $207 million or $0.75 per share.

•Solid results from the Haynesville shale drilling program with 22 (16.5 net) operated wells turned to sales since the Company's last update with an average initial production rate of 24 MMcf per day.

•Added 23,000 net acres in the Western Haynesville, increasing our acreage in the play to over 250,000 net acres.

•Latest Western Haynesville successful well is currently producing at a rate of 31 MMcf per day.

Financial Results for the Three Months Ended December 31, 2023

Comstock's natural gas and oil sales in the fourth quarter of 2023 totaled $353.5 million (including realized hedging gains of $4.1 million). Operating cash flow (excluding changes in working capital) generated in the fourth quarter of 2023 was $206.9 million, and net income available to common stockholders for the fourth quarter was $108.4 million or $0.39 per share. Net income in the quarter included a pre-tax $107.3 million unrealized gain on hedging contracts held for natural gas price risk management. Excluding this item, adjusted net income for the fourth quarter of 2023 was $27.9 million, or $0.10 per share.

Comstock's production cost per Mcfe in the fourth quarter averaged $0.81 per Mcfe, which was comprised of $0.33 for gathering and transportation costs, $0.23 for lease operating costs, $0.23 for production and other taxes and $0.02 for cash general and administrative expenses. Comstock's unhedged operating margin was 67% in the fourth quarter of 2023 and 68% after hedging.

Financial Results for the Year Ended December 31, 2023

Natural gas and oil sales for the year ended December 31, 2023 totaled $1.3 billion (including realized hedging gains of $80.3 million). Operating cash flow (excluding changes in working capital) generated during the year was $774.5 million, and net income available to common stockholders was $211.9 million or $0.76 per share. Adjusted net income excluding unrealized gain on hedging contracts for the year ended December 31, 2023 was $132.7 million or $0.47 per share.

Comstock's production cost per Mcfe during the year ended December 31, 2023 averaged $0.83 per Mcfe, which was comprised of $0.35 for gathering and transportation costs, $0.25 for lease operating costs, $0.18 for production and other taxes and $0.05 for cash general and administrative expenses. Comstock's unhedged operating margin was 65% during 2023 and 68% after hedging.

2023 Drilling Results

Comstock drilled 67 (55.5 net) operated horizontal Haynesville/Bossier shale wells in 2023, which had an average lateral length of 10,796 feet. Comstock also turned 74 (55.7 net) operated wells to sales in 2023, which had an average initial production rate of 25 MMcf per day.

Since its last operational update in November, Comstock has turned an additional 22 (16.5 net) operated Haynesville/Bossier shale wells to sales. These wells had initial daily production rates that averaged 24 MMcf per day. The completed lateral length of these wells averaged 11,966 feet. Included in the wells turned to sales since the last operational update was the eighth successful Western Haynesville well – the Neyland MMM #1, which was drilled to a total vertical depth of 16,752 feet with a 10,438 foot completed lateral. The well is currently producing 31 MMcf per day and has not reached its maximum initial production rate.

2023 Proved Oil and Gas Reserves

Comstock also announced that proved natural gas and oil reserves as of December 31, 2023 were estimated at 4.9 trillion cubic feet equivalent ("Tcfe") as compared to 6.7 Tcfe as of December 31, 2022. The reserve estimates were determined under SEC guidelines and were audited by the Company's independent reserve engineering firm. The 4.9 Tcfe of proved reserves at December 31, 2023 were substantially all natural gas, 56% developed and 98% operated by Comstock. The decrease is the result of lower natural gas prices used in the determination. The present value, using a 10% discount rate, of the future net cash flows before income taxes of the proved reserves (the "PV-10 Value"), was approximately $2.5 billion using the Company's average first of month 2023 prices of $2.39 per thousand cubic feet of natural gas and $72.63 per barrel of oil. The natural gas and oil prices used in determining the December 31, 2023 proved reserve estimates were 56% lower for natural gas and 14% lower for oil as compared to prices used at December 31, 2022. Comstock's proved reserves would have been 6.6 Tcfe with a PV-10 Value of $5.2 billion using NYMEX reference prices of $3.50 per Mcf for natural gas and $75.00 per barrel of oil less the Company's differentials.

The following table reflects the changes in the SEC proved reserve estimates since the end of 2022:

|

|

|

|

|

Total

(Bcfe) |

|

Proved Reserves: |

|

|

Proved Reserves at December 31, 2022 |

|

6,700.9 |

|

Production |

|

(524.9 |

) |

Extensions and discoveries |

|

571.4 |

|

Revisions |

|

(1,803.9 |

) |

Proved Reserves at December 31, 2023 |

|

4,943.5 |

|

Despite the lower prices used in determining proved reserves, Comstock replaced 109% of its 2023 production excluding revisions, which were related to the lower prices used in the determination.

2024 Budget

In response to weak natural gas prices, Comstock plans to suspend its quarterly dividend until natural gas prices improve. In addition, the Company plans to reduce the number of operating drilling rigs it is running from seven to five. Two of the five drilling rigs will continue to be deployed in the Company's Western Haynesville play. As a result, Comstock plans to spend approximately $750 million to $850 million in 2024 on its development and exploration projects to drill 46 (35.9 net) operated horizontal wells and to turn 44 (38.2 net) operated wells to sales in 2024. Comstock expects to spend $125 million to $150 million on its Western Haynesville midstream system, which will be funded by its midstream partnership.

Earnings Call Information

Comstock has planned a conference call for 10:00 a.m. Central Time on February 14, 2024, to discuss the fourth quarter 2024 operational and financial results. Investors wishing to listen should visit the Company's website at www.comstockresources.com for a live webcast. Investors wishing to participate in the conference call telephonically will need to register at:

https://register.vevent.com/register/BI9aed23e8af74454f89bd226e82af31c9

Upon registering to participate in the conference call, participants will receive the dial-in number and a personal PIN number to access the conference call. On the day of the call, please dial in at least 15 minutes in advance to ensure a timely connection to the call. The conference call will also be broadcast live in listen-only mode and can be accessed via the website URL: https://edge.media-server.com/mmc/p/jx7owzgq.

If you are unable to participate in the original conference call, a web replay will be available for twelve months beginning at 1:00 p.m. CT on February 14, 2024. The replay of the conference can be accessed using the webcast link: https://edge.media-server.com/mmc/p/jx7owzgq.

This press release may contain "forward-looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements are based on management's current expectations and are subject to a number of factors and uncertainties which could cause actual results to differ materially from those described herein. Although the Company believes the expectations in such statements to be reasonable, there can be no assurance that such expectations will prove to be correct. Information concerning the assumptions, uncertainties and risks that may affect the actual results can be found in the Company's filings with the Securities and Exchange Commission ("SEC") available on the Company's website or the SEC's website at sec.gov.

Comstock Resources, Inc. is a leading independent natural gas producer with operations focused on the development of the Haynesville shale in North Louisiana and East Texas. The Company's stock is traded on the New York Stock Exchange under the symbol CRK.

COMSTOCK RESOURCES, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Natural gas sales |

|

$ |

348,385 |

|

|

$ |

740,320 |

|

|

$ |

1,259,450 |

|

|

$ |

3,117,094 |

|

Oil sales |

|

|

1,050 |

|

|

|

1,273 |

|

|

|

5,161 |

|

|

|

7,597 |

|

Total natural gas and oil sales |

|

|

349,435 |

|

|

|

741,593 |

|

|

|

1,264,611 |

|

|

|

3,124,691 |

|

Gas services |

|

|

61,148 |

|

|

|

180,791 |

|

|

|

300,498 |

|

|

|

503,366 |

|

Total revenues |

|

|

410,583 |

|

|

|

922,384 |

|

|

|

1,565,109 |

|

|

|

3,628,057 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Production and ad valorem taxes |

|

|

31,912 |

|

|

|

17,837 |

|

|

|

91,803 |

|

|

|

77,917 |

|

Gathering and transportation |

|

|

46,925 |

|

|

|

41,882 |

|

|

|

184,906 |

|

|

|

155,679 |

|

Lease operating |

|

|

31,678 |

|

|

|

31,261 |

|

|

|

132,203 |

|

|

|

111,134 |

|

Exploration |

|

|

— |

|

|

|

4,924 |

|

|

|

1,775 |

|

|

|

8,287 |

|

Depreciation, depletion and amortization |

|

|

185,558 |

|

|

|

134,456 |

|

|

|

607,908 |

|

|

|

489,450 |

|

Gas services |

|

|

57,733 |

|

|

|

159,773 |

|

|

|

282,050 |

|

|

|

465,044 |

|

General and administrative |

|

|

6,000 |

|

|

|

11,954 |

|

|

|

37,992 |

|

|

|

39,405 |

|

Gain on sale of assets |

|

|

— |

|

|

|

(319 |

) |

|

|

(125 |

) |

|

|

(340 |

) |

Total operating expenses |

|

|

359,806 |

|

|

|

401,768 |

|

|

|

1,338,512 |

|

|

|

1,346,576 |

|

Operating income |

|

|

50,777 |

|

|

|

520,616 |

|

|

|

226,597 |

|

|

|

2,281,481 |

|

Other income (expenses): |

|

|

|

|

|

|

|

|

|

|

|

|

Gain (loss) from derivative financial instruments |

|

|

111,449 |

|

|

|

119,132 |

|

|

|

187,639 |

|

|

|

(662,522 |

) |

Other income |

|

|

304 |

|

|

|

410 |

|

|

|

1,771 |

|

|

|

916 |

|

Interest expense |

|

|

(47,936 |

) |

|

|

(38,888 |

) |

|

|

(169,018 |

) |

|

|

(171,092 |

) |

Loss on early retirement of debt |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(46,840 |

) |

Total other income (expenses) |

|

|

63,817 |

|

|

|

80,654 |

|

|

|

20,392 |

|

|

|

(879,538 |

) |

Income before income taxes |

|

|

114,594 |

|

|

|

601,270 |

|

|

|

246,989 |

|

|

|

1,401,943 |

|

Provision for income taxes |

|

|

(6,217 |

) |

|

|

(81,451 |

) |

|

|

(35,095 |

) |

|

|

(261,061 |

) |

Net income |

|

|

108,377 |

|

|

|

519,819 |

|

|

|

211,894 |

|

|

|

1,140,882 |

|

Preferred stock dividends |

|

|

— |

|

|

|

(2,925 |

) |

|

|

— |

|

|

|

(16,014 |

) |

Net income available to common stockholders |

|

|

108,377 |

|

|

|

516,894 |

|

|

|

211,894 |

|

|

|

1,124,868 |

|

Net income attributable to noncontrolling interest |

|

|

(777 |

) |

|

|

— |

|

|

|

(777 |

) |

|

|

— |

|

Net income attributable to Comstock |

|

$ |

107,600 |

|

|

$ |

516,894 |

|

|

$ |

211,117 |

|

|

$ |

1,124,868 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.39 |

|

|

$ |

2.08 |

|

|

$ |

0.76 |

|

|

$ |

4.75 |

|

Diluted |

|

$ |

0.39 |

|

|

$ |

1.87 |

|

|

$ |

0.76 |

|

|

$ |

4.11 |

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

276,999 |

|

|

|

247,543 |

|

|

|

276,806 |

|

|

|

236,045 |

|

Diluted |

|

|

276,999 |

|

|

|

277,032 |

|

|

|

276,806 |

|

|

|

277,465 |

|

Dividends per share |

|

$ |

0.125 |

|

|

$ |

0.125 |

|

|

$ |

0.50 |

|

|

$ |

0.125 |

|

COMSTOCK RESOURCES, INC.

OPERATING RESULTS

(In thousands, except per unit amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Natural gas production (MMcf) |

|

|

140,565 |

|

|

|

132,858 |

|

|

|

524,467 |

|

|

|

500,616 |

|

Oil production (Mbbls) |

|

|

13 |

|

|

|

16 |

|

|

|

70 |

|

|

|

82 |

|

Total production (MMcfe) |

|

|

140,649 |

|

|

|

132,955 |

|

|

|

524,890 |

|

|

|

501,107 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural gas sales |

|

$ |

348,385 |

|

|

$ |

740,320 |

|

|

$ |

1,259,450 |

|

|

$ |

3,117,094 |

|

Natural gas hedging settlements (1) |

|

|

4,107 |

|

|

|

(183,677 |

) |

|

|

80,328 |

|

|

|

(862,715 |

) |

Total natural gas including hedging |

|

|

352,492 |

|

|

|

556,643 |

|

|

|

1,339,778 |

|

|

|

2,254,379 |

|

Oil sales |

|

|

1,050 |

|

|

|

1,273 |

|

|

|

5,161 |

|

|

|

7,597 |

|

Total natural gas and oil sales including hedging |

|

$ |

353,542 |

|

|

$ |

557,916 |

|

|

$ |

1,344,939 |

|

|

$ |

2,261,976 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average natural gas price (per Mcf) |

|

$ |

2.48 |

|

|

$ |

5.57 |

|

|

$ |

2.40 |

|

|

$ |

6.23 |

|

Average natural gas price including hedging (per Mcf) |

|

$ |

2.51 |

|

|

$ |

4.19 |

|

|

$ |

2.55 |

|

|

$ |

4.50 |

|

Average oil price (per barrel) |

|

$ |

80.77 |

|

|

$ |

79.56 |

|

|

$ |

73.73 |

|

|

$ |

92.65 |

|

Average price (per Mcfe) |

|

$ |

2.48 |

|

|

$ |

5.58 |

|

|

$ |

2.41 |

|

|

$ |

6.24 |

|

Average price including hedging (per Mcfe) |

|

$ |

2.51 |

|

|

$ |

4.20 |

|

|

$ |

2.56 |

|

|

$ |

4.51 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production and ad valorem taxes |

|

$ |

31,912 |

|

|

$ |

17,837 |

|

|

$ |

91,803 |

|

|

$ |

77,917 |

|

Gathering and transportation |

|

|

46,925 |

|

|

|

41,882 |

|

|

|

184,906 |

|

|

|

155,679 |

|

Lease operating |

|

|

31,678 |

|

|

|

31,261 |

|

|

|

132,203 |

|

|

|

111,134 |

|

Cash general and administrative (2) |

|

|

3,141 |

|

|

|

10,262 |

|

|

|

28,125 |

|

|

|

32,795 |

|

Total production costs |

|

$ |

113,656 |

|

|

$ |

101,242 |

|

|

$ |

437,037 |

|

|

$ |

377,525 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production and ad valorem taxes (per Mcfe) |

|

$ |

0.23 |

|

|

$ |

0.12 |

|

|

$ |

0.18 |

|

|

$ |

0.16 |

|

Gathering and transportation (per Mcfe) |

|

|

0.33 |

|

|

|

0.32 |

|

|

|

0.35 |

|

|

|

0.31 |

|

Lease operating (per Mcfe) |

|

|

0.23 |

|

|

|

0.24 |

|

|

|

0.25 |

|

|

|

0.22 |

|

Cash general and administrative (per Mcfe) |

|

|

0.02 |

|

|

|

0.08 |

|

|

|

0.05 |

|

|

|

0.07 |

|

Total production costs (per Mcfe) |

|

$ |

0.81 |

|

|

$ |

0.76 |

|

|

$ |

0.83 |

|

|

$ |

0.76 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unhedged operating margin |

|

|

67 |

% |

|

|

86 |

% |

|

|

65 |

% |

|

|

88 |

% |

Hedged operating margin |

|

|

68 |

% |

|

|

82 |

% |

|

|

68 |

% |

|

|

83 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gas services revenues |

|

$ |

61,148 |

|

|

$ |

180,791 |

|

|

$ |

300,498 |

|

|

$ |

503,366 |

|

Gas services expenses |

|

|

57,733 |

|

|

|

159,773 |

|

|

|

282,050 |

|

|

|

465,044 |

|

Gas services margin |

|

$ |

3,415 |

|

|

$ |

21,018 |

|

|

$ |

18,448 |

|

|

$ |

38,322 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural Gas and Oil Capital Expenditures: |

|

|

|

|

|

|

|

|

|

|

|

|

Proved property acquisitions |

|

$ |

— |

|

|

$ |

295 |

|

|

$ |

— |

|

|

$ |

500 |

|

Unproved property acquisitions |

|

|

21,907 |

|

|

|

16,724 |

|

|

|

98,553 |

|

|

|

54,120 |

|

Total natural gas and oil properties acquisitions |

|

$ |

21,907 |

|

|

$ |

17,019 |

|

|

$ |

98,553 |

|

|

$ |

54,620 |

|

Exploration and Development: |

|

|

|

|

|

|

|

|

|

|

|

|

Development leasehold |

|

$ |

8,818 |

|

|

$ |

5,429 |

|

|

$ |

27,905 |

|

|

$ |

13,727 |

|

Exploratory drilling and completion |

|

|

65,079 |

|

|

|

14,517 |

|

|

|

244,129 |

|

|

|

63,520 |

|

Development drilling and completion |

|

|

233,856 |

|

|

|

281,653 |

|

|

|

974,664 |

|

|

|

901,026 |

|

Other development costs |

|

|

6,262 |

|

|

|

1,193 |

|

|

|

25,130 |

|

|

|

53,693 |

|

Total exploration and development capital expenditures |

|

$ |

314,015 |

|

|

$ |

302,792 |

|

|

$ |

1,271,828 |

|

|

$ |

1,031,966 |

|

(1)Included in gain (loss) from derivative financial instruments in operating results.

(2)Excludes stock-based compensation.

COMSTOCK RESOURCES, INC.

NON-GAAP FINANCIAL MEASURES

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

ADJUSTED NET INCOME: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income available to common stockholders |

|

$ |

108,377 |

|

|

$ |

516,894 |

|

|

$ |

211,894 |

|

|

$ |

1,124,868 |

|

Unrealized gain from derivative financial instruments |

|

|

(107,342 |

) |

|

|

(302,809 |

) |

|

|

(107,311 |

) |

|

|

(200,193 |

) |

Loss on early retirement of debt |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

46,840 |

|

Non-cash interest amortization from adjusting debt assumed in acquisition to fair value |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,174 |

|

Exploration expense |

|

|

— |

|

|

|

4,924 |

|

|

|

1,775 |

|

|

|

8,287 |

|

Gain on sale of assets |

|

|

— |

|

|

|

(319 |

) |

|

|

(125 |

) |

|

|

(340 |

) |

Adjustment to income taxes |

|

|

26,868 |

|

|

|

68,970 |

|

|

|

26,450 |

|

|

|

39,011 |

|

Adjusted net income (1) |

|

$ |

27,903 |

|

|

$ |

287,660 |

|

|

$ |

132,683 |

|

|

$ |

1,022,647 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income per share (2) |

|

$ |

0.10 |

|

|

$ |

1.05 |

|

|

$ |

0.47 |

|

|

$ |

3.73 |

|

Diluted shares outstanding |

|

|

276,999 |

|

|

|

277,032 |

|

|

|

276,806 |

|

|

|

277,464 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED EBITDAX: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

108,377 |

|

|

$ |

519,819 |

|

|

$ |

211,894 |

|

|

$ |

1,140,882 |

|

Interest expense |

|

|

47,936 |

|

|

|

38,888 |

|

|

|

169,018 |

|

|

|

171,092 |

|

Income taxes |

|

|

6,217 |

|

|

|

81,451 |

|

|

|

35,095 |

|

|

|

261,061 |

|

Depreciation, depletion, and amortization |

|

|

185,558 |

|

|

|

134,456 |

|

|

|

607,908 |

|

|

|

489,450 |

|

Exploration |

|

|

— |

|

|

|

4,924 |

|

|

|

1,775 |

|

|

|

8,287 |

|

Unrealized gain from derivative financial instruments |

|

|

(107,342 |

) |

|

|

(302,809 |

) |

|

|

(107,311 |

) |

|

|

(200,193 |

) |

Stock-based compensation |

|

|

2,861 |

|

|

|

1,692 |

|

|

|

9,867 |

|

|

|

6,610 |

|

Loss on early extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

46,840 |

|

Gain on sale of assets |

|

|

— |

|

|

|

(319 |

) |

|

|

(125 |

) |

|

|

(340 |

) |

Total Adjusted EBITDAX (3) |

|

$ |

243,607 |

|

|

$ |

478,102 |

|

|

$ |

928,121 |

|

|

$ |

1,923,689 |

|

(1)Adjusted net income is presented because of its acceptance by investors and by Comstock management as an indicator of the Company's profitability excluding loss on early retirement of debt, non-cash unrealized gains and losses on derivative financial instruments, gains and losses on sales of assets and other unusual items.

(2)Adjusted net income per share is calculated to include the dilutive effects of unvested restricted stock pursuant to the two-class method and performance stock units and preferred stock pursuant to the treasury stock method.

(3)Adjusted EBITDAX is presented in the earnings release because management believes that adjusted EBITDAX, which represents Comstock's results from operations before interest, income taxes, and certain non-cash items, including loss on early retirement of debt, depreciation, depletion and amortization and exploration expense, is a common alternative measure of operating performance used by certain investors and financial analysts.

COMSTOCK RESOURCES, INC.

NON-GAAP FINANCIAL MEASURES

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

OPERATING CASH FLOW (1): |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

108,377 |

|

|

$ |

519,819 |

|

|

$ |

211,894 |

|

|

$ |

1,140,882 |

|

Reconciling items: |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain from derivative financial instruments |

|

|

(107,342 |

) |

|

|

(302,809 |

) |

|

|

(107,311 |

) |

|

|

(200,193 |

) |

Deferred income taxes |

|

|

15,423 |

|

|

|

79,928 |

|

|

|

44,301 |

|

|

|

228,317 |

|

Depreciation, depletion and amortization |

|

|

185,558 |

|

|

|

134,456 |

|

|

|

607,908 |

|

|

|

489,450 |

|

Loss on early retirement of debt |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

46,840 |

|

Amortization of debt discount and issuance costs |

|

|

1,984 |

|

|

|

1,713 |

|

|

|

7,964 |

|

|

|

10,255 |

|

Stock-based compensation |

|

|

2,861 |

|

|

|

1,692 |

|

|

|

9,867 |

|

|

|

6,610 |

|

Gain on sale of assets |

|

|

— |

|

|

|

(319 |

) |

|

|

(125 |

) |

|

|

(340 |

) |

Operating cash flow |

|

$ |

206,861 |

|

|

$ |

434,480 |

|

|

$ |

774,498 |

|

|

$ |

1,721,821 |

|

(Increase) decrease in accounts receivable |

|

|

(16,626 |

) |

|

|

117,211 |

|

|

|

278,697 |

|

|

|

(242,389 |

) |

(Increase) decrease in other current assets |

|

|

1,369 |

|

|

|

(10,655 |

) |

|

|

745 |

|

|

|

(10,296 |

) |

Increase (decrease) in accounts payable and other accrued expenses |

|

|

36,603 |

|

|

|

(72,704 |

) |

|

|

(37,094 |

) |

|

|

229,252 |

|

Net cash provided by operating activities |

|

$ |

228,207 |

|

|

$ |

468,332 |

|

|

$ |

1,016,846 |

|

|

$ |

1,698,388 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

FREE CASH FLOW (2): |

|

|

|

|

|

|

|

|

|

|

|

|

Operating cash flow |

|

$ |

206,861 |

|

|

$ |

434,480 |

|

|

$ |

774,498 |

|

|

$ |

1,721,821 |

|

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

Exploration and development capital expenditures |

|

|

(314,015 |

) |

|

|

(302,792 |

) |

|

|

(1,271,828 |

) |

|

|

(1,031,966 |

) |

Midstream capital expenditures |

|

|

(14,098 |

) |

|

|

— |

|

|

|

(35,694 |

) |

|

|

— |

|

Other capital expenditures |

|

|

(11 |

) |

|

|

(147 |

) |

|

|

(491 |

) |

|

|

(803 |

) |

Preferred stock dividends |

|

|

— |

|

|

|

(2,925 |

) |

|

|

— |

|

|

|

(16,014 |

) |

Contributions from midstream partnership |

|

|

24,000 |

|

|

|

— |

|

|

|

24,000 |

|

|

|

— |

|

Free cash flow (deficit) from operations |

|

$ |

(97,263 |

) |

|

$ |

128,616 |

|

|

$ |

(509,515 |

) |

|

$ |

673,038 |

|

Acquisitions |

|

|

(21,907 |

) |

|

|

(18,044 |

) |

|

|

(98,553 |

) |

|

|

(72,593 |

) |

Proceeds from divestitures |

|

|

— |

|

|

|

4,093 |

|

|

|

41,295 |

|

|

|

4,186 |

|

Free cash flow (deficit) after acquisition and divestiture activity |

|

$ |

(119,170 |

) |

|

$ |

114,665 |

|

|

$ |

(566,773 |

) |

|

$ |

604,631 |

|

(1)Operating cash flow is presented in the earnings release because management believes it to be useful to investors as a common alternative measure of cash flows which excludes changes to other working capital accounts.

(2)Free cash flow from operations and free cash flow after acquisition and divestiture activity are presented in the earnings release because management believes them to be useful indicators of the Company's ability to internally fund acquisitions and debt maturities after exploration and development capital expenditures, midstream and other capital expenditures, preferred dividend payments, proved and unproved property acquisitions, and proceeds from divestitures of natural gas and oil properties.

COMSTOCK RESOURCES, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

December 31,

2023 |

|

|

December 31,

2022 |

|

ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

16,669 |

|

|

$ |

54,652 |

|

Accounts receivable |

|

|

231,430 |

|

|

|

510,127 |

|

Derivative financial instruments |

|

|

126,775 |

|

|

|

23,884 |

|

Other current assets |

|

|

86,619 |

|

|

|

56,324 |

|

Total current assets |

|

|

461,493 |

|

|

|

644,987 |

|

Property and equipment, net |

|

|

5,384,771 |

|

|

|

4,622,655 |

|

Goodwill |

|

|

335,897 |

|

|

|

335,897 |

|

Operating lease right-of-use assets |

|

|

71,462 |

|

|

|

90,716 |

|

|

|

$ |

6,253,623 |

|

|

$ |

5,694,255 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Accounts payable |

|

$ |

523,260 |

|

|

$ |

530,195 |

|

Accrued costs |

|

|

134,466 |

|

|

|

183,111 |

|

Operating leases |

|

|

23,765 |

|

|

|

38,411 |

|

Derivative financial instruments |

|

|

— |

|

|

|

4,420 |

|

Total current liabilities |

|

|

681,491 |

|

|

|

756,137 |

|

Long-term debt |

|

|

2,640,391 |

|

|

|

2,152,571 |

|

Deferred income taxes |

|

|

470,035 |

|

|

|

425,734 |

|

Derivative financial instruments |

|

|

— |

|

|

|

— |

|

Long-term operating leases |

|

|

47,742 |

|

|

|

52,385 |

|

Asset retirement obligation |

|

|

30,773 |

|

|

|

29,114 |

|

Total liabilities |

|

|

3,870,432 |

|

|

|

3,415,941 |

|

Stockholders' Equity: |

|

|

|

|

|

|

Common stock |

|

|

139,214 |

|

|

|

138,759 |

|

Additional paid-in capital |

|

|

1,260,930 |

|

|

|

1,253,417 |

|

Accumulated earnings |

|

|

958,270 |

|

|

|

886,138 |

|

Total stockholders' equity attributable to Comstock |

|

|

2,358,414 |

|

|

|

2,278,314 |

|

Noncontrolling interest |

|

|

24,777 |

|

|

|

— |

|

Total stockholders' equity |

|

|

2,383,191 |

|

|

|

2,278,314 |

|

|

|

$ |

6,253,623 |

|

|

$ |

5,694,255 |

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

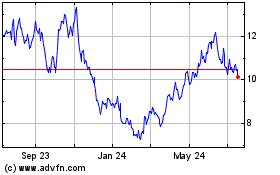

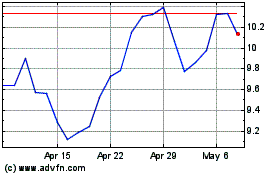

Comstock Resources (NYSE:CRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comstock Resources (NYSE:CRK)

Historical Stock Chart

From Apr 2023 to Apr 2024